If the employer does not pay wages on time, the employee has the right to suspend work.

Difficulties in the process of activity can arise for almost every company. Sometimes, due to financial difficulties, an employer cannot pay employees wages. In this case, even if the employer is not at fault, the employee has the right to suspend his work and not resume it until the debt is fully repaid. An employee has this opportunity only if the delay in payment exceeds 15 days (142 Labor Code of the Russian Federation). After receiving a notice from the employer indicating that the employer is willing to repay the debt, the employee is required to return to work. In this case, the company is obliged to pay the employee the average salary for all the days while he was at home and did not perform his duties. If the employer refuses to do this, the employee has the right to go to court.

The conditions allowing an employee to suspend his work will be as follows:

- The salary delay exceeded 15 days;

- The employee notified the employer in writing of the suspension;

- The organization in which the employee works does not belong to those bodies where suspension of work is prohibited for employees.

If the employer does not pay the bonus

Since the bonus is one of the components of the salary, the following question arises: is it possible to suspend work due to non-payment of the bonus? However, in this case it will not be possible to suspend work on legal grounds. The issue of bonus payment itself can be considered controversial. The fact is that the employee’s due salary must be paid, but the employee’s bonus may be deprived. And the question of the legality of its non-payment will already be controversial.

If an employee is 100% sure that he is entitled to a bonus, that is, he has fulfilled all the conditions for its appointment and the company’s regulatory documents provide for its payment, then in this case it is recommended to contact the authorities that consider labor disputes. The employee should remember that he does not have the right to suspend work due to non-payment of bonuses. The absence of an employee due to non-payment of a bonus can be considered as absenteeism, for which the employee faces disciplinary action, including absenteeism.

Actions of an employee under the Labor Code of the Russian Federation in connection with non-payment for more than 15 days

According to Part 6 of Article 136 of the Labor Code of the Russian Federation and the letter of the Ministry of Labor of the Russian Federation, wages must be paid to subordinates carrying out labor activities on the basis of an employment contract, 2 times a month.

In rare cases, at the request of the employee, it is allowed to transfer earnings once on the day the main part is issued.

Payment dates are fixed in the statutory documents and agreed upon with the trade union organization:

- an employment contract signed by both parties to the agreement;

- collective agreement;

- other regulatory acts of internal regulations.

The law allows for force majeure circumstances and provides the employer with 15 days to resolve financial issues.

This period begins to count from the first day of the end of the period for which wages were accrued.

This regulation is presented in Federal Law No. 272 of July 3, 2016.

Based on the norms, if subordinates’ salaries are delayed for more than 15 days, then employees can take the following legal actions:

- Write a claim to the employer demanding repayment of the wage debt.

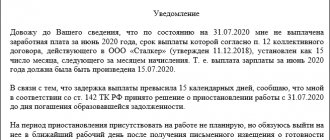

- Notify the employer in writing of the suspension of the performance of one’s official duties due to late wages and absence from work - a sample notification.

- Do not begin to perform official duties until written notice is received from management of the intention to pay the previously unpaid amount of wages.

- Go to court to assert your rights, citing violation of civil and labor standards in connection with non-payment of wages.

Payment for suspension time

The entire time of suspension of work must be paid by the employer in the amount of average daily earnings for each day of downtime. If the employer refuses to do this, the employee has the right to go to court. However, there are several opinions on this matter. Rostrud, for example, in this matter, takes the employer’s side and says that the employee did not work during this period of time, which means he is not entitled to a salary. In some cases, it is proposed to consider such a suspension of work as downtime due to the fault of the organization. In this case, payment is provided in the amount of 2/3 of the salary. But in this case, the employee loses part of his salary, which worsens his situation. Therefore, idle conditions cannot be used instead of suspension; these are two completely different concepts.

Judicial authorities usually side with the employee, indicating that in addition to average earnings, the employer is also obliged to pay compensation for the entire delay. This is explained by the fact that the employee’s adoption of such a decision is a forced measure, which is permitted by law to encourage the employer to pay wages on time. This right allows you to eliminate the violation committed by the employer in the issue of payment of delayed wages.

Important! The employer is obliged to pay for the period of suspension due to delayed wages during which the employee did not perform his work duties.

Conditions for suspension of work

Work can be suspended by sending written notice to the employer on any day starting from the 16th day of delay in salary or part thereof. The days are counted from the date of receipt of the advance or payment, which is specified in the employment contract or other local acts of the company.

An employee who has suspended work may not appear at the workplace until he receives from the employer a notification of readiness to pay the entire amount of the debt on the day he returns to work.

When suspension of work is prohibited

According to Art. 142 of the Labor Code, suspension of work due to delayed wages is prohibited:

- when a state of emergency or martial law is declared;

- in military organizations, structures of the armed forces , the FSB and the Ministry of Internal Affairs;

- during emergency, search and rescue and fire fighting operations;

- in response to natural disasters;

- for personnel serving particularly hazardous industries;

- for civil servants;

- for workers servicing electrical networks, heating systems , water and gas supply systems;

- for ambulance and emergency workers.

Step-by-step instruction

Registration of suspension of labor activity includes the following steps:

- In the first days of salary delay, the employee sends a complaint to the company management.

- After 15 days, an application for suspension of work is submitted.

- The employee receives a mark of acceptance of the application and stops going to work from the next day.

- On days of forced downtime, a complaint is filed with the labor inspectorate.

- Upon receipt of notification of readiness to pay wages, the employee goes to work the next day.

A claim for unpaid wages is sent to the head of the department. The claim must state the requirement to pay the entire amount of the debt, and also indicate the possible suspension of work in accordance with the Labor Code of the Russian Federation if this requirement is not met.

A sample standard claim for unpaid wages can be found here.

The purpose of filing a claim is to indicate readiness to resolve the issue amicably and warn the employer about the consequences of further delays in wages. If the reason for the delay was the incorrect work of an accountant or other bureaucratic costs of the company, then usually the salary is paid and a strike can be avoided.

If wages are not paid by the 16th day of delay, an application for suspension of work is drawn up. The application must indicate:

- Full name of the manager and name of the organization;

- Full name and position of the employee;

- salary payment date according to the contract;

- term and amount of debt;

- date of suspension;

- date and signature.

A sample application for suspension of work due to non-payment of wages can be downloaded here.

The application is drawn up in two copies and submitted on the last day of work to the immediate supervisor, head of the personnel department or director. One of the copies must bear a mark of acceptance, certified by the signature of the receiving person with a transcript - this copy remains with the employee.

If officials refuse to accept the application or mark it, citing employment or other reasons, it is necessary to hand over a copy, calling two witnesses, and it is advisable to film the process on camera, accompanying the submission of the paper with an oral message about the intention to suspend work starting tomorrow, according to Art. 142 Labor Code of the Russian Federation.

During forced downtime, the employee should file a complaint about non-payment of wages to the labor inspectorate at the location of the enterprise. The period for consideration of a complaint is 30 days, but the appeal will be considered faster if it is sent in a collective form from a group of workers whose wages were delayed.

It should be remembered that when conducting an inspection, inspectors do not have the right to disclose the names of those who filed a complaint to the company administration.

Working without payment of wages

Continuation of a labor function by an employee without payment of wages may be regarded as forced labor. Such work is prohibited (4 Labor Code of the Russian Federation). The responsibility to provide work with appropriate conditions rests with the employer. In addition, it is also the employer’s responsibility to pay wages on time. By ignoring his duty and not paying wages on time, the employer thereby creates forced labor, which is prohibited not only by the Labor Code of the Russian Federation, but also by the Constitution.

Further actions of the parties

After a situation arises with absenteeism due to non-payment of wages, it is in the interests of the enterprise to find opportunities to repay the debt as quickly as possible.

If you adhere to all formalities, then after making a decision to repay the debt to employees, management must notify them in writing that they are ready to pay their salaries in full on the day they return to work.

In turn, employees must report to work the next day after receiving such written notice from their senior management.

If the salary debt is partially repaid, the employee is not required to go to work.

Average earnings

The entire period of work suspension must be paid based on the employee’s average earnings. To do this, the average daily earnings are multiplied by all days of suspension. To determine the average daily earnings, payments for the entire pay period must be divided by the number of days that the employee worked in the pay period. The calculation period is taken to be 12 months preceding the month of suspension of work. For example, if the suspension of work was in December 2021, then the billing period will be from December 2021 to November 2021.

All days when the employee retained his average salary, for example, vacation pay, business trips, etc., are excluded from the billing period. Payments for the billing period include only those that are directly related to the wage system. For excluded periods of time, payments must also be excluded.

Where else can you go?

If the salary has not been transferred within 15 days and the employer does not respond to the written request, the citizen can contact:

- To the local labor commission, which includes representatives of the Trade Union.

- To the state labor inspectorate to initiate an inspection. You can go there in the first 2 months.

- To the prosecutor's office or court if the period exceeds 2 months.

In addition to the demand to pay money, the former employee may indicate regular violation of deadlines. This will become a reason for conducting inspections and imposing administrative or criminal penalties.

Punishment for violation

If checks confirm a constant delay in salary payments for more than 2 months, the employer will face administrative or criminal liability.

A citizen who has not received payment for his services under the contract can also go to court. We are not talking about a permanent employee, but one hired for a certain time or for a specific job. The severity of the penalty depends on what kind of non-payment occurred - full or partial. The latter is a transfer of less than half of the salary for 3 months, full is the absence of salary at all for more than 2 months.

Administrative responsibilities will be as follows:

- For the first violation, a fine of 10-30 thousand rubles is imposed for officials, 1-3 thousand - for individual entrepreneurs, 30-50 thousand - for legal entities.

- In case of repeated violation, the fine increases to 30 thousand for individual entrepreneurs and officials, 50-100 thousand for legal entities.

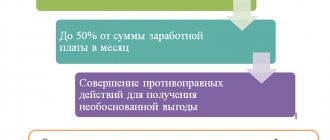

Criminal penalties may also apply . We are talking about the following cases:

- In case of partial non-payment, the culprit is punishable by a fine of up to 120 thousand rubles, imprisonment for a year or two years of forced labor.

- In case of complete non-payment, the culprit will face a fine of up to half a million rubles, up to 3 years of imprisonment or forced labor.

- If non-payment of wages resulted in serious consequences, the punishment becomes more severe.

In addition, the employee has the right to compensation. It is calculated by the formula:

Penalty = SZ * KS * 1/150, where SZ is the amount of debt, KS is the key bank rate.

An employee can demand compensation regardless of whether the employer is at fault.

But all these punishments can only be imposed by the court if the employer is found guilty. If, after demanding that the boss pay the debt, the money was transferred, the citizen can only initiate a check for compliance with labor standards.

Documents for court

In addition to the application, the citizen must provide evidence to the court that his payments are being delayed. These include:

- bank account statement about non-receipt of funds;

- a copy of the employment contract, which specifies the amount and payment procedure, or a copy of the work book;

- a copy of the request that was previously sent to the employer, with a note of its receipt.

Audio or video recordings in which the employer makes a promise but does not keep it can also be useful.

Typically, employers still try not to bring the matter to court and pay debts immediately after receiving the first demand. Many lawyers also urge people not to be afraid to sue, since in Russia workers win such cases quite often.

Dismissal is not the most pleasant procedure for many employees, especially when the reason is the employer’s non-payment of wages. This difficult situation is regulated by an article of the Labor Code, and it can also be resolved through the court if the boss does not meet the employee halfway. In the latter case, in addition to the obligation to fully repay the debt, the company may be required to pay compensation and a fine, and in some cases the culprit will go to prison.

What to do if wages are delayed at an unofficial job

Unfortunately, if you are employed without a contract, you will not be able to protect your material interests. This is due to the fact that unofficial work does not provide for the emergence of mutual rights and obligations between participants. In addition, such work is a direct violation of Russian tax legislation, since each of the parties evades paying mandatory taxes in favor of the budget.

Carrying out activities without a contract, but within the framework of a civil agreement, allows the employee to file a complaint about any violations of the employer. This includes delays in wages for work performed.

If you need advice, our employment lawyer will help you.

Video:

Anonymous filing of a complaint

As practice shows, the majority of workers, fearing for their future employment, refuse to file a complaint with regulatory authorities for delaying wages. Therefore, a mechanism for sending requests anonymously is provided.

Applications without indicating the applicant’s name are accepted at the labor inspectorate. To do this, it is enough to indicate when submitting an application that the application is submitted anonymously without displaying the employee’s personal data.

Attention! In this case, the inspectorate employee undertakes to maintain confidentiality. If the applicant's name is disclosed to the employer, the official will be subject to legal sanctions.

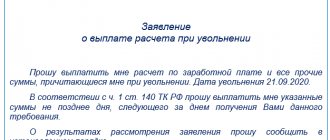

How to write a statement of claim correctly

In Art. 392 of the Labor Code of the Russian Federation states that an employee has 1 year to go to court to resolve a dispute over the payment of wages. Therefore, he has time to appeal to the FIT, and then to the court. The period begins to run from the day on which the payment should have been made.

For the court it is necessary to draw up a statement of claim. The document is drawn up according to the same rules as a complaint to the FIT, but in compliance with the requirements prescribed in Art. 130 – 131 Code of Civil Procedure of the Russian Federation.

The statement of claim must contain the following information:

- full name of the court. It is necessary to choose the right jurisdiction for the case under consideration;

- information about the plaintiff - his full name, position, registered address, contact information;

- information about the defendant, that is, about the employer. This is the full name, legal address, position and full name of the manager, contact information;

- "body" of the claim. Here it is necessary to indicate the reason for filing the claim, when the payment should have been made, what the total period of delay was, whether the employer took measures to eliminate the debt, and other information;

- references to legal norms that the employer violated;

- a request to the court to make a decision in favor of the plaintiff, a demand for payments and the amount of compensation, as well as bringing the employer to other liability;

- application. This is a list of documents that must be attached to the claim to support your words. This:

- a copy of the claim for the defendant;

- a copy of the applicant's passport;

- calculation of the amount to be paid that the plaintiff requires;

- a copy of the employment contract;

- certificate 2-NDLF;

- other documents if necessary.

- date of filing the claim;

- the applicant's signature and its transcript.

Sample statement of claim demanding payment of wages and compensation