What happens if the deadlines for paying salaries are not fixed anywhere?

If this fact is discovered by inspectors, claims and prosecution will definitely follow.

Moreover, this applies even to those cases when salaries are issued on the same dates month after month, but they are not specified in local documents. How to fix the situation? Of course, put the necessary documents in order, and if for some reason they are still missing, do the following:

- If possible, retroactively republish an incorrect document, but only if doing so does not cause any discrepancies with your other documentation. Unfortunately, this is not always possible.

- If changes are made to the collective agreement, it is necessary to assemble a commission consisting of representatives of both parties - both the employees and the employer. The commission formalizes the results of the negotiations in an additional agreement, which includes new terms for salary payments.

- The most time-consuming method is if the salary dates are fixed in the employment contract, since you will have to draw up an additional agreement for each such contract.

- Changes made to the PVTR are formalized by an order, which is familiarized to each employee against signature.

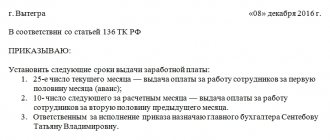

What an order for the payment of wages that changes the terms looks like can be seen here.

An order establishing the timing of payment of wages is an optional, but desirable document. The absence of local acts in which the dates of salary payments must be recorded is considered a violation. The same applies to cases when such documents exist, but the dates indicated in them are contrary to the norms of Art. 136 of the Labor Code of the Russian Federation or do not coincide with the days of actual payments. To avoid penalties, such violations must be corrected urgently.

Be the first to know about important tax changes

Drafting of documents

According to the Labor Code, the deadline for payment of wages was not previously approved. But this year they made changes. From 10/03/2016, salaries must be transferred by the 15th of each month. Those enterprises that had other dates draw up an order to change (postponement) the deadlines. A prerequisite for its execution is the fixation of a specific payment date. Other details that must be contained in the document:

- name of company;

- date of creation (after creation of a legal entity and registration);

- place of compilation;

- type of form (order, instruction, etc.);

- Name;

- manager's signature and seal.

About

Administrative measures

Article 5 of the Code of Administrative Offenses talks about administrative punishment for delayed wages. Liability under this article depends not only on the size of the debt and the timing of non-payment, but also on the form of business and the frequency of violations. If the law was violated for the first time, the fine will be:

- 50 thousand rubles. from the company;

- 20 thousand rubles. personally from the guilty person;

- Up to 5 thousand rubles. with IP.

If the delay in wages was repeated, the amount of the fine will increase to:

You can read more about fines for late wages in a special article prepared by our editors.

These measures are intended to encourage management to make payments on time and in full. Administrative fines can be issued by GIT employees and the court. That is, in order for management to be punished, the employee will need to write a statement to the judicial or supervisory authorities.

We invite you to read the Petition to postpone the consideration of an administrative case

After considering the complaint, the enterprise conducts an inspection, based on the results of which a fine is issued. If the violation is serious and a fine alone is not enough, the case is sent to law enforcement agencies for further investigation, and possibly the initiation of a criminal case.

We are trying to get payment

Most regulatory and human rights organizations have a complaint procedure. That is, before writing a statement to the Ministry of Internal Affairs, the Investigative Committee or the court, you should try to resolve the problem directly with the employer.

is sent to the general director of the enterprise demanding payment of wages and compensation for the delay . Most often, a conflict situation is resolved at this stage, because not a single boss is interested in conducting inspections at his company.

Let's learn how to file a claim against an employer for non-payment of wages by reading this article.

The standard period for consideration of a claim is 10 days. If after this period no measures are taken to eliminate violations of the law, the employee should forward complaints to other authorities to protect his interests.

Where should I complain?

Where to file a wage arrears complaint first depends on the complainant's goals. Each authority has its own powers; with the help of one appeal you can punish the employer, with another – to achieve payment of the debt and compensation.

An application to the State Tax Inspectorate may result in management issuing a fine and an order to eliminate violations. Among these instructions, most likely, will be the payment of wage arrears. If the case takes a more serious turn (fraud or money fraud is discovered), the information will be sent to other departments.

Contacting the labor inspectorate does not imply a mandatory claim procedure. The application can be submitted simultaneously with the letter to the enterprise.

Law enforcement agencies should be contacted in case of gross violation of the law. An application to the Investigative Committee or the Ministry of Internal Affairs will allow the unscrupulous employer to be punished according to the law, perhaps even depriving him of his position. The court will help collect arrears of wages. In addition to the debt, the employee has the opportunity to demand payment of moral damages, lost profits and compensation for delays.

Special material has been prepared on the topic of how to write an application to the prosecutor’s office against an employer; we recommend that you read it.

Salary compensation and its calculation

As mentioned above, financial liability is provided for violating the terms of salary payments. This means that from the first day of delay, the employer must charge, in addition to funds for wages, compensation, the amount of which is currently equal to 1/150 of the Central Bank rate .

For clarity, let’s look at an example of calculating the amount of compensation. Given:

- Salary delay period = 17 days.

- Central Bank rate = 7.25%.

That is, in addition to the main debt, management is obliged to transfer compensation to the employee in the amount of 246.5 rubles. In this case, the amount of compensation was insignificant, but, as a rule, wages are delayed for longer periods, and accordingly, the amount of the penalty will be greater.

You may find the following information interesting: how to calculate compensation for delayed wages?

Salary for the first half of the month

This payment procedure causes difficulties, because... in accordance with the Tax Code and the position of the Ministry of Finance, personal income tax must be calculated based on monthly results, taking into account the provision of standard deductions. In addition, other deductions (for example, alimony) are also calculated from the salary for the entire month. Therefore, it turns out that if you make payments for the first half of the month according to the time actually worked, but without taking into account deductions from your salary, then the salary for the second half of the month will be less, because When calculating, you will need to take into account salary deductions for the entire month.

Therefore, most accountants calculate salaries for the first half of the month in the form of an advance: they set each employee an amount that is approximately half of the amount payable for the month (including deductions) and pay it without dividing it into specific additional payments, allowances and without withholding income tax.

Approach each employee individually. If an employee was on vacation for the entire first half of the month, he does not need to pay an advance, because he has already received vacation pay for this period. If the employee did not work for some reason or worked less time, then the amount of the advance must be reduced.

When should salaries be paid?

From October 3, 2016, the content of Article 136 of the Labor Code of the Russian Federation was adjusted, requiring the employer to designate the days of payment of wages in two amounts up to and including the 15th day from the end of the period for which the wages were calculated. At the same time, there is a rule according to which the minimum interval between payment dates is established - half a month.

Taking both requirements into account simultaneously leads to the following procedure for establishing payment deadlines:

- For the first part of the month, the payment date is up to and including the 30th day of this month;

- For the second part – until the 15th day inclusive of the next month.

Is it possible to set deadlines using an order?

Part 6 of Article 136 of the Labor Code of the Russian Federation clearly states with the help of which documents you can set the deadline for issuing earned funds:

- Internal Labor Regulations (ILR);

- Collective agreement;

- Employment agreements with each individual employee.

The specified list does not include an order, and therefore it is not permissible to use it as a document establishing the timing of the issuance of funds to personnel.

The employer is obliged to pay wages within the terms established in accordance with the Labor Code of the Russian Federation, the collective agreement, internal labor regulations, and employment contracts (Part 2 of Article 22 of the Labor Code of the Russian Federation).

Let us remind you that wages must be paid at least every half month, and the final payment to the employee for the past month must be made no later than the 15th day of the next month (Part 6 of Article 136 of the Labor Code of the Russian Federation). Is it necessary to draw up an order on the timing of payment of wages?

We suggest you read: When bailiffs do not have the right to write off debts from a pension card - Mikhail Vyacheslavovich Frolkov, October 28, 2018

When should salaries be paid?

The legislation clearly states that every employee must receive a salary at least twice a month, i.e. every two weeks. If the employer has the desire, he can pay his subordinates more often - even every day at the end of the shift.

It is impossible to issue salaries less than twice a month: violation of this rule threatens enterprises and organizations with serious sanctions from supervisory structures.

At the same time, exactly how the wages will be divided: equal shares or not – is at the discretion of the employer.

From October 3, 2021, legislators have determined the exact day by which wages must be transferred to employees - this is the 15th of the current month. If the enterprise previously established deadlines that did not comply with this rule (for example, “finishing” for the previous month was paid on the 16th or later), it is necessary to issue an order to postpone the payment of wages.

This procedure should also include written notification to all employees of the enterprise about upcoming changes in the timing of salary payments at least two months before the event itself.

If the employee does not agree with the innovation, according to Art. 74, clause 7, part 1, art. 77, art. 178 of the Labor Code of the Russian Federation, the employer has the right to fire him.

It should be noted that if the dates of payment of wages in fact comply with the norms of the Labor Code of the Russian Federation, but are not documented anywhere, this may also subject the company and its director to administrative fines: from 30 tr. rub. up to 50 tr. rub.. – for the company itself and from 1t. R. rub. up to 5t. R. rub. - for its leader.

Sample order on the timing of payment of wages

The form of this order is developed by the employer independently. It is recommended to include the following details and information:

- publication date;

- registration number under which the order is recorded in the journal of local administrative documents;

- place of compilation;

- employer's name;

- title of the document (order on the timing of payment of wages);

- The text part of the order itself, which indicates specific dates for payment of wages (for the first and second half of the month), provides a link to the legislation - Art. 136 of the Labor Code of the Russian Federation, and a responsible employee is appointed who will familiarize employees with the approved deadlines;

- manager's signature;

- signature of the designated responsible employee.

You can find a sample salary order here.

Sample design

Each organization can independently prepare for itself an order form, the main details that must be included in this form:

- Date of preparation;

- number received when making a registration entry in the journal to record executed administrative documents;

- city where the organization is located;

- the name of the organization itself;

- document title;

- the need to fulfill the requirement of Article 136 of the Labor Code of the Russian Federation;

- an order to establish certain deadlines for the payment of wages - the day of issuance of the advance for the first half of the current month (usually set on the 20th of the current month) and the day of issuance of wages for the second half of the month (at the beginning of the next month);

- an order to appoint a responsible person who will familiarize all employees with the established deadlines; all employees must know when their work will be paid; if the deadlines are not met, they can complain to the labor inspectorate, the prosecutor's office, or collect the debt through the court;

- signature of the manager and introductory signature of the person in charge.

About

Order for payment of wages

Add to favoritesSend by mail Order on wages - a sample of it may be needed to establish or correct the timing of salary payments. You will learn everything about how to issue such orders and what the consequences are if the dates for issuing salaries are not recorded in your local documents in our article.

Labor Code of the Russian Federation on the terms of payment of wages Sample order on the terms of payment of wages What to do if the terms of payment of wages are not recorded anywhere? Results of the Labor Code of the Russian Federation on the timing of salary payments According to Art. 136 of the Labor Code of the Russian Federation, employers set the deadlines for paying wages independently, but with the obligatory observance of two conditions: payments are made at least 2 times a month and no later than 15 calendar days from the end of the period for which wages were accrued. IMPORTANT! If the “payday” day falls on a weekend, the money is issued the day before.

How to write an order correctly

Today there is no standard uniform template for all orders on the timing of payment of wages, so employers can write it in any form. In some cases, enterprises use internal document templates approved in the company's accounting policies. But, regardless of which path is chosen, the order must include a number of mandatory information. These include:

- Date of preparation,

- Name of the organization,

- the essence of the order, i.e. exact dates of payment of wages,

- the basis for its writing,

- persons responsible for its execution, indicating their positions and full names.

If any additional papers are attached to the document, they must be noted in a separate paragraph.

Order for early payment in December of an interim advance: sample

Let's assume that the accountant has chosen the option that the interim advance for December will be paid in December 2021. And the final salary payment will be made in January 2021.

It is, of course, advisable to prepare the order in advance so that the accountant has time to carry out all the calculations and prepare them for payment through the bank. In our opinion, it is logical to stipulate in the order, at a minimum:

- reason for early payment;

- early payment period;

- instruction regarding the deadline for final payment for December.

Here is an example of an order for early payment of wages in December 2021. Such a document is needed, first of all, for accounting in order to make calculations correctly.

Collective and individual labor agreements

If the terms of payment of funds in the contracts do not comply with the requirements of Article 136 of the Labor Code, then it is necessary to conclude an additional agreement. If this is a collective document, then the change is drawn up in one file, and if it is an individual document, then for each employee it is necessary to prepare an additional agreement to the agreement on changing the payment terms. If the employee does not give consent, then you have the right to dismiss such an employee on legal grounds (Article 74, 178 of the Labor Code).

Additional agreement No. 3

to the employment contract dated December 12, 2012 No. 15

On amendments due to the entry into force of new norms of the Labor Code. Rostov 07/20/2016

In pursuance of the requirements of Article 136 of the Labor Code, the parties agreed to amend the clauses of the employment contract in order to bring them into line with the changes, namely to state clause 5.7 as follows:

- Other terms of the Employment Agreement remain unchanged.

- The agreement begins on October 1, 2016.

- The agreement is drawn up in 2 copies: for each party. They have equal legal force.

- Set salary payment deadlines:

- for the first half of the month worked – on the 17th day of the current month;

- for the second half of the month worked - on the 2nd day of the month following the current one.

Next, the details of both parties must be indicated and the employer’s stamp must be affixed.

Please note: if the salary payment period is fixed in the collective agreement, then the procedure for making changes is more complicated. First of all, a commission is created from representatives of employees and managers. After the meeting, an additional agreement to the collective agreement is drawn up. It contains new data.

Deadlines for salary payments: order

The Labor Code of the Russian Federation provides that specific dates for the payment of wages are established by internal labor regulations, a collective agreement or an employment contract (Part 6 of Article 136 of the Labor Code of the Russian Federation). This means that the timing of payment of wages to employees must be given in any of the specified documents. The order is not named in this list. Therefore, it is impossible to set the deadline for payment of wages by order alone.

We invite you to familiarize yourself with New fines: job quotas for people with disabilities 2018

At the same time, in order to additionally inform employees, the employer, of course, has the right to issue an order in which, with reference to the provisions of the collective agreement, employment contracts or internal labor regulations, reminds of the deadlines for payment of wages in force in the organization. The same order, for example, will be a guide for the accounting department: when to pay employees their salaries.

In addition, the order may establish new deadlines for the payment of wages, if such deadlines were previously determined by the internal labor regulations, and the issued order involves making changes to these rules.

Here is a sample order on the timing of payment of wages, which is issued simultaneously with the approval of new deadlines in employment contracts with employees, a collective agreement or internal labor regulations.

In this article we will look at whether it is necessary to draw up an order on the timing of payment of wages or whether the deadlines specified in the employment contract are sufficient. What are the features of drawing up an order on the timing of payments and what must be indicated in it. And also, what responsibility does the employer bear for violating the terms of payment of wages? From this article you will learn:

- features of drawing up an order for the payment of wages;

- Is it necessary to draw up an order if there are employment contracts;

- sample order on the timing of payment of wages;

- who is responsible in case of violation of the payment deadline.

How to draw up an order for the payment of wages and take into account deadlines The goal of any work activity is not just satisfaction from the labor process itself, but also to receive monetary compensation for this as wages.

Is it possible to pay before the due date?

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

In contrast to delays in the provision of wages, transferring funds to a bank account or issuing cash at the cash desk earlier than the regulated period is not punishable by law. This fact takes into account the linking of transactions for transferring funds to employee cards to banking days.

This is important to know: Documents for receiving maternity payments in 2021

For this reason, banks transfer salaries to company employees not on Saturday or Sunday, but on Friday, since the last two days of the week are not banking days.

And if the payment is made on Monday, it will be possible to talk about a delay, which will mean additional expenses for employers.

Also, an employee can receive a salary ahead of schedule

- when going on vacation;

- under special circumstances in the life of the employee himself;

- ahead of the long holiday period;

- before a long business trip.

Questions

Is it possible to transfer at the initiative of an employee?

The labor relations of the parties presuppose a contractual basis, taking into account the norms of the Labor Code, meaning that if there is a request from the worker to establish a different period for payment of wages, as well as good reasons and the consent of the employer, a postponement is possible. At the same time, you should be prepared for the fact that regulatory authorities will definitely have questions about an individual approach to an employee, and therefore, the postponement must be justified, for example, by remote work.

How to submit an application for payment ahead of schedule (sample)

Cases where an employee urgently needs money now, but the planned payment of wages is still far away, are not uncommon.

In such a situation, the employer can go to the meeting and make payment earlier than the deadline established by local regulations, but only as an exception and on the basis of an application, as well as an issued order allowing such one-time actions.

Is a stamp required on the 2-NDFL certificate? Details are in our article. You will find rules for filling out a time sheet in this article.

How many rest hours should there be between shifts? Find out here.

What if it falls on a weekend?

To pay wages, a specific date is prescribed in the local acts of the company, for example the 15th and 30th.

But throughout the calendar year, these dates do not always coincide with working days, and the enterprise can work on a five-day basis. It is for such situations that the law provides a way out, which is to postpone the date of accrual of remuneration 1 day earlier, that is, on the eve of the weekend.

How to pay if an employee is on a business trip?

By virtue of Article 167 of the Labor Code of the Russian Federation, for the period of performance of an official assignment in another location on a business trip, the employee is still subject to the norms of local acts, which implies compliance with the deadlines for payment of remuneration.

Wherein:

- If the form of payment involves the use of bank cards, no special problems arise, given that the employee will receive a salary even while being five hundred kilometers away.

- If payment for labor is made in cash on the basis of a salary sheet, at the employee’s request in writing, the remuneration is sent to him in the manner prescribed by clause 11 of the Decree of the Government of the Russian Federation of October 13, 2008 N 749 with compensation for postage expenses at the expense of the employer.

When should the bonus be paid?

The bonus is paid simultaneously with the salary in the basic terms determined by the institution.

But in some situations, other options are possible, which depend on the status of the award itself:

- That is, if the payment is an integral part of wages on the basis of an employment contract, the period for its accrual coincides with the basic salary.

- If the premium is not mandatory and is paid only if certain conditions are met, the date of its accrual may differ from the base period.

How to withhold personal income tax? How many times a month?

Within the framework of the tax legislation of the Russian Federation, actual income is the final amount of allocated funds for a fully worked reporting period.

And since the advance is only a partial payment, which in some cases is paid even for a period not fully worked, according to Part 2 of Article 223 of the Tax Code of the Russian Federation, personal income tax is charged only on wages in the basic amount of -13% once a month.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Salary

Notice of change in deadlines

In accordance with the Labor Code of Russia, all questions regarding the place of payment of wages, the procedure and timing of its issuance are stipulated in the local documents of the employing company or in an employment or collective agreement. However, the Labor Code of the Russian Federation contains a number of restrictions that the employer has no right to neglect.

Recognition of unemployed status takes 2-3 weeks, and if childbirth occurs during this period, there will be no one to pay for sick leave. If you work in an organization with a branch structure, then when liquidating a unit in your city, request a transfer to the central office. The liquidation of an enterprise and the liquidation of its division are legally different precedents.

Agreement)/otherwise the paragraph should be deleted) - MTPL policy. You will find important information about extracting from the order in the material here.

Responsibility for violation of norms

Failure to pay funds on time is a violation of the law. For such a case, criminal and administrative liability is provided. Cash compensation is also paid to the employee at a fixed rate. Previously, it was 1/300 of the refinancing rate. Now it is 1/150 of the key rate.

The changes that have taken place have significantly increased the amount of additional compensation payments to the employee. The fines for violations are significant if this happens systematically. They also underwent an upward change due to changes in the Labor Code. If the delay is made for the first time, then individual entrepreneurs and organizations will pay 1-5 thousand.

rubles and 30-50 thousand rubles, respectively, or will not carry out activities for 3 months. Repeated actions increase the fine to 10-30 thousand rubles and 50-100 thousand rubles, respectively. The official is also responsible. It is obliged to pay 10-20 thousand rubles or receive a warning, the next time the amount is 20-30 thousand rubles, or a ban on occupying a place for up to 3 years is possible.

In cases where such non-payments result in serious consequences, the fine will be 120-500 thousand rubles, the amount of income for 1-3 years of work. In some situations, imprisonment is possible (this period can be up to 7 years). A fine also awaits those who pay less than the established minimum wage (minimum wage). The company will pay 30–50 thousand rubles.

The employee has the right to know. when exactly he must receive wages according to the law, as well as how many times a month. The Labor Code of the Russian Federation contains all the necessary information. The employee must know his rights and protect them in situations where the employer ignores legal requirements regarding the timing of payments.