What are “Deferred Expenses”

The concept of deferred expenses (FPO) has historically evolved from the need for organizations to capitalize their sunk expenses and investments in production prospects. These expenses are temporarily added to the capital of the enterprise and are included in the balance sheet asset. Subsequently, when written off in subsequent reporting periods, this capital goes to cost accounts.

In order for incurred costs to be classified as BPR, two conditions must be met:

- costs must be recognized as an asset;

- must relate to several periods.

There is a limited list of expenses that can be classified as BPR. These are the costs associated with:

- seasonality of work;

- mastering new technology and equipment;

- mining and preparatory work;

- land reclamation;

- environmental protection enterprises;

- OS repair (in the absence of reserve).

In practice, this account is used much more widely. Often, accountants send expenses to RBP in order to minimize temporary differences when calculating income tax, that is, they use this account to equalize accounting and non-accounting accounts.

In 2021, only two types can be classified as deferred expenses:

- for upcoming construction costs;

- for licensed software.

Expenses of the first type can be, for example, materials transferred to the construction site. To recognize construction expenses as a RBP, the following conditions must be met:

- the ability to reliably determine costs;

- During the period in which costs are incurred, there is also the possibility of concluding a contract.

Other expenses may also be included in deferred costs. The accountant, at his discretion, may classify expenses as those that need to be written off over a long period of time.

Advances transferred for the execution of some work do not apply .

What is taken into account in account 97?

Deferred expenses must meet two key requirements:

- they can be recognized as an asset;

- they relate to several reporting periods at once.

The accounting regulations distinguish two areas for spending funds, which allow expenses to be attributed to future periods:

- Construction expenses that must be incurred in the upcoming period.

- Expenses associated with the purchase of a licensed software product.

For the first group of costs, accounting account 97 is used, for example, when transferring materials to a construction site. Subscriptions to periodicals or payment of vacation pay to staff cannot be included under these expense items, even if an appropriate reserve was created and its size was not enough.

Account 97 in accounting

The account is active and belongs to the group of financial distribution accounts. Analytical accounting on the account is carried out by type of expense. The Dt account collects all expenses, the Kt account includes financial accounts and accounts of material assets.

Postings to account 97 for RBP accounting

Typical correspondence 97 accounts:

Prospects for using account 97 in accounting

Since 2011, the concept of deferred expenses has not existed in the Russian accounting system, and a line with the corresponding name has been excluded from the balance sheet.

The gradually advancing process of convergence between RAS and IFRS led to the abandonment of the very concept of RBP, but account 97 in the Chart of Accounts still remained.

The main discrepancy is the fact that account 97 is in the balance sheet asset, while in fact it is a reflection of expenses. Account 97 is included in the section of current assets (line 1260) or inventories (line 1210).

Currently, one can imagine two scenarios for the development of events with a score of 97: complete refusal or continued use.

In the first case, all expenses attributed to account 97 should be reflected as current expenses. Transactions under construction contracts will be reflected as work in progress. Expenses for repairs of operating systems (in the absence of reserves) will need to be recognized in the period of actual repairs.

The costs of obtaining licenses will also have to be recognized as a lump sum at the time of actual payment.

This could be called a suitable and logical option, but the realities of our life are unlikely to allow us to achieve it. There are still a number of existing regulations and PBUs that operate with the concept of RBP. This means that, in accordance with them, the accountant will have to attribute expenses corresponding to these acts to account 97, despite the fact that they will not be reflected in Form-1, and in order to be included in its other lines, these expenses will require additional decoding.

In fact, we are moving towards a complete abandonment of the use of the BPO account. But since in practice it is used by organizations to align accounting and financial accounting, this is unlikely to happen soon, despite the assurances of the Ministry of Finance.

Postings to account “97.21”

By debit

| Debit | Credit | Content | Document |

| 97.21 | 60.01 | Inclusion of the cost of services (values) into future expenses. Reflection of debt to the supplier under the contract in rubles. | Receipts (acts, invoices) |

| 97.21 | 60.21 | Inclusion of the cost of services (values) into future expenses. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 97.21 | 60.31 | Inclusion of the cost of services (values) into future expenses. Reflection of debt to the supplier under the contract in monetary units. | Receipts (acts, invoices) |

| 97.21 | 71.01 | Inclusion in deferred expenses of the accountable person's expenses in rubles. | Advance report |

| 97.21 | 71.21 | Inclusion of expenses of an accountable person in foreign currency into deferred expenses | Advance report |

| 97.21 | 76.01.1 | Inclusion in future expenses of expenses for property and personal insurance in rubles. | Receipts (acts, invoices) |

| 97.21 | 76.01.2 | Inclusion in deferred expenses of expenses for voluntary insurance of employees | Receipts (acts, invoices) |

| 97.21 | 76.05 | Inclusion in deferred expenses of the cost of services (valuables) received from other suppliers and contractors under the contract in rubles. | Receipts (acts, invoices) |

| 97.21 | 76.21 | Inclusion of expenses for property and personal insurance in foreign currency into deferred expenses | Receipts (acts, invoices) |

| 97.21 | 76.25 | Inclusion in deferred expenses of the cost of services (valuables) received from other foreign suppliers and contractors under a contract in foreign currency | Receipts (acts, invoices) |

| 97.21 | 76.35 | Inclusion in deferred expenses of the cost of services (values) received from other suppliers and contractors under the contract in monetary units. | Receipts (acts, invoices) |

By loan

| Debit | Credit | Content | Document |

| 000 | 97.21 | Entering opening balances: deferred expenses | Entering balances |

| 20.01 | 97.21 | Inclusion of part of future expenses into the costs of main production | Regular operation |

| 23 | 97.21 | Inclusion of part of deferred expenses into auxiliary production costs | Regular operation |

| 25 | 97.21 | Including part of deferred expenses in general production expenses | Regular operation |

| 26 | 97.21 | Inclusion of part of deferred expenses into general business expenses | Regular operation |

| 29 | 97.21 | Inclusion of part of the expenses of future periods into the expenses of service industries and farms | Regular operation |

| 29 | 97.21 | Inclusion of part of the expenses of future periods into the costs of service industries and farms | Regular operation |

| 44.01 | 97.21 | Inclusion in distribution costs of a portion of deferred expenses in organizations engaged in trading activities | Regular operation |

| 44.02 | 97.21 | Inclusion in commercial expenses of a portion of deferred expenses in organizations engaged in industrial and other production activities | Regular operation |

| 91.02 | 97.21 | Inclusion in other expenses not related to core activities of part of deferred expenses | Regular operation |

Examples of using 97 accounts

Example 1

Technoserv LLC purchased a licensed computer program at a cost of 72,000 rubles. The period of use of the program is 5 years.

Let's do the calculation. Monthly write-off amount: 72,000 / (12*5) = 1,200 rubles.

The receipt will be reflected by postings to account 97:

| Dt | CT | Operation description | Amount, rub. | Document |

| 60 | 51 | Reflection of payment to supplier | 72 000 | Plat. order ref. |

| 97 | 60 | Reflection of software receipt | 72 000 | Invoice |

Every month for 5 years the software will be written off as follows:

| Dt | CT | Operation description | Amount, rub. | Document |

| 26 | 97 | Reflection of write-off of RBP | 1 200 | Accounting information |

Why are future costs necessary?

This means that the organization spent money now, but will write off the amount as expenses later. In this case, accounts receivable and accounts payable are closed in the current period. Such expenses include:

- property insurance costs;

- purchasing licenses;

- mandatory product certification;

- non-exclusive rights to software products;

- land reclamation;

- mining preparatory work.

In accounting, account 97 is classified as active, so all expenses are written off to the debit of other accounts. Accordingly, loan turnover reduces the debit balance. Amounts are shown net of value added tax.

Note from the author! Active accounts are those whose balances can only be accumulated by debit. This has an impact on the structure of the balance sheet. In this case, “active” literally means an asset on the balance sheet.

Analytical accounting of deferred expenses (FPR) is carried out for each incoming asset. This means that each name will have its own card, which indicates:

- Name;

- contract amount;

- recognition of expenses in days or months;

- write-off period corresponding to the validity period specified in the contract;

- accounting account for writing off costs;

- cost item.

For each type of future expenses, its own subaccounts were provided:

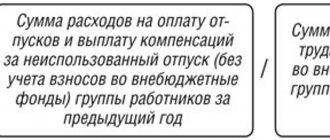

- 97.01 is usually intended for labor costs for future periods (vacation, compensation for dismissal).

- 97.02 is used to account for the costs of voluntary insurance of employees.

- 97.21 is used for other expenses.

Reference! After the release of Order of the Ministry of Finance of the Russian Federation No. 186n dated December 24, 2010, RBP for wages are taken into account in account 96 “Reserves for future expenses”, and subaccount 97.02 is used for insurance of any types provided for in the organization. Paragraph 65 of the order states that costs can be written off in the same way as other assets. However, most enterprises prefer to continue to separately account for assets that extend into the future.

What costs can be attributed to future periods?

Based on the fact that in the Chart of Accounts and the instructions for its use, account 97 “Deferred Expenses” remains (and also in some PBUs this concept exists), it is possible to identify expenses that are written off to cost not immediately, but gradually. These are the costs:

- related to upcoming construction work (clause 16 of PBU 2/2008);

- made as a one-time payment for the right to use licensed software (clause 39 of PBU 14/2007).

In addition, the accountant himself may attribute some types of costs to the PBU if his specific case is not specified in any PBU.

To do this, it is necessary to comply with the conditions under which the costs incurred can be classified as expenses (clause 16 of PBU 10/99):

- the expense is made on the basis of a specific agreement in accordance with the requirements of the law and business customs;

- there is reason to believe that as a result of this operation the economic benefit of the organization will decrease;

- the amount of costs can be determined.

If at least one of the listed conditions is not met, then the expenses incurred cannot be considered expenses and must be reflected in accounting as accounts receivable.

About the basic principles of grouping costs in accounting, read the article “List of the most frequently used cost items in accounting.”