Author of the article: Yulia Kaisina Last modified: January 2021 8306

Lawyers working with cases related to inheritance law sometimes have to face questions like: what to do if the heir died before the testator? How is the inherited property divided in this case and who has the right to claim it? This article will provide complete information on these issues, taking into account all the nuances that may arise during the division of property.

Inheritance: how to formalize it correctly?

Inheritance is movable and immovable property: a house, a car, company shares, which after the death of a person will pass to his relatives.

The inheritance can be received after the death of the testator in order of priority or by will.

If a person left a will before his death, then the property will be inherited by those people and in the shares determined by the testator. Everything is simple here. Much more difficult are those cases when a deceased relative does not leave a will and his property is divided among potential heirs.

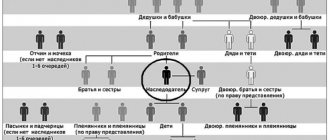

In total, Russian legislation distinguishes 8 queues - both immediate relatives and the state:

- The inheritance by law goes to the closest relatives: children, spouses and parents.

- The second is siblings, as well as brothers and sisters related to one of the parents. This also includes grandparents.

- The third is the aunts and uncles of the testator.

- Subsequent lines are the most distant relatives.

- Stepmothers, stepfathers, stepsons and stepdaughters are least likely to receive an inheritance, since they are not considered relatives at all.

- The eighth and final stage is the state.

If the testator has no relatives, and he has not written a will, then in this case all his property will go into the sole use of the state.

It is worth noting that the following are subject to inheritance:

- cars;

- jewelry;

- real estate;

- securities.

Death of the receiver after inheritance

To avoid problems with the division of inheritance and to be sure that after death the will of the testator will be fulfilled, he must not only think about the heir, but also about the sub-designation of his successor. In this situation, if the main heir managed to enter into the inheritance, but did not have time to fully accept it due to his death, then his rights can be transferred to the successor who is indicated as the second applicant.

By appointing a backup heir in advance, the testator will be able to solve many problems associated with the struggle for his property.

The latter can receive rights to inheritance both according to the will and legally. The new heir, after assuming his rights, has the right to dispose of the received property, regardless of how much time has passed since its receipt.

Rules of inheritance upon death of an heir

If an heir under a will dies, then his part goes to close people. But the forms of redistribution of shares depend on the time and circumstances of the death of the successor:

- died before the death of the testator;

- died on the same day as the testator;

- died after opening the will without accepting the inheritance;

- entered into an inheritance before his death.

In Russia, inheritance is transferred in two ways - by will and by law. The documented will of the deceased takes precedence. Its exact execution is violated only by the presence of obligatory heirs, whose interests were not taken into account.

When there is no will or is declared invalid, a law comes into force requiring that the inheritance be distributed among legal successors of the same degree of kinship. Direct heirs are parents, spouse and children (also adopted children).

If an heir under a will dies before the testator, then the testator has the right to indicate in the document another candidate to whom the rights of the deceased will be transferred (Article 1121 of the Civil Code of the Russian Federation). Then the second candidate turns to the notary and inherits according to the usual procedure. But not everyone does this.

Example: Elena Vasilievna bequeathed a house and land to her nephew and appointed her own sister in the event of his death. And so it happened - the sister inherited the property.

The day of opening of the inheritance of the Civil Code of the Russian Federation determines the date of death of a citizen or recognition of such a fact by the court. From now on, candidates for possession of his property have the right to apply in writing to the notary's office near the last address of the deceased and declare rights.

In the expression of will, the author has the right to indicate those persons whom he does not want to see among the legal successors under any circumstances. If a court decision recognizes a person as an unworthy heir, then he is also excluded from the list of applicants for the inheritance (Article 1117 of the Civil Code of the Russian Federation).

The heir dies before the testator

If an heir under a will dies before the testator, then his share is not transferred to those who are also included in it. This part of the inheritance is considered intestate and, by law, goes to representatives of the first stage or subsequent degrees of kinship (Articles 1142-1145 of the Civil Code of the Russian Federation).

Example. Vera Petrovna died, bequeathing her apartment and car to her husband and his son from his first marriage. The husband died shortly before his wife and her will remained unchanged. Vera Petrovna's closest relatives are her mother and father. They will share among themselves the share that their son-in-law would receive. The second part goes to the husband's son.

After the death of the son or daughter of the testator, the inheritance mass is transferred to the grandchildren by right of representation (Article 1146 of the Civil Code of the Russian Federation). For example, Zakhar Pavlovich died before the death of his father Pavel Vasilyevich, who bequeathed all his property to him and his brother. Zakhar Pavlovich is survived by a son and daughter, who are the deceased’s grandchildren. They receive the inheritance instead of their father, along with their uncle.

The heir died without making a will

The citizen died soon after the person who included him in the will, but did not have time to enter into an inheritance after 6 months allotted by law. Then the hereditary transmission begins to operate (Article 1156 of the Civil Code of the Russian Federation).

The rights to the property of the deceased are transferred to legal successors both by will and by law. When death overtakes a citizen less than 3 months before receiving an inheritance, then for his legal successors the period is increased by another 3 months, then by a court decision (Article 1155 of the Civil Code of the Russian Federation). The paperwork is completed as usual.

Example. Pavel Stepanovich planned to leave the house and car to his brother Oleg Stepanovich. But he died 4 months after him. Oleg Stepanovich was left with two sons, to whom he, in turn, bequeathed his property in his will. His children turn to a notary and open two inheritance cases.

The obligatory heirs of the deceased are not owed anything (Article 1149 of the Civil Code of the Russian Federation).

When a person has managed to enter into an inheritance, having received a notarial certificate, the acquired property is inherited by the successors in the manner provided for by Russian legislation.

The heir died at the same time as the testator

When a person written in a will passes away on the same day as the testator (death on the same day is considered simultaneous), then they do not transfer the inheritance from one to the other. Close people open separate inheritance cases with a notary and receive what is due to them by law or included in the wills of the deceased (Clause 2 of Article 1114 of the Civil Code of the Russian Federation).

Example. A childless husband and wife crashed in the mountains. Each wrote into each other's will. Then the wife's inheritance will be received by her parents, and the husband's - his.

In what cases do the rules on hereditary transmission not apply?

There are two such prohibitions. The first concerns the right to an obligatory share in the inheritance.

By leaving a will, the testator thereby expresses his will to transfer his property to a specific person or several persons, and it does not matter whether the testator is connected by blood ties with such heirs or not. However, there are categories of heirs by law who have the right to an obligatory share in the inheritance even in the presence of a will

However, there are categories of heirs by law who have the right to an obligatory share in the inheritance even in the presence of a will.

These include minor or disabled adult children of the testator, his disabled spouse, as well as.

But it should be remembered that the right to an obligatory share in the inheritance does not pass through transmission. In other words, if a deceased heir during his lifetime had the right to an obligatory share in the inheritance, in the event of his death this right will not pass to his heirs through hereditary transmission (Article 1149 of the Civil Code of the Russian Federation).

Also, the right of inheritance does not pass to the heirs of the deceased heir by way of hereditary transmission.

In other words, if the deceased heir himself had the right of inheritance by way of hereditary transmission, which was not exercised by him during his lifetime, this right is not transferred by way of hereditary transmission to his heirs, since it is not part of the inheritance that opens after his death (Article 1156 of the Civil Code of the Russian Federation ).

Thus, the following does not pass through the order of hereditary transmission:

- The right to an obligatory share in the inheritance

- Right of inheritance by hereditary transmission

The legal heir died before the testator

If this situation arises, you need to pay attention to the following factors:

- the deceased is a legal heir, that is, he has family ties with the testator;

- the successor died before the testators or at the same time as him;

- the testator did not draw up a testamentary act during his lifetime.

In this case, the law regarding succession, that is, the transfer of inheritance rights to the descendants of the successor by law, comes into force.

Important! Based on the Civil Code of the Russian Federation, if the legal heir died earlier than the testator or at the same time as him, then the inheritance rights of the deceased will be received by his descendants on the basis of a legislative act on succession.

Simply put, if the testator died before the testator, then his inheritance rights will be taken over by his children, brothers/sisters, grandchildren, nephews/nieces.

This feature applies only to the first three circles of the hereditary queue:

- If the heir of the first circle of succession dies, the inheritance will be given to the grandchildren of the testator. One of the most common examples of succession includes the transfer of inheritance rights specifically to natural or adopted children;

- If the recipient of the second round of priority dies, the property will be transferred to grandparents or nephews/nieces. If the heir by law dies earlier than the testator, and at the same time he belongs to the second circle of priority, and he did not have children, parents or a wife/husband, his part of the inheritance passes to the descendants represented by nephews and grandparents;

- If the heir of the third circle of succession dies, his share of the property will be transferred to his cousins/brothers. In this case, the principle of division of property will be similar to those described above. If the deceased testator has a third-ranking heir who died, then the inheritance will pass to his descendants, in other words, to the testator’s cousins/brothers.

Expert commentary

Shadrin Alexey

Lawyer

These rights apply only to successors belonging to the first three circles of succession. If the deceased heir was a representative of the rest of the line, then his inheritance rights do not pass to another person.

Death of the person who assumed the rights

In order not to confuse anything and achieve the fulfillment of his own will, the testator must think not only about the possible heir, but also about his intended successor.

In this case, if the first person who took possession of the valuables, but did not complete the procedure for accepting them, died, the owner may become the one indicated in the document as the second applicant. Having one will solve many problems associated with the struggle for property.

The death of a citizen who entered into a will allows not only the potential heirs of the maker, but also citizens who are heirs of the person who accepted it, to claim property.

The latter receive rights to existing property in the manner prescribed by inheritance law:

- by will;

- in law.

The new owner has the right to dispose of the property regardless of how much time has passed since its receipt.

Transfer of rights under a will

The testator can indicate his property in any way he wishes. Including future acquired property.

In this case, the law allows the testator to divide all property into parts in advance. The inheritance can be divided as follows:

- broken down into specific shares for each recipient;

- bequeathed in full to a certain circle of recipients without division into shares between them.

Let's look at an example:

- After the death of citizen N., an inheritance case was opened in the notary's office. In the will, the testator decided to bequeath all of his property at the time of death, in whatever form it may be, to his daughter and son. Son N. dies before the testator. And after 5 months, the grief-stricken father dies due to illness. Thus, the rights to all property were transferred to the daughter of the deceased testator.

In the second case, there is one important nuance. If a specific share for each recipient was not allocated by the testator himself, then the citizen who, within 6 months after the death of the testator, declares his claims, becomes the testator's legal successor, without having time to change the will.

How does hereditary transmission work?

Here we are talking about the transmission channel. The article helps the heirs of the previous appointee to claim the “freed” share. Moreover, these can be both beneficiaries under the will and legal successors. They claim a part of the inheritance on the same basis for all.

The specificity of the reassignment of a free share is its transfer to a single existing heir or several heirs. In the second case, the size of the share per person is reduced in proportion to the number of applicants. The exception to the transfer of such a part of the inheritance is the status of the share as mandatory (assigned to dependents regardless of the will).

In law

Legal order presupposes the existence of a sequence, that is, a sequence in which the relatives of the deceased line up to claim their share. The number of queues is 7. Those who are not included in any of these groups are considered to be outside the queue (if they have the right of inheritance). The movement from the beginning to the end of the sequence is parallel to the decrease in kinship with the deceased.

The obligatory share, the right of representation and the transmission line are reasons to consider a person out of turn. The difference lies, for example, in comparing the first candidate with the remaining two. The mandatory allocation of a share diminishes the scope of the rights of other participants in the inheritance case. And the remaining 2 points imply the replacement of one heir with another or several.

Distribution of property in accordance and in order

The specificity of the order of priority is that the transition to each of the categories of heirs occurs in the absence of representatives from the previous ones. That is, only candidates from one of the current queues can be called up for inheritance at a time. Within the boundaries of the first is the spouse of the deceased, his children or mother/father.

The second category includes brothers and sisters, then uncles and aunts, etc. Accordingly, applicants, through the right of representation or a transmission channel, acquire their status exclusively in the event of the death of an already called subject (and not in one of the categories to which the turn has not reached ).

By will

The current ways of replacing a person called to inherit and who has died untimely are transmission and sub-appointment. Replacements come from people who are either listed as such in the will or are not there. In the second case, the author of the will may, in principle, be unfamiliar with them.

Transfer of property to persons specified in the will

The right of representation within a will is prohibited. Of the remaining legal methods, subassignment becomes the more pressing here. It means the testator independently determines a replacement for the heir under the will if he dies earlier (without entering into the inheritance). Such a clause is added to the will at the request of the author.

Cancellation of a will with 1 heir after his death

If it is implied that there are no substitutes within any legal path after the death of the sole successor, then the inheritance becomes escheat. However, it cannot remain without an owner. In the absence of physical or legal applicants, it goes to the state represented by federal or municipal bodies.

When does the transmission fail?

After the death of the applicant, disputes often arise due to ignorance of the principles of redistribution of inheritance rights. The determining factor is the ratio of the dates of death of the testator and the successor. If the last one died first, there can be no talk of transmission, since it is considered that the inheritance remains intestate, even if the person is indicated in the will. But there is an additional number of cases when the transmission mechanism cannot be used.

Missing a deadline

After the opening of the inheritance case, six months are allotted for the procedure. The period will be reduced to three months, based on the fact that there is only one applicant. After the death of the heir, you must contact a notary within this period. Otherwise, you will have to file a statement of claim. 3 years are allotted for this. This is the general limitation period under the Civil Code.

In exceptional cases, a claim is accepted later, but there must be special reasons for this. An heir who died after the opening of the inheritance leaves the property due to his descendants, but if all the deadlines are missed, the transmission does not work, it is no longer possible to use the material benefits and the claim will be left without consideration. To prevent this from happening, contact a lawyer in a timely manner and initiate the inheritance process.

The key points are the timing of entry and the method. When death takes away a legal successor, relatives of the same line become applicants. These are not only people who are blood related to the deceased. A valid marriage (at the time of the events) or adoption are also sufficient grounds for receiving an inheritance. A will changes the rules of distribution, and everything is decided by the terms specified in the text.

Mandatory share

When dying, the testator leaves an inheritance to the persons specified in the will and relatives, as well as obligatory claimants. The last category includes minor children, disabled parents and dependents who support the deceased in the last year of life. Without having time to accept the obligatory share, the heir deprives his children of the opportunity to use the transmission.

Simultaneous death of testator and heir

If the day of opening of the inheritance coincides with the date of death of the heir, the transfer of valuables to the latter’s relatives is excluded. This situation is equivalent to the case when there was no successor even before the time of accession. It is considered that the estate is not willed. The relatives of the successor have no right to claim the share that would have been transferred to him by right of inheritance if his life had not been cut short so early.

The heir left a will

It is better to consider this case with an example. Relatives learned that the head of the family managed to write a will for all the property acquired during his lifetime and died. Before this, his father passed away, from whom the inheritance remained. Relatives cannot lay claim to valuables if the will states that everything must be transferred to a third party. To cancel this fact, it is necessary to obtain the annulment of the will through the court.

The heir died without entering into the inheritance

If the heir under the will died after the testator, but did not enter into inheritance rights, hereditary transmission is applied (Article 1156 of the Civil Code of the Russian Federation). The share due to him passes to his immediate successors. When a citizen dies less than three months before entering into inheritance, then for those newly called in this case, the period for completing a set of papers is extended by three months. After its expiration, an increase in the period is possible only by court decision. At the request of interested parties, a notary opens two inheritance cases: to receive the property of the testator and the property of the deceased heir.

If a citizen entered into the inheritance of a relative and then died, his successors enter into a will in accordance with the legislation of the Russian Federation.

If the heir died before receiving the inheritance

To begin with, let’s figure out what the essence of a will is. This is a legally approved type of document, which is the direct expression of the will of the testator. In it, the testator has the right to express his wishes regarding the fate of his property after his death.

A will can be drawn up at any stage of the testator's life. At the discretion of the property owner, this document can be changed or canceled at any time.

However, if the heir dies before the testator, quite controversial situations arise related to the property. The law does not provide for how property should be divided if the successor under a will dies. Therefore, when the testator does not have time to correct the document before his own death, controversial situations arise.

If an heir under a will dies before the testator, there are ways to solve the problem. There are four branches of transfer of property to other legal successors in such a case:

- recipients with the right of representation;

- heirs at law;

- heirs under a will;

- sub-designation of recipients.

What documents are needed?

The inheritance procedure after the death of the closest person - the mother - can occur in two ways:

- If there is a will, then according to the will specified in this document, the division of property occurs.

- If a will has not been drawn up, then the inheritance takes place in accordance with the order established by the Civil Code (Article 1142-). Children are considered the first line of inheritance (Article 1142 of the Civil Code of the Russian Federation). Therefore, if there is no written testamentary document, then all property is transferred to relatives of the first priority: daughters/sons, spouse and parents.

Read more about the will of a mother or father for an apartment for a minor child - daughter or son.

Read more about who the first heirs are after the death of a father or mother and when they have the right to inherit property.

For two methods of inheritance, the following documents are required:

- A document confirming the death of the mother: without the original, you cannot obtain inheritance rights. Based on the date specified in this document, the time for opening the inheritance case will be established. If a citizen goes missing, a decision from the judicial authorities is required to declare her dead.

- Applicant's passport: if there are several children, then the passports of all heirs should be provided.

- Certificate of mother's last place of residence. The place where the inheritance case will be opened will be determined at this address.

- All papers for inherited property, certifying the rights of the mother as the owner.

- Technical and cadastral property documentation.

In the case of inheritance under a will, you should determine its location and contact the notary office where it is located. The opening of the inheritance case should also be carried out there. When transferring property by law, additional documents will be required indicating that the applicant or applicants are the children of the deceased:

- Birth certificate, where the surname of the deceased will be indicated in the “Mother” column. A certificate of adoption is also presented if the children were adopted.

- When changing your last name, you must bring the paper on the basis of which the change occurred. This can be either a marriage registration certificate or a document on its dissolution.

Ownership

The required package of documents when accepting an inheritance may vary depending on the type of property that is being inherited.

When receiving an apartment or house as an inheritance, you will need the following documents:

When inheriting a land plot, the following documents are required:

- title document for land;

- cadastral passport. It must indicate the boundaries established during land surveying. If this document was issued according to a simplified scheme without boundary work, then the heirs must order their implementation;

- technical passport for all structures on this site;

- certificate of absence of any restrictions: arrest, lease, easements;

- a document confirming the absence of land tax debts;

- market value of the site, carried out by independent experts.

Inheriting a vehicle involves providing the following documentation for it:

- PTS – vehicle passport;

- STS – vehicle registration certificate;

- certificate of absence of debts on fines;

- expert report on the market value of the car.

When inheriting cash deposits, the heirs must collect documents confirming the existence of a deposit in the bank: an agreement or a savings book. If these documents are not available, then you need to submit a request to the bank through a notary.

If children do not know about the deposit, then the bank is not obliged to inform them about it.

Securities can also be inherited if the following documentation is available:

- extract from the register of the company of shareholders;

- constituent documents of the company that issued the securities;

- certificate with the cost determined by experts.

Algorithm of actions

The transmitter must contact one or different notaries. An inheritance case is opened for each property separately. In any case, the acceptance of the benefits acquired by the deceased is carried out in accordance with a certain algorithm of actions.

Step 1. Submitting an application

Separate applications are submitted for each type of inheritance:

- At the place of residence of the testator (A);

- At the place of residence of the transmitter (B).

If the place of residence is not reliably determined, it is necessary to contact the location of the real estate or the most valuable part of the movable property.

Sample application for inheritance through hereditary transmission

If one notary is involved in the affairs, different statements written according to the model are submitted to him. When acquiring property by right of representation, one application is submitted.

Step 2. Providing documents

List of required documents

| No. | Document function | Title of the document |

| 1 | Identity cards of legal successors | Passport, birth certificate for minors, identity cards and their translation for foreign citizens |

| 2 | Evidence of the death of the owners | Death certificates of testators |

| 3 | Data on the presence of family ties | Birth certificate, marriage certificate |

| 4 | To reliably determine the place of opening of the inheritance | certificate of residence |

| 5 | To determine the circle of legal successors | Certificate of family composition |

| 6 | Title documents for the deceased's valuables | Property purchase and sale agreement, certificate of ownership, registration certificate |

| 7 | Documents on the assessment of inherited property to determine the amount of state duty | Certificate from Rosreestr, BTI or assessment report from a commercial organization |

At this stage, you must pay the state fee and provide the notary with a receipt for payment.

Step 3. Obtaining a certificate of inheritance

Deadlines for issuing the document:

- If less than 3 months remain before the acceptance of the inheritance by right of transmission from the date of death of the testator, the period will be extended to 3 months, after which a certificate is issued. It will be impossible to restore the deadline.

- If the inheritance occurs by right of representation, the document will be issued 6 months from the date of opening of the inheritance.

Certificates can be issued earlier if the circle of legal successors is reliably determined and all documents are collected by the notary. Subsequently, they are presented to Rosreestr and the State Traffic Safety Inspectorate for registration of ownership.

Death of a successor who did not enter into inheritance

If the heir has died without having time to receive inheritance rights to the property bequeathed to him, then upon his death, his part of the property will be distributed using hereditary transmission, which is a transfer of ownership rights to the person who is the legal successor of the deceased heir.

This right comes into force in the following cases:

- absence of a consent application for acceptance of property;

- unconfirmed fact of use of the received property.

To obtain inheritance rights, you must collect the documents submitted:

- death certificate of the testator;

- death certificate of the main successor, if he died earlier than the heir;

- a document confirming relationship with the deceased heir;

- a certificate from the Housing Office about the last place of residence of the testator;

- certificate of family composition.

If the deceased heir has no heirs, then his share will be legally distributed among the heirs according to the circle of succession.

Expert commentary

Shadrin Alexey

Lawyer

A testamentary act is not a static document, since the testator can change its contents or cancel it altogether. According to Article No. 1130 of the Civil Code of the Russian Federation, in the event of the death of an heir, the testator can make changes to the document and appoint a new successor.

Documentation

In order to receive an inheritance, it is necessary to prepare a fairly voluminous package of documents. When drawing up a will, no papers are attached that, for example, prove ownership of an apartment or car. All these issues must be dealt with by the recipient, which sometimes greatly complicates the process. To receive inherited property you must prepare the following documents:

- Death certificate of the testator. You will need to prepare both the original and a copy of this paper.

- Will, if any. If you are a legal successor, then documents are required that confirm your family ties with the testator.

- Papers that confirm that the testator is indeed the owner.

- Documents confirming the identity of the applicant.

If you doubt that you can independently understand this matter, then you should seek help from a professional lawyer. In this case, they will help you collect all the necessary documents and fill out the application correctly. Such actions will save your time and protect you from serious mistakes.

Problems may arise if you are not a relative of the deceased, but he is still included in the will. Close relatives may not like this, and they will try to challenge the will in court. Sometimes this actually helps, and the will is declared invalid. This can happen in the following situations:

- The testator was already quite old and it could happen that he was not fully responsible for his actions. This can happen due to the fault of the notary who certified the will. The fact is that if the testator is over 60 years old, then the notary must require paper from him from a medical institution. This paper confirms the fact that a person is fully responsible for his actions.

- Relatives may try to prove that the testator was pressured or threatened. If the will was written under threats, it will have to be declared invalid. In this case, everything depends on what evidence the relatives provide to the court.

If you contact a good lawyer, this will help you avoid such problems, as he will help you do everything as correctly as possible. The main thing is not to delay deadlines and start preparing documents as early as possible.