Home / Labor Law / Payment and benefits / Maternity payments

Back

Published: 03/01/2016

Reading time: 6 min

0

4169

Receiving maternity payments on time and in full worries many women preparing to become mothers. But, unfortunately, in legal practice there are cases when employers evade paying this social assistance or postpone it until after the birth of the child.

An equally frequent question concerns the length of service required to receive maternity benefits. In both cases mentioned, the situation is regulated according to the provisions of labor legislation. Receiving financial assistance in connection with pregnancy and upcoming childbirth is the right of any Russian citizen, regardless of her social status .

- Who is responsible for payments?

- How long do you need to work?

- Is studying included in the work experience?

- Length of service and amount of maternity leave

- Unofficial work

How many days are required for the 1st vacation?

For each month worked, an employee is accrued approximately 2.33 vacation days. This means that continuous work activity over the next 6 months gives the employee the legal right to receive a full 28 days of rest, and not 2 weeks, as vacation is provided in the first year of work by unscrupulous employers. Just do not confuse it with the terms for paid annual leave, which is legally established for a mandatory period of 14 days (and the remaining days of leave - in parts).

If the month worked is incomplete, monetary compensation is accrued in full, as in the case of receiving leave after 6 months under the Labor Code (if the actual time worked is more than 15 days). If an employee is employed temporarily, and his employment contract with the company expires after 2 months or less, then he is awarded 2 days of rest for each month worked.

Knowing for sure how much work a new employee needs to work to go on vacation, it is not difficult to guess what the employer really risks by agreeing to provide vacation to a new employee. There is always the possibility that an employee will not return from a full 28-day vacation, having worked only half of the allotted time. This means how many days of the first vacation after 6 months have been worked in the current working year (not to be confused with calendar calculation!). The working year begins its countdown from the first day of employment of an employee at the enterprise, and therefore is not at all tied to the days of the calendar year.

A newcomer must understand that he may not be allowed to go on vacation after six calendar months. The time when it is possible to go on vacation after 6 months of work according to the Labor Code of the Russian Federation is determined no later than the 11th month. Within the framework of the law, it is the 12th month that is considered the onset of paid leave, so it is included in the current working year (even if a new calendar year has already begun).

Examples of determining payments

The amount of benefits is determined taking into account the time worked by the employee. In each specific case, it is necessary to pay attention to the nuances in calculating compensation.

If work experience is more than 2 years

For example, the monthly salary of an employee is 33 thousand rubles. Before going on leave due to the birth of her baby, she worked for more than 2 years. At the same time, there are no periods deducted from the length of service, and pregnancy and childbirth proceeded normally (singleton, without complications). The lump sum payment will be calculated in the following order:

- wages are multiplied by the number of months taken over the billing period;

- the resulting value is divided by the number of days in the calendar period (730 or 731 in a leap year);

- the number is multiplied by the vacation period in days.

Thus, the amount of the lump sum payment will be 151.9 thousand rubles.

The monthly benefit is calculated according to the same scheme. However, instead of the number of days in a year, the number of days in a month is taken (30.4). It is worth remembering that the amount of compensation is 40% of the average monthly salary. In this case, the woman will receive 13.2 thousand rubles monthly.

The indexation coefficient in 2021 is 1.043 (Government Decree No. 32 dated January 24, 2019). The one-time benefit for the birth of a child in 2021 from February 1 is 17,479.72 rubles. (RUB 16,759.09 × 1.043).

If the maternity worker has worked for less than 24 months

If the work experience is a year or one and a half, then the employee will receive exactly the same amount as with two years of work experience. This is explained by a similar procedure for determining the base for calculating benefits.

With less than six months of experience

If a woman worked for less than 6 months before maternity leave, then instead of wages, it is necessary to take into account the size of the minimum wage (11,163 thousand rubles). Thus, in the previously indicated case, the employee will qualify for one-time assistance in the amount of 35.9 thousand rubles and monthly payments in the amount of 3 thousand rubles.

Unemployed

If a woman has indicated her status to the Central Employment Service, then she will be able to receive maternity payments, calculated based on the amount of unemployment benefit, which is 850 rubles. Thus, she will receive 3.9 thousand rubles as one-time financial assistance, and 335.8 rubles as monthly financial assistance.

How long do you need to work to get maternity leave?

Every woman is entitled to maternity benefits for pregnancy, childbirth and child care. However, their composition and total amounts depend on the length of service of the insured.

Therefore, employees who are planning to go on maternity leave often have a question: how long do they need to work in order to receive the maximum amount of maternity leave.

In addition to fixed payments (benefits for early registration and for the birth of children), women employed at the time of pregnancy have the right to take out maternity leave.

How to correctly calculate maternity payments in 2021

Good day, my readers, especially expectant mothers! Does everyone remember the sensational pension reform? They say that a lot will change in 2021.

And then I began to wonder, what about maternity payments? Are there changes coming, and how are maternity benefits calculated in 2021? There is a lot to figure out.

Especially if you are pregnant with your first child and have no idea how money is paid for pregnancy.

How long do you need to work to get maternity leave?

Maternity leave is always a long-awaited time for any woman. After all, the desire to have a child is inherent in us by nature. When it’s time to go on maternity leave, any woman faces a pressing question: how to get maternity benefits?

How much will payments be made, and does length of service affect the size of these payments?

Let's look at all these issues in more detail. In principle, everyone knows what maternity leave is.

How long do you need to work to get maternity leave in 2018?

In Russia, every pregnant and young mother receives financial assistance; for those who worked, the amount is much higher. Therefore, many representatives of the weaker half of humanity are interested in: how much time do you need to work to get maternity leave in 2018?

How long do you need to work to receive maternity leave?

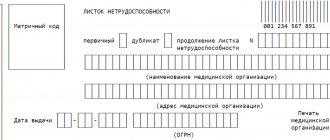

Registration of maternity leave for pregnant women working on the basis of the Labor Code of the Russian Federation is carried out at the thirtieth week of pregnancy.

since it is at this time that the doctor prescribes a certificate of temporary incapacity for work to the expectant mother.

Only pregnant women have the right to receive benefits for early registration at the consultation, as well as for sick leave, and they must be officially registered with their employer.

How long do you need to work to go on maternity leave?

In general, in order to go on maternity leave, you need to work at least one day in the organization.

Those. It turns out that if today you officially started working in an organization, tomorrow you can go on maternity leave. For a singleton pregnancy and childbirth without complications, you can count on 70 days of leave before the birth and 70 days of leave after the birth (140 days in total).

For singleton pregnancies and childbirth with complications, you can count on 70 days of leave before childbirth and 86 days of leave after birth (156 days in total).

The birth of a baby is a very happy event, but it entails material expenses, and considerable ones at that.

The new mother, of course, will receive help from the state.

But to what extent and is it available to everyone? Many women are interested in how long they need to work to get maternity leave.

Is the housewife entitled to these payments?

To understand exactly what payments and to what extent can be affected by the fact and duration of employment, we must first consider what the expectant mother and her child are generally entitled to from the state.

How long do you need to work to get maternity leave: official data, law

According to current legislation, every woman can count on social support during pregnancy and childbirth, as well as in the first years of a baby’s life.

But working girls, of course, get more. Therefore, many people are wondering how much they need to work to get maternity leave. To be honest, most women try to work as long as possible in order to get more money in the end.

The influence of length of service on the amount of maternity benefits

Of fundamental importance when determining the amount of payments is the woman’s work experience before going on maternity leave. If it does not exceed 6 months, then the minimum of her earnings for 1 month will be taken as the basis for the calculation. In the event that the length of service exceeds 6 months, payments will be calculated based on the average daily earnings for the last two years.

How long do you need to work to get maternity leave?

- up to 2 years, the monthly benefit is 40% of average earnings;

- for more than 24 months, the monthly benefit is 100% of average earnings.

Birth leave can be issued to close relatives.

These include grandparents, husbands, adult sisters and brothers.

Features of recording work experience for women

How much length of service is required for retirement for the female population? The authorities of our country take into account the true purpose of the fair sex, in addition to its social adaptation and labor activity for the benefit of the state’s economy. Of course, this is raising a new generation for a worthy succession, which requires even greater labor and psychological costs than standard work in state or private enterprises

Thus, when determining the length of service for a pension for women in the Russian Federation, the following privileges have been introduced at the legislative level:

- The minimum retirement age for women working under standard conditions as of August 2021 is 55 years.

- How long must you work to qualify for old-age social benefits? Despite the fact that according to the current laws of our country, in order to receive old-age compensation, it is enough to overcome the temporary threshold of 5 years of total work activity, all pension payments for women start from 20 years of interrupted or continuous service.

- In 2021, a woman must collect at least 13.8 conventional units to calculate benefits for an individual insurance number. This means that during the entire length of service, starting from 2003, the employer is obliged to transfer to the pension fund for each officially employed employee a percentage of wages determined for the current year, which forms a certain capital of the employee, intended for its spending at the age of survival. .

- As mentioned above, if a woman plans and gives birth to children, her work experience is not interrupted, and her pension continues to accumulate. So, if during her life she has three children of her own, she has the opportunity to be on maternity leave without interrupting her work experience from 4.5 to 18 years.

Important! If we take into account all the pension adjustments in our country in recent years, the information relevant for the current year may change, since the authorities have not yet come to a unified mechanism for accounting and calculating payments to citizens upon reaching old age

Is studying included in the work experience?

Work experience is divided into three types:

- for people in public service;

- for those working in hazardous industries or in environmentally hazardous regions (special);

- length of service accrued from adulthood until retirement, and accompanied by regular contributions to the Pension Fund (insurance).

Obviously, studying at a university or technical school cannot be classified as one of the above types of work experience.

But, as with any rule, there are exceptions here too. For cadets of educational institutions belonging to the Ministry of Internal Affairs and the Ministry of Defense, the accrual of insurance experience begins from the moment of their admission. Such a person is considered a military personnel.

How long do you need to work to get maternity leave in 2021?

In addition, a woman has the right to receive benefits from the Social Insurance Fund. By the way, the second part of the leave related to caring for a minor can be used by the mother’s immediate relatives

Important! Employees employed in several companies can count on guarantees similar to those provided to employees carrying out part-time activities. It is worth noting that a one-time payment is made to those employers where an employment agreement has been concluded with the maternity leaver.

Monthly benefits, in turn, are recognized as basic. Material support, in contrast to leave, is entitled to every woman, regardless of the category of citizens in which she is located (employed, unemployed, full-time students, military personnel).

At the same time, unemployed people who have not registered with the Employment Center and have not received the appropriate status are not entitled to benefits.

The employee’s insurance length does not affect the receipt of benefits, but directly affects its amount.

Minimum benefit amount in 2021

The minimum amount of maternity leave is paid to a certain category of women:

- working less than 6 months;

- officially unemployed.

In the first case, the benefit is calculated based on the minimum wage; in the second case, the calculation base will be unemployment benefits.

The law regulates the minimum amounts of maternity payments:

- for the first child – 3065.69 rubles;

- for the second child – 6131.37 rubles.

Neither the Social Insurance Fund nor the employer has the right to pay benefits of the following amounts.

If several children are born at the same time, payments increase. For example, at the birth of twins, the minimum amount of maternity leave will be calculated as follows:

3065,69+6131,37 = 9 191,06

What affects the benefit amount?

The amount of social benefits for pregnant women is influenced by several factors:

- woman's length of service;

- the average salary received by a pregnant woman during the two years before going on maternity leave.

In this case, the insurance period is taken into account, that is, the period during which the employer made payments for its employee to the social insurance fund.

Currently, there is a rule that those representatives of the fair sex who work under an employment contract for less than six months have the right to receive social benefits in the minimum amount.

For women with longer experience, payments are made based on their wages, but cannot be less than the amounts specified in the current legislation.

There are a number of things to consider when calculating your average income. If a woman goes on maternity leave in 2021, even if this happens on December 31, then the employer must take as a basis the salary given to her in 2014 and 2015.

In cases where the number of days worked is less than seven hundred thirty (two years), the total amount of income is still divided by this period.

But the resulting monthly income cannot be less than the minimum wage accepted in the woman’s region of residence.

Maximum and minimum amount

At the legislative level, the issue of the amount of social benefits issued during pregnancy and after childbirth is clearly regulated.

In some cases, their size is the same for all residents of the country, for example, a one-time benefit for the birth of a child, while in others only maximum and minimum payment values are established.

Currently, this only applies to payment of sick leave and benefits paid for the period of caring for a child under one and a half years old.

Documents for maternity leave must be submitted in full.

Is maternity leave included in the length of service for calculating a pension? Read here.

How much do people on maternity leave get paid? Detailed information in this article.

Currently, the minimum sick leave benefit is thirty-four thousand rubles, and its maximum value cannot exceed two hundred forty-eight thousand rubles, even if contributions to the Social Insurance Fund were paid from a salary exceeding this amount.

Also, women receive at least two thousand nine hundred eight rubles for caring for their first child, and five thousand eight hundred seventeen rubles for subsequent ones.

Maternity leave for unofficial employment

According to the labor code, in case of unofficial employment, maternity leave is not paid.

This situation can be corrected in several ways:

- independently make contributions to the social insurance fund;

- confirm your unemployed status.

Independent deduction of insurance contributions to the Pension Fund involves the payment of a standard or desired amount. Even a one-time deduction gives a woman the right to receive maternity benefits. To apply for benefits, you must contact the FSS.

Having received official unemployed status, a woman will receive monthly unemployment benefits until she goes on maternity leave. In this case, a minimum amount of maternity payments is provided, based on the minimum wage in a particular region.

What will be the pension if there is no work experience?

When there is no standard of work experience, or the citizen has not reached the age at which a pension can be assigned, then he is not entitled to insurance payments. Despite this, a certain type of pension provision is prescribed - old-age social pension.

Unemployed citizens can receive similar payments on the basis of Part 5 of Article 11 of Law No. 166 (dated December 15, 2001). The amount of social pension is determined by clause 1 of part 1 of article 18 of the above law.

Attention! Taking into account the current level of subsistence minimum (subsistence level) of the pensioner, every year from the beginning of April, the size of this pension is subject to indexation. Eg:

Eg:

- until April 2021, the amount of social pension assigned for old age was determined at the level of 5,180 rubles 24 kopecks;

- already from the beginning of April 2021, as soon as the payment value was indexed, the amount was set at 5.304 rubles 57 kopecks (the figure increased by 2.4%).

The amount of benefit received by a citizen should not be inferior to the pensioner’s minimum wage established for the region of residence. Therefore, the size of payments is directly dependent on the regional value of the subsistence minimum and is subject to adjustment to its level. Additional payment up to the amount of the corresponding PM is organized at the federal or regional level.

Social benefits are issued in connection with old age five years later than the usual age established by law for assigning a pension.

How to check whether the old-age pension is calculated correctly?

Since from 2021 there will be a gradual increase in the minimum age for receiving a pension, the age at which you can apply for a social pension will change accordingly:

- Men will receive payments upon reaching the age of 65.5 years (in 2019);

- Next year (2020) the figure will be different – from 66.5;

- The final determination of the age for access to social pension will occur in 2023 - men will be able to receive benefits from the age of 70.

Watch the video. How to find out the size of your future pension:

Deadlines for assigning payments after submitting an application

According to the rules established by Article 22 of Law No. 400, pension payments are assigned from the date the Pension Fund accepts the candidate’s documents for the assignment of payments, but not before the latter has the right to receive insurance benefits.

If a citizen submits all documents for applying for a pension through the MFC, what date is considered the day of application to the Pension Fund?

Attention! It is considered that the citizen applied for insurance benefits from the moment the corresponding application was received by the MFC. The date of application for payment processing is calculated similarly when sending an application by the postal service or through Internet resources.

In the first case, this is a postmark with the date and month of acceptance of the documents by the Pension Fund of the Russian Federation. In the second - the date when the electronic form was filled out through the official resource of the Pension Fund of Russia

The date of application for processing payments is calculated similarly when sending an application by the postal service or through Internet resources. In the first case, this is a postmark with the date and month of acceptance of the documents by the Pension Fund of the Russian Federation. In the second - the date when the electronic form was filled out through the official resource of the Pension Fund.

As soon as the application for a pension is received by the Pension Fund of Russia, 10 days are counted down - this is the maximum period for consideration of the application.

If it turns out that an incomplete list of documents has been collected, then the interested party is given additional time to eliminate the deficiencies. A maximum of three months is allocated for this.

Who makes the payments?

If a woman goes on maternity leave, the employer is responsible for timely payment of benefits.

The period for transferring funds is regulated by law and is 10 days from the date of application by the copyright holder.

If a woman applies for maternity benefits after 6 months, the benefits will be paid by the social insurance fund. The reasons for missing the deadline for applying for benefits must be valid.

In the absence of insurance experience, the payment of unemployment benefits and maternity benefits is carried out by the employment center.

Required length of service for calculating pension payments

Many residents of our country are interested in the question, how many years do you need to work to receive a pension? According to the decisions of the authorities, all pensions accrued today are divided into 2 main parts - insurance and funded. Thus, benefits are calculated based on the following criteria:

When calculating the funded part, Pension Fund employees take into account the citizen’s age, as well as his work experience, confirmed by documents or based on the testimony of at least two former colleagues. The insurance part of the pension is accrued to the number of the individual insurance certificate put into circulation starting in 2003. These measures were taken by the authorities in order to personalize payments depending on the actual contributions of citizens to a special fund over the course of active work.

So, upon reaching a certain age, an account is opened for citizens to which they made contributions, and if during the remaining age of survival the individual has not exhausted the savings, they can be inherited.

Assignment of old age pension

How long do you need to work to receive an old-age pension? All old-age accruals today depend on the points accrued, which in turn are based on the qualitative indicators of the person’s work activity. In order for citizens to begin receiving payments from the state, the following conditions must occur:

- Reaching 55 years for the beautiful and 60 for the stronger half of humanity (information is current as of August 2021). However, there are certain categories of citizens whose work is characterized by harmfulness, and they are entitled to retire somewhat earlier than others; these categories include mining industry workers, medical workers, overhead crane operators, etc.

- Contributions to the insurance fund must occur for at least 5 years with possible interruptions. For example, if a citizen of the Russian Federation worked from 2009 to 2013, and then was unemployed, but was able to continue active work from 2021 to 2021, he already has the right to apply for an old-age pension.

- Due to the fact that the point system of contributions was introduced not so long ago, the total amount of insurance contributions for citizens retiring today should be equivalent to 13.8 points. In the future, these contributions to the insurance fund will have to increase to 30 points.

Combat veterans

Important! If the pension program developed by the Russian government does not fail over the years, then by 2025 the minimum length of service for citizens will have to be 15 years, since only in this case will they be able to score the 30 points required for accrual

How is maternity leave paid?

It should immediately be noted that in each individual case the amount of maternity payments will differ. The amount of this compensation is directly influenced by the following factors:

- Pregnant status - in total, 4 main categories of women can be distinguished: officially employed, undergoing training, unemployed (subject to certain conditions) and those in military service under contract. For each of these cases, there is a different procedure for determining the amount of maternity payments, which affects their size.

- Salary - the main indicator that is involved in the calculation of maternity payments is the income received by the woman over the previous 2 years. Thus, the higher the salary, the higher the maternity benefit.

- Amount of time worked - if the employee worked for less than 2 years before becoming pregnant, then when calculating maternity benefits, the employer must focus on the minimum wage (clause 11(1) of the Government of the Russian Federation of June 15, 2007 No. 375).

- Features of childbirth - as noted above, if the birth was difficult, then when calculating maternity leave, a longer period of leave is used (70 and 86 days).

- Number of children born - if the pregnancy is multiple, then the calculation period is 194 days (84 before and 110 days after birth). Consequently, this circumstance also increases the amount of the benefit.

In general, the amounts of maternity payments have certain limits that they cannot exceed. The minimum and maximum amounts of such compensation are fixed at the legislative level.

Read also: Certificate for childbirth: who needs it and why?

The minimum amount of maternity payments depends on the minimum wage level adopted in a particular year. For 2021, its size is 12,130 rubles. Thus, the maternity benefit should not be lower than the following amounts, depending on the duration of the leave:

- 55,830.60 rubles (140 days);

- 62,211.24 rubles (156 days);

- 77,365.26 rubles (194 days).

The maximum possible amount of maternity payments in 2020 is the following values:

- 322,000 rubles (140 days);

- 358,800 rubles (156 days);

- 446,200 rubles (194 days).

Periods included in the length of service for calculating an old-age pension

There are circumstances in which a person does not have the opportunity to carry out full-time work activities. The law stipulates individual stages taken into account when calculating length of service.

The following periods are subject to mandatory inclusion in the length of service taken into account when assigning old-age pension payments:

- The period when a person served in the ranks of the RF Armed Forces, in law enforcement agencies, or studied at one of the military institutions;

- Maternity leave period. Only one and a half years are taken into account here. If a woman took two leaves at once to care for children, they will not be included in the total work experience;

- The period when a person cared for a relative due to the latter’s illness or infirmity (due to old age);

- A time when a person did not have official earnings, but only if he had the status of unemployed (this requires registration with the central bank);

- The time during which a person served time in prison or another place of confinement after conviction;

- The time during which the citizen was engaged in public paid activities;

- Studying can be equated to working time if it is combined with official employment and parallel contributions to the insurance fund.

The above periods are counted only if all the conditions specified in the law are met. Non-insurance periods are included in the length of service for registration of pension payments if the person worked before (or after) and insurance premiums were transferred for it. Any period of work is taken into account.

Mandatory experience and requirements for obtaining it

The standard duration of maternity leave is 140 days. Sometimes this period increases if there are complications or other circumstances surrounding the birth of the baby(ies). Labor legislation guarantees B&R payments only to women who are officially employed. The employment relationship must be secured by agreement, and the employer must bear full responsibility for tax payments and fees for the employee.

The benefit is due to any employee going on maternity leave, but the amount of payment will vary. A significant factor influencing the final amount is length of service.

- To receive a large sum, you need to work in one place for 6 years or more with a good salary.

- Having at least two years of experience will help you get good, average-sized payments.

- The main requirement is to work in the last place for the last 13 weeks.

Answering the question of how long you need to work for maternity leave, it can be noted that a period of less than a year will allow you to receive benefits significantly lower than average. The longer the experience, the greater the payments. Otherwise, there are no restrictions by law. In Russia, a woman only needs to work in place for even a month to already count on maternity payments. Even an employee who occupies a temporary position and has gone on maternity leave has the right to receive the required payments.

Benefits for pregnant women in 2021

In Russia, every pregnant and young mother receives financial assistance; for those who worked, the amount is much higher. Therefore, many representatives of the weaker half of humanity are interested in: how much time do you need to work to get maternity leave in 2017?

The main payments include:

- assistance in early fixation of an interesting position (for up to 12 weeks);

- childbirth and pregnancy;

- money that is given until the child turns 1.5 years old;

- compensation amounts if the child is under 3 years old.

A total lack of money, the high cost of children's things, strollers and food force the expectant mother to work hard for as long as possible - this is the only way to provide more or less impressive help.

Results

Now we know everything that can be said about maternity and social benefits for women, both working and housewives. To be honest, many try to work as much as possible, right up to giving birth. This technique will not greatly affect your maternity leave, but it may well affect your health. And it’s good if it doesn’t affect the baby in any way.

From now on, it is clear how much work you need to do to receive maternity leave. You can figure out for yourself whether it is worth officially getting a job, as well as for how long to work. Maternity leave is usually issued at 30 weeks of pregnancy.