If the salary for May increases due to the minimum wage for all employees of a structural unit, branch or institution, this will affect the calculation of vacation pay. Let's look at examples of how the second increase in the minimum wage in a year will affect the calculation of vacation pay. Is it necessary to pay extra vacation pay if it is less than the minimum wage? Read the article. Since the beginning of the year, the minimum wage has been increased twice.

WATCH THE VIDEO ON THE TOPIC: Recalculation of vacation pay after a salary increase.

Minimum wage and wage indexation

Vacation is a paid period of vacation that is provided to all employees who have performed their job function for 11 months. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:.

So, he is able to exercise his right to leave after 6 months. Some categories of workers may take it earlier. Thus, a minor employee has the right to go on vacation before the expiration of the six-month period. Vacation payments are calculated based on average earnings. This indicator is multiplied by the number of days.

This way you can calculate the amount of vacation pay. Labor laws provide minimum guarantees for workers. In particular, the legal act stipulates that the average monthly salary cannot be lower than the minimum wage. This indicator is approved annually at the state level.

It increases as inflation rises. To calculate vacation pay, you need to calculate two indicators:. The duration of vacation, as a general rule, is 28 days Art. Those employees who have performed their job function for 11 months after being hired for a new position or since the last vacation can apply for this leave. An employee can receive his legal half of vacation after 6 months.

An employee can divide his vacation into parts according to the rules approved by the Labor Code of the Russian Federation. Average earnings is an indicator that is calculated using the formula:. The minimum wage is an indicator approved at the legal level. It serves as the guaranteed minimum that the employee will receive when performing work functions. Consequently, this includes compensation incentives, bonuses, etc.

Also, only those workers who performed their labor function during the established working hours can apply for the minimum wage. The minimum wage is approved at the federal level. Subjects of the Russian Federation can set their own indicator, which will exceed the federal figure.

It was significantly increased compared to the previously approved figure of rubles. Vacation payments are calculated according to the rules that we have already mentioned earlier. This indicator will depend on the employee’s income and the duration of the vacation. The billing period can be 11 months. In some cases, this figure will be less, for example, 6 months.

Individual days are excluded from the calculation period - the employee is on sick leave, on leave without pay, etc. In July, he took sick leave and actually worked 14 days. When should vacation pay be transferred according to the law? Find out here. To get the average earnings, you need to add up all the income received by the employee in the billing period.

It must be taken into account that some profits are not considered when calculating this indicator. Let's give an example of calculating vacation pay. Sidrov P. He worked for 12 months. During this period, he received income in the amount of thousand minimum wages - an indicator that affects many payments.

Thus, it is taken into account when calculating maternity benefits or disability benefits. It also plays a role when calculating vacation pay for an employee.

If a certain employee performed his labor function during the entire working time during the billing period, then his average earnings cannot be lower than the minimum wage. So, at the final stage of calculation it is necessary to compare vacation pay and the minimum wage.

What to do if the number turns out lower? The employee must be paid additionally. Let's give an example. Ivanov A. At the moment, the minimum wage was in force in the amount of 7.5 thousand. When calculating the amount of vacation pay, it was revealed that Ivanov’s average monthly income was 6 thousand.

Thus, Ivanov has the right to claim an additional payment to vacation pay in the amount of .32 rubles. If an employee performs a labor function on a part-time basis, then the calculation is also made. At the same time, additional steps are taken to calculate the minimum wage in proportion to the amount of time worked. Do you need a formula for calculating unused vacation upon dismissal? Read here.

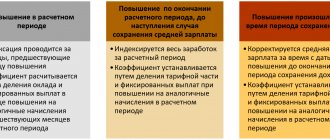

What to do if vacation pay is not paid on time? Details in this article. Indexation upon salary increase If there is a salary increase, then the answer to the question of whether vacation pay needs to be indexed will depend on the moment the decision was made:. Trending Deductions from wages Recalculation of wages Transfer of wages to a card Unofficial salary Salary below the minimum wage Salary payroll Supplement to salary Debts on salary Deductions from salary What percentage of the salary is an advance?

The amount of vacation pay is calculated using a special formula. Payment of vacation pay upon dismissal is mandatory. Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems. Add a comment Cancel.

Indexation of vacation pay when salaries increase in 2021: how to correctly calculate vacation pay

One of the pressing and controversial issues for managers of commercial organizations and accountants remains the indexation of vacation pay when salaries are increased in 2021.

Despite the fact that this issue is spelled out in the Labor Code, not everyone correctly understands the procedure for calculating such a coefficient and the method of calculation.

In this article we will describe in detail how indexing is carried out and what are the legal grounds for its implementation.

Indexation of vacation pay when salaries increase in 2021

Legal basis

The meaning of indexing should be properly understood. This is a coefficient that adjusts for price increases. Thus, when wages or other payments are indexed, the general financial condition of workers does not increase, but remains at the same level compared to the same period last year.

This adjustment is made at the beginning of the year, and many workers mistakenly confuse it with a wage increase. However, these two concepts have completely different legal basis. If the salary increase occurs solely by decision of the enterprise management, depending on capabilities and budget, then indexation is mandatory.

Regardless of the wage fund or the intentions of management, each employee, according to the Labor Code, must have their pay indexed annually. Such state guarantees are regulated by Article 134 of the Labor Code of the Russian Federation and make it possible to provide workers with the necessary living wage, taking into account rising prices.

Article 134 of the Labor Code of the Russian Federation

This clause must be specified in the employment contract or any other act that is the basis for establishing labor relations between the employer and the employee.

Pay increases and indexation: similarities and differences

The only thing that these two concepts have in common is that both increased pay and indexation are aimed at increasing wages. The difference is that the bonus does not imply an increase in the employee’s well-being. That is, the employee receives the same level of payment, but adjusted for real consumer prices. This indicator directly depends on the level of inflation in the country.

An adjustment can also be made for the cost of living, the minimum food basket. Therefore, the amount of such surcharge may differ in different regions. After all, the cost of living level is set for each region separately.

Dynamics of the cost of living in Russia

Indexation procedure

The agency analyzes and compares prices for the required list of food and household goods, determining the minimum amount. Thus, inflation is designed to protect the employee from price increases by keeping his salary at the same economic level, regardless of rising inflation.

Inflation allows an employee's salary to remain at the same level as rising prices

Table 1. Differences between inflation and salary increases

Indexation Salary increase

| Personal decision of the employer, increasing the profit of the enterprise | ||

| Degree of obligation for employer | Mandatory according to the Labor Code | Not necessary |

Considering that the recalculation of wages is regulated at the legislative level, the employer is obliged to reflect the size of this coefficient in local documents.

The absence of such indexation may result in the imposition of an administrative fine. As for the frequency of holding, the law does not clearly formulate this issue.

But, despite this, such an increase must be made annually to the general level of annual inflation.

Federal Law No. 68 of 04/06/2016

The accrual procedure is established for state enterprises of the Labor Code, and for commercial companies - by an employment contract. However, in the context of the economic crisis, the government adopted a resolution and introduced a moratorium on increasing social benefits, pensions, and wages from April 6, 2021.

Frequently asked questions about indexing

Recalculation of salaries in 2021

Now the situation in the country has stabilized and starting from 2021, all salaries of budget structures have been recalculated by an average of 4%.

This indicator was the result of an analysis of the level of consumer prices and inflation.

In addition, from January 1 of this year, the government introduced a new minimum wage level, according to which the remuneration of a worker, regardless of specialty and qualifications, cannot be less than the established threshold.

The amount of indexation depends on the minimum wage

Forecasts

Therefore, if the salary is less than the minimum wage, even taking into account inflation, the employer is obliged to raise the payment to the established level. According to the latest data, the salary increase will affect an average of 2 million citizens (and this is only data from government agencies).

Additional payment of vacation pay up to the minimum wage

The Labor Code of the Russian Federation defines the basic rules for granting, determining the amount and payment of leave. The article of the Code establishes the right of employees to be granted annual leave of 28 calendar days. During the vacation, the employee retains his place of work and payment of average earnings. How to calculate holiday pay in a new way and examples of calculation are given in the article based on these rules. The amount of accrued vacation pay must be included in expenses in proportion to the vacation days that occurred in each reporting period. The amount of accrued vacation pay for annual paid vacation is included in income tax expenses in proportion to the vacation days falling on each reporting period.

When annual wage indexation is an unconditional obligation, which includes a proposal on the timing of increasing the minimum wage, the minimum wage is set per calendar month and applies to. How to correctly calculate and pay vacation pay.

How to pay temporary disability benefits from the new minimum wage

Calculate the average daily earnings from the minimum wage using the formula:

Otherwise, calculate the benefit as usual - multiply the average daily earnings by the percentage of payment and the number of sick days. Below we give a possible example of calculating sick leave from the new minimum wage.

An example of calculating sick leave from the minimum wage in 2021.

Suvorov A.B. first hired on December 3, 2019.

- the remaining amount (RUB 1,674.94) is paid from the Social Insurance Fund budget.

We take into account changes in the minimum wage in our work

Accountants have to count vacation pay during the year no less often than salaries and other payments to employees. The algorithm for calculating vacation pay per year, examples of how to carry out a new calculation of vacation pay per year, which you will find in this article, will help you understand even the most confusing situations. According to the Regulations on the specifics of the procedure for calculating average wages approved. How to avoid mistakes in calculating vacation pay. Especially for subscribers of the newspaper “Accounting.

Vacation is a paid period of vacation that is provided to all employees who have performed their job function for 11 months.