Can a director work without salary?

Important! There are several ways to prevent a director from paying wages. However, they cannot be called safe, since each option carries certain risks.

| Methods | Description |

| Payment for time worked | If the director works part-time, then his salary will be less, but insurance premiums and personal income tax will also need to be withheld from his salary. |

| Payment of dividends instead of salary | The payment of dividends every month can be regarded by regulatory authorities as a salary, which means that the company will charge insurance premiums and taxes. |

| Taking a vacation at your own expense | If the director is on vacation, then he does not have to perform his duties, including signing documents. |

| Application for waiver of salary | During the inspection, inspectors will consider that there was an employment relationship, but there was no salary. Therefore, taxes and contributions will be charged on the minimum wage. |

| Conclusion of an agreement for free services | The director may advise the organization on legal matters. |

What the law says

The current Russian legislation does not contain a clear answer to the question about the need and even the possibility of concluding an employment contract and, as a consequence, paying wages to the head of the organization, who is its sole owner. An employment contract is concluded between two parties - the employee and the employer. According to the latest version of Rostrud (Letter No. 177-6-1 dated March 6, 2013), the manager, who is the sole founder of the Company, cannot enter into an agreement with himself. In this situation, the owner must, by his decision, assume the duties of a director. And if there is no employment contract, there is no salary. The Ministry of Finance also agreed with this position in Letter dated October 17, 2014 No. 03-11-11/52558. Accordingly, to the question whether it is possible for the general director not to pay a salary if he is the sole owner of the company, the answer is positive. However, these clarifications are not normative legal acts, therefore they are not mandatory for courts to apply. Yes, and official bodies may change their position, which may also be fraught with penalties for the organization.

Method 1: Pay the director only for time worked

The head of the company can be transferred to part-time work, and from any date. To do this, you will need to draw up an additional agreement to the employment contract, as well as issue an order (93 Labor Code of the Russian Federation). The order indicates the start date of the new working time regime, the length of the working day, wages, as well as the period for which such a regime is introduced. The director will work part-time, for example, only two hours, or only one day a week, instead of five days and eight hours. Insurance premiums and personal income tax will also need to be withheld from his salary; accordingly, he will not be able to receive any benefits (

Registration and calculation of salaries

Taking into account the established salary, benefits, sick leave, vacation pay, bonuses, allowances and fines, wages are calculated every month for employees of a company, firm or institution. When issuing payments, it is important for accountants not only to correctly accrue and issue, but also to document these transactions. The whole procedure is quite complicated for novice accountants, however, experienced workers also constantly update their knowledge, read news in this area and get acquainted with new orders.

Documentation of calculations is part of accounting for salary calculations, since pay is calculated based on working hours. For time-based wages, the T-thirteen accounting sheet is used. This is an internal document that is issued to all employees upon joining.

Method 2: Pay dividends instead of salary

Paying dividends to a director instead of a salary is quite dangerous. Because upon inspection it turns out that the company is hiding employment relationships. Dividends are paid:

- once a quarter;

- based on the net profit that remains after paying taxes;

- by the owner's decision.

If you do not follow these rules and pay dividends monthly, the tax authority may decide that the dividends are a salary, which means they will charge taxes and contributions on this amount .

Documents required for calculation and payroll

Before understanding payroll calculation step by step (for beginners, detailed information is provided below), you need to familiarize yourself with the types of documents for which payments are issued. Special statements are used for processing and calculating wages. According to the law (Article 9) 402-FZ of December 6, 2011 “On Accounting”, all accounting documents and statements are developed according to standard requirements. But the state does not prohibit enterprises from developing such statements independently. It is only necessary to approve the new forms in the order on accounting policies.

Settlement document T-fifty-one is one of the main accounting documents that is used to calculate payments to employees of an enterprise. The form is filled out as follows: opposite the employee’s last name, first name and patronymic there is his personnel number, job title, rate according to the contract, number of hours per month and amount of payments. This statement must be signed by the accountant who compiled it.

Payroll T-53 is a statement that confirms the fact that wages are paid to employees. It is convenient to use, since with the help of such a document you can immediately calculate payments to a large number of employees.

T-49 - a statement of primary accounting, necessary for calculating wages for labor. It is used in small firms with a small number of workers. If you use this statement, then documents T-51 and T-53 are not drawn up.

Method 3: The director is on vacation at his own expense

The manager may be on vacation at his own expense, but the company cannot remain without a director. This means that his responsibilities must be transferred to another employee. If the director’s responsibilities are not delegated to anyone and he wants to sign the documents himself, then each time he leaves vacation he will need to be formalized and paid for. Moreover, the director is paid for the full day of work, and not just for a few hours. If the director is on vacation and at the same time signs documents, then this approach may lead to claims from the inspection authorities.

Important! If the director is on vacation, then he does not have to perform his duties, including signing documents. In this case, the regulatory authorities will conclude that the company sent the manager on vacation only based on documents. If, while on vacation, the director signs documents, they may be declared invalid. In addition, the company will be assessed a fine for non-payment of wages in the amount of 30 to 50 thousand rubles. The director will be fined in the amount of 10 to 20 thousand rubles.

If the company is not operating, then it is possible to send the manager on leave without pay, only if he does not sign documents on his own behalf. When making an application for leave, he must indicate some reason that is considered valid. For example, family circumstances. An order or statement cannot indicate that the director went on vacation due to lack of orders. In this case, the inspectors will consider such leave to be downtime, and the company will have to pay for it in the amount of 2/3 of the average salary.

What to pay attention to

There is no judicial practice regarding whether the director of an LLC may not receive a salary while being the sole founder of the company. Apparently because no one sues themselves. However, almost all courts agree that such a director has every right to both conclude an employment contract and pay for his work. Therefore, most owners, when they take the helm of their company, still prefer to receive a salary for it.

But for various reasons, there are periods when organizations, especially small ones, are forced to suspend work. We have already written that for hired workers this situation means forced downtime. What to do with the manager? There is no activity - the director’s salary is not paid? The answer to this question should also be sought in labor legislation. And the head of the company, working under an employment contract, also has the right to apply for downtime. In this case, you cannot simply stop paying salaries. But you can take a vacation without pay. And do this for any period and an unlimited number of times, naturally, indicating in the order the terms of such leave.

Well, when the company begins to generate income, the owner who manages it will be able to compensate for his work at the expense of profit. According to the law, LLC has the right to make a decision quarterly, once every six months or a year on the distribution of net profit among the members of the Company. And if there is only one participant, then he makes the decision on the distribution of profits alone.

Payroll calculation step by step for beginners: postings

In accounting, there are certain rules that govern the filling of data in the program. These rules cannot be violated, as the entire accounting data can be distorted. The latter will lead to errors, which will be very difficult to correct. This may result in the accountant being reprimanded or fired.

To record the amount of an account in accounting, you need to create an account posting with certain rules. In the posting you need to indicate: credit to the accounting account, debit to the accounting account and the amount. An entry is a computer or paper journal entry that records a change in the debit of one account and the credit of another, and outputs one amount.

Postings must be created according to certain rules. What is prohibited to be entered:

- you cannot write an amount to one account without checking another account;

- Using one entry, you cannot record two different amounts.

Such rules prevent incorrect information from entering accounting records, which makes it possible to balance the balance successfully in the end.

What else should be mentioned when talking about calculating salaries step by step (for beginners)? Postings in 1C can be created in two ways:

- enter in the form of a document, indicating the account debit, credit and amount;

- using a document that itself will conduct transactions according to a specially written program algorithm.

Typically, salaries are paid from the cash register, so based on a cash check, a certain amount is withdrawn from the current account. To do this, you need to use wiring D50 and K51. This amount can be with the cashier for only three days. If payment is not made within a certain period, the money is returned to the bank based on an announcement for a cash deposit. Postings K50 and D70 display salary payments.

Pitfalls and nuances

The difficulty in calculating wages with the general director of an organization lies in the frequent disagreement on controversial issues between representatives of the Tax Inspectorate, the Ministry of Finance and the judiciary.

It is also worth remembering that the calculation of the formal minimum salary for the CEO will affect the size of the future pension, so saving on tax deductions may be very unhelpful in the future.

Thus, organizations that are starting to operate should carefully study the specifics of hiring a general director and the procedure for calculating his salary in order to avoid possible fines and claims in the future.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Salary

Payroll calculation in 1C 8.2

In 1C version 8.2, there are two methods of calculating and calculating salaries step by step for beginners. You can manually calculate using documents in a certain sequence. You can also use the Payroll Assistant. Payroll calculation step by step for beginners without using the “Salary Accounting Assistant” involves the following steps:

- Enter all personnel orders.

- Entering constant additional payments and allowances.

- Calculation of payments for one month.

- Crediting insurance premiums from payroll.

- Formation of salary statements.

No activity - no salary

If no one else works for a company with a single founder, it enters into rare one-time deals, and the revenue is small, then we can say that permanent operations have not yet been established. In this situation, it is not profitable for the founder to set his own salary, since his efforts do not bring results.

But the lack of constant activity can be taken advantage of only if the turnover really tends to zero. In practice, this argument will not work in a situation where the director received money on account, purchased materials, entered into supply contracts, purchased and delivered goods, and the company’s revenue for the year exceeded 1 million rubles.

When should salaries be calculated?

Regardless of the number of working days of employees, it must be accrued for time worked from the first to the thirtieth day or from the twenty-eighth to the thirty-first day. These accrual conditions are specified in the law of the Russian Federation, article one hundred thirty-three of the Labor Code.

Bonuses are paid at the time of payment of the basic salary or in the manner specified in the documentation of the enterprise. The company pays benefits as rights to receive them arise.

The cashier issues the salary. The payment is issued at the company's cash desk or transferred to the employee's personal bank account. Enrollment occurs according to the data in the payroll T-53. The statement for issuing money T-53 is handed over to the cashier for five days, after which it is closed. When receiving money, employees leave their signature on the form.

Salaries in budgetary organizations

In what order does salary accrual occur step by step for beginners? For step-by-step salary accrual, you need to establish data on the staffing table, the category of employees, the rate of time tariffs, as well as timesheet information for the month. It is also necessary to take into account the regulations that regulate payment calculations.

In order to streamline and normalize wages for public sector employees, the law introduced:

- A unified tariff schedule.

- Hourly wages.

- Tariff categories.

Account seventy in accounting

Companies and firms use account seventy to display and pay remunerations - these are settlements with employees for wages. On account seventy, transactions are made for all types of payments:

- salaries;

- bonuses, bonuses;

- allowances and surcharges;

- sick leave, benefits, vacations.

Also, with the help of the account, pensions are calculated and paid to working pensioners, and alimony deductions are paid for certain employees. Typically, one such account is used to account for one employee of the enterprise.

Where does the director get the money?

The situation is especially risky when the sole founder does not pay himself not only a salary, but also dividends. Then the tax authorities will accuse him of cashing out, withdrawing shadow wages and evading personal income tax.

It is important to explain how the director lives if he does not need a salary. For example, he may receive a salary from another company, dividends from another company. Perhaps he sold the property and lives on the proceeds. He had bank deposits, which he began to spend. All these amounts must be confirmed by documents.

Compound

The first part of Article 129 of the Labor Code of the Russian Federation reflects the components of the salary of the general director, as one of the company’s employees:

- Remuneration for work: salary, tariff rate, compensation payments credited in the presence of working conditions that deviate from the norm;

- Incentive payments: bonuses.

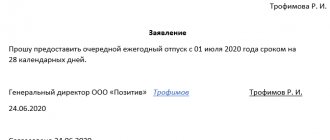

To whom does the CEO write a vacation application? Find out from the article. A sample order for unpaid leave of the CEO is here.

Payroll calculation step by step for beginners in 1C

How to use account seventy and calculate payments to employees in the 1C program? Payroll calculation step by step for beginners is described below:

- In the program, you need to go to the “Salary” tab - “Payroll for employees of the organization.”

- You must indicate your department on the open form.

- The date on the form is set automatically (the last day of the month).

- You must click the “Fill” button on the toolbar. After this, the program will automatically pull up the entire list of workers from the “Enterprise Employees” directory.

- The employee’s salary will be automatically set in the “Result” column. It can be manually changed.

- In the “Personal Income Tax Code” field, income tax is automatically calculated.

- After entering all the necessary data, you must save the document by clicking the “OK” button.