Who owns the premarital property of the deceased spouse?

As a general rule, everything that each spouse owned before marriage remains their personal property and cannot be recognized as community property. The following situations are exceptions:

- one of the spouses, at the expense of personal funds and efforts, significantly improved the premarital property of the other spouse or increased its value (for example, if an apartment belonging to the wife before marriage was renovated during marriage at the expense of joint funds, or an unfinished construction project was put into operation during the marriage, in including thanks to the personal or financial participation of the husband);

- the spouses have entered into a marriage contract between themselves, under the terms of which their premarital property is included in the joint property of the husband and wife;

- Before marriage, the deceased acquired real estate with the help of a mortgage, while the mortgage was repaid during the marriage from the joint funds of the spouses. In such a situation, it is necessary to establish this fact through the court in order to have the right to allocate the surviving spouse’s share in the ownership of real estate acquired with a mortgage before marriage.

Thus, if the testator was officially married, all his property can be divided into two categories:

- his personal property, in which the second spouse does not have a share;

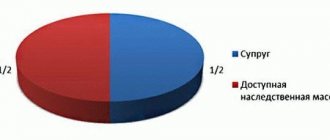

- common joint property with the surviving spouse, who, as a general rule, is entitled to half of it.

Except for the cases provided for in Art. 37 of the RF IC, the second spouse can only claim the personal premarital property of the deceased spouse on a common basis with the other heirs. Such property is not considered jointly acquired property, therefore the second spouse does not have a mandatory share in it.

Consequently, in order to protect their property interests, the spouse of the deceased testator must submit an application to the notary for the allocation of the spousal share from the inheritance mass. In this case, the remaining heirs will not be able to claim this property.

What documents does a notary need to formalize and enter into an inheritance?

When does the marital share rule apply?

The regime of joint ownership implies equal rights of spouses to the property they have acquired. The legal fact does not depend on who specifically the papers are issued for. The marital share rule applies to property acquired after marriage.

The exception is:

- donated;

- inherited;

- personal property (acquired with personal funds);

- copyright.

If spouses divorce or one of them dies, then the share of the husband or wife is separated from the total. When registering an inheritance, the division of property is handled by a notary. To obtain a certificate for his half of the property, the spouse will have to submit an appropriate application.

Example. A family of three lived in a 2-room apartment. The property was purchased during marriage. 3 years after purchasing the home, the man died in an accident. The composition of legal successors is the spouse, child, parents of the testator. The parents waived their rights by default. The wife decided to allocate her half of the joint property. The notary issued the woman a separate certificate. The remainder of the property was divided equally between the testator's widow and child. Shares of heirs: wife – ¾, child – ¼ of the apartment.

When it comes to personal property, different rules apply. Neither in the event of a divorce nor in the event of the death of a husband or wife, the spousal share is not allocated. However, the spouses are included in the legal successors.

Example. A family of three lived in a 2-room apartment. The property was the personal property of the head of the family. His parents gave him the apartment immediately after the wedding. Five years later, the man was in a car accident. Doctors were unable to save his life. A month after the funeral, the wife submitted an application to a notary. The testator's parents did not declare their rights. The applicants also included a young child of the deceased man. The notary divided the property equally between the son and wife of the testator. The marital share rule did not apply.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

Personal property of spouses may be recognized as their joint property in special cases. For example, if the value of personal property has increased significantly due to investments by the second spouse. This includes major repairs of housing or reconstruction of a building (Article 37 of the RF IC). In such a situation, the allocation of the marital share occurs by court decision.

Inheritance of a spouse's premarital property by law

In the absence of a will, the order of inheritance is determined by the rules established by the Civil Code of the Russian Federation. The document provides for the order in which potential heirs are called to accept the inheritance.

So, first of all, children, wife/husband and parents of the deceased can claim the inheritance. In this case, the property is distributed between them in equal shares, including that which belonged to the deceased before marriage. Such property is the personal property of the deceased, therefore, there is no share of the surviving spouse in it, and it is completely included in the estate and distributed equally among the heirs.

The law includes brothers, grandmothers, sisters and grandfathers of the deceased as second-stage heirs. They have the right to claim the inheritance only if the heirs of the first priority for some reason did not enter into the inheritance. For example, there are no such heirs; they voluntarily refused to accept the inheritance or, conversely, were forcibly excluded from inheritance.

How much does it cost to enter into an inheritance with a notary?

Grounds for acquiring an inheritance

One of the spouses who survives the other may become the successor of the testator by law or by will.

Inheritance by law

The Civil Code (Articles 1142-1148 of the Civil Code of the Russian Federation) establishes 8 lines of inheritance. The husband or wife, children, parents and grandchildren, by right of representation, are members of the first priority, that is, they have a priority right over other relatives.

According to the law, the inheritance mass is divided between applicants of the same line in equal shares.

Successors of other orders can claim the inheritance only in the absence of representatives of the previous order.

Spouses can inherit property in order of priority only if they have a marriage certificate registered in the registry office. In the event of a divorce, the former spouse is deprived of the right to acquire inheritance by law.

Inheritance by will

During his lifetime, the testator has the right to draw up a will, according to which all property acquired will be transferred to the persons indicated in it.

If the property was acquired after marriage, then the testator has the right to bequeath only half, that is, the part that belongs exclusively to him, and if everything was acquired before marriage, then all the valuables can be disposed of in their entirety.

Example. As a result of the divorce, the spouses divided their jointly acquired property, and each became the owner of ½ half of the house. After the death of the testator, the second wife became his direct heir, receiving only part of the real estate belonging to her husband.

When drawing up a document, it is important to take into account that a certain group of persons has the right to an obligatory share in the inheritance (Article 1149 of the Civil Code of the Russian Federation):

- minors, disabled heirs by law;

- disabled parents and spouses, dependents.

They are entitled to at least ½ of the share due by law in the absence of a will.

Inheritance of goods under a will, if they were acquired before marriage, does not raise doubts regarding the shares of the heirs, since the document clearly defines the rights and obligations of the applicants.

Features of inheritance by will

If the deceased during his lifetime made an order regarding how his property should be distributed after death, the provisions of the Civil Code on the order of inheritance as a general rule do not apply.

In this case, the spouse can solely receive all the property, regardless of when it was acquired by the deceased - before marriage or during the marriage relationship. The opposite option is also possible, when the surviving spouse will be deprived of the right to receive things, real estate, or the car of the deceased, if the latter ordered that it be transferred into the ownership of other persons.

Recipients of inheritance under a will can be not only individuals, but also government authorities. In this case, it is not necessary to dispose of all the property: the testator can indicate in the will only part of his property, distributing it among the heirs at his own discretion. The property of the deceased not specified in the will will be distributed among the heirs according to the general rules enshrined in the Civil Code of the Russian Federation.

How to find out if there is a will for inheritance

Methods of inheritance

The transfer of the testator's property to legal successors is carried out:

- within the law;

- by will.

The first method is most often used. The rule of priority applies here.

The first priority applicants are the family members of the deceased citizen:

- Parents.

- Blood/adopted children.

- Living spouse.

After them come the brothers/sisters and grandparents of the testator.

Reasons for the transfer of property to the next legal successors

| No. | Cause |

| 1 | Non-acceptance of property by priority heirs |

| 2 | Refusal of 1st priority recipients |

| 3 | Removal of main claimants from inheritance |

The inheritance may include any movable/immovable property. Identified assets are divided equally between claimants of the same line.

The law does not provide any preferences for individual family members. If the testator had dependents, then they are included in the heirs of the corresponding line.

The second method of inheritance is by will. Here, the procedure for distribution of property and the composition of legal successors can be significantly changed:

- The owner has the right to call on close or distant relatives to inherit.

- Also, organizations or authorities can act as legal successors.

- At the same time, he can deprive the property of any of the legitimate claimants.

- The will can indicate the type of property and the size of the shares of legal successors.

- The testator may also make a conditional will or appoint an executor.

- If the order applies to part of the property, then the remainder of the property is inherited by law.

The only drawback of the order is that the testator does not have the right to deprive the property of obligatory legal successors. These include:

- parents who have lost their ability to work,

- dependents,

- disabled spouse of the deceased subject;

- young children.

If such persons are identified, they will be included in the list of applicants, regardless of the text of the will.

Take yours and leave your debts behind?

The inheritance mass does not always include only assets (expensive and liquid property). If the deceased had debts during his lifetime, but did not have time to pay them off, such obligations pass to his heirs. At the same time, the law prohibits accepting only the liquid part of the inheritance. Consequently, each heir who has legally received the property of the deceased becomes liable for his debts to the extent of the value of the share that has passed to him.

It is worth considering that debts that arose before marriage can be classified as joint property of the spouses: for example, if the loan was spent on the purchase of common real estate or a family car, renovation of the surviving spouse’s apartment, or other needs of both spouses.

Inheritance in a civil marriage

Cohabitation in itself without an official marriage does not give the right to claim inheritance of property acquired before marriage. But there are two exceptions:

- if the spouse of the deceased testator was dependent on him for more than a year;

- they have a minor child who was the same dependent.

These exceptions are the basis for the right to participate in the division of the inheritance. However, it must be taken into account that such a spouse is considered a relative of the eighth (last) order. If she receives part of the inheritance, she pays a fee at a rate of 0.6% of the assessed value.

Property acquired before marriage is inherited depending on the presence of a will or its absence, as well as taking into account a number of the above-described features of its joint use and cohabitation of spouses and dependents.

All this in real life is often associated with unprovable or weakly provable claims of specific relatives to receive a share in the inheritance of property acquired before marriage. Therefore, it is worth paying attention to the execution and storage of documents that clearly define the rights of ownership and inheritance of this property.

If the marriage was not formalized

While calling themselves the spouse of the deceased, not all potential heirs are such. Thus, from the point of view of family and civil law, only the spouse whose marriage with the deceased was registered in the manner prescribed by law has the right to an obligatory share in the inheritance. In other words, the so-called “civil marriage” does not give rise to a regime of common joint property, regardless of the value of the property acquired by the man and woman and the duration of cohabitation.

Therefore, in the event of the death of one of the couple, in this case the second person will not have the right to inherit his premarital property if the marriage was not registered. There is an exception to this rule: if a potential heir can prove that he was dependent on the deceased testator, such a person will have the right to claim an obligatory share in the inheritance. The fact of being a dependent can be established through the court if the following circumstances exist:

- living together with the testator for at least one year before his death;

- joint farming;

- incapacity for work of the person claiming to be a dependent.

The size of the obligatory share in the inheritance of such a person is determined according to the general rules on the order of inheritance. If the deceased left a will, then such a citizen is entitled to at least half of what he could claim in the event of inheritance by law.

In order to protect yourself and legally gain the opportunity to inherit the property of your de facto (civil) spouse, you must draw up a will with the appropriate instructions. And in the case of acquiring expensive property in a civil marriage, it is recommended to register it in equal shares for the man and woman.

Rights of a common-law spouse

Not all citizens legalize their relationships. Many couples live in civil marriages. However, the law does not provide for this form of family relations.

The question of registering a marriage usually becomes relevant when a relationship breaks down or in the event of the death of one of the cohabitants. The legality of the relationship is confirmed by a marriage registration certificate. If the document is missing, then the common-law spouse has no rights to the property of the cohabitant.

Example. The man and woman lived together for about 5 years. They managed to buy a house in the village and a car. After a while, the cohabitants decided to legalize the relationship. They contacted the registry office. A month later, the married couple was given a marriage registration certificate. Soon the man died. Due to legal ignorance, the head of the family did not make a will. While he had two children from his first marriage. The claimants declared their rights. The property was divided equally between them. The wife received only 1/3 of the property.

The only way not to lose your share of property:

- draw up documents for two co-owners;

- make a will.

An exception may be a situation in which the cohabitant is a dependent of the testator. However, such a legal fact must be confirmed by relevant documents (Article 1148 of the Civil Code of the Russian Federation).

What if cohabitants have a child together? If the common-law spouse is not entitled to anything from the property of the cohabitant, then the child is the direct successor of the testator.

However, for a child to have rights to inheritance, it is necessary for the father to officially recognize him. If there is no entry in the minor’s documents, paternity must be established in court. Otherwise, the child will lose rights to inheritance.

Where to apply to receive an inheritance

In the Russian Federation, notaries handle cases related to the inheritance of the property of a deceased person. After the death of the testator, interested parties must contact such a specialist with an application to accept the inheritance. Which notary should I contact when entering into an inheritance?

The notary will determine in what order the inheritance will be carried out: by law or by will, determine the shares due to each heir, and issue them with the appropriate documents.

When disputes arise between potential recipients of inheritance, most of them are resolved in court. Thus, in order to allocate the marital share from the personal (premarital) property of the deceased on the basis enshrined in Art. 37 of the Family Code of the Russian Federation, the surviving spouse must file a claim in court for the allocation of the marital share from the inherited property.

You can submit an application to accept an inheritance within 6 months from the date of death of the testator. If this deadline is missed, in exceptional cases it can be restored, but only by court decision and if there are good reasons.

Order of succession

To receive a spouse's property as an inheritance, you must contact a notary at the place where the inheritance case was opened.

The deadline for applying is 6 months from the date of the death of the spouse or the entry into force of a court decision declaring him dead.

The notary must provide the following documents:

- passport;

- death certificate of the spouse;

- Marriage certificate;

- will (if any);

- certificate from place of residence;

- inheritance documents;

- confirmation of payment of state duty.

The full list of documents is determined by the notary.

If the valuables were acquired after the wedding, it is necessary to submit an application for the allocation of the marital share, which should be notified to all interested parties.

The result of the action will be the receipt of a certificate of inheritance.

Is property received through a deed of gift divided during a divorce?

During a divorce, a gift agreement, on the basis of which one of the spouses received this or that property, is considered as the main supporting document. Its provisions determine the status of property and influence the order of its division between spouses severing their marital relationship. Movable or immovable property given as a gift is not considered community property within the framework of a marriage; therefore, it cannot be divided. This rule applies at the legislative level if there are no additional circumstances in the case, the presence of which transfers the status of the property to the status of common or jointly acquired property.

- Movable and immovable property;

- Salary or pension savings;

- Bank deposits and securities;

- Intellectual property;

- Shares, units, benefits, etc.;

- Debts and loans;

Regardless of who is officially registered in the name of this or that property, it is recognized as common property if it was acquired during the period of marital relations between persons. The spouse who, for good reasons (illness or raising children) did not participate in the acquisition of property, has an equal right to it.

- Clothing and footwear;

- Personal hygiene items;

- Professional tools;

- Other names on the use of which personal life or work activity depends.

The law also provides for circumstances the presence of which may lead to the division of personal property of one of the spouses after a divorce.

The apartment was gifted to both spouses

If real estate was gifted to spouses within the scope of the marriage relationship, and the rights to own it were registered as joint, then, in the event of a divorce, it is subject to division in a special way.

Since in this case each spouse owns a part of the property received as a gift, this share is recognized as his personal property. This means that the specified real estate is not involved in the division process, but the ownership of its parts remains with the spouses.

Joint funds of spouses are invested in real estate

An exceptional circumstance affecting the division of gifted real estate after a divorce is the factor of investing material assets acquired jointly into the property. An apartment can be received as a gift by one of the spouses, but if, within the framework of the marriage relationship, it has undergone any changes at the common expense, the party who is not the recipient of the gift has the right to indicate its claims to part of the residential property. But, upon inheritance, the spouse will have the right to part of the apartment, since the real estate will be included in the total inheritance mass, and the spouses are heirs of the first priority. Even if there is a will, the spouse will receive 1/4 of the property, that is, half of what would be due under the law.

In such a situation, the shared interest is calculated by identifying the difference between the estimated value of the property before investments and the value after their implementation

Only material value that directly depends on the changes made is taken into account. This does not take into account the factor of inflation and price increases due to the passage of time.

Facts of making common investments in property owned by one of the spouses must be documented. They can be confirmed by presenting:

- An agreement on the implementation of repair work or an acceptance certificate for the object;

- Receipts for payment for construction materials;

- Other documents confirming the completion of the relevant payment transactions;

- Other relevant evidence.

If the spouse who received gifted property invested in it funds also received by gift, this will not be considered a basis for division, since such material security is not recognized as jointly acquired.

If the donated apartment was sold

In some cases, property acquired in this way may be considered personal. This status is assigned as a result of a trial during which, on the basis of reliable evidence, it was established that the second spouse did not invest personal or other funds in the purchase.

Examples

- Situation 1. Citizen S. lived with citizen O. without formalizing the relationship for 10 years, during which he purchased a house and a car, after which the union was officially registered. After his death, the claimants to the property were: his legal wife, daughter and son from his first marriage. Since citizen S. did not make a will, the inheritance was divided between the claimants in equal shares, 1/3 each.

- Situation 2. How would the division occur in the above example if citizen S. and citizen O. had previously registered their relationship and the house and car were purchased after marriage? The spouse would have the right to allocate the marital share, that is, ½ of the jointly acquired property. The remaining part would be divided among all first-stage applicants according to the law. Thus, the shares of each of the heirs would be: spouses - 4/6, daughters and sons - 1/6 each.

- Situation 3. If citizen S. had not registered a union with citizen O., then in the absence of a will allocating her a share of property, O. could not be among the applicants (except for cases where the right to an obligatory share of the inheritance applies).

- Situation 4. If citizen S. made a will, then regardless of whether a marriage was concluded, the property will be distributed between the persons indicated in the document in the shares determined by the testator or equally.

Often, spouses do not even know what share of the property is due to them. Relatives of the deceased can be misleading by arguing that the wife has no rights to the values acquired by the husband. It is especially difficult to resolve issues if the marriage has not been formalized. Even a will drawn up unprofessionally, illiterately, does not guarantee the acquisition of valuables and can be challenged or declared void.

What to do in such situations? Enlist the support of specialists in the field of jurisprudence, namely, lawyers from the site ros-nasledstvo.ru. It is easy to get what you are entitled to by law if you know your rights and act on the basis of the law.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

33

Entry into inheritance after death under a will

The procedure and rules for entering into inheritance under a will are established by the chapter...

19

Lawsuit to restore the deadline for accepting an inheritance in 2020

The judicial hearing of the case on restoration of the period for accepting an inheritance begins with...

23

How to draw up a will for an apartment

The legislation of the Russian Federation establishes the right of every capable citizen to perform posthumous...

7

How to find out if there is an inheritance

The sudden death of the testator or lack of contact with other applicants may...

13

Mandatory share in the inheritance by will and by law (without a will)

The legislative act regulating civil law in the field of inheritance (section V...

12

Are loan debts inherited?

The short answer is YES, debts are inherited if the heir accepts the inheritance...