Every day, thousands of Emergency Situations Ministry workers put their lives in danger so that other citizens can safely go to work, raise their children, and love their loved ones. For such people, the state has developed a number of laws, including the law on pension provision - on preferential pensions for emergency workers.

In this article we will talk about what types of pension payments employees of the Ministry of Emergency Situations can apply for, what length of service and conditions are required. Let's look at how to calculate your payments, as well as what documents you need to collect and where to submit them.

Experience for receiving a pension

When applying for an early pension, employees of the Ministry of Emergency Situations must have either 20 years of service or 12 and a half years of service with 25 years of total experience. Prior to special experience, studies in a specialty within 5 years, as well as the period of military service, are counted.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Service in areas of the Far North or equivalent to the Far North is calculated in multiples (double or one and a half).

Is it possible to leave early?

According to the Law of the Russian Federation No. 4468-I, employees of the Ministry of Emergency Situations are equal to military personnel and are entitled to appropriate benefits.

The required age limit for taking undeserved rest is 50. The required work experience is 25 years and above.

What benefits can emergency rescue workers count on?

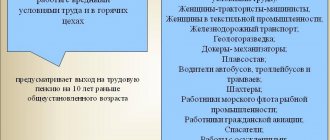

Rescuers of the Ministry of Emergency Situations who work in difficult conditions are also entitled to receive benefits. At what age do firefighters retire?

The state only offers access to a labor pension, for which several requirements must be met:

- work experience in hazardous conditions for life of at least 15 years;

- The rescuer must be over 40 years old.

It is worth noting that age limits do not apply to rescuers of categories 1-3. By law, they are allowed early retirement on a preferential pension as soon as the threshold of 15 years of work experience is reached.

Based on the specifics of their work, employees of the federal service of the Ministry of Emergency Situations are entitled to a preferential pension. Regional services have slightly different conditions for retirement, so if for some reason an employee wants to change from a federal department to a regional one, then he is deprived of the right to retire upon receiving 15 years of service.

Since the severity of the work of employees of the regional services of the Ministry of Emergency Situations is different, their conditions for receiving a preferential pension are adjusted:

- The employee must be at least 50 years old;

- The total length of service in GPS positions is 25 years.

According to the standards for calculating seniority, only those days that have been worked in full and in certain positions will be counted. In other words, those working days for which wages were calculated and there were deductions to the Russian Pension Fund are counted.

The length of service will be calculated using the calendar method - 12 working months per 12 months of work experience. It is important to know that for regional employees of the Ministry of Emergency Situations there is no preferential length of service, according to which 1 working year is taken into account for 2 years of work experience.

Also, periods of training or advanced training will not be counted toward the total length of service.

Are there plans to increase the retirement age?

The issue related to increasing the age threshold for calculating a pension has been repeatedly discussed in parliament. Today such a bill was heard in parliament. This document reflects the increase in the required special experience to 30 years, until 2025.

Bill on extending the service life limit for employees of the Federal Penitentiary Service and the State Fire Service of the Ministry of Emergency Situations

By a majority vote of the deputies of the Russian Federation, it was decided to increase the age threshold for retirement. This will apply not only to the Ministry of Emergency Situations, but also to civil servants. This increase will not occur immediately, but gradually.

Pension paid according to length of service

You can apply for a long-service pension if you have 20 years of service with 12.5 years of qualifying service and 45 years of age. Only then can you count on at least the minimum payment. Having more experience than necessary, you can count on an increased amount of payments.

Good to know. In the absence of experience, appointment occurs upon reaching the required age level and on general conditions.

Fireman's pension

Fire service employees, having worked in the specialties that are listed in Resolution No. 437, for 25 years and reaching 50 years of age, can count on legal payments. Work in the State Fire Service of the Ministry of Internal Affairs, as well as work in federal services, counts towards length of service.

Important! Military service and studies are not taken into account when considering pensions for firefighters.

According to the current legislation of the Russian Federation, previously assigned preferential pensions to employees of the fire department of the Ministry of Emergency Situations are indexed annually and increased by 2%.

Benefits for the loss of a breadwinner

In the event of death in the line of duty of an employee of the Ministry, people who were dependent on him may qualify for cash benefits for the loss of a breadwinner. The category of dependents includes: minor children, parents, one of the spouses, children studying as full-time students in educational institutions, as well as a brother or sister.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The amount of payments reaches 50% of the deceased’s salary for one child and 40% for others supported by the deceased.

Disability content

As a result of an injury received while performing his official duty, an employee of the Ministry of Emergency Situations registers one of the disability groups and only after that applies for cash benefits. The cash benefit directly depends on what disability group is assigned, 1,2 or 3.

After a disabled person has reached an age sufficient to receive general payments, annual re-examinations are not carried out, and the expiration date is set indefinitely.

Important! Only if there is a dismissal from the Ministry of Emergency Situations, a cash benefit due to disability is paid.

Mixed service pension

Payments taking into account mixed experience are made upon reaching 45 years of age, taking into account 25 years of total experience with 12.5 years of experience in the specialty. After the appointment of such payments, you can work in a civilian specialty. Upon reaching retirement age, a corresponding payment is issued. Moreover, the initial appointment is not suspended.

Allowances for length of service in the Ministry of Emergency Situations and correction factors

The principles for calculating pension payments for former employees of the department are determined by Article 14 of Law No. 4468-1, and the amount of accruals is directly affected by:

- salary amount;

- the value of the reduction factor;

- duration of service;

- presence of disability;

- regional correction factors.

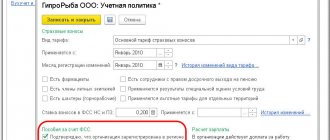

To independently calculate the expected pension amount, you need to sum up all the components of an employee’s salary (salaries according to position and rank, additional pay for length of service). The current salary amounts are indicated in Government Decree No. 1020 of December 8, 2011.

Indexation of military pay has been suspended for an indefinite period until the economic situation in the country improves.

The resulting figure is then multiplied by a reduction factor, which for 2021 is 73.23%. In accordance with Article 43 of Law No. 4468-1, the value of the reduction coefficient must increase annually by 2% until it reaches 100%, due to which the amount of military pensions will increase.

The amount received is the basis for calculating pension benefits. The final calculation is carried out according to the following principles:

- If an employee has served in the ranks of the Ministry of Emergency Situations for 20 years, then the amount of his pension will be 50% of the base amount.

- An increase is provided for service experience of more than 20 years - plus 3% for each additional year (with mixed experience this amount is 1%). But there are restrictions - the maximum value of the coefficient should not be more than 85%.

- For disability resulting from a work injury, the percentage of accruals is 40-85% of the base figure. The exact meaning varies by group.

- Regional coefficient - determined depending on the natural and climatic conditions of the region of service.

Indexation of military pensions by inflation is regulated by Law No. 400-FZ of December 28, 2013 and occurs in the standard manner annually in February. Recalculation of the amount of money occurs automatically; there is no need to collect additional documents.

Features of providing security to former employees of the Ministry of Emergency Situations

When working in positions such as dispatcher, accountant, supplier, personnel officer, i.e. where there are no titles, the right to reduce the retirement age is not provided. Firefighting services do not enjoy such benefits. They will receive pension payments like all ordinary citizens. Firefighters enjoy special benefits.

Formula for calculation

The pension for employees of the Ministry of Emergency Situations is calculated using a simple formula:

P=ZP/100*S+Pr

Where:

- P-size of pension.

- Salary is the salary at the time of applying for a pension.

- C-number%, depends on the years worked (from 50% to 85%).

- Pr-various increases.

Amount of surcharge

With 20 years of experience, the payment will be equal to 50% of the salary. For each additional year worked, an additional payment of 3% is provided, but not higher than 85%.

Also, depending on the quantity and quality of awards, different amounts of additional payments to monthly payments from the Pension Fund are established.

How to calculate your pension?

To calculate a pension, it is necessary to take into account all the main characteristics of a particular person. When calculating, the specialist takes into account basic data, such as:

- Salary part - a tax official sums up cash receipts by position, rank, allowances for years worked;

- The amount is reduced by exactly half after 20 years of experience. Each year worked adds another three percent to the overall coefficient. However, the resulting value cannot be higher than 85%.

For mixed length of service, a 1% bonus is added for each year!

The procedure for calculating a pension is as follows: apply the coefficient of 69.45% to the last salary. Next, adjust the numbers according to the following principles:

- 50% – for 20 years of experience;

- 50%+3% for the number of extra years, if the experience is more than 20 years;

- 85% – with disability, the main reason is a work injury;

- 75% – disability, deterioration of health after performing official duties;

- 40-50% – 3rd disability group.

And at the end they add a regional coefficient.

For ease of understanding, here is an approximate calculation:

Conditions: On March 1, 2016, Senior Inspector A.A. retired. Ivanov. He lives in the Kirov region. The rank is captain, the official salary is 16 thousand, according to rank - 11 thousand. Supplement - 10,800 rubles. Special experience - 25 years.

Actual calculation:

- First, we identify the total amount of monetary remuneration by adding all components of the salary: 16,000 + 11,000 + 10,800 = 37,800 rubles;

- Then we identify the basic salary, taking into account the coefficient of 69.45%: 37800 * 0.6945 = 26,252 rubles;

- For the period of service under consideration, the pension percentage will be fifty percent plus three for each year of overtime, in the end we calculate: 50+(3*5)=65%;

- We add the regional coefficient for the Kirov region, which is equal to 1.15. We get the final calculation: 26,252 rubles * 0.65 * 1.15 = 19,623 rubles - the amount of the pension.

For those who prefer a simpler option, a pension calculator for employees of the Ministry of Emergency Situations is suitable, which can be found on the website www.fireman.club/kalkulyator-pensii. This method has a number of advantages, such as:

- ease;

- fast speed;

- a large number of attempts;

- free service.

It is important to know! Payment of pensions in the city of Omsk

The following indicators must be entered into the table:

- Job title;

- full name of the rank;

- number of years worked;

- mixed experience (if any);

- amount of allowances;

- regional coefficient;

- salary in all respects.

Registration of a pension for mixed service

If you have less than 20 years of experience, a former employee of the Ministry of Emergency Situations can receive a mixed pension. To design it, you must consider:

- age parameters - more than 45 years;

- total period of work - 25 years;

- 12.5 years - working in the structure of the Ministry of Emergency Situations;

- dismissal due to: the occurrence of a serious illness; exceeding the maximum age limits; optimization of staffing.

Dismissal of one's own free will does not give the right to receive a mixed pension.

Let's give a clear example. Conditions of the task: the commander of the republic, Mari EL, resigned due to the extension of his maximum service life. He worked in the fire service for 15 years. Before that, he underwent specialized training and worked for 13 years in a private company. As a result, the total experience was 28 years. Rank: ensign. Age over 45 years. The salary part is 14 thousand, the salary according to rank is 8 thousand.

Pension calculation:

- 13+3=16 years – total civil experience;

- 16+15 = 31 years = mixed experience;

- 14+8*0.6945=15,279 rubles - we calculate the basic allowance;

- 15,279 * 0.5 (edge coefficient) = 7,639 rubles - the final pension amount.

Features of retirement for employees of the Ministry of Emergency Situations

Only employees of the Ministry of Emergency Situations without special ranks can count on accruals calculated on general terms.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The main condition for starting payments from the state is the presence of the necessary work experience (for registration of length of service) or one of the disability groups (for the assignment of disability benefits).

Also, do not forget about the amount of wages, service life, service time and various allowances.

Documents for registration

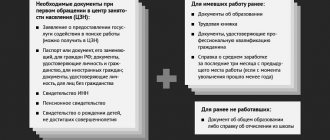

Emergencies Ministry employees who have achieved the right to certain payments contact their HR department with the following documents:

- Statement of the established form.

- Passport.

- Work book.

- Cash certificate in two copies.

- Confirmation of special experience.

- MSEC certificate (for disability pension).

- Award documents (if any).

- Permission to use personal data.

If you find an error, please select a piece of text and press Ctrl+Enter.

Additional payments and benefits

If the length of service is 20 years, then the payment is equal to half of the salary. If the firefighter continues to work, then for each subsequent year an additional payment is assigned, which is 3%. The payment amount increases until it reaches 85%.

Pension Fund representatives additionally assign different types of pension supplements, which are offered exclusively to employees of the Ministry of Emergency Situations who have any awards or titles.

Local authorities offer different types of benefits, which include:

- widows of firefighters receive their husband's pension, as well as a large sum in the form of compensation for funeral expenses;

- discounts on housing and communal services;

- compensation for the cost of home repairs or the purchase of fuel intended for heating a residential building;

- discounts on fares on city public transport;

- free issuance of vouchers to sanatoriums, as well as payment of travel to this institution and back;

- receiving benefits for minor children.

Such benefits continue even after a firefighter retires, and some preferences are offered to retirees at the local level.

Registration procedure

If a firefighter registers the first or second disability group, and also reaches the required retirement age, then he has the right to apply for a disability pension or based on length of service. It is recommended to make calculations in advance to determine the amount of the payment, which takes into account the number of years worked, the size of the salary and the right to various bonuses.

Registration of pensions should be done not in the branches of the Pension Fund, but through the structural divisions of government institutions. Employees of the Ministry of Emergency Situations must apply for a pension, based on length of service or on another basis, to employees of the Ministry of Internal Affairs. When submitting an application, the length of service and the optimal pension amount are automatically determined.

Reference! When making payments, the provisions of PP No. 941 are taken into account.

Based on Federal Law No. 247, employees of the Ministry of Emergency Situations do not receive severance pay when they retire. The benefit, which is equal to the salary, is maintained for 12 months only when firefighters who have not reached the minimum length of service are dismissed, but are dismissed due to injury, occupational disease or staff reduction. Pensioners, after the payment has been assigned, can receive a refund of paid land and property taxes.

A firefighter planning to retire can contact the human resources department for benefits.

For this purpose, the following documentation is prepared:

- service sample application;

- employee's passport;

- employment history;

- documents confirming the optimal duration of special training;

- ITU certificate, on the basis of which a citizen receives a certain disability group;

- if a firefighter received any awards or titles during his service, then award documents are prepared that have a positive effect on the size of his future pension, since various additional payments are often provided at the local level;

- signed permission allowing the use of personal data for interaction between different government agencies.

Based on this documentation, a correct calculation is made to determine the optimal pension amount.

What documents are needed

To receive pension payments, a person must prepare a complete package of papers in advance. On their basis, the monthly allowance will be calculated, and a corresponding certificate will be prepared.

The future pensioner must collect a complete package of papers in advance. It includes the following documents:

- statement or report;

- certificate of length of service;

- personal file (original);

- conclusion of a medical military commission (if necessary);

- certificate from ITU;

- documents that confirm the right to receive benefits.

Above is the main list of documents that allow a person to retire deservedly.

However, in some cases, additional paperwork may be required to accurately determine pension payments. It is worth noting that most of the documents are provided by Emergency Situations Ministry employees.