How is a pension recalculated after the dismissal of a working pensioner?

In the event of dismissal, the pensioner's pension is recalculated taking into account those indexations that he missed during his working life. This right to recalculation after dismissal is enshrined in Part 3 of Art. 26.1 of Law No. 400-FZ. The indexed pension will be assigned from the 1st day of the month following dismissal from work. For example, if a person quits on any day in August, then the increase will be assigned from September 1.

However, a citizen will be able to receive an increased pension several months after stopping work. This is due to the procedure for transferring information from the employer to the Pension Fund.

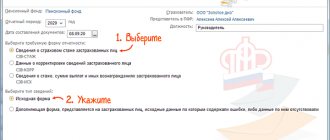

Below is a step-by-step diagram showing how pensions will be recalculated for working pensioners after dismissal. The scheme reflects the procedure for recalculation if a citizen quits in December, but similarly, you can substitute any other date - the mechanism will be similar.

Monetizing vacations

Like other retiring citizens, working pensioners have the right to monetary compensation for unused vacation during the entire period of work at the enterprise. At the same time, the duration of unpaid leave for the same period is subtracted from the duration of the leave you were entitled to (of course, if you had to take such leave).

This opportunity is available both to citizens who quit their jobs voluntarily and to those who were forced to leave their jobs due to staff reductions. It follows from this that it is most profitable for you to submit your resignation letter after your vacation - then you will also receive vacation payments.

Moreover, the duration of the vacation will be added to your insurance period, the amount of which matters at any age.

As we see, a working pensioner has the opportunity to choose the time to leave work with maximum benefit for himself - of course, if he calculates this time of his own free will, and is not forced to leave due to staff reductions or even bankruptcy of the company. But even in this case, he is entitled to good bonuses, and at least one of them (pension indexation) will not be canceled even upon subsequent employment.

And yet, older people who continue to work are extremely sensitive to any hint that they may be forced to retire, otherwise depriving them of the right to receive both a pension and a salary.

This is due both to the fact that the needs of older people, who need proper nutrition, comfortable clothes for the season, and medicines, are far from minimal, and to the fact that work is not only a source of income, but also socialization necessary even at an advanced age.

Recalculation of pensions for working pensioners after dismissal in 2020

Step-by-step recalculation scheme

Accordingly, if work is stopped in December, then indexation will be scheduled from January 1. Moreover, the payment delay will be 3 months, and the pensioner will receive the indexed payment in April along with additional payments for January, February and March.

Note that this scheme reflects the most profitable option for dismissing a pensioner in order to receive indexation (we will explain this in more detail later).

When is it better for a working pensioner to quit in order to get indexation?

When choosing a dismissal date, you need to start from the specific goals that the retiree is pursuing. Depending on them, the recommendations will be as follows:

If a pensioner has been working for a long time and just wants his pension to be indexed, then he can quit at any time. True, it is most profitable to quit on the last day of the month, since the promotion will be assigned on the 1st of the next month. If the dismissal is formalized at the beginning and middle of the month, the citizen will simply lose his salary during this time - from the date of dismissal until the end of the current month.

If a pensioner does not want to miss the next annual indexation (such as a 6.6% increase from January 1, 2021), it is advantageous to resign so that on the date of indexation the person is already considered unemployed. For example, if a citizen wants to receive January indexation, he needs to quit before the end of December, and then be unemployed throughout January.

How long do you have to stop working for your pension to be indexed?

The Pension Fund learns that a pensioner has become unemployed if insurance premiums are no longer paid for him. That is, the employer must receive reports that will not contain information about the contributions paid for the pensioner. And since the reporting is monthly, you need not work a single day during the calendar month so as not to “get included in the report.”

You must not work from the first to the last day of the month, for example, from January 1 to January 31. Then the report for January will not contain information about the payment of contributions for the pensioner.

If a citizen decides to quit at the beginning or middle of the month, then he needs to not work until the end of this month and throughout the next month. For example, if the dismissal was formalized on May 15, you must not work until the end of May and throughout June.

Recalculation of insurance pensions

Recalculation of the insurance pension amount is an adjustment of the payment amount through an increase in the IPC (individual pension coefficient) and (or) a fixed payment. Since this is not indexation, let’s figure out what awaits working pensioners in 2021 in this area.

In what cases is recalculation made:

- if the pensioner has additional income from which insurance contributions to the Pension Fund are paid;

- in connection with new information about labor activity;

- in connection with innovations in laws;

- due to other circumstances.

Recalculation is carried out:

- without submitting an application from the pensioner to the Pension Fund (automatic, non-application recalculation);

- according to an application to the Pension Fund.

Pension recalculation formula

It is impossible to say anything new about pensions for working pensioners in 2021, but the Pension Fund of the Russian Federation promises that from August 1, all employed Russians over 55 (60) years old will have their payments automatically recalculated taking into account the amounts transferred for pension insurance.

Payments to non-working pensioners will also be recalculated if circumstances arise that affect the size of the individual pension coefficient (according to information received by the Pension Fund).

Recalculation formula for old-age insurance pension:

SPst = SPstp + (IPKi × SPK),

Where:

- SPst - the amount of payment after recalculation;

- SPstp - the amount of payment established as of July 31;

- IPKi - individual pension coefficient at the beginning of the year, not taken into account in the previous recalculation;

- SPK - the cost of one pension coefficient (as of 01/01/2020 SPK = 93 rubles).

Undeclared recalculation of insurance pensions

The annual automatic recalculation of insurance pension payments will occur on August 1.

Based on clause 4 of Art. 18 400-ФЗ dated December 28, 2013, with an undeclared recalculation, the maximum value of IPi (not taken into account at the time of recalculation) does not exceed:

- 3.0 - for pensioners who do not have pension savings;

- 1.875 - for pensioners who are forming pension savings.

The annual automatic recalculation of the insurance part of the pension for working pensioners in 2021 will take place on August 1, subject to deductions of insurance contributions to the Pension Fund, which were not previously taken into account:

- during the previous recalculation;

- when assigning an insurance benefit (for old age or disability);

- when assigning an insurance benefit in the event of the loss of a breadwinner (adjusted once: in August of the year following the year of its appointment);

- when transferring to another type of insurance benefit (old age or disability).

Automatic (non-declaration) recalculation of the fixed payment amount is carried out:

- when a pensioner reaches 80 years of age;

- disabled people of group I.

For them, the fixed payment is doubled.

Recalculation of insurance pensions upon application

In a number of circumstances, recalculation is made upon a personal application to the Pension Fund. They increase both the IPC (individual pension coefficient) and the fixed payment.

What circumstances give the right to an additional recalculation? Non-insurance periods (for which insurance premiums were not received by the Pension Fund), which provide grounds for increasing the IPC, are presented in Art. 15 and 18 Federal Law-400 dated December 28, 2013:

- completion of military service upon conscription;

- receiving social benefits for temporary disability;

- care for each child up to one and a half years old (but not more than six years in total);

- receiving unemployment benefits;

- caring for a disabled person of group I, a disabled child or an elderly person over 80 years of age;

- residence of military spouses in areas where there was no opportunity to find a job (but not more than five years in total);

- residence abroad of spouses of civil service employees (but not more than five years in total);

- operational-search activities;

- detention and serving sentences of persons unjustifiably prosecuted, repressed and subsequently rehabilitated;

- a period of temporary suspension from work of a person who was unjustifiably prosecuted and later rehabilitated.

IMPORTANT!

Such periods are added to the length of service if they were preceded and (or) followed by working periods for which deductions were made to the Pension Fund (Article 11 No. 144-FZ of 08/12/1995).

The fixed payment increases in the following cases (Articles 15 and 17 of Federal Law No. 400-FZ of December 28, 2013):

- increasing the number of disabled dependent family members (no more than three dependents are taken into account). An increased fixed payment is established for old-age and disability insurance benefits;

- living in the Far North. The fixed payment increases taking into account the regional coefficient for the entire period of residence;

- achieving the required work experience in the Far North and (or) insurance experience. The fixed payment to the insurance benefit (for old age or disability) increases;

- changes in the category of survivors' insurance benefit recipients.

IMPORTANT!

The law provides for recalculation in the event of an increase in the IPC and (or) an increase in the fixed payment (Articles 17 and 18 No. 400-FZ of December 28, 2013).

Adjustment of funded pension

Recalculation of pension savings is carried out on August 1 annually without submitting an application. There is no indexing.

The adjustment occurs based on unaccounted receipts when it was assigned or the previous adjustment (Article 8 of Law No. 424-FZ of December 28, 2013):

- from insurance premiums;

- from additional voluntary insurance contributions;

- from contributions for co-financing and the result of their investment;

- from maternity capital funds and the result of its investment.

The adjustment is made according to the formula:

NP = NPk + PNk / T,

Where:

- NP - payment amount;

- NPK - the established amount of payment as of July 31 of the year of adjustment;

- PNk - the amount of pension savings as of July 1;

- T is the number of months of the expected payment period as of July 31.

The amount of the funded pension is adjusted based on the results of investing funds from the payment reserve in accordance with Art. 12 of Federal Law No. 360-FZ “On the procedure for financing payments from pension savings” dated November 30, 2011.

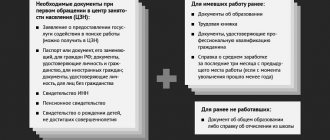

A pensioner quit his job: do I need to inform the Pension Fund?

The law does not oblige a pensioner to notify the Pension Fund of his dismissal or subsequent employment. All information about a citizen’s status (working or non-working) is contained in the individual personalized accounting system. Information in this database comes from the employer in the form of monthly reporting.

However, according to part 5 of Art. 26.1 of Law No. 400-FZ, a citizen has the right to inform the Pension Fund of the Russian Federation about his dismissal or subsequent employment. You can notify by personally contacting the Pension Fund, MFC, or by submitting an application through State Services or your Personal Account on the Pension Fund website.

Please note: the law states that “pensioners have the right” to notify the Pension Fund, but are not required to do so. In fact, it is everyone’s personal choice whether to notify or not. In addition, this will not affect the date of recalculation after dismissal. All the same, payments will be recalculated only on the basis of accounting information and incoming employer reports. Personal notification will not speed up the recalculation procedure.

When can I get a job again?

A working pensioner can get a new job or return to his previous place of work, without even waiting for an increase from recalculation. The main condition: to be unemployed for a full calendar month. And immediately after the end of this period, you can get a job - the increase will not be lost. In this case, the terms of recalculation will be standard, and the increase will arrive in no less than 3 months (see the recalculation diagram).

For example, a pensioner decided to quit on April 25. In order for his pension to be indexed, he must not work until May 31 inclusive. Already from June 1, he can get a job, and he will not lose the increase from the recalculation. According to the recalculation mechanism, he will receive an increased pension in August, and along with it additional payments for May, June and July (since the right to indexation will be established from May 1).

Let us remind you that according to Part 8 of Art. 26.1 of Law No. 400-FZ, in case of resumption of work for a pensioner, the right to indexation is again “frozen”. He will receive the amount of pension that was due to him on the date preceding his employment.

Compensation for frozen pensions

As you know, starting from 2021 to this day, Russian working pensioners have lost the right to annual indexation of insurance pensions until dismissal. After leaving work, not only the indexation of the current year is restored for them, but also all indexations missed since reaching retirement age. It is easy to calculate that since 2021, 6 such indexations have already taken place .

But this compensation does not begin immediately, but approximately three months after the termination of the employment contract. This is the period required for your former employer to submit information to the Pension Fund, to verify the data provided to the Pension Fund and to actually recalculate the pension.

If you quit, for example, on April 30, you will be recognized as unemployed starting from May 1 and will thus receive the maximum benefit (both in the form of compensation for missed indexations of the insurance pension, and in the form of salary for the entire last month you spent at work). If you left your job in June, your indexation will be restored starting next month, but you will receive the money itself in September.

The compensation will not be added to your pension immediately, but only three months after your dismissal is recognized. This period is needed for the Pension Fund to collect and verify all documents confirming your legal rights. After the specified period, you will be paid compensation for 3 “test” months.

Moreover, if after some time you wish to return to work, the pension indexation already accrued to you will not be cancelled. But since you will again become a working pensioner, further indexation will be “frozen” until the moment when you want to quit again and the size of your pension will be indexed based on the accumulated pension points. There are no financial sanctions for re-dismissal . These are the general rules established for working pensioners throughout Russia, including Moscow and the Moscow region.

It is worth keeping in mind that you have the right to leave your job at your own request, but the employer does not have the right to fire you on its own whim. In particular, the law prohibits dismissing a pensioner because he has reached old age (except for those situations where there is a legally prescribed service life limit for a given profession or position).

Also, you cannot be forced to undergo two weeks of work, which is mandatory for other citizens resigning at their own request.