In what cases is a civil contract concluded?

A contract may be concluded in the following cases:

- The company needs to perform work that is not related to its main activity (a grocery store is carrying out lighting repairs).

- The company needs to perform some one-time work (it is necessary to unload construction materials).

- The company needs to perform work and services for which it is not advisable to have a full-time employee (PC maintenance, preparation of annual reports, software updates, etc.).

The legislator does not limit organizations in concluding such agreements and in their number.

Main types of GPA - what are the types of agreements?

There are two types of contracts most often used:

- Contracts - they are used to perform work (repair, unloading, installation, etc.).

- Service agreements are used when an enterprise needs to perform any work, the result of which is expressed in an intangible dimension (accounting services, software updates, advertising services, etc.).

Very often, the subject of the agreement is difficult to attribute to one or another agreement (for example, the creation of a billboard and the placement of advertising in the media by the same organization).

Therefore, employers most often enter into a contract with individuals and a contract for the provision of services with legal entities. Although the legislation does not establish such a gradation.

Pros and cons for the parties

A contract provides employers with the following advantages:

- You don't need to have someone on staff to do this job.

- In addition to the amount agreed upon in the contract, you do not need to pay anything additional (vacation pay, sick leave).

- You can part with the Contractor at any time.

- The tax burden on such an employee is slightly less than on an ordinary one.

The disadvantages include the Contractor's right to terminate the contractual relationship at any time before the work is completed and the inability to influence him through disciplinary methods.

There are fewer advantages for employees:

- You don't need to be present at work the entire working day.

- You can terminate your employment relationship without working off.

The disadvantages include:

- Lack of permanent work, and as a result, the employee cannot use the guarantees established by the Labor Code of the Russian Federation (vacation, sick leave, compensation for layoffs, etc.).

- All disputes between the parties are resolved only in court.

- The customer may cancel the contract at any time.

In order for both the Customer and the Contractor to be insured against financial losses in the event of premature termination of the contract, the Civil Code of the Russian Federation allows them to prescribe the procedure for compensation in the contract.

Employment under a civil contract

When an employee is also a performer, then when he is hired, a record of this is not entered in the work book. In addition, the contract must clearly indicate the purpose for which the employee was hired, as well as indicate what exactly will be considered the result of the work done. The performer is free to independently decide how to perform the task, and is also not obliged to comply with the daily routine at the customer’s company.

Taxation

The taxation procedure differs slightly from that applied to full-time employees.

For employee

Regarding the calculation and withholding of various taxes for an employee who has entered into a contract, there may be the following nuances:

- Amounts of remuneration under the contract cannot be taken into account when calculating sick leave and benefits.

- You cannot receive tax deductions at your place of work.

- In terms of pension savings, citizens working under a contract will not suffer; the employer pays the same contributions for them as for employees.

Important! If a citizen submits a 3-NDFL declaration to receive a deduction, then all income can be included in it, not just salary.

Civil agreement with a full-time employee

The law does not prohibit concluding civil contracts with full-time employees. Such work is carried out within the organization:

- in addition to official duties;

- or during the period of paid annual leave.

When an employee of an organization becomes a party to such an agreement, when concluding a civil contract, the employer is obliged to comply with the following basic requirements:

- relations are regulated by the Civil Code;

- the tasks performed differ from the main duties of the TD;

- are performed in free time from the main job;

- The document contains no signs of an employment contract.

Draw up any agreement for free using a special agreement designer from ConsultantPlus.

The difference between a GPC agreement and an employment contract

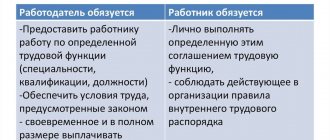

The differences between an employment contract and a GPC contract are shown in the table below:

| Comparison criterion | Employment contract | Civil contract |

| 1. | 2. | 3. |

| What legislation is it subject to? | Labor Code of the Russian Federation | Civil Code of the Russian Federation |

| Parties to the agreement | The parties are called the Employee and the Employer | The parties to the contract are the Customer and the Contractor* |

| Position, job function | Clearly stated in the text of the contract; moreover, the Employer sets the rules for how to perform the work (job description) | The text of the contract specifies a specific work or service. |

| Subject of the agreement | The process of performing the work assigned to a person | The result of performing work or providing a service |

| Procedure for concluding an agreement | In addition to the employment contract, a number of documents must be drawn up for the employee (work book, personal card, order, etc.) | No additional documents are required other than a signed agreement |

| Contract time | Can be either urgent or indefinite | Always concluded for a specific period |

| Contract expiration date | If there are no grounds for concluding a fixed-term contract, then the end date of the work is not determined | The contract must clearly state the start and end dates, and, if necessary, intermediate dates for the delivery of part of the work. |

| Is it necessary to obey the internal regulations of the organization? | The employee must comply with the daily routine established for him | The Contractor performs the work at a time convenient for him, or coordinates it with the Customer |

| Who is responsible for labor protection | The employer bears full responsibility for organizing labor protection | Organization of ore protection is entrusted to the Contractor |

| Social guarantees | The employee is provided with paid leave and retains his place during illness. | Not provided |

| Payment order | Payment is made for the labor process, it can consist of several parts (salary, bonus, bonuses, etc.) | Payment is set for the final result, the form of payment is agreed upon between the parties. |

| Disciplinary action | The employee is obliged to observe labor discipline, otherwise the employer has the right to punish him | The contractor is not obliged to comply with labor discipline |

| Procedure for early termination of the contract | The grounds for termination of the contract are provided for by the Labor Code of the Russian Federation; when applying them, the procedure established by law must be followed. | The Civil Code of the Russian Federation allows the termination of contracts unilaterally without explaining the grounds, while the parties pay each other compensation provided either by the Code or the text of the contract. |

| Pension contributions | 22% | 22% |

| Contributions to the Social Insurance Fund | 8% | 5,1% |

| Income tax | 13% | 13% |

When is a civil agreement concluded?

A civil law agreement (CLA), or a civil law agreement (CLA), refers to bilateral transactions (Article 153, paragraph 1 of Article 154, paragraph 1 of Article 420 of the Civil Code of the Russian Federation). Draws up in accordance with the Civil Code. In the economic turnover of organizations, the conclusion of a GPC agreement with an individual is used to formalize:

- provision of services (author's order);

- various types of work (contract).

Article 421 of the Civil Code allows it to be executed on any terms agreed upon by the counterparties. The sides are presented in various combinations:

- legal entities and individuals;

- legal entities;

- individuals.

IMPORTANT!

A citizen who is a party to such a civil agreement may have the status of an individual entrepreneur or an NPA payer.

The main current rule is that the legislation allows employers to employ persons on the basis of the employment contract only for other paid work not provided for in the employment contract (Letter of the Ministry of Labor of the Russian Federation No. 17? 3/B-383 dated 08/13/2014). Under such agreements, income is collected according to special rules. When registering them, many nuances should be taken into account so that they are not reclassified as labor. Registration errors lead to serious tax consequences - additional charges and fines.

Additionally: how to reflect transactions under civil contracts with individuals in accounting.

The legislative framework

- Article 702 of the Civil Code of the Russian Federation “Contract of work” – defines this type of contract

- Article 703 of the Civil Code of the Russian Federation “Work performed under a work contract” - determines what work is performed under a work contract

- Article 708 of the Civil Code of the Russian Federation “Time limits for completing work” - regulates the procedure for indicating and changing deadlines in the contract

- Article 709 of the Civil Code of the Russian Federation “Price of work” - the procedure for indicating the price in the contract

- Article 711 of the Civil Code of the Russian Federation “Procedure for payment for work” - regulates the procedure for payment for work performed.

- Article 717 of the Civil Code of the Russian Federation “Customer’s refusal to perform a work contract” – the procedure for the customer’s refusal to refuse a work contract.

- Article 720 of the Civil Code of the Russian Federation “Acceptance by the customer of work performed by the contractor” - the procedure and rules for accepting the work performed.

- Article 779 of the Civil Code of the Russian Federation “Contract for paid provision of services” - gives the concept of a contract for the provision of services

- Article 781 of the Civil Code of the Russian Federation “Payment for services” – regulates the procedure for payment under a service agreement

- Article 782 of the Civil Code of the Russian Federation “Unilateral refusal to execute a contract for the provision of services for a fee” – the procedure for terminating a contract for the provision of services.

- Article 783 of the Civil Code of the Russian Federation “Legal regulation of the contract for the provision of services for a fee” - determines the priority articles that govern the contract for the provision of services.

Contract form

The agreement comes into force and becomes binding on the parties from the moment of its conclusion.

According to the method of conclusion (execution), all contracts can be divided into the following types:

- oral;

- electronic;

- simple written;

- written - notarized.

All contracts that are executed upon their conclusion and for which the laws do not require a mandatory written form can be concluded orally

A feature of Russian legislation is the close relationship between the issue of the existence of a written form of an agreement and the presence or absence of a signature on the document, which expresses the will of the party to conclude an agreement. At the same time, the requirement for each party to sign a document expressing its will, as a condition for compliance with the written form, creates serious obstacles to the sale of goods, works, and services via the Internet. In contrast to the requirements for writing, which formalize the content of the agreements of the parties, a signature performs slightly different functions: identifying a person, providing certainty that this person participated in the act of signing, and expressing his consent to its contents.

The identification and conciliation functions of the signature can be compensated by the behavior of the party, indicating that it is the party to the contract and agrees to fulfill its terms (implicit actions). It cannot be considered that the written form of the contract was not complied with due to the lack of signatures, because:

- the parties have a document that sets out the terms of the agreement;

- the parties fulfill these terms of the agreement;

- in case of disagreement, resolve disputes with reference to the agreement,

therefore, the main objective of a written contract has been achieved: the parties have a source of its terms, which is not the case if the contract is concluded orally.

Article 160 of the Civil Code of the Russian Federation. Written form of the transaction

- A transaction in writing must be concluded by drawing up a document expressing its contents and signed by the person or persons entering into the transaction, or their duly authorized persons.

- When making transactions, the use of a facsimile reproduction of a signature using mechanical or other copying means, an electronic signature or another analogue of a handwritten signature is permitted in cases and in the manner provided for by law, other legal acts or agreement of the parties. (as amended by Federal Law dated 04/06/2011 N 65-FZ)

- If a citizen, due to a physical disability, illness or illiteracy, cannot sign with his own hand, then, at his request, another citizen can sign the transaction. The signature of the latter must be certified by a notary or other official who has the right to perform such a notarial act, indicating the reasons why the person making the transaction could not sign it with his own hand.

However, when making transactions specified in paragraph 4 of Article 1851 of this Code, and powers of attorney for their execution, the signature of the one who signs the transaction may also be certified by the organization where the citizen works, who cannot sign with his own hand, or by the administration of the inpatient medical institution in which he is being treated by a medical organization in which he is being treated in an inpatient setting.

When making powers of attorney specified in paragraph 3 of Article 185.1 of this Code, the signature of the one who signs the power of attorney can also be certified by the organization where the citizen works, who cannot sign with his own hand, or by the administration of the medical organization where he is being treated in an inpatient setting . (Paragraph 2, Clause 3 as amended by Federal Law No. 116-FZ dated May 23, 2018)

Bilateral (multilateral) transactions can be carried out in the ways established by paragraphs 2 and 3 of Article 434 of this Code.

The law, other legal acts and agreement of the parties may establish additional requirements that the form of the transaction must comply with (execution on a certain form, sealed, etc.), and provide for the consequences of non-compliance with these requirements. If such consequences are not provided for, the consequences of failure to comply with the simple written form of the transaction are applied (clause 1 of Article 162).

The written form of a transaction is also considered to be complied with if a person carries out a transaction using electronic or other technical means that make it possible to reproduce the contents of the transaction unchanged on a tangible medium, while the requirement for a signature is considered fulfilled if any method is used that allows one to reliably identify the person who expressed will. The law, other legal acts and agreement of the parties may provide for a special method of reliably identifying the person who expressed the will.

Bilateral (multilateral) transactions can be carried out in the ways established by paragraphs 2 and 3 of Article 434 of this Code.

The law, other legal acts and agreement of the parties may establish additional requirements that the form of the transaction must comply with (execution on a certain form, sealed, etc.), and provide for the consequences of non-compliance with these requirements. If such consequences are not provided for, the consequences of failure to comply with the simple written form of the transaction are applied (clause 1 of Article 162). (Clause 1 as amended by Federal Law dated March 18, 2019 No. 34-FZ)

Commentary on Article 160 of the Civil Code

It follows from Article 160 of the Civil Code that an agreement can be concluded both in traditional (paper) form, and through the exchange of letters, telegrams, telexes, telefaxes, electronic documents, as well as through acceptance of the offer by conclusive actions.

Failure to comply with written form

The Plenum of the Supreme Court of the Russian Federation in its Resolution dated December 25, 2018 No. 49 in paragraph 3 explains that failure to comply with the requirements for the form of the contract when the parties reach an agreement on all essential conditions (clause 1 of Article 432 of the Civil Code of the Russian Federation) does not indicate that the contract was not concluded In this case, the consequences of non-compliance with the form of the contract are determined in accordance with special rules on the consequences of non-compliance with the form of certain types of contracts, and in their absence - by general rules on the consequences of non-compliance with the form of the contract and the form of the transaction (Article 162, paragraph 3 of Article 163, Article 165 of the Civil Code of the Russian Federation) . Thus, if the requirement for a written form of an agreement for trust management of movable property is not met, such an agreement is invalid (clauses 1 and 3 of Article 1017 of the Civil Code of the Russian Federation). At the same time, according to paragraph 1 of Article 609 of the Civil Code of the Russian Federation, a lease agreement for movable property for a period of more than a year, and if at least one of the parties to the agreement is a legal entity, regardless of the term, must be concluded in writing, in case of non-compliance with which the parties have no right to refer for witness testimony in support of the contract and its terms (clause 1 of Article 162 of the Civil Code of the Russian Federation).

Using facsimiles

You can also sign an agreement with a “live” signature, an electronic signature, as well as a facsimile or an analogue of your signature. If the parties decide to use any option (except for a “live” signature), then this condition must be indicated in the contract.

A facsimile (from the Latin fac simile - “do like this”) is a stamp that provides an accurate reproduction of a handwritten signature.

Paragraph 2 of Article 160 of the Civil Code allows facsimile reproduction of a signature when making transactions in cases and in the manner provided for by law, other legal acts or agreement of the parties.

The cases and procedure for reproducing a facsimile signature are not provided for by special laws, therefore the use of a facsimile is permitted by agreement between the parties to the contract. It should be taken into account that a facsimile signature will not be recognized by government agencies, courts and counterparties when:

- the presence of a facsimile is not provided for by agreement of the parties;

- the presence of a facsimile is not expressly provided for by law;

- The facsimile is used outside the framework of civil law relations (administrative, labor, tax (letters of the Ministry of Finance of Russia dated 04/13/2015 N 03-03-06/20808, dated 03/15/2010 No. 03-02-08/13, dated 10/26/2005 No. 03 -01-10/8-404, the Ministry of Taxes of Russia dated 04/01/2004 clarified that the use of facsimiles is not allowed on powers of attorney, payment documents, or other documents that have financial consequences). indicated that the use of facsimiles in primary documentation is not provided for by current legislation and is therefore not permitted);

- the presence of special legal regulation when the law requires the presence of a personal signature;

- dishonest use of facsimiles for the purpose of obtaining unjustified tax or material benefits at the expense of counterparties (third parties).

Using analogues of a handwritten signature (codes, passwords and other means as a signature)

Paragraph 2 of Article 160 of the Civil Code follows that an agreement can be signed with an electronic signature, as well as an analogue of a handwritten signature, which can be:

- dealer code;

- various ciphers;

- login and password for your account on the website;

- E-mail address;

- personal identification number of the owner of a credit or debit payment card (PIN code) and other electronic means of payment;

- other technical devices and types of communication confirming that the order was given by an authorized person (for example, exchange of scanned copies).

One of the analogues of a handwritten signature (clause 2 of Article 160) is the use of an electronic means of payment (ESP), i.e. — codes, passwords and other means, as well as the use of various types of bank cards, other technical devices and types of communication if the ESP allows us to confirm that the order was given by an authorized person.

Expression by a person of his will using electronic or other similar technical means (for example, by transmitting a signal, including when filling out a form on the Internet) is equivalent to a simple written form of a transaction. This lays the foundation for concluding what is colloquially called a “smart contract”, but also makes it possible to simplify the execution of a number of one-sided transactions. The condition for compliance with the written form in such cases will be the circumstances in which the will is expressed using technical means:

- according to the conditions of acceptance of the expression of will, the commission of these actions is sufficient to express the will. For example, on a page on the Internet, in an information system, including in an application installed on a smartphone, the conditions for pressing the OK key are described, and from these conditions it follows that such a press is sufficient for a full expression of will;

- It follows from the custom established in the relevant field of activity that such actions are sufficient.

It is important to take into account that a significant number of expressions of will in the modern world are made by sending signals (by pressing a button on a smartphone, by pressing a key on a desktop computer, etc.). All these actions are essentially legally significant messages (Article 165.1 of the Civil Code), but a large number of them are also unilateral transactions.

Article 161 of the Civil Code of the Russian Federation. Transactions concluded in simple written form

- Must be made in simple written form, with the exception of transactions requiring notarization:

1) transactions of legal entities among themselves and with citizens;

2) transactions between citizens in an amount exceeding at least ten times the minimum wage established by law, ten thousand rubles , and in cases provided for by law - regardless of the amount of the transaction.

- Compliance with a simple written form is not required for transactions that, in accordance with Article 159 of this Code, can be concluded orally.

Commentary on Article 161 of the Civil Code of the Russian Federation

According to Article 161 of the Civil Code of the Russian Federation, contracts are concluded simple written form

- in which at least one of the parties is a legal entity;

- citizens among themselves in an amount exceeding at least ten times the minimum wage established by law (from September 1, 2013 - in an amount exceeding 10,000 rubles);

- in cases expressly provided for by law (for example, a real estate purchase and sale agreement).

mandatory notarization only in cases where this is expressly provided for by law.

The following are subject to mandatory notarization:

- a mortgage agreement, as well as an agreement on the pledge of movable property or rights to property to secure obligations under the agreement, which must be notarized (clause 2 of Article 339 of the Civil Code);

- an agreement on the assignment of claims (clause 1 of Article 389 of the Civil Code), as well as an agreement on the transfer of debt (clause 1 of Article 391 of the Civil Code), if the claims or debt themselves are based on a transaction completed in notarial form;

- annuity agreement (Article 584 of the Civil Code);

- an agreement aimed at alienating or pledging a share or part of a share in the authorized capital of a limited liability company (Clause 11, Article 21, Article 22 of the Law on Limited Liability Companies).

At the request of the parties, any transaction can be notarized. Typically, the services of a notary are resorted to when concluding contracts for the purchase and sale of real estate.

Why?

The purpose of notarization of transactions is to officially confirm the fact of their completion. It does not guarantee the validity of the transaction, but it eliminates the basis for subsequent disputes on many issues (the authenticity of the signatures on the document, the ability to account for one’s actions at the time of the transaction, freedom of expression to complete the transaction, the absence of misconceptions regarding the nature of the transaction, etc.), and also simplifies the procedure for registering the transfer of ownership of real estate.

Types of contracts

All contracts can be divided according to several criteria: by the method of conclusion, the subject and other criteria.

According to the method of conclusion, all contracts can be divided into the following types:

- public contract;

- agreement of adhesion;

- preliminary agreement;

- agreement in favor of a third party;

- framework agreement;

- option agreement;

- subscription agreement.

- public auction.

According to the subject, all contracts can be divided into the following types:

- purchase and sale;

- exchange;

- donation;

- annuity and life support with dependents;

- rent;

- rental of residential premises;

- free use;

- contract;

- execution of work;

- performing R&D;

- paid provision of services;

- shipping;

- transport expedition;

- loan and credit;

- financing against the assignment of a monetary claim;

- Bank deposit;

- Bank account;

- storage in a safe deposit box

- insurance;

- assignment;

- commission;

- agency;

- commercial concession;

- author's.

The article was written and posted on June 10, 2012. Added - 07/14/2013, 10/26/2014, 04/27/2015, 03/28/2017, 02/16/2018, 01/04/2019, 03/19/2019

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.