Sample order for conducting an inventory upon dismissal

Materials based on the inventory results must be submitted to the financial department no later than the year.

6. The financial department (full name) checks and compares the data from inventory lists and inventory reports with budget accounting data and prepares proposals to the manager based on the results of the inventory before the end of the year. In addition to the director, the document must be marked by the designated responsible person and the employee appointed as the supervisor.

The mark consists of the full names of the listed persons, the names of their positions and the time of their familiarization with the order. An order to change the financially responsible person is not the only document in the system of distribution of material assets.

Order for inventory in connection with dismissal sample

In the event of visits by representatives of State Financial Control bodies, the attention of the inspectors will be focused precisely on the listed points. To avoid claims, it is recommended to follow the methodological recommendations of the Ministry of Finance of the Russian Federation when displaying this information. For journal keeping, the INV-23 form is provided.

The standard form of an order to change a financially responsible employee is not currently established at the legislative level. In addition, if the company has its own document template, developed and approved by management, then when creating all other orders, you need to focus on it.

Inventory when changing the financially responsible person

The management of the organization must provide the conditions and provide the necessary assistance in carrying out the operation in question to obtain the most objective and complete inventory result. For this purpose, he (as necessary) should provide the members of the commission with relevant workers, measuring instruments, etc. Obviously, if the commission does not have the ability to fully count and measure material assets when conducting an inventory of the MOL, its results can hardly be considered objective.

The question often arises whether the financially responsible person can carry out an inventory. Answer: maybe, if his financial responsibility in this case is not the subject of inventory. This answer is the same for both the transmitter and the recipient.

Inventory and registration of its results

The verification consists of comparing and contrasting the actual volumes of values with those recorded in the primary documents. Therefore, first, the commission members get acquainted with the inventories of existing valuables, goods, and supplies. They then compare the assets on hand to what is on paper.

At the end of the counting and comparison procedure, the commission members draw up documents containing the results of the inspection. Most often this is not one document, but several. Thus, the identified discrepancies are recorded in the results sheet. As a template for such a document, you can use form No. INV-26 from Resolution of the State Statistics Committee of March 27, 2000 No. 26.

Documents for recording the results of the inventory are drawn up after it is completed. For example, if your organization carried out an inventory before drawing up annual reports in December 2018, then you can draw up documents based on its results as early as January 2019. If a discrepancy is identified between the actual data and accounting data, then they must be recorded in the reconciliation statement. A separate comparison sheet is drawn up for objects in custody or leased objects.

The accountant must draw up a matching statement in two copies. One of them will be kept in the accounting department, the second will be transferred to the financially responsible person.

Later, the results are discussed at a special meeting of the permanent inventory commission, which is the basis for drawing up a protocol. There is no approved form for the protocol, so the main requirements are to correctly indicate the data from the order on the initiation of control measures, about the members of the commission, and the discrepancies identified. If there are no discrepancies, this must be documented. The commission also puts forward proposals to capitalize, write off identified surpluses (deficiencies), and reflect them on the balance sheet. In addition, other initiatives can be recorded in the protocol, for example, strengthening security in order to avoid theft in the future. So, the list of final documents may contain the following documents:

- a statement of records of the results identified by the inventory;

- comparison sheet of inventory results;

- a comparative statement of the results of the inventory of valuables owned by the organization;

- a comparative statement of the results of the inventory of rented objects;

- inventory list;

- explanatory letter.

Order for inventory upon dismissal

The two-month period is calculated from the date of delivery to the employee of the document informing about the reduction. The Labor Code requires, simultaneously with the delivery of the document informing the employee about the layoff, to offer the employee another vacancy in the organization - of course, if such a vacancy exists.

In the second case, the act is drawn up when the depositor takes back material assets from the custodian. At the same time, the act indicates that all the agreed terms of the contract have been properly fulfilled, that is, the item has been received back or delivered to the appointed place. In addition, the material value must be taken into account: it must correspond to the original quality.

How to formalize the dismissal of a materially responsible person

- To clarify the timing and inventory items subject to inventory, an inventory commission is created by order of the manager.

- Before starting the inventory, the chief accountant is obliged to present to each member of the commission the entire list of the company’s property with cost characteristics, as well as liabilities.

- Information in the registers reflects: the date of the business transaction, the amount of the business transaction, the remaining value as of the inventory date.

- The head of the commission endorses all accounting data.

- Receipts for write-offs and receipts are taken from MOL employees.

- All information is verified.

However, if the inventory has taken place, the employer has the right to present its claims. Article 232 of the Labor Code regulates the fact that dismissal does not exempt MOL from compensation for damage that was caused to the enterprise during its employment.

Dismissal without service, or by agreement of the parties

One day dismissal is described in Article 81 of the Labor Code of the Russian Federation. These postulates apply to any full-time employee.

Dismissal “by agreement of the parties, without working off, is allowed in several cases:

- The employee entered a university for a full-time training program. He presented a certificate from the dean's office.

- The employee decided to resign due to retirement.

- An employee travels to another location, including for medical reasons.

- The child is forced to resign in order to care for an elderly relative or a child under 14 years of age, as well as a disabled child.

See how to obtain citizenship of the Republic of Belarus. About Spanish citizenship for Russians. Find it at the link.

Application for dismissal without inventory, sample

An application for same-day dismissal must be in writing.

Example:

Head of the enterprise Full name

from position, full name

Statement

I ask you to dismiss me “by agreement of the parties”, in accordance with Article 81 of the Labor Code of the Russian Federation, in connection with leaving for Spain for permanent residence with my wife.

Appendix: 1. Copies of air tickets.

- Copies of an open visa.

Date Signature Explanation

Order for inventory upon dismissal, sample filling

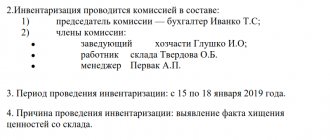

Order on inventory No. INV-22. An order to conduct an inventory for a particular case can be drawn up taking into account the details provided for this form. As a sample, below is the form of the Order to conduct an inventory.

- company name;

- date of preparation and document number;

- the purpose of the inspection and what it will concern: goods, fixed assets, tangible assets, accounts receivable, all property of the company;

- divisions and departments of the company in which the inspection will be carried out: warehouse, store, accounting or the entire company as a whole;

- period and duration of the event - from what date to what date, when to provide the results of verification actions;

- composition of the commission and full name

What to do if a shortage is detected based on inventory results

If, as a result of the recount, a shortage of valuables is revealed and there are serious reasons to believe that the dismissed employee is to blame for this, the employer is obliged to conduct an internal audit (Article 247 of the Labor Code of the Russian Federation). During it, all the circumstances of the shortage are clarified, the degree of guilt of the employee and the amount of direct actual damage caused are established.

Verification steps:

- Signing an order to conduct an inspection and create a corresponding commission.

- Carrying out all procedures for studying inventory materials - interviewing witnesses, considering other available evidence.

- Drawing up a report based on the results of the circumstances under investigation (signed by all members of the commission).

- Requesting written explanations from the employee based on the results of the inspection.

SAMPLE OFFICE INVESTIGATION ACT

If an employee refuses to give an explanation, a written statement about this must be drawn up, also signed by all members of the commission.

The amount of damage within the limits of average monthly earnings can be withheld upon dismissal - based on the order of the employer. If the amount of losses is more than a month’s earnings, you can contact the employee with a demand to compensate him on a voluntary basis (clause and part 1, part 2 of Article 243, Article 244 of the Labor Code of the Russian Federation). If he refuses to do this, the employer has the right to go to court to claim compensation for losses caused.

Inventory upon dismissal of a financially responsible person

It is not always easy to lay off an employee; there are some nuances that you should know. In particular, the legislation defines a list of employees who have such an advantage as the right to remain in the position held by the employee despite the reduction.

- The financially responsible person transfers the valuables entrusted to him to another employee according to the act.

- The head of the enterprise issues an order on the temporary appointment of this employee (he must belong to the same category of personnel). An agreement is concluded with an employee of the organization and valuables are transferred to him according to the act.

- They hire a new employee and sign a contract with him. The temporarily appointed employee transfers the valuables to the newly hired employee under the act.

The procedure for transferring values

There are two transmission schemes. values that presuppose a specific algorithm of actions:

- there is an applicant for a vacant position who is ready to start work the next day after the current employee leaves;

- A candidate for the vacant position has not yet been found.

In the first case, it is recommended to start searching for a candidate among the employees already on staff, since trusting the company’s values to the first person you meet is unwise.

It is also better to enter into an agreement on full responsibility with those wishing to enter into an employment relationship (which will allow the employer to avoid considerable expenses in the event of an unforeseen situation).

In the first case, the procedure will be as follows:

- A new employee is elected.

- An inventory is being taken.

- The previous employee leaves the workplace.

- The next day he is replaced by a newly hired person.

The second case implies the absence of a candidate for the position from outside and the consent of one of the employees to perform labor functions as a part-time job (on a part-time basis):

- consent for the combination has been received;

- an inventory is carried out, property is transferred according to the act;

- dismissal is issued. responsible person;

- another worker is assigned to perform an additional function;

- a temporary combination agreement is concluded;

- a search for a new employee is carried out;

- a re-inspection is carried out;

- part-time work is cancelled;

- a new worker is hired;

- an agreement on the performance of activities is concluded;

- the incumbent transfers the property under the deed.

Inventory upon dismissal of a financially responsible employee

Directly conducting an inventory is a mandatory procedure not only when changing financially responsible employees. Inventory can be carried out at certain intervals and under certain conditions, at the initiative of the employer himself or at the request of regulatory and supervisory authorities. At the same time, the change of a financially responsible person, as one of such situations, practically does not distinguish the inventory procedure itself at the enterprise from similar actions performed in other cases. The general inventory process is as follows:

- Top management of the enterprise. Managers of all ranks, chief accountants and their deputies.

- Accounting and finance workers. Persons who carry out such activities may also bear full financial responsibility for their actions.

- Cashiers, salespeople, administrators and hall employees whose activities involve the ability to access the financial resources of the enterprise or clients.

- Storekeepers, laboratory assistants, librarians and other persons responsible for the effective storage of material assets and valuables.

- Any employees whose work activities are related to precious stones, securities or direct circulation of financial assets.

Order to change the materially responsible person

To do this, information about their publication must be recorded in a special document - a journal (as a rule, it is kept either by the secretary or another responsible employee). Here it is enough to enter the name and number of the order, the date of its issue. If necessary, this data will help not only prove the fact that the order was created, but also quickly and easily find it

As for the design, the drafters of the order are also free to choose: make it handwritten or printed. Only in the second case the order must be printed. For printing, both a simple sheet of paper and a form with the details and company logo printed on it are suitable.

All about changing the financially responsible person: sample order and step-by-step instructions

The signing of the transfer and acceptance certificate becomes the main basis only for internal movement. When dismissing and hiring a new employee, the acceptance certificate comes into force only if an employment contract and a liability agreement are drawn up with the newly hired person.

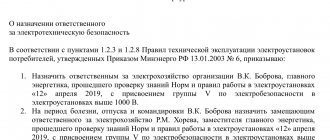

- Appoint a financially responsible person from among the organization’s full-time employees.

- Confirm the appointment by order.

- Transfer to an authorized employee by conducting an inventory all existing valuables.

- Dismiss the financially responsible person.

- Accept a new employee by concluding an employment contract and a liability agreement with him.

- Draw up a new order, on the basis of which the intermediate employee authorized to store property transfers material assets to the newly hired person.

- Registration of the acceptance procedure with an act.

Types of liability

Article 21 of the Labor Code contains information that every employee of an enterprise must treat property belonging to the organization responsibly. Therefore, if equipment or other items registered with the company are intentionally or accidentally destroyed or broken, the guilty citizen must compensate for the losses incurred.

But for some employees, for example, a warehouse manager, their job responsibilities include the need to preserve material assets. Responsibility may be:

- full;

- collective;

- within the limits of the damage caused.

In the latter case, it is not even necessary to sign any separate agreement with the employee. During the performance of work duties, a person uses property belonging to the company, and he must treat it with care so as not to violate its integrity. If, for various reasons, property breaks or is destroyed, and there is evidence of the employee’s guilt, then the citizen will have to compensate for the damage caused.

Some careless employers force all new employees to sign a liability agreement, but this violates the provisions of the Labor Code if the position of a citizen is not included in the list approved by PP No. 823.

Order to conduct an inventory in connection with the change of pier

Home → Accounting consultations → Inventory Updated: February 9, 2021 Dismissal and other circumstances may become the basis for conducting an inventory when changing the financially responsible person (hereinafter also referred to as the MOL). The procedure for its conduct and registration is regulated in detail by the legislation of the Russian Federation. The result of such an inventory may be surpluses or shortages. How to properly conduct such an inventory and document its results will be discussed below. Inventory after the dismissal of a financially responsible person The legislation of the Russian Federation provides for several cases in which an inventory is necessary. One of such cases is the change of one financially responsible person to another (clause 27 of PBU dated July 29, 1998 No. 34n).

There is no unified form of the order; it is drawn up on the basis of the office management system adopted in each specific enterprise or on the form of the established form for organizational documents. This document must contain the required details: name of the organization, title of the document (Order on change of materially responsible persons), date of its preparation.

Grounds for termination of an employment contract with MOL

When dismissing an employee who is a materially responsible person, the general procedure for terminating employment relations, stipulated by Chapter 13 of the Labor Code of the Russian Federation, applies. However, the presence of material liability regulated by an employment contract or an additional agreement to it still imposes its own specifics.

If we are guided by Article 77 of the Labor Code of the Russian Federation, the dismissal of an employee who is a MOL can be carried out on the following possible grounds:

- The parties reached an appropriate agreement (Article 78 of the Labor Code of the Russian Federation).

- The employment contract has expired (Article 79 of the Labor Code of the Russian Federation).

- The employee’s own desire (personal initiative), which is stipulated by Article 80 of the Labor Code of the Russian Federation.

- Personal initiative of the management of the organization (employer), as provided for in Articles and 81 of the Labor Code of the Russian Federation.

- The employee changed employers or took an elected position. Such a reason is allowed if the employee himself asked for it or, alternatively, gave his consent to it.

- The employee refused to continue working due to a change in the ownership of the employing company's assets or its reorganization (Article 75 of the Labor Code of the Russian Federation).

- The citizen refused to continue working with this employer due to a change in the parameters of the employment contract previously determined by the parties (clause 4 of Article 74 of the Labor Code of the Russian Federation).

- The citizen refused to be transferred to another job if such a transfer was assigned to him in accordance with a proper medical report. Another reason in this context is that the employer was unable to provide such an employee with appropriate employment. Such reasons are provided for in parts 3-4 of Article 73 of the Labor Code of the Russian Federation.

- The employer changed his geographical location, and the employee refused to follow him for the subsequent performance of work duties (Part 1 of Article 72.1 of the Labor Code of the Russian Federation).

- Circumstances the occurrence of which does not depend on the will and desire of the parties. The basis is Article 83 of the Labor Code of the Russian Federation.

- When drawing up an employment contract, certain rules regulated by the Labor Code or other federal law were violated, which resulted in the impossibility of further work. The basis is Article 84 of the Labor Code of the Russian Federation.

- Other grounds stipulated by the current legislation of the Russian Federation.

Thus, the financially responsible person terminates the employment relationship on general legal grounds.

The specificity of MOL's departure is that before his dismissal he must officially transfer (return) the assets entrusted to him to the employer. This must be done 14 days before the last working day.

If an employee leaves on his own initiative (Article 80 of the Labor Code), he sends a corresponding statement to the employer 14 days before the upcoming departure (but no later).

During this two-week period, the employee, who is the financially responsible person, transfers the entrusted assets to the employer. In this case, the fact that the parties have no mutual claims is formalized by an appropriate act of the employer.

How to fire at will - step-by-step instructions

If an employee registered as a materially responsible person resigns from the organization on his own initiative, the general dismissal regulations provided for in Article 80 of the Labor Code are applied.

The fact that this employee is responsible for the inventory items entrusted to him certainly imposes its own specifics on the dismissal procedure.

The corresponding dismissal procedure is implemented as follows:

- Step 1. An application from the retiring employee is sent to the management of the employing organization.

The resigning citizen must submit such paper 14 days before his upcoming departure (no later). However, the parties have the right to stipulate a different period for filing the appropriate notice.

A two-week period is required to transfer all cases, perform an inventory (audit) of inventory items, and select another candidate for the vacancy.

- Step 2. Conducting an audit of entrusted assets (inventory and materials).

The audit is carried out by a special commission on the basis of a corresponding order from the management of the organization. Inventory is stipulated by an additional agreement defining the employee’s financial responsibility.

This procedure is carried out with the participation of both parties – the employee (materially responsible person) and the employer’s representative.

Relevant assets are subject to identification, careful recalculation and detailed verification. Further actions are determined by the results of this audit.

- Step 3. Transfer and acceptance of entrusted assets.

The procedure for acceptance and transfer of inventory items is carried out if, based on the results of the audit, there are no inconsistencies, and is formalized by drawing up an appropriate act.

The document is signed by the retiring employee, a representative of the employing company, as well as a new employee who has filled the vacancy.

- Step 4. The employer draws up an administrative act (order) approving the dismissal of the financially responsible person at his own request.

The paper is drawn up according to the T-8 template and contains all the necessary information about this disposal.

- Step 5. Providing the retired employee with labor documentation.

The employer issues him a work book, documentation of earnings, a 2-NDFL certificate, as well as other papers provided upon a separate request.

- Step 6. Carrying out settlements (mutual settlements) with the retired employee.

The procedure is carried out simultaneously with the provision of labor documentation to him. The dismissed person is given a salary, as well as compensation for unused vacation. Calculation of payments upon dismissal is carried out by filling out the calculation note T-61.

It is these payments that are considered mandatory if the employee resigns on his own initiative.

Read more about payments upon dismissal at your own request here.

Inventory procedure

If an employee registered as a financially responsible person resigns, an audit of the assets entrusted to him (inventory and materials) must be carried out.

Based on the results of such an inventory, an act is drawn up confirming the safety of the transferred property or, conversely, its loss.

The inspection is carried out by a special commission created on the basis of a proper order from the employer. It is carried out with the personal participation of the resigning employee, a representative of the organization’s management, as well as a new employee filling the MOL vacancy (if a new employee has already been found and is ready to take this position).

When a financially responsible person is dismissed, an audit is carried out to establish probable damage or confirm the absence of such damage.

If the fact of loss (shortage, damage to goods and materials) is discovered, the resigning financially responsible employee will bear due responsibility.

For such an audit, the following algorithm is provided:

- Management issues the appropriate order.

- A special inventory commission is being formed.

- Inspected assets are identified, identified, counted, and then verified against accounting records. At the same time, their quality and physical condition are checked.

- Based on the results of checking the quality and quantity, an act is issued approving the results of the inventory. As a rule, it is drawn up in triplicate (for accounting, for a resigning employee, for a new employee).

- If a discrepancy is detected - a surplus or shortage - this fact is documented by drawing up a proper inventory. Missing or excess items are recorded in this list.

- Based on the facts of detected discrepancies (shortages, surpluses), the departing employee provides explanations, which are documented in a written explanatory note.

- The damage caused to the employer by these inconsistencies is assessed. A cause-and-effect relationship is established between the employee’s behavior (MOL) and the identified damage.

- Recovery of damages from an employee is formalized by a corresponding resolution (order) of the employer.

Transfer of material assets from one person to another

When a financially responsible employee is dismissed, a mandatory transfer of assets (materials and materials) officially entrusted to him for storage is carried out. In other words, the employee (MOL) must return these assets to the employer.

This procedure must be formalized by drawing up a special act of acceptance and transfer of inventory items, recording the following information:

- List of assets to be returned. A list of goods and materials subject to transfer and acceptance is compiled. For each item, the quantity and cost are indicated.

- The exact date of drawing up this act.

- Information about the employer (basic details, name, address).

- Information about the departing employee.

- Information about the new employee - if there is one.

- The period of time during which the financially responsible employee was responsible for the safety of the assets entrusted to him.

This act is signed by the resigning employee, the new employee (if any) and the employer’s representative.

The signing of this act means the removal of financial responsibility from the retiring employee and, accordingly, the transfer of such responsibility to a new person.

.

What documents need to be completed?

To dismiss a working citizen who is an MOL, you need to take care of completing the following documentation:

- Statement of upcoming dismissal addressed to the company management.

- An order from the employer to take inventory of entrusted assets, indicating the date of its completion and the proper basis.

- An inventory report confirming its results (compliance, surplus, shortage). Signed by commission members and responsible persons.

- The act of return (transfer-reception) of entrusted assets.

- An employer's order to dismiss a working citizen.

- Entering relevant information into the work book of the retiring person.

- Resolution on the recovery of damages from the retiring employee (if necessary).

- A written explanatory statement from the resigning subject regarding the facts of shortage or surplus (if required).