The legislative framework

In general, each employee can resign at any time of his own free will, but he must notify the employer no later than 14 calendar days in advance - the same rule applies to the employee who is financially responsible.

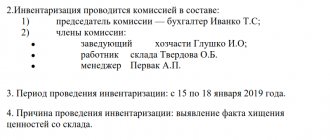

You can quit without working, if the parties were able to agree on this by signing the appropriate agreement. However, in practice, work is most often needed, since during these 14 days the employee must transfer all material assets:

- A new employee whom the employer hires instead of the previous one.

- To another responsible person authorized by the employer.

Along with this, at the same time (or in advance), the company is obliged to carry out an inventory in order to establish the presence/absence of discrepancies and their cause. This is directly stated in the Order of the Ministry of Finance of the Russian Federation.

Thus, formally the procedure is exactly the same, but the employer must:

- Organize the reception of valuables that were previously in his charge.

- Organize an inventory to identify discrepancies and the reasons for them (if any).

The full list of financially responsible employees is defined in the relevant Resolution of the Ministry of Labor. These may be managers, their deputies, cashiers and other employees (other employees cannot be classified in this category).

The company must necessarily enter into agreements with them on full financial responsibility, reflecting this fact in employment contracts. Otherwise, the employee can only bear limited liability, which is calculated in amounts within the limits of his average salary in a given company.

General information

The Labor Code in force in the country allows a materially responsible employee to resign from his job in the general manner for such cases. But there is one important point here. Before leaving his position, the employee must conduct an inventory of valuables and transfer them to the employee who will replace him in the new place. But before proceeding with such a procedure, a dismissal order must be issued, confirmed by the signature of the head of the company.

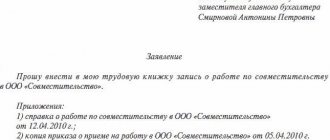

In most cases, the dismissal of a reporting employee at his own request takes place without any complications. Such cases are subject to the provisions of Article 84.1 of the Labor Code. The dismissal process begins with the fact that the accountable person must draw up a corresponding statement.

This must be done at least 2 weeks before the day you leave work. In this document, the employee may not indicate the reason that forced him to take such a step. After submitting the application to the head of the company, the resigning employee must work for at least 2 weeks. While he continues to perform his job duties, the personnel department must find a replacement for him.

Sometimes the process of dismissing such an employee may be prescribed in a special agreement that is concluded with him at the time of hiring. Such a need may arise when this procedure provides for a slightly different procedure than that determined by current legislation. However, here, too, the conditions and rules of dismissal should not put the employee at a disadvantage, and the manager is prohibited from establishing additional requirements or claims against such employees.

No later than two weeks from the date of hiring, the employee must receive a work book. During this period, the organization is obliged to pay him in full and pay him the due amounts, and an inventory of material assets must also be carried out. This is a mandatory condition, without which the accountable person cannot quit his job.

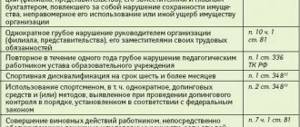

If an employer violated at least one dismissal rule while working for him, then certain sanctions may be applied to him. Thus, in case of refusal to issue a work book, penalties may be imposed.

If a company commits gross violations of the Labor Code, a temporary suspension of its activities is possible. When determining the size and severity of the punishment, the period during which the company delayed issuing the work book or payments due to the employee is taken into account.

Types of financial liability

The obligation to take care of the company’s property is one of the main ones prescribed in Art. 21 Labor Code of the Russian Federation. This means that the intentional destruction or accidental loss of any value that is used in work or stored by the enterprise must be compensated by the guilty employee.

However, there are a number of specialists whose direct responsibilities include the preservation of inventory. This responsibility can be assigned in several ways:

- full;

- collective complete;

- within the limits of proven actual damage caused (based on a custody agreement or investigation data)

It is noteworthy that a person becomes financially responsible even if an agreement on full liability was not initially signed with him. During the course of work, an employee may be given some property for use in the performance of work functions. If a transfer document was signed, then the person must understand that this is called custody and can have material consequences.

This is also important to know:

Can a pregnant woman be fired from work: reasons for dismissal according to the Labor Code of the Russian Federation

In recent years, a situation has arisen everywhere where new and old employees are universally asked to sign agreements on full financial responsibility. In this way, the employer carries out preventive work, believing that the fear of official paper will contribute to increasing thriftiness in the team. But by referring to the norms of the Labor Code of the Russian Federation, one can understand that such clauses in an employment contract or an additional agreement to it can only be used when hiring positions from the list approved by Decree of the Government of the Russian Federation No. 823 (for example, cashiers, sales workers, storekeepers, etc. .)

An extraordinary inventory is carried out with each change of responsible persons (temporary absence from work or dismissal).

Features of dismissal of a financially responsible person

If your employee has written a letter of resignation of his own free will, then you, as an employer, have the right to demand from him 14 days of work, starting from the day following the day the application was submitted. And on the last day of the employee’s work, pay him and give him a work book (Article 80 of the Labor Code of the Russian Federation). This is the general procedure for dismissing employees.

But if an employee who is a financially responsible person in your organization decides to resign, then during these 14 days you must carry out an inventory and transfer the property entrusted to him according to the act to a new financially responsible person (clause 22 of the Methodological Instructions, approved by Order of the Ministry of Finance dated December 28 .2001 N 119n, clause 1.5 of the Methodological Instructions, approved by Order of the Ministry of Finance dated June 13, 1995 N 49). If a new employee has not yet been found to replace the resigning employee, then the valuables must be transferred to another person who will temporarily perform his duties.

Dismissal of a financially responsible person at his own request

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

All dismissal options are considered in the provisions of the Labor Code of the Russian Federation. An employee can be dismissed solely on the basis of any article violated by the employee. For his part, he can resign on his own initiative.

The dismissal of a financially responsible person at his own request occurs in the same manner as the dismissal of an ordinary employee, however, the process contains some nuances. An employee writes an application for planned dismissal. The employer has the right to demand work within a two-week period from the day following the day of submission of the application. In this case, the last day coincides with the day of payment and return of the work book.

The rules for dismissing a financially responsible person state that during a two-week period of work, the employer is obliged to take an inventory of all valuables for which the leaving financially responsible employee is responsible. After verification, the entrusted property is transferred to the newly appointed financially responsible person on the basis of an internal act. In the event that such an employee has not yet been found, the property must be transferred to any person who temporarily performs the duties of the resigned employee.

An act is an internal document that completely removes responsibility from one employee and shifts it to another. From the moment the act is signed, the resigned employee is no longer considered a financially responsible person of his organization.

Highly qualified legal specialists will help protect the interests of employees upon dismissal.

Process nuances

The legislation clearly states that during the inventory the presence of the financially responsible employee being dismissed is not mandatory.

But if the head of the company issues a corresponding order, the employee will have to obey. The director himself, before issuing this document, must provide compelling reasons, which are usually the terms of the agreement on financial liability concluded with the employee at the stage of his hiring. Quite often in companies the question arises: do they have the right to fire an employee without taking inventory. The current legislation does not provide for this. But at the hiring stage, an employee may refuse to sign a special agreement on such responsibility if he has not previously been introduced to the values for which he will be responsible. Therefore, if such an agreement has not been drawn up, then the employee has every right to refuse to conduct an audit and resign without further delay.

Transfer of valuables

Before the material assets entrusted to the resigning employee are transferred to the new one, it is imperative to draw up an acceptance certificate. In order for this document to acquire legal force, it must be secured with their signatures:

- An employee who decides to resign of his own free will.

- A new employee who has been selected to replace an old employee.

After completion of the procedure, the agreement with the former employee on financial responsibility loses legal force. From this moment on, all his responsibilities are assigned to the new employee, who will be responsible for the safety of the valuables entrusted to him.

It is extremely important that material assets are transferred to the new employee no later than two weeks - the period during which the old employee must complete the work required by law before dismissal. After this period, the resigning employee must be released from his position, and the employer has no right to detain him longer than this time.

Participants of the procedure

When the moment of transfer of values comes, it is carried out between the leaving employee and the new employee. Such a procedure requires the signing of a special act, which must be certified by the signatures of a number of company employees:

- chief accountant;

- head of the company;

- the head of the department in which the reporting person worked;

- warehouse manager

Such a document does not have a standard form. Each company has the right, at its own discretion, to compile it in the form most convenient for itself.

It happens that an employee who has decided to resign of his own free will does not want to sign the document on the acceptance and transfer of valuables. In such cases, the employer has every right to unilaterally terminate the contract concluded with him, without risking further facing any sanctions.

Paperwork

The head of every modern company must know how to fire a financially responsible person at his own request. The process of terminating a contract with such an employee must be carried out in the manner prescribed by current legislation, which requires compliance with a number of requirements.

In cases where the employee was not able to be present at the workplace during the two-week work period and he can confirm this with valid reasons, the employer does not have the right to apply any sanctions against him. Within the framework of the law, he has no choice but to dismiss the employee on the day indicated in the previously submitted application.

To consider the given reasons valid, the employee must present the relevant documents . For example, this could be a certificate of incapacity for work, which should indicate the illness that prevented the employee from being present at his workplace.

In cases where the employee cannot take part in the audit, he must indicate his consent, which is drawn up in writing, to carry out this procedure without him.

In accordance with the current rules, on the last day of work, the employee must receive a work book and the salary due to him for the period of service, including vacation pay and severance pay.

Specifics of collection of shortages

Based on the results of the inventory, certain violations may sometimes be discovered. In such cases, the accountable person must compensate for the shortfall. To do this, the employee can transfer the coverage amount in full to the company’s cash desk or in the form of periodic payments. In any case, everything must be carried out in accordance with the rules defined by the current Labor Code, which also establishes the procedure for dismissal of a financially responsible person due to shortages.

In order for a deduction from the earnings of a reporting employee to be considered legal, a corresponding order from the manager must be issued. In this case, it must be drawn up in accordance with all the rules and contain the following information:

- surname, name and patronymic of the employee indicating his position;

- the amount of the shortfall that must be compensated;

- reimbursement procedure;

- links to documents confirming the shortage.

After the corresponding order is issued, it must be transferred to the accounting department.

If there are good reasons for this, the manager can apply for compensation for the shortfall to the judicial authorities. Dismissing an employee with financial responsibility is a very important decision. The presence of only a corresponding order is not enough to initiate such a procedure. Often, in addition to dismissal, it is necessary to resolve issues with compensation for shortages, which can only be detected based on the results of an inventory.

It can be carried out either in the presence of an employee or without the participation of an employee. To ensure that the audit does not violate the law, the appropriate consent of such an employee must first be obtained.

Only after this can you proceed to this procedure. In any case, all necessary actions must be carried out only in compliance with the current legislation. This should be remembered not only by the management of the enterprise, but also by the employee himself, who was entrusted with material assets during his work in the company. Therefore, before applying for a job, it would not hurt to find out how to quit a financially responsible person without problems.

General procedure for dismissal of a financially responsible person

If an employee wishes to resign from a financially responsible position, the general provisions of the Labor Code on dismissal are applicable to such a procedure. In particular, the employee must notify the employer two weeks in advance of his intention to leave. Although a liability agreement may prescribe the procedure for dismissing such an employee, the provisions of the agreement cannot aggravate the employee’s position in comparison with the norms specified in the Code.

This is also important to know:

How to correctly write a letter of resignation at your own request

The dismissal of an employee must take place according to the general procedure specified in Art. 84.1 Labor Code of the Russian Federation. That is, after submitting the application, having worked the allotted time, the employee on the last day of his work must be issued a work book and all the estimated funds. Therefore, it is not allowed to delay the procedure for transferring inventory from one employee to another. If an inventory is required, it should not take more than the specified two weeks.

The law prohibits delaying the dismissal of an employee and the issuance of his pay. For this, the employer faces both financial liability and administrative liability, up to and including suspension of the company’s activities. Back to contents

Liability for violating the procedure for dismissing a pensioner

For delay in dismissal, expressed in late issuance of a work book or payment of full payment, as well as violation of its procedure, the employer faces:

- administrative punishment in the form of a fine under Art. 5.27 Code of Administrative Offenses of the Russian Federation;

- payment of penalties for late payment of wages under Art. 236 Labor Code of the Russian Federation;

- the possibility of declaring the dismissal illegal with the subsequent reinstatement of the employee in court and payment of lost earnings and moral damages (paragraph and article 234, part and article 394 of the Labor Code of the Russian Federation).

Is inventory necessary?

The Law “On Accounting” establishes mandatory inventory at an enterprise if the financially responsible person servicing material assets has changed. Or, in this case, the employee is fired. Difficulty may arise when an employee leaves, and there is no one to accept the valuables, since a replacement has not yet been found. After all, the employer cannot authorize any employee. Only certain positions in the enterprise can be financially responsible, and an appropriate agreement must be concluded with them.

All these nuances must be spelled out in the employee’s financial liability agreement. Including the procedure for his dismissal, conducting an inventory upon dismissal at his own request. Either in the contract itself, or by order of the manager, persons who are authorized to accept material assets transferred by an employee upon dismissal can be established.

Based on the Methodological Instructions for Accounting No. 119n, the financially responsible person must submit a statement of material assets to an accountant before his dismissal. And paragraph 258 of these instructions, in addition, contains a provision that positions such as warehouse manager, storekeeper, and indeed all financially responsible persons, can be dismissed from their positions only after an inventory has been carried out.

The transfer of values, as a rule, occurs by deed. This act must be signed by the chief accountant and the head of the enterprise, or by the head of a department or warehouse.

The procedure for conducting an inventory is established by the specified regulatory legal acts. In particular, paragraph 27 of the Accounting Regulations also establishes mandatory inventory when changing a materially responsible employee. But none of these legal acts imposes obligations on the employee himself to carry out an inventory. He may be involved in this procedure on the basis of the issued Order of the employer. In this order, the manager must refer to the clauses of the agreement on the employee’s financial liability, and to the acts indicated above.

Inventory Features

Before proceeding with the audit of material assets, an appropriate decree must first be issued. Only after this can the corresponding procedure be initiated, which involves a number of mandatory measures:

- The audit begins with compiling a list of all the valuables that were entrusted to the employee. As part of the audit, their condition, degree of wear, and actual cost including depreciation are assessed.

- Next, they move on to the second stage, when an act of transferring the object to a new employee is drawn up. The document must provide links to reports on the inventory of liabilities and assets.

At the time of dismissal, this person transfers the valuables to a new employee, manager or other employee who was vested with such powers by decision of the head of the enterprise.

Dismissal of a materially responsible person during a protracted inventory count

The dismissal of a financially responsible person ends after 14 calendar days, and during this period some organizations are not able to conduct an inventory. According to the Labor Code of the Russian Federation, the employer does not have the right to delay payments and the issuance of documentation to a former employee. Then the organization acts according to 2 types of the following action algorithms:

- Dismiss the employee on the last working day, and if there is a shortage, go to court with a claim for compensation for material damage.

- Agree with the employee to terminate the employment relationship by agreement of the parties (Article 78 of the Labor Code of the Russian Federation). In this agreement, employers stipulate the date of dismissal at the end of the inventory, and the amount of severance pay. This method is considered an alternative for both parties.

Registration of dismissal of an employee

On the last day of work of the financially responsible person, he needs to be given a work book, documents related to the work, the necessary certificates at the request of the employee, as well as all amounts of payments due to him. These include compensation for vacation and wages. If during a two-week work period an employee was not at work due to illness, they cannot refuse to dismiss him. The dismissal of an employee must be carried out by order. An absent employee can give his consent to carry out an inventory.

If for some reason the employee refuses to transfer the valuables, and it is impossible not to fire him, some employers carry out the dismissal, after which they initiate a lawsuit. In this case, the financially responsible person will have to prove the fact that material assets were transferred to him, and that the shortage did not occur through his fault (if any). In this case, the labor dispute develops into a property dispute, since it concerns compensation for damage caused to the enterprise in the form of a sum of money.

Was the information interesting or useful?

Yes332

No38

Share online

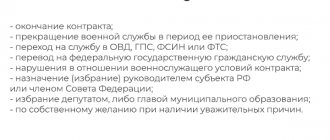

Dismissal due to retirement of the financially responsible person

In such situations, difficulties often arise. The problems arise from the fact that when a financially responsible person is dismissed due to retirement, different Labor Code norms apply simultaneously. On the one hand, given the reason for dismissal, the employer, by law, is obliged to terminate the contract on the day specified in the application. That is, in this case, the employee, as a rule, does not work for two weeks.

This is also important to know:

Dismissal by agreement of the parties with payment of compensation: how to formalize and calculate the amount of payment

At the same time, it is necessary to conduct an inventory when dismissing a financially responsible person. The audit takes a certain time, and the employee will not be able to leave until it is completed. If you do not check, after the dismissal of the financially responsible person, it will be difficult to deal with the deficiency identified later. The contract will already be terminated, therefore, it will be problematic to collect anything from it. The manager of the enterprise will have to prove that the shortage arose through the fault of the employee.

If an audit is carried out before the contract is terminated, the identified shortfall will be compensated by the person who has not yet been dismissed. In such cases, an act is drawn up, on the basis of which the collection is subsequently made.

The procedure for transferring values

There are two generalized models of the transfer of values, and neither is standardized by law.

- The first is that a candidate for the vacant position that is being vacated has not yet been found.

- The second is that there is already another employee ready to start work the next day after the predecessor leaves the position.

Let's consider the first model. It is clear that the work related to maintaining the organization’s property cannot be entrusted to the first person who comes along. Therefore, finding a candidate may take some time. Under such conditions, it is worth looking for a replacement among the company’s employees.

ATTENTION! Valuables should not be transferred to employees with whom it is impossible to conclude a full agreement. responsibility. Such a mistake can cost the employer dearly. The legislation does not allow the employer to enter into an agreement with all employees of the enterprise.

If the agreement was signed with an employee of the organization, whose job responsibilities (work performed) are not on the list set out in the said resolution, the employer will not be able to hold him accountable and recover damages from him.

You should not transfer valuables or enter into an agreement with a person who is not officially hired for the position.

- Before dismissal, the employee transfers the valuables to the commission, which conducts an inventory.

- The room where material assets are stored (a safe with monetary values) is sealed by the commission.

- The next day, after the dismissal of the previous employee is formalized, a new one is hired and the valuables are transferred to him.

It is this kind of procedure that is provided for by the legislation of the Russian Federation.

What to do if a shortage is detected

The shortage can be found out only by the results of the inventory and comparison of its results with the planned balance.

If the results of the audit do not reveal any contradictions, then there will be no claims against the financially responsible person.

If a shortage is identified, then:

- The organization calls a special commission that will find out the reasons for the discrepancies between the actual and planned availability of valuables, as well as identify the guilty employees (Article 247 of the Labor Code of the Russian Federation). The manager must carry out an internal investigation, since without evidence he has no right to make claims against the employee. If an investigation does not occur, the employee can appeal the decision even if he is guilty.

- The employee is required to write an explanatory note indicating the reasons for the shortage.

- The commission that conducted the investigation must draw up a report and provide it to the employee for review. The employee, in turn, is required to sign the document. If an employee refuses to sign the act, the commission confirms this in writing and with the signatures of witnesses.

- The shortage must be converted into monetary terms in accordance with the prices that are valid at the time the discrepancies are identified. If the shortfall does not exceed the average monthly salary of the guilty employee, then it can be recovered without going to court.

- During the dismissal process, the employee may give his consent in writing to compensation for the shortfall. If he leaves the organization and payment of the shortfall stops, then the manager has the right to go to court. The circulation period is one year.

If a shortage is detected

If during the audit a shortage of finances or property is identified, this fact is reflected in the Act. Next, the head of the enterprise appoints an internal inspection. Its purpose is to determine the size of the shortage and establish the reasons why it arose.

Expert commentary

Platonov Alexander

Lawyer

During the inspection, the employee is required to provide a written explanation of the reasons for the shortage. If he refuses to provide it, a written Certificate of Refusal is drawn up, which is signed by two employee-witnesses.

Carrying out an internal audit is accompanied by the preparation of a number of documents:

- An order to order an inspection based on the identified shortage;

- Order on the formation of a commission to conduct an inspection;

- Report on the results of the internal audit.

Collection of shortfalls

As a general rule, recovery from the guilty employee of the amount of damage caused, not exceeding the average monthly earnings, is carried out by order of the employer (Article 248 of the Labor Code of the Russian Federation). To do this, the employer must issue an order to recover from the offending employee an amount within the specified amount. Such an order is issued no later than one month from the date of final determination of the amount of damage caused by the employee. Of course, this is possible if the employee has not terminated his employment relationship with the employer. The employee has the right to compensate for damage voluntarily in whole or in part. By agreement of the parties, compensation for damage by installments is allowed. In this case, the employee submits to the employer a written obligation to compensate for damages, indicating specific payment terms. Only through the court can recovery be carried out in the following cases: if the employee refuses to admit his guilt and voluntarily compensate for damages exceeding his average monthly earnings, if the employee terminates his employment relationship with the employer. With collective financial liability and with voluntary compensation for damage, the amount of guilt of each member of the team is determined by agreement between the team members and the employer. And if the damage is recovered in court, then the guilt of each member of the team will be determined by the court. Also, only through the court can an employer try to make claims against a former employee if he quit without conducting an audit or before its completion, without waiting for the results and without taking part in filing the shortage. In accordance with paragraph. 2 tbsp. 392 of the Labor Code of the Russian Federation, the right to go to court is retained for a year from the date of discovery of the damage caused, that is, from the date of completion of the inventory and drawing up of the act, and the period missed for a good reason can be restored by the court. True, in this case, it will be extremely difficult for the employer to prove the connection of the damage with the dismissed MOL, because if a shortage is revealed, the former employee will claim that the shortage arose after his departure and he is not to blame for it.

Financial liability of the employer to the employee

Every owner of an organization must provide workers with proper working conditions.

It is he who is financially responsible for the untimely payment of wages to employees, as well as for the possible infliction of moral losses on them.

If an employee, due to the fault of the employer, did not receive income or was deprived of the opportunity to work productively, the employer compensates him for the lost wages.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

Financial liability of the employee to the employer

Kinds:

- Partial . With this type of liability, the maximum amount of compensation for damage caused to the organization’s property due to the fault of the worker is limited to the average monthly earnings.

- Full . This option can be legally applied in an organization to a certain circle of people, for example, to the head of the organization or chief accountant, cashier or controller.

This is also important to know:

Should sick leave be paid after dismissal?

This aspect is reflected in the employment contract.

A complete list of positions with full financial responsibility is contained in Resolution of the Ministry of Labor of Russia for 2002 No. 85.

Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 N 85

Article 243 of the Labor Code of the Russian Federation contains a list of situations in the event of which the amount of loss is recovered in full:

- criminal acts of the employee proven in court;

- administrative violations;

- the employee being drunk, resulting in losses;

- the employee is in a state of narcotic or toxic intoxication;

- intentional damage to property;

- disclosure by an employee of commercial or state secrets and other information.

For minor workers, full liability of a material nature is provided only in case of intentional damage to the property of the organization, in cases of crimes and misdemeanors, as well as in cases of intoxication.

Without working off

The notorious “two-week service” is perceived by many as an axiom, although no one can say for sure in which article of the Labor Code such “duty” is approved. How to resign from MOL without working off? The fact is that the Labor Code does not contain such a rule at all. It is said that an employee who wishes to leave, no matter what obligations he has, is obliged to notify the director about this no later than two weeks before the planned departure.

The following are also considered significant reasons:

- the employee entered an educational institution (for which he provided documents);

- the employer violated the terms of the contract;

- the employee moves to another city;

- retirement (it doesn’t matter whether it happened on time or whether a working pensioner quits);

- disease.

However, in case of illness, you must provide your written consent to carry out the inspection and transfer of valuables to another person without your presence. You can, of course, not transfer them. But then, if damage is discovered, you will have to prove to the court that you are not involved.

Order for dismissal of a financially responsible person - sample

Termination of legal relations with such an employee occurs on the basis of a special order. The preparation of this document is carried out according to standard rules. In this case, it is necessary to take into account the requirements of office work. The main requirement involves indicating in the order the grounds for termination of legal relations.

Sample act of acceptance of transfer when changing the financially responsible person

The transfer of cases upon dismissal of the financially responsible person involves drawing up an act of acceptance of the transfer. Such an act includes an indication of all records that the employee transfers to his successor and specific values. Thus, it is possible to secure the availability of all entrusted valuables and their accounting journals. It should be indicated that drawing up an act is necessary. After all, a new employee needs to be entrusted with the same values. This means that he must make sure that they are available.

This is also important to know:

How to formalize the dismissal of an employee by way of transfer to another position or to another organization

How to fire?

A lot will depend on whether the person leaves the organization of his own free will. This may be the dismissal of the person responsible for the MC at his own request, by agreement of the parties, or on the initiative of management for an offense. The procedure for dismissing a financially responsible person at his own request or for any other reason will be as follows:

In any case, the 14-day countdown begins. During this period:

- the initiator warns the other party about the planned termination of the employment relationship;

- inventory is taken. The person resigning himself participates in it; in addition, he must be given a certificate of the results of the inspection to sign;

- the person leaving must transfer the things entrusted to him to another employee. The basis is the act of acceptance and transfer.

You cannot detain a person for more than two weeks. An exception is the identification of discrepancies during inventory.

After completing all procedures, a dismissal order is issued, and the person leaving the organization receives documents and a full payment.

What does the full calculation include:

- income for actual time worked;

- compensation for unused vacations;

- severance pay.

Inventory is carried out if it was specified in the contract. A mandatory condition is the presence of the employee himself, unless he is sick (important: illness during these two weeks is not an obstacle to dismissal!). In this case, the departing person must sign a paper confirming his consent to carry out the inspection and transfer without him.

The inventory of a financially responsible person upon dismissal may not be carried out completely, but partially - only in relation to large valuables. It doesn’t matter whether the employer managed to finish it or not - that’s his problem; he has no right to delay the issuance of the work book and money.

If a person refuses to recalculate and re-hand over property, these procedures are carried out after his dismissal.

The employer can sue the fired person if a shortage is discovered, but he will have to prove that it occurred during the dismissal person’s work and that it is related specifically to his actions. In turn, the defendant proves that he was not involved in the shortage.

Act of acceptance and transfer of valuables

It contains the name of the goods that are transferred to someone else’s jurisdiction, the name of the organization, and who is transferring it to whom. It is necessary to indicate who was present. Next is the date and signature.

Who signs:

- dismissed;

- receiving;

- director;

- head of the department where the outgoing employee worked;

- Chief Accountant.

Sample act of acceptance and transfer of valuables.

Sources:

- https://viplawyer.ru/uvolnenie-materialno-otvetstvennogo-litsa/

- https://fb.ru/article/348101/poryadok-uvolneniya-materialno-otvetstvennogo-litsa

- https://lawr.ru/services/trudovye-vzaimootnoshenija/uvolnenie-s-raboty/uvolnenie-materialno-otvetstvennogo-lica

- https://ipinform.ru/kadry/uvolnenie-rabotnikov/uvolnenie-materialno-otvetstvennogo.html

- https://urexpert.online/trudovoe-pravo/materialnaya-otvetstvennost/uvolnenie-mo-litsa.html

- https://lawyer-guide.ru/trudovoe-pravo/prava-rabotnikov/uvolnenie-materialno-otvetstvennogo-lica-po-sobstvennomu-zhelaniyu.html

- https://2ann.ru/

- https://kadriruem.ru/uvolnenie-materialno-otvetstvennogo-lica/

- https://lawyer-consult.ru/labor/materialnaya-otvetstvennost/uvolnenie-otvetstvennogo-litsa.html

- https://glavkniga.ru/situations/k502982

- https://classomsk.com/zashhita-prav-rabotnika-i-rabotodatelya/uvolnenie-materialno-otvetstvennogo-lica-poryadok-uvolneniya.html

- https://buhguru.com/kadrovaya-rabota/uvolit-mat-otvetst-lico.html

- https://lexandbusiness.ru/view-article.php?id=4818

Subscribe to the latest news