Vacation pay amount: 0 rub.

Employees who enter into an employment contract upon hiring are entitled to compulsory leave. The calculation of vacation pay in 2021 is provided for by the Labor Legislation of the Russian Federation. The rest period is paid by the employer in accordance with the established payment system. An online vacation pay calculator allows you to easily calculate the amount of money that a company is required to pay to each employee.

Legal leave

The Labor Code says: every officially working citizen has the right to request leave provided by his superiors every year. It often lasts 28 days, although many bosses ask their subordinates to take vacation in “pieces” of a week or a week and a half. All vacation days are paid by the company. This is stated in Article 115 of the Labor Code of the Russian Federation.

Article 115 of the Labor Code of the Russian Federation

A person should be allowed to rest every year from the moment he has worked for at least six months (Article 122 of the Labor Code of the Russian Federation). However, you can agree with your employer and ask for a break a little earlier, but there must be good reasons for this. For minor citizens, leave can be issued earlier, and management is obliged to satisfy the request (Article 267 of the Labor Code of the Russian Federation).

Important ! If an employer refuses to let an employee go, then he is violating his rights.

Article 122 of the Labor Code of the Russian Federation

Calculating the amount of money for an incomplete calculation period is not an easy task, and this issue is very acute for all participants in the employment contract.

Vacation rules in 2021

The paid rest period is calculated for all employees with whom the organization has entered into any type of contract. Regardless of the form of employment, be it seasonal, temporary or remote work, the norms for vacation pay are established by law. They are not provided only to individuals with civil law contracts (GPC). Rules for calculating and counting funds:

- The calculation period for vacation pay is 12 months of work. Only hired employees are entitled to leave 6 months after hiring.

- Vacation is provided according to the schedule approved before the new year. Employees should be familiarized with it.

- The billing period does not include sick leave, bonuses, business trips, or forced downtime.

- Vacation pay is indexed along with wages.

- Personal income tax is deducted from the amount of vacation pay, and the required insurance contribution is transferred to the budget.

- The employee must receive the funds 3 days before the break in work.

According to the Labor Code of the Russian Federation, the period of paid leave is twenty-eight days. It is extended as necessary if the employee has distinguished himself with particular success in the company. Each employee has the opportunity to divide vacation days into several parts, one of which must be 14 calendar days. The remaining parts can be divided at your discretion.

How are vacation pay calculated?

The law assumes that money is either given to the employee in person or transferred to a bank card. This happens three days before the vacation (this is specified in Article 136 of the Labor Code of the Russian Federation). Sometimes money is given out earlier, but if they do it later, they are breaking the law.

When a citizen has worked for the required period, the procedure for calculating vacation pay is as follows:

- the person must submit an application requesting leave;

- then an order for the enterprise is formed;

- in the settlement department the amount of money is calculated.

Example of a vacation application

You can take annual paid leave.

Necessary documents for calculating vacation pay

Payments are calculated on specially designated forms. They are mandatory, because without them the procedure cannot be carried out. Basic documents for calculating vacation pay in 2021:

- an employee’s statement of desire to receive the leave due to him;

- a calculation note drawn up by the HR department to determine the amount of payments for a certain period of work;

- employer's permission for vacation (formed on the basis of the schedule).

After submitting all documents, the owner of the company must pay the money at least three days before the start of dismissal. If the deadline falls on a weekend, then the payment must be calculated in advance, and it is prohibited to delay the period. An exception is the case when the employee wrote a statement right before the vacation. Delays in payment of holiday pay in order to add them to the advance payment or salary are not permitted. Otherwise, the organization receives penalties.

Calculation of vacation pay in 2021: indicators for calculation

Duration of vacation

The standard duration of annual leave is 28 calendar days. An employee registered only under an employment contract can take advantage of the right to leave. Vacation is provided in accordance with the vacation schedule for 2018 or at other times by agreement with management. An employee can also take leave after the first 6 months of work and take early leave in the event of: upcoming maternity leave or after it; adoption of a child under the age of 3 months; the employee is not yet 18 years old. It is important to remember that in addition to annual paid leave, the employee has the right to receive leave without pay (Article 128 of the Labor Code of the Russian Federation). In this case, you do not need to calculate anything, but leave without pay for more than 14 days affects the working year and length of service for which the employee is entitled to annual paid leave. The employee was hired on February 2, 2016. Working year is the period from February 1, 2021 to January 31, 2018. Leave without pay - 30 days. The working year for which 28 days of vacation is due is from February 1, 2021 to February 16, 2018 (adjustment by 16 days).

The working year and the number of actual vacation days due to the employee affect the amount of the vacation pay reserve.

Note-calculation on granting leave to an employee (fragment)

Calculation period for vacation pay

To calculate vacation pay, you must take the previous 12 months and the actual time worked in them. The company can establish a different pay period (for example, 6 or 3 months), enshrining it in the collective agreement, but this should not worsen the situation of employees and reduce the amount of vacation pay.

For employees hired in the middle of the year and who worked part of the period, the actual time worked is taken into account.

Days excluded from the billing period

It is necessary to exclude days in which the employee was on sick leave, maternity leave, or child care leave. The full list of such periods is determined by paragraph 5 of the Regulations (approved by Resolution No. 922).

When determining excluded days, you should take into account the clarifications of the Ministry of Labor (letter dated April 15, 2016 No. 14-1/B-351) regarding holidays that fall during the vacation period. Vacation is automatically extended for holidays without payment. In accordance with the position of officials, such holidays are not excluded in the future. For example, if an employee was on vacation from December 25, 2021 to January 15, 2021, then when determining the period for the next vacation, holidays are counted as worked.

The following situation is also possible: the period is excluded completely. Then you need to take the previous period, which has been fully worked out. If the previous period is excluded, the current month and the accruals in it must be taken into account.

Days of downtime caused by the employer are also excluded from the calculation period. Downtime is a temporary suspension of work for reasons of production or organizational and technical nature. That is, companies themselves determine whether the reasons are sufficient to introduce a downtime regime. For example, if deliveries have ended and resumption is not expected, or serious problems have been discovered in the equipment, these are all sufficient reasons for introducing downtime.

The company pays for the period during which employees did not work due to downtime in the amount of at least 2/3 of the average salary (Article 157 of the Labor Code of the Russian Federation). This earnings and downtime are not included in the calculation of vacation pay.

Payments in the billing period

To calculate vacation pay in 2021, you must also determine the payments included in the calculation of average earnings and excluded from it. According to Resolution No. 922, all payments to an employee approved in the regulations on remuneration and labor incentives are taken into account, regardless of the method of payment (in cash or in kind).

How to take bonuses into account in average earnings

Fully - one bonus for one indicator.

At the end of the year - no more than 12.

Completely—the quarter is fully included in the billing period.

Partially - according to the number of months included in the billing period.

Fully - payments accrued for the previous calendar year.

Proportional to the time worked - the billing period has not been fully worked or there are excluded periods.

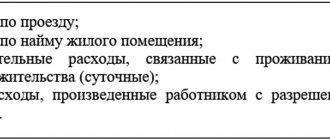

The calculation does not include payments:

- bonuses and remunerations not taken into account in the salary regulations;

- financial assistance to employees;

- compensation for transportation and food expenses;

- payment for training and advanced training.

Are taxes collected on vacation pay?

Interest on taxes to the Pension Fund and to the Compulsory Medical Insurance of the Russian Federation is necessarily deducted from the amount. Tax payments are taken from each type of leave, whether educational or additional. Taxation does not apply to people who:

- suffered work-related injuries;

- suffered as a result of the Chernobyl Nuclear Power Plant or participated in its liquidation.

Employees receive vacation pay with tax already calculated. For most citizens it is 13%. For stateless residents of the country, the tax rate is 30%. It is necessary that each payment be entered into the enterprise’s settlement base immediately after accrual. This is mandatory for calculating the company's budget, which occurs before the 15th of the next month.

Legal regulation

All accounting operations, one way or another related to the calculation of average earnings, are regulated by the same Decree of the Government of the Russian Federation No. 922, as amended on December 10, 2016.

Thus, when calculating, all types of payments within the framework of remuneration are taken into account. Let us clarify what exactly labor is, since any allowances for food, travel, financial assistance of any kind, various compensations will be excluded from the total income received as a result of labor activity.

The calculation period is taken to be the last 12 months before the start of the period for the emergence of rights to average earnings.

The 12-month period excludes time periods during which the employee did not actually perform his job duties. Thus, the following times are subject to exclusion:

- confirmed disability of the employee;

- employee maternity leave;

- downtime of the enterprise due to the fault of the enterprise itself, or for reasons beyond its control, for example in the case of a strike in which the employee, although he did not take part, was not able to perform his labor functions;

- provided as additional days off to care for disabled children;

Accordingly, amounts received by employees during the above periods are also excluded from the calculation of average earnings.

Rules for calculating vacation pay

To determine the amount of vacation pay, you need to know your average earnings. This is also required for calculating compensation for vacation in the event that the employee does not use it or quits altogether. First you need to calculate the calculation period for accrual of payments. Usually they focus on data of 6 months or one quarter. Online vacation pay calculators do not allow you to regulate the range of indicators, because the resource independently calculates the amount of funds for the year. The formula for calculating vacation pay to correctly determine average earnings:

- SZ = (ZP1+ZP2+…+ZP12)/12/29.3

When an employee knows the amount of average earnings, you can calculate the amount of vacation pay. During the calculation, the period of all previous layoffs and sick leave should be taken into account. Indicator 29.3 is the number of days that the employee stayed in the organization. The coefficient is determined by dividing the total number of vacation days, including holidays and weekends, by the number of days in a month. Therefore, to determine the amount of vacation pay, you need to multiply your average earnings by vacation days.

The 2021 vacation pay calculator is actively used by business accountants. The simple process of determining funds causes many inconveniences and questions in some situations. The online resource allows you to accurately calculate the amount, taking into account many nuances. There is no longer any need to waste time studying all the details; the service will simply and quickly determine vacation pay.

Calculation examples

What situations might a specialist encounter when calculating the amount of vacation pay? Let's look at some examples:

Example 1

The employee has been working for the company since January 2015. His salary is 15,000 rubles. From July 13, 2015, he goes on vacation for 28 calendar days. What will be the amount of vacation pay for this employee?

Based on the above formulas, the employee’s average daily earnings will be 512 rubles. We multiply the resulting amount by 28 (the number of vacation days). The amount of vacation pay is 14,336 rubles.

Example 2

The HR specialist got a job in September 2015. For the first three months, while on probation, she received a salary of 12.5 thousand rubles. Then the payment was increased to 18 thousand rubles. The employee also received a bonus in December - 5 thousand rubles. From February 1, 2021, the employee takes paid leave for two weeks. What kind of vacation pay will a HR specialist receive?

Thanks to a bonus of 5 thousand rubles, the employee’s income in December was 23 thousand rubles. Average daily earnings are 549 rubles. Therefore, the amount of vacation pay for 14 days of vacation will be 7,686 rubles.

Example 3

The engineer got a job in October 2015, and in April 2016 he plans to exercise the right to take vacation (28 calendar days). The engineer's salary is 35 thousand rubles; in January 2021, the employee received a bonus of 10 thousand rubles in connection with his 50th anniversary. In addition, he received compensation for travel for two months in a row - 500 rubles. How much vacation pay can an engineer expect?

Since the bonus of 10 thousand for the anniversary and travel compensation are not included in the calculation of average daily earnings, only the engineer’s salary will be taken into account when calculating the amount of vacation pay. Thus, the amount of vacation pay for 28 calendar days will be equal to 33,447 rubles.

Example 4

The employee has been working as a storekeeper in the organization since August 2015. The storekeeper's salary is 10 thousand rubles. In November, the employee took sick leave for 7 days. Salary for November, excluding sick leave, is 8 thousand rubles. In February, the storekeeper wants to take a vacation for 10 days. How much holiday pay will she receive?

When calculating average daily earnings, sick leave payment is not taken into account. And also a seven-day sick leave period will be excluded from the calculation, so the average daily earnings of an employee is 343 rubles. We multiply this amount by the number of vacation days (10), the total amount of vacation pay is 3,430 rubles.

How to calculate with a calculator?

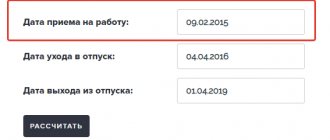

After determining the average earnings and vacation period, you need to enter the indicators in the appropriate forms. The resource contains two sections - a pivot table, as well as source data. To begin with, the calculator asks you to write:

- type of leave;

- start and end date of dismissal;

- billing period with specified sick leave, business trips and non-working days;

- salary increases throughout the organization, if any.

The user must complete all provided fields in the source data and pivot table. It must indicate the amount of payments for each month. The calculator shows the order of its actions and provides the correct formulas for your reference. As a result, a complete calculation of the employee’s vacation pay will appear on the website. The calculator immediately deducts personal income tax, so it is convenient to use. The program is needed mainly by accountants who do not have time for additional calculations. However, a person without economic education can quickly calculate the amount of funds allocated to him.

Calculation of vacation pay for changed salaries

When in the company where the employee works, during the calculation period, at the end of this time, but before the start of the citizen’s vacation or during his vacation, the salary amount was changed, then the payment associated with the vacation will have to be recalculated.

This nuance is presented in detail in paragraph 16 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages.”

Calculation of the vacation pay correction factor due to an increase in salary - formula:

Salary received by a person during an increase in the amount: salary received by employees for each point of calculation = increasing factor.

If the employee's salary has been changed, an increasing factor is calculated

Example five . Finding out the salary increase rate

A person earned 20 thousand rubles a month in September and October of 2016. In November, the salary increased, and it now amounts to 24 thousand rubles (that is, 4 thousand rubles more).

Let's calculate the increasing factor:

24,000 rubles: 20,000 rubles = 1.2.

When the salary was increased within the calculation time, the citizen’s working salary is multiplied by the increase factor.

Salaries are divided if you need to find out the increase rate

Example six . We determine vacation pay taking into account the increase factor

The employee will be given a vacation of 28 calendar days from 08/21/17.

The salary before 1.02 was 20 thousand. Then the amount increased to 22 thousand.

Let's find out what the vacation pay will be:

- Let's find out the increasing coefficient:

22,000 rubles: 20,000 rubles = 1.1.

- The time period from January to July of the 17th year is taken into account.

- Let's find out the number of payments required to be taken into account when calculating vacation pay:

We take into account the amount of salary before the increase for six months (that is, from August 16 to February 17), the increase coefficient is 1.1, and we take the amount of salary at the time after the increase and without the coefficient (that is, the period from February to July 17 year).

(20,000 rubles * 6 months * 1.1) + (22,000 rubles * 6 months) = 264,000 rubles.

- Let's find out what the average daily earnings are:

264,000 rubles: 29.3 calendar days: 12 months = 750.85 rubles.

- We calculate vacation pay:

750.85 rubles * 28 vacation days = 21,023.8 rubles.

If the salary was increased in a certain period, only this number of days is multiplied by the increase factor

It is also necessary to make adjustments to the average earnings figure when the salary was increased outside the calculation, before the time period when the employee received leave.

Example seven . Correction in the amount of vacation pay when the salary was increased after calculation, before the start of the vacation

The person will be given leave from 08/21/17 for 14 days. Until August 1, the salary is 18 thousand rubles.

From the 1st, wages were increased, then the employee’s salary became 21 thousand 600 rubles.

Let's calculate vacation pay:

- We determine the increase factor:

21,600 rubles: 18,000 rubles = 1.2

- Let's find out the scope of the calculation period.

It consists of the period from January to July of the 17th year.

This is provided that the employee was not sick, did not take time off at his own expense, that is, he worked everything he was supposed to.

- The average salary when calculating vacation pay is as follows:

(18,000 rubles * 6 months): 6 months: 29.3 calendar days = 614.33 rubles.

- We find out vacation pay accrued for 14 days:

614.33 rubles * 14 calendar days = 8,600 rubles.

- Let's make adjustments to the number of vacation pay when taking into account the coefficient. The salary increased after the end of the calculation, but when the vacation had not yet begun.

8,600 rubles * 1.2 = 10,320 rubles.

If the salary was increased after calculation, but before the start of the vacation, the increase factor is also taken into account

There are also cases when the salary increases during vacation (although this is rare), and then it is necessary to make adjustments to the amount of the average salary, which occurred from the day the salary was increased until the start of the vacation.

Example eight . Adjustments to the amount of vacation pay when the salary was increased during the vacation

A person goes on vacation from March 27, 2017, the number of vacation days is 14, that is, until April 9.

The employee's salary is 28 thousand rubles. He worked for six months, that is, 6 months.

The calculation time consists of: the time period from September 2016 to February 2021.

All the time before the vacation, the employee did not take sick leave, that is, he worked all that he was supposed to.

On April 3, the company increased workers' salaries. After this, the salary changed to 30 thousand rubles.

Let's find out what the vacation pay will be:

- Find out the average salary:

(28,000 rubles * 6 months): 6 months: 29.3 calendar days = 955.63 rubles.

- We calculate according to the general rule:

955.63 rubles * 14 calendar days = 13,378.82 rubles.

- While the employee was on vacation, the salary was increased. We find out the increase factor: 30,000 rubles: 28,000 rubles = 1.07.

Don't forget that the moment of promotion coincided with vacation. In other words, it is necessary to make corrections in the time period from April 3 to April 9, 17, this is a calendar week.

- Let's determine the amount of vacation payments for these 7 days.

The average salary before the holiday was 955.63 rubles.

Vacation pay per calendar week:

955.63 rubles * 7 calendar days = 6,689.41 rubles.

- Let's find out what the amount of vacation payments was during that time period when the salary was increased - this is 7 calendar days.

To do this, multiply the salary amount by the increasing factor:

955.63 rubles * 7 calendar days * 1.07 = 7,157.67 rubles.

- Let's find out what the total vacation pay figure is. To do this, we sum up the vacation pay before and after the increase.

6,689.41+7,157.67=13,847.08 rubles.

- Let's find out how much additional money a citizen should receive.

Since the money paid for vacation is provided before the start of the vacation, it is necessary to find out the difference obtained by adjusting the amount of vacation pay for 7 calendar days from the moment the salary is increased by the coefficient. This money is given to the employee.

Let's calculate the difference:

13,847.08-13,378.82 rubles = 468.26 rubles.

During vacation, salary increases are infrequent, but in this case the employee must receive an additional portion of vacation pay

Step-by-step procedure for calculating payment for student leave

Calculation of student leave is carried out on the basis of an order in the following order:

- establishing a billing period;

- calculation of total earnings for the selected period;

- identifying months partially worked and counting days worked;

- determination of the total number of days (calendar);

- calculation of average daily earnings;

- accrual of vacation pay for school weekends.

According to general standards, the calculation period is 12 months preceding the month of registration of student leave.

Example:

If the session begins in September 2021, then the accountant makes all calculations for the period from September 2021 to August 2019.

The calculation base includes the employee’s salary and additional incentive payments for actual time worked, regulated by the remuneration system.

But not all payments are included in the base.

The following payments are not taken into account in average earnings:

- social benefits (maternity, sick leave);

- payment for business trips;

- vacation pay;

- other accruals based on average earnings upon release from labor functions;

- material aid;

- compensation for food and travel, cellular communications.

We recommend reading: how to arrange a study leave?

Formulas for determining average earnings

Compared to last year, the algorithm for calculating study leave has not changed; it is similar to the procedure for calculating vacation pay for annual leave. The employee's average income for one day is taken as a basis. Funds for study leave are paid for each day of rest, including weekends (holidays).

General formula for calculation:

Vacation pay for study leave = SD * n,

where: SD - average daily earnings, n - number of days of student leave.

The average salary per day is calculated using the formula:

SD = Base / RD

where: Base - payments in favor of the employee for the previous 12 months, RD - number of days worked for the selected period.

The base includes: wages, additional payments for length of service, allowances for special working conditions, bonuses based on work results.

Formula for calculating days worked:

RD = 29.3 * months. + slave/cd * 29.3, where:

- months — the entire number of months worked;

- slave - the number of days worked in an incomplete month;

- kd - calendar days in partial months.

If there are several partial months in the billing period, then the days worked are calculated separately for each. The month in which there was a business trip, sick leave, vacation, maternity leave, absenteeism, or downtime is considered incomplete.

Example for 2021

Initial data:

S.N. Kozlov, an employee of Svoboda LLC, who is a first-year student at an accredited university through correspondence education, is sent to the session from June 24, 2021 for 21 days.

For the previous 12 months (from June 1, 2021 to May 31, 2019), he was accrued 425,000 rubles, which, in addition to salary, included:

- vacation pay - 18,000 rubles;

- sick leave benefit - 8,500 rubles;

- financial assistance - 10,000 rubles,

- travel compensation - 3000 rubles,

- one-time bonus on the occasion of the employee’s anniversary - 5,000 rubles.

The leave was issued in July 2021 for 14 calendar days from the 9th, a certificate of incapacity for work was issued in February 2021 for 7 days from February 11.

During the billing period, only 10 months or 293 days (10 * 29.3) were fully worked.

Calculation:

Calculation base = 425000 - 18000 - 8500 - 10000 - 3000 - 5000 = 380500.

The number of days worked for July 2021 is 16.07 = (29.3 / 31 days * (31 - 14 days), and for February 2021 - 21.98 = (29.3 / 28 days × (28 days - 7 days)).

The total number of days worked in the billing period is 331.05 = 293+16.07+21.98.

SD = 380500 / 331.05 = 1149.37.

Vacation pay to the student was accrued in the amount of 1149.37 * 14 days = 16091.18.

If an employee, by agreement with management, leaves for a session this year after working for less than 1 month, then payment for educational leave is calculated based on the time actually worked.

Example, if worked less than 1 month

Store administrator of Onyx LLC Potapov S.L. was hired on June 3, 2019 with a salary of 25,000 rubles.

From June 24, in accordance with the summons certificate, the student is sent to 14-day training, and he is issued a study leave at work.

Guided by clause 7 of the Regulations (Resolution No. 922), the accountant takes the accrual amount for days worked in June 2021 to calculate the average income for calculating educational leave.

For June 2021, the salary accrual amounted to 25,000 / 20 * 15 = 18,750 rubles.

The duration of the work period for calculating vacation pay was 21 (calendar days from June 3 to June 23) / 30 * 29.3 = 20.51.)

Average daily earnings = 18750 / 20.51 = 914.19.

Amount of vacation pay = 914.19 * 14 days. = 12798.66.