Domestic legislation allows two ways of dividing inheritance. The first presupposes the existence of a will with the distribution of property according to the will of the testator. The second option is used in the absence of such a document and is called inheritance by force of law. Its main principle is the distribution of property in accordance with the order of heirs. The laws governing this procedure are relatively complex. Therefore, the question of how the inheritance is divided between the first-line heirs is rightly considered one of the most pressing. The detailed answer is contained in the article.

How to divide an inheritance between first-line heirs: basic rules

The rules of inheritance in force in Russia are regulated by the provisions of two basic documents. The first is the Family Code of the Russian Federation (put into effect after the adoption of No. 223-FZ of December 29, 1995, the current version was approved on February 6, 2020). It defines the principles of kinship, which play a key role in determining the order of inheritance under the law.

The second document - Part 3 of the Civil Code of the Russian Federation (came into force after the signing of No. 146-FZ of November 26, 2001, the current version was adopted on March 18, 2019) - directly determines the procedure for inheriting property. Chapter 5 of the legislative act is entirely devoted to its description.

Chapter 61 of the document is devoted to a description of the general principles of inheritance. The other two chapters - 62 and 63 - describe the procedure for inheritance by will and by law, respectively.

According to the provisions of the RF IC and the RF Civil Code, priority means the order of inheritance by law, determined taking into account the degree of relationship in relation to the testator. Therefore, the concept is used primarily when there is no will.

Important

. The rights of certain categories of heirs are protected by law even when the distribution of inheritance is carried out on the basis of a will. In this case we are talking about such shares of the inheritance, described in detail below, as obligatory and spousal,

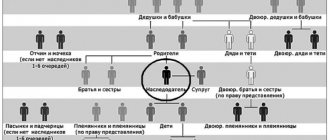

The legislation divides heirs into 7 stages: starting with the 1st, which includes children, spouses and parents of the deceased, and ending with the 7th, which includes non-adopted children.

The immediate relatives of the testator quite logically receive preferential rights. The main principle by which property is distributed between the lines of heirs is very clear: for the next line to participate, the absence of all the previous ones is necessary.

As noted above, the division of property occurs according to one of two options. The features of each need to be considered in more detail.

Rules reflected in the law

Speaking about how inheritance is divided in the Russian Federation, it is necessary to point out that legal successors classified in the first group have priority over other representatives. In some situations, they are deprived of the opportunity to receive an inherited mass.

This will happen:

- when there is a judicial act according to which a person is recognized as an unworthy legal successor;

- failure to appear at the notary's office within the time limits reflected in the law;

- renunciation of the inheritance mass formed in accordance with the established procedure.

If the listed circumstances arise, this will entail a change in the states of representatives of the second category.

Division by will

Every citizen has the right to bequeath his own property to whomever he sees fit. To do this, it is enough to properly draw up a will. It can be canceled or adjusted at any time at the request of the testator. There are three main requirements for the document - preparation in writing, notarization and the personal signature of the testator.

Despite the right of the testator to independently decide the fate of his property, participation in the inheritance of certain categories of relatives is additionally ensured. The protection mechanism involves the separation of the so-called obligatory and spousal shares.

Mandatory

It represents half of what the heirs were legally entitled to receive, regardless of the contents of the will. In such a situation we are talking about the following persons:

- children of the testator until they turn 18 years old;

- adult children who are unable to work due to poor health;

- disabled first-degree relatives or dependents.

In each of the listed cases, the right to inheritance must be proven documented. For example, incapacity for work is confirmed by a medical certificate, minority - by presenting a birth certificate or passport.

Marital

An analysis of the legal framework in force today allows us to draw an unambiguous conclusion: property acquired during marriage is divided equally between spouses. Therefore, in the event of the death of a husband/wife, regardless of the presence or absence of a will, half of the joint property must go to the second spouse. This rule does not depend on how the inheritance is distributed among the remaining heirs.

A change in the size of the marital share - both up and down - is possible in several cases clearly specified in legislative acts:

- signing a marriage contract defining the rights of the spouses, including inheritance;

- presence of a common minor child;

- waste of family property or lack of income generated by the deceased during the marriage.

How is inheritance distributed after death?

How is the inheritance divided among heirs? Shares are distributed according to Art. 1141 of the Civil Code of the Russian Federation. If all the successors of one line are alive, then they inherit in equal parts , with the exception of relatives who inherit by right of representation (for example, grandchildren).

For example, if the husband dies, then 1/2 of the property acquired during the marriage goes to the surviving spouse, regardless of other direct heirs. And everything that was purchased before the wedding will be divided proportionally between the first-degree relatives (including the wife).

There are precedents in legal practice when the surviving spouse received half of the property acquired before marriage. For example, an apartment was purchased before marriage, but the wife invested a large sum of money in its renovation and redevelopment. The fact must be confirmed by receipts for the purchase of building materials, a certificate of completion of work with the contractor and payment orders for payment for the services of the contractor company.

The law also establishes the so-called “preemptive right”, according to which a relative living in the same territory as the testator at the time of his death can receive household items and furnishings against his share (Article 1169 of the Civil Code of the Russian Federation).

The dependents' share of the inheritance is ¼ of the property.

If the first-degree successor dies, his share will be divided equally among his descendants. The size of the share depends on the number of successors.

For example, a man and his son died in a traffic accident. The heirs are his wife, father and mother. The daughter has 3 adult children. In this case, ¼ each will go to the wife, father, mother and daughter’s children. In turn, the children will divide their share among themselves into three equal parts.

If the testator did not have time or did not consider it necessary to divide his property during his lifetime, the rights to it in equal shares are received by the heirs of the first priority within 6 months after his death. In case of failure to submit an application for inheritance during this period, over the next three months the right passes to the applicants of the second priority, then the third and further down the list. The procedure for obtaining a share as a result of refusal by priority successors looks similar, only in this case the time frame for declaring one’s rights is doubled.

Otherwise, the nuances of asset distribution may vary slightly depending on the type of relationship with the testator.

From father

After the death of the father, the inheritance is divided between the children, spouse and surviving parents. As already mentioned, each of them receives the same part and what will be included in it can be determined both by agreement between the heirs and in court.

Also on the topic: How to register an inheritance for a mortgaged apartment?

In the latter case, when dividing property that includes indivisible objects, for example, an apartment or a house, the advantage of transferring ownership of a share of the living space will be given to the person who already has ownership rights to part of it, and in the absence of such, to the person living in it and not having other housing.

Here it is necessary to take into account such an important circumstance as the existence of property acquired during marriage. If it is available, half of the joint property of the father and mother (or stepmother) is allocated, which is not inherited by the children and parents of the testator. And this fact does not deprive the father’s wife of the right to a share of his half of the property as an inheritance.

The presence of dependents also matters. They receive property on an equal basis with the heirs of the first stage, even if they are not included in it.

From mother

The property rights and responsibilities of the mother after her death are distributed between natural and adopted children, legal husband and parents. This happens in a similar way to inheritance from the father. Moreover, if one or more heirs renounce their share without indicating the person in whose favor the refusal is being made, his part of the inheritance passes in equal shares to the remaining legal successors who have assumed their rights.

In the event of the death of the mother's husband before accepting the inheritance, his rights are transferred downward to the children, and not only from marriage with the now deceased.

From my husband

The property of the deceased husband is equally received by other close relatives: parents and children. All children of the spouse are taken into account, including adopted children and those not born at the time of opening of the inheritance, but conceived during the husband’s lifetime.

The widow's inheritance share, not counting her legal half of the property acquired during the marriage, depends on the total number of equal applicants.

Only the legal spouse of the testator has the right to inherit. The “common-law” wife and ex-wife are deprived of this right. An exception is the mother of a minor child of the deceased, who is responsible for managing his property until he reaches 18 years of age.

From my wife

A widower assumes the property rights of his late wife based on their marriage certificate. In addition, the spouse’s property goes in equal shares to her other first-degree heirs and, if any, dependents.

It should be taken into account that the death of a successor in a descending line provides the basis for his children, that is, the grandchildren of his wife, to receive a part of the inheritance. If there are none, then the share of the deceased testator is added to the share of the testator's spouse.

Division without a will (by law)

Making a will significantly simplifies the decision on how to divide the inheritance between the relatives and friends of the deceased. Inheritance by law is somewhat more complicated, and therefore is often accompanied by conflicts and controversial situations that arise even between close relatives.

The basic principle of inheritance without a will is quite simple. First, the inheritance is distributed among the first-line heirs. Only in their absence does the right to inheritance pass to persons included in the 2nd and all subsequent stages, up to the last, seventh.

Heirs of the 1st stage

The circle of 1st order heirs is extremely limited. These include:

- children. It does not matter whether the case concerns a natural child or an officially adopted one. An illegitimate child can also become a first-degree heir, for which he will need to document the relationship using genetic testing. The presence of an unborn child of the testator leads to the impossibility of distributing the inheritance before his birth;

- husband wife. The only mandatory condition is the presence of a marriage that is officially registered. Wedding or civil marriage are not grounds for including a spouse in the number of heirs of the 1st priority. A divorce carried out before the opening of the inheritance means the inability to take part in the division of the property of the deceased husband or wife;

- parents. The category of heirs under consideration includes both the natural father and mother, as well as the official adoptive parents. Parents whose parental rights have been taken away by a court decision do not have rights to inherit by law;

- dependents. The condition for obtaining inheritance rights is confirmed dependent status for at least a year. In this case, the place of actual residence of the person does not matter.

Important

. If there is a death of one of the heirs of the 1st stage - together with or before the testator, his place in the procedure for distribution of property by right of representation is taken by his descendants. A typical example of such a situation is a grandson receiving his grandfather's inheritance instead of his deceased father.

Rules for distribution of inheritance

The answer to the question of how to divide an inheritance according to the law requires taking into account many related factors. The procedure provided for by the legal framework is somewhat more complicated than in inheritance under a testamentary document, so conflicts and disputes in such a situation can hardly be called a rare occurrence.

For example, the distribution of inheritance among first-priority heirs takes into account the marital share, the definition of which is given above. In addition, it is important to remember that heirs have the legal opportunity to independently distribute shares of the inheritance and sign a settlement agreement on this. The main requirements for a document in such a situation are the fulfillment of two mandatory conditions: the consent of all heirs of the 1st stage and notarization.

The third complicating factor is the possibility of legal challenge by one of the heirs not only of his own share in inheritance by law, but even of the provisions of an officially drawn up will. The basis for filing a claim may be non-compliance with the rights of owners of a mandatory or marital share, doubts about the authenticity of the document, etc.

Considering the above, it becomes clear why the issue of distribution of property often becomes extremely painful even for first-line heirs, most of whom are close relatives. The legal procedure for dividing inheritance requires compliance with the following principles:

- First of all, the marital share is removed from the testator's property. Property received by the wife or husband is excluded from further inheritance procedures;

- the remaining inheritance is distributed equally among the heirs of the 1st stage, including the wife or husband who received the marital share;

- if there is one heir of the 1st stage, he receives all the property. The only exception to this rule is that a dependent cannot inherit more than a quarter of the testator’s property;

- heirs by right of representation receive the share of the deceased heir of the first priority and divide it equally;

- when dividing indivisible property (furniture, car), it is either sold with the subsequent distribution of funds according to the above rules, or transferred to one of the heirs of the 1st priority with the payment of monetary compensation to the others.

Division of property between the first priority

The current legislation reflects that the savings of the deceased are subject to division among all persons classified as first or subsequent priority. In this case, everyone gets an equal part of the mass. Sometimes other decisions regarding the division of the inheritance may be made. This happens depending on which category of followers is recognized for inheritance and the type of property.

In particular, we are talking about the fact that among the legal successors there is the husband or wife of the deceased. Initially, the share belonging to him by right of ownership is allocated. This is due to the fact that it cannot be divided among heirs. Such property remains with the spouse. The remaining estate is subject to division among legal successors. In this situation, the wife/husband also claims to inherit. If part of the property belongs to representatives, it is divided among his followers.

The parts are allocated of equal size. Depending on how many descendants a citizen has, the size of each person’s share varies. For example, when there are two of them, then each will get half, if there are three, then one third. Regardless of what rules are established regarding the determination of shares, property owners can independently determine the amount of the share due to a person.

Time frame for the procedure

Registration of inheritance occurs six months after the death of the owner of the property. There are 3 situations in which the specified time period can be changed:

- the period is counted not from the date of death, but from the moment the testator receives the status of deceased or missing by a court decision;

- the heir has a reasoned basis to explain the missed deadline for entering into inheritance established by law. In such a situation, he can restore his own rights in one of two ways - by applying to the judicial authorities or through an out-of-court procedure. The second option requires the consent of all other heirs;

- the heir is an unborn child who can inherit after birth.

In the absence of heirs of the 1st stage, the rights listed above pass to the representatives of the 2nd stage. In this case, the period allotted for entering into inheritance, which is equal to 6 months, begins anew.

The main stages of registering the acceptance of an inheritance

The Russian Civil Code (Article 1153) stipulates two methods for accepting an inheritance - in fact and with the help of notarization. In both cases, the parents will first have to register the right of inheritance to own property after the death of their son. You can arrange an inheritance after the death of your son/daughter by taking some steps.

Article 1153 of the Civil Code of the Russian Federation “Methods of accepting inheritance”

Where to contact

At stage 1, you will need to accept the property left after the death of the testator, and in its entirety.

You cannot receive only part or refuse it, including debts. The actual method of inheritance is used in certain cases:

- inheritance, for example, an apartment, is used after the death of a son/daughter and is adequately supported by parents or other successors;

- the property is safe and secure, ensured by the heirs;

- the son/daughter died, and the father/mother (recipients of the inheritance) assumed the share of the inheritance and all obligations, including debts.

When contacting a notary, you must meet the necessary deadlines for entering into your inheritance rights. The period required for their adoption is 6 months from the day the testator died. In order for parents to enter into rights to the inheritance of their deceased daughter/son, they need to make actual acceptance within the specified time frame or draw up an application on a special form. Moreover, this can be done either in person, by coming to the office, or delivered with a proxy or sent by mail (documents - an application and a power of attorney for the proxy to act - must be notarized).

According to Art. 1115 of the Civil Code, an inheritance case is opened in a notary office located closer to the place of last registration of the deceased or the largest property (for example, residential premises). Inheritance cases can be distributed among notaries, in accordance with the letter with which the surname of the deceased begins.

To find this office and notary, you can go to the region’s website and look at the list with all contacts. A phone call will help clarify where and who exactly is involved in the inheritance matter.

Read also: Search for heirs

The presence/absence of a will is reported by a notary on the day of death of its maker. If the date is uncertain, it will be made public upon the fact that he is declared dead in court. A will can be open or closed. In the first case, acquaintance with him is possible through family ties. In the second, only in the presence of all persons determined by the testator himself before the death.

Article 1115 of the Civil Code of the Russian Federation “Place of opening of inheritance”

Required package of documents

Having moved to the second stage, in order to receive an inheritance after the death of their son/daughter, parents first of all need to obtain a certificate confirming the fact of the death of the testator. And also collect the following documents:

- extract from the house register (last registration);

- a copy of the DM from the Criminal Code;

- a certificate of family composition and all persons registered in the living space of the deceased owner;

Family composition certificate form - a copy of the will;

- papers with proof of relationship between the successors and the testator;

- applicant's passport;

- information about the presence of other applicants for the inheritance;

- plan and explication of housing from the BTI and Rosreestr;

- documents on the testator's property: extract from the Unified State Register or certificate;

- other documents of title for ownership of property (court decision, contract, etc.);

The required package of documents also includes an application filled out in person at a notary's office by the parent who enters into the inheritance after the death of their son/daughter.

State duty upon entering into inheritance

The duty is paid in accordance with the Russian Tax Code (clause 22, article 333.24), since the mother/father’s share in the inheritance after the death of the daughter/son is acquired profit. The amount of the duty established by the state depends on the degree of relationship with the deceased and the size of the inherited property received or its share:

- 1st and 2nd priority (parents, children, spouses, brothers/sisters) - 0.3% of the inheritance valuation amount (not more than 100 thousand rubles);

- the rest - 0.6% of the assessed amount (no more than 1 million rubles).

The law provides for tax benefits. Persons who are heirs are exempt from it:

- living space and at the same time lived on it together with the deceased;

- property of citizens who died in the performance of public duty;

- property of victims of political repression;

- cash on bank deposits, from pension payments and rewards for intellectual abilities;

- insurance payments resulting from death and industrial accidents.

Those who do not pay the state fee include children under 18 years of age and incompetent persons. Disabled people of groups I and II can apply for a discount of 50% of the fee.

Article 333.24 of the Tax Code of the Russian Federation “Amount of state duty for performing notarial acts”

Deadline for inheritance

At the last 4th stage, the notary examines the inheritance case within the six months approved by law.

When it is closed, all successors established by the fact of inheritance are issued a certificate. It confirms the right to accept an inheritance. This document is the basis for re-registering the received property in your name. The six-month period can be extended upon the opening of an inheritance for new persons who have received this right due to:

- refusal of one of the heirs (the period of entry into legal ownership is 6 months from the date of refusal);

- non-acceptance of inheritance by other persons (additional 3 months as soon as six months have passed from the date of death of the owner of this property).

If the deadline for acquiring legal ownership of the property has been missed, and no one has refused it and there has been no failure to accept the inheritance, you can negotiate with the heir so that he agrees to be included in the list of successors.

In the event that the opening of the inheritance did not take place due to the fact that no one showed up or the only successor was late on the date of entry, the property, as escheated, goes into the state fund or into the ownership of municipalities. In this case, the issue will have to be resolved in court. To do this, a claim is filed, but there must be a good reason for the delay (ignorance, serious illness, illiteracy, etc.). The defendants are those who are currently the heir.

Read also: Mandatory share in inheritance

Step-by-step instructions for opening an inheritance case to restore rights without a will and in the absence of disputes:

- oral and written consent of all legal successors, certified by a notary;

- the notary redistributes the shares of the inherited property;

- certificates of inheritance rights issued previously are canceled and new ones are issued;

- re-registration in the state register.

As a rule, the fact of reviewing an inheritance case is decided not by agreement, but in court.

Features and rules of refusal of inheritance

The right of inheritance is voluntary. To refuse to participate in the division of property, it is enough to use one of two methods. The first provides for inaction in matters of registration of inheritance for six months. As a result, the testator's property will be divided without the participation of the heir.

The second option is to issue a written refusal. To do this, the easiest way is to contact a notary handling the inheritance case. The heir must submit a corresponding application and have the document certified by a specialist. In this case, it is possible to transfer your share to one of the other heirs.

In legal you can get free legal advice on any issue that interests you.

Types of inheritance

The law provides for two options for transferring real estate by inheritance. This is inheritance by law and by will.

Inheritance by law occurs much more often in life than inheritance by will. Heirs by law are persons who are closely related to the deceased, most often those who were part of the same family with the testator. That is why the first priority heirs are children, spouse, and parents. Today there are eight lines of succession by law. If there are heirs of a higher order, then lower heirs do not participate in the inheritance.

Particularly noted as possible heirs by law are persons who, although not related to the deceased, were members of the same family with him - dependents of the testator. To acquire the right to inherit as a dependent, it is necessary to establish that such a person is disabled at the time of the death of the testator. The law classifies as disabled women who have reached 55 years of age, men - 60 years of age, disabled people, persons under 16 years of age, and students - 18 years of age.

The share of an heir by law who died before the opening of the inheritance or at the same time as the testator passes by right of representation to his descendants.

Often in legal practice there are cases when a citizen has just submitted documents for the privatization of an apartment, but died before becoming the owner of the apartment. Do the heirs have legal rights to this apartment? Yes, they do. Judicial practice is on the side of future heirs, because the citizen (testator) expressed his will to privatize the apartment as his property.

Inheritance by will.

The fundamental difference between transferring an apartment by will is that the testator can make a will for his property not only to relatives, but also to any other person of his choice. A will is a transaction, i.e. legal action of a citizen.

Article 1126 of the Civil Code of the Russian Federation provides for a closed will. Such a will must be written in his own hand and signed by the testator, after which it must be handed over to the notary personally in a sealed envelope in the presence of two witnesses who put their signatures on the envelope. The text of such a will is announced by a notary only after the death of the testator.

Will

– voluntary disposal of one’s property in the event of death. In this case, the owner of the apartment remains the owner until the end of his days. What does the heir to the will risk?

Firstly

, in that in this case there is no guarantee that he will have the rights to the apartment after the death of the testator, because the will can be canceled and drawn up in favor of another person. Thus, the last will of the testator cancels the previous one, if there was one.

Secondly

, freedom of testament is limited by the rules on compulsory shares in the inheritance (Article 1149 of the Civil Code of the Russian Federation), and, therefore, if there is such a category of heirs, you will have to share the apartment like a piece of pie.

Minors or disabled children of the testator have a mandatory share in the inheritance. The spouse and parents are heirs with a mandatory share only if they are disabled or old-age pensioners. That is, relatives have the right to an obligatory share: disabled people, pensioners and minor children. The former spouse can only inherit as a dependent.

Persons falling under the category of “obligatory heirs”, even if a will is left, will have at least half of the share due to them upon inheritance by law.

Refusal of an obligatory share in the inheritance is considered void. It is impossible to persuade a citizen who has the right to receive an obligatory share in the inheritance to draw up a refusal even before the death of the testator. No matter what, after the death of the testator, the right to an obligatory share in the inheritance remains with him.

Inheriting property (in particular an apartment) under a will certainly has advantages for the testator himself.

Firstly

, the registration process is not burdensome: visiting a notary, drawing up a will without the presence of an heir. The procedure takes about half an hour and costs from 150 to 250 rubles.

Secondly

, the testator remains the owner of the property until the end of his life and is not tormented by doubts about the fact that he may lose his apartment.

Third

, a will can be revoked and drawn up in favor of another person countless times, but only the last one is valid.

In the event that the testator really has serious intentions to transfer the apartment only to the only heir, but there are heirs who have rights to the obligatory share, this method of disposing of the apartment is not acceptable.

The disadvantages of transferring an apartment by inheritance concern mainly heirs.

First minus

. You must wait six months after the death of the testator to enter into the inheritance. Only after this the apartment will become the property of the heir. But even then, incidents are possible if other heirs who did not get a piece of the pie challenge this fact in court.

Second minus

. There is a danger that other applicants will challenge the heir's right to receive an apartment under the will. For example, you can challenge the legal capacity of the testator at the time of signing the will and recognize the will as an invalid transaction if there are grounds.

Minus the third

. Heirs may appear with an obligatory share in the inheritance and then they will have to share.

Fourth minus

. Entering into an inheritance is a troublesome matter and again you will have to incur expenses in order to obtain a document confirming the right to property.

Inheritance

Upon the death of citizens who had some property, an inheritance case is opened. It does not matter whether a will was written or not. Any citizens, companies, charitable, religious organizations, and municipal authorities have the right to become successors in a will.

Any will of the deceased must be carried out. The exception is cases in which it is necessary to allocate a share to obligatory legal successors. When inheriting by law, property is distributed in equal shares among all primary legal successors. If at least 1 primary heir is alive, other persons have no right to lay claim to the property. He will receive all the property of the deceased.

Attention! The materials on our website fully disclose general issues of inheritance. But it is impossible to cover every particular case in articles. In this regard, the service offers free online legal consultation. Ask your question through the site form and receive an answer within 5 minutes!

Rights of the testator when transferring property

The only rule that must be followed when drawing up a will is the existence of property or the rights and obligations associated with it at the time of the death of the testator. In addition, the testator has the following rights:

| Freedom of choice in the essence of a will | To write a declaration of will, you do not need to discuss it with relatives. There is no need to obtain the approval of the heirs for the transfer |

| Freedom of disposal of future property | The testator may indicate property that does not belong to him, but he plans to acquire it. There is a certain wording for this, which the notary will suggest |

| Freedom to choose an heir | The testator independently chooses the people to whom the property will be transferred. Moreover, not only relatives, but also strangers can be heirs. The testator can also divide the property, indicating the size of the shares |

| Possibility of disinheritance | A person may not indicate in his will the persons to whom he does not want to leave something. Thus, relatives who are unworthy, in the opinion of the testator, will not receive anything. But there are clarifications in the law. A list of people who will receive a share, even if not specified in the will. These include dependents, disabled people, elderly parents, minor children and disabled spouses |

| Possibility of changing a will | A person, while alive, has the right to change a will at any time or even cancel its validity, without giving reasons |

| Possibility to include additional conditions | When drawing up a will, you can list not only the property being transferred, but also the conditions under which the heir can receive it. For example, you can bequeath an apartment, with the condition of caring for pets, or getting married. If the expression of will is not carried out, the relative will lose the inheritance |

| Freedom to choose an executor | If doubts arise about the accuracy and correctness of the execution of the last will, then the person has the right to choose an executor who will control this. |

Important! The transferred property is the legal property of the testator, so he can dispose of it at his own discretion. And also, according to the law, a person has the right to draw up not one, but several inheritance documents. The only condition is that their contents should not contradict each other.

Typically, large pieces of property are transferred in a separate will - a car, living space, land. If several wills drawn up contradict each other, then the one drawn up later will have legal force.