How to draw up a will for an apartment

Drawing up an administrative document is a citizen’s right, not an obligation. In the absence of a will, the property will be divided among the heirs based on the legal order. If the owner wishes to independently determine the list of heirs and establish their share of the property, then he must draw up a will.

| pros | Minuses |

| Possibility to change a will at any time | It is not possible to transfer the entire apartment under a will if there are citizens who can claim an obligatory share |

| Full right to an apartment and the ability to dispose of it at your own discretion until death (sale, rental) | The heirs will be able to dispose of the apartment only after the death of the testator, in contrast to the gift agreement. |

| Possibility to revoke a will | Heirs can challenge the will in court. In this case, the inheritance will be divided in the order of legal priority (it is easier to challenge a will than a gift agreement). |

To summarize: Among the advantages of a will is the possibility of transferring property to close relatives or strangers, the possibility of drawing up an administrative document for property that has not yet been purchased. The main disadvantage is the risk of appealing the distribution document in the future.

You can draw up an administrative document at any time. The main thing is that the desire is voluntary and not imposed by other participants. If the fact of coercion or abuse of trust is confirmed, the will can be annulled in court.

When drawing up an administrative document, there is a possibility of its subsequent cancellation after the death of the testator. The risk is associated with the fact that the person himself will no longer be able to protect his property interests. To avoid such situations, it is necessary to follow the rules approved by civil law. It would be a good idea to involve a lawyer in the procedure, who will help you avoid problems and tell you how to correctly draw up administrative documents.

How to make a will for property

A will has a lot more power than it seems. A simple piece of paper with your signature and a notary’s stamp can deprive even a close relative of property and allow you to transfer everything to a neighbor and impose restrictions and obligations on the heirs.

Here are some examples of what can be done under a will, but cannot be done without it.

For example, giving the car to your stepson, and not to your own daughter. Let's say there is a certain citizen R. who has his own daughter, stepson and wife. According to the law, after the death of the head of the family, the wife and daughter will receive the inheritance, while the stepson will receive nothing. But the daughter has been living her own life for a long time and does not communicate with her father and mother, but the stepson is a doctor, he helps his stepfather. In a will, a citizen has the right to write directly: an apartment for his wife, a car for his stepson. In this case, the daughter will not get anything.

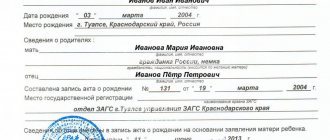

To draw up a will, you will need a passport and a list of heirs. Property documents are not needed, everything is recorded according to the testator. You can even indicate property that does not yet exist, but may exist at the time of death. It is worth indicating the signs that identify the property as accurately as possible, so that in the future no one will have the opportunity to challenge the will, citing difficulties in its interpretation. For example, if you are going to include a plot of land in your will, then it is better to indicate its area, exact address, name and village or dacha cooperative. Without documents at hand, this will be more difficult.

The heirs' data is recorded according to the testator: full name, date of birth, degree of relationship (if any).

After the death of a loved one, all of his movable and immovable property passes into the possession of his heirs. At the same time, according to the law, there is a certain order of entry into ownership rights. Drawing up a will helps to avoid formalities and allows you to bequeath the total inheritance or a separate part to a specific person.

If the testator has a worthy successor in mind, drawing up a last will document is beneficial to both parties. Let's consider the main nuances of the process of registering and receiving an inheritance.

When drawing up a will, the owner is not limited in the expression of his will. He can bequeath his movable, immovable property, bank accounts to several heirs, in this case:

- compiling a specific list of things and values for each legal successor;

- dividing the entire inheritance mass between the heirs in shares (for example, ¼ to each of the 4).

The testator has the right to dispose of the property that belongs to him by right of ownership. Municipal housing is owned by the municipality and is transferred for use to citizens on the basis of a social tenancy agreement.

Therefore, municipal apartments cannot be inherited.

The only opportunity to continue to use the living space for the relatives of the deceased registered in the apartment is to contact the council or municipality and renew the social tenancy agreement in their name.

The process of pronouncing the last will

We recommend reading: The deadline for entering into an inheritance has been missed - the procedure for restoration

With a standard will: after receiving official notification of the death of the testator, the notary opens the envelope no later than 14 days later. This often happens faster. The notary must explain the essence of the will to the heirs and relatives. At this event, the same witnesses must be present as when drawing up the will, as well as all persons interested in this matter. Upon opening the envelope and explaining its essence, a protocol is drawn up, copies of which are certified by a notary and all heirs receive. The notary himself is responsible for storing the original document.

In case of a closed will: the notary must notify all those present that, upon receipt of the information, no one is allowed to disseminate it. If a leak occurs, the heir has the right to demand financial compensation for moral damage from the person who provoked it.

What are the pros and cons of making a will for an apartment?

It is impossible to dispose of a non-privatized apartment, since it is not the property of the testator.

But if there is a document reflecting the last will of the testator, the heir has the right to claim such living space.

To do this, it is necessary that during his lifetime the testator draws up and submits an application for privatization to the appropriate authorities. If there is such a document, the testator must follow a certain algorithm:

- Contact a notary and open an inheritance case.

- Write an application to the housing department of the local administration about your claims to the apartment by right of inheritance.

- Write a statement of claim for recognition of ownership rights (6 months after the death of the testator).

Successors who have received an apartment or other real estate by will have the right to put them up for sale immediately after taking possession.

It is important to take into account that, according to Russian law, real estate that has belonged to the owner for less than 5 years is subject to tax upon sale.

Upon inheritance and subsequent sale, the seller will have to pay the state a tax of 13% of the total cost of the apartment received under the will.

During life, few people want to think about death, but drawing up a will for an apartment has a number of pros and cons for the testator:

- confidence that the property will go to the right person;

- the ability to freely change or cancel an existing will;

- affordability;

- the opportunity to use your property, since ownership rights will pass to the heirs only after death;

- property can be transferred to any persons (not relatives, organizations);

- a will can be drawn up with additional requirements for legal successors (for example, with the condition not to sell the parental apartment);

- speed of registration;

- minimum package of documents for creation and certification.

The disadvantages include the following:

- if there is the slightest mistake, dissatisfied relatives can challenge it;

- If the chosen successor does not submit documents for ownership rights on time, he may lose everything bequeathed to him.

The Civil Code of the Russian Federation establishes 8 lines of inheritance according to the law. Each of them consists of relatives of the testator in descending order of kinship, as well as proximity to the testator (spouses, children, parents, uncles, sisters). According to the law, if there are no heirs of the first stage or they refuse the inheritance, heirs of the second stage and subsequent ones can inherit.

A testamentary disposition has a number of positive and negative aspects that directly affect the testator.

If you draw up a will for an apartment, the advantages will be as follows:

- inexpensive design;

- the testator retains ownership;

- the document can always be changed or canceled (which cannot be done with a deed of gift) if the testator changes his mind about leaving the property to any person;

- the owner retains all his rights to real estate: he can live in it, rent it out, donate it, sell it at any time. When signing a deed of gift, he is immediately deprived of all these opportunities along with the right of ownership.

A will can be revoked automatically when a new will is made.

The most recent document will be considered valid. You can also write a statement to a notary to declare the will invalid. Thus, the testator can always change his mind and change his decision regarding the fate of the property.

The procedure for registering a will for an apartment with a notary

Since we are talking about documents for an apartment, we will list those that you can provide to the notary.

- First of all, this is a certificate of ownership .

- If you went through the state privatization procedure, please attach a report about it .

- Take certificates from the BTI , which indicate the presence or absence of debts and encumbrances on the apartment.

- If possible, make an extract from the house register so that the heir understands who else is registered in this property and with whom you share ownership rights.

- You can also take an extract from the Unified State Register , which will contain a record that you are indeed the owner of the property; moreover, you cannot be limited in any way in these rights.

- Having all these documents in hand, the heir will have much fewer problems when he registers his property rights.

If a person is elderly, then in addition to a medical certificate, it is advisable to provide him with a pension certificate. The fact is that after the death of a person, unscrupulous heirs continue to receive a pension for the deceased. In order to warn citizens against this, the name of the pension certificate is indicated.

Important! If an elderly person was disabled, or was affiliated with any other social group, then the ID number will help future heirs receive payment and compensation.

The will of not the whole apartment, but only its share contains some nuances. For example, you must obtain consent from other apartment owners-holders that you are transferring this property as an inheritance estate.

The fact is that other owners have the primary right to purchase part of the real estate from you. Therefore, if they are outraged against your transfer of real estate by inheritance, and go to court, it is likely that the court will oblige you to sell them a share for the price indicated by the appraisers

To prevent this from happening, talk in advance with other owners and study their consent to transfer the share by inheritance in relation to another person.

Some even neglect such requirements and do not ask the consent of other shareholders. In this case, if 3 years have passed since the death of the person, and no one has made any demands for the cancellation of the will or its revision in court due to violation of the rights of third parties, then this means that the heir can no longer be afraid that someone will claim its rights to the share.

The will must contain reliable information about the applicant’s property, which is checked by the notary before executing the document. The envelope itself must contain information about the date and place of the paper. If the will is closed, then according to the provisions of Art. 1126 of the Civil Code of the Russian Federation, information about time and place is indicated directly on the envelope.

The form of presentation of the paper is not legally established: the document can be written either by hand or using a word processor on a computer. If the text of the will is written by hand, then you must use a blue ballpoint pen. The use of colored pens, felt-tip pens and pencils is not permissible according to Art. 45 Legislation on notaries.

How to write a will

The documentation package includes:

- identification document of the testator - passport;

- a document recording ownership of bequeathed property. This could be a purchase and sale agreement, gift, exchange, USRN certificate, which is issued at the Rosreestr branch, etc.;

- information about the persons to whom property is transferred by inheritance, indicating their permanent location and date of birth.

Features of a closed will

The main form of making a will is notarial. One of the types of notarized wills is closed (Article 1126 of the Civil Code of the Russian Federation).

For your information

This type of expression of the last will takes place when a citizen wants to keep the contents of this document secret, including from a notary.

When executing such a document, it is necessary to comply with some more stringent mandatory conditions of the law:

- Unlike the requirements for a notarial form, a closed will must not only be signed, but also handwritten (that is, by hand) by the testator.

- Also, such a document must be sealed in an envelope and handed over to a notary in the presence of two witnesses. Next, the notary seals it in another envelope. In this case, the envelope must bear a certification inscription, as well as signatures of witnesses and personal data of the testator and witnesses, the place and date of acceptance of the envelope.

- The testator is explained the provisions of the Civil Code of the Russian Federation on the obligatory share in the inheritance (Article 1149).

- The testator is issued a document indicating the acceptance of a closed will (certificate).

Failure to comply with these requirements entails the invalidity of the document expressing the last will of the testator.

Information

A closed will limits the circle of persons capable of making it, since a citizen with physical disabilities such as blindness or illiteracy cannot express his last will in his own hand.

Additionally

A will, which has been certified by persons authorized for this purpose, is sent at the first opportunity to a notary at the place of residence of the testator through the territorial bodies of the federal executive body, which perform control functions in the field of notaries. If the person who certified the will knows the place of residence of the testator, he sends the will himself directly to the notary.

According to

Art. 1127 Civil Code of Russia

The following types of wills in the Russian Federation are equivalent to notarized ones:

- certified by the chief physicians of hospitals, hospitals, nursing homes and other inpatient medical institutions (their deputies);

- expression of the will of individuals serving while sailing on ships flying the Russian flag. Wills are certified by ship captains;

- a document on the inheritance legal relations of citizens undergoing military service in places where there are no notaries. The document is certified by the commander of the military unit. Such wills are also drawn up for civilians - family members of military personnel and working citizens;

- wills of members of research or scientific expeditions, certified by their superiors;

- wills of prisoners, certified by the warden.

We invite you to read: Peculiarities of bequeathing an apartment

This type of final disposition of individuals is signed by the testator, a witness to the procedure and the person certifying the document.

This type of official inheritance paper is drawn up in person by the will-maker himself, signed, placed in an envelope and sealed.

It is handed over to the notary in a sealed envelope signed by witnesses in their presence. The official then places the envelope containing the will in another bag and seals it. The testator is given a document by the notary confirming the acceptance of the will. An inscription is placed on the envelope indicating who the envelope was received from, the place, date and date of the event, and the passport details of witnesses.

In the video, a notary answers questions about the nuances of wills

The opening of the envelope with the disclosure of the contents of the paper is carried out in the presence of the heirs and witnesses within 15 days after the death of the testator. Then follows the mandatory execution of a protocol containing the text of the expression of will. Interested parties are given a copy of the protocol, and the original remains in the custody of the notary.

You can ask questions about the features of different types of wills in the comments to the article.

The most important things about making a will

Is it possible to register an apartment for a minor child?

Many people think about how to create an inheritance for housing - an apartment, a house in the city, a plot of land, etc. For those who decide to take matters into their own hands, they need to compare what is more profitable: bequeathing valuables or drawing up a deed of gift, the pros and cons.

From a purely legal perspective, it is easier to draw up a will. In addition to the simplicity of this procedure, the risks for the heir of being left without property are also reduced. The fact is that the right of ownership in a gift transfers at the moment of signing the contract for the privatized property. Accordingly, at this time the new owner indicated in the gift agreement must assume legal rights. Accordingly, the testator completely loses his rights to the living space.

Pitfalls when preparing a document can be:

- the presence of several documents at once - in this case, the last one is considered valid;

- obligatory share in the inheritance;

- the document is challenged in court;

- the presence in the will of difficult-to-fulfill conditions that must be fulfilled in order to be able to enter into legal rights;

- the presence of debts that are legally transferred to the new owner;

- inheritance can be contested.

If the apartment is privatized, then the owner can freely dispose of shares in it. The registration procedure will be standard and will not depend on protests from other apartment owners: there is no need to obtain consent from them.

The procedure for registering a share is regulated by Art. 1130 Civil Code of the Russian Federation. You will need:

- identification;

- documents for the apartment;

- the necessary certificate of legal capacity (if the person is over 70 years old), preferably for a period of no more than a month;

- share calculation.

Note! The right to an obligatory share is reserved for incapacitated relatives. Thus, only ½ of the share can be bequeathed.

According to Art. 1153 of the Civil Code of the Russian Federation, you can only accept an inheritance remotely. It can only be issued during a personal visit to a notary. Exceptions are cases when a person is physically unable to appear at a notary's office. In these cases, it is necessary to obtain the signature of the witness, as indicated above in the text. This is the head doctor of the hospital, the head of the prison and other citizens in accordance with current legislation.

Before contacting a notary's office, a citizen who wishes to write a will must determine the size of the shares for each heir. It is important to comply with the condition, the essence of which is that each heir should be entitled to a certain share of the property, even if it was not included in the main will.

In this case, it is necessary to take into account the consequences that may be caused by certain provisions in the document being created. To some they may seem unfair, which will lead to disputes that only the judiciary has the right to resolve.

In addition, it is also worth thinking about the relevance of a certain share for a particular heir. If in doubt, it is strongly recommended to appoint a manager to oversee it for a specified period of time.

Simple Will in Emergency Circumstances

The main form of making a will is notarial, but the legislator allows cases of expressing the last will in simple written form. The law allows the expression of the last will in simple written form if a citizen is in a situation that threatens his life and is deprived of the opportunity to do this according to general rules. This situation in the Civil Code of the Russian Federation sounds like emergency circumstances (Article 1129 of the Civil Code of the Russian Federation).

For this type of will, several mandatory conditions must be met:

- At the time of drawing up such a document, the person must actually be in circumstances that threaten his life;

- The text of the document must be personally written and signed in the presence of two persons (witnesses);

- It should be clear from the text of the document that this is a will.

An important feature of a will made in emergency circumstances is that it is valid for one month after the cessation of such circumstances. It is understood that if such circumstances no longer exist, the citizen must contact a notary to express his last will in another form.

Attention

It is subject to execution only if the fact of its commission is recognized by a court decision. In this case, interested parties (heirs) must apply to the court within six months from the date of death of the testator.

We invite you to read: Help make a will

Statement of a will in simple written form is practiced when the testator, under conditions of a threat to his life, has no other opportunity to reveal his last will. The procedure is regulated by Article 1129 of the Civil Code of the Russian Federation (clause 1).

A necessary condition for such an expression of will is the presence of two witnesses. An individual must personally state the text of the expression of will, from which it follows that the document is precisely a will. The testator's signature is placed at the bottom.

If, after one month has passed after writing the will in a simple form, the testator does not draw up the document in accordance with the rules of Articles of the Civil Code No. 1124–1128, the will will lose its legal force (learn the grounds for invalidating a will from the article https://nasledstvo.today/2732-priznanie- zaveshhaniya-nedeistvitelnym-osnovaniya-iskovoe-zayavlenie-v-sud). Thirty days are given to the testator to bring the will into notarial or equivalent form.

There are also other types of papers that are drawn up under special conditions and subsequently act as a will. For example, a will with a condition is not a typical deed that determines heirs. The testator sets a certain condition that the successors must comply with in order to gain access to the inheritance. Often, we are talking about the recipient reaching the age of majority.

When bequeathing real estate, the owner has the right to dispose of the object at his own request, but there are a number of people whose rights are prohibited from being deprived - young children and disabled citizens, parents and dependents. It is allowed to bequeath property with an encumbrance.

In accordance with the provisions of civil law, a will is a transaction between the testator and heirs. Therefore, certain requirements on the part of the testator can be inserted into its text.

Among the most common conditions accompanying the last will of the deceased is life maintenance, or lifelong residence of certain persons in the bequeathed property. A will with a condition of lifelong residence implies that a certain third party has the right to live in the inherited apartment for life.

For example, a citizen decided to inherit his home to his grandson. But, caring about the future of his wife, he includes in the text of the document a provision stating that she has the right to live in the house indefinitely. Theoretically, a will with a condition can be challenged by the testator in court. But, in most cases, the court sides with the deceased testator and the person referred to in the condition of lifelong residence.

Will for an apartment between relatives: pros and cons

Knowing what papers are needed to draw up a will for an apartment will speed up the process of document preparation as much as possible.

The required list looks like this:

- Owner's passport;

- Passports of the heirs specified in the will;

- Papers confirming ownership of the apartment;

- Medical certificate.

The specialist will need information about the heirs, contact details, phone numbers.

The cost of notary services consists of state fees and legal services. The amount of payment is set by the notary chamber. The cost of document certification is one hundred rubles. The fee for specialist services is taken into account separately. The price can vary from one thousand to two thousand rubles for an open type, from one and a half to two and a half for a closed type.

When calling a notary to your home, the cost of services may be slightly higher.

If the documents are correctly submitted, checking the package takes no more than a week. Most often, a specialist compiles a paper within 24 hours.

You can draw up a will yourself or with the help of a notary, but in any case you will need to pay a 100 ruble state fee for notarization. The services of a notary or lawyer for consultation and drafting the text of a will depend on the region and the notary company itself - on average it will cost 2-4 thousand rubles.

Entering into an inheritance will also require money - close relatives will have to pay 0.3% of the value of the property (but not more than 100 thousand rubles), other persons - 0.6% (but not more than 1 million rubles).

A will provides ample opportunity for subsequent maneuvers - it can be changed at any time, or even revoked as if it never existed. Also, during his lifetime, the owner can do whatever he wants with his real estate, even with a written will - rent it out, register other tenants in it, donate it, sell it - in the last two cases, when the will is disclosed, the heirs will simply have nothing to receive.

Is it possible to prohibit the sale of inherited real estate in a will?

The will cannot include conditions that could limit the rights and freedoms of the country's citizens guaranteed by the Russian Constitution. Thus, it is impossible to oblige the heir to live in a certain locality, set conditions on entering or not marrying someone, choosing a profession, and the like. It is also impossible to include in the will a prohibition on the sale of real estate that the heir will receive, its rental or donation. But at the same time, it can be stipulated that when selling the property, the heir will have to pay part of the cost to someone else.

no comments

Documents required to register a will for an apartment with a notary

If you draw up an agreement yourself without notarization, you will only have to pay the state fee for registering the transfer of ownership - 2 thousand rubles. If you need advice and certification from a notary, it will cost about 6 thousand rubles.

The tax on an accepted gift does not apply to close relatives (children, spouses, parents, grandparents, grandchildren, brothers and sisters). In another case, the recipient will have to pay a tax of 13% of the cadastral value of the property.

Just as you can bequeath, you can donate any real estate: an apartment, a house, a plot of land, a dacha, your rights under the DDU agreement.

Who can give real estate to?

Almost anyone. This is a common way of transferring real estate to close relatives, who will not have to pay tax on the property received. Also, the donated real estate will not be considered jointly acquired property during marriage - if a mother decides to give an apartment to her daughter who is married, then it will belong only to her - the husband will not have any rights to the donated real estate.

But there are categories of persons who, due to the nature of their activities, do not have the right to receive property as a gift: these are civil servants, employees of educational, medical institutions and social protection agencies, and employees of municipal services. Donations between commercial organizations are also prohibited. But at the same time, a legal entity can donate real estate to an individual and vice versa.

Gifting is usually unconditional. The giver cannot demand material benefits or the fulfillment of any conditions for his gift.

However, if the donor wants the property to pass to a specific person, and not, for example, to his heirs, the contract can stipulate that if the donor survives the donee, the contract will be canceled and the property will return to the previous owner (if it was in property of the accused).

When concluding a gift agreement, the main thing to understand is that after registering the transfer of ownership, the property no longer belongs to you and you do not have any rights to it. It's important to keep a sense of reality when making such expensive gifts, especially if this is your only place to live. A gift agreement, unlike a will, cannot be changed or revoked - once the agreement is signed and registered with Rosreestr, there is no turning back.

How to register a will for an apartment with a notary?

The law allows you to revoke a will, make changes to it, or make a new will as many times as you like. There are no restrictions. Moreover, each new will automatically cancels the previous one.

Therefore, it makes sense to draw up a will based on the current situation and change it if life circumstances change. In the absence of a will, all property will be transferred to the heirs according to the law, and if there are no such heirs, to the state.

You can learn about the features of registering and drawing up a will from the videos below. A practicing notary will tell you in detail about all the aspects and features of drawing up a will.

Today, many citizens prefer to dispose of their property by transferring it to the category of inheritance. After the inheritance case is opened, the re-registration of the apartment according to the will begins. The document must be drawn up in one of the notary offices. If your health does not allow it or there is an acute lack of time, then you can invite a lawyer to your home. The inheritance process is characterized by the fact that it is a unilateral transaction in which one party (the testator) can at any time change its terms or cancel it completely. However, after the death of the apartment owner, his last will becomes final and irreversible. No one can abolish or correct it. The only exceptions are cases when the prerogative is revoked if violations were committed during its preparation and execution. This is a process that is clearly stipulated in the legislative acts of the Russian Federation. Let's look at the stages of this process and all the steps that need to be taken to re-register property under a will.

Read more: Tax refund for mortgage interest paid

A correctly executed will must contain several mandatory entries - in their absence, the document is invalidated:

- Information about the testator – full name, year of birth, passport details.

- Date the document was signed.

- In the case of a notarization, the date and place of execution of the certification record and the notary's data must be indicated.

- The signature of the testator himself or the person who signed the document in his place. The testator must sign the document in the presence of a notary after the notary reads the text of the will out loud and makes sure that the citizen understands the meaning of what is written and agrees. If he cannot sign the will, for example, due to physical impossibility or illiteracy, then in the presence of a notary another person can do this instead of the testator.

- Witness signatures when required:

- if a closed will is transferred to a notary;

- if a will is drawn up without the participation of a notary (equated to a notarized will or a will in emergency circumstances);

- at the request of the testator.

If you suspect that a will may be contested, there are additional steps you need to take to help protect wills from being contested.

- Draw up the text of the will in accordance with all requirements. To do this, you need to use the help of a notary or lawyer.

- Draw up the paper in two or more copies and have it certified by a notary.

- Prepare certificates that confirm that the testator at the time of drawing up the paper is mentally and physically healthy, capable, and is not registered with a drug treatment center or a psychiatrist.

- When drawing up and verifying the paper, use video footage or involve several witnesses.

How to transfer real estate: will or deed of gift

A will for an apartment can be drawn up anywhere; the method of its execution will depend on the specific circumstances. The best way is to contact a notary in a calm atmosphere.

If the situation requires an urgent solution, then you can write a will both in the hospital and at home - for this it is best to invite a notary for an additional fee. As a last resort, the will can be written by hand in front of 2 witnesses. The document can be certified, for example, by the chief physician of a medical institution, his deputy or the doctor on duty. To make the will more legal, you need to film the entire process – even a phone camera will do.

In my opinion, there is no ideal scheme. You can determine the distribution of inherited property by will. Here it is necessary to understand that incapacitated heirs of the first priority at the time of the death of the testator can claim a compulsory share in the property.

Donation with reservations is contrary to the Civil Code of the Russian Federation. Giving is an unconditional and undoubted gift. The donee has the right to dispose of the property from the moment of transfer of ownership.

There is also no practice of monitoring the execution of a conditional will in our country, although such options are now being considered at the legislative level. My recommendation is to write your will as you see fit and live in peace. You can't be safe in all cases.

If you acquire property during marriage, then your spouse already has a mandatory spousal share in the acquired property. Therefore, even if all the property is purchased with your money, you are not the only owner.

In such a situation, I can recommend that you enter into a marriage contract, in which you define the ownership mode - joint, shared (for example, indicate that the spouse will own ½ of the apartment) or separate (for example, the spouse will be the sole owner of the car). In this case, a marriage contract can be concluded both in relation to existing property and in relation to property that will be acquired in the future.

It would also be appropriate for your situation to write a will. At your discretion, you have the right to indicate persons who may qualify for the inheritance, as well as determine the shares of the heirs. Moreover, you can include in your will an order to assign property responsibilities to the heirs (for example, granting the right to use residential premises to your spouse).

- How to write a will for an inheritance Ordinary open will

- Closed will

- Testament of deposits with a notary

- Testamentary refusal, assignment

The legislation establishes two procedures for transferring the property of a deceased citizen to his heirs. During his lifetime, he has the right to draw up a will for inheritance with a notary and distribute everything at his own discretion. In the absence of such a document, the testator's property will be received by the next of kin in the order of succession according to law.

The Right Action

There must be at least 2 witnesses in the notary's office. When the envelope is handed over to the notary, they put their own signatures on the envelope. After this, the document must be sealed and placed in another envelope, on which the notary personally signs. He must enter all the necessary information about the testator from whom he independently accepts a sealed will. Anyone who wants to know how to draw up a will for an apartment should familiarize themselves with this sequence of actions without disclosing their intentions.

The testator enters in a special form the place and date of drawing up the will, as well as information about the persons who are witnesses to the drawing up of this document. Their full initials, as well as permanent addresses, must be written down. Only in this case the procedure will be carried out correctly. If you want to know how to draw up a will according to all the rules, you need to remember this point.

When the notary accepts the envelope from the owner’s hands, he is obliged to clarify and explain the need for hand-written signing of the document, as well as remind the rules that regulate the obligatory share in the inheritance; it is noted on the second envelope when the document is finally packaged. You need to decide in advance where to draw up a will for an apartment in order to thoroughly prepare for this. When the procedure is completed, the notary will issue the testator a special document that confirms the specialist’s acceptance of the hidden will.

Bequeath or donate? Useful tips from a notary

Starting from 2021, both spouses can draw up a will with a notary together. It is possible to distribute among the heirs both the personal property of each of them, as well as property acquired jointly during the marriage. The document is drawn up in open form, and with the consent of the spouses, the notarial act is recorded on videotape. After the couple divorces, such a will becomes invalid. It can be canceled at any time; this can be done by one of the spouses. The second half is notified by the notary about the completed action.

A testamentary document can be drawn up in the name of any relative or several, leave property to a stranger or organization, or establish a targeted inheritance fund. You can make a will in relation to part of the inheritance, for example, an apartment or car, or intellectual property rights in the name of a specific heir. The following rules are observed.

- You can only bequeath what belongs to the citizen personally. Therefore, of the property acquired during marriage, only ½ part will be included in the inheritance mass - the legal spouse has the right to allocate her half.

- Inheritance not specified in the will passes to the relatives of the deceased according to the rules of legal inheritance. That is, it is distributed equally among the heirs of the summoned queue.

- You can bequeath not only what is actually available on the day the will is made, but also what will be acquired in the future. There is no need to submit property documents.

- A will of a share of an inheritance does not deprive its recipient of the right to participate on general terms in the distribution of property that was not mentioned in the testamentary disposition.

- You can draw up several testamentary dispositions, indicating different objects and items. If the instructions relate to the same property, the document drawn up last is valid.

Before drawing up the document, the applicant is warned against signature about the provisions of the law regarding compulsory heirs. These include children under the age of majority, elderly parents, spouses of retirement age, as well as able-bodied relatives with disabilities.

Additionally, the circle of compulsory heirs includes the testator’s dependents, even those who are not related, if he supported them for at least a year before his death. The listed categories of persons receive half of what would be due to them upon inheritance by law.

It does not cost much to create a death directive. The cost of notarization does not depend on the composition of the property: real estate (land, houses, apartments) or movable things (car, collections). There is no need for their appraisal or property documents. All this will be required by successors who, after the death of the testator, will apply to inherit under the will.

The price of registering a will consists of a state fee and payment for legal (technical) services. The latter includes the work of a notary and storage services. The cost of notary services is set by the city notary chamber and is the same throughout the region.

A will is a one-sided transaction in favor of the heirs; drawing it up is simple and inexpensive. At the same time, the testator prevents possible disputes between relatives after his death, deciding the fate of the property during his lifetime at his own discretion. All hassles associated with obtaining property, registering it and paying state fees will be borne by the legal successors.

Our notary office is located in the very center of Moscow, on Strastnoy Boulevard, 7.

The work schedule is daily, until late evening (21.00), without lunch. You can contact us by phone to make an appointment at a convenient time and invite a notary to your home. We accept visitors on weekends and holidays, so you can have your will certified by a notary on any day.

Only its owner has the right to formalize the transfer of housing by gift or will. Those. his ownership must be registered by Rosreestr. In this case, the property of the donor/testator must be exclusively personal.

If housing was acquired (received or purchased) during marriage, it is the joint property of the spouses, even if their marriage was subsequently dissolved. Its owners do not have the right to dispose of an apartment that is jointly owned individually.

Testamentary dispositions and refusals

A citizen who wants to manage his cash deposit in a bank can do this in two ways. One way is to make a will according to the general rules, the second is a testamentary disposition of rights to funds in a bank (hereinafter referred to as the disposition).

The procedure for making orders is regulated not only by the Civil Code of the Russian Federation (Article 1128), but also by such a normative act as the Rules for making orders of rights to funds in banks, approved by the Government of the Russian Federation dated May 27, 2002 No. 351 (hereinafter referred to as the Rules). A citizen has the right to manage money only in the bank, as well as in another credit organization in which he has deposits or accounts.

The order is drawn up in writing at the bank (credit organization) where the testator has a deposit or several deposits. Moreover, if a citizen has several deposits, then one order can be drawn up for all of them. The order must bear the date of preparation and the personal signature of the citizen.

Such an order can only be certified by a bank employee who is specially authorized (has the right) to accept orders from the depositor on accounts (deposits). The testamentary disposition must be drawn up in two copies, one for each party.

The testator's account will contain a note indicating that the testamentary disposition has been made. In the event of the death of a citizen, the notary is obliged to make a request to the bank regarding the fact that the bank employees have certified the testamentary disposition.

For your information

Even if a testamentary disposition is made in relation to the funds in the bank, in accordance with the legislation of the Russian Federation they will be included in the general inheritance mass and inherited on a general basis. Funds are issued upon presentation by heirs

certificates of inheritance

.

Taking into account the paperwork, as well as the order and form in which such acts are submitted for certification and storage by a notary, we can distinguish the following types of wills:

- open and closed;

- certified by a notary or authorized persons;

- written under emergency circumstances;

- including certain conditions;

- on immovable objects;

- testamentary dispositions.

This is not a standard will that is made in relation to a checking account or deposit. The document is drawn up and certified by an employee of the financial institution. In other words, we are talking about a will for money that is kept in the bank.

We invite you to read: Establishing kinship in court