What is included in the internship

- The days when the future pensioner carried out official work. Confirmation of officiality - deductions to a personal account in the Pension Fund. This can be done either by the employer or by the future pensioner himself, if he is the director of an LLC or individual entrepreneur.

- Periods of days taken towards vacation and leave, including maternity leave for women.

- Periods of leave to care for a dependent whose age is up to 1.5 years. This is true for both women and men: now, more and more often, men go on maternity leave instead of women. The total amount includes a period of no more than 4.5 years (that is, for three children).

- Days when sick leave was issued.

- Care for a disabled person or a person over 80 years of age, formalized by law.

- Periods of military service.

- Periods of official registration at the Employment Center (which gives the right to consider a citizen unemployed).

- The period of residence with a spouse who left for assignment to work in the regions of the far north or territories equivalent to it (no more than 5 years).

- The period of serving a sentence in a colony.

Procedure for assigning early pension

Having extensive work experience is not a prerequisite for retirement. Those who have not completed that many years of service will retire according to standard requirements.

To apply for a pension, you should contact the Pension Fund to find out what documents are required. The day the pension is assigned is considered the day the application is submitted with a set of papers. You can submit the application only when you already have the right to a pension, not earlier. To find out what documents are needed, you should apply six months in advance.

As a rule, the standard package of documents will be considered to be the provision of:

- passports;

- work book;

- military ID, if any;

- certificates of average earnings for 60 consecutive months before 2002;

- SZV-STAZH or certificates of insurance premiums;

- other certificates, depending on the category of citizens.

Let's take a closer look at what SZV-STAZH is. This is an annual reporting form for employers, which displays the same insurance payments. The report must be submitted by March 1 of the current year for the previous calendar year. If an employee decides to apply for pension payments, then he writes a free-form application at work about submitting a SZV-STAZH report for him. The employer is obliged to submit it within three days.

In this form, the employer indicates the type of information “Pension assignment”, the current year, fills in the employee’s data, periods of work, vacation, sick leave, etc. The last period line is filled in with the applicant’s date of birth, if he submits documents in advance, or with the planned date of submission of documents. Afterwards, the employer submits a report to the Pension Fund. If more than 25 people are employed, the reports are submitted electronically, if less, they can be submitted in paper form.

An application for payments can be submitted in person to the Pension Fund or sent by letter. The date shown on the postmark will be considered the date of acceptance.

If any documents are missing, the citizen is given 3 months to submit the missing papers. Then the date of receipt of the application is equal to the date of application. If you do not meet these deadlines, you will have to resubmit your documents.

Within ten days, the Pension Fund considers the application, checks all documents and issues a decision on the appointment. If the documents are not in order or the length of service is not enough, then within five days the Pension Fund sends a refusal with explanations.

What if the length of service is much greater than the minimum value?

A citizen who has worked the required number of years can retire before reaching the normal retirement age ( in 2021 this is 62 years for men and 57 years for women ).

In what cases can this be implemented:

- Mothers of many children who had at least 5 young (under 8 years old) children - their own or adopted.

- Parents or guardians of a disabled child who raised him from 0-8 years.

- Teachers.

- Workers in some creative professions (for example, ballerinas).

- Persons diagnosed with dwarfism.

However, you still need to achieve a certain length of service ( usually 20 years for women, 25 for men ). So, if by the age of 55 the father of a disabled child has accumulated 20 years of experience, he has the right to submit documents to the Pension Fund and apply for disability benefits.

Exceptions:

- Medical workers and teachers working with children can apply for a pension at any age: the main thing is that their experience is at least 20 years for women and 25 years for men.

- People who are blind from birth or who acquire this disability later can apply for a pension if: a man has reached the age of 50 and worked 15 years, a woman has lived to be 40 years old and worked 10 of them.

Each citizen can find out whether it is possible to retire early from the Pension Fund on an individual basis. The right to apply for an old-age pension without waiting until age is available to those who were laid off 2 years before retirement, but who managed to accumulate length of service (20 years for women, 25 for men).

Retirement age - table by year

From January 1, 2021, the retirement age is gradually increasing to 60 and 65 years (women and men). These changes will apply to all those citizens who were supposed to receive payments starting in 2019. Law No. 350-FZ dated October 3, 2018 establishes the following plan for increasing the age standard:

- The value increases annually by 1 year, starting from 01/01/2019 during the transition period - until 2023.

- Citizens who, according to the standards of the old law, were supposed to retire in 2019/2020, will be able to receive payments 6 months earlier than the new deadlines established for them - this amendment to the law was made by Vladimir Putin.

Thus:

- in 2021, the retirement age will increase not by 1 year, but only by 6 months (to 55.5 and 60.5 years, respectively, for the female and male population);

- in 2021 the increase will be not by 2 years, but by 1 year 6 months (up to 56.5 and 61.5 years, respectively).

Taking into account these changes, the table of retirement age by year under the new law is given in the table below:

If the experience is not enough

For those who have not worked enough during their lives and do not have the required number of years of service, there are other rules for calculating pensions:

- You can enter your retirement pension 5 years later than the currently accepted retirement age (in 2021 it is 66.5 years for women and 71.5 years for men).

- You can purchase the missing experience. This right is available to those who have accumulated at least half of the minimum wage in the IPC (9.3) and length of service (5.5 years). Every year you can purchase additional experience and IPC by making voluntary contributions to the Pension Fund. Payments will have to be made once a year. This is convenient for those who quit their jobs, but were several months short of reaching the minimum values. Having paid, the citizen provides himself with a labor pension now, and does not wait 5 years for a small social allowance.

- You can continue to work. The IPC of pre-retirees accumulates somewhat faster than that of ordinary able-bodied people, and the length of service continues even after reaching the official retirement age. The length of service always increases as long as contributions are made to the Pension Fund for the employee.

Important! Additional voluntary contributions will not give the right to apply for an early pension. Do not buy teaching experience, northern, and others. Only the standard insurance period increases.

Minimum figures for a pension in the Russian Federation

Initially, the pension system worked without calculating coefficients, points and other elements. Gradually, it began to change and in 2015 new concepts were introduced. It was then that the first minimum indicators for receiving a pension were established.

In 2015, it was enough to have 6 years of work experience to receive a pension. Gradually, the indicator increased and in 2021 it became equal to 10 years. In 2021, it increased by several more years, and by 2024, the time requirements will reach a maximum of 15 years. According to the established scheme, the final transition to a point system for calculating pension benefits will take place in 2025. For men and women these indicators are the same.

What if there is no experience at all?

This applies to those who have not worked a single day or have too little experience ( for 2021, less than 5.5 years of experience is considered too short ). They will not be able to increase their length of service through voluntary contributions, and will not be able to retire due to incapacity for work.

But such citizens will not be left without food. Anyone who has not fulfilled the conditions for receiving a labor pension is given the opportunity to achieve the missing indicators. You can work for 5 years, buy work experience and IP, or just wait. In the end, a social pension is awarded. Its size is very small; regional coefficients increase it to the subsistence level of a pensioner in the region.

Calculation of pension payments

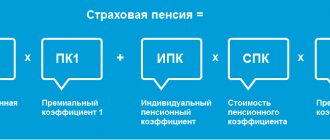

The size of the pension is calculated in the same way as the old-age pension, with the exception of taking into account the increasing coefficient.

So, the amount of early payments based on length of service will be equal to the product of the individual pension coefficient and the value of the pension point at the time of registration; the amount of the fixed payment of the insurance pension is added to this value.

Calculation formula

Amount of early payment = IPC*SPK+FV.

In [2019], SPK = 98.86, PV = 6044.48 rubles.

The fixed payment indicator changes annually depending on variations in prices for meeting basic needs. Simultaneous payments for length of service are also provided if the citizen meets this criterion.

How to apply for a pension when the minimum length of service has been reached

- Write an application for an old-age pension. This can be done at the regional Pension Fund or through government services.

- Attach copies and originals of your passport, work book, SNILS, information about dependents, if any, to your application.

- After 10 days, receive a decision on the assignment of a pension and its amount.

Important! The day of application to the Pension Fund is the day from which the pension will be assigned. If a pensioner is a little late and decides to apply for benefits six months after reaching retirement age, the missed six months will not be taken into account.

What is the minimum length of service for pension payment?

Work experience is the total duration of work and other activities. For the payment of a pension, the insurance period is important, i.e. the periods of time when a person received income and the employer made contributions to the Pension Fund for the person. If it is less than established by law, then he will not be able to be assigned an old-age insurance pension.

The minimum period of work is not the only condition for assigning insurance pension payments. In the Russian Federation, the so-called point system is used. A person needs to score a certain number of points (receive the appropriate individual pension coefficient (IPC)), otherwise, even if he has the required period for paying insurance premiums, he will not be assigned an old-age insurance pension.

It is also useful to read: How pension points are calculated

Important! Disabled people receive insurance pension payments provided they work at least 1 day.

The system with points and insurance (work) experience began to be used in 2015. Before this time period, different rules applied.

It is also useful to read: How to increase pension points

What length of service is needed to receive a pension under the new law in 2021?

From January 1, 2021, the minimum length of service for calculating an insurance pension is 12 years (in 2021, only 11 were required). The change in length of service standards has nothing to do with the pension reform carried out by the Government in 2021, when the retirement age in Russia was raised. The length of service requirements have changed annually since 2015, and such adjustments will continue until 2024.

Those citizens who do not have enough years of work in 2021, or who have never worked at all, will not be entitled to receive insurance payments.

- They will only be entitled to a social old-age pension, which is assigned 5 years later than the insurance pension - that is, at 65 for women and 70 for men.

- The size of the social pension is fixed - about 5,600 rubles in 2021. But in fact, the pensioner will receive an additional payment up to the subsistence level in his region, which means he will receive a minimum payment.

Retirement of teachers and doctors

Teachers and doctors have the right to retire early in accordance with Federal Law No. 400 and Government Decree No. 555. The list of specialties that allow male teachers to qualify for termination of work upon reaching the established age:

- Director of the educational institution.

- Deputy director (head teacher).

- Teachers of universities and secondary educational institutions.

- Secondary school teachers.

- Kindergarten teachers.

To obtain the right to early retirement, a teacher will need to work in his profession for at least 25 years. In this situation, he has the right to apply for an insurance pension five years earlier than other working citizens on a general basis.

Another area of the social sphere whose workers can count on early retirement is medicine. Male doctors working in hospitals, clinics, maternity hospitals and outpatient clinics can take advantage of this opportunity under the following conditions:

- Work experience in the field of medicine in rural areas is 25 years.

- Work experience in cities and towns - over 30 years.

Changes in the pension threshold that occurred in accordance with Federal Law No. 350 also affected medical workers. Starting from 2021 the minimum permissible retirement age for them increases in proportion to the increase in the retirement age for other citizens. This relationship is shown in the following table: