An employee is always entitled to payments for unused vacation upon dismissal (Article 127 of the Labor Code of the Russian Federation), if he is not against such a replacement, or if it is actually impossible to give him this period, for example, during the liquidation of an enterprise.

In this case, it is necessary to determine several variables in the calculus formula: the number of unused days, average earnings per day, how long the citizen applied for rest. It should also be noted that not all payments are included in the calculation of average daily earnings.

Learn more about what workers' compensation is entitled to.

The Labor Code of the Russian Federation, namely Article 127, states that each member of the team has the right to annual leave.

In this case, he has the opportunity to choose:

- use rest time as intended;

- refuse vacation in favor of receiving monetary compensation.

Compensation and vacation pay are calculated in a specific manner, which is regulated by Article 139 of the Labor Code. This takes into account the average salary and hours worked.

Thus, compensation for unused leave upon departure is cash payments that the employee receives in the same amount as if he had received them when using leave. It is legally established that a team member has the right to receive benefits in full.

However, if an employee leaves of his own free will, there will be no other compensation or incentive payments for him.

The law of the Russian Federation provides 2 options for receiving compensation for rest in case of care:

- if the employee did not use rest at all;

- if he did not complete any part of his vacation in the current or previous years.

It is important to know. When making payments, the employer is obliged to pay all compensation that is due to the employee, regardless of the statute of limitations for this debt.

However, if the employee has already used all the rest and received vacation pay, but has not completed the year (or at least 11 working months of the year), the excess amount of these payments will be withheld during the calculation. The employer has all legal grounds for this.

Worth considering. It is not uncommon for vacation compensation, which is paid upon dismissal, to be confused with compensation for the remainder of compensation. However, these are not identical concepts. In the latter option, it is necessary to reimburse vacation days that exceed the mandatory 28 days. The remaining cases are compensation for the main period of vacation days.

Such a replacement is not acceptable for certain types of workers:

- pregnant women;

- minors;

- workers in hazardous or hazardous work.

Payment terms

Guided by Art. 140 of the Labor Code of the Russian Federation, the employer is obliged to pay the required amounts on the last day before dismissal. If this day falls on a weekend, then payment is made the next day.

If the situation is controversial and the parties do not agree with each other’s claims for payments, then the employer is obliged to compensate only the amount that does not raise doubts, and to continue the proceedings with the controlling organization regarding the rest.

For delays, the management and officials of the company are held accountable and punished with a fine of 1/150 of the resignation of the Central Bank of the Russian Federation. In addition, the employee is paid compensation for missing a deadline.

In conclusion, two important points can be highlighted. First of all, vacation pay upon dismissal on the personal initiative of an employee is paid without fail, and secondly, the period can be used to avoid the mandatory 2-week work period. Calculations are carried out in a standard manner, and payments are made within the time limits prescribed in labor legislation.

Features of vacation pay upon voluntary dismissal

When making such payments, it is worth considering:

compensation is calculated for days not taken off, and it does not matter their number and the personal working year during which the person earned rest.- A person can take time off immediately before the day of departure. So, the last day of work will be the last day of vacation, and the day of calculation will be the working day before the vacation. By the way, the employee has the right to change his mind about quitting and withdraw his application before going on vacation.

- If an employee takes more rest days than required, based on the part of the current working year worked, the employer can withhold up to 20% of the payment amount.

Who can't get it and why?

By law, every employee (regardless of the reason for leaving their position) has the right to receive payment for vacation time taken. However, in some situations it may not be possible to receive such compensation. This may happen in the following cases:

- If the dismissed employee has fully used his vacation - in accordance with Part 1 of Art. 115 of the Labor Code of the Russian Federation, the total duration of annual paid leave is 28 days (except for cases when we are talking about extended main leave). Thus, if an employee takes this period off during the year, there will be no need to pay compensation upon dismissal.

- If the dismissed person worked in his position for less than 6 months - in accordance with Part 2 of Art. 122 of the Labor Code of the Russian Federation, the right to go on vacation arises for an employee (in the first year of work) after 6 months have passed from the date of employment with a specific employer.

The only exceptions are certain categories of employees (women preparing to go on maternity leave, minors under the age of 18, etc.), who may request annual paid leave earlier than the established period. But if an employee took vacation “in advance,” the paid vacation pay will be deducted from him when calculating.

Our specialists have prepared a number of materials for you, from which you will learn how to act if you are not given a salary upon termination of a trade union, whether it is due upon dismissal under the article, and how to formalize and file a claim for its recovery.

How do they pay?

Vacation compensation is based on the average daily salary during the current calendar year.

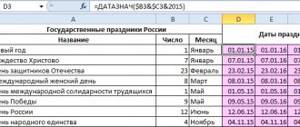

According to Article 139 of the Labor Code of the Russian Federation, the average daily earnings for vacation payments and compensation for unused rest days are calculated for 12 months. To do this, the amount of the accrued salary is divided by 12 and 29.3 (the last number is the average monthly number of calendar days).

Referring to Letter of the Ministry of Social Development No. 4334-17, a period less than the middle of the month is not taken into account, and a period of more than half a month is rounded up to a full month. The reason for the employee's departure does not matter.

Worth paying attention. To calculate the number of days that are eligible for reimbursement, you need to consider several factors:

- length of service (from the first day of work until the day of dismissal inclusive);

- time boundaries of the current working year for a specific person.

The following days must be subtracted from the length of service:

- baby care;

- duration of social leave without salary, not exceeding a 14-day period;

- absence from work without good reason.

Further, the calculation of vacation compensation is based on the employee’s total length of service.

For those team members who have worked at the enterprise for more than 11 calendar months, there is a general calculation procedure called “full compensation.” Its main provisions are:

for each working year there are the number of days of 1 annual leave, which is established by the contract;- the working year is calculated purely individually: it begins from the first working day, time that does not relate to work experience is subtracted from it;

- all days of vacation not taken are reimbursed, regardless of whether the employee earned this right in the current or previous years;

- for the current year (and it is often not worked out to the end), the number of days that are subject to compensation is calculated in direct proportion to the working months.

How to calculate the amount of compensation for unused vacation - see the video below:

Example of calculating compensable days

The employee has been working in the organization since January 14, 2014. Resigns effective August 20, 2021. The duration of vacation in the organization is 28 days. 28 days were used for 2014, 23 for 2015, 21 for 2021, 28 for 2021.

Upon dismissal, the organization is obliged to calculate the amount of compensation for unused vacation (if any).

- total length of service in the organization - 4 years, 7 months (6 days are not taken into account, since they are less than 15 days)

- the total number of days of allotted vacation for all years of work is 128.33 days

- number of days of vacation used – 100 days

- difference between allocated and used leave – 28.33 days

Compensation must be accrued in 28.33 days.

How to calculate average daily salary?

Calculations of such salaries are established by the Decree of the Government of the Russian Federation.

To correctly calculate average daily earnings, two positions are used:

- number of working days for 12 months;

- employee's income for the same period of time.

There is a certain algorithm for calculating the average wage:

- The year that comes before the date of departure of the employee is taken into account.

- Absence time is subtracted from this time period (sick leave is also taken into account). If such calculations exclude the entire period, it must be moved back another year.

- The calculation is carried out in working days, based on a calendar with 6 working days per week.

- If working time and a specific working period are summed up, then the average wage itself is calculated in hours.

- A calendar month, according to the standard, consists of 29.3 days. The concept for calculating a part-time working month is as follows: divide 29.3 by the actual number of days in the month, multiply by the number of days worked.

Healthy. Here is an example of a formula for calculating the average daily payment: divide the amount of income by the number of days worked during the calculation period.

For example, a certain Petrova N.N. receives 259,400 rubles per year. We take this amount and divide it by 338.2 days, we get 767.017 rubles.

Based on the results, it is not difficult to calculate the specific amount of compensation. Here is the formula:

compensation = number of unused days multiplied by the average daily salary.

Registration of vacation pay

Before dismissal from a position, an employee can exercise the right to his unused vacation. It is often practiced to take leave instead of the 2-week work required by law. This approach is legally permitted and therefore eliminates any difficulties. It is permissible to replace the work if the employer gives his permission.

In case of registration of vacation, the employer provides for payment of vacation pay. In order to decide what is more profitable - taking a vacation or receiving compensation upon dismissal, it is important to understand how such payments are calculated.

First, the employer calculates the average one-day earnings, after which the result is multiplied by the number of days that were days off. There shouldn't be any difference in the calculations. This means that both vacation pay and compensation are accrued in the same amounts.

To provide an employee with leave or money upon dismissal, it is important to write a letter of resignation correctly. The choice in this case is entirely up to the employee. Employers usually support this desire of a colleague.

The subordinate should remember that the resignation letter must be submitted 2 weeks before dismissal.

This way, the employer will be able to fully compensate the employee for all payments. Payments are paid a few days before dismissal by transferring funds to a bank card or at the company's cash desk.

To correctly understand what is more profitable - vacation followed by dismissal or compensation, you need to take into account that the calculation is made using the same formula, so there is no difference. The choice is up to each employee - to go on vacation or receive a cash payment.

Tax liens

According to Article 217 of the Tax Code of the Russian Federation and Article 9 of Federal Law of Russia No. 212, vacation compensation is subject to insurance contributions and personal income tax.

Important. The tax must be transferred exactly on the day of issuance of payments, and contributions to the Social Insurance Fund and the Pension Fund before the 15th day of the month following the day of departure of the employee.

The Federal Tax Service informs that payment for vacations not taken must be reflected in the person’s income certificate.

When fees and taxes are withheld from the accrued amount, alimony and other debts specified by the court must be deducted from the amount received.

Is vacation compensation subject to personal income tax upon dismissal?

Personal income tax is always deducted from payments on days not taken off (paragraph 6, paragraph 3, article 217 of the Tax Code). Funds for this tax are allocated no later than the next date after payment (clause 6 of Article 226 of the Tax Code) at a rate of 13 and 30%, respectively, for residents and non-residents of the Russian Federation.

The amount received by the employee is not payment for the performance of work duties, therefore it is displayed by the date of its actual transfer.

Data on this tax are recorded in increments in sections 1, 2 of Form 6 of personal income tax. Certificate 2-NDFL reflects this parameter with code 2013 (letter of the Federal Tax Service No. ММВ-7-11/). Data on what was paid is shown in 6-NDFL for the period before the employee’s dismissal, and in 2-NDFL - when preparing and submitting annual reports after his departure.

The employer is obliged to issue a 2-NDFL certificate to the dismissed person, as well as any other work-related documents, within 3 days after his written request, regardless of the reasons for the procedure being carried out. This document is required by employment agencies, tax departments and similar institutions, as well as by financial and credit organizations when applying for loans. Simply put, this is a document about the amount of income received.

How to apply for payment of compensation?

To legally dismiss an employee and accrue all necessary payments to him, you will need the following documents:

- employee statement.

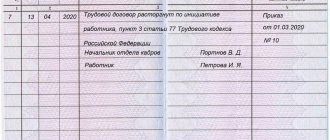

- An administrative document, namely an order of dismissal. It is drawn up on a special T-8 form. If desired, here you can write down the instructions of the responsible accountant about the need to pay compensation.

- Document on the calculation of payments provided upon dismissal. Compiled according to a single form T-8.

Order form T-8.

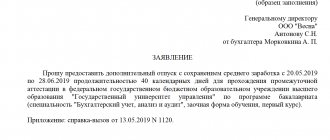

Example of an employee statement

If an employee decides to leave of his own free will, he must write a statement. It is compiled in any form. The document must indicate your details, position and reason for leaving.

In this case, it is not necessary to register a requirement for compensation for unspent vacation. These payments are required by law by default. However, this wording is necessary if the employee wants to take advantage of vacation before dismissal.

The resignation letter has the following structure:

- A cap;

- title;

- main part of the text;

- date, employee signature.

Below is an example of the wording of this document.

Example of a resignation document

The dismissal order must be issued in Form T-8. It indicates the employee’s data, the reason for leaving, the date of dismissal, the employer’s signature and the company’s seal.

Below is an example of a document.

So, calculating compensation for unused vacation is a multi-step process that requires knowledge and experience from the accountant.

How are they calculated?

Compensation for unpaid vacation is accrued on the employee’s last working day at the workplace along with the amount of unpaid wages.

If the employee resigns voluntarily, this day will occur two weeks after submitting the resignation letter or at another time agreed with the employer.

The employee notifies the employer two weeks before the date of the expected termination of the employment relationship. This can be done even while you are away from the workplace, for example during vacation or sick leave. However, if the employee has extenuating circumstances or the employer has already found a replacement for him, the dismissal date may be postponed to an earlier date.

The basis for starting the calculation of compensation is the dismissal order . This order is drawn up on the basis of an employee’s application to terminate the employment relationship at his own request (how to apply for dismissal with compensation for unused vacation?).

From the materials of our experts, you will learn where to go if you have not received your salary upon termination of an employment contract, whether you should count on it if you are dismissed under the article, and how to draw up and file a claim in court to recover it.

How to calculate the number of unused days

Few employees record vacation balances for previous years and know how vacation days are calculated for the current year, taking into account certain specifics of calculating vacation periods for certain categories of employees. The accounting department also does not have certain information; they only calculate compensation upon dismissal or vacation pay for the number of vacation days already calculated.

That is why, at the initial stage, based on the employee’s application, the calculation of vacation days subject to compensation is carried out by the HR department inspector on a special form - a dismissal or vacation note. But before the result is drawn, the specialist will calculate the length of service, which has certain features that affect the subsequent number of days of rest.

Seniority

From the point of view of many workers, the reporting period for which vacation days are calculated is the calendar year, but this is a mistaken opinion. Each employee has his own individual period of time, which is called a working year.

This indicator is calculated from the moment a worker is hired for a position until the date of dismissal, thus amounting to a whole year or several.

In pursuance of Article 122 of the Labor Code of the Russian Federation, an employee can take a full-length vacation in the first year of work after six months of employment, and for the second and subsequent years, according to the schedule, at any time of the year, without taking into account the individual working period. At the same time, despite the registration of vacation even less than six months later in the subsequent months of work, it is assumed that the employee must work the entire year, so part of the vacation is, as it were, provided in advance.

If an employee quits without working a full working period, days of unrealized rest can be calculated in several ways:

- If dismissal leave has not yet been issued in the current year, only the time actually worked is taken into account, that is, from the date of admission to the day of dismissal. For example, an employee was hired on April 10, 2015, and quits on November 7, 2019. 4 vacations were provided for previous years, that is, until April 10, 2019, the vacation was fully implemented. Compensation will be calculated for the period from April 10, 2019 to November 7, 2019 , that is, for 6 months and 27 days .

- If vacation this year has already been taken, but the full year has not been worked out, there is essentially nothing to compensate, because the vacation was sold in advance. In such a situation, compensation is not accrued; moreover, part of the vacation pay that was paid earlier is deducted from the last salary. For example, an employee worked only for six months, but used all the vacation days; when calculating, 14 days of vacation pay will be deducted from him.

- If, instead of monetary compensation, the employee is granted leave with subsequent dismissal. Under the described circumstances, the vacation is issued in full, that is, 28 days , but compensation is calculated only in proportion to the time worked. Let's say you worked 8 months , vacation is granted for the full duration, but vacation pay is accrued only for 19 days (18.64 after rounding). These rules are applied on the basis of part 2 of the letter of clarification of the Federal Labor Service No. 5277-6-1.

Separately, it is worth noting the procedure for rounding a month to a full month if not the entire month has been worked. Thus, the Letter of Explanation of the Federal Labor Service No. 944-6 states that if an employee worked less than 15 days in a month, the specified period is excluded and is not taken into account at all when calculating, but if more than 15 days were worked, the month is rounded up to a full month and accordingly taken into account calculation.

Fractional numbers can be formed not only when calculating length of service in months, but also when calculating the number of vacation days, given that each month is 2.33 days. But there are also additional holidays, for example, 7 days per year, which will ultimately be counted as 0.58 days per month.