Ilya Vladimirovich contacted our agency. His wife died in a car accident a few months ago. This was her second marriage; from her first marriage she has a 15-year-old daughter. They were married for three years. Two years ago, a three-room apartment was bought and completely registered in Ilya Vladimirovich’s name. The spouses did not have a marriage contract. The late wife herself had a house in the Moscow region, inherited from her grandmother. A year ago, she made a will, certified by a notary, and left all the property to her only daughter. At the moment, the legal representative of the girl, who is his own father, has opened an inheritance case with a notary. Since Ilya Vladimirovich is also a legal heir, he came to the notary and learned about the separation of the marital share from the common apartment and its inclusion in the inheritance estate. The client turned to us for help and wants to know how to proceed further in this difficult situation.

The lawyers analyzed the situation from the standpoint of the Family Code of the Russian Federation and the Civil Code of the Russian Federation, and explained the following to the client:

What is a spousal share

So, jointly acquired property, that is, acquired during marriage, is considered their common property. The only possible exception is the existence of a prenuptial agreement, which contains information about what belongs to whom in the event of divorce or death.

Joint property includes:

- all income received by the spouses;

- various benefits and pension payments;

- property, both movable and immovable;

- existing deposits, all securities;

- parts available from commercial companies;

- jewelry, antiques or so-called luxury goods.

You should know that all this must be acquired during the marriage using funds that are common. According to the law, it does not matter to whom the title of ownership will be registered; only the period in which it was acquired is taken into account.

Thus, jointly acquired property means everything that was acquired during the period of marriage, but one should not confuse the concept of personal belongings. In this case, these are items purchased for personal use, for example, clothes, etc.

IMPORTANT !!! Also, the property that was given to one of the spouses under a gift agreement or was acquired before the marriage relationship will not be considered joint.

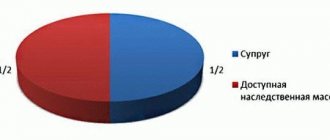

The concept of marital share refers to the portion of property acquired jointly during marriage. Its size is half (50%) of everything that relates to such property.

Arbitrage practice

Judicial practice considers many controversial issues related to the allocation of the required part of joint property. There are known situations of including the inherited property of the deceased, recognizing the object as jointly acquired property. The widowed husband/wife will have to prove through the court significant material investments that influenced the increase in the value of the property. Expenses from the joint budget must be documented. Evidence includes copies of checks, contracts, invoices, photographs, video materials, and witness statements. If there are a sufficient number of weighty arguments, the court recognizes the property as joint.

There are widespread examples of relatives challenging the size of their share. Attempts to include in the designated part of the personal property of the deceased property that belonged before entering into the union. Purchasing real estate during marriage using funds accumulated before the union, using inherited funds.

We recommend reading: Increment of inherited shares

A competent lawyer specializing in civil and family issues can help resolve particularly complex and controversial situations.

Allocation of a share by law or by will

The legislation of the Russian Federation provides for several ways to obtain an inheritance mass, these include:

- receipt in order of priority or by law. In this case, the Civil Code of the Russian Federation contains a list of queues, which include relatives and, in accordance with these compositions, the heirs can lay claim to the property of the deceased relative;

- according to the will, in this case, the deceased has the right to draw up a document indicating the future owner of all property; this can be one or several people. And also the owner has the right to indicate what specific part of the property he is transferring, and the rest will be inherited in the manner prescribed by law.

When allocating a mandatory share in cases where the inheritance is divided in order of priority, the part (mandatory) that is due to the remaining spouse is first allocated, that is, half of what is available. Next, the division of property occurs in accordance with the queue. The first applicants are the spouse, children and parents of the deceased person. It turns out that in addition to the allotted half of everything acquired during the marriage, the spouse is also entitled to a share of the second half; as a rule, the inheritance mass is divided in equal shares between the applicants. Well, if there are no more applicants besides the second spouse, then everything becomes his possession.

ATTENTION !!! When making a will, the owner may not know that half belongs to his spouse and when writing the document, for example, he may assign everything to his child. In such cases, the heirs must determine how the division will take place, since regardless of what is written in the will, the second spouse has the right to receive his share of the jointly acquired property. The issue can be resolved by drawing up a peace agreement or in court. As a rule, the first option is chosen, especially if the claims for the share are legal.

It should also be remembered that obligatory marital share and obligatory share are different concepts. Matrimonial property is that which is due from the common jointly acquired property and is exactly half of it.

Mandatory is the one that applies to a certain category of persons, which includes:

- disabled subjects who were dependent on the deceased, this could be a spouse, children, parents.

In accordance with this, it turns out that if a will is left, for example, for those benefits that were acquired before marriage, the spouse can claim half of the part allotted if he were the first priority applicant. For example, a husband left his son an apartment purchased before marriage, but by the time of his death the wife was no longer able to work; it turns out that, by law, the spouse can claim one-fourth of the apartment. Since there would have been only two heirs by law and the wife would have been entitled to half of the housing, but the will was drawn up for the son, the disabled wife retained the right to receive half of what she could receive by law.

Another important point that concerns compulsory shares is that sometimes, as a result of recognizing the heirs as unworthy, the court deprives them of the right to receive an inheritance; this fact does not apply to the compulsory spousal share. No one can deprive her.

Inheritance in order of priority

Inheritance by law is the division of inheritance between heirs in the order of priority provided for by the Civil Code of the Russian Federation. The general rule is that heirs of the same line inherit from the deceased in equal shares, with the exception of heirs by right of representation.

A widow or widower is a first-degree heir along with the children and parents of the deceased. If, besides the deceased’s spouse, there are no other heirs of the first priority, then the surviving spouse becomes the sole owner of all property.

The marital share of the inheritance according to the law is half of the jointly acquired property. This means that the estate includes the second part of the joint property, which is divided among the heirs in equal shares.

The issues of inheritance in order of priority are set out in more detail in the article “Inheritance by Law”.

Selection paths

In matters of inheritance distribution, controversial issues most often arise because when dividing property, everyone feels that they are being deprived. And in cases with marital shares, everything is generally complicated. Since during the period of marriage, one can give expensive things to the other that are not personal and, in accordance with the law, are subject to division. But the recipient considers them personal, as it is a gift, and of course this is correct, but in order for the court to recognize this, confirmation of this fact is necessary, for example, a deed of gift. And that's when the difficulties begin.

The allocation of part of the required property can be carried out in several ways:

- by concluding an agreement or marriage contract, if such papers are available, the allocation of the share will be carried out in accordance with the data specified in them;

- in court, in which case you will need to file a statement of claim with the appropriate authority. With this version of the division, it may happen that the court decides to refuse to allocate a part, but if there are compelling circumstances.

Depending on the situation and the mood of the heirs, a way to solve this problem is chosen.

Attention: the law does not provide for the allocation of shares if the issue concerns property acquired for the needs of a child, or if the issue concerns the financial resources necessary to help rehabilitate a child with disabilities.

Where should I contact?

A joint will can change the order of distribution. The joint will of the spouses provides for the transfer of the marital share to the second half for the duration of her life, without the possibility of alienation.

After the loss of the other half, the husband or wife must take a number of mandatory actions. The sequence of actions is as follows:

- Submit a written request to the notary office specialist responsible for the distribution of property;

- A specialist from a notary office is obliged to issue a certificate for half of the marital share, unless there is a marital agreement providing for a different procedure for the distribution of property;

- The notary notifies the other receivers about the allocation of the part.

The notification is made to provide for the possibility of challenging the share through the court.

The document is submitted in a strictly regulated form, which looks like this:

- Full name of the notary office, location address;

- Spouse details, contact phone number, address;

- Details of the deceased, date of death, residential address;

- List of joint ownership;

- Indicate the existence or absence of a marital agreement;

- Request for allocation of a part;

- The paper is certified with a signature and date.

The paper is issued upon availability of a package of documents, which we will consider in more detail.

Filing a claim

If the receivers were unable to reach a common decision, they have the right to go to court. To do this, you must write a claim in accordance with the established requirements for the document, otherwise the court will not accept it for consideration.

The text must include the following points:

- the name of the court to which the claim will be filed;

- information about the person submitting the paper (plaintiff) and the defendants, full name, addresses at which the participants reside and are registered, and information on how to contact everyone (the plaintiff is the spouse of the deceased, and other successors are the defendants);

- the cost of the claim document, it is determined by assessing all property that is considered common;

- Next I indicate all the circumstances due to which the right to a share arose, that is, this is the day of the death of the spouse;

- then it is necessary to indicate a list of what was acquired jointly and explain the essence of the controversial issue, because of which it was necessary to resort to the help of the court;

- request to allocate the portion due to the remaining spouse and recognize his property rights in accordance with the norms established by law;

- indicate a list of documentation that will be attached to the claim;

- date and resolution of the applicant.

The main document (claim) submitted to the court will need to be accompanied by the same package of papers as in the case of applying to a notary for the allocation of a marital share. That is, these are death and marriage certificates, a testamentary document or a marriage agreement, etc. sometimes the court may require additional papers, but this depends on the case individually.

Inheritance law in Russian legislation

Refusal of inheritance under the legislation of the Russian Federation is regulated by the Civil Code (Section V), which includes all norms of civil law aimed at regulating the procedure and forms of transfer (inheritance) of property rights and obligations (inheritance) of the deceased (testator) to other persons (heirs) .

In addition, when regulating inheritance legal relations, Resolution of the Plenum of the Supreme Court of the Russian Federation No. 9 of May 29, 2012 “On judicial practice in inheritance cases” is used, as well as Methodological recommendations for registration of inheritance rights. These documents, as well as some others, constitute Russian inheritance law.

How to get

In order to receive part of the trusting property, you will need to follow a certain prescribed procedure, which includes:

- determining the order of inheritance, in this case it all depends on how this will happen in order of priority or in accordance with the testamentary document. For inheritance by law, the remaining spouse has the right to receive half of what was acquired jointly, and then, as a first-rank applicant, he has the right to receive an equal share of the remaining share of the property with the other heirs. If there is a will, everything becomes simpler, especially if according to the document the spouse is the only claimant, but if not, then first of all, the obligatory part of the property is allocated to everyone who has the right to it;

- the next stage is the acceptance of the hereditary part. To do this, you will need to contact a notary and submit an application; you should apply at the place of registration of the deceased. This must be done within the period established by law, or rather within six months from the moment the spouse passes away;

- collection of papers that will be required, these include a death certificate, documents giving the right to claim part of the property (will, contract, document confirming marriage, papers on the testator’s ownership of the property that is being inherited, assessment of possessions subject to inheritance, You must also provide a receipt for payment of the state fee);

- obtaining a document of ownership.

According to the law, after the death of a spouse, the scheme for obtaining the obligatory share of the second spouse, allocated from the inheritance, does not require a wait of six months; upon presentation of all the necessary documents, the spouse can receive it upon application. This happens because the right to the share remains only with him, and no one else can claim it.

Features of inheritance by spouses

As noted above, a citizen has the right to inherit from a deceased spouse on several grounds, and they differ depending on the order of inheritance.

By law (without a will)

If the procedure defined by law (Chapter 63 of the Civil Code of the Russian Federation) was recognized as legal for a given inheritance case, then the widow or widower of the testator has a preferential right to receive part of his property. This circumstance is defined and supported by Art. 1142 of the Civil Code of the Russian Federation, the content of which indicates that the spouse belongs to the first line of inheritance. This situation is shared with him by the parents of the deceased and children, both joint and other officially recognized ones, including adopted ones.

By will

The existence of a notarized will can radically change the status of an official family member and the order of inheritance established by law. By drawing up an act of expression of will, every capable citizen has complete freedom to choose the future owners of his property and distribute it among them. It is thanks to this opportunity that the widowed spouse can inherit after her husband or wife:

- all property of the deceased;

- its certain part (not necessarily equal to the shares of the remaining successors);

- the right to use a specific object of inheritance;

- receipt of a specified item, a lump sum of money, or regular payments from the new owners of the property.

But a will can also deprive the legal heir of the right to accept the due share. In this case, the testator’s husband or wife is left only with the property that he acquired during the marriage together with the now deceased.

Documentation

In order to claim part of the share due as a legal spouse, the applicant will have to collect and provide a package of papers:

- an application completed in accordance with the requirements;

- if a marriage contract was drawn up between the spouses, then it must also be provided;

- information about the passport of the deceased person;

- all papers evidencing joint ownership of existing property (documents on the right to property, registration information, etc.);

- a document confirming that the relationship was registered (marriage certificate);

- confirmation that the second spouse has passed away;

- If you have children under eighteen years of age, you must provide permission from guardianship and trusteeship.

Despite the fact that there is no time frame for the spouse receiving the due portion, they should not delay the application. Please remember that you must pay a state fee.

What should you consider when inheriting?

During the marriage, the parties could choose a regime for disposing of property that was convenient for them. There are several types of legal regime of property:

- in law,

- under contract.

In the first case, the regulation of family property relations occurs according to Ch. 7 SK.

A contractual regime means that the parties have established a procedure for disposing of property that is different from the legal one. The rules for drawing up a marriage contract are regulated by Chapter. 8 SK. Thus, the parties have the right to establish specific property as personal property, and classify some objects as jointly acquired property. The main thing is that the interests of one of the parties are not violated, since in this case the marriage contract is invalid. The property that is allocated to the deceased by agreement is included in the estate and is transferred to the heirs.

Application for allocation of spousal share in inheritance

The application for the allocation of a marital share has a list of certain items that must be indicated:

- information about the notary office and the person to whom the application is being submitted;

- information about the applicant himself;

- the fact that gave rise to the right to the marital share;

- a list of joint possessions, their full description;

- papers confirming the right to own it;

- number assigned to the inheritance file;

- day of writing the application and signature.

IMPORTANT !!! To eliminate errors when drawing up a document, it is recommended to seek the help of a specialist, in this case a lawyer.

Settlement agreement

The content of the marital share can be determined by agreement with the remaining heirs. This is done as follows:

- The surviving spouse receives a certificate of ownership of the share in the common joint property of the spouses.

- At the notary, the widower/widow and the heirs draw up an agreement to determine the composition of the allocated marital share.

The parties to the agreement are the heirs and the co-owner of the property common to the testator. In the document they state:

- Full name of the surviving spouse, heirs, testator (his date of death);

- composition of jointly acquired property indicating the value of the objects;

- a list of assets included in the marital share and included in the inheritance estate;

- additional notes.

Sample settlement agreement

As an example of an agreement on the allocation of a marital share, you can consider this sample:

Increasing the spousal share of the inheritance

By law, spouses have the right to claim half of what they managed to acquire during their life together. But sometimes the court decides to increase the required marital share; this action is provided for by the Criminal Code, Article 39.

But for this to happen, certain circumstances must be present on the basis of which the court will make such a decision:

- the deceased had a tendency towards alcoholism and drug addiction and thus caused considerable damage to the family;

- in the presence of children whose age has not reached adulthood;

- and in cases where the remaining spouse is disabled.

In cases where it is proven that the spouse did not help the other during the marriage relationship, did not support children, etc. the court may reduce the required marital share.

What property is considered escheat?

If after the death of the testator no one applied for acceptance of the inheritance and there are no persons who actually accepted the property, it is called escheat. It will also be escheated if the heirs are found unworthy or are deprived of their inheritance.

The state becomes the legal successor in relation to such property with all the ensuing consequences. Read more in the article “What is escheat property.”

How much does it cost to register a spousal share after the death of a husband?

In order to obtain the due share you will have to fork out a little:

- due to the fact that the marital share is not an inheritance, you will not have to pay a fee of 0.3%, but for the part that will be due as an inheritance, you will need to pay the prescribed percentage of the total amount;

- You will also have to pay a notary fee, which depends on your region of residence.

You will also need to re-register the received part of the inheritance in your name, and you will also have to pay for this.

Cost of actions for registration of refusal

The cost of notary services is regulated by the Tax Code, or rather, its Art. 333.24, which indicates the amount of state duty for performing notarial acts. So, for example, the cost of registering a refusal of inheritance in favor of another heir is 100 rubles, and issuing a power of attorney to a representative is 200 rubles. However, this amount is not final, since you will need to pay for a notary consultation and technical work, which increases the final amount.

Refusal

The law provides for the spouse’s refusal of the share due to him; for this he needs to write a corresponding statement. If such paper is available, the notary includes in the list of inheritance everything that the deceased had and the division of property will take place in accordance with the situation.

A notary cannot refuse to accept an application to renounce a share; in accordance with the Insurance Code, the spouse has the right not to accept it and write a refusal.

According to the law, after the death of a spouse, the Civil Code gives the right to receive exactly half of the acquired benefits. And this part will not be affected in any way by how many other applicants the testator has. Even a court cannot deprive a spouse; the only thing it can do is reduce it, but for this there must be compelling, confirmed circumstances.

Deadlines

The law does not limit the period for allocating the marital half of the property, but it is better if the copyright holder does this as early as possible. Delaying the process may threaten the loss of jointly acquired assets in kind, for example, if they are sold by heirs. And although this does not cancel the purpose of the compensation payment, receiving it may not be as easy or as quickly as the rightful owner would like.

As for the obligatory share of the inheritance due to the disabled husband or wife of the deceased, it must be accepted within 6 months after the death of the spouse.

Can a former spouse claim an inheritance?

As a general rule, divorce serves as the basis for the termination of personal and material obligations of citizens to each other, including the rights to inherit from each other. The absence of marriage ties turns former spouses into strangers, since the law does not include ex-wives and husbands among relatives.

The former spouse has the right to inherit only in the following cases:

- if the testator indicates it in the will,

- if there are children under 18 years of age from the marriage, and the parent, being their representative by law, enters into inheritance on their behalf,

- if a citizen is a compulsory heir by law, for example, after a divorce he remained dependent on the testator until his death.

Reference! The share from the common property is not allocated, since the division of property has already been made during the divorce. Everyone is left with their part, and the jointly acquired property ceases to exist.