Not every employer sends employees on business trips abroad. However, if the company nevertheless decides to send its employee to a foreign country, you need to know how the registration of a foreign business trip differs. In this article we talk about registration of a business trip abroad 2021: what and how to prepare documents.

Also see:

- Work related to business trips abroad: what you need to know

- Amount of daily allowance for business trips and their calculation

Main nuances

Here is a list of activities that must be completed when sending an employee on a business trip abroad. This:

- Issuance of an order to be sent on a business trip outside the Russian Federation.

- Registration of a foreign passport and verification of permission to travel abroad.

- Obtaining a visa.

- Availability of mandatory vaccinations upon entry into a particular country.

- Preparation of calculations or estimates for travel expenses.

- Issuing an advance for a business trip.

- Preparation of advance report.

If you are not very familiar with processing Russian business trips, we recommend our article “How to properly arrange a business trip.”

It would also be a good idea to read our material on business trips abroad, “ Business trip abroad: what are the accounting nuances.”

And now in more detail about these stages.

How to calculate

The head of the enterprise independently decides which currency to use for transferring daily allowances outside his country. However, the employee is given the corresponding amount in rubles, equivalent to the currency.

Daily allowances are calculated in the following order:

- If an employee was sent on a work trip abroad, payment for his accommodation must be made in accordance with legal regulations corresponding to foreign business trips and the countries where the employee is sent.

- The return of an official from abroad to the workplace is accompanied by the payment of daily allowances in accordance with Russian standards. The organization must make payment before the moment when it crosses the border, namely, the day before.

- If you visit several countries during a work trip, the daily allowance is calculated according to government regulations, taking into account the employee’s location on the last day of the trip.

Business trip order

Before preparing an order, you need to check:

- whether the posted employee belongs to the category of persons who are prohibited from being sent on business trips;

- Are there any restrictions on sending a specific employee on a trip?

In the event of a travel ban, you must look for another candidate for a business trip. And if there are restrictions on business trips, it is necessary to inform the employee that he has the right to refuse a business trip and obtain written consent from him for the trip.

The order for a foreign business trip indicates the country and city (locality/settlement) to which the employee is sent. The receiving party is also indicated - the organization that sent the invitation or challenge.

In addition, the order can reflect at whose expense the business trip will be paid. The fact is that there are business trips, the expenses of which are paid by the host company (in whole or in part).

It makes sense in the order to reflect the type of transport on which the traveler is sent. This is especially true if the employee crosses the border in a personal or company car.

If the company’s internal regulations provide for the publication of other documents during a business trip (for example, an official assignment, an internal memorandum, etc.), it is necessary to prepare them as well.

We suggest you familiarize yourself with registering a business trip abroad using a memo in the article “What you need to know about a memo about sending you on a business trip.”

If it is customary for the company to issue only a business trip order, you only need to prepare it. There is no special form for this order. You can use the T-9 form or develop your own.

You can download the T-9 order form for free from the link below:

FORM T-9

You can also familiarize yourself with the T-9 order form in our article “Order (order) on sending on a business trip.”

If the company additionally uses its own developed document templates, you can take samples from our material “How to draw up and execute an order for daily allowance on a business trip.”

Registration procedure

Registration of a business trip involves the creation of a number of papers. The first most important document is an order. The employee must be familiarized with it. The employee signs to confirm familiarization. An order will need to be issued. The business trip is taken into account in the time sheet, as well as in the journal. Accepted by Fr. Let's consider all the stages of registration of a business trip:

- Report to the manager on the travel arrangements.

- Issuance of an order specifying the purposes of the trip, its objectives and duration.

- Issuance of a travel certificate if an employee is sent to the CIS countries.

- Familiarization of the employee with the completed documents.

- Calculation of travel costs. This takes into account advances and exchange rates.

IMPORTANT! The procedure for registration of one-day trips is similar to registration of multi-day trips.

ATTENTION! The employee’s obligation to go on business trips must be established in the employment contract. If this condition is not specified in the agreement, the person may refuse the trip.

Control activities

To prevent the trip from being disrupted and the company not to incur unnecessary expenses, it is necessary to carry out so-called control procedures in advance.

First of all, you need to check whether the posted employee has any debt on the FSSP website. He will not pass border control when traveling abroad if he has a debt of more than 10,000 rubles for alimony and 30,000 rubles or more for other requirements.

Due to the fact that debt repayment data is not immediately , it is important to take care of debt repayment in advance.

Further, if you plan to travel to exotic countries (Vietnam, Sri Lanka, African countries, etc.), you need to find out about mandatory and recommended vaccinations . This also needs to be done in advance - at least 1 month before the employee’s expected departure. Thus, you will protect his life and health.

It is also necessary to make sure in advance that the traveler has a valid passport. Getting a new passport is not a quick process. Therefore, you need to plan this in advance.

In addition, you need to obtain an exit visa (if necessary) in advance. This is also additional time, as well as extra expenses. If an employee pays for his visa himself, the company is obliged to compensate him for these expenses in accordance with labor law.

Normative base

Let's start with Russian labor legislation. The concept of a business trip and the process for deciding it are described in Article 166 of the Labor Code. The law guarantees that the business traveler will retain his job, that he will receive compensation for travel expenses and his regular salary.

Other regulatory documents that must be followed when sending an employee on a foreign business trip:

- Article 167 of the Russian Labor Code.

- Government Decree No. 749, which we have already referred to more than once in our articles on business trips.

- Tax code.

- Federal Law No. 173, adopted in 2013.

In addition, the enterprise can also prescribe the specifics of foreign business trips in a special provision, adopt a collective agreement on this issue, as well as other local documents.

Important

The situation in the political arena and relations between states change frequently. Therefore, the manager needs to receive up-to-date information about the system of entry of foreigners into a particular state. Only in this case, all documents of an employee who is sent on a business trip abroad will be prepared in accordance with all the rules of the host country.

Advance paynemt

If the company's regulations provide for the preparation of a preliminary calculation or estimate for a business trip abroad, it is necessary to formalize it.

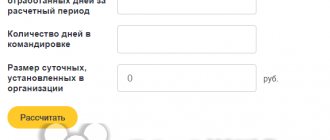

The calculation or estimate determines the amount that should be given to the employee in advance, taking into account his expected expenses - daily allowance, approximate travel and accommodation expenses.

ADVICE

We recommend giving the employee a certain amount for unforeseen expenses so that he does not end up abroad in a difficult situation without money. Also, this amount will be able to cover daily or other expenses in the event of a business trip extension or a plane or train flight being rescheduled. He will return the excess advance upon his return from a business trip.

An advance for a business trip is issued on the basis of a prepared calculation and a signed order.

You can learn how to correctly process a calculation when traveling abroad in our article “How to calculate daily allowances when traveling abroad.”

What is the daily allowance abroad in 2021?

Let’s say right away that the amounts of daily allowance issued for business trips abroad in 2021 are important for:

- calculation of income tax (tax accounting of expenses);

- calculations and payments of personal income tax (not subject to personal income tax, contributions for temporary disability and maternity, compulsory health insurance and compulsory medical insurance - 700 rubles for business trips in Russia and 2500 rubles for business trips abroad).

As a general rule, the employer sets the amount of daily allowance in 2021 independently , fixing any specific amounts in a collective agreement or local regulation (Article 168 of the Labor Code of the Russian Federation).

Please note that some companies set different daily allowances for business trips abroad, depending on which country the employee is sent to to perform a work assignment.

However, for budgetary organizations, the amount of daily allowance for business trips abroad in 2021 is set by the Government of the Russian Federation. At the same time, commercial organizations, if desired, can focus on these daily allowance amounts (see below).

Advance report

Exactly what documents must be drawn up before the start of a business trip and after returning from it must be specified in the company’s local act. This act may be a travel regulation.

You will learn how to prepare it from our article “What the Regulations on Business Travel Should Be.”

Let us remind you that upon returning from a business trip, the employee is given 3 days to prepare an advance report. It must be submitted to the employer's accounting department.

You can learn how to prepare an advance report from our article “What should a business trip report be like?”

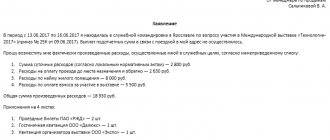

The company can independently develop a business trip report form. It is important that it must reflect all expenses for a business trip abroad. Namely:

- daily allowance (based on established standards);

- travel expenses;

- living expenses (hotel or apartment);

- visa or consular fees;

- mandatory fees and insurance at the airport or railway station;

- receipts confirming currency exchange fees;

- expenses for cellular communications and Internet;

- payment of membership fees or invitations (if necessary);

- receipts for the use of bed linen;

- other expenses.

Features of registration of a foreign business trip in budgetary organizations

Foreign business trips for public sector employees generally do not differ in any way from the general procedure. There are only a few nuances. Firstly, this is the deadline for drawing up and submitting an advance report - the employee is obliged to submit it immediately on the day of return. Secondly, in relation to budget employees, it is possible for the receiving party to charge daily allowances. If it only compensates for food, then these amounts are paid by the main enterprise in which the citizen works, in a reduced amount - 30% of the norm.

In what currency are they charged?

The management of the organization has the right to determine the currency in which daily allowances are provided. However, in this matter it is necessary to take into account several nuances.

Among them:

- Daily allowances for internal travel within the Russian Federation are issued only in rubles.

- In foreign currency, money can be transferred in cash or to a personal bank card.

- When issuing cash, the employee must present all documents certifying expenses.

- When issuing in rubles, you will need to present a certificate from the exchange office.

The availability of supporting documents is a very important factor. Receipts and checks are required for subsequent reporting and verification of expenses.

About the rules of foreign business trips in the video: