What is included in the calculation when leaving at your own request?

In accordance with current legislation, upon dismissal on his initiative, the following payments are made to an employee:

- wages for the period worked before termination of work;

- bonuses, allowances and other amounts provided by the organization, accrued to wages;

- compensation in cash equivalent for the days of regular annual paid leave and additional paid days that were not taken off by the employee before the dismissal;

- other payments provided for by the collective labor agreement and industry agreement (Articles 57, 178 of the Labor Code).

A situation may arise when the next vacation was spent by the employee in advance, i.e. for the period before the end of the working year. Then, in accordance with paragraph. 5 hours 2 tbsp. 137 of the Labor Code of the Russian Federation, the employer has the right to deduct from the amount paid before dismissal for unworked vacation days. But this is only possible when the amount of deductions is no more than the charges themselves. Otherwise, they have no right to recover the overpayment for vacation time taken.

Important points

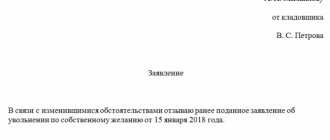

The paper is written in any form. It is better to make it in two copies. One is for the employer, the second (with the signature of the boss) the employee keeps for himself (may be useful in court). Information about the document submitted to the manager must be entered in the incoming correspondence journal.

Sample request for payment upon dismissal

At the top of the document we indicate:

- position and full name employer, name of organization;

- FULL NAME. the dismissed person, his passport details;

- date of document preparation.

The following is the text:

- FULL NAME. applicant, position, period of work and date of dismissal;

- the reason for the request;

- the settlement amount that the employee is claiming;

- It is also advisable to indicate a list of attached documents (if any).

After this, it must be signed and handed over to the employer or his representative.

How do you calculate when you resign at your own request?

When calculating the amounts due to an employee upon voluntary dismissal, accounting makes the following calculations:

- Wage . Days worked are counted in the usual manner, including:

- payment for working days, taking into account the day considered the day of dismissal;

- bonus amounts;

- accrued payments for overtime hours, night and evening shifts, work on weekends and holidays, additional payment for combinations;

- amounts for length of service;

- travel and sick leave payments if there was a fact of being on a business trip or presenting a certificate of incapacity for work;

- other payments provided for in the organization, approved by a collective agreement, industry agreement or local regulations.

All wage calculations are made in accordance with the time worked until the date of dismissal. To record it, the organization’s personnel service must maintain a time sheet in the T-13 form. A separate report card is drawn up for the dismissed person, which is endorsed by his immediate superior and the head of the personnel department.

Based on the submitted document, the accountant calculates wages using the formula:

Salary = (Salary + Bonuses + Other payments) / Planned number of working days in a month × Actual number of days worked, including the day of dismissal.

- Compensation for vacation days . Vacation pay is calculated based on the fact that for every month worked there are 2.33 days of vacation. This follows from the provisions of Art. 115 of the Labor Code, which states that a citizen who has worked continuously in an organization for 11 months is entitled to receive 28 calendar days of leave.

The formula for calculating days of unused vacation is as follows:

Vacation days = Number of full months of work × 2.33 days – Number of vacation days taken.

- Compensation for additional days of rest . The calculation occurs in a situation where the employment contract with the employee stipulates work on irregular working hours. Additional days of vacation are granted after the main vacation has been exhausted. Upon dismissal, compensation is also accrued for them.

What is a statement?

This document is an appeal from one individual or individual entrepreneur to another. In this case, the addressee can be any official, company, institution or government agency. This appeal may indicate a requirement or a request to take the necessary action. Moreover, the statement is supported by the legal right of every Russian citizen to work or rest.

Each such document must be drawn up according to certain rules. This applies even when we are talking about statements in free form. You need to start creating a document with the so-called header, which consists of two sections. It should be located in the upper right corner. First of all, it is necessary to indicate the position, surname and initials of the official to whom the application is intended. It is important to remember that the initials must be indicated after the last name.

Next, in the header of the application, you must indicate from whom it was submitted. In this case, one important rule must be observed, namely, write information about the applicant in the genitive case. Everything is written on a new line and without the preposition “from”.

Next comes the name of the document itself, which is written in the middle of the line and without a dot at the end. Starting with a new paragraph, you must state the essence of the application, where you should describe in detail your request or demand. In some cases, an application is submitted to forward a complaint to management. In such a situation, the document is filled out in the same way. Most often, complaints are addressed to government officials.

At the end, you must indicate the date the document was created and put a personal signature. This must be done in one line, but from different sides. Numbers are indicated on the left side, and letters are indicated on the right side.

Payment terms

The accounting department is obliged to make all payments to the resigning employee on his last working day (Article 140 of the Labor Code). In some situations, the law establishes other payment terms:

- When the employee was not at work on the day of dismissal, payment of amounts due upon termination of the employment contract must be made after he applies for payment. Then the deadline for their transfer is the day following the day of application.

- The employee decided to first take a vacation and then quit immediately:

- amounts accrued as vacation pay must be paid three days before the start of the vacation;

- the final payment to the employee is made on the last working day preceding the start of the vacation.

For example, an employee fell ill and did not close his sick leave until he was fired. The employer is obliged to make payments no later than the next day after the day of application, if payments are made in cash at the organization's cash desk. For example, an employee closed and submitted sick leave on February 4, 2021. The accounting department must make the final payment, including sick leave, on February 4 or 5.

For non-cash payments, amounts calculated in the general manner are transferred on the day of dismissal specified by the employee in the application. The sick leave will be paid later after it is presented to the accounting department.

In what cases should you write

As a rule, all payments to company employees are made through banks. Therefore, as a rule, employees do not have problems with timely receipt of payments. But some companies still continue to issue salaries to their employees through the accounting department.

As mentioned above, the employer is obliged to give the employee a full payment on the last day of his stay at the enterprise. But situations are not uncommon when, for one reason or another, a person cannot receive money on the due day. For example:

- due to personal circumstances, for example illness;

- due to delay in payments by the employer;

- if the employee disagrees with the amount of payments received.

In such cases, the employee should write a request for payment upon dismissal.

Administrative liability for late payment of wages

In addition to financial sanctions in the form of monetary compensation for late payments, the employer may face administrative liability.

If an employee complains about the employer to the labor inspectorate, the employer faces administrative punishment under the provisions of Part 6 of Art. 5.27 of the Administrative Code in the form of a fine.

Its size depends on the type of ownership of the employer:

- for organizations with the status of a legal entity, the fine can be 30-50 thousand rubles;

- for entrepreneurs – 1-5 thousand rubles.

Also, according to the provisions of this article, officials of the organization can also be held accountable. They face a fine of 10-20 thousand rubles.

In case of repeated violation of the law, the fine will be much higher (under Part 7 of Article 5.27 of the Administrative Code).

Thus, delay in payment of wages is punishable by penalties for each day of delay and can be classified as an administrative offense.

Time limits for consideration of an application for dismissal

Every person has the right to choose their own workplace. Therefore, it is not unusual that one day an employee needs to submit a resignation letter in order to move to another job. Here you need not only to draw up the document correctly, but also to provide it to your boss in advance.

The time frame for consideration of an application for dismissal is established by the labor legislation of the Russian Federation. If a company employee decides to permanently leave the workplace of his own free will, he must notify his boss two weeks before the expected date of dismissal. There are some exceptions to this, but they depend on specific situations.

An application for dismissal is created in any form, but without fail, taking into account all the rules for drawing up documents of this type. It is important to provide the employer with a written version of the application. Things are not decided by words. The application is drawn up in the name of your immediate supervisor or the head of a department or company, depending on the requirements of the company’s internal regulations. There are no special restrictions in drawing up the document. It can be written by hand or printed on a computer. Some companies have special application forms that you can use.

It is best to submit the document personally to the employer to be sure that the application will reach the boss’s desk on time. If it is not possible to personally deliver the paper, it can be sent by fax, letter, or even telegram. It is important that the delivery time and the date of registration of the workers’ application are recorded. This may be necessary if the matter goes to trial.

If a company employee decides to send an application by email, this option is also allowed. However, in this case, the document may not be accepted if the employee does not have his own digital signature.

Regarding the time for consideration of the application for dismissal, it is important to submit the document no later than 2 weeks before the intended dismissal. After this period has expired, the employer is obliged to officially dismiss the person. The management has no right to delay time, as this is illegal. The only exceptions are special categories of employees.

Compensation for late payment

If the employer violated the payment deadline, then he must pay compensation for the delay from the calculation (amount of delay * 1/500 of the current Central Bank key rate). This calculation procedure is contained in Article 236 of the Labor Code of the Russian Federation.

The key rate is regularly revised by the Central Bank of the Russian Federation, so the amount of compensation may vary. As of the end of May 2018, it is 7.25%.

Compensation is paid for each day of delay in obligations, starting from the next day after the scheduled payment. It is paid along with all due payments.

According to the general rules, compensation is not subject to taxation (personal income tax of 13%) , i.e. it is transferred to the employee in full without reduction for tax.

For example, an employee’s salary upon dismissal was delayed in the amount of 23 thousand rubles. (already minus personal income tax). He quit on May 10, but the money was actually paid to him on May 23. Compensation must be paid for the period from May 11 to May 23, i.e., 13 days.

The calculation of compensation to an employee for overdue wages will look like this: 23000 * 7.25 * 1/150 * 13 days. The amount of compensation will be 144.52 rubles. The employee will need to pay 23,144.52 rubles.

On probation

During the probationary period, the employee must also inform the company management in advance about his dismissal. The minimum processing time is 3 days. The application procedure and subsequent dismissal are standard, as for voluntary dismissal.

It is also possible to terminate the employment relationship if the employee fails to pass the test satisfactorily. In this case, the employer provides a written notice 3 working days in advance to the employee with whom the decision has been made to part ways.

The notice must indicate the reasons why the employee is not suitable for the position held. This will help avoid lawsuits in the future.