Chief accountant - what is the position?

The chief accountant is an employee who:

- manages the entire system of the accounting department in the company

- Responsible for internal and external financial document flow of the company

The chief accountant reports directly to the head of the legal entity, however, without his signature, all documents relating to finances, current accounts and credit obligations are invalid.

Position characteristics

The chief accountant is a significant person responsible for the financial and accounting side of the organization. Drawing up reporting documents, monitoring internal calculations and the accuracy of payments - all this is the responsibility of such a specialist. He is responsible for the correct performance of his tasks, taking into account the requirements of the law.

For more details, see “Job Description for Chief Accountant”.

Activities of the chief accountant

Let's consider the main responsibilities of the chief accountant. This will allow us to better understand the nature of its activities. So, firstly, he is responsible for financial reporting and control of all business transactions that the company performs. Secondly, this is a public job, which consists of complete leadership of the entire accounting department.

If we look at the functions in more detail, they include:

- organization of accounting policies

methodological consultation for all employees- organization and regulation of all settlement operations

- control of transactions execution and reporting

- warning of all attempts and completed actions that are aimed at inappropriate spending

- registration of all documents and control of their transfer to the relevant authorities in cases where theft has occurred

- rationalize the company's operating methods and expenses

The list is incomplete and often in real practice the scope of responsibility is much wider. However, for basic familiarization this is more than enough.

When and for what purpose is an order created?

Organizing the work of the accounting department is the responsibility of the head of the enterprise. It can go one of three ways:

- appoint a specialist according to the staffing schedule;

- conclude an agreement on accounting services on an outsourcing basis with a third-party organization;

- assign this function to yourself.

The latter is possible when a company cannot, for some reason, maintain a separate specialist in the position of chief accountant and uses the simplified tax system (USN), a simplified taxation system (the main tax system, due to some of its features and rather high complexity, requires special education and knowledge).

It is necessary to make a choice immediately after the creation of a Limited Liability Company at the very beginning of the enterprise’s activities through the issuance of an appropriate order.

Sometimes this document is also called “Order No. 2” (the first order is on the appointment of a director), because According to the staff of any LLC, two main positions are a priori defined: director and chief accountant.

It should be noted that sometimes the transfer of responsibilities occurs during the period of active activity of the organization: this is not prohibited by law and this procedure does not require any special explanation.

After the order is issued, full responsibility for the financial part of the enterprise’s work, including submission of reports, calculations, payment of taxes, etc. falls on the director. The right to sign payment documents is automatically transferred to him.

How to organize the work of a company without a chief accountant

In a situation where a replacement person has already been found, all that remains is to competently organize the work of the entire department. So, although it is not required to provide information about the person who replaced the chief accountant, all supervisors need to provide information about the temporary replacement.

The following should be notified about this: the tax office, analytics and social insurance services, partner banks, etc. Moreover, in the case of banks, it is recommended to provide in advance for the presence of a temporary seal and signature. Otherwise, the chief accountant will not be able to perform his duties.

However, if the organization provides for an electronic signature, then such personalization is useless. This is due to the fact that all employees who are affected by the main documents have access to it: their editing, implementation and use.

Assignment of director's duties to the chief accountant

There are situations when someone in an organization needs to play the role of director during a long absence. If the company has the position of deputy director, then no documents are required, since this issue is resolved in accordance with the job description of the deputy.

But if the staffing table does not include the position of deputy manager, then the duties of the director can be assigned to another employee. Most often, these powers are vested in the chief accountant of the organization. In this case, an additional agreement to the employment contract must be drawn up, which specifies all transferred powers.

The assignment of director duties to the chief accountant or any other employee of the enterprise can occur in the following scenarios:

- combining two positions if the applicant meets the requirements of the Law “On Accounting” for combining;

- temporary transfer to the position of manager.

Who can replace the chief accountant

Only 3 people can replace the chief accountant, more details in table 1.

| Name | Description |

| Director | This choice is economically feasible only in cases where the company is small and additional employment will not affect profits. In the case of large companies, the director will not be physically able to perform the functions of the chief accountant. |

| Employee | The place of an accountant can be taken by an employee of the organization who has enough skills to competently perform all the necessary work. |

| Outsource | Hiring from outside is also an economically sound decision, but requires a little more time than using your own employee. The cost of this method depends entirely on the state of the accounting department. |

Each choice should justify itself, and not just simplify reporting.

Video about the work of the director as the chief accountant:

Payment for combination

As a rule, combining any positions leads to an increase in the volume of work, for which an appropriate additional payment must be made (151 Labor Code of the Russian Federation). The amount of such additional payment is determined by agreement of the parties, that is, the employee and the employer. The amount of additional payment is established by the order of combination. The additional payment can be set at a fixed amount or as a percentage of the basic salary. It is important to remember that combined time is not taken into account separately, since work duties are performed throughout the working day, and not after it ends, that is, not outside working hours. However, if the company decides not to formalize separately the combination of the positions of chief accountant and director, then there is no need to indicate the payment for this anywhere. In this case, you can simply increase the director’s salary, or pay him monthly bonuses.

Important! If the manager initially assumes responsibility for accounting in the company, then this is part of his job functions and does not require additional payment. If the director temporarily assumes the responsibilities of the chief accountant, then he is entitled to additional payment.

When responsibilities cannot be delegated

However, there are cases in which transfer of responsibilities is not possible. There are quite a lot of them and they are all tied to regulations. So, let's consider the two most popular cases:

Transfer of responsibilities is impossible when the chief accountant has deputies who agree to carry out his work. Often this is not so much an actual agreement to work, but rather the availability of free time in the work schedule.- The second situation relates to incompetence. Despite the manager’s best wishes, it is impossible to delegate responsibilities to an employee who has never worked with accounting before. Most likely, this will be against his will and, as a result, a violation of the law.

As for other cases, they have more nuances, and they can only be implemented under special conditions.

The chief accountant is on vacation, the general is at work

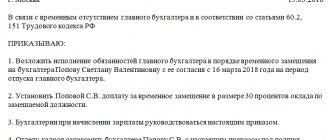

However, not every legal entity has the organizational and financial capabilities to employ a deputy chief accountant. As a rule, the vast majority of organizations have only two management positions: general director and chief accountant. And if the latter is resting, then the general at this time, almost “automatically,” also has to perform his duties. This is formalized by an order approximately as follows (sample of the right to sign for the chief accountant during the director’s vacation):

Procedure for transfer of powers

Please note that there is no official procedure for transferring powers, as well as no form of order. The manager must independently determine actions for his company within the framework of Federal Law No. 129, which will allow him to delegate powers to other entities.

If we consider situations without taking into account the development of the company and its characteristics, then the algorithm of actions should be as follows:

- Issue of an order. Here it is necessary to briefly reflect the reason for the transfer of responsibilities and their complete list. In addition, you need to enter the full names of all participating persons and the date of the planned transfer.

Carrying out inventory. Analysis of the remaining financial resources at the time of appointing a new person to the position.- Checking reports. Designed to determine the status of all constituent documents, reports, contracts, bank statements, etc. for violations and inaccuracies.

- Drawing up an act. The main responsibilities, full name of the appointed person and other information that legitimize the transfer are indicated in free form.

- Alert authorities. An important stage, which was described in more detail above.

It is also necessary to sign all documents on behalf of management and affix company seals. An important nuance is that if the chief accountant is an official position, this becomes the reason for increasing the salary of the replacement.

Responsibility of the controlling person

After Law No. 402-FZ came into force, the number of court cases involving chief accountants was sharply reduced. However, there are non-tax cases where it may be arguable to hold the director liable. Let's list just a few of them.

- Vicarious liability for the inability to fully repay creditors' claims

Who is recognized as a controlling person when considering a case of bringing to bankruptcy is stated in the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 21, 2017 No. 53. Paragraph 23 of the document explains that persons who are responsible for maintaining and storing relevant documentation are recognized as controlling persons. For example, if it is proven that the bankruptcy procedure was significantly complicated by the facts of non-transfer (concealment, loss or distortion) of documentation (Article 61.11 of the Federal Law of October 26, 2002 No. 127-FZ). That is, a representative of the accounting department may well be held jointly liable with the manager.

- Subsidiary liability in case of unjustified receipt of a loan

The Supreme Court, in Ruling No. 305-ES18-15540 dated January 28, 2019, found worthy of attention the bank’s argument that the defendant’s accountants, who received a loan based on distorted balance sheets, must:

- recognize the defendant as controlling persons;

- bring to justice, including financial responsibility.

The case will be considered at the highest level, but the result is already obvious.

- Request for documents

Resolution of the Arbitration Court of the North-Western District dated September 3, 2018 No. F07-10700/2018 in case No. A56-67582/2015 illustrates the usefulness of assigning the responsibility for maintaining and storing the debtor’s documentation to the chief accountant. The court noted that the bankruptcy trustee could not demand documents from the debtor’s former managers without checking:

- arguments that the chief accountant was obliged to keep the requested documents;

- confirmation of the fact that the documents were located with the chief accountant (it was he who carried out business activities, made calculations, and used seals).

The court noted that the burden of proving the fact of transfer of documents and valuables of the debtor lies precisely with the person who was obliged to transfer them to the subsequent manager. That is, in this case - the chief accountant.

- When the director is the chief accountant

The arbitration court granted the bankruptcy trustee's application for recovery of damages, since the defendant, being the head of the debtor, assumed the responsibilities of its chief accountant (Resolution of the Arbitration Court of the North-Western District dated December 17, 2018 N F07-12714/2018). At the same time, he did not fulfill the obligation to deposit cash received from persons with whom the debtor entered into preliminary agreements for the purchase and sale of residential premises:

- to the debtor's cash desk;

- to the debtor's bank account.

Let us note that in this situation, the director was not helped even by the fact that in the period from 2010 to 2014 she was on maternity leave and on maternity leave.

Order service

How to create an order correctly

It is worth initially noting that there is no single form for drawing up an order, so the manager has the right to choose any template. The only exception is the internal regulations of the company, which may establish a mandatory form for this document.

There is only a mandatory minimum that must be contained in the document:

- full name of the legal entity

- full date when the order was created

- content and reason for creating the order

If additional papers are required, they will be issued as attachments.

Combination and part-time work of the General Director

Author: Skryabina O.N. United editorial office of business magazines

When the CEO becomes the chief accountant...

Very often in small companies the general director combines the position of chief accountant. Is this legal? How to document this correctly? What is better: combining the positions of chief accountant and general director or assigning the duties of chief accountant to the general director? Let's figure it out.

Right to combination

The Labor Code does not contain restrictions on the combination of positions by heads of organizations. At the same time, Resolution of the Council of Ministers of the USSR dated December 4, 1981 No. 1145 “On the procedure and conditions for combining professions (positions)” (hereinafter referred to as Resolution No. 1145) is still in force. It contains a list of categories of workers who are allowed to combine positions. According to subparagraph “a” of paragraph 15 of this resolution, it does not apply to managers, their deputies and assistants. In other words, combining positions by the general director is not allowed. However, by the ruling of the Cassation Board of the Supreme Court of the Russian Federation dated March 25, 2003 No. KAS03-90, subparagraph “a” of paragraph 15 of Resolution No. 1145 was declared invalid in relation to “heads of structural divisions, departments, workshops, services and their deputies.” And by the decision of the Supreme Court of the Russian Federation dated October 20, 2003 No. GKPI03-1072 - regarding the main specialists. However, the restriction for organizational leaders remains. Probably due to the fact that in this part it was simply not appealed. But there is one more point: Resolution No. 1145 is valid only in that part that does not contradict the Labor Code. As is known, the Labor Code does not contain any restrictions regarding combinations of jobs for general directors. Therefore, we believe that the general director has the right to combine the positions of manager and chief accountant in one company. However, this is still a controversial point, so be prepared that labor inspectors will not agree with this point of view.

So, according to paragraph 2 of Article 6 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting” (hereinafter referred to as Law No. 129-FZ), heads of organizations, depending on the volume of accounting work, have the right:

- establish an accounting service as a structural unit headed by a chief accountant;

- add an accountant position to the staff;

- transfer on a contractual basis the maintenance of accounting to a centralized accounting department, a specialized organization or a specialist accountant;

- maintain accounting records personally.

Thus, the ability of the head of an organization to personally conduct accounting is directly provided for by law, and, therefore, it is not at all necessary to have a chief accountant on the staff of the organization.

So, if the head of an organization has decided to personally maintain accounting records, this should be reflected in the order on the organization’s accounting policy. In this case, the introduction of the position of chief accountant into the staffing table is not required. If the director of an organization personally maintains accounting records and additionally employs an accountant and a cashier as assistants, then in this situation, accounting is carried out not only by the director of the organization, but also by the hired accountant. Therefore, an organization can take advantage of the provision of subparagraph “a” of paragraph 2 of Article 6 of Law No. 129-FZ and establish an accounting service headed by a chief accountant, which will include an accountant and a cashier to be hired. In this case, the director of the organization will be able to perform the work of the chief accountant. However, in this case, the position of chief accountant should already be provided for in the staffing table, and the fact that his duties are performed by the director should be fixed in the order of the organization. In addition, the employment contract with the general director must include a separate clause stating that he performs the duties of the chief accountant (Article 57 of the Labor Code of the Russian Federation).

Please note: if the staffing table provides only for the position of an accountant, then subparagraph “b” of paragraph 2 of Article 6 of Law No. 129-FZ will apply to the organization. That is, the hired accountant will be responsible for maintaining accounting records. In addition, all monetary and settlement documents, as well as financial and credit obligations of the organization will be invalid without his signature (clauses 1–3 of Article 7 of Law No. 129-FZ).

To pay or not to pay for combination?

As a general rule, when combining positions, increasing the volume of work, or performing the duties of a temporarily absent employee without release from work specified in the employment contract, the employee is paid additionally (Article 151 of the Labor Code of the Russian Federation). The amount of the additional payment is established by agreement of the parties to the employment contract between the founder (employer) and the head of the organization (employee). The specific amounts of additional payments (wages) are determined in the relevant order (instruction) on the assignment of additional work for another position.

Let us note that when working under conditions of combining positions, there is no need to separately take into account the time during which the director performs the duties of the chief accountant, since this work is performed by the employee within the normal working hours established for the main job.

Again, if you are inclined to the point of view that it is impossible for the general director to combine positions, then there cannot be any separate agreements or clauses on additional payment for combining positions. The way out of the situation is as follows: negotiate an additional payment verbally and either increase the director’s salary or make additional payments in the form of bonuses.

Right of first and second signature in the bank

When combining the position of chief accountant with the general director, one signature is indicated on the card with sample signatures in accordance with Instruction of the Central Bank of the Russian Federation dated September 14, 2006 No. 28-I “On opening and closing bank accounts, deposit accounts.”

The same instructions say that if the head of a legal entity personally maintains accounting records (in cases provided for by the legislation of the Russian Federation), then the handwritten signature (signatures) of the person (persons) entitled only to the first signature is affixed to the card. In this case, in the “Second signature” field on the card, it is indicated that the person entitled to the second signature is absent.

Classic and optimal design options

The general rule for registering a combination is as follows. The General Director issues an order to take office and assume the duties of chief accountant. His employment contract sets out the conditions for combination and the amount of additional payments for such combination.

But, since the possibility of combining director positions with other positions is still controversial and you do not want possible disputes with the labor inspectorate, the best option for you would be to assign the general director by order the obligation to conduct accounting personally, without registering the combination (see Example 1) . In this case, it is advisable to exclude the position of chief accountant from the staffing table.

Example 1

Work of the General Director in an organization on an external part-time basis

The head of the organization, like other employees, can work part-time. However, in accordance with Article 276 of the Labor Code of the Russian Federation, he can occupy paid positions in other organizations only with the permission of the authorized body of the legal entity, the owner of the organization’s property or a person (body) authorized by the owner. Therefore, in order to comply with the procedure, the head of the organization should submit a written request (application) to the authorized body of the legal entity with a request for permission to work part-time (see Example 2).

Example 2

The application of the head of the organization is considered at the general meeting of the company's participants. The decision of the meeting, documented in the minutes (see Example 3), is transferred in brief form to the statement of the head of the organization (in the form of the requisite “Note on the execution of the document and sending it to the file”), after which it is filed in the personal file of the head.

Example 3

Now all that’s left to do is to appoint a part-time director for a new job. At the general meeting, the issue of appointing a part-time general director is also decided and the corresponding minutes are drawn up (see Example 4).

Example 4

An employment contract is concluded with the head of the organization, which reflects the conditions of part-time work and the corresponding working hours (an excerpt from this document is given in Example 5).

Example 5

On his first working day, the director of the company issues an order to take office at a new part-time job (see Example 6).

Example 6

For employees hired on a part-time basis, a T-2 personal card is issued in accordance with the general procedure, followed by its registration in the personal card accounting book. An entry in the work book about part-time work is made at the request of the employee at the main place of work on the basis of a certificate received from the place of part-time work. The certificate must include a reference to the document on the basis of which the employment was issued. For a sample entry in a work book about part-time work, see Example 7.

Example 7

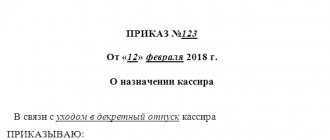

order assigning the duties of the chief accountant to the general director

order assigning the duties of the chief accountant to the director

combination of positions

sample application for combining positions

order assigning duties to the chief accountant

application for combining positions

assignment of the duties of the chief accountant to the general director

part-time general director

sample application for combining positions

part-time order sample

sample part-time order

application for combination

order to assign cashier duties to the chief accountant

can the general director be a part-time employee?

sample order to assign the duties of the chief accountant to the director

order for the appointment of deputy general director sample

combination

Organization of document storage

The order in which an order is stored depends on its condition (Table 2).

| Name | Description |

| Active | If it is valid, then it must be entered into the folder that is responsible for the administrative documentation of the legal entity. This can be done only if the procedure for drawing up the document, its endorsement and publication are followed. |

| Inactive | If the order is terminated, it is sent to the archive. The storage period in this case is determined by administrative documents within the company. They must clearly state the duration of storage. In exceptional cases, you will have to be guided by the legislation of the Russian Federation. |

Video about checking the work:

Key points when placing an order

There are no special requirements for both the information part of the document and its design: the document can be printed on a computer or written by hand (with a ballpoint pen of any dark color, but not with a pencil). Both the company's letterhead and a regular A4 sheet are suitable for the order.

Only one condition must be strictly observed: the document must bear the personal signature of the director of the organization or any employee authorized to act on his behalf in the matter of signing such papers (the use of facsimile signatures, i.e. printed in any way, is unacceptable).

It is not necessary to stamp the form using the official seal, since from 2021 legal entities have the right to use stamp products in their activities only if this norm is enshrined in the local documentation of the company.

The order is usually written in a single original copy and must be registered in the journal of internal documents.

After drawing up the order, you need to make several copies, which should be submitted to the banking institution serving the organization, as well as to the tax office and extra-budgetary funds.

When there is no one to replace the chief accountant, what to do?

In cases where there is no one to replace the chief accountant, there are usually two options:

the manager appoints himself to this position in the form of combining activities, and not completely replacing one area with another- an external employee is hired - more on that later

You also need to understand that the manager may not always use this function. If the company's annual turnover exceeds 800 million rubles, then this is impossible to do.

How can a director avoid risks?

If there is an urgent need to urgently open a current account, the director is ready to provide any documents required by the bank. However, when the question arises about liability for errors in accounting (tax) accounting and reporting, the understanding comes that it would be better to have a different order. After opening a current account, you can recognize the order provided to the bank as invalid (banks do not require you to inform them of this fact). In order for the previous order to lose force, it is enough to mention this in the new order issued on the basis of paragraph 3 of Article 6 of Law No. 402-FZ.

In the new order, you can indicate that the company’s accounting is carried out by:

- “other official”, that is, the employee of the company who actually does this;

- outsourcing company providing relevant services.

Let us note that providing the bank with an agreement with an outsourcing company can eliminate the need to create an essentially false order to assign the duties of chief accountant to the director. At the same time, it is not necessary to outsource the use of the bank to the client.

Requirements for a person who plans to replace an accountant

Mandatory requirements for such a subject are not predetermined by law.

The manager must rely primarily on the specifics of the company, as well as the personal skills of the employee. Testing is usually carried out to determine the extent to which a particular person is suitable for a position or not.

If the chief accountant leaves, you can save significant money in the long term by simply transferring responsibilities to another person. However, such a script is a tool that you need to know how to use.

Top

Write your question in the form below

Appointment of an interim CEO

When an employee is temporarily transferred to a managerial position, the employee is relieved of his previous duties for the period of the transfer. In this case, it is necessary to draw up both an additional agreement to the employment contract and a transfer order using the unified form No. T-5.

An interim CEO may be appointed during the period of vacation, business trip or illness of the manager. His term of office is clearly defined. During his tenure, he must be given a power of attorney from the manager.

How to complete a transfer in accordance with all the rules, see the article “Order to transfer an employee to another position - sample.”

In what cases is a power of attorney required?

In the Unified State Register of Legal Entities there is an entry about a person who has the right to act on behalf of an organization without a power of attorney (subparagraph “l”, paragraph 1, article 5 of the Federal Law of 08.08.01 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”) . As a rule, this person is the manager. He does not need a power of attorney to submit documents to various government agencies or receive them.

Any other person who will submit or receive documents from government agencies during the chief accountant’s vacation will need a power of attorney to perform such actions. An order alone on the performance of the duties of the chief accountant will not be enough, since such an order is an internal document of the company.

If the chief accountant has a deputy

If the company has a deputy chief accountant on staff, then during the latter’s absence, the deputy can sign for him on all documents. The employment contract with the deputy should specify his responsibilities for replacing the chief accountant during vacation.

If there are several deputies (this occurs in large companies), then the head of the company must issue an order indicating who exactly is entrusted with performing the duties of the chief accountant. You can also distribute authority among several deputies.

Note that in practice, deputies most often do not receive additional payment for the time they replace the chief accountant. This is explained by the fact that the need to fulfill the duties of a temporarily absent chief accountant is taken into account at the stage of establishing the official salaries of his deputies.

Dismissal at your own request

As already mentioned, an accountant has the right to resign at any time . It is clear that during the submission of reports, or when there is no replacement yet, as a rule, chief accountants do not leave. But this depends on the employer and on the relationship that has developed with the chief accountant.

If the relationship is not the best, management refuses to accept the application and fire the chief accountant, who has other options for this application to reach the employer.

Firstly, he can submit an application through the secretary (if there is one). If the secretary is given strict instructions from the chief accountant not to accept anything, then there is also Russian Post. The resignation letter is sent by a valuable letter with a list of attachments.

Calculation, compensation for unused vacation, entry in the work book - do not differ from those with other employees.