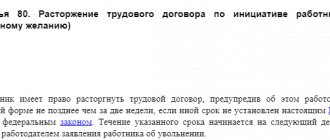

Often its importance for the enterprise is so great that the figure of the chief accountant is rightfully placed on a par with the manager. It is not surprising that the decision to dismiss the chief accountant at his own request will not leave the team and its head indifferent. At the same time, the Labor Code of the Russian Federation does not distinguish the chief accountant from the general mass of other employees and does not contain special articles on the topic of his dismissal on personal initiative. So, having written a statement, the chief accountant will leave his workplace within 14 days, and no one can legally prevent him from doing this (Article 80 of the Labor Code of the Russian Federation).

Not a single article of the Labor Code of the Russian Federation contains additional conditions or specifics for the dismissal of the chief accountant of an enterprise on personal initiative. The warning period and procedures do not depend on the organizational and legal form of the enterprise or its form of ownership.

Procedure for transferring cases

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

A written statement begins the difficult and thorny path of transferring business from the outgoing employee to the new one. Since the law does not contain clear requirements regarding the mandatory nature and form of the act of acceptance and transfer of cases, it can be approved and the details of the process can be specified in the order of the head (Article 8 of the Labor Code of the Russian Federation):

- Full names and positions of the participants in the transfer (a new chief accountant, deputy, any other employee, or the head of the enterprise himself can be appointed as a successor).

- Timing of the procedure and completion.

- Date of division of responsibility (the last period is determined, which must be completely closed by the old chief accountant, including the last reporting period and its list).

- Range of questions for verification (balance sheet, balances on accounting accounts, statements of synthetic and analytical accounting, breakdown of receivables and payables, etc.)

- List of property, documents and other valuables that are subject to responsible storage by the new head of the accounting department (originals of title documents, carriers of information about electronic signatures, seals and stamps, keys to safes and their contents).

- Data of officials entitled to be present at the transfer.

- Form of the final document.

Even if a new chief accountant has already been found and is ready to start work, this will not be enough to sign the document acceptance certificate. The fact is that signing such a document means accepting all papers and valuables for storage and use, and only an employee of the enterprise can do this. This means that on the date of signing the act, an employment contract must be drawn up with the person. Since two chief accountants at one enterprise are nonsense, it is better to accept a candidate for the position of chief accountant as his deputy or one of his deputies. And then transfer him to the already vacated post.

If there is no desire to produce personnel orders, then the transfer act can be signed by the manager himself. Moreover, paragraph 1 of Art. 7 402-FZ directly obliges him to organize the safety of documentation in the company. Please remember that in this case you will need to go through the transfer procedure again. Now the act will be signed between the manager and the new chief accountant who has taken office. Otherwise, it will not be possible to hold him responsible for documents and valuables.

Dismissal by agreement of the parties

Dismissal by agreement of the parties is initiated by the employer or the accountant himself. The parties discuss the nuances of the process, agree on conditions, compensation, deadlines, payment and what will happen if the agreement is violated. For example, that the chief accountant works until he finds a replacement employee, and then transfers the cases to him within two days. The agreement is drawn up in free form - it will be useful if one of the parties violates the terms.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

What should be transferred?

Documenting the process of transferring cases when the chief accountant resigns at his own request is interesting for all parties in as much detail as possible. Both the incoming and outgoing specialist will be able to protect themselves from the boss and inspectors with a detailed list of documents and information listed in the act. Therefore, when the question arises about what should be included in the final document, you need to use a simple rule: if there is an accounting entry, there must be a primary document. In other words, if at one time the chief accountant entered a figure into the accounting registers or used it to prepare reports, then he must present the new employee taking office with the paper from which it was taken.

Those who have experience working as an accountant or auditor understand perfectly well how much primary documentation and documentation compiled on its basis can accumulate in an enterprise even over a short period of work. It’s good if the enterprise has already undergone a documentary audit relatively recently, then documents only for the subsequent period after the audit are subject to transfer. You can simply read the report following the inspection to make sure that the predecessor has fulfilled all the requirements set out in it and paid all penalties.

Main list

Regardless of the specifics of the enterprise’s activities, there is a constant list of transferred documents and valuables that the chief accountant must hand over upon dismissal:

- cash documents and reports;

- bank statements;

- accounting registers and turnover accounting statements;

- receipt and expenditure documents for inventory items;

- certificates of work performed and services received;

- inventory cards for accounting, depreciation and movement of fixed assets, inventory sheets and inventories of the latest inventory;

- acts of write-off of valuables, replenishment or reconstruction of fixed assets;

- advance reports and supporting documents;

- documents on targeted or government financing, if such transactions took place in the company;

- loan agreements and annexes thereto;

- statements of accrual and payments to employees;

- estimates, calculations and technological maps.

The transfer act must also record the balances of the accounting accounts as of the date of division of responsibility specified in the order:

- the balance of funds in the cash register and on current accounts of the enterprise, and it is advisable to immediately carry out a sudden inventory of them;

- decipher accounts receivable and payable in the context of counterparties (consumers of the enterprise’s products and suppliers of goods and services);

- balances or overexpenditures on accountable amounts in the context of financially responsible persons;

When drawing up the act, it would be useful to include information that the new chief accountant is familiar with the order on accounting policies, the job description of the chief accountant, the regulations on bonuses and incentives for employees, the collective agreement and the charter of the enterprise. Also, all items and intangible assets stored by the previous chief accountant are transferred against signature.

Sample order for acceptance and transfer of the chief accountant's file:

Act on the acceptance and transfer of cases by the head office:

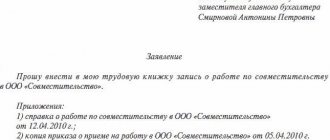

Sample entry in a work book:

Deadlines

If the company from which the chief accountant is leaving is quite young and its period of activity does not exceed a couple of years, then you need to transfer documents for the entire period of work. If the life of the company is much longer, then the parties to the transfer need to decide on the depth of verification and inventory of the archive:

| Date of last check | Document transfer period | Base |

| Less than three years ago | The original audit report and all documents for the subsequent period are transferred | Art. 113 Tax Code of the Russian Federation |

| Three to five years ago | For the entire period from the date of the last inspection | Art. 23, pp. 8 clause 1 of the Tax Code of the Russian Federation, art. 29 402-FZ |

| More than five years ago or never | For the last five complete annual reporting periods | Art. 29 402-FZ |

| Regardless of the timing of the inspection | Long-term storage documents (from 10 years), such as personal files of employees and salary slips, are submitted for the entire period of operation of the enterprise | Order of the Ministry of Culture of Russia No. 558 |

It is unlikely that absolutely all the primary documents of the enterprise are in the custody of the chief accountant, but knowing their storage periods will be useful for conducting an inventory in departments and areas in the accounting department. The new specialist only needs to submit those papers that were in the personal charge of the old chief accountant.

The responsibility of the resigning chief accountant to transfer affairs applies only to those documents that are under his direct control or provided to him under a custody agreement.

How to avoid problems when dismissing a chief accountant

The chief accountant has access to important information of the organization. To protect yourself, follow a few conditions.

- Dismiss legally according to the established procedure. This will help avoid lawsuits if the employee considers himself fired unfairly.

- Draw up competent contracts that stipulate the accountant’s responsibility for disclosing secrets. This will protect against information leakage.

- Duplicate data. This will protect against information loss. There is a risk that the accountant may change or destroy data to which he has access.

- Duplicate the position of chief accountant with his deputy. He will insure the company in case of dismissal during the search for a new chief accountant.

What to do if a shortage is identified during transfer?

One of the most important sections of the act of transferring cases is the reflection of shortages and errors in documents. After all, it is often during the submission of documents that the absence of the primary form or gaps in its completion are discovered. This may be a reason for the new accountant not to sign the document. It is clear that correction or restoration is the responsibility of the former specialist, but he may not have time to do this before the date of dismissal or even refuse to do it. Then you need to place data on defects and violations in accounting, as well as storage of documentation, in a separate section or find another way to notify management. The decision about who will fix errors and how they will be paid for this falls within the competence of management.

If the cases are not transferred according to the act, whoever discovers shortcomings in the maintenance of documentation or the safety of the primary accountant, the responsibility will fall on the resigned chief accountant.

What if there is no one to delegate matters to?

If the chief accountant’s own desire has become an unpleasant surprise for the employer, difficulties may arise with the search for a new specialist and the smooth transfer of affairs. The boss will simply sabotage the process by not appointing a successor and not signing the act himself. And although his actions can be indirectly regarded as an attempt to detain a specialist, it will be problematic to prove this in the same court. After all, the Labor Code does not say a word about how exactly this process should be organized; the enterprise is given complete freedom in this matter (Article 8 of the Labor Code of the Russian Federation).

You can partially try to protect yourself with the help of your subordinates, because the position of chief accountant most often implies the presence of several more accountants in the company. Each of them is responsible for their own area of work, and, if these employees are loyal, you can try to sign with each of them your own copy of the act on the integrity of documents for the current and previous periods.

If the enterprise is large enough and has an archival service in its structure, then it is best to hand over the papers to the archivist. In any case, it is better to spend the two-week warning period for the chief accountant to check and put all the files in order, even if there is no one to hand them over to.

Unlike the retiring manager, it will be difficult for the chief accountant to transfer the archive for storage to a third-party organization or take the documents with him for self-storage.

Intentional harm and liability

Intentional sabotage in the form of destruction of any papers on the part of management is unlikely, because responsibility for the accurate reflection of accounting information and administrative liability for its violation extends to the director to the same extent. The norms of the Tax Code of the Russian Federation speak about the responsibility of the taxpayer (you need to understand - enterprises), and the Code of Administrative Offenses of the Russian Federation - about the responsibility of officials (that is, both the manager and the chief accountant). So in this sense, the director and chief accountant are “in the same team” and the management will not harm the departed specialist in this way.

conclusions

Thus, the chief accountant is dismissed on the generally accepted grounds and procedures of the Labor Code of the Russian Federation. If he has the status of a financially responsible person or a managerial employee, his dismissal may be carried out with some nuances. For example, an inventory of accounting documentation, an expert audit, and an audit will be required.

An important point is the transfer of affairs to the new employee from the outgoing chief accountant. The fact of such a transfer can (and is even strongly recommended) be formalized by a special transfer deed. This act is not regulated by law, but it must be signed by both parties. At the same time, the legislation provides for the responsibility of the chief accountant for accidental errors and intentional misconduct.

What will you have to answer for after leaving?

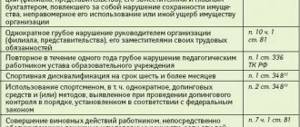

As in the case of the former manager, the dismissal of the chief accountant will not be a reason to forget about everything and erase the period of work in the company from life. At least for the next few years. Here is a non-exhaustive list of the most common reasons:

| Regulatory document | Article | Type of violation | Statute of limitations |

| Tax Code of the Russian Federation | Art. 120 | Gross violations in accounting, including those resulting in understatement of taxes (lack of primary documents or intentional distortions in statements and reports) | 3 years from the end of the reporting period (Article 113 of the Tax Code of the Russian Federation) |

| Art. 122 | Late payment of taxes | ||

| Code of Administrative Offenses of the Russian Federation | Chapter 15 | Fines in connection with violation of deadlines for registration, filing reports, distortions in accounting, misuse of funds, etc. This article implies personal liability of company officials. | 1 year from the date of discovery (Article 4.5 of the Code of Administrative Offenses of the Russian Federation) |

| Criminal Code of the Russian Federation | Art. 198, 199 | Evasion of timely payment of taxes | Minor violations - 24 months from the date of establishment of the crime, moderate violations - 6 years, serious violations - 10 years (Article 78 of the Criminal Code of the Russian Federation) |

| Art. 165 | Damage resulting from breach of trust | ||

| Art. 201 | Abuse of official position | ||

| Art. 293 | Negligent attitude towards work | ||

| Art. 327 | Forgery of documents | ||

| Labor Code of the Russian Federation | Art. 238 | Material damage due to the direct fault of the chief accountant (charged in the amount of average monthly earnings, unless the employment contract stipulates full financial responsibility, Article 241 of the Labor Code of the Russian Federation) | 1 year from the date of discovery of the fact of damage (Article 392 of the Labor Code of the Russian Federation) |

Even if facts of violations or economic crimes were discovered at the enterprise after the departure of the chief accountant, he can be held accountable only if there is intent or direct guilt of the dismissed person.

Situations excluding the dismissal of the chief accountant

The restrictions associated with the impossibility of dismissal do not differ from other cases. They are associated with temporary disability or the employee being on vacation. Before dismissing the chief accountant at the initiative of the employer, he must return to work. The only exception is the liquidation of a company, when it actually ceases its activities. A similar procedure applies to individual entrepreneurs. Otherwise, the employer is guided by the provisions of Art. 81 of the Labor Code of the Russian Federation, which provides for the grounds and circumstances of dismissal.

Financial liability to the employer

The opportunity to recover material damage from an employee, provided for in Article 238 of the Labor Code of the Russian Federation, provides only for cases of direct calculable financial harm. The favorite topic of some employers about lost profits is completely excluded from the Labor Code of the Russian Federation.

Since Article 241 of the Labor Code of the Russian Federation limits the amount of liability to the average salary, and the chief accountant is not included in the list of positions with which a separate agreement on full financial liability can be concluded, the obligation to compensate for damage can only be prescribed in an employment contract (Article 243 of the Labor Code). But even then, the employee retains the right to refuse to deduct material damage from his salary. In such circumstances, the employer will be forced to prove the need for compensation and the amount of damage in court (Article 248 of the Labor Code).

Working off

The status and position of the chief accountant do not affect the duration of his work. Here the law also does not make any exceptions. The period is 2 weeks, but can be reduced by agreement of the parties. In some cases described above, the reduction is radical in nature when the employee is fired on the day the application is submitted.

The specifics of the chief accountant's activities leave their mark. Regardless of the circumstances, he must hand over the files and material assets according to the act, as well as documents according to the inventory. Refusal always has consequences. Thus, the responsibility of the chief accountant after dismissal (if violations are discovered) may also be of a criminal nature.

Audit as a way to reconcile the parties

It is unlikely that the chief accountant will suddenly decide to resign of his own free will. The brief and streamlined formulation often hides the idea of changing jobs that has been mulled over for weeks or months, as well as accumulated mutual dissatisfaction with management. In this case, it may be acceptable for both parties to conduct an audit of the enterprise’s activities over the past few years.

Firstly, auditors will perform a complete review of all documentation instead of a selective one, which is practiced during the standard transfer of cases between accountants. Secondly, if deficiencies are detected, the company will be given recommendations on correcting them or restoring missing papers. Thirdly, under an agreement with the audit company, responsibility for all detected violations of tax or other legislation during the audited period will be assigned to the involved auditors.

How not to work off

Now it is clear how the chief accountant is dismissed at his own request. Working off, as already mentioned, in this situation is provided for by the legislation of the Russian Federation. But sometimes it can be avoided.

How exactly? For this, standard secrets are used. Namely:

- an agreement with the employer (it is almost impossible to achieve, but it is worth trying);

- dismissal due to incapacity for work (termination of the contract is carried out on the day specified in the application);

- going on sick leave followed by filing a letter of resignation;

- vacation (at your own expense), accompanied by notice of termination of the relationship.

There are no more tips and recommendations on how to legally not work 2 weeks. It is clear how the dismissal of the chief accountant is formalized according to the Labor Code. This process, if done correctly, does not cause any trouble.

Financial outcome of dismissal (compensation)

Since the Labor Code does not distinguish chief accountants from other employees, they also do not provide for special compensation payments for voluntary dismissal. On the day of dismissal, the chief accountant will receive a salary for the partial month worked, arrears in payments or accountable amounts, if any, and compensation for unused vacation days (Article 140 of the Labor Code).

Additional financial compensation may be specified in a collective agreement or an employment contract concluded with a specialist on an individual basis. The dismissal of the chief accountant is a significant event in the enterprise. Proper organization and consistent work on the transfer of affairs will provide the company with calm work in the future, and the dismissed employee will only have good memories of his previous place of work.

Zinovieva Natalya Igorevna

Lawyer at the Legal Defense Board. Specializes in handling cases related to labor disputes. Defense in court, preparation of claims and other regulatory documents to regulatory authorities.

Is it possible to fire the chief accountant?

The legislation of the Russian Federation does not provide for a special provision for the dismissal of the chief accountant. Theoretically, the chief accountant can be fired in the same way as any other employee. However, this issue should be approached with full responsibility. Before parting with the chief accountant, you need to make sure that he has transferred all his affairs to a new employee or the head of the organization. This is a prerequisite, since it is he who owns all the information about the financial condition of the company, controls cash flows and regulates tax obligations.

The transfer of affairs is a mandatory procedure for any chief accountant, since all further activities of the company depend on this information.

The responsibility of the chief accountant remains with him upon dismissal for all his decisions made during his work.

Release from a position can occur either at the employee’s own request or at the initiative of the employer. In addition, there are reasons beyond the control of both of them. Let's look at all the options in more detail.

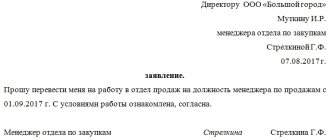

1. Dismissal of the chief accountant at his own request.

If the chief accountant has decided to terminate his employment in this company, he is obliged to inform the manager about this no later than 14 days before the date of dismissal. Within two weeks, the chief accountant puts his affairs in order and prepares them for transfer to a new employee or general director.

After this, the person accepting the affairs and the chief accountant sign the act of transfer of affairs, thereby recording the transfer of responsibility. However, we note that the chief accountant, even after dismissal, continues to be responsible for all actions committed by him while working in this company.

The head of the organization does not have the right to demand that the accountant work beyond the two weeks provided for by law. Even if you have to fire an employee during the reporting period. If the employer refuses to accept the resignation letter or register it with the secretariat, the accountant has the right to send the application by registered mail and stop working after the two weeks required by the Labor Code of the Russian Federation. Upon dismissal, the accountant is paid compensation for unused vacation days, as well as severance pay.

2. Dismissal of the chief accountant at the initiative of the employer.

There are times when a manager decides to fire the chief accountant. There may be several reasons for this: loss of trust, dishonest performance of official duties, causing material damage and many others. In addition, when the owner of the company changes, the chief accountant is also replaced, since each manager wants to see his own person in this position.

Another reason for the dismissal of an accountant is a reduction in staff, for example, if the manager, with small volumes of document flow and operations, decided to independently keep records and draw up reports. In all these cases, the dismissed employee is paid severance pay in an amount equal to three average monthly salaries.

If, when dismissing at your own request, working for two weeks is mandatory, then when dismissing at the initiative of the employer, this is not the case. The manager has the right to dismiss an employee at any time. Also, by agreement of the parties, other working periods may be established, but no more than 14 days permitted by law.

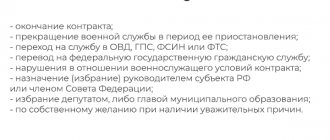

It should be noted that there are cases in which the manager must fire the chief accountant without work. All of them are reflected in the Labor Code of the Russian Federation (Article 80). For example:

- employee retirement;

- admission of an accountant to an educational institution;

- if the manager delays payment of wages, thereby violating the labor legislation of the Russian Federation.

- moving to another city (country) due to the transfer of the chief accountant's spouse at work;

- if an employee has a need for continuous care for a sick family member;

- if the employee is unable to perform his job duties due to health reasons (for example, coma).

If the chief accountant has one of these reasons, he must indicate it in his application. The employer, in turn, is obliged to dismiss the employee on the exact day written in the application.

3. Occurrence of circumstances beyond the control of the parties.

Such circumstances are recognized as the death of the employer or employee, which becomes the natural reason for termination of the employment contract.

The place of work of the chief accountant is not of fundamental importance for his dismissal. The procedure for terminating employment in both a budgetary organization and a private company is absolutely the same. It is regulated by the norms of the Labor Code of the Russian Federation.