Error caused by an employee

It should be noted that excessively accrued and paid wages are regarded as material damage caused to the employer. In this regard, the management of the organization has every right to recover the amount of overpayment from the accountant who made a mistake (Article 238 of the Labor Code of the Russian Federation).

An important role is played by the agreement on full financial responsibility concluded with the employee who made the mistake. In this case, the employer will be able to withhold the full amount of damage. However, in accordance with Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85, such an agreement can only be concluded with a cashier.

If the overpayment occurred due to the fault of the accountant, then he will bear financial responsibility only within the framework of his average monthly salary (Article 241 of the Labor Code of the Russian Federation).

How to collect wages from an accountant?

So, the recovery of overpaid wages from the guilty person is carried out as follows:

- First, by order of the general director, a commission is appointed that identifies the cause and amount of the overpayment.

- Then the accountant must write an explanatory note addressed to the head of the organization.

- Next, a report is drawn up about the mistake made when calculating wages.

- An order is issued to withhold the amount of overpayment from the accountant through whose fault the error was made.

- The guilty person compensates for the damage caused.

What amounts cannot be deducted from debts?

Federal Law No. 229 is the main document regulating this area. The following payments from an employer to an employee are not eligible for withholding:

- Full or partial compensation for the cost of vouchers. An exception is amounts paid to other citizens who do not work in this organization.

- One-time financial assistance in the event of the birth of a child and registration of marriage, death of a family member, terrorist attack, natural disaster, or other emergency circumstances.

- Insurance coverage under a mandatory social program, including funeral payments.

- Compensatory payments prescribed by the legislation of the Russian Federation.

- Cash benefits in favor of injured persons.

- Compensation for damage due to the loss of a breadwinner.

- Compensation for damage caused to health.

Recalculation after dismissal

Even if the employee in whose favor the excess payment was made quits, the employer still has the right to recover the amount of the overpayment from him. However, some difficulties may arise here. In particular, if a former employee left the country, the return of overpaid wages may be significantly delayed or may not occur at all.

The employer has three options:

- You can contact the dismissed employee and try to negotiate with him about a voluntary return of funds.

- Contact the judicial authorities with the appropriate statement of claim. This option is relevant if the employee categorically does not want to make contact.

- The employer can simply write off the resulting debt as expenses of the organization.

In this case, in any case, it will be necessary to draw up a report on the identified error, as well as send a notification to the former employee that he is in debt (in the first and second options).

Employee actions

After receiving a notice of the need to return overpaid funds, the former employee can take one of the following paths :

- Report to your previous place of work and voluntarily deposit the overpayment amount into the cash register;

- Refuse refund. However, in this case, you should be prepared for the former employer to sue. Moreover, if his claim is satisfied, then in addition to the return of overpaid wages, he will have to compensate for all legal expenses.

Features of processing return applications

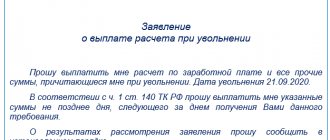

The manager has the right to carry out the procedure only if there are no objections from the subordinate. Therefore, the other party must be notified in advance about upcoming changes.

A separate deadline is set for objections, if any. If the application is not received, then the procedure is carried out according to the presented schedule. The employee’s consent to the withholding is formalized in the form of a statement.

It must contain information about the addressee and originator and confirm that there are no objections to the performance of a particular action. The amount and reason for withholding are indicated. A personal signature along with the date is required. The procedure is performed differently, depending on what specific amounts are meant.

When can overpaid and overpaid wages be returned?

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

In Part 4 of Art. 137 of the Labor Code of the Russian Federation contains an exhaustive list of situations when overpaid wages to an employee can be recovered. This:

- counting error;

- the employee’s fault for failure to comply with labor standards or idle time;

- unlawful actions of an employee.

A technical glitch in a payroll program may or may not be considered a counting error. The judicial position on this issue is contradictory:

If we are talking about the guilty actions of an employee, it is necessary to draw up documents confirming this fact: record it in a simple act, report to the police about the fact of theft of funds by an accountant who accrued an extra salary to himself.

Committing illegal actions that resulted in excessive payment

This is one of the most difficult grounds for an employer, since the legislation does not contain specific criteria for unlawful actions. Consequently, any illegal acts that result in receiving a salary in a larger amount than required can be recognized as such. The illegality must be confirmed in court. Therefore, in order to use this basis, the employer must have appropriate evidence.

For example, if an employee falsified documents confirming the fact of his employment, the employer will have the right to demand the return of unlawfully received wages.

In each specific case, the relevant criteria for the illegality of an employee’s actions are subject to consideration by the court, taking into account all the circumstances of the case.

How to get back an incorrectly paid salary

The employer has 3 options for returning excess accrued and paid wages:

- Agree with the employee about the latter’s voluntary contribution of extra money to the company’s cash desk.

- With the consent of the employee, make deductions from his salary.

- Go to court to forcefully collect the debt from the employee.

In any case, if an overpayment is detected, a report is drawn up, which records the fact of the error and the amount of the overpaid salary.

IMPORTANT! From the provisions of Art. 137 of the Labor Code of the Russian Federation and analysis of judicial practice, it is possible to determine situations in which a counting error does not occur. This is payment for a vacation of a longer duration, payment of a larger bonus, receiving a double salary (determination of the RF Armed Forces dated January 20, 2012 No. 59-B11-17, etc.).

A copy of the act and a notice of the need to return the overpaid salary are sent to the employee.

The employee either deposits funds into the cash register using a cash receipt order or agrees to deductions from wages.

NOTE! The list of grounds for making deductions from wages is closed; counting errors and downtime or failure by the employee to comply with labor standards stipulated by the contract are included in this list (paragraph 3, part 2, article 137 of the Labor Code of the Russian Federation).

In case of a failed hold

This happens if the subordinate does not give consent or when, after withholding, even a full 20% of the salary is not enough to pay off the debt. Then an appeal to the court is permissible, but only under certain circumstances:

- There is a counting error.

- It has been proven that the employee is guilty of dishonesty. This applies to unlawful salary calculations, abuse of official position, presentation of false information, and creation of false documents.

- The court found that the employee was guilty of simple failure to comply with standards.

If such circumstances are absent, then the courts in most cases refuse.

Employee actions↑

When will you have to return it?

The law is harsh on the employer. Overpaid wages can only be recovered in exceptional cases. Article 137 of the Labor Code recognizes such

- counting error;

- proven guilt of the employee in failure to comply with labor standards or downtime;

- unlawful actions of an employee aimed at receiving “extra” money, which must be established by the court.

What error is considered counting?

The legislation does not contain a definition of counting error. However, the Supreme Court Decision No. 59-B11-17 dated January 20, 2012 states that a counting error should be considered an error made in arithmetic operations, that is, in actions related to counting.

Thus, you will have to return the overpayment if the accountant added two plus two and got five.

Technical errors, including those made through the fault of the employer, are not countable. Thus, you will not have to pay “extra” salary in case of a mechanical error when entering data into the accounting program, failures in the operation of the accounting program, typos and clerical errors in financial documents, as well as incorrect application of legislation or regulations of the organization.

In particular, you won’t have to part with your money if:

- paid vacation of a longer duration than required, as a result, the amount of vacation pay turns out to be overestimated;

- when calculating average earnings, the accountant took into account the bonus accrued after the billing period, etc.;

- you received your salary twice;

- you were paid both vacation pay and salary during the vacation;

- the accountant has accrued an allowance that is not set for you;

- you were accidentally paid a bonus without a corresponding order from management.

What does “proven guilt” mean?

If the employer, after paying the salary, finds out that during the paid period you did nothing, or did it incorrectly, the overpaid salary will also have to be returned. But only if the fact of non-compliance with the norm or downtime is recognized by the body for the consideration of individual labor disputes.

Otherwise, the employer will have to prove your guilt in court.

What actions are considered illegal?

If you are to blame for the error that led to an excessive payment of wages - for example, it was you who deliberately made a mistake when entering data into an accounting program - the employer can sue you and prove that your actions were aimed at receiving amounts that were not due to him.

When not to return

In all other cases, the problem of overpayment does not concern you. This is directly stated in paragraph 3 of Article 1109 of the Civil Code of the Russian Federation, according to which “salaries and equivalent payments, pensions, benefits, scholarships, compensation for harm caused to life or health, alimony and other sums of money” are not subject to return as unjust enrichment. provided to a citizen as a means of subsistence, in the absence of dishonesty on his part and a calculation error.”

You can also keep the money if the statute of limitations has expired and the withholding order was never issued. According to Article 137 of the Labor Code of the Russian Federation, “the employer has the right to decide to withhold from the employee’s wages no later than one month from the date of expiration of the decision to withhold overpaid wages.”

However, if you continue to work in this organization and build a career there, think about it. Maybe we should return the excess voluntarily?

Write-off of funds if there is a defect in work

If an employee has already received bonuses for a conscientious attitude to work or piecework payment for production, and later an irreparable defect was discovered in the manufactured products, or another production violation was discovered, then the employees, as a rule, refuse to sign an agreement to write off. In this case, the following procedure is applied to withhold overpaid funds:

- The employer notifies the employee of the amount of debt and the need to write it off.

- After the employee refuses, the employer convenes a labor dispute commission.

- The commission considers the dispute and makes a decision on the presence of defects in the work , the volume of defects and the amount of damage.

- The management of the company issues an order based on the minutes of the commission meeting.

- Funds are withheld from the employee's subsequent salaries..

The labor dispute resolution commission should consist of an equal number of management representatives and ordinary employees. After the employer convenes the commission, workers have 10 days to send their representatives to the commission. Representatives are elected at a general meeting or conference of employees of a structural unit.

First, the commission establishes the existence of a defect, then determines the degree of involvement of a particular employee in these violations. This may require:

- carrying out a partial inventory;

- submitting a request to the warehouse and accounting department;

- carrying out an examination of products manufactured by an employee.

After establishing the fact of the defect and the guilt of the employee, a confirming act is drawn up, signed by a simple majority of the members of the commission present, after which the damage is calculated (with a piece-rate payment system) or the percentage of reduction in the paid bonus is determined (with a salary and time-based payment system).

It is important to note that the time that employee representatives spent working on the commission is paid in the amount of their average earnings for the last year. Based on the results of all activities, the commission adopts a protocol describing all the decisions of the commission made during its work.

Within 3 days after signing the protocol, an order to withhold funds from the salary is signed; it must include the following data:

- name of the organization , full name of the head;

- basis for withholding funds;

- list of supporting documents;

- withholding amount;

- date and signature of the manager;

- signature of the employee in familiarization with the order.

Attached documents include:

- act on the presence and extent of defects drawn up by the commission;

- damage calculation;

- protocol of commission decisions.

A sample order can be downloaded here. The order is sent to the accounting department to process the debiting of funds.

If the labor dispute commission was unable to resolve the issue of write-off, or if the employee does not agree with the decision made, then the issue is transferred to the local judicial authority for consideration on the merits.

Prohibition on retention

When a person quits, he will always be provided with a number of payments required by law. There are mandatory accruals in the form of salaries and compensations and additional ones. Vacation pay is a mandatory payment. Despite the fact that the law allows them to be withheld in the event of certain circumstances, provisions are also defined that, on the contrary, impose a ban on such events.

Much in the question of how to keep money for vacation depends on the reasons for which the employee quits. The fact of using rest days in advance upon dismissal may not always result in a person being deprived of his payments. There are a number of circumstances that form a ban on the actions in question. These may include both certain types of reasons for dismissal, as well as force majeure situations that do not allow a person to be deprived of his funds.

It is necessary to rely only on the provisions of the labor law. If the Labor Code of the Russian Federation does not provide for a basis for withholding, and there is no direct prohibition on this, then it will still be impossible to deprive a person of payments.

Speaking about specific prohibitions on retention, first of all, it is important to note the main variants of the circumstances limiting the actions of the employer in this part of the relationship with the employee.

These include the following:

- The employee refused to move to another job, but due to his health or because the employer himself could not provide such an opportunity.

- Termination of the organization's work, measures to reduce employees, or a change in the owner of the company, resulting in the dismissal of the previous management.

- The decision to reinstate an employee after dismissal. It can be accepted either by the labor inspectorate or the court.

- Calling a person to serve. An alternative option for serving is also taken into account.

- Obtaining a person's status as disabled, which is confirmed by medical indications.

- Force majeure situations, which are such only in accordance with the law.

- Death of the employer if he acted as an individual entrepreneur.

These prohibitions directly depend on the reasons for dismissal. If at least one of the above circumstances is established, then withholding vacation pay will be impossible.

Regarding force majeure, the law specifies that such situations must also be clearly established. The peculiarity of this category of circumstances is that the reasons for dismissal are not the initiative of one of the parties. Neither the employer nor the employee himself can in any way influence the reasons why the relationship should be terminated; accordingly, there can be no deductions either. Force majeure is recognized as various natural disasters, military actions, catastrophes, any major accident, epidemic or other similar situations.

If this or that circumstance is not recognized by the Government of the Russian Federation as force majeure, then it is unacceptable to use it as a basis for a ban.

In addition to direct prohibitions on retention, there are also restrictive frameworks reflected in a separate article 138 of the labor law. This rule indicates that even if the employer can withhold vacation pay, then not the entire amount previously paid. As a general rule, the penalty should be no more than twenty percent. However, exceptions are also envisaged that allow the employee to be deprived of half of the payment. At the same time, everything must be justified, otherwise the employer will eventually have problems when recalculating funds and paying taxes.