What threatens the employer if the salary is less than the minimum wage?

The minimum wage (SMW) is a constantly changing value, so it needs to be monitored.

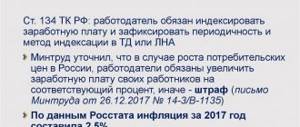

Its size is established by amending the Law “On Minimum Wages” dated June 19, 2000 No. 82-FZ. As of January 1, 2020, it was RUB 12,130. (see our article for more details). From 01/01/2021 the minimum wage is 12,792 rubles. The size of the minimum wage corresponds to the level of the subsistence minimum established for the 2nd quarter of 2021. However, this is the last minimum wage defined in this way - the value of the minimum wage will subsequently be determined as 42% of the median wage in Russia (calculated by Rosstat). In addition, it will have to meet two conditions: not be lower than the minimum wage for the previous year and not lower than the subsistence level for the current year (Article 3 of Law No. 473-FZ dated December 29, 2020).

The obligation to adhere to the minimum wage is laid down in the Constitution of the Russian Federation (Articles 7, 27), the Labor Code of the Russian Federation (Articles 133, 133.1) and Law No. 82-FZ (Articles 2, 3). Failure to comply will result in administrative liability under Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, which determines the elements of the offense: setting a salary in an amount less than that provided for by labor legislation.

Punishment for legal entities is a fine from 30,000 to 50,000 rubles. In addition, according to the same norm, the manager can be fined at the same time, in the amount of 10,000 to 20,000 rubles. (Part 3 of Article 2.1 of the Code of Administrative Offenses of the Russian Federation, paragraph 1 of paragraph 15 of the resolution of the plenum of the Armed Forces of the Russian Federation dated March 24, 2005 No. 5).

In case of repeated commission of the same violation, Part 7 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, in which the fines are higher.

Note! For entrepreneurs and managers, criminal liability is also provided if (Part 2 of Article 145.1 of the Criminal Code of the Russian Federation):

- wages below the minimum wage were paid for more than 2 months;

- this was done out of selfish or other personal interest.

Sanctions under Part 2 are a fine, forced labor, and imprisonment. According to Part 3, the same act that entails grave consequences is punishable.

How to calculate and arrange an additional payment up to the minimum wage, read the ready-made solution ConsultantPlus. If you do not have access to the ConsultantPlus system, you can register for free for 2 days.

What is the minimum wage and how is it applied?

Each subject of labor relations must understand that the minimum wage represents the lowest level of remuneration accrued to an employee for his work activity, provided that he has worked the standard period of working time in a month.

The size of the minimum wage is adopted at the state level and is fixed through the publication of a legislative act. All employers who employ individuals under employment agreements must comply with the established minimum value in force for a given period of time.

Competent persons have the right to inspect business entities for compliance with this rule, and in cases where a violation is committed, bring employers to appropriate penalties. Responsibility for paying salaries to employees below the minimum wage is provided for by the Code of Administrative Offenses.

Attention! At the same time, an organization or individual entrepreneur must still bring the salary of its employees to the minimum established by law, even if they have paid all the fines. You also need to take into account that the salary may consist of various parts. To compare it with the minimum wage value, the total amount is accepted.

Therefore, the answer to the question whether the salary can be less than the minimum wage can be answered - yes, this is possible. But if the staffing table, in addition to the salary, provides for other accruals for this employee (bonuses, additional payments, etc.), you need to sum up all the parts. However, if the employee has a piece-rate wage calculation option, the final remuneration cannot be less than the minimum wage.

There are two types of minimum wage depending on who accepts the value. If the law is issued by the federation, then the minimum wage is federal and must be observed throughout Russia.

When this standard is issued by the constituent entities of the federation, the adopted value is valid in the territory of a particular region and cannot be lower than the established federal minimum wage.

Companies and entrepreneurs are required to comply with the regional minimum wage, and it may be higher than the federal level. This is due to the fact that regional authorities take into account existing working conditions when establishing this minimum. Today, 85 regions of Russia have adopted regional minimum wages.

Important! The minimum wage is used not only to regulate employee remuneration under employment contracts, but also to determine social benefits (disability benefits, maternity benefits, etc.).

Until 2021, its value was used to calculate the contributions entrepreneurs paid for compulsory insurance for themselves. But with the introduction of fixed amounts, the minimum wage ceased to be used for these purposes.

When the basic minimum wage is established, the calculation mechanism is based on the cost of living in effect in the second quarter of the previous year. If, when setting the value for the next year, the value of the subsistence minimum turns out to be less than the current one, then the minimum wage will not be lowered. Its value will be taken at the level of the previous year.

The competent authority will check whether it was possible to pay wages less than the minimum wage

Important! Prosecution is preceded by an inspection, which can be carried out following a complaint from an employee or a report in the media, or on a scheduled basis (Article 360 of the Labor Code of the Russian Federation). Inspections are usually carried out by a special supervisory body - a territorial body of the Federal Service for Labor and Employment (Rostrudinspektsiya) or the prosecutor's office, where employees often turn. However, if a violation is detected by the tax authority, it will be reported to the labor inspectorate under jurisdiction. So there are many options for detecting this fact.

State labor inspectors are empowered to freely enter the territory of any employer upon presentation of a certificate (Article 357 of the Labor Code of the Russian Federation). If violations are detected, an order to eliminate them may be issued. But most importantly, they can draw up a protocol on an administrative offense - such a power is enshrined in Art. 28.3 of the Code of Administrative Offenses of the Russian Federation (for more details about the procedure, see our article “Administrative liability of legal entities - concept”).

When conducting an inspection:

- There is no need to shy away from giving explanations. An employee who does not have sufficient information may refer to this when giving explanations, since the organization will have the opportunity to provide the necessary documents and explanations (objections) before considering the case.

- It happens that not all documents are available at the time of the audit (for example, they were transferred to the auditor). This also needs to be indicated in the explanations.

The concept of a living wage

Our country's economy is based on clearly defined financial values.

They allow you to calculate current expenses and profits, as well as plan upcoming periods. The value closest to ordinary citizens is the cost of living.

Federal Law No. 134 of 1997 deals with the lower limit of payments. This indicator consists of the cost of all vital goods consumed:

- payment for accommodation, utilities;

- spending on food needs;

- spending on non-food products;

- fare;

- economic needs;

- minimum cultural needs and others.

These calculations are revised quarterly, based on the real prices of goods and services that are included in the indicator in question. Temporary analytical groups are specially created to compare and calculate all types of spending by the average Russian.

The standard calculation of the living wage is carried out in relation to all categories of citizens, including:

- minor children;

- pensioners;

- able-bodied citizens.

The size of this amount is also affected by the region of residence and its location.

After all, this is due to climatic conditions and nature. Important: From the beginning of January of this year, the cost of the minimum standard of living will increase slightly, since the dynamics of prices for goods and services is creeping up very quickly.

And yet, can a salary or salary be less than the minimum wage?

Let's consider the options when an employee can quite legally receive less than the minimum wage or his salary is less (which is not the same thing):

- The salary may be less than the regional figure if the organization has not joined the regional agreement in accordance with Art. 133.1 of the Labor Code of the Russian Federation (i.e., within 30 days after publication of the proposal, it sent objections).

- An employee’s salary (fixed payment per month) can be less than the minimum wage only in 1 case: if the employee receives incentive payments, compensation and allowances in addition to it (confirmed by the decision of the RF Armed Forces dated August 30, 2013 No. 93-KGPR13-2). However, regional coefficients should not be included in these categories. They apply to wages, which must no longer be less than the minimum wage.

- The employee did not comply with working time standards or labor standards (the condition for compliance is stipulated in Article 133 of the Labor Code of the Russian Federation). This case should not be confused with situations where reduced working hours are established by law (for example, for people with disabilities - Article 92 of the Labor Code of the Russian Federation).

- An employee can receive a salary that is less than the minimum for the reason that 13% personal income tax is withheld from it. The eligibility requirement applies to the original earnings.

***

Thus, the employee's salary may be less than the minimum wage.

But you need to remember that the minimum wage is changing upward, and there are also nuances in calculating wages, and avoid violating legal requirements, given the high level of responsibility applied to the employer in this case. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What should an employee do and where should he go?

If an employee is paid less than the minimum wage, he can complain to the regulatory authorities:

- An active trade union - it is authorized to resolve labor disputes between its members and the business entity. If necessary, he will provide assistance in preparing a complaint to the labor inspectorate, prosecutor's office, and other regulatory authorities.

- Labor Inspectorate - oversees compliance with labor laws. Accepts a written statement of violation, on the basis of which an inspection can be initiated. Does not resolve issues related to money - if an employee wants to receive compensation for the time when he had a salary less than the minimum wage, he must go to court.

- The prosecutor's office is a supervisory body that can receive statements of violations from employees and conduct inspections. Based on their results, the prosecutor's office is authorized to open administrative or criminal court cases.

- Court - to go to court, it is necessary to prepare an evidence base, as well as hire a lawyer who will represent the interests of the employee. Based on the results of the proceedings, the employee may be awarded compensation for the entire period, for delayed wages, coverage for moral damage caused, compensation for attorney fees, etc.

Cases of appointment

The purpose and rules for using this indicator are as follows:

- control and adjustment of employee salary levels;

- regulation of the amount of social payments (unemployment benefits, maternity benefits, sick leave and others);

- assessment of the rights of categories of citizens insured under pension provision.

Article 129 of the Labor Code of the Russian Federation and other legal acts clearly define the components of national significance in their content:

- when calculating an employee’s salary, it is necessary to take into account his qualifications, the amount of work performed, and working conditions;

- it is necessary to make additional payments for irregular working hours or for difficult working conditions;

- on top of the salary, pay bonuses, allowances and other payments to team members.

But if, with all the compensation and incentive additional payments, the amount is less than the minimum, then the director is obliged to pay the employee additionally.

Attention: In the case of additional workload or work at 1.5 times the rate, this is not a reason to assume that the total earnings should be the minimum.

In what cases can a salary be less than the minimum wage?

Some bosses are interested in the question: is it possible to pay a salary less than the minimum wage?

It is worth knowing that such a concept as wages includes several concepts:

- official salary;

- allowances;

- additional payments;

- incentive payments;

- processing and others.

The number of possible cases in which a reduced rate of monetary remuneration for work is allowed is quite large. Let's take a closer look at some of them.

Part-time work

Persons working part-time or on a reduced schedule may receive a salary less than the amount established by the state. Its calculation is carried out in proportion to the period of time worked or in accordance with the amount of work performed.

It is worth noting that the reduced working hours regime is prescribed in the agreement between the participants in the labor process.

Employee has been working for less than a month

There are situations when an employee joins or leaves an enterprise within a month. It follows that wages cannot be paid in full, but only for the period of time actually worked.

In this case, a full-time employee can count on a reduced salary below the current rate.

There was downtime in production

In the event of downtime at production, which may be due to various economic, technical, technological or organizational reasons, their employees continue to receive at least 2/3 of the average salary (Part 1 of Article 157 of the Labor Code of the Russian Federation).

But provided that this situation arose due to the fault of the employer or independent reasons. According to Art. 107 of the Labor Code of the Russian Federation, this time does not in any way relate to the employee’s rest.

Salary deductions

Each employer legally deducts 13% personal income tax from the salaries of its subordinates. As a result, workers may receive wages below the established minimum wage. There are no violations here if the amount of payments before withholding was higher than or equal to the state indicator.

Important: If an employee has deductions made under a writ of execution to pay for alimony or other financial liability, then the total amount may be less than the minimum. This is also not a violation if the total salary was initially within the normal range.

Part-time work

Part-time work is additional paid work in another position or profession. An accepted part-time worker performs official duties in his free time from his main job (Part 1, Article 60.2 of the Labor Code of the Russian Federation).

Such work is paid only for actual time worked. For example, a person is accepted at 0.5 rate, which means that his monthly payment should not be less than 50% of the federal figure.

Thus, the salary of such an employee may be below the minimum value.

Being on sick leave or on vacation at your own expense

Having temporarily lost the ability to work, an employee can only count on remuneration from the employer for the time actually worked. And sick days are compensated from the Social Insurance Fund.

If a person is on free leave or absenteeism, this period of time is not subject to payment. At the end of the month, he will receive a salary only for the days worked.

Other cases

If work or services for a company are provided under the terms of a civil contract, which has nothing to do with an employment contract, then remuneration is piecework and the cost of work performed is not regulated by minimum wage legislation.

The terms of the concluded agreement are determined at the discretion of both parties before signing.

Employer's liability

The employer is liable under Art. 5.27 Code of Administrative Offences. It involves fines for officials and the company. The official may be disqualified. In case of a short-term offense, the employer may limit himself to a warning.

If it is found that the employer reduced wages and embezzled employees’ money, then he may incur criminal liability under Art. 145.1 of the Criminal Code of the Russian Federation.

If the employer’s actions show signs of fraud, he may be held liable under Art. 159 of the Criminal Code of the Russian Federation.

Are there any fines?

As part of administrative liability, the fine is 1-5 thousand rubles for individual entrepreneurs. For a company it is 30-50 thousand rubles.

In case of repeated violation, the fine for an individual entrepreneur increases to 10-20 thousand rubles, for an organization - 50-70 thousand rubles.

As part of criminal liability, an employer may be punished with a fine of up to 500 thousand rubles for complete non-payment of wages.

In case of partial non-payment, including due to illegal salary reduction, the fine is up to 120 thousand rubles.

To answer the question - can a salary be less than the minimum wage - you need to remember that the employer can use alternative forms of employment. An employee may be hired under a contract for paid services.

This is also considered illegal and is punishable by an administrative fine of up to 100 thousand rubles. – if the violation is detected for the first time .

In case of repeated violation, the amount of the fine increases to 200 thousand rubles

Find out what percentage of pension contributions from your salary. How many days between advance and salary in 2021? Information here.

What to do if your salary is in arrears for more than 3 months? Details in this article.

You should take into account the prospects for remuneration even before employment in a particular company, so as not to test your patience with long-term violations of labor rights by the employer and possible protracted conflicts on this matter.

Some nuances

As we mentioned above, there are two minimum indicators:

- federal;

- regional.

The latter is adopted in each region separately on the basis of the federal one and has increased significance. But business entities retain the right to choose which value to rely on when calculating employee salaries.

They can also independently approve payment systems. Moreover, the maximum wage is not established by law.

After the regional value is adopted, employers are obliged to comply with its conditions by default, of course, unless they submit a written refusal within a month, presenting compelling reasons.

The cost of living in Russia

Each quarter, the value of the minimum indicator varies under the influence of inflation trends in the national economy.

The cost of living for the first quarter of 2021 will be established based on the results of the last quarter of 2021. Each category of citizens has their own consumption baskets, so the accrued amounts are different.

The national average for the last quarter was the following statistics of minimum payments:

- for an able-bodied citizen – 11,280 rubles;

- for a minor child – 10,390 rubles;

- for a pensioner – 8,583 rubles;

- per capita (on average) – 10,444 rubles.

These are the amounts that constitute the living wage in Russia at the beginning of 2021.

Can wages be below the subsistence level?

Many workers often wonder whether a salary can be less than the living wage? The Labor Code of the Russian Federation clearly defines that wages below the subsistence level are not allowed.

Reduced wages are a problem not only for the employee, but also for the employer, because according to Article 133 of the Labor Code of the Russian Federation, wages cannot be lower than the officially recorded minimum subsistence level.

But only under the following conditions:

- the citizen is the main worker of a certain organization;

- the employee works for a full eight-hour day;

- the person fully fulfills the temporary norms established by the labor regulations.

The legislation of the Russian Federation provides for sanctions in the form of holding the management of the organization accountable by imposing a fine in case of violation of payments to employees of the funds due.

Attention: A citizen employed on the basis of a civil contract does not have the right to demand a minimum payment from his boss.

Where and how to complain about low wages?

The law of the Russian Federation is always on the side of the workers. But in fact, there are often cases when the monthly payment is below the subsistence level. It is quite logical for offended employees to ask what to do in this situation and where to turn to protect their own rights?

Labour Inspectorate

The competence of this body is to protect the rights of workers from the arbitrariness of employers. If you know that the company’s management is deceiving and paying a small amount illegally, then know that there are various types of liability for this.

An employee has the right to appeal the unlawful actions of the company administration by contacting the Labor Inspectorate and receive the due monetary remuneration.

This authority must organize an unscheduled inspection of the company. If violations are confirmed, the inspector will take the necessary measures to eliminate them:

- suspend the activities of the enterprise;

- impose a fine;

- will bring violators to criminal or administrative liability.

To contact the Labor Inspectorate, the victim must draw up a statement in which he describes with maximum accuracy all the facts of the violation.

Prosecutor's office

When contacting the supervisory authority, you also need to write an application and send it in any convenient way. It must be accompanied by papers that serve as evidence of the violations described. If an employee is wary of harassment from his superiors, he can state in the application that it is anonymous.

After accepting the application, the Prosecutor's Office conducts an investigation into the stated circumstances and, if the employer is confirmed guilty, will hold him accountable.

There are three ways to submit an appeal to the Prosecutor's Office or the Labor Inspectorate:

- Submit your application in person.

- Send the complaint by mail with a notification letter.

- Submit an application directly on the official website.

Important: No matter what authority a person contacts, each authority must give a written response about the presence or absence of violations of labor laws in the employer’s actions.