When buying an apartment, we are filled with a feeling of joy and optimism. Finally, the dream came true and we became the owners of the long-awaited home. However, after living in marriage for some time, there may come a time when the apartment and acquired property have to be divided. In this article we will talk about how property (apartment) is divided if it was purchased during an official marriage, but the owner is only one of the spouses.

Regulatory framework

According to the Civil Code (Article 256), all property acquired by spouses during an official marriage is considered joint property and is divided equally upon divorce, unless this is stipulated in a separate written agreement (nuptial agreement). In this case, the property is divided according to the algorithm prescribed in it.

If an apartment purchased during marriage is registered in the name of one of the spouses, then it is still considered common joint property and you will not be able to sell it without the notarial consent of the wife (husband) (Article 35, paragraph 3 of the Family Code). The consent of the spouse is not required if more than three years have passed since the divorce.

What to choose?

To avoid the risk of unfair division of property, experts suggest registering the purchased apartment as shared ownership if the spouses have a marriage contract. Moreover, the shares do not have to be equal - they can be set at the discretion of the buyers. If the shares are not allocated, then in the event of a divorce and subsequent division of jointly acquired property, you should understand that you will have a trial, during which the division will be carried out. By default, the court will proceed from the fact that both spouses have equal rights to property acquired jointly, and the division is made in equal parts. If one spouse is able to prove that he has the right to a larger share and confirms this with documents, the court may decide to divide the property in a different ratio.

It is necessary to understand that even if the apartment purchased during marriage is not jointly acquired property, but belongs to one of the spouses, the court will apply the same division rules as in the case of joint property.

How are rights distributed?

- Own. If the apartment was registered as ownership before marriage or in a civil marriage, then it is sole property and does not require any additional permits for sale. When purchased in an official marriage, the apartment is considered joint property and upon sale the notarized consent of the other half will be required.

- Common joint property. It can only be registered in an official marriage and the presence of both owners will be required during the sale. If one of the spouses cannot be present at the transaction, then a notarized power of attorney for the sale is issued. Spouses have equal rights and in case of divorce the apartment is divided equally.

- Common shared ownership. It can be formalized in both official and civil marriage. In this case, ownership arises for a certain share in the apartment, according to an agreement that is stated in the main agreement. During the sale, the presence of all participants in the transaction will be required and, according to Federal Law No. 172 of June 2, 2016, it falls under the notarial category.

When is ownership recognized as sole ownership?

Certain circumstances of purchasing an apartment make it possible not to share it with your other half in the event of a divorce:

- Ownership of the residential premises was obtained before marriage. In this case, the apartment is not subject to division.

- Own funds. When purchasing an apartment, personal savings or funds received from the sale of other real estate were used. In this case, you will have to prove it in court and document it.

- Ownership rights were acquired as a result of privatization.

- The apartment was registered through a donation agreement.

- The property was inherited.

- If three years have passed since the divorce, then the apartment can be sold without the consent of the other half.

- If, when purchasing real estate, a marriage contract was drawn up and, according to it, the purchased apartment is registered as the property of one of the spouses, then the other party cannot claim it.

Important! Only property that was acquired during marriage on a common basis is subject to division.

Division of property during divorce

Imagine, married spouses purchase a house or apartment, but the funds are transferred to the seller’s account from one of the spouses - all, or a smaller or larger part. But it is not important. It is established at the legislative level that all purchases made during marriage are the common property of the spouses.

Therefore, during a divorce, the property will be divided exactly in half, and the spouse who invested more money is unlikely to prove his right to a larger share. This requires a good lawyer and a lengthy legal battle.

Cases when a spouse will not receive part of the apartment during a divorce, even if it is a joint property

Therefore, it is better to insure yourself in advance and take care of protecting your interests when purchasing real estate.

How to register only for yourself and not share?

By buying an apartment with your own funds, you can protect yourself from the claims of your other half. In this case, there are certain schemes for purchasing housing so that it does not go to the husband or wife after a divorce.

Buying a home through third parties

The apartment is registered in the name of the closest relative (mother, father, brother, sister).

After registration and receipt of ownership of the apartment, a gift agreement is drawn up. The transaction is registered with the MFC and ownership of the object passes to you. Such registration will require some time and money. In this case, your other half has no legal basis to claim living space.

Donation

By registering an apartment through a gift deed, you will protect yourself from the claims of your other half in the event of a divorce, but you can pay tax. After receiving a deed of gift for residential premises, you must draw up a declaration and submit it to the tax office for verification. If the apartment was received from an outsider, you will have to pay a tax in the amount of 13% of the cadastral value of the property.

When registering a gift agreement, no tax is paid if the apartment was donated by a close relative:

- mother;

- father;

- Brother;

- sister.

In this case, it is necessary to prove family ties.

Inheritance

If you are an only child, then the apartment can be registered in the name of one of the parents. Sooner or later the apartment will become your property, but the husband or wife will not be able to claim it.

Personal funds

When buying an apartment with your own personal funds, you cannot guarantee yourself complete security in preserving the property. By law, an apartment acquired during marriage is considered joint property and upon divorce is divided between spouses in equal shares .

If you fail to reach an agreement with your other half, you will have to prove your right in court. And it’s not a fact that the court will side with you. Most likely, you will have to pay monetary compensation.

Acquisition of property by one of the spouses during separation

If you are officially married, but live separately, then the purchased housing is not subject to division (Article 38 Part 4 of the Family Code). To do this, it is necessary to confirm in court the fact of separation (registration, testimony of neighbors, etc.).

The right to a privatized apartment

A separate category considers the issue of division of property acquired during family life under a gratuitous transaction, but not as a gift. Here we are talking about the emergence of ownership rights to privatized housing. In this case, the basic concept that real estate acquired during marriage is joint property only applies if the spouses mutually participate in the procedure. For example, if a woman has written an application to refuse privatization, then she has no right to claim this living space during a divorce. Only the husband will be the owner of the privatized premises. At the same time, while married, the wife can live in the apartment on a permanent basis, but does not have the right to dispose of it.

Important point! If spouses participated in privatization together, they both become full owners of the living space.

If such a procedure was completed by one of the couple before the wedding, then one of the spouses is recognized as the sole owner of the property. The second person has no right to claim a share in this apartment, even if he lived in it while married. In accordance with the Housing Code of the Russian Federation, a spouse must change his place of residence after a divorce. This is due to the legal termination of family relationships. That is, the husband or wife loses the right to use the residential premises upon divorce, since they are no longer a member of the owner’s family.

USEFUL INFORMATION: How is maternity capital divided during a divorce?

If the apartment is registered in the name of the husband, he can voluntarily transfer part of the property to his wife and children. But no one has the right to oblige him to do this by law. A spouse can claim part of the apartment only if it can be proven that major repairs were carried out at his (her) expense. In this case, it is considered that the living space has been increased or improved at the expense of the family budget, which means that the apartment is recognized as joint property.

Retaining the right to use an apartment after divorce

When considering a dispute over the division of real estate, the court may decide to retain the spouse’s right to use the residential premises, even if he is not considered the owner of the privatized apartment. This issue, according to the law, is resolved at the discretion of the judge. The right of use can be established either for a certain period or for life.

To make such a decision, there must be compelling reasons, for example, if the spouse does not have another home, and due to his property status, he cannot purchase or rent a new one.

The right to use privatized housing must be terminated in the following cases:

- the period established by the court decision has expired;

- according to an agreement signed between the former spouses;

- the circumstances on the basis of which the husband or wife received (a) the right to use privatized housing have been terminated. For example, I bought my own apartment. In this case, the purchase terminates the circumstances under which the use of the privatized premises was possible.

Documents required to prove ownership of housing

When selling a home, you will need passports and title documents for the property, which include:

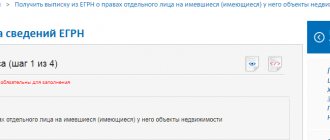

- certificate of state registration of rights or an extract from the unified state register of real estate;

- a document, but on the basis of which the ownership right was registered (agreement on the gratuitous transfer of apartments into the ownership of citizens, a purchase and sale agreement, a gift agreement, a certificate of inheritance, etc.).

Reference! If the apartment is sold for cash, then these documents are quite enough to formalize and register the transaction with the MFC. You will also need a certificate from the Housing Office about registered persons.

Is my spouse's consent required to purchase an apartment in 2021?

First, let's look at the articles of the Family Code, which says:

- jointly acquired property during marriage is common for the spouses. In case of divorce, it is divided in half, regardless of the level of income, unless other conditions are provided for in the marriage contract (Article 34 of the RF IC);

- By default, the purchase of property is considered to be agreed upon between the spouses. Therefore, no oral or written consent is required (Article 35 of the RF IC). However, the transaction is contestable if it is proven that one of them does not agree or did not know about it.

The need to obtain a notarial consent of the spouse for the purchase of an apartment is determined in each specific case. Usually, if a realtor is involved in the transaction, he recommends receiving the document when the second spouse:

- does not take part in any stages of the transaction: inspection of the apartment, discussion of the purchase, selection of documents, etc.;

- I strongly disagree with the purchase of real estate.

When is a share in someone else's real estate due?

The most common cases:

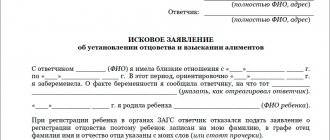

- Inheritance. The closest relatives of the deceased may claim a share in the apartment.

- Will. Persons included in the will can count on a legal share in the apartment.

- Mortgage. If the apartment was purchased with a mortgage, but the husband or wife is registered as a co-borrower, they can be included in the number of owners of the residential premises.

- General farming. When running a joint farm for a long time (more than 3 years).

- Repair. If you spent your own money on expensive repairs.

- Marriage contract. If the marriage contract contains a clause on including a person among the owners.

- Sale of an apartment. When selling a privatized apartment and purchasing other real estate, all citizens must be included in the number of owners of the new home.

What can the second spouse claim if the transaction took place before the wedding?

Help: If the apartment was purchased before marriage, then it belongs to the person to whom it was registered or registered.

Let's consider cases when one of the spouses can claim a share in an apartment or monetary compensation:

- if one of the spouses invested their own funds and can prove this in court;

- maintaining a common joint household and living in the same area for a long time;

- if a person is a co-borrower in a mortgage loan, he can claim a share in the apartment even without being officially married.

Video review of the premarital apartment section:

How to insure yourself?

If one of the spouses does not want to divide the property and wants it to remain his during a divorce, then it is necessary:

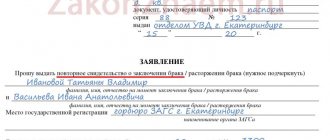

- Conclude a marriage contract. It specifies the conditions under which the apartment remains with one of the parties and is not subject to division.

- Draw up an agreement for donating an apartment through third parties so that it is not divided during a divorce.

- Opening a bank account. When purchasing an apartment, carry out transactions from your account. During the trial, it will be easier to prove that personal funds are used.

Buying an apartment while married requires certain knowledge and skills. Consult an experienced real estate attorney before purchasing. He will tell you how best to act in a given situation. And remember that you won’t have to share the apartment if you arrange it correctly.

If you find an error, please select a piece of text and press Ctrl+Enter.