What's new in payroll in 2021 was provided for in 2021

An important role in changes in wage calculation in 2021 is played by the established minimum wage.

This figure is revised annually, in general cases upward. For 2021, the federal minimum wage is set at 12,130 rubles. Regional authorities have the right to approve their own sizes, but they are not lower than the federal value. Thus, each individual, within the framework of an employment contract, provided that the monthly working hours are fully worked out, cannot receive a monthly salary of less than 12,130 rubles. This figure will also be needed to calculate and pay benefits for temporary disability, maternity and others.

As for insurance premiums calculated from wages, the values of the maximum bases for 2021 have been updated:

- for contributions to VNiM - 912,000 rubles, if this threshold is exceeded, contributions stop accruing;

- for contributions to compulsory pension insurance - 1,292,000 rubles; if this limit is exceeded during the year, in the remaining months, contributions to pension insurance are calculated based on a rate of 10% instead of the standard 22%.

For 2021, salary indexation is provided for most categories of public sector employees: employees of the Ministry of Internal Affairs, military personnel, medical workers, and teachers.

What is salary

Basic concepts and definitions regarding wages are set out in Chapters 20 and 21 of the Labor Code of the Russian Federation. According to Article 129 of the Labor Code of the Russian Federation

,

wages - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in territories exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Labor Code of the Russian Federation / Article 129

The state provides guarantees for the remuneration of workers, which include:

- Establishing a minimum wage (minimum wage

): wages should not be lower than the minimum wage, otherwise the enterprise or individual entrepreneur is guaranteed inspections and fines. - Measures to ensure an increase in the level of real wages. The main one is its indexation

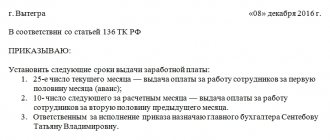

, which should be carried out once a year and depends on the increase in consumer prices for goods and services (Article 134 of the Labor Code of the Russian Federation). - Terms and order of salary payment.

The timing of payment of wages must be fixed in the employment contract by specific dates with clear wording. The interval between payment of the first and second parts of the salary should not exceed 15 days. For exceeding the interval between them, the company faces a fine of 50,000 rubles. - Responsibility of employers for violation of the requirements established by labor legislation and other regulatory legal acts containing labor law norms, collective agreements, and agreements.

- Restriction on remuneration in kind. Thus, the share of wages paid in non-monetary form cannot exceed 20 percent of the accrued monthly wage.

- Limitation of the list of grounds and amounts of deductions from wages by order of the employer, as well as the amount of taxation of income from wages. For example, when withholding under several executive documents, the employee must in any case be retained 50 percent of the salary.

State guarantees for the payment of wages to employees are the main points that the employer needs to pay attention to, since most complaints and inspections regarding the calculation and payment of wages are carried out precisely on them.

What salary calculation changes have been planned since March 18, 2020

Initially, a nationwide vote for the bill on amendments to the Constitution of the Russian Federation was planned for April 22, 2021. Wednesday, April 22, was supposed to be a non-working day so that everyone could come and express their opinion on amending the basic law or vote against it.

The president was supposed to sign the decree declaring this date a day off on March 18, the day of Crimea’s annexation to Russia. In this case, it would turn out that April 22, 2021 is a paid day off. The payment procedure would depend on what system the employee works on - salary or another. The norm of working days according to the production calendar would be reduced; employers would have to pay employees for this day at double the rate.

In the final version, the president signed the decree on March 17, but the fight against the coronavirus epidemic in Russia that unfolded at the end of March made adjustments and instead of one day off, the country first received a week, and then a whole month of non-working days. How these changes affected wages will be discussed in the next section.

What changes in payroll in 2021 resulted from measures to combat coronavirus?

On March 25, 2021, the Russian president, as one of the measures to combat the spread of the new disease, declared the days from March 30 to April 3 non-working. On this issue, the Ministry of Labor and Social Protection issued a letter dated March 26, 2020 No. 14-4/10/P-2696, in which it explained the work procedure during this period, as well as the new rules for calculating wages in 2021 for March and April and transferring vacations, falling within this period:

- The presence of additionally established non-working days is not a basis for reducing employee salaries.

- Piece workers must be paid remuneration for the specified non-working days in accordance with current local regulations.

- If an employee is on vacation, the specified non-working days are not included in the number of vacation days and the vacation is not extended for these days.

- Payments to employees who continue to perform work functions should not be made at an increased rate for these days, since they are not weekends or holidays.

- Issues regarding the continuation or termination of work carried out on a rotational basis are regulated by agreement of the parties to the employment contract.

In addition, the letter contains a list of organizations that are not subject to the presidential decree establishing non-working days. This list was then supplemented by the department’s letter dated March 27, 2020 No. 14-4/10/P-2741.

On April 2, the president’s second address related to coronavirus infection took place. In it, he called for extending the period of non-working days until April 30. Further, non-working days were extended until May 11, 2021.

To learn about the deadlines for paying taxes and paying wages due to coronavirus, read the following articles:

- “Is it possible to defer taxes due to coronavirus?”;

- “When should wages be paid in April 2020”;

- “Salaries in May due to holidays are issued according to special rules.”

ConsultantPlus experts have prepared a review “Non-working weeks: what to do as a personnel officer and accountant.” If you have access to K+, skip ahead to this review. If you don't have access, get it for free for a trial period.

Changes in personal income tax from 2021

1. From January 1, 2021, a progressive personal income tax scale will be introduced. This means that the amount of tax will depend on your income level: the more you earn, the more you pay. The personal income tax rate will increase from 13 to 15 percent for those who earn more than 5 million rubles a year. But 15% will have to be paid not on all income, but only from the moment the amount exceeds 5 million rubles. For example, if you earn 6 million rubles, 5 million will be taxed at a rate of 13%, and another 1 million at a rate of 15%.

The increased rate applies to residents and non-residents. But the increased rate will not apply to the income of Russian residents from the sale of personal property or receiving property as a gift, unless we are talking about securities. Also, 15% does not apply to income in the form of insurance payments.

For increased personal income tax, a special KBK has been approved: 182 1 0100 110. According to the instructions of the president, these amounts will be used for the treatment of children, the purchase of expensive medicines, medical equipment, etc.

Draft Law of September 17, 2020 No. 1022669-7

2. Individuals, including individual entrepreneurs, will pay personal income tax on interest on their deposits and account balances. The standard tax rate is 13%.

Please note that tax is not calculated on the deposit amount, but on the accrued interest. Moreover, only in the case when they exceed the amount calculated as 1,000,000 rubles × Central Bank of the Russian Federation rate. The rate is taken at the beginning of the year for which the tax is calculated. Since the amendments will come into force in 2021, the Federal Tax Service will take the rate for calculation as of January 1, 2021. This tax will need to be paid for the first time before December 1, 2022, and the tax office will send a notification with the calculated amount.

Example. Let's assume that the rate of the Central Bank of the Russian Federation as of January 1, 2021 is 4.25%. Victor has two bank deposits. One deposit is for 1.5 million rubles with a rate of 4.3%, another deposit is for 1 million rubles with a rate of 3.5%. Interest for the year was:

- for the first deposit 64,500 rubles (1,500,000 × 4.3%);

- for the second deposit 35,000 rubles (1,000,000 × 3.5%).

The total amount of interest for the year is 99,500 rubles. Let's calculate personal income tax from interest payable:

- Personal income tax payable - 7,410 rubles ((99,500 rubles - 1,000,000 × 4.25%) × 13%).

Federal Law dated April 1, 2020 No. 102-FZ

3. New lists of services for social deductions for personal income tax have been approved. The list has been clarified and expanded. Medical services have been added

medical evacuation and palliative care. Expensive services include orthopedic treatment of congenital and acquired dental defects and palliative care. The list of expensive reproductive technology services has also been expanded.

Government Decree No. 458 dated 04/08/2020

4. New rules for determining tax residence have been approved. Now a resident of the Russian Federation can be recognized as an employee who was in the Russian Federation from 90 to 182 calendar days during 2020. Previously, to obtain this status, you had to stay in Russia for at least 183 days.

Instead of the 30% personal income tax rate, the standard rate of 13% will be applied to former non-residents. To become a resident under the new conditions, you need to submit an application to the Federal Tax Service by April 30, 2021.

Federal Law of July 31, 2020 No. 265-FZ

5. Material benefits from savings on interest during the grace period are not recognized as subject to personal income tax. Now banks will not withhold and pay tax themselves or report to the Federal Tax Service about the impossibility of withholding.

Federal Law of May 21, 2020 N 150-FZ

6. When selling property (except for securities) received free of charge, as a gift or for partial payment, proceeds from the sale can be reduced by the amount of documented expenses in the form of amounts on which tax was calculated and paid upon acquisition (receipt) of such property.

No. 325-FZ

How to calculate salaries according to the new rules in 2021 for March and April

The procedure for calculating wages for non-working days in March-April 2021 depends on whether these days were actually non-working days for a particular organization or whether it was included in the list of exceptions provided for by presidential decrees and letters from the Ministry of Labor.

Let's try to make a new calculation of wages starting from 2021 for employees of an organization for which March 30 and 31 were non-working days.

Salary calculation for a salaryman

According to the Ministry of Labor, the salary for March should be paid in full to a salaryman if he worked all days from March 1 to March 27. If the salary consists not only of salary, then it will be necessary to take into account all permanent bonuses for non-working days on March 30 and 31 in the same way as if the person went to work on these days.

Example:

The employee's salary is 42,000 rubles. The person worked 19 working days in full in March. March 30 and 31 became non-working days for the organization. You need to calculate accrued wages.

Salary accruals: RUB 42,000. / 21 workers days × 19 work. days = 38,000 rub.

Salary for days not worked: 42,000 rubles. / 21 workers days × 2 non-working hours days = 4000 rub.

For March you need to credit 38,000 + 4,000 = 42,000 rubles.

Calculation of wages for a piece worker

The Ministry of Labor left the issue of remuneration for piece workers for non-working days on March 30 and 31 to employers. However, here you need to understand that for a fully worked month, the salary cannot be less than the minimum wage. Thus, payment to piece workers for non-working days can be calculated either in the amount of earnings for production according to the norm, or average earnings, or the daily part of the minimum wage.

Example:

According to the norm, a piece worker produces 30 products per day for 50 rubles, his earnings per shift are 1,500 rubles. For 19 working days in March, he will be credited with 28,500 rubles. It is necessary to calculate the accrual options for non-working March 30 and 31.

- Payment from earnings for production according to the norm

For two missed shifts, March 30 and 31, the pieceworker will receive less than 1,500 rubles. × 2 non-working hours days = 3,000 rub. The payment amount will be 3,000 rubles.

- Payment from the daily part of the minimum wage

The region has not established the value of its own minimum wage, so you need to rely on the federal minimum wage, i.e. 12,130 rubles. For two shifts on March 30 and 31, the piece worker must be charged 12,130 rubles. / 21 workers days × 2 non-working hours days = 1155.24 rub.

As you can see, the first option is more profitable for the employee and less for the employer, since there was no production, and more money needs to be paid.

In general cases, this issue is regulated by local regulations or labor/collective agreements, i.e. payment is made in accordance with their provisions.

ConsultantPlus experts told us everything about an employer’s responsibilities in connection with the coronavirus outbreak. If you do not have access to the system, register for free and proceed to the instructions.

Payroll for non-working hours

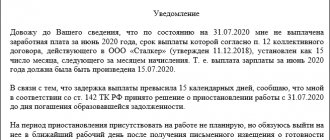

Payment of wages during non-working days is one of the most painful issues for both the employee and the employer. Changes in wages due to forced days off are inevitable.

Note! Changes in payroll in 2021 will not affect those organizations that are not subject to the non-working days regime. Since such organizations must work in the usual manner (the list is given above in the article), the new payroll calculation from 2021 will not affect them.

The more difficult issue is resolved with those who do not have to work. Since the specific term “non-working days with pay” has been introduced, it will not be possible to declare downtime or send an employee against his will on leave without pay.

According to officials, non-working days must be paid in a single amount, since, according to the recommendations of the Ministry of Labor, they do not apply to weekends or holidays. However, remembering that there is no ban on remote work, an option that is not entirely fair to employees may turn out when a working and non-working employee receives equal pay for non-working days. For its part, the employer can financially reward the employee who performed his duties, but most likely, not many employers, who already find themselves in a difficult situation, will be able to find the funds for this.

Will there be a new remuneration system in 2021?

Officials do not plan to introduce any new wage system. They are currently developing a bill on a new labor regime - part-time remote employment.

The meaning of this regime is that the employee will be able to combine work on the employer’s premises with remote work. Currently, you can only choose one of these options in an employment contract.

In the context of the fight against coronavirus infection, the issue of the new regime is more acute than ever, because many employees have been transferred to remote work, but for one reason or another are required to attend the office. Legislators propose to formulate all the main points concerning this regime in a new article of the labor code “Temporary remote work”.

Remuneration at enterprises as an object of accounting

When forming an internal payroll accounting system, special attention is paid to state guarantees for wages for employees of enterprises of all forms of ownership.

In this regard, regular checks are carried out, and employees often use the mechanism of complaints against the employer in order to increase his motivation. The main provisions describing the principles of employee incentives are set out in the Labor Code of the Russian Federation in Articles No. 20 and No. 21. To state the provisions of the legislative act in simpler language, wages imply financial incentives for a person involved in the performance of duties or work. The amount of remuneration depends on skills and qualifications. The amount of earnings can be influenced by the characteristics and quality of the work performed, as well as the conditions under which they are performed and the total number of labor hours charged at the established rate.

Salary includes basic, additional, incentive and compensation payments and allowances. An employee has the right to receive more money for overtime work, as well as for performing his duties in conditions that differ from generally accepted ones. These may include the “harmfulness” of production, climatic conditions, work on official days off, and so on. The legislation also defines incentive payments. We are usually talking about bonuses and additional payments, the amount of which is set at the discretion of management.

Legislative guarantees for payment are fixed in Art. No. 129 Labor Code of the Russian Federation:

- establishing a national minimum wage;

- carrying out indexation depending on economic conditions and price increases (additional conditions are described in Article No. 134 of the Labor Code of the Russian Federation);

- temporary terms of remuneration, according to existing requirements, the timing of receipt of funds from the employer must be clearly described by the employment agreement with the employee. Moreover, tax authorities encourage the introduction of internal fines for enterprises for delays in payments;

- liability of enterprise managers for untimely payments;

- limiting employee incentives in the form of goods and services to within 20%;

- limiting the deductions by the enterprise from the salaries of employees to 50% of the total wages.

What changes are expected in salary payments in 2021

In June 2021, changes are also expected in salary payments. When making payments to employees, the accountant will have to fill out field 20. Previously, it was not required to fill it out when transferring salaries.

Here are the designations of the new codes in salary payments for 2020 with a breakdown:

- 1 - payment of wages, remuneration under civil and personal agreements, vacation pay and other income from which it is possible to collect debts;

- 2 - transfer of child benefits, travel allowances and other funds from which debts cannot be collected;

- 3—transfer of amounts of compensation for damage to health and compensation from the budget to persons affected by radiation and man-made disasters, from whom it is allowed to collect only alimony for minor children or compensation for loss of a breadwinner.

Based on the entered value, banks and bailiffs will understand whether or not it is possible to make deductions from the transferred funds.

New statistical format for headcount and wages

Starting from the report for January 2021, all organizations, except representatives of small businesses, must submit to the territorial body Rosstat information on the number and wages of employees according to the new form No. P-4. It was approved by Rosstat order No. 404 dated July 15, 2019.

The rules for filling it out can be found in the instructions approved by Rosstat Order No. 772 dated November 22, 2017.

This information is filled out for the legal entity without data for separate divisions and separately for each division.

As a general rule, form No. P-4 is submitted quarterly, if during the previous 2 years:

- the average number of employees is no more than 15 people;

- annual turnover – up to 800 million rubles. inclusive.

If at least one limit is not met, you must submit it monthly.

The deadline for submission is no later than the 15th day after the reporting period.

Read also

23.09.2019

Results

In 2021, various changes in the calculation and calculation of wages have already occurred and will continue to occur. Some of them were planned in advance: an increase in the minimum wage, indexation of salaries of budget workers and maximum limits on the bases for insurance premiums. Accountants will begin processing salary payments in a new way from June 2021. They will have to enter the value of the required code in field 20, which previously remained empty for the specified translations.

However, most of the changes are related to the implementation of measures to combat the coronavirus pandemic. The end of March, April and the beginning of May suddenly became non-working days, but employers are required to pay for these days. The Ministry of Labor explains how to calculate the standard working time, transfer vacation days and pay for the transaction. The development of a bill on the introduction of a new working regime related to the combination of office work and remote work has also accelerated.

To ease the tax burden, the government has provided the opportunity for small and medium-sized businesses to calculate insurance premiums on a portion of the income accrued to employees at reduced rates.

All this will undoubtedly affect the work of HR and accounting specialists. We monitor and report on all innovations online.

Sources:

- Labor Code

- tax code

- Decree of the Government of the Russian Federation dated April 2, 2020 No. 409 “On measures to ensure sustainable economic development”

- Decree of the President of the Russian Federation dated March 17, 2020 No. 188 (as amended on March 25, 2020) “On the appointment of an all-Russian vote on the issue of approving amendments to the Constitution of the Russian Federation”

- Decree of the President of the Russian Federation dated March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation”

- Decree of the President of the Russian Federation dated April 2, 2020 No. 239 “On measures to ensure the sanitary and epidemiological well-being of the population on the territory of the Russian Federation in connection with the spread of the new coronavirus infection (COVID-19)”

- letter of the Ministry of Labor of Russia dated March 26, 2020 No. 14-4/10/P-2696 “On sending Recommendations to employees and employers in connection with Decree of the President of the Russian Federation dated March 25, 2020 No. 206”

- letter of the Ministry of Labor of Russia dated March 27, 2020 No. 14-4/10/P-2741 “On supplementing Recommendations for employees and employers in connection with Decree of the President of the Russian Federation dated March 25, 2020 No. 206”

- Directive of the Bank of Russia dated October 14, 2019 No. 5286-U “On the procedure for indicating the code of the type of income in orders for the transfer of funds”

- Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Changing salary limits

Behind the coronavirus pandemic, other changes remain almost unnoticed, but they are nevertheless just as important.

From 01/01/2020, a new federal minimum wage was established in the amount of 12,130 rubles. (Article 1 of Law No. 82-FZ dated June 19, 2020). Regions can set their own minimum wage, but in an amount no less than the federal one.

You can find the regional minimum wage in the ConsultantPlus reference information. Find out about all the innovations related to the pandemic by signing up for a free trial access to K+.

For the work of an accountant, the amount of the minimum wage is significant, since it is used when calculating various payments in favor of employees, for example, when calculating sick leave and benefits for accounting.

The salary limits for calculating insurance premiums have also been increased:

- if RUB 1,292,000 is exceeded. Pension contributions are paid at a rate of 10%;

- if RUB 912,000 is exceeded. Social insurance contributions are not paid.

There are no limits on medical contributions.

If you exceed RUB 350,000. standard deductions for personal income tax purposes are no longer provided until the end of the year. This limit has remained unchanged over the past years.

We remind you about the introduction of reduced insurance premium rates for all small businesses from April 1 until the end of 2020 due to the pandemic.