General characteristics of the account and its closure

According to the main types of classification of accounts. 23 is:

- In relation to the balance sheet, it is active, i.e. this account can only have a debit balance, which, when reporting, forms a balance sheet asset.

- In terms of economic content - a calculation account for accounting for business processes, and specifically production costs.

- In terms of detail - synthetic. It takes into account generalized data on the costs of auxiliary production in monetary terms. Analytical accounting can be organized by type of production, cost items, etc.

In addition, since on the account. 23, costs accumulate and the closing procedure is applied to it at the end of the reporting period. This will be discussed in more detail in the corresponding section.

What is an account

Every commercial company is created for the purpose of making a profit. At the same time, she makes various transactions every day, the accounting of which is very easy to get confused without a clearly organized accounting structure. Moreover, according to Art. 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, all legal entities are required to maintain accounting records.

It is organized through continuous documentation of each business transaction and carries several functions:

- informational;

- control;

- feedback;

- analytical.

One of the accounting methods is double entry using accounts approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (for commercial structures).

Accounting objects and subaccounts

Account 23 reflects information about those productions that are not related to the main activities of the enterprise, but provide conditions for its functioning. For different types of business, the types of auxiliary production may be different. However, several categories can be distinguished for which subaccounts of account 23 are usually opened:

- Generation of energy of all types (electricity, heat, etc.).

- Transport divisions.

- Repair of vehicles, equipment, etc.

- Providing food for company employees.

- Production of tools, equipment, spare parts.

- Installation of individual structures, parts (for construction organizations).

- Construction of temporary structures.

- Canning of food products (for agricultural enterprises).

What are auxiliary productions?

At manufacturing enterprises with a complex technological process structure, there are almost always workshops and divisions that perform functions that are assistive in relation to the main production cycle.

Examples include:

- own transport fleet;

- repair and commissioning department;

- energy management;

- workshop for the production of special equipment and tools.

All such divisions also produce products or provide services, but the main consumer of their products (services) is the enterprise itself. More precisely, they are needed to carry out the main production process of the enterprise.

A separate account 23 is intended for accounting for auxiliary production. Analytics on it is carried out by divisions of auxiliary production and types of costs. The specificity is that the account is also intended to account for the production process and cost calculation, so most of the item analytics that may be present on account 20 “Main production” will find their place on account 23 “Auxiliary production”.

Unlike accounting for main production (on account 20), the cost of production of auxiliary production formed on account 23 is not transferred to separate accounts intended for further accounting of finished main products (accounts 40, 43). The cost of auxiliary production is written off immediately to the credit of account 23.

For example, if one auxiliary division produces something for another auxiliary division, a posting is made Debit 23 Credit 23 for the subaccounts of the corresponding divisions.

Important! Some of the products of auxiliary production can be sold externally. In this case, the cost of sales is also reflected by posting Dt 90 (91) Kt 23, bypassing the accounts for accounting for finished products of the main production.

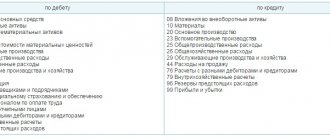

Postings by debit

The debit of account 23 - Auxiliary production - reflects expenses associated with the implementation of the corresponding production process. First of all, these are direct costs, the main of which are:

- Write-off of raw materials and materials:

Dt 23 Kt 10.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

- Calculation of wages and contributions to extra-budgetary funds:

Dt 23 Kt 70;

Dt 23 Kt 69.

- Services and works purchased from third parties or individuals:

Dt 23 Kt 60 (76).

In addition, in the debit of the account. 23, part of the overhead costs that relate to the activities of auxiliary production is written off:

- Dt 23 Kt 25 - general production expenses are written off;

- Dt 23 Kt 26 - general business expenses are written off.

The costs of organizing production, if appropriate, can be taken into account directly in the account. 23, without using count. 25.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Using account 70 in accounting

Count 70 is passive. On the credit side of the account, settlements with employees are made - the formation of amounts intended for payments to employees, and on the debit side - transactions for deductions from wages.

When making mutual settlements with employees, account 70 provides for the opening of subaccounts. This greatly simplifies the work, since each employee is assigned to a separate sub-account. This provision is purely advisory in nature and is not mandatory; a decision on it is made by the management team and is reflected in the accounting policies of the organization.

Account 70 reflects the flow of material resources for mutual settlements with employees of the enterprise and costs associated with all kinds of obligations of employees. Calculations are carried out for each employee, and then the data is collected into a final reporting sheet for the entire organization.

In the event that an employee does not receive wages on time (for example, due to absence from work), the unclaimed amount is identified as deposited and at the end of the month is transferred to a special separate account.

Loan transactions

The credit entries in account 23 primarily reflect write-offs of expenses. Corresponding accounts show which cost categories the accumulated amounts are distributed to:

- Dt 20 Kt 23 - costs are allocated to main production;

- Dt 25 Kt 23 - for general production expenses;

- Dt 26 Kt 23 - for general business expenses.

Accounting for the costs of repair departments is possible in two options, depending on whether the enterprise has a repair fund. If there is no such fund, then “repair” costs are written off as shown above.

If the fund is created, then its funds are accounted for in a separate subaccount to the account. 96 “Reserves for future expenses.” In this case, repair costs are written off from account 23 to debit 96:

Dt 96 Kt 23.

Also, auxiliary production can provide services on the side. For example, a repair department - to service equipment of other organizations, or a boiler room - to heat not only the company’s buildings, but also its neighbors. In this case, part of the costs related to “third-party” revenue is written off to the debit of the account. 90.2 “Cost of sales”:

Dt 90.2 Kt 23.

Typical postings for subaccounts of account 68

Debit entries:

D68 K50 – the amount of tax or fee was paid to the budget in cash from the cash register.

D68 K51 – the amount of tax or fee to the budget is transferred from the current account.

D68 K19 – VAT presented by suppliers is sent for deduction.

Loan transactions:

D70 K68.1 – personal income tax is withheld from employees’ salaries for payment to the budget.

D90.3 K68.2 – VAT is charged on goods, products, works, services sold for payment to the budget.

D91.2 K68.2 – VAT is charged on sold fixed assets and intangible assets.

D76.Advance K68.2 – VAT is charged on advances received from buyers.

D99 K68.4 – income tax has been accrued and must be paid to the budget.

D20 (26, 44, 91.2) K68.7 – transport tax payable has been accrued.

D26 (44, 91.2) K68.8 – property tax is assessed for payment to the budget.

D99 K68.11 – accrued for payment of UTII.

D99 K68.12 – a single tax of the simplified tax system has been accrued for payment to the budget.

Tax fines and penalties are also reflected in subaccounts depending on the type of tax. The debit of account 68 reflects the payment of penalties and fines, and the credit reflects their accrual for payment.

Account 68 is complex and has subaccounts, click on the link and read in more detail about the accounting objects: 68.1 - personal income tax calculations; 68.2 - payment of VAT; 68.3 - excise tax accounting; 68.4 - payment of income tax; 68.7 - transport tax; 68.8 - tax on property of the organization;

68.11 – payment of UTII; 68.12 – individual entrepreneur reporting on the simplified tax system.

How to close account 23

Closing a costing account is a procedure for allocating the costs collected on it to the cost of finished products (services). It is carried out at the end of each reporting period. This period is usually a month, since most recurring costs are accrued monthly.

The basis for distribution when closing account 23 depends on the specifics of the auxiliary production. If we are talking about energy resources, then Gcal or kWh is chosen as the base, for water supply - a cubic meter of water, for a transport section - t/km, etc. In the case when auxiliary production facilities provide services on the side, the corresponding costs for them must be taken into account and distributed separately.

In some cases, a debit balance may remain after closing, indicating the presence of work in progress. This could be, for example, unfinished complex repairs or the construction of a temporary structure.

***

Accounting account 23 is used to summarize information about the costs of divisions providing main production. The debit of the account collects expenses, and the credit reflects their distribution among accounting objects. The balance on account 23 indicates the presence of work in progress.

How is count 20 used in accounting?

An experienced accountant knows that all costs arising during work processes must be recorded in account 20. We are talking about costs associated with the main activity of the enterprise - hence the name of the account.

The expenses collected on the balance of account 20 are called work in progress by accountants. Which is quite logical, because the invoice reflects them until the full cost of the product is formed.

The accounting policies of most enterprises indicate that expenses will be written off to the 20th account. The field of activity, with the exception of trade, does not affect this. Industrial and agricultural enterprises, construction and transport companies can use this write-off method. Closing account 20 indicates that the products have been produced, and for works and services this means that the person who has undertaken certain obligations has fulfilled them.

For small businesses, a simplified scheme is provided, according to which costs are taken into account in account 20, and other accounts (23, 25, 26) do not need to be used.

Tags: asset, balance sheet, accountant, water supply, capital, loan, tax, order, expense, write-off, transport

Accounting for losses from defects

Defects in production are considered to be products, products, semi-finished products, parts, work that, in terms of their quality, do not meet established standards or technical conditions and cannot be used for their intended purpose or can be used after eliminating detected defects.

Depending on the nature of the defects, a distinction is made between correctable and irreparable (final) defects.

Correctable defects are products, semi-finished products (parts and assemblies) and work that can be used for their intended purpose after correction of defects, and their correction is technically possible and economically feasible.

Final (irreparable) defects are considered to be products, semi-finished products, parts and work that cannot be used for their intended purpose and the correction of which is technically impossible or economically impractical, that is, in cases where correcting the defect will require costs exceeding the costs of manufacturing new products instead defective.

In accordance with the Chart of Accounts, accounting for losses from defects is carried out using account 28 “Defects in production”. The debit of account 28 takes into account the cost of irreparable defects, as well as the costs of correcting defects. The credit of account 28 reflects amounts that reduce losses from defects, in particular, the cost of defective products capitalized at the price of possible use, amounts recovered from those responsible for the defects, amounts recovered from suppliers of substandard materials, the use of which was defective.

Non-refundable amounts of losses from defects are included in the cost of those types of products for which defects are detected. If in the period in which a defect was detected, this type of product was not produced, then the amount of losses from defects is distributed by type of product as general production expenses.

Internal marriage

If a defect is detected directly at the enterprise, at certain stages of the technological process, or directly in finished products before they are transferred to customers, the defect is considered internal.

Losses from internal defects are reflected in the costs of the month in which the defect was detected.

The cost of internal irreparable defects, to be reflected on account 28, is determined by the amount of costs for the manufacture of defective products, which includes the cost of raw materials used, labor costs and the corresponding amounts of unified social tax, costs of maintaining and operating equipment, and part of general production expenses.

Accounting for irreparable internal defects is documented by accounting entries:

- Dt 28

“Defects in production”

Kt 20

“Main production”,

21

“Semi-finished products of own production”,

43

“Finished products” - the cost of defective products is written off; - Dt 10

“Materials”,

21

“Semi-finished products of own production”,

41

“Goods”

Kt 28

“Defects in production” - defective products are capitalized at the price of possible use; - Dt 73

“Settlements from personnel for other operations”

Kt 28

“Defects in production” - amounts to be recovered from those responsible for the defect have been accrued; - Dt 76

subaccount “Calculations for claims”

Kt 28

“Defects in production” - amounts to be recovered from suppliers of defective materials have been accrued; - Dt 20, 23 Kt 28

“Defects in production” - losses from defects are included in the cost of production

Example

The company discovered an irreparable defect in a batch of products, the cause of which was the use of low-quality materials.

The costs of manufacturing defective products were: Cost of materials consumed - 25,000 rubles; Salary - 15,000 rubles; The amount of unified social tax is 5,340 rubles; The share of general production expenses is RUB 7,500. The possible sale price of defective products is 20,000 rubles. A claim has been filed against the supplier of low-quality materials; the amount to be recovered is 10,000 rubles.

Contents of operation Dt CT Amount, rub The cost of defective products is reflected (25,000 + 15,000 + 5,340 + 7,500) 28 20 52 840 Defective products are capitalized at the price of possible sale 43 28 20 000 The amount to be collected from the supplier has been accrued 76 28 10 000 Losses from defects are included in the cost of production (52,840 – 20,000 – 10,000) 20 28 22 840

The cost of internal correctable defects includes the cost of raw materials and supplies spent in correcting defects, the wages of employees directly involved in correcting defects, the corresponding amounts of accrued unified social tax, the share of costs for the maintenance and operation of equipment and general production costs attributable to operations to correct defects.

Accounting for correctable internal defects is documented using the following accounting entries:

- Dt 29

“Defects in production”

Kt 10

“Materials” - the cost of raw materials and supplies used to correct the defect has been written off; - Dt 28

“Defects in production”

Kt 70

- calculation of wages for workers involved in correcting defects; - Dt 28

“Defects in production”

Kt 69

- accrual of unified social tax for the wages of workers engaged in correcting defects; - Dt 28

“Defects in production”

Kt 25

- the corresponding share of general production costs is written off; - Dt 73

“Settlements with personnel for other operations”

Kt 28

“Defects in production” - amounts to be recovered from those responsible for the defect have been accrued; - Dt 76

subaccount “Calculations for claims”

Kt 28

“Defects in production” - amounts to be recovered from suppliers of defective materials have been accrued; - Dt 20, 23 Kt 28

“Defects in production” - the costs of correcting defects are included in the cost of production

Example

A defective batch of products was detected at the enterprise.

The costs of manufacturing defective products were: Cost of materials consumed - 25,000 rubles; Salary - 15,000 rubles; The amount of unified social tax is 5,340 rubles; The share of general production expenses is RUB 7,500. Total - 52,840 rubles. The costs for correcting the defect were: Cost of materials used - 8,000 rubles; Salary - 7,000 rubles; The amount of UST is RUB 2,492; The share of general production expenses is 1,500 rubles. Total - 18,992 rubles 5,000 rubles were recovered from those responsible for the marriage.

Contents of operation Dt CT Amount, rub The cost of materials for correcting defects was written off 28 10 8 000 Wages accrued for correcting defects 28 70 7 000 UST accrued 28 69 2 492 General production costs incurred to correct defects have been written off 28 25 1 500 The amount to be recovered from those responsible for the marriage has been accrued 73 28 5 000 The amount collected is withheld from the employees' salaries 70 73 5 000 The amount of losses from defects is included in the cost of production (8,000 + 7,000 + 2,492 - 5,000) 20 28 13 992 The production cost of finished products is reflected (52,840 + 13,992) 43 20 66 832

PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT

Complete information about accounting rules and taxes for an accountant. Only a specific algorithm of actions, practical examples and expert advice. Nothing extra. Always up-to-date information.

Connect berator