Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/07/2020

Reading time: 6 min

3

1149

- Good afternoon. The employer offered me to pay part of my salary in the form of a salary officially on a card, and the other part - monthly in an envelope. This will supposedly be beneficial for both me and him. Is it worth agreeing to this? Is this really beneficial for the employee and what risks need to be taken into account? And what responsibility is provided for the employee and the employer for receiving a gray salary?

- What is “gray salary”

- Responsibility for the employer Tax consequences

- Criminal liability

- Tax

What determines the “color” of wages?

The phrases “white”, “black” and “gray” salaries are not official; these are established designations for the form of payment to hired personnel of the money they earn.

- White salary is an amount corresponding to the salary or tariff rate, paid according to the official payroll and is fully subject to income tax and contributions to social funds.

- Black wages are money paid without a concluded employment contract (synonymous with “amount in an envelope”).

- A gray salary is a remuneration officially paid to an employed employee in a minimum or reduced amount, and most of the funds end up in hands outside of cash accounting.

Question: Does the labor inspectorate have the authority, when forcibly collecting unpaid wages from an employer, to include compensation for delayed payment of wages in the amount of the collection? View answer

How to prove the fact of black income in court?

The employee must provide the following evidence that he actually worked for the company:

- Testimony of other employees;

- Gazette;

- Photo and video recordings from surveillance cameras.

Attention! How to prove black wages? This requires the collection of documents with which you can establish the fact of payment of unofficial wages to the employee, as well as its size.

They can be:

- Pay slips with the employee’s mark of receipt;

- Envelope with name and amount;

- An advertisement in a newspaper or on a website indicating the vacancy and salary amount;

- Testimony of employees who can confirm the agreement on the amount of salary.

Attention! If the court considers the evidence presented sufficient, it will record the fact of the employment relationship between the parties and also decide to pay off the non-payment of wages.

Reasons for the “change in color” of wages

It is logical that employers decide to pay money to employees “besides the cash register” not because of a good life. There may be many reasons that may prompt them to pay gray salaries:

- quite a large percentage for payments to social funds;

- stagnation in the modern domestic economy;

- high level of inflation;

- dependence of production on rising prices for raw materials, materials, services, etc.;

- additional government fees for small and medium-sized businesses.

What are the consequences of receiving a “gray” salary ?

For an employee, the reason to agree to a gray salary may be the opportunity to pay 13% personal income tax on a smaller amount, receiving significantly more in hand than with white salaries.

REFERENCE! Today in Russia, gray salaries have become very common and tend to increase.

According to research results, some white earnings have decreased by almost one and a half times, while about 30% of employers use various variations of “gray” schemes.

When does the tax office become interested?

State supervisory authorities have launched a broad campaign to combat wage shadowing. The company will attract their interest if:

- the declared salary of employees of a particular qualification is stated to be significantly lower than the average level for a given region or for a similar industry;

- According to documents, employees in management positions receive less money than ordinary employees;

- according to data from certificates for 2-NDFL, an employee who changed his place of work began to receive a salary lower than the old one (logic dictates that a person will not change his place to a less profitable one);

- an employee of an organization, in order to obtain a loan, indicated in bank documents a different salary level than what is listed in the tax reports for his organization;

- a signal was received about the payment of a gray or black salary (an employee’s complaint, appeal, or even an anonymous call or letter).

What written evidence can confirm the fact of issuing “gray” wages ?

What threatens an exposed company?

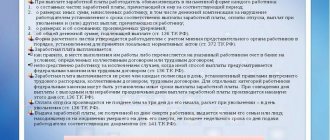

An organization that practices “gray” schemes for “optimizing” wages must be prepared for the fact that this fact will be revealed as a result of an audit by the tax authorities. If an employer does not pay personal income tax on funds issued to employees and does not deduct contributions to social funds on their basis, he is subject to administrative and criminal liability:

- Art. 122 of the Tax Code of the Russian Federation provides for a fine in the amount of a fifth of the unpaid amount for underestimating the tax base or incorrectly calculating the amount of tax payable. The fine will be assessed even if the situation of arrears or non-payment of tax was caused by the employer’s inaction.

- The same act, committed intentionally, if it can be proven, entails a double fine.

- In addition to fines and penalties, you will have to pay all unaccrued amounts in full.

- The heads of organizations may be summoned to a special commission on wages, where they will have to answer to representatives of the tax service and municipal officials and, as a result, increase the official salary, or they may face an on-site audit, where additional violations may be revealed, in addition to wage fraud.

- According to Art. 199 of the Criminal Code of the Russian Federation, if an organization does not provide tax returns or other required documents related to wages on time or if these documents contain deliberately false information, it may be assessed a fine of 100 thousand to 300 thousand rubles. And the person guilty of such a violation may be fined the amount of annual income (from 1 to 3 years), deprived of the right to certain activities or positions, or sentenced to forced labor for up to 2 years, and a six-month arrest or imprisonment (up to 2 years) is also possible.

- If problems with tax returns arose due to the preliminary conspiracy of a group of persons or the size of the violation is particularly large, the amount of fines will increase (maximum up to 500 thousand rubles), and the terms of punishment will be lengthened (forced labor for up to 5 years, restrictions on activities for up to 3 years, imprisonment for up to 6 years).

Where to complain

If a conflict situation arises with the management of the company, it will be very difficult to achieve payment in the event of dismissal based on the actual salary paid. This can only be achieved through the courts.

Of course, you can try to solve the problem peacefully. It will be necessary to send the employer a written notice of failure to fulfill obligations and possible recourse to court. But, as a rule, the organization’s administration is convinced that the employee is unlikely to resort to legal proceedings. And not everyone can prove the guilt of management.

But at the same time, it remains possible to contact the Federal Tax Service or the labor inspectorate. They pay very close attention to information about tax evasion and violation of employee rights.

But this does not always bring the desired result.

it is quite possible to prove the payment of “gray” wages in court without involving a lawyer. This will require the presentation of substantial evidence during the process.

It can be:

· Certificates in form 2-NDFL, issued earlier, the information in which differs from that indicated in the salary statement:

· Testimony of witnesses;

· Video shooting or photography;

· Any documentation confirming the funds actually issued.

Existing judicial practice confirms that to prove the employer’s guilt when posting vacancies where a higher income is indicated than shown in the statement, or a discrepancy between the position and remuneration.

Learn important things: How to become self-employed - Instructions

In this case, both the employee and the tax inspectorate can make claims. To initiate an inspection, the employee will need to file a complaint with the labor inspectorate. He can also attach a request for non-disclosure of personal data to a third party and then the company management will not know on whose initiative the verification activities are being carried out.

You can contact the regional office of the Labor Inspectorate of the locality by calling or making an appointment. You can also leave a complaint on the Rostrud service portal.

ATTENTION! Before submitting an application, you need to fully compensate the resulting personal income tax debt, because the liability in this case will affect not only the employer, but also the employee.

In addition, you can file a complaint with the tax authorities or the prosecutor's office. The procedure for contacting all authorities is identical. You will need to send a written appeal, attaching evidence on this fact. The letter can be sent by post, submitted in person, or the application can be made by telephone.

IMPORTANT! The response is sent to the applicant within 30 days from the date of registration of the statement of infringement of rights. But first, a check must be carried out on the stated facts and a conclusion must be prepared.

Possible consequences for personnel

It may seem that the blame for gray wages lies entirely with the employer and only one party is responsible before the law. However, it is not. An employee who has received income on which taxes required by law have not been paid must declare it independently and pay the required amounts to the budget. The deadline for this is until April 30 of the following year, and for payment - until July 15.

If a person did not do this and was caught, he will be held accountable under Art. 228 of the Tax Code of the Russian Federation, according to which individuals themselves are responsible for paying personal income tax if the duty of a tax agent has not been fulfilled. He faces a fine of 5% of the amount of unpaid tax for each overdue month (up to 30% of the full amount, not less than 1000 rubles). And if the violation was repeated or particularly large in size, liability may be criminal:

- fine from 100 to 500 thousand rubles;

- a fine in the amount of salary or other income for a period of 1 to 3 years;

- arrest for 4-6 months;

- imprisonment for up to 3 years.

Responsibility for accruing earnings below the minimum wage

Types of liability

The issue of administrative punishment of an unscrupulous employer is considered in accordance with Parts 1, 2 of Art. 23.1, 23.12 Code of Administrative Offenses of the Russian Federation in the labor inspectorate or in court. In addition, if employees are paid wages below the minimum wage for more than two months, the head of the enterprise faces criminal liability.

Federal Law No. 82 “On Minimum Wages” of 2000 stipulates that an employee’s salary cannot be less than the established minimum wage. The obligation to comply with this provision is established by Art. 7 of the Constitution of the Russian Federation, art. 133 Labor Code of the Russian Federation.

The employer's responsibility for wages below the minimum wage is established by the Code of Administrative Offenses of the Russian Federation. So, if wages are accrued in a smaller amount than regulated by labor legislation, then management is held accountable under the Code of Administrative Offenses of the Russian Federation:

- Assignment to payment of a fine. For companies and enterprises registered as legal entities. persons, it is provided in the amount of 30,000 rubles.

- When a salary is re-calculated below the minimum wage, the amount of the sanction increases (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Watch the video about the employer's responsibility in case of non-payment of wages or when the paid wages are “black” or below the minimum wage

Why is a white salary still preferable?

For employers, the main incentive to pay white wages is still the fear of possible liability before the law. But if workers do not agree to these schemes, the employer will have to withdraw their earnings from the shadows. What is the benefit of an official white salary for employees?

- Motivation. Work paid for in cash will be more productive, since the employee will feel care and official security, which cannot be promised by payment in an envelope.

- Guarantees. Payment of wages on time and in the prescribed amount is the legal obligation of the employer. For a late or incomplete “envelope”, the employee cannot demand compensation from the employer or legally influence him to restore the violated rights.

- Social sphere. Many social payments, for example, maternity benefits, child care benefits, disability benefits, vacation pay, etc., are calculated based on the amount of wages officially indicated in the documents.

- Lending. When receiving a loan, a person receiving a white salary will not have any problems, because his income is recorded in all funds, and with a gray salary, discrepancies are possible.

- Future pension. This argument is decisive in many cases. The size of a working citizen’s future pension directly depends on contributions to the Pension Fund. If they are not made or are paid in reduced amounts, this will inevitably affect the amount of future pension provision. The person receiving a gray salary makes a choice in favor of an immediate increase in the amount received in hand, thereby depriving himself of a significant part of his future pension savings.

NOTE! If the employer refuses to pay the salary or part of it officially, despite the employee’s request, the employee has the right to contact the labor or tax inspectorate or the prosecutor’s office.

Advantages and disadvantages

When using such a settlement scheme between employer and employee, there are advantages and disadvantages, and before deciding on such cooperation, it is worth weighing the pros and cons.

A positive aspect for an employed person is receiving the highest income, from which the amount of tax is not deducted.

The disadvantages include:

· If labor disputes arise, employees of the organization will be able to receive only the smallest compensation;

· Compensation for sick leave, assistance upon dismissal, vacation pay will be as small as possible;

· No contributions are made to the Pension Fund of the Russian Federation, which participate in the formation of a future pension; the employer does not pay wages in full;

· When applying for a loan, a certificate of income officially confirmed by tax reporting is provided.

There is also no opportunity to receive a tax deduction, since you cannot take a 2-NDFL certificate and the tax is not paid.

A significant negative point for the employer is the risk of prosecution and the imposition of penalties due to non-compliance with labor laws.