Consequences for the employee

If the fact that an employee receives illegal wages becomes known, he will not face any punishment.

However, this method of remuneration creates a number of problems for him:

- If the boss pays for work unofficially, the very fact of receiving a salary and its amount depend on his personal qualities. There is a risk that the employee will not receive the money in whole or in part.

- If an employee who has been registered resigns, he is entitled to certain payments (for example, for unused vacation). In the situation under consideration, not only should he not count on additional payments, but he may not receive payment for the work already done.

- If someone who worked officially loses their job, they can count on full assistance from the employment service. An unofficial employee can expect much less assistance. In particular, it must be taken into account that the amount of unemployment benefits paid is determined by the official salary.

- If an employee falls ill while performing unofficial duties, he cannot count on sick pay or the fact that he will not lose his job during this time.

- If you are injured while working under an agreement, it makes no sense to expect any compensation payments. And if it is severe, then it will be very difficult to prove the employer’s guilt (if any).

- At a young age, most people believe that it is important to find a job now and think about retirement sometime later. However, pension payments are determined by lifetime service, and such work does not provide insurance coverage.

- When a woman is expecting a child and at its birth counts on financial support from the state. But if you apply for a job unofficially, the amount received will be significantly less than with official employment.

- For some categories of the population, the legislation provides for such forms of support as the prohibition of dismissal in certain situations, the provision of special working hours, additional leaves, and others. This applies in particular to people with disabilities. If a person works unofficially, then these rules cease to apply.

- When obtaining bank loans, you must provide proof of your income. This can be easily done if the employment is official. However, when working without registration, the bank will not be able to prove the existence of income.

Our comment:

Anna Ustyushenko, INTELLECT-S, especially for the Labor Law magazine:

The problem of unofficial wages is so acute today that labor disputes over its collection have become an expectedly common occurrence.

Ustyushenko Anna Mikhailovna

Partner

I believe that the judicial statistics of such disputes do not reflect the real situation on the labor market: if the recovery of such wages were guaranteed (or the plaintiff was presumed to be right in the dispute), their number would be significant.

However, the real situation is that the courts in disputes about the collection of “black” wages take the position of arbitrator due to them (unlike other types of labor disputes). That is, we can talk about a refined application of Article 56 of the Civil Procedure Code of the Russian Federation, obliging each party to prove the circumstances to which it refers as the basis for its claims and objections.

In this case, a letter in which the reader describes his success in the case of collecting unofficial wages is proof of this. It is worth paying attention to the following facts of this case:

- voluntary additional payment made to the employee repeatedly (with the involvement of supervisory authorities);

- passive participation of the defendant in the case (absence of his representative);

- the plaintiff has evidence of the declared amount of wages.

With such a preponderance of evidence in favor of the plaintiff, the court’s decision to satisfy the stated requirements is natural.

With this conclusion I do not want to diminish the perseverance of the reader (the plaintiff), since many workers who find themselves in a similar situation, seeing no prospects, refuse to try to collect the unofficial part of their wages.

Meanwhile, it should be noted that cases of this kind are often not hopeless. Their success depends on the quality of evidence that the employee has in his hands.

Often you have to communicate with employees who want to collect gray wages, who are ready to bring witnesses (former or current employees of the same employer) to court. This kind of evidence - the testimony of witnesses when it comes to proving the amount of salary - is not enough.

However, such evidence as advertisements in newspapers or on Internet portals, staffing schedules where a higher salary is set for a single-ranking position, and finally, certificates from statistical authorities or the tax inspectorate, recording the average salary in the industry, may well be used as evidence of the size of the unofficial part of the salary fees.

Thus, the success of each specific case will entirely depend on the level of preparedness of the parties to the process. For an employee, this means selecting the most extensive evidence base, usually consisting of indirect evidence, the totality of which will convince the court of the validity of the stated claims. In cases of this category, you should not count on the loyalty of the court and its assistance in proving. The position of the court most often boils down to the fact that the parties signed an employment contract of their own free will, agreed on the amount of wages, the receipt of an unofficial part of the salary was carried out in order to save on taxes by both parties, and therefore the parties should be on equal terms in the dispute.

personnel records management, personnel reduction, labor law, labor disputes

Where to report black wages

If an employee wants to prove the fact that his salary was paid unofficially, then he will have to go to court. In order for the case to be successful, it will be necessary to provide the court with comprehensive evidence.

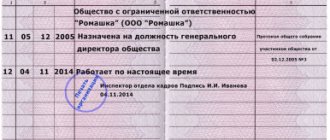

If the court supported the employee’s claim, then its decision will subsequently be evidence of this fact. During such proceedings, the employer must prove:

- the fact that the employee received wages;

- that it was paid on time.

And the employee will need to prove the fact that he worked here and justify exactly what amount of salary he received. Here, a situation is possible where part of the salary was paid officially, and part was given “in envelopes”. In this case, the availability of the latter type of payment will need to be proven to the employee.

You can also contact:

- to the tax office;

- to the labor inspectorate;

- in the FSS;

- to the Pension Fund.

You can also complain to the Prosecutor's Office or the police department.

Upon application, these services will begin an inspection of the enterprise. If violations are detected, arrears will be collected and penalties will be imposed.

Employee payment form

White salary is the official salary, the entire amount of payments, the amount of taxes paid on this amount is reflected in the accounting documentation. The salary is fixed in the employment contract, local orders, and in controversial cases you can always refer to them, both in court and in the labor inspectorate.

Currently, only budgetary and municipal institutions, unfortunately, pay full salaries.

Gray salary – here the situation is a little worse. To save on tax costs, the employer officially shows only part of the employee’s salary, and pays part in an envelope . For example, the amount of money specified in the contract is transferred to a bank card, and the unaccounted amount, which is not recorded in white bookkeeping, is paid in cash.

The employee is on the payroll, taxes are paid from his salary, a work book is kept, there are some benefits, and usually the main points regarding payment, work and rest are discussed with the employer orally.

Therefore, with a gray salary, there is a high probability of proving the existence of a contractual relationship in court; unlawful actions of superiors can be challenged and appealed.

A gray salary negatively affects pensions, when calculating unemployment benefits, maternity payments, and, if necessary, confirming your income with a banking institution. But in many cases, especially against the backdrop of the upcoming pension reform, employees themselves choose this type of payment with them, and all other aspects are discussed with the employer. If he needs you as an employee, then he will meet the nuances that arise.

Black wages - with this method of payment for labor, the employee’s monetary remuneration is not reflected at all in any accounting documents.

The employee is not on the staff, his legal status is unemployed. Social guarantees from the employer, pension contributions, this does not exist with a black salary.

What punishment does the employer face?

By not paying wage taxes, an entrepreneur is breaking the law. If the fact of unofficial payment of labor is discovered, the company will receive an audit from the tax office, which will determine the amount of arrears and establish penalties for the fact that the taxes accrued to it were not paid on time.

Since in the situation under consideration there was a failure to pay insurance premiums, an appropriate audit will be carried out and the company will have to pay in full not only what it owes, but also significant administrative fines.

They can relate to both the company and the officials who work in it.

The danger of “black wages” for future retirees

Until 2013, everyone counted on a guaranteed pension from the state; the length of work experience and the amount of salary did not matter. Since that year, everything has changed. And not right away.

Having reached the required age (55 years for women and 60 years for men), citizens will be able to receive a pension with a certain number of years of work behind them. For example, in 2017, 8 years of experience are required; from 2024, at least 15 years of experience will be required.

Otherwise, you will have to wait another 5 years to become eligible for a social pension or continue to work to accumulate the missing number of points. This is what “black” wages threaten citizens approaching retirement age.

How to force an employer to pay

With informal hiring, a situation is possible when the manager simply does not pay the money earned by the employee. Considering that the employment contract has not been drawn up, the employee cannot actually demand anything from him.

However, it can do the following:

- If you simply talk to the employer and appeal to his honesty, then, although this is unlikely, it is still possible that he will meet you halfway. It may be that non-payment is determined by his difficult business situation and he will pay his employee later. However, in most cases you should not count on this.

- Threaten to contact regulatory authorities. In case of inspections, the entrepreneur will have to bear the responsibility associated with the payment of black wages.

- Go to court to officially recognize the fact of hiring and non-payment of wages. In this case, the employee’s position will be stronger, the more convincing his evidence is.

Having the appropriate court decision in hand, you can receive the due compensation. However, it is impossible to know in advance what the court will decide. In such cases, he will make a decision that is consistent with the evidence presented.

Filing a claim

When turning to the court, the employee must understand that it is he who is required to prove the existence of an employment relationship with the employer, as well as the actual salary.

The employee as a plaintiff must prove:

- the fact of work in a specific organization;

- refusal to pay remuneration or partial payment;

- delay in payment.

The application is submitted to the court based on the amount of unpaid earnings (up to 50 thousand - global, above - regional) at the location of the employer. When submitting, certain conditions must be met:

- compliance with the application deadline (1 year after the employer violates the employee’s rights);

- the application is submitted in the number of copies that corresponds to the number of participants in the litigation;

- It is preferable to send documentation via mail, by registered mail with a full description of the attachments and notification;

- It is possible to use the services of a representative.

If the outcome of the case is positive, the employer is obligated to employ the employee legally, as well as pay all outstanding deductions. In addition, the management will be subject to various sanctions.

Contents of the claim

Regardless of which court (district or magistrate) the worker applies to, in the claim he must indicate:

- The addressee is the court at the location of the employer.

- Passport information about the applicant (full name, registration, telephone, Email).

- Details of the employing organization.

- Full details of the problem.

- Payment amount (white and black)

- List of third parties (tax service, social insurance, pension fund);

- Requirements.

- Indication of the norms of the Labor Code of the Russian Federation and the Tax Code of the Russian Federation.

- Submission day.

- Plaintiff's signature.

- Description of applications.

The claim may also contain demands:

- on the legal registration of the plaintiff at work;

- on concluding an employment contract;

- on the inclusion of the full amount of salary in the contract;

- on compensation for moral damage (if justified);

- on the implementation of accruals in social networks. funds;

- about making a corresponding note in the labor report.

Legal conflicts between employers and employees are not subject to fees. Any costs (including lawyers, examinations, etc.) may be borne by the losing party.

What evidence may the employee have?

If a situation arises that an employee is paid a salary without registration, in most cases this leads to a conflict. The employee needs to be prepared for such a situation, and this will require convincing evidence that the court can accept.

To do this, you can collect facts and documents throughout your work with this entrepreneur. The following may be used as evidence:

- Records made using a voice recorder, which indicate the amount of salary received or the facts of its unofficial payment.

- Any kind of documents that record payments of black wages will be useful.

- Certificates issued to obtain a loan, which take into account not only the official part of the salary, but also all payments received.

- The court may accept testimony on the topic under consideration.

How to recover illegal wages from an employer: contact the regulatory authorities

After the employee has collected all possible evidence, it is highly recommended to file a complaint against the employer with one or more of the following authorities:

- State Labor Inspectorate.

- Prosecutor's office.

- The Federal Tax Service.

This must be done before collecting unofficial wages through the court. Or in parallel with going to court. The statute of limitations for going to court in disputes about establishing the fact of labor relations is 3 months from the moment the employee learned of the violation of rights.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

An appeal to other authorities is not a valid reason for missing the deadline for going to court and does not prevent such an appeal.

The facts of violations on the part of the employer established by the regulatory authorities will be excellent evidence in court. Unsatisfactory responses to complaints (so-called unsubscribes) can and should be appealed to higher authorities.

Please note that from December 13, 2021, not only the court, but also the State Tax Inspectorate has the right to recover wages.

How to prove illegal wages for alimony in court

Sometimes an employee prefers to receive his salary unofficially due to the fact that he must pay alimony. Here you can pretend that there is no income and not make payments. However, the following must be taken into account:

- The absence of an official salary does not mean that alimony is not calculated. They can be calculated from the average salary, and in some cases in a fixed amount.

- To get money, the mother can foreclose on the debtor's property. In this case, the executive service will carry out the sale and pay the debt from the proceeds.

- Through the court, you can try to prove the existence of unofficial wages. The outcome of the review depends on the evidence provided.

Consequences of concealing income affecting the employee

Sometimes they simply refuse to hire an employee in compliance with the law. By insisting on refusing to formalize the relationship or offering partial registration (half-time while actually working full time), the employer tries to show the positive side of the situation in that payroll is hidden from the state.

Perhaps the only dubious advantage for an employee is savings on taxes and social contributions. Some men use this to get rid of paying alimony or reduce its amount.

But “salary in an envelope” carries serious negative consequences:

- The funded part of the pension or the pension itself is lost (more on this below).

- Minimum payments during maternity leave or unemployment.

- Reduced amount or complete absence of payments due to illness.

- Lack of entries in the work book confirming periods of employment (affects the chances of employment for a similar position in another company).

- The risk of losing compensation payments due to staff reduction or dismissal.

If income is partially hidden, then the employee loses part of the benefits; if income is completely hidden, there is a risk of being left without government support altogether. Thus, even a small salary is not the best compromise.

Filing a claim

The statement of claim can be filed in the magistrates' or district court.

When preparing a claim, the employee must clearly formulate what exactly he demands. The claim may include claims relating to the following issues:

- The fact of the existence of an employment relationship.

- Payment of unofficial wages.

- Incomplete payment of money.

- Delay in payment of wages.

In addition, the statement of claim may require that an employment contract be formally concluded indicating the full amount of remuneration.

What to use as evidence

Article 55 of the Code of Civil Procedure explains what evidence is. This information, on the basis of which the court determines the presence or absence of circumstances, must be:

- obtained legally

- be of value for the proper consideration of the case

It is better to collect all the evidence before the trial, so as not to delay the consideration of the case, not to file a motion to postpone the date, etc.

What is rational to use as evidence regarding black wages:

1.Job advertisement from an employer in open sources

If you prove the fact of the existence of an employment relationship, that the employer recruits employees, and then either kicks them out without paying, or does not give the promised amount.

You can find an archive with advertisements on an Internet resource, print out the information, or better yet, have the data notarized.

2. Correspondence with the employer via email

3. Recordings of telephone conversations

4. Voice recordings of dialogues

5. Testimony of witnesses or third parties who know and can tell significant information in court

6. Video recordings with dates and directly related to the case under consideration

7. Documentation of black accounting

The employer is still forced from time to time to record payment for services; in many offices with black accounting, homemade statements are used, which indicate the amount and the signature of the person receiving it. A photocopy or photo of this document.

8. Pay slips, in any form from the employer

9. Audio recordings - if there is not much written evidence, then the input includes recordings of negotiations with the employer, from the context of which a violation clearly follows

You have the right to record all conversations with your boss, accountant, and colleagues. Of course, if it is related to work issues. From many conversations one can draw a conclusion about what is going on at the enterprise.

It is better to collect evidence, copy statements and existing payments in the accounting department before the conflict escalates. Otherwise, after you go to court, they will try to hide all information from you and will not allow you to talk about questions that interest you. They will try in every possible way to protect you from the flow of information, even prohibiting colleagues from communicating.

It is important to justify to the court the need to include a particular medium with information in the case. It is desirable that it contains direct information proving the payment of black wages, and not indirect information.

Before going to court, collect the full package of evidence that you can handle. Attach the results of inspections by the State Tax Inspectorate, the Federal Tax Service, and the Pension Fund of the Russian Federation, if you or your colleagues applied there.

Consult with employment law lawyers who will point out what you have not taken into account or done incorrectly.

Punishment for paying “gray” wages

Payment of unofficial wages to employees is punishable under Russian law and can be classified as both an administrative offense and a criminal offense.

An important fact is that an employee is not liable for non-payment of taxes when receiving a gray salary, since his tax agent is the employer, which means that the responsibility for this lies with him.

At the same time, the provided sanctions do not relate to the direct issuance of unofficial salaries to employees, but only affect fines and penalties for non-payment of tax and insurance contributions.

Consequences for the employer

First of all, the initiative to pay wages unofficially comes from the employer.

The reasons for this are obvious: every company bears a serious tax burden and, in addition to the actual payments to its employees, must pay large amounts of money to the budget and funds. If the wages of its employees are lower, then these payments, calculated as a percentage of it, will also be lower. Therefore, there is a great temptation to reach an agreement with employees that at least part of the payment will be made to them, bypassing the supervisory authorities. Thus, the advantages will be as follows:

- Reducing the tax burden.

- Reducing social security costs for employees.

The list is small, but both points are extremely important. Flaws? If the fact of deliberate understatement or concealment of payments is revealed in accordance with Article 123 of the Tax Code, it will be necessary to pay 20% of the amount subject to withholding. The punishment would be completely ridiculous, but Article 5.27 of the Code of Administrative Offenses also adds fines for violation of labor laws: from 1,000 to 5,000 rubles for an official and individual entrepreneur, from 30,000 to 50,000 for a legal entity.

However, these fines are not severe enough to deter employers from violating the law, and therefore further we will talk about what an employee should do if he is paid unprofitable wages or if they are no longer even paid at all.

Salary in envelope

First, you should take a closer look at the phenomenon of unofficial payments: wages are divided into three types: “white”, “gray” and “black”, and then we will analyze each of them.

- White is completely official; all required payments to the budget and funds are made from it. If you get exactly this, then there are no problems on this side.

- The black one is issued bypassing official papers, this is called issuance “in envelopes,” thus indicating that the employer is hiding the very fact of payments from the tax service.

- Gray is a combination of the two previous types, that is, part of the earnings is paid officially, and the other is paid extra “in an envelope.” All statements indicate payments in one volume, but in reality they are made in another.

Sometimes the importance of the fact that wages are not formalized is underestimated by citizens. At the same time, they proceed from the fact that they pay on time, consistently, in the amount agreed upon - what more could you want? Moreover, those who receive a “gray” salary tend to turn a blind eye to the significance of manipulations with legislation, since it is formalized, and the difference between the formalized and the real one can be perceived as a kind of additional payment. But in both cases the responsibility is significant, and the risks are great.

Evidence of the employer's guilt

The law does not establish the required evidence limit for prosecution. But it is stipulated that an accusation based on one document or testimony of a witness is unacceptable; a complex of evidence is required. In practice the following are used:

- Statements and settlement registers. In order for documents to be accepted in court, they must be signed by company employees and administration representatives. The law establishes that the statement can be compiled without complying with accounting standards, but it must contain all the elements: date, company details, signatures. A document can also be used in court if its receipt does not violate the law and the employees of the organization indicated in it were interviewed by inspection inspectors.

- Protocol of interrogation of participants in the case. It is not enough for the court to report a gray salary to one employee. Tax services are required to conduct a survey of all employees of the organization and representatives of the administration. Protocols must be drawn up in compliance with procedural norms and requirements.

- Previously issued 2-NDFL certificates to employees, if the data in them differs from the official salary of employees.

- Testimony of employees. Citizens sometimes do not know what to do if they do not pay gray wages, and are ready to testify in court in order to subsequently collect the debt from the organization.

It is necessary to understand that a citizen who does not pay personal income tax in the proper amount is personally guilty of this, even taking into account the fact that the responsibility for remitting the tax rests with the employer. You will have to pay off your personal income tax debt yourself, since this tax is levied on the citizen’s income. It is optimal if, before filing a claim, a complaint about gray wages is sent to the Labor Inspectorate. Law enforcement agencies have more opportunities to hold the employer accountable.

Subscribe to the latest news

Responsibility for the employer

Based on clause 4 of Art. 226 of the Tax Code (TC), the tax agent-employer must withhold personal income tax from the actual income of the taxpayer. With a mediocre salary, he fulfills his duty only partially.

Tax consequences

The consequences of using gray wages are:

- Conducting on-site inspections by tax inspectors, prosecutors, Social Insurance Fund, Department of Internal Affairs, etc.

- Accrual of taxes payable, which the company had to transfer from the unofficial part.

- Accrual of penalties and fines for unintentional non-payment of taxes.

According to Art. 122 of the Tax Code, non-payment or incomplete payment of the tax amount as a result of underestimation of the tax base, incorrect calculation of tax and other illegal actions, if such an act does not contain signs of tax violations, entails a fine of 20% of the amount of personal income tax not transferred to the budget.

Payment of penalties and fines does not relieve the employer from the obligation to transfer the tax itself to the budget (under Article 108 of the Tax Code).

Non-payment or incomplete payment of tax amounts as a result of underestimation of the tax base or incorrect calculation of personal income tax, committed intentionally, entails a fine of 40% of the unpaid amount.

Also, tax inspectors will probably have questions about what funds are used to pay the salary in the envelope. Most likely, this is a consequence of an understatement of the tax base and failure to display part of the income in reporting. As a result, VAT, income tax or the simplified tax system are not paid in full.

Criminal liability

The consequences of paying wages “in an envelope” threaten liability for the manager, accountant and other employees who were involved in the preparation of primary documents. Art. may be applied to them. 199 (Criminal Code (Criminal Code) “Tax evasion...".

Based on Art. 199 of the Criminal Code, tax evasion on a large scale is subject to a fine of 100-300 thousand rubles. or in the amount of salary or other income of the convicted person for a period of 1-2 years or:

- forced labor for up to 2 years with or without deprivation of the right to hold certain positions for up to 3 years;

- arrest for up to 6 months;

- imprisonment for up to 2 years.

An act that was committed by a group of persons by prior conspiracy, or if we are talking about a particularly large amount, threatens the employer:

- a fine of 200-500 thousand rubles or the amount of salary for 1-3 years;

- forced labor for up to 5 years;

- imprisonment for up to 6 years.

Arbitrage practice

Plaintiff R.N. Abramov filed a claim against the Glavinstrument company for the recovery of unpaid wages, as well as corresponding compensation. The basis for the appeal was that the salary was not paid to the plaintiff in full as established by the employment contract.

The plaintiff himself did not appear in court, but his representative supported the demands. In addition, he added that the plaintiff previously worked at the Metalplast enterprise, which was then replaced by a new one, Glavinstrument. After its formation, the employees were told that since the enterprise had just been formed, they needed help, namely, to officially agree to a salary lower than before, but at the same time the rest had to be paid extra, bypassing taxation, that is, “in an envelope.” In the end, the plaintiff never received this unofficial part.

After presenting the case materials - payroll and pay slips, the court found a violation in terms of dismissal in the form of untimely payments. However, the court was critical of the amount of his salary indicated by the plaintiff. Witnesses confirmed the division of payments at the enterprise into “black” and “white”, but the plaintiff’s arguments about the amount of wages he was entitled to were never confirmed by concrete evidence.

The court ruled that the company had no debt to the plaintiff, since the calculation should be based on official documents. Thus, it was decided to partially satisfy the claim: to recover compensation from the enterprise for unused vacation, as well as for the delay in its payment. The part about unpaid wages was refused, since the presence of this unpaid part was not recorded in official papers. Thus, the return of “black wages” if the employer refused to pay it is usually fraught with difficulties. The entire case can be viewed here.

Decision of March 14, 2021 in case No. 2-1206/2017

- Look