How to calculate payroll

Salary is the remuneration that a business entity must pay to its employees.

Its size is determined by the employment contract signed by the employee with the company management. At the same time, the employer determines the salary based on the current staffing table at the enterprise, as well as such local acts as the Regulations on remuneration, Regulations on bonuses, Internal regulations, Collective agreement, etc.

The Labor Code of the Russian Federation defines provisions on social guarantees and benefits that must be taken into account when calculating employee benefits.

Payment can be made either for time worked or for work performed.

The main document for determining it is the time sheet. It is necessary for all remuneration systems. To calculate piecework wages, you also need work orders and other documents to record production.

The Regulations may also provide for bonuses as incentive payments.

According to current standards, employees are paid not only remuneration for their work, but also rest time, downtime, periods of incapacity, as well as other compensation payments.

There are surcharges for working on weekends and holidays, overtime and night time, as well as surcharges for combined work, special working conditions, etc. In any case, when calculating these amounts, you need to take into account the information from the working time sheet, the contract with the employee, and relevant legal norms etc.

In addition, it is necessary to take into account the area in which the organization or individual entrepreneur operates, since regions and regions can establish regional increasing coefficients, as well as “northern” allowances. So, for example, when carrying out activities in the Sverdlovsk region, the employer must add another 15% to the salary. But such coefficients are not available in all regions; in Moscow they are completely absent.

Important! In accordance with the Labor Code of the Russian Federation, salaries must be paid no less than twice a month. The calculation should be made on the basis of the time actually worked by employees in each part of the month. Paying fixed amounts in advance if they do not correspond to the timesheet is a violation and may result in the employer being held liable.

The main document for calculating wages is the payroll from which the salary is calculated and the payroll from which it is paid, or the payroll. Here not only the accrued amounts are recorded, but also deductions are made from the salary.

What is salary according to the Labor Code

The term “salary”, as well as the accompanying definitions “basic salary”, “official salary” and “wages” are deciphered in Art. 129 Labor Code of the Russian Federation. To understand how to calculate the salary from the salary and apply the appropriate formula, let’s understand these terms:

Based on the definitions given in the Labor Code of the Russian Federation, salary is the minimum fixed amount of money that the employer is obliged to pay to the employee for each month worked, subject to the fulfillment of the job duties assigned to him.

Recommendations from ConsultantPlus experts will help you check whether you have set the salaries of your employees correctly. Get free demo access to the system and go to the Ready-made solution.

Salary is a more expanded concept, which includes, in addition to salary, various additional payments, bonuses and bonuses to which an employee is entitled.

Salary and wages are the same in value if for a fully worked billing month the employee, in addition to the salary, is not accrued compensation and incentive payments.

Wages can be calculated not only on the basis of salary, but also on the basis of the tariff rate - a fixed amount of remuneration for fulfilling a standard of work of a certain complexity per unit of time (hour, day, decade, month) without taking into account compensation and additional payments.

The formulas for calculating wages based on salary and based on the tariff rate are different. Next, we will tell you how to correctly calculate salary based on salary.

Minimum wage amount

The law establishes the minimum monthly wage.

It is necessary to regulate remuneration when it is determined in employment contracts. According to the Labor Code of the Russian Federation, the employer does not have the right to set the employee’s wages below this amount, provided that he has worked the standard duration. This amount is approved every year, and sometimes several times during a given period.

There is a general minimum wage for the whole country, as well as a regional one. It is also used in determining various benefits, including disability benefits in the absence of work experience.

SCP support from the First BIT company

SLA support is a specialized support service for corporate systems. The service allows you to get the expected result from maintaining information systems at a fixed price and within a specific time frame.

Technical support for corporate systems (including the 1C: Manufacturing Enterprise Management platform) is carried out in accordance with the International Industry Standards ITIL (IT Infrastructure Library) under the SLA (Service Level Agreement).

For whom: The service is recommended for medium and large businesses who want to receive information systems (IS) support according to international standards and at the same time reduce maintenance costs by up to 60%.

Salary taxes paid by the employee

Personal income tax

According to the Tax Code of the Russian Federation, an employee’s income, which includes almost all payments provided for in a concluded employment contract, must be subject to personal income tax. The responsibility for calculation and payment rests with the employer, who acts as a tax agent. That is, he deducts taxes from wages before paying them.

There are two rates that are used to determine the salary tax for a resident - 13% and 35%. The first is mainly used to calculate income tax on wages received by an employee; it also calculates tax on income received from dividends (until December 1, 2015, income from dividends was calculated at a rate of 9%). The second applies if an employee receives gifts or winnings in an amount exceeding 4,000 rubles.

For non-residents, that is, persons arriving in the Russian Federation for less than 180 days, a tax rate of 30% should be used.

Attention! An organization or individual entrepreneur, as a tax agent, must calculate and pay personal income tax on the income received by citizens, after which reporting is provided - once a year 2-NDFL and quarterly 6-NDFL.

There are currently no other payroll taxes.

Tax deductions

The Tax Code of the Russian Federation allows an employee to take advantage, if available, of the following deductions when calculating tax:

- Standard - provided for children, as well as in certain cases for the employee himself;

- Social - this deduction represents a reduction in the tax base by the amount of expenses for education, treatment, etc.;

- Property - a person can use it when buying or selling property (car, house, apartment, etc.);

- Investment – it can be used when performing transactions with securities.

These standard tax deductions are applied after the company has paid personal income tax to the budget and do not affect the tax base when calculating taxes on an employee’s salary.

Standard deduction for children in 2021

The main benefit when calculating personal income tax is the standard deduction for children. Its size depends on their number, as well as the child’s health condition:

- 1400 rubles for the first;

- 1400 rubles for the second;

- 3000 rubles for the third and subsequent children;

- 12,000 rubles (trustees 6,000 rubles) for each disabled child under 18 years old or up to 24 years old when receiving full-time education.

For example. The employee has two children in the family, whose age does not exceed 10 years. The monthly income is 20 thousand rubles. If you do not apply the deduction, then the personal income tax will be 20 thousand rubles. * 13% = 2600, respectively, he will receive 17,400 rubles in his hands. However, by writing an application for the use of deductions, he has the right to reduce the tax base on his salary by 2,800 rubles for two children.

Applying deductions we get the following:

The base for calculating income tax will be 20,000 – 2800 = 17,200, so the personal income tax in this case will be 17,200 * 13% = 2,236 rubles. The employee's savings will be 364 rubles. In some cases, the employer pays the income tax itself without collecting these amounts from the employee, so it is always worth using this benefit.

If the employee is a single parent, then the amount of this deduction is doubled.

Important! These benefits can be used as long as the employee’s cumulative earnings from the beginning of the year do not exceed 350,000 rubles. In a month where this amount exceeded the permissible threshold, the deduction is not applied. From the beginning of next year, the base for deductions is calculated from scratch. To receive it, the employee must write to the employer an application for a tax deduction for children.

Income tax benefits for the employee himself:

- 500 rubles per month are provided to Heroes of the USSR and Russia, participants in combat operations, war veterans, Leningrad siege survivors, prisoners, disabled workers of groups 1 and 2; as well as persons who took part, were evacuated during the Chernobyl accident, etc.

- 3000 rubles - to victims of radiation exposure, disabled people of the Second World War and other military operations.

Attention! Read more about child tax credits and how to get them here.

How to calculate personal income tax

Companies and entrepreneurs that pay salaries to their employees act as tax agents in relation to them. This means that they need to calculate personal income tax, withhold it from the employee’s income and transfer it to the budget.

Tax is assessed on wages, vacation pay, sick leave benefits, except for maternity benefits, as well as on payments in kind: lunches, participation in corporate events. The personal income tax rate in this case is 13%. If the employee is not a resident, then 30%. The amount of personal income tax withheld should not exceed 50% of the amount paid to the employee.

Let's look at an example.

In January, the employee received 35,000 rubles from the employer.

- Let's multiply 35,000 rubles by 13%, we get 4,550 rubles. This is the amount of tax on an employee’s salary.

- Let's subtract the tax amount from 35,000 rubles, we get 30,450 rubles. This is how much the employee received in his hands.

That is, the amount of tax withheld did not exceed the 50 percent limit.

Payroll example

Let’s say an organization or individual entrepreneur operates in the Sverdlovsk region. Let's take the example of manager Vasiliev, whose salary depends on the amount of time worked. In accordance with the staffing table, his salary is 50 thousand rubles monthly. The employee has three minor children. The billing month is June. According to the production calendar for 2021, there are 21 working days in June, but the employee only worked 20 days.

Step 1. Determining salary

The first step is to determine his salary. Since Vasiliev worked not 21 days, but 20, we calculate his daily income, for this 50 thousand rubles. divide by 21 days, we get 2,380.95 rubles. Now we multiply by days worked: 2380.95 * 20 = 47,619 rubles.

Step 2. Surcharge factors

Due to the fact that the organization operates in the Sverdlovsk region, the employee must receive a bonus of 15%. So, we get 47619 + 47619 * 15% = 47619 + 7142.85 = 54761.85

Step 3: Apply deductions

The next step is to take into account the employee’s deductions, if he has any. In our case, Vasiliev has 3 children. For the first two he gets 2800 rubles, and for the third he gets 3000 rubles, so in total we get 5800 rubles. Before applying the required deductions, it is necessary to compare his income from the beginning of the year with the threshold of 350 thousand rubles established for 2021, exceeding which the deduction is not applied.

How to calculate wages using a salary system

With a salary system, the employee receives a salary - a fixed amount of money for the month worked. If the month is not fully worked, then a portion of the salary is paid, proportional to the time actually worked.

Let's look at an example.

Administrator Alena's salary is 45,000 rubles.

She did not work the entire month of November: from the 12th to the 18th, Alena was on vacation, and from November 27th to 30th she took sick leave.

According to the time sheet, the employee was on duty for 12 working days. There are a total of 21 working days in November. Thus, Alena’s salary for November, not counting vacation pay and sick pay, amounted to 25,714 rubles (45,000 / 21×12).

Salary payment deadline

In June, amendments to the Labor Code were adopted, which redefine the deadline for paying wages in 2021 to an employee.

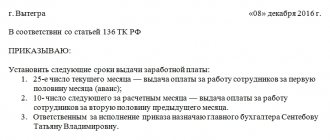

Now the payment date cannot be set later than 15 days from the end of the period for which it was accrued. In this case, payments must be made at least every half month. This means that the advance must be paid no later than the 30th of the current month, and the remaining balance no later than the 15th of the following month.

At the same time, the exact date when these events occur must be fixed in local regulations on internal regulations, employment contracts, wage regulations, etc.

Also, the same amendment increased compensation for delayed salaries. Now it is calculated as 1/150 of the Central Bank Key Rate of the amount of unpaid earnings for each day of delay. Administrative fines for this offense imposed on an official, entrepreneur or company have also become larger.

Transferring salaries to employees' accounts

In order to distribute wages that were sent to the bank among the accounts of company employees, a data exchange mechanism was proposed, developed by 1C in collaboration with Sberbank of the Russian Federation. In more detail, the exchange of information about the transferred salary amounts is carried out using XML files.

The proposed mechanism makes it possible to transmit to a financial institution the information in electronic form that is required to open employee accounts. Thanks to this, you can receive appropriate confirmation from the bank that the accounts were opened with the required parameters of the card accounts of the organization’s employees. Next, you should take care of organizing the regular transfer of wages to staff accounts.

Thanks to this application solution, you can automate all the main types of payroll calculations that are usually used in enterprises. Additionally, all taxes, fees, and deductions will be automated.

The most popular forms of remuneration were implemented: not only time-based and piece-rate, but also their modifications.

When choosing time-based wages for staff, it is enough to indicate the established amount of wages and work schedule when registering the employee.

Moreover, you do not need to take into account the time worked. It is calculated as the amount of planned time that must be worked by the employee according to the schedule minus the deviations recorded in documents. We are talking about absences that occur due to being on vacation or sick leave.

When choosing piecework payment to calculate the amount of payment, you should indicate the employee's output monthly using piecework orders. Additionally, it is required to indicate the exact work schedule, since it is necessary for making other types of calculations.

Deadlines for paying taxes on payroll

In 2021, a single date for transferring personal income tax from wages was introduced. Now it needs to be transferred to the budget no later than the day after the employee’s salary is paid. It doesn’t matter exactly how it was made - on a card, from a cash register or any other. However, this rule does not apply to sick leave and vacation pay.

For these two types of payments, income must now be transferred no later than the last day of the month in which they were made. This makes it possible not to pay taxes to the budget for each employee, but with one payment for everyone at once.

Failure to pay taxes on time may result in penalties. They are calculated taking into account 1/300 of the refinancing rate for each overdue day.

Important! Salary contributions in 2021, which include pension, medical, social insurance and injuries, must be paid no later than the 15th day of the month following the reporting month. If this time falls on a weekend or holiday, the deadline is transferred to the first working day after the rest.

Accruals and deductions

It is necessary to pay attention to the fact that all accruals of the enterprise are combined into the following categories:

- Basic. This may include those types of accruals that have a validity period (for example, payment for days when the employee was not at work, payment according to the tariff).

- Additional. These are accruals that differ only in one accrual date (for example, dividends, as well as bonuses). These categories of accruals are often calculated taking into account the amounts that were previously accrued for the main accruals.

Please note that each type of accrual differs in the method of calculation and other parameters.

A distinctive feature of the configuration is that it contains a sufficient number of predefined deductions and accruals. For example, appropriate accruals are provided for different categories of downtime (during working hours), for several categories of vacations, as well as alimony deductions. If necessary, the user adds other types of required deductions and charges.

If you look at the basic charges, we can conclude that they can be calculated in the following basic ways:

- According to a fixed amount.

- According to the tariff rate. The calculation occurs for the period of validity of this accrual.

- A percentage of the amounts that were accrued according to basic accruals.

- According to the average salary for vacation by calendar days.

- According to the average salary for vacation when calculated from days that are working days.

- According to the average salary for calculating temporary disability benefits.

- According to the average salary (for example, to pay for business trips).

- As a benefit for caring for a child under 1.5 years of age.

- As a benefit for caring for a child less than 3 years old.

Additional charges are calculated:

- fixed amount;

- a percentage of the amounts that were accrued for the selected basic accruals;

- for deduction under various executive documents.

Let's look at these settings in more detail, step by step:

- General settings. In this example, we selected the “In this program” item, since otherwise some of the documents we need will not be available. The second setup option involves maintaining personnel and payroll records in another program, for example, in 1C ZUP. The “Salary Accounting Setup” subsection specifies the method of reflecting salaries in accounting, the timing of salary payments, vacation reserves, territorial conditions, and the like.

- Salary calculation. Here we indicate that we will take into account sick leave, vacations and executive documents. It is important to remember that this functionality will only work if the number of employees does not exceed 60 people. The types of accruals and deductions are also configured here. For convenience, we will also install an automatic recalculation of the “Payroll” document.

- Reflection in accounting. In this section, accounts are set up to reflect salaries and mandatory contributions from the payroll in accounting. Let's leave the default settings.

- Personnel accounting. In this example, full accounting was selected so that basic personnel documents were available.

- Classifiers. We will leave the settings in this paragraph as default. Here you configure the types of income and deductions used in calculating personal income tax and the parameters for calculating insurance premiums.

What is the thirteenth salary?

How to calculate the 13th salary? This concept is actively used by employees of commercial and government companies, but is not enshrined in any of the current regulations.

According to the provisions of the Labor Code of the Russian Federation, the employer is free to choose ways to reward specialists for their work. The form depends on the wishes of the management; the “arsenal” is varied: from the presentation of a certificate to the payment of a million-dollar bonus. What to do is decided by the management.

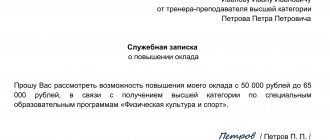

There is no clear procedure for calculating the required salary bonus; there is no calculation calculator. In practice, the following options for determining the amount of incentives are common:

- Payment of salary

This is the thirteenth salary - the specialist is given an “extra” salary at the end of the year. Its amount depends on the position held and does not vary in proportion to the results of work activity.

- Fixed amount

A management order on bonuses is issued, according to which the bonus is awarded in a fixed amount. “Calculator” is reflected in the document. For example, ordinary specialists are entitled to 20 thousand rubles, top managers – 50 thousand rubles.

- Calculation proportional to salary

The wage calculation formula is supplemented by a company-specific algorithm for determining bonuses. For example, with 100% results, a specialist is entitled to 100% of the salary, with satisfactory performance of duties - 70%, with unsatisfactory performance - 50%. The “rules of the game” are individual to the organization and are fixed by order of management.