Unfortunately, the list of grounds for termination of an employment contract also includes the death of an employee. Moreover, it is not as rare as it might seem at first glance. Employees of the personnel services of large enterprises, where the staff can number tens of thousands of people, from time to time are forced to draw up a lot of documents related to the termination of the employment contract, guided precisely by Article No. 83 of the Labor Code of the Russian Federation.

On the one hand, this is just one of the situations provided for by the current legislation, on the other hand, it is a delicate topic when it is necessary to make payments to the relatives of the deceased, as well as draw up all the necessary documents as correctly as possible, taking into account all the nuances of this process.

Today, the Labor Code quite clearly defines the procedure for terminating the employment relationship between an employer and an employee in connection with the death of the latter.

Article of the Labor Code of the Russian Federation: Dismissal due to the death of an employee

In accordance with Article 83 of the Labor Code of Russia, an employment contract can be terminated for reasons beyond the control of the employee and the employer. Paragraph 6 of the article provides for such a circumstance of termination of employment relations as the death of an employee or employer.

Reference! The news of the death of an employee does not yet constitute a reason for terminating an employment contract without supporting documents. The head of an enterprise is obliged to act in accordance with the law upon learning of the death of a citizen.

Compensation

In addition to wages, when an employment relationship is terminated due to the death of an employee, compensation payments are sometimes accrued. The money should be paid within a week after the relatives provide the relevant documents.

At the same time, the Civil Code of the Russian Federation establishes a period of 4 months when relatives have the right to claim money. If they do not submit an application within this time, the amount of money will be included in the inheritance and distributed among the heirs. If the amount of money is not paid in the prescribed manner, relatives have the right to demand compensation. Its amount is equal to 1/150 of the refinancing rate for overdue days. These amounts include:

- wages that have not been paid;

- compensation for unused vacation;

- sick leave benefit;

- amount of one-time assistance.

Dismissal procedure

Following the news of the death of a person, the employer, accountant and personnel officer are tasked with processing the relevant documents and paying appropriate benefits to relatives.

Obtaining a death certificate from the relatives of a deceased employee

Only documented death leads to termination of the employment contract due to death. A call from a relative that a person died the day before is not grounds for terminating the contract. There are only two documents that legally certify the fact of a person’s death. A certificate from the morgue is not included in these certificates.

- A certificate confirming the death of a person, executed on the prescribed form and issued by the civil registry office.

- A court ruling declaring a citizen dead.

Relevant documents are provided by the relatives of the deceased employee in photocopies. The original document remains with the relatives of the deceased citizen.

Important! If the deceased person does not have close relatives, the head of the organization must independently take care of and request the relevant documents from the relevant authorities and services.

Creation and registration of an order to terminate an employment contract with an employee

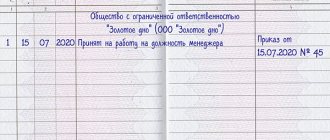

After the necessary papers certifying the fact of the worker’s death fall into the hands of the employer, he must issue the appropriate death order . There is an established sample order for termination of a contract .

The order must reflect the following information:

- document number and date;

- details and position of the deceased employee;

- grounds for dismissal (the number and date of the certificate are written);

- link to the TC article;

- manager's signature.

The order to terminate the contract must be signed on the date when information about the death of the employee became known or when the relevant documents certifying the death of the employee were received.

Making an entry in your personal card and work book

After issuing the relevant order, it is necessary to make an entry in the employee’s personal card and work book . A personal card with a record of the citizen’s death remains in the personnel department, and will subsequently be moved to the archive.

The work book must reflect the serial number of the entry , the date (the date of death written in the certificate is indicated), information about the termination of the contract due to death (link to the Labor Code article), the date and number of the order, the signature of the HR department employee or the head of the organization, in where the deceased citizen worked.

The work record book of the deceased person is given to relatives or sent to them by mail. You can receive the document:

- spouse of the deceased;

- biological or adoptive parents;

- children;

- brothers and sisters;

- other relatives who can document their relationship with the deceased.

If the deceased was a single person or if relatives do not want to take the document, it is kept by the organization for fifty years . After which it is destroyed.

In addition to the book, the relatives of the deceased may request other documents related to the work activities of the deceased: income certificates, medical records, all kinds of orders. The head of the organization is obliged to provide documents at the request of relatives within three days.

Calculation upon termination of an employment contract

The employer is obliged to make final payments to the relatives of the deceased person. Payments are made to close relatives: the widow (widower), children or parents of the deceased person. Final payments include the following benefits:

- wage;

- compensation for unused vacation;

- if the employee was on sick leave before his death, sick leave is due;

- the employer can financially help the relatives of the deceased;

- in some cases, employers help organize funerals and memorials.

Attention! Funeral benefits are paid from the state budget.

In order to receive payments and compensation in a timely manner, close relatives of the deceased must go to the organization where the deceased worked no later than four months from the date of the death of the citizen. If the citizen’s relatives have not applied within the specified period of time, all unpaid amounts and benefits will be part of the deceased’s inheritance.

Calculation: salary, compensation and assistance

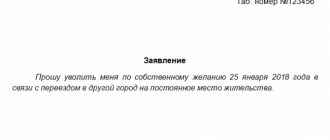

As for wages, vacation pay and other payments, they should be paid to close relatives: spouse, children, parents (Article 141 of the Labor Code of the Russian Federation). Dependents of the deceased at the time of death, for example, persons under his guardianship, are also entitled to receive this money. Salaries can be received within 4 months from the date of death of the employee, as defined in Article 1183 of the Civil Code of the Russian Federation. This means that the employee’s relatives must have time to contact the employer within this period. From the moment of such an application, the entire due amount must be paid out within a week. To receive you will need:

- statement;

- applicant's passport;

- document on relationship (marriage, birth or adoption certificate).

In addition, relatives may be entitled to financial assistance. This must be provided for by the terms of the employment or collective agreement. The employer can also arrange such a payment by its internal act. In some cases, at the place of work of the deceased, it is also possible to receive a social benefit for funeral, which is paid from the Social Insurance Fund.

In accordance with the provisions of Article 217 of the Tax Code of the Russian Federation, all money earned by a deceased person after his dismissal is not subject to personal income tax. Therefore, you need to hand over the entire amount without deductions. Insurance premiums for such payments are also not charged.

What documents are required by the employer?

In order for the paperwork to be completed without violations, the employer must have the following documents:

- Death certificate issued by an authorized body (registry office). We take a copy and attach it to the order. If the form is not provided by relatives, the employer must obtain it independently.

- A court decision or act confirming the fact of an accident, if the death occurred at work, on a business trip, or the employer is guilty of the incident.

- Documents of the person (passport) claiming to receive the deceased’s funds.

- Receipts or invoices for funeral expenses if relatives are applying for benefits.

- Applications in any form from relatives to receive funds, compensation, benefits and a work book.

- Sick leave if death occurred during the employee’s illness.

It is possible that other documents will be needed if circumstances require it.

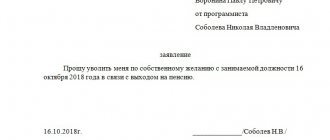

Application for issuance of TC

In the case where relatives come directly to collect the work book, the employer must protect himself before the law and ask for an application to be drawn up from the relatives of the deceased employee for the issuance of a work book, according to which it will be indicated to whom and on what basis the work book was given.

How to compose it correctly?

An application for the issuance of a work book in connection with the death of an employee is drawn up on sheet A4. If the organization has an established form for filling out applications, then you can use it, but if not, then the relative can fill it out at his own discretion.

In the upper right part it is indicated to whom the application is intended. In our case, this is the employer of a specific organization.

Next it is written from whom this statement was drawn up. Now the application must indicate the degree of relationship and the grounds on which the work is confiscated.

Only after this does the relative sign the application, and the employer, if he agrees with it, puts a stamp and issues a work permit.

Death at work: employer actions

If the management of a company or enterprise was faced with the premature death of a subordinate directly at the workplace, the responsible person must:

- immediately call the police and an ambulance to the scene of the incident (clearly indicate the reason for the call, provide all currently known details, state the applicant’s last name, first name and position);

- inform the relatives of the deceased employee about the tragedy (when communicating with the victim’s relatives, you need to choose the right words, but not mislead them - tell everything as it is);

- notify the authorities of the social insurance fund about the incident (this is necessary so that in the future the relatives of the deceased can easily receive the social payments due to them).

It is also necessary to notify the state labor inspectorate at the place of registration of the company about the incident. Representatives of the State Inspectorate are required to conduct an inspection to determine if an accident occurred. During the investigation, the state inspectorate must determine whether the death at work was caused by the employer's negligence.

The death of a work colleague must be reported to the appropriate authorities as soon as possible. If this is not done, the company's management will be accused of trying to hide the fact of a fatal accident.

Who can receive a deceased person's TC?

The work book is always kept by the employer if the employee officially carries out his work activities. The work record book is kept in the employee’s personal file along with some other documents.

A work book can be issued to an employee or his representatives only upon death. But what to do if the employee dies. Perhaps you just need to get rid of your work record?

In fact, this is not so and several people have the right to receive a work book , let's take a closer look at who they are for the employee.

What if several people apply for a book?

It often happens that an employee has many relatives. Parents, spouses, children, sisters, brothers.

All these people, perhaps after death, want to preserve the memory of the deceased people and will begin to carry out actions related to collecting the things of the deceased. They may also come to collect a work book.

Of course, the employer can only give the work to the relatives of the deceased .

This action is carried out in order of kinship; first, spouses and children have the right to receive the document, then parents, and so on.

If several people came, the employer, after checking the documents of those who came, must establish the degree of relationship of each person with the deceased, and only then decide whether to issue a work book or not.

Basic Rules

It would seem that death does not require any additional approvals at the level of labor relations. But the legislator ordered otherwise. The fact of death must be clearly recorded both in the employer's records and in the documents of the former employee. Entering a death record in the work book is confirmation of this.

Despite the fact that the fact of death is equated to dismissal (severance of the employment agreement), the procedure for registering this fact differs from the standard one. Thus, the employer needs to issue an order to the organization in the established form T-8, instead of the usual dismissal order.

After this action, the employee’s personal file is raised. The documents are double-checked and prepared for issuance to relatives, and a corresponding entry is made in the work book stating that the contract was terminated due to the death of the employee.

If we talk about the date, then the day of death is the actual date of termination of the employment contract . That is, in the left column of the labor form the number indicated as the date of death is entered. If for any reason the employer does not know the date of the tragic incident, then he has the right to set the date of the last day the employee performs his work duties.

In the event of termination of an employment contract in such circumstances, an appropriate entry is made indicating that the document has lost legal force due to death.

Next, you must refer to Article 83 of the Labor Code of the Russian Federation and the number of the order drawn up for the organization.

After an important entry is left in the work book with the death of the employee, an accrual of payment for the employee’s work is made , which he did not manage to receive and is transferred to the next of kin.

Issuance of a work book of a deceased employee to relatives

In connection with the death of an employee, the work book is given to his relatives, and no one has the right to deny them the right to receive it.

The legislator has provided for the sequence of issuing work permits and highlighted a number of nuances and features, which we will familiarize ourselves with.

Issue methods

How to issue a work book to the relatives of a deceased employee? The work book can be given to relatives in different ways.

Labor legislation does not limit citizens in one single way, so it is advisable to consider everything.

In your arms

The work book can be handed over to relatives.

To do this, it is enough to present a document proving your relationship with the deceased.

By mail

If relatives do not have the opportunity to come for a work book, the employer contacts them by phone and discusses the details of sending the work book by post with notification.

Only after that he goes to the post office and sends the labor document. To the right address.