Everyone faced with a mortgage loan dreams of the moment of the last payment and entering into full ownership rights. And then, like a bolt from the blue, the incomprehensible “removal of mortgage encumbrance” appears. Why is this strange phrase never mentioned in most cases?

Mortgage loans are taken out for a long period of time, the arrival of a pleasant final part is such a distant prospect that a modern person, accustomed to quick decisions, does not think much about it. Thinking in advance about such a distant future is not something worthy of attention. I would like to deal with interest, monthly payments and similar problems that arise during the acquisition of real estate.

Time passes. What seemed unrealistic and distant eventually comes and becomes a very tangible present.

The last payment was made on time or, even more pleasantly, made ahead of schedule. It's time to celebrate full ownership of one property or another. But it was not there.

It is at this very moment that the concept of “removal of mortgage encumbrance” appears. Below we will try to understand verbatim the concept itself, the time of its occurrence and other questions that may arise.

Types of encumbrance

The law identifies the following types of encumbrances:

- Rent . To sell an apartment, it is necessary to carry out an eviction, which may be accompanied by judicial intervention. The owner must completely vacate the premises from tenants, but an agreement between the guests and the owner may become an obstacle, which affects the period of removal (Chapter 34 of the Civil Code of the Russian Federation).

- Mortgage . To receive money from a credit institution, the owner must provide a strong guarantee of its return. Therefore, you should not carry out real estate transactions before the deadline for the return of funds and the closing of the contract. Obtaining a mortgage is the most common encumbrance on an apartment. It is withdrawn early in the following cases: early payment and payment of maternity capital. In some cases, an apartment with a mortgage cannot be renovated without the consent of the lending institution. The owner’s obligations are spelled out in Article 25 of the Federal Law of July 16, 1998 No. 102-FZ “On Mortgage”.

- Arrest is a complex encumbrance . It is imposed in case of non-payment of services and bills (Article 140 of the Civil Procedure Code of the Russian Federation). This decision is made by government services, so third parties cannot influence it in any way. Arrest can be imposed in varying degrees, up to the eviction of the owner from his own apartment.

- Rent . The case of selling an apartment, which in the future will pass to another owner, a potential buyer, is excluded. The exception is the desire of the current owner to terminate the contract with the future owner. In this case, it is necessary to return the funds received earlier and recalculate the funds allocated for the purchase of food, essential items or medicines. Find out about the removal of encumbrances - Chapter 33 of the Civil Code of the Russian Federation.

- Trust management . This is the supervision of an apartment by a third party under a contract drawn up for a period. Property rights are transferred to the temporary owner. The agreement can be terminated before the established period in two cases: the death of the permanent owner or by agreement of the parties (Chapter 53 of the Civil Code of the Russian Federation).

Dangers when selling an apartment for the owner and buyer

If the owner does not submit documents to remove the encumbrance on time, he will face the problem of litigation. A difficult situation is when the buyer travels abroad after drawing up a purchase and sale agreement and is unable to be present when the problem is resolved. The owner-seller should take the help of professionals. If the encumbered apartment has already been sold, all costs of resolving disputes with the new owners are borne by the previous owner . Therefore, it is more profitable to get rid of restrictions in advance by drawing up an application for the removal of the encumbrance.

DOWNLOAD:

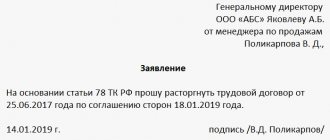

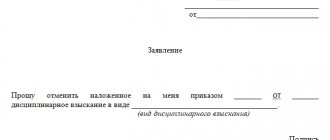

- Sample application for removal of encumbrance from an apartment.

The buyer is constrained by restrictions and does not have the right to fully dispose of the property. Refunds are not available until the situation is resolved, and legal proceedings may continue indefinitely.

The most difficult option is to purchase an apartment with an encumbrance where a minor is registered and he is a co-owner. Then the participation of trustees is necessary, who do not always agree to resolve such disputes. Sometimes it is impossible for the previous owner to live in (tenants or lifelong residents): termination of the contract and return of finances, as well as transfer of the apartment, can take years.

What to watch out for

It is necessary to remove the encumbrance as soon as the circumstances limiting your rights have disappeared in order to avoid possible difficulties.

For example, mortgage payments were paid on time and without delays, the debt was repaid, and after a while the bank that issued the mortgage closes. If you did not receive the necessary documents from there on time and did not have the application for removal of the encumbrance certified by the bank, your rights to the apartment will remain limited. You will have to look for an authorized manager who was on the staff of the organization, or go to court.

Bank claims against owners for incomplete repayment of debt are possible even after restrictions are lifted. The court will help prove you are right.

Procedure for removing the encumbrance

To freely dispose of the apartment, you must submit documents to remove the encumbrance. Each case - rent, lease or mortgage - requires the provision of certain papers. Therefore, before selling an apartment, it is worth checking whether there is an encumbrance on it and, if necessary, removing it. The main document to confirm the absence of encumbrance is:

- from the bank - a certificate of mortgage repayment;

- for government agencies – a certificate confirming the payment of debts and the lifting of restrictions in this regard; a decision on the division of property between members of a married couple who have equal shares in the apartment;

- for trust management - an expired agreement, a death certificate of the owner or a paper guaranteeing mutual termination of the agreement.

To obtain the necessary documents from the relevant institution or authority, you must submit an application. It is written on behalf of the owner. A potential buyer does the same - he needs to check the authenticity of the removal of the encumbrance from the property. Confirmation from the State Register www.rosreestr.ru/ will be a response to submitting an application to the appropriate service.

This statement is valid for 30 days . But the most accurate and reliable data is valid for up to three weeks from the date of receipt of the statement. You can find out about the removal of the encumbrance, the procedure for removal and other procedures from those institutions that have placed the encumbrance on the apartment.

In what cases should you go to court?

In most cases, the owner does not need to apply to a judicial authority to cancel the encumbrance. For example, a life annuity agreement terminates at the death of the annuitant. In this case, to remove the restriction on real estate, the other party only needs to submit a death certificate to Rosreestr.

If we are talking about renting residential premises, then the basis for releasing the apartment from the rights of guests will be an agreement that specifies the specific period of validity of such an encumbrance.

In this case, you will definitely need a mortgage from the bank with a note stating that the borrower has fully fulfilled his obligations. However, some unscrupulous creditors deliberately avoid issuing such a document.

Finding himself in such a situation, the client is forced to file a statement of claim with the court containing a demand for a court decision, according to which the plaintiff will be able to independently cancel the imposed encumbrance.

There may also be another situation where litigation may be required. We are talking about lifting the arrest from a property. The need to file a claim containing such a claim may arise in the following cases:

- the presence of rights to the seized housing on the part of other persons (if the bailiff described property that does not belong to the debtor by right of ownership);

- if such a restriction was imposed on an apartment that is also owned by the debtor’s spouse;

- The bailiff unreasonably refuses to remove the encumbrance from the seized living space, etc.

Other documents for removing the encumbrance

If the buyer is ready to pay off the bank mortgage and remove the encumbrance instead of the previous owner, a power of attorney can be issued. The document indicates information about the principal and the authorized person, indicating that the previous owner entrusts the authorized person with the right to be a representative in institutions and organizations of the city where the apartment is registered. The right to resolve issues regarding the removal of encumbrance (mortgage) on an apartment with the specified address is also indicated.

The authorized representative submits applications on behalf of the principal, submits certificates and documents necessary to lift the restriction, performs all formal actions and signs the necessary documents. A power of attorney is issued for a year, and the authorized person does not have the right to transfer the power of attorney - this is indicated in the document.

What to do after a court decision is made

If the claim is satisfied by the court, the plaintiff will be able to remove all encumbrances unilaterally. To do this you need:

- Get a court decision.

- Write an application and collect the necessary documents.

- Submit papers to Rosreestr. It is possible to either contact one of the branches in person or send an application through the State Services portal. In addition, you can submit documents through the MFC.

If the object has been seized, then the documents are sent to Rosreestr by a bailiff. However, the plaintiff can do this on his own.

Next, Rosreestr employees will process the information received and make changes to the system. After this, all restrictions will be lifted.

Papers for submission to the institution that has placed an encumbrance on the apartment

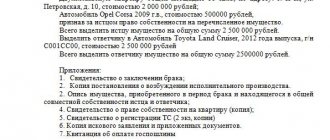

The list of required documents looks like this:

- An application for the removal of the encumbrance certified and signed by bank employees. First, the owner receives an invitation to come to the MFC (multifunctional center) pgu.mos.ru/ru/md within 1-2 weeks to fill out an application.

- Copies and originals of the passport of the mortgagor - the person indicated in the document of ownership.

- Certificate of payment of the state fee for another certificate, as well as its copy.

- Contract of sale.

- Certificate of state registration of property rights.

- Documented fact of payment of the loan.

- Original and copy of the mortgage. The need for this document is regulated by Art. 25 of the Law “On Mortgage” (Federal Law No. 122 of July 16, 1998).

After submitting the documents, the period for removing the encumbrance is 5 working days , then a decision will be made to remove the encumbrance from the property. The owner receives a new certificate of ownership within a month. The entire process is free - except for the state duty, the amount of which is approximately 350 rubles . It is paid only to obtain a new certificate, but not for services for removing a mortgage, since this is illegal.

Information for potential buyers

In order to verify the encumbrance or absence of it, you should look at the Unified State Register - on the website www.rosreestr.ru, having also previously paid the state fee. Having received the extract, you can find out from the record whether the property is registered as an encumbrance or not. In some cases, several restrictions may be placed on an apartment. This often occurs after a purchase on credit that is not repaid by the owner.

Video: advice and recommendations from a lawyer when buying and selling an apartment with an encumbrance.

What to do with an electronic mortgage?

Since 2021, electronic mortgages have appeared in Russia.

One of the goals of introducing electronic mortgages is to eliminate the possibility of their loss. “An electronic mortgage equally ensures the fulfillment of the borrower’s obligations to the creditor bank, just like a documentary mortgage. But the form of the security itself - uncertificated - practically eliminates the risk of loss, which always exists in the presence of documentary circulation,” notes Tatyana Manakova, head of the legal department of the Padva and Epshtein law office. The electronic mortgage is signed with an electronic digital signature and transferred by Rosreestr for storage to the depository. Information about it is reflected in the Unified Register of Real Estate Rights.

There is no need to apply for cancellation of an electronic mortgage anywhere, says managing partner of the legal entity Artem Denisov. The termination of a mortgage is carried out by Rosreestr on the basis of a joint application from the bank and the owner with the provision of an account statement.