How to correctly approve the timing of salary payments

To set deadlines, you need to specify specific dates in the PVTR, collective or labor agreement. The first local act is the most preferable and convenient for setting deadlines for the enterprise as a whole.

In addition, it is easier to make changes to the PVTR - this is an internal local act of the company, the rules in which the employer sets independently without coordination with anyone. The main thing is to take into account the provisions of labor laws.

It is convenient to set terms in an employment contract that differ from those in force for the enterprise as a whole, when special dates for the issuance of funds are determined for individual employees. Changing the content of an employment contract, and especially a collective one, is more difficult and takes longer, and therefore this method of setting deadlines is less common in practice.

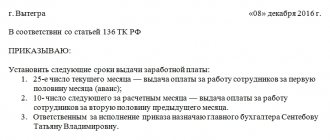

Sample order to change deadlines in PVTR

- Organization details;

- Publication date and number;

- Title;

- The basis for preparing the order is the content of Article 136 of the Labor Code of the Russian Federation;

- An order obliging to make updates to the current Rules, a new wording of the paragraph of the Rules is provided, where the deadlines are prescribed;

- Moment of entry into force of the changes;

- An order to monitor the execution of the order and familiarize employees with the new deadlines;

- Instructing the chief accountant to make payments within the specified time frame;

- Approval signature of the manager.

An order on the timing of payment of wages is an organizational and administrative document that establishes specific days on which the organization’s employees receive wages.

Is it possible to set deadlines using an order?

Part 6 of Article 136 of the Labor Code of the Russian Federation clearly states with the help of which documents you can set the deadline for issuing earned funds:

- Internal Labor Regulations (ILR);

- Collective agreement;

- Employment agreements with each individual employee.

The specified list does not include an order, and therefore it is not permissible to use it as a document establishing the timing of the issuance of funds to personnel.

The employer is obliged to pay wages within the terms established in accordance with the Labor Code of the Russian Federation, the collective agreement, internal labor regulations, and employment contracts (Part 2 of Article 22 of the Labor Code of the Russian Federation).

Let us remind you that wages must be paid at least every half month, and the final payment to the employee for the past month must be made no later than the 15th day of the next month (Part 6 of Article 136 of the Labor Code of the Russian Federation). Is it necessary to draw up an order on the timing of payment of wages?

We suggest you read: When bailiffs do not have the right to write off debts from a pension card - Mikhail Vyacheslavovich Frolkov, October 28, 2018

How to write an order correctly

There is no unified form of the document; it is drawn up in any form accepted by the enterprise, taking into account the general rules for drawing up organizational and administrative documentation. Mandatory elements of the order:

- Date of preparation;

- Name of the organization;

- basis for publication;

- the essence of the order, i.e. exact dates of salary payment;

- persons responsible for its execution, indicating their positions and full names;

- manager's signature;

- list of persons familiarized with signature.

Sample order to change deadlines in PVTR

- Organization details;

- Publication date and number;

- Title;

- The basis for preparing the order is the content of Article 136 of the Labor Code of the Russian Federation;

- An order obliging to make updates to the current Rules, a new wording of the paragraph of the Rules is provided, where the deadlines are prescribed;

- Moment of entry into force of the changes;

- An order to monitor the execution of the order and familiarize employees with the new deadlines;

- Instructing the chief accountant to make payments within the specified time frame;

- Approval signature of the manager.

Methods and terms of order storage

For the entire period of practical relevance, the document is stored in a separate folder, bound with administrative documentation. If the action is completed, it continues to be stored in the enterprise archive.

The order on the general terms of the organization for issuing remuneration relates to administrative and economic documents. According to the list of standard management archival documents (Rosarkhiv order No. 236 dated December 20, 2019), they are stored for 5 years after termination (clause 1.2.19 of the list).

If the order is drawn up on the basis of an employment contract for a specific employee, then it relates to personnel documents and is stored for 75 years (clause 8.1.434).

What happens if salary payment deadlines are not fixed?

The Labor Code of the Russian Federation (Article 136) from October 3, 2016 obliges the employer to set dates for the payment of earnings in two installments up to and including the 15th day from the end of the billing period.

The minimum interval between dates is half a month. Labor legislation requires that salary payment days be indicated in local documents.

If this rule is violated, the organization is held accountable, even if the remuneration is actually paid in accordance with all norms.

According to Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation (as amended on April 24, 2020), a recorded violation leads to a warning or the imposition of an administrative fine:

When should salaries be paid?

From October 3, 2016, the content of Article 136 of the Labor Code of the Russian Federation was adjusted, requiring the employer to designate the days of payment of wages in two amounts up to and including the 15th day from the end of the period for which the wages were calculated. At the same time, there is a rule according to which the minimum interval between payment dates is established - half a month.

Taking both requirements into account simultaneously leads to the following procedure for establishing payment deadlines:

- For the first part of the month, the payment date is up to and including the 30th day of this month;

- For the second part – until the 15th day inclusive of the next month.

The employee will receive part of the earnings in the current month, the rest in the next month. The first part of the month is the first 15 calendar days, respectively, the second part of the month is the remaining days.

Instructions: preparing orders for approval and changes in wages

Micro-enterprises that use a standard contract in their activities are also exempt from this obligation. The order approving the salary regulations in 2021 must be signed by the general director or other official.

In the latter case, such powers must be contained in the employee’s job description, the document of appointment to the position and in the power of attorney issued in his name.

Regarding the latter, also make sure that it has not yet expired, otherwise the employee’s signature will be invalid.

The powers of the General Director are confirmed by the Charter of the organization. The state has not established a standard form for the order, so organizations are free to submit it.

You can use any convenient method. The only requirement is that it must clearly follow from the text what, when and by whom it is put into effect. Check that the text contains: information about the company;

Order on deadlines for payment of wages sample 2021

In addition, it is easier to make changes to the PVTR - this is an internal local act of the company, the rules in which the employer sets independently without coordination with anyone.

The main thing is to take into account the provisions of labor laws. In an employment contract, it is convenient to establish terms that differ from those in force for the enterprise as a whole, when special dates for the issuance of funds are determined for individual employees. In it, she will request documents confirming the validity of reflecting such amounts and tariffs. Your task is correctly answer this requirement. A new procedure for tax authorities to deal with uncleared payments has been approved. Starting from 12/01/2020, the rules by which tax authorities will deal with uncleared payments to the budget will change. A special place in the new rules is given to clarifying payment slips for the payment of insurance premiums. Daily allowances for traveling workers: should personal income tax and contributions be calculated If the employee’s work is related to

Changing the timing of salary payments: how to correctly change the days of salary payment, how to issue an order to postpone the days, is it necessary to draw up a notice?

Moreover, if the payment day coincides with a weekend or non-working holiday, then the payment of wages is made on the eve of this day. Legislation obliges the employer to familiarize employees, upon signature, with the adopted local regulations directly related to their work activities.

So, for example, when hiring (before signing an employment contract), as well as in case of changes made to this document, the employee must be familiarized with signature.

will relate to the mandatory terms of the employment contract - wages, as in your case)

An order to change the salary: in what case is it issued, how to draw it up,

This occurs when individual legislative acts come into force, or on the initiative of the administration itself, subject to the availability of financial opportunities. The most common situation for salary changes is when it is set at the minimum wage.

As soon as a decision is made at the legislative level to increase this indicator, the administration is also obliged to revise the employee’s earnings upward. Otherwise, the company will be held liable for failure to comply with the requirements of the law.

Order on the timing of salary payment

The same order, for example, will be a guide for the accounting department: when to pay employees their salaries.

In addition, the order may establish new deadlines for the payment of wages, if such deadlines were previously determined by the internal labor regulations, and the issued order involves making changes to these rules. Here is a sample order on the timing of payment of wages, which is issued simultaneously with the approval of new deadlines in employment contracts with employees, a collective agreement or internal labor regulations.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

Considering that the order on the timing of payment of wages duplicates the information specified in employment contracts or labor regulations, it is not necessary to familiarize employees with it against signature.

What to include in PFR reporting

Disputes arose regarding filling out reports to the Pension Fund of Russia using the SZV-M and SZV-STAZh forms. Accountants are at a loss what to include in reporting if the LLC has only one director and he is not paid a salary.

The latest clarifications from the Ministry of Finance have eliminated the contradictions - they are given in Letter No. 17-4/10/B-1846 dated March 16, 2018. Now information about the sole founder must be reflected in pension reporting for 2021.

Example.

Vesna LLC has one founder. There is no employment contract or GPC agreement concluded with the founder, and no wages are accrued. But information about the owner of the company must be included in SZV-M and SZV-STAZH.

Order on early payment of wages in December 2021 - 2021 samples

the exact dates of payment of wages, the basis for its writing, the persons responsible for its execution, indicating their positions and full names. It is allowed to set different payment terms for different departments.

But you can postpone the payment date if it falls on a weekend.

Sample order for early payment of wages in December (by final payment) The changes helped increase the amount of payments in case of delays in money. Thus, fines for violating employment contracts are quite significant, especially if this is not the first time this has happened.

Please help me figure it out. By order of the enterprise, the terms for payment of wages have been changed from 02/01/2018 to now 13.

In general, changes can be made to an employment contract only with the mutual consent of its parties (Art.

72 of the Labor Code of the Russian Federation). In this case, the initiator of changes can be both an employee and an employer (Chapter

12 of the Labor Code of the Russian Federation). In addition, in exceptional cases, an organization can change an employment contract unilaterally (Article 74 of the Labor Code of the Russian Federation). Labor legislation does not determine how to amend the PVTR and other local regulations.

The law only specifies the procedure for their adoption.

Please attach a rationale for the need for such changes to the document.

Early salary payment in December: is it possible or not?

Is it possible to pay wages for the second half of December 2020 before the New Year and is it necessary to issue an order for this purpose? Many accountants may be faced with this question as 2020 begins. Let's look at the legislation.

So, wages must be paid at least every half month. The exact date of payment of wages must be specified in the internal labor regulations, collective or employment agreement - no later than 15 calendar days from the end of the period for which it was accrued. This is provided for in Article 136 of the Labor Code of the Russian Federation.

Let’s assume that in the employment contract the date of payment of wages for the second half of the month is the 8th. However, January 8, 2021 is a public holiday. Therefore, the second part of the salary must be paid the day before. That is, December 31, 2021. This is required by Part 8 of Article 136 of the Labor Code of the Russian Federation.

However, in many organizations, the second part of the December salary payment does not fall on a weekend (for example, it falls on January 10, 2021). Can this part of the salary be paid ahead of schedule in December 2021? There are different opinions on this matter.

Opinion 1: December wages cannot be paid before the new year

If the payment deadline for the salary falls on January 10, 2021 (Friday), then you must pay the salary on January 10. It is impossible to issue wages earlier, since Article 136 of the Labor Code of the Russian Federation requires determining a specific date for payment of wages.

Opinion 2: December salaries can be paid early

Article 136 of the Labor Code of the Russian Federation provides that wages should be paid “at least every half month.” Thus, the law establishes “not less often.” But it is not necessary to pay exactly twice. You can pay three or more times. There are no prohibitions in this regard in the Labor Code of the Russian Federation.

Our opinion

In our opinion, the employer has the right to pay wages for December ahead of schedule. This does not violate workers' rights in any way. In this regard, salaries can be issued not in January 2021, but, for example, in the period from December 25 to December 31, 2021. However, we believe that the most logical thing to do during this period is not to issue the final payment for December 2021, but to make another interim payment - an “unscheduled advance.” And in January 2021 (within the period established by the documents) it will be possible to make the final payment, pay the “balances” and withhold personal income tax.

The employer does not face a fine for issuing wages ahead of time. It doesn’t matter for what reason the organization violated the regularity of payments - due to upcoming weekends and holidays or just like that. This opinion is shared by the Ministry of Labor in letter dated December 6, 2021 No. 14-1/B-1226.

You can also highlight the following positions of the Ministry of Labor:

- The company may make concessions to the employee and, at his request, issue wages early. It doesn’t matter that the intervals between payments will shift because of this. This improves the employee’s position, which means it does not violate the Labor Code rules. This is what the Ministry of Labor expressed (letter dated July 26, 2020 No. 14–1/B-582).

- The Ministry of Labor in letter No. 14-1/ОOG-8602 explained that money can be issued ahead of schedule. According to the department, early payment is not a violation, since it improves the situation of employees. Therefore, money for December can be issued at the end of December. And it doesn’t matter if you have specified different payment dates in the collective or employment contract of your employees.

It is important to say that the explanations of the Ministry of Labor should be used with caution. The law allows changing paydays only if they coincide with holidays. Then the money must be issued the day before (Part 8 of Article 136 of the Labor Code). For example, if payday is January 2, 5 or 7, 2029, money can be issued in December. But it is prohibited to arbitrarily postpone the deadline.

Example

Salary Petrenko N.V. is 30,000 rubles. The employment contract stipulates that the advance payment is paid on the 25th, and the second part of the salary is paid on the 10th. December 25, 2021 Petrenko N.V. paid an advance for December in the amount of 15,000 rubles. The employer, on his own initiative, wants to pay the employee his salary for December ahead of schedule - December 30, 2021. On this day Petrenko N.V. will transfer another “interim advance” in the amount of 14,500 rubles. Another 500 rubles (final payment) will be transferred to the employee on January 10, 2020. Thus, by January 10, 2021 Petrenko N.V. will receive his full salary: 30,000 rubles (15,000 + 14,500 + 500). Moreover, the employee will receive most of it before the New Year.

It is, in principle, possible to make the final payment for December 2021 in December, but it is not very logical. Moreover, this may require the accountant to recalculate in the future. The fact is that the logic is lost - the month has not yet ended, and the accountant has already drawn up a time sheet and accrued wages. In our opinion, this should not be done.

Salary payment deadline 2021

Since December 15 is a Saturday, accordingly, wages must be paid on the last working day before this weekend.

Employers whose payment terms do not meet the requirements of the Labor Code of the Russian Federation need to make changes to their internal documents. And the execution of changes will depend on which document records the salary terms. Changes in the terms of payment of wages reflected in the internal labor regulations are formalized by order.

Moreover, if there is a trade union, it is necessary to take into account its opinion regarding changes in the terms of payment of wages. You can familiarize yourself with a sample order to change the timing of salary payments. After making changes to the PVTR, do not forget to familiarize each employee with these changes against signature.

According to the laws established today, payment for staff work is carried out twice a month, with an interval of two weeks. The internal documentation of the enterprise indicates the date when the payment was made. Quite often, the administration of the enterprise uses special orders that set deadlines for payment of wages.

Below, we propose to consider the rules for drawing up such documents, and we will tell you how to set a new payment deadline.

The commented law provided for changes to Article 136 of the Labor Code of the Russian Federation

- Principle of documentation

- Different types of employment contracts

- How to fill out the paperwork

- Who is responsible for complying with current regulations?

Who is responsible for complying with current regulations?

Changing the deadlines for payment of wages without notification, as well as failure to pay on time, is a crime. In this situation, such violations may entail administrative or criminal liability. In case of violation, the organization must provide financial compensation to the employee. The amount of compensation previously amounted to one three hundredth of the refinancing rate. Today, this amount is one hundred and fiftieth of the key rate.

The resulting number should be multiplied by the amount of wages. The result obtained is the amount of compensation per day of delay. Compensation to an employee for violation of payment terms for work activities may exceed the given figures if this nuance was specified in advance in the employment contract. In this case, the reason for the delay in financial payment is not taken into account.

Amendments to the current Legislation have significantly increased the amount of additional financial compensation to an employee. In case of systematic violations by the enterprise administration, high financial penalties are provided. These circumstances are discussed in detail in the Labor Code. For the first delay in payment of finances, the amount of the fine in relation to individual entrepreneurs and organizations ranges from 1,000 to 5,000 rubles, and from 30,000 to 50,000 rubles, respectively. Otherwise, the tax authorities have the right to stop the company’s activities for three months. For further violations, the amount of penalties increases to 10,000–30,000 rubles and 50,000–100,000 rubles, respectively.

It should also be noted that such responsibility rests with the official. If there are violations, the amount of penalties ranges from 10,000 to 20,000 rubles. In addition, a warning is issued to the official. In case of repeated non-compliance with the rules, the fine varies from 20,000 to 30,000 rubles. In addition, tax authorities may issue a ban on holding a position for a period of three years.

Salaries cannot be paid less than twice a month.

The current law of the Labor Code also provides for situations where delays in issuing wages to employees entail serious consequences. In such a situation, the amount of the fine ranges from 120,000 to 500,000 rubles or is calculated based on the amount of income for the last thirty-six months. Also, such violations may result in imprisonment for up to seven years. Penalties may also be imposed on those organizations that pay wages below the established minimum (Minimum Monthly Wage). In such a situation, the fine varies from 30,000 to 50,000 rubles.

The current bill obliges the management of organizations to strictly notify their staff of the date of payment of wages. The employer is also obliged to provide staff with information about the number of monthly payments. Employees carrying out their labor activities within various enterprises must not only be aware of their rights, but also have the opportunity to protect them in situations where management deliberately ignores the requirements of the law regarding the timing of payment of wages.

Principle of documentation

Previously, the Labor Code of the Russian Federation did not consider the timing of payment of wages. However, in two thousand and sixteen, this provision was revised.

According to the decree of October 3, salary payment must be made by the fifteenth day of each month. In this regard, many organizations where payment of wages is carried out later must draw up a report on changes in payment terms. The order on the timing of payment of wages in accordance with the established procedure must contain the exact date of payment.

Let's look at what else this document should contain:

- name and details of the enterprise;

- date of writing the document;

- place where the document was written;

- type of form;

- table of contents.

The completed order must be certified by the signature of the head of the enterprise and a seal.

According to the new resolution, documents such as the Regulations on Remuneration, the employment contract and internal regulations must indicate specific deadlines for issuing payment. If this documentation does not contain a clearly established framework, then the above documents need to be completely redone .

To summarize all of the above, we can say that today, when drawing up an order for calculating wages, you should indicate a specific date, and not an approximate period, as was previously allowed.

Important! If there is a need to change the deadline for issuing a salary, the enterprise administration must notify each employee . Such notices will be provided in writing. It should also be taken into account that such documents are drawn up in advance (at least two months from the date of payment).

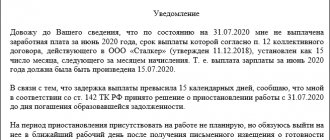

According to the new resolution, all employees of the enterprise must be notified of the new issuance deadlines. Let's look at what a sample order on the timing of payment of wages looks like:

on amendments to the employment agreement

CJSC "Pyramid" brings to your attention that according to the current rules of legislation, based on changes dated October 3, 2016 under Article No. 136 of the Labor Code, the data of the employment agreement (dated March 23, 2021 No. 90 - Labor Contract) has been corrected. From October 1, 2021, clause 6.4 of the Employment Agreement will be amended as follows: “The advance payment is issued on the 21st of the current month.

Payments are made on the 7th day of the month following the previous one.”

Chief: I.T. Mikhailov Acquainted: D.B. Potapov."

In each organization this date is determined individually

How to fill out the paperwork

The initial task of the accounting department employees is to check current standards for compliance with the new requirements set out in the amendments to the Labor Code. If the current documentation complies with the established form, then no additional changes are required. If inconsistencies are discovered, an appropriate order should be prepared, where new dates will be prescribed. When setting new payroll dates, the wishes of the staff should be taken into account. If there is a trade union company in the organization, it is necessary to obtain its consent. In most cases, the management of the enterprise tries to issue salaries on the first days of the month.

Due to changes in the law, many organizations are wondering whether it is possible to issue wages earlier than the deadline. This approach is often practiced and is not considered illegal. This situation does not imply the imposition of penalties on the management of the company. Once the deadline for issuing wages has been agreed upon, an order must be prepared. Let's see what a sample of this document looks like:

“Closed Joint Stock Company “Zima” Order No. 231 September 09, 2016 Omsk

About making edits

To bring changes and amendments into conformity with the standards specified in Article No. 136 of the Labor Code

I order:

Make the necessary amendments to the order of Zima CJSC dated June 21, 2015 No. 5 “On labor regulations”, setting out paragraph 4.9 as follows: The amendments made will take effect from October 1, 2021. To the head of the HR department, P.V. Koshkina. bring this information to each employee of the company, against signature.

To the head of the accounting department - chief accountant Valieva T.V. make payments for work within the period specified below.

Employees of Zima CJSC are paid for their labor activities twice a month:

- For the first part of the month – the nineteenth day of the current month;

- For the second part of the month - the fourth day of the month following the current one.

Head: Tarasov P.D.”

If the company has a large staff, it is necessary to attach an employee familiarization sheet to this order.

If the employer has the desire, he can pay his subordinates at least every day at the end of the shift

Different types of employment contracts

According to article of law No. 136 of the Labor Code, the administration of the enterprise is obliged to enter into an additional agreement with the staff if the timing of the payment of wages does not meet the requirements in the above article . If there is a collective document, such changes are formalized in one act.

In the case of individual contracts, it is necessary to prepare additional agreements for each employee. In the event that a company employee refuses to sign the above act, the administration has the right to dismiss the employee. This rule is spelled out in the seventy-fourth and one hundred and seventy-eighth articles of the Employment Agreement.

Below we offer an example of additional consent:

“Additional consent No. 6 to the labor agreement dated May 15, 2007 No. 26

On amendments to the employment agreement, according to the new law of the Labor Code

Voronezh November 20, 2016

CJSC "Pyramid", hereinafter referred to as the "Employer" represented by the head Mikhailov I.T., and the employee of the marketing department Arsenyev V.P., hereinafter referred to as the "Employee" entered into an agreement, which is an integral part of labor agreement No. 26 of May 15 2007 about the following:

In accordance with the requirements specified in Article No. 136 of the Labor Code, the parties agreed on changes to the clauses of the labor agreement in order to bring them into line with the amendments, namely to clarify clause No. 5.7 as follows:

- Other terms of the previously concluded employment agreement remain unchanged.

- This agreement comes into force on October 1, 2016.

- This document was drawn up in several copies for each party.

- Each copy has equal legal force.

Set the following dates for payment of wages:

- for the first half of the month worked – the sixteenth day of the current month;

- for the second half of the month worked - the first day of the month following the current one.”

The details of each party must be specified below, and the completed document must be certified by the seal of the organization. It should also be noted that with a fixed period for salary payment in the collective agreement, this procedure has a number of its own features.

When making amendments to a collective agreement, a special commission must be created, consisting of representatives of the personnel and management of the enterprise . At the meeting, details and details of the future agreement are discussed.

Only after such a meeting is held, the act itself is drawn up, in which various amendments are indicated.

The legislation clearly states that every employee must receive a salary at least twice a month

When should salaries be paid?

The legislation clearly states that every employee must receive a salary at least twice a month, i.e. every two weeks. If the employer has the desire, he can pay his subordinates more often - even every day at the end of the shift.

It is impossible to issue salaries less than twice a month: violation of this rule threatens enterprises and organizations with serious sanctions from supervisory structures.

At the same time, exactly how the wages will be divided: equal shares or not – is at the discretion of the employer.

From October 3, 2021, legislators have determined the exact day by which wages must be transferred to employees - this is the 15th of the current month. If the enterprise previously established deadlines that did not comply with this rule (for example, “finishing” for the previous month was paid on the 16th or later), it is necessary to issue an order to postpone the payment of wages.

This procedure should also include written notification to all employees of the enterprise about upcoming changes in the timing of salary payments at least two months before the event itself.

If the employee does not agree with the innovation, according to Art. 74, clause 7, part 1, art. 77, art. 178 of the Labor Code of the Russian Federation, the employer has the right to fire him.

It should be noted that if the dates of payment of wages in fact comply with the norms of the Labor Code of the Russian Federation, but are not documented anywhere, this may also subject the company and its director to administrative fines: from 30 tr. rub. up to 50 tr. rub.. – for the company itself and from 1t. R. rub. up to 5t. R. rub. - for its leader.