Types of salary supplements

When preparing documentation, you must adhere to precise wording. If we talk about allowances, they are sometimes called surcharges. The fact is that allowances according to their functionality are divided into:

- stimulating;

- compensatory.

The latter are more often called additional payments. This is due to the fact that additional payments are compensation to the employee for harmful working conditions, especially hard work, and performing their duties beyond the norm. In most cases, these are payments required by law that the employer has no right to ignore.

Incentive bonuses are another matter. They are a voluntary expression of gratitude to an employee or employees for their responsibility and work. Bonuses of this kind affect the motivation of individual employees. Such payments include bonuses and other incentive payments.

Who gets credit and who doesn't?

Absolutely all officially employed persons who live and work in the Russian Federation have the right to receive additional payments. This right is not affected by the field of activity, age, or length of service of employees. However, the person who is a party to the labor relationship can receive payments. To do this, he must be officially hired.

Citizens who were not officially employed cannot count on the bonus. Even if a civil contract (contract, paid services, etc.) was concluded between the employer and them.

This is interesting: Sample loan agreement between individuals

Since such agreements give rise to civil legal relations, and they are regulated by the Civil Code. However, the parties can independently determine the procedure for calculating and assigning allowances, and indicate this in the contract or in an additional agreement .

What are the bonuses for?

The Labor Code regulates only the minimum acceptable values. The general level of allowances in a particular organization remains at the discretion of the manager. Thus, allowances can be set:

- For having a special type and level of education, an academic degree, awards, etc. The more qualified an employee performs the duties assigned to him, the greater the bonus he deserves.

- For high results of efforts made in professional activities in this organization.

- For high professional excellence in the performance of their duties.

- For performing a particularly responsible and important function in the overall cycle of work, etc.

Formation of payment

The employer is required to document the payment. The document must reflect the reason for calculating the premium and its amount.

Basically, the amount of additional money is calculated as a percentage.

What influences the formation of the incentive amount:

- Amount of work completed.

- Timely completion of assigned tasks.

- Experience.

- Salary size.

- Employee qualifications.

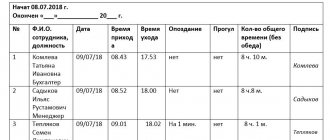

To take into account all important aspects, the employer or person to whom the payment will be made should use a score sheet. It is available in almost all organizations.

Components of an order

The best option is to draw up such documents on the official letterhead of the organization. The company details necessary for legal literacy of registration are initially printed on them at the top. After the details, the order must contain:

- Order number.

- Date of.

- City.

- Link to Article 129 of the Labor Code.

- A link to a specific clause of the collective labor agreement, the Regulations on remuneration or other local regulatory act of the company, which talks about bonuses. This is the stating part of the order.

After the word “I order” there is a list of orders, divided into separate paragraphs. They contain:

- Position and full name of the employee who receives the bonus. If necessary, the structural unit of the organization in which the employee serves is also indicated here.

- Supplement amount. It is indicated in rubles, and not as a percentage of the salary. This is because, from a legal point of view, the premium is part of the overall benefits.

- How often is the specified amount paid? It can be either a one-time payment or accrued monthly. There are options for paying a quarterly bonus if certain targets are met. Be that as it may, this information must be duplicated in the employment contract. Inconsistencies in data are unacceptable.

- From what date will the order be executed, from what date does the salary bonus actually begin to accrue.

- An order regarding the accountant’s duties to calculate the payments due to the employee, as amended by the first paragraph of the order.

- Who is responsible for familiarizing the employee with the order.

- Who remains in control of the implementation of all points of the document.

- Base. The date and number of the collective labor agreement, regulations on remuneration or other local regulatory act, which states the amount of the bonus in specific situations, are indicated here.

At the very bottom of the sheet (at the end of the document) there should be signatures of the manager, a representative of the accounting department (if it was mentioned in the order), as well as the employee himself.

An order for a wage increase is registered in the personnel order journal and stored for 75 years.

Order to increase the scope of work. Sample and Form 2021

You will need

- — written notice;

- - additional agreement;

- - order;

- - notification to the accounting department.

Instructions 1 To arrange a salary increase, notify the employee two months before the event. Although in practice, the employer increases salaries only by verbally warning the employee on the eve of the increase, since due to the increase in salary, it is unlikely that anyone will complain to the labor inspectorate.

However, for failure to comply with the requirements for changing wages specified in labor legislation, administrative penalties may be imposed on you, so it is better to give written notice to everyone to whom you plan to change wages.

2 You can increase the salary and indicate its increase in the form of a monetary amount or indicate by what percentage the salary is increased.

Additional payment for increasing the volume of work

Important

If his work function is performed by a deputy director or chief engineer, then this will be called a combination. Write down in the additional agreement to the contract with the employee a list of responsibilities that are assigned to him, having familiarized him with the instructions in advance.

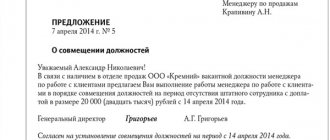

Indicate the period for which the volume of work should be increased or combined. Certify the document with the signature of the head of the company or other authorized person, the seal of the organization, and the signature of the employee. 3 Based on the additional agreement, draw up an order. At the top of it, indicate the full and abbreviated name of the company, assign a number and date to the document. Attention

The subject of the order in this case will correspond to the purpose of the additional payment to the employee (indicate his position in accordance with the staffing table, last name, initials). The reason for drawing up the document may be an employee going on vacation, illness, or a business trip.

Order to increase the scope of work

Thus, the employee will testify that he voluntarily agreed to increase the amount of work, and the employer, in the future, if something happens, will have on hand evidence that there were no violations of legal norms on his part.

After the employee writes a statement of consent to increase the scope of work, an additional agreement to the employment contract must be concluded with him. It is made in two copies (similar to an employment contract) and contains the same sections and clauses.

It is necessary to carefully specify the conditions for increasing the workload: number of hours, amount of additional payment, period, etc.

It would also be useful to indicate in the additional agreement that the employee who has taken on additional functions is not relieved of his main responsibilities.

Sample order for additional payment for increasing the volume of work

- Order to perform additional work. Expansion of service areas (filling sample)

- Sample order for additional payment for an expanded scope of work

- Sample order for additional payment for an expanded scope of work

- SAMPLE LIBRARY

- STANDARD FORMS

- SAMPLE MENU

- Sample order to increase the volume of work performed

- How to establish an additional payment for increasing the volume of work?

- Ukts abb

- Additional payment for increasing the volume of work

How to correctly draw up an order to combine positions Let us emphasize that in this case, in the work book, at the request of the part-time worker, an entry can be made that he worked under a second contract.

Ipc-zvezda.ru

It is important to correctly draw up additional agreements, contracts, orders to increase the amount of work (sample). At the same time, keep in mind that if an employee has to engage in a new activity for him for a certain time, it is better to arrange an internal part-time job or a combination job.

Info

Prepare all the necessary papers based on the Labor Code of the Russian Federation. Help When additional payment is possible

- With an internal part-time job, the employee carries out additional activities in his free time from his main job (Article 60.1 and Part 1 of Article 282 of the Labor Code of the Russian Federation). To do this, the employer concludes a separate employment contract with the employee and prepares a sample order for additional payment for an increase in the volume of work (Art.

60.1 Labor Code of the Russian Federation).

- When combining professions, a specialist is engaged in other work during his working day. Additional work is subject to payment, and is possible only with the written consent of the employee.

What is a salary supplement and what is it paid for?

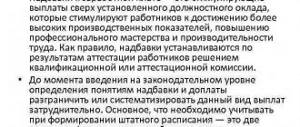

Allowances and additional payments are payments made by the management of an enterprise in addition to the official salary or tariff rate.

It is necessary to distinguish an allowance from an additional payment: while an additional payment most often performs compensatory functions, is guaranteed in nature and is calculated in accordance with the requirements of the labor code, allowances are optional, perform mainly an incentive function and are paid at the discretion of management.

Don't miss: the main material of the month from leading specialists of the Ministry of Labor and Rostrud

Encyclopedia of personnel orders from the Personnel System.

Additional payments may be paid in connection with the special nature or conditions of the work performed, for overtime, work on holidays, when combining positions, etc. Allowances are always inextricably linked with certain business qualities of the employee. Most often bonuses are paid:

- for professionalism and skill;

- for a high level of qualifications;

- length of service (length of service);

- for performing work that is classified as particularly important for a certain period of time;

- knowledge and use in work of one or more foreign languages;

- for high achievements in work;

- as personal allowances for the employee.

Read more Notification of the military registration and enlistment office about a change of residence Allowances and additional payments allow you to:

- create incentives to improve quality and increase the intensity and responsibility when an employee fulfills his work obligations;

- increase the objectivity of assessing the labor qualities and skills of specific specialists;

- optimize the system of material incentives for employees who have fulfilled and exceeded the production standards established for them.

Additional payment for increasing the volume of work (2018)

Additional payment for increasing the volume of work: The Labor Code regulates this procedure in Article 60.2 of the Labor Code of the Russian Federation. An increase in the volume of work is considered to be the performance by an employee of additional work in the same profession, but in a larger volume than provided for in the contract.

Such work should be paid accordingly. Main points In case of production necessity, the employer can involve the employee in additional work. The Labor Code of the Russian Federation provides three ways for an employee to perform additional work without exemption from the main one:

- combination of positions;

- increase in the volume of work;

- fulfilling the duties of a temporarily absent colleague.

Additional duties are performed under the following conditions:

- without interrupting your main job;

- during the established working hours (Part 1, Article 60.2 of the Labor Code of the Russian Federation).

According to Art.

Order to increase the amount of work performed for an employee (filling sample)

This is required so that the manager, as well as all employees designated in it, can sign. You can print out a sample order for additional payment for an increase in the amount of work on a regular piece of paper or on paper with the company’s details and its logo printed in advance.

A document must be certified with a seal when the organization uses a seal. The order must be made in one original copy, and if necessary, it can be photocopied, after which all additional copies must be properly certified.

Information about the order is entered into a special journal, which not only certifies the fact that the document was created, but also, if necessary, makes it possible to easily find the required order. The journal records the name and number of the order, as well as the date of its issue. The issued sample order for additional payment for an increase in the volume of work must be kept according to the rules.

Increasing the volume of work: how to register

But, nevertheless, the manager must sign that he has been notified of the start of the vacation; this must be done two weeks before it begins. After which the notice is sent to the HR department. 3 The General Director, like any other employee, must be included in the vacation schedule.

When leaving for the required rest, it is advisable to appoint a deputy. It’s good if the organization has a person replacing him, but what if not? 4 In this case, a responsible person is appointed by order of the General Director.

Remember that you must approach the choice of such a person responsibly, because when you go on vacation, you entrust your business to another person. 5 If the decision on vacation is made by the meeting, then it is the participants who choose the deputy. All this is documented in a protocol (decision), where everyone signs.

Source: https://FondBiz.ru/dokumenty/doplata-za-uvelichenie.html

Relations with the tax service

According to Article 57 of the Labor Code, mention of the amount of the bonus is mandatory in the employment contract (or the presence in it of a reference to the local regulatory act of the organization). In addition, Article 255 of the Tax Code clearly states that the taxpayer’s labor costs include allowances of any kind.

These clarifications in the legislation exist so that the heads of organizations are not tempted to set a minimum wage for all employees in their companies, and arrange the rest in the form of bonuses.

All additional payments and allowances are subject to taxes, just like the employee’s basic salary.

How are minimum wages and salaries related?

Before presenting you with a sample order to establish an additional payment up to the minimum wage, we will find out the relationship between wages and the minimum wage (minimum wage).

Minimum wages and salaries are closely interrelated. According to the norms of Art. 133 of the Labor Code of the Russian Federation, an employee’s salary for 1 month cannot be lower than the minimum wage. In this case, the employee must work a monthly working time standard and fulfill his job duties (labor standard).

In general, the minimum wage is the amount established by law (federal or regional):

- below which labor duties performed in full cannot be paid;

- participating in the calculation of the amount of benefits for temporary disability and for other purposes of compulsory social insurance.

The minimum wage is not a constant value. According to Art. 1 of the Law “On the Minimum Wage” of June 19, 2000 No. 82-FZ, starting from 01/01/2021 and thereafter annually from January 1 of the corresponding year, the minimum wage is set in the amount of the median wage approved by statistics. Thus, from 01/01/2021 the minimum wage is 12,792 rubles.

For the dynamics of changes in the minimum wage in recent years (until 01/01/2021), see the figure:

Find out more about the minimum wage from this material.

Any doubts left? Ask on our forum! For example, here forum members share their experience of how additional payments to the minimum wage should be calculated in practice.

Is it necessary to include it in an employment contract?

Since an allowance (of any nature), according to the Labor Code, is considered an integral part of wages, it will need to be reflected in the employment contract. This applies to both collective agreements and individual employee agreements.

But there are certain nuances here. The specific amount of the bonus may not be reflected in the employment contract. You just need to provide a link to one of the company’s local regulations that discusses this point in detail. This may be a signed and entered into force Regulation on Remuneration.

Procedure for calculating personal allowance

An incentive payment can also be established for a working person individually, subject to certain conditions.

Thus, PN is assigned to the salary of full-time employees who work under an employment contract (including a fixed-term one), as well as part-time jobs. Most often, such an increase is assigned as a reward for high performance in work, upon successful fulfillment of performance criteria at work.

The decision on personal payments is made by the employer personally based on the recommendation of the head of the department.

Often the financial director, chief accountant, or other authorized person is given the right to make such decisions. During the absence of the general director (vacation), all issues are resolved by his deputy. Then the head of the department submits the corresponding petition to one of them. In all cases, the decision must be justified and lawful. The employer is not obliged to report to employees about the amounts of incentive bonuses, but must notify the termination of such payments.

Requirements

The conditions that must be met by the employer when assigning any types of bonuses can be found in articles 147-154 of the Labor Code. They discuss the main key points that relate to the employee-employer relationship. Some of them are mandatory. Their minimum permissible size is also determined.

In general, we can say that an order for a salary increase is an integral part of the document flow when assigning such payments. The most important thing is not to limit yourself only to them. It is necessary to coordinate the information contained in it with the employment contract and local regulations of the company, which establish the specific amount of payments.

We draw up an order for additional payment

The law does not require that an order for additional payment be drawn up. At the same time, there must be a basis for accruing certain payments to an employee. Therefore, if, for example, an employment contract with an employee or the relevant local regulatory act (for example, the Regulations on Additional Payments) specifies the procedure for providing additional payments to an employee and provides an unconditional procedure for determining their size (for example, the additional payment is indicated in an absolute amount), an order for additional payments can be do not make up. The basis for their calculation will be the employment contract or the corresponding position of the employer.

If additional payments are provided only if certain conditions are met, and the amount of such additional payments is subject to calculation, an order for additional payments cannot be avoided.

Regardless of the type of surcharge, the order is drawn up in any form. It indicates the basis for calculating additional payments, incl. with reference to the relevant clause of the employment contract, the persons who are entitled to such additional payment, and the amount of the additional payment. The order for additional payments must be familiarized with the signature of the persons to whom it is due.

For an order for additional payment to an employee, we will provide a sample of its completion for the case when an employee is paid additionally up to his salary while such an employee is on a business trip.

Registration of a personal allowance for an employee of an organization

The installation, cancellation of an incentive bonus or change in its value by decision of the employer (authorized person) is formalized by an appropriate order. The basis for its publication is mostly a memo from the head of the department. It is through this internal document that the manager requests to establish, extend, cancel, increase or reduce personal payments to a specific employee.

The order for the appointment (extension, change of size) of the allowance is drawn up in free form. However, the content of such a document must meet a number of requirements.

| Structure of the order for the appointment of a personal allowance | What does it include? |

| Introductory part | Number, date of publication, title of the order; motivation for the decision, reflection of its financial feasibility |

| Main part | Indicated: the established amount of personal allowance (its changed value), payment validity period; the responsibility of the accounting department to calculate salaries taking into account the increase; responsible for the execution of the order; the need to familiarize the employee with the order |

| Final part | Includes a reference to the basis for the decision; CEO's signature |