02.07.2019

0

58

6 min.

When hiring a new employee to an enterprise, management sets a personal schedule for him, according to which, in the future, wages will be calculated. But due to various circumstances, personnel may not always fulfill their mandatory quota. To ensure that such situations do not create financial problems, in this article we will learn how to calculate wages for less than a full month under certain circumstances.

General concepts

Wages are material rewards that are intended for performing certain tasks in production. The procedure for its calculation and the daily amount are established by the employer and are prescribed in the employment contract drawn up for a specific time period. Accrual of allowances, benefits and bonuses on top of the monthly rate occurs according to the working time sheet, which indicates all absenteeism and overtime of a person for the standard period.

The very procedure for registering and issuing a PO, prescribed in the unified regulations of the Labor Code of the Russian Federation, consists of five simple steps:

- The employer or accountant from the enterprise calculates the monthly salary for the staff, based on the hours worked for each shift;

- Possible benefits, allowances for exceeding standards, bonuses (personally for each employee) are added to the single salary rate;

- From the resulting salary amount, personal income tax is calculated, as well as an insurance premium intended for payments for disability, retirement age and other circumstances;

- The remaining wages are distributed among advances and other deductions in the form of: court-ordered alimony, damages, etc. (if any);

- The net salary is certified by an accountant and issued on a certain day.

Attention! In addition to the standard procedure for calculating wages, it would be useful to find out how wages are calculated after vacation. After all, this period is mandatory for every employee, in accordance with the legislation of the Russian Federation.

Features of calculation for a shift schedule

Payroll calculation according to a shift schedule can be formed as follows:

There is a certain store that is open from 8 to 22 pm. Work schedule - 2 days every other. One shift of a salesperson is 14 hours. The first saleswoman begins her work in the current billing period on the 2nd, and the second - on the 4th. There are only 30 days in a month, so the first one worked 16 days, and the second one 14. However, the first saleswoman missed 4 of her shifts due to illness, and the second one had to replace her during this period of time. The employer has established a fee for one shift in the amount of 1200 rubles.

We first calculate the amount of wages that should have been initially:

- Salary of the first employee: 16*1200 = 19200 rubles.

- Salary of the second employee: 14*1200 = 16800 rubles.

However, the first saleswoman did not work 4 shifts, so we subtract the cost of these shifts from her salary:

19200 - 4*1200 = 14400 rubles will be received by the first employee for less than a month.

Accordingly, the second’s salary will increase proportionally:

16800 + 4*1200 = 21600 rubles.

Reasons for paying partial wages

According to the Labor Code of the Russian Federation, the manager is fully responsible for the delay in salary for his staff, except for the cases listed below:

- The employee was on legal leave;

- A citizen who had previously been voluntarily dismissed was reinstated;

- The person worked part-time (on personal initiative or at the request of his superiors);

- The employee was suspended from duty mid-month.

In these situations, salary calculation after vacation, dismissal, etc. is carried out on a personal basis. However, this does not apply to the cases prescribed in Art. 142 of the Labor Code of the Russian Federation.

After vacation

Vacation, according to the Labor Code of the Russian Federation, is considered a period of time during which an employee has the right not to attend the workplace without losing his established salary and position. It is divided into two main types:

- Annual (at least 28 days);

- Additional (from 1 day).

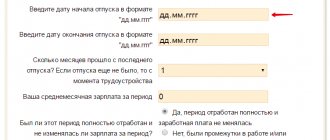

In order to independently calculate the salary for an incomplete month using a calculator taking into account vacation, a citizen only needs to know two components:

- The full amount of salary for the last year;

- The size of the single coefficient (29.3).

Having the listed data in hand, an employee can calculate his average monthly salary, minus personal income tax and insurance fees, using the following formula: CO = , where:

- SO – amount of vacation pay;

- ZG – annual salary;

- KD – the number of calendar days worked, according to the accounting sheet;

- DO – duration of leave (in days).

This will be his rate for the vacation period. If a citizen has worked for less than a full year, then instead of the value of the CD it is necessary to substitute the previously mentioned coefficient of 29.3. In order to find out the remaining salary after leaving vacation, the resulting CO amount is sufficient to subtract from the average monthly salary of the staff.

Newly hired

The general procedure for organizing wage payments to the workforce is regulated by Art. 136 of the Labor Code of the Russian Federation, which clearly states that the manager is obliged to pay wages to his employees at least 2 times during the standard period. In a situation with a newly hired person, this requirement is violated, since for him the salary will be calculated with the deduction of the advance.

The boss can solve this problem by drawing up a separate act on remuneration for a specific subordinate. In accordance with this document, the accounting department will have the right to increase the employee’s salary by adding to it part of the salary for the first half of the month (no more than 30%) in which he was hired for the current position. In this way, the manager will relieve himself of claims from his subordinate and from the law.

Part time

Part-time work is a forced reduction in working hours at an enterprise, followed by a reduction in staff wages. The reasons for this phenomenon may be: a temporary crisis, an impending dissolution of staff, or an excess of production capacity. Therefore, it is not always advisable to retain a position in such a situation.

A similar term is also used for employees enrolled in secondary or higher educational institutions. But for them, salary accrual in the described situation occurs in the standard mode, without a salary cut. In other cases, the calculation of staff salaries for less than a full month will be carried out using the following formula: ZP = CO\(KTD * KFD) + PR – NG, where:

- ZP – wages for the standard period, taking into account reduced hours;

- SO – the amount of salary specified in the employment contract;

- KCH – number of working hours in the current month;

- CFC – hours actually worked;

- PR – premium funds;

- NG – personal income tax and insurance premium.

It is important to know! Also, salary calculations for a reduced schedule can be made based on the output of subordinates and the cost of finished products sold by the enterprise. But in any of the listed calculation options, the final salary amount should not be less than the minimum level established by law (11,280 rubles, as of 2021).

Dismissal

When an employee is laid off, the manager is obliged to pay him severance pay, vacation funds, as well as partial salary for the period from the date he received the last advance until the date the employee leaves the enterprise. The manager can calculate the amount of wages upon dismissal using the following formula: CO = BH * FD – NG + PM, where:

- SO – the amount of salary for an incomplete month;

- CHK – the number of hours in a day during which a citizen must be present at the enterprise in accordance with the employment contract;

- FC – actual days worked in the current calendar month;

- NG – single tax and insurance fee;

- PM – bonus funds accrued for exceeding the norm.

In accordance with the Labor Code of the Russian Federation, a dismissed person must work for at least 14 more days after signing the decree on his departure from the enterprise. But this obligation can be easily avoided by taking an annual vacation (if you choose this option, the suspended employee will not be paid a salary for the time of unused vacation).

In what cases is partial salary paid?

According to the rules of labor legislation, the total hours of work per week per employee should not exceed 40 hours (Article 91).

At the same time, the employee is not required to work all the established deadlines. A reduction in working hours can occur legally, for example:

- when going on leave (vacation);

- if the employee is temporarily unable to work due to illness;

- when employed not from the beginning of the pay period.

In addition, it is possible to establish an individual shortened schedule. The schedule, which consists of fewer working days and hours, must be agreed upon with the manager. Such conditions are reflected in the employment contract.

Usually this applies to:

- students who are unable to work full time;

- persons working part-time;

- persons who for other reasons cannot work more hours.

The legislator closes the list.

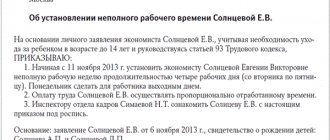

In addition to the employment contract, information about an employee’s part-time work is displayed in a separate local act. When an accountant summarizes the salary amounts, he refers to this document first. The local act serves as justification for the amount of the subordinate’s earnings in case it is contested.

In practice, cases arise when an incomplete period of work brings the employee income that does not reach the minimum subsistence level (hereinafter referred to as the minimum wage) or leaves the employee with nothing. Some workers believe that under Art. 133 they have the right to receive at least the minimum wage, but this is not entirely true. The norm guarantees benefits not less than the minimum wage only if the person works the full term.

This means that initially, when concluding an employment contract, the employer does not have the right to establish a payment to a subordinate that is less than the minimum wage. But if, due to some circumstances, full working time was not worked, transferring an amount less than the minimum to the employee is not considered a violation.

Features of calculation for an incomplete month

In addition to special rules, the Labor Code also provides additional nuances for calculating an employee’s salary for a part-time working month. Namely:

- For holidays and weekends, the subordinate must receive a double rate (Article 113 of the Labor Code of the Russian Federation);

- Annual rest is necessarily taken into account for all personnel, except for those employees who have worked for less than six months (maternity leave is not included in this case);

- If a suspended citizen has children, the amount of personal income tax and insurance contribution for him is reduced (the minimum amount of tax provided for by law is 4,000 rubles).

Before calculating partial salary after vacation, dismissal or hiring, the manager must familiarize himself with the above requirements. Otherwise, he may incur administrative liability for underpayment of salaries to staff.

Nuances

When making calculations, you need to pay attention to a number of nuances. A new employee who does not have time to work a full month is paid the same as for existing employees, taking into account the actual time worked. Only working days according to the production calendar are always taken into account.

If there are holidays at the beginning of the month (January) and a new employee started working after the end of this period and worked until the end of the month, he must be paid in full for the month.

According to Art. 2-7, art. 130-2 of the Labor Code of the Russian Federation, an employee is guaranteed a minimum wage. If the month is not fully worked, the actual salary may be less than the minimum wage. This will not be a violation of the Labor Code of the Russian Federation. If an employee is assigned a part-time working day and has worked an incomplete month, payment for the incomplete month will be made based on the rate established by the contract (1/4, 1/2).

Payment procedure for different payment systems

In addition to the correct calculation of wages for an incomplete month, the Labor Code also regulates the procedure for registering wages for full-time workers under different contracts. Namely:

- With piecework wages, a person receives a monetary reward for the amount of work performed, without taking into account the time spent;

- With a daily tariff, the citizen is paid a salary based on the actual number of hours worked (in this case, overfulfillment of the plan is taken into account);

- With a commission system of remuneration, a person claims a salary calculated based on the number of products sold per month (unlike a piece-rate salary, this version of the contract implies a minimum rate, which must be summed up with all deductions to calculate the full salary).

Advice! When drawing up an employment contract, it is very important to choose the correct salary calculation system. Otherwise, you risk receiving an income below the national subsistence level.

Calculation formulas

There are several ways to determine the amount of earnings for an incomplete period:

- Divide the monthly salary indicator (hereinafter referred to as the minimum wage) by the number of working days in the month (hereinafter referred to as the RDM). Multiply the resulting figure by the amount of days actually worked (hereinafter - FOD) - minimum wage / RDM x FOD. So, for example, if citizen P. worked for 17 days in July, with 21 RDM, and his salary is 60,000 rubles, then: 60,000 / 21 x 17. For 17 days, citizen P. will be given 48,571 rubles.

- You can also subtract the average salary for a certain period. In this case, the salary (hereinafter - O) is divided by the average number of days per month established by the state, after which the resulting figure is multiplied by the FOD - O / 29.4 x FOD. For example, a driver got a job on June 20 and worked for a total of 8 days. His minimum wage is 45,000 rubles. Thus, 45,000 / 29.4 x 8. The driver will be charged 12,244 rubles.

These are standard formulas used by accountants in organizations.

As already mentioned, the requirement for a salary not less than the subsistence minimum must be strictly observed by all employers. This amount is set as a minimum if the employee has completed the entire amount of work. Accordingly, if a citizen worked 5 days in a month, he will receive an amount corresponding to the hours of work.

For example: a seamstress works in an organization where the minimum wage is 40,000 rubles. Due to employment at the end of the month, she worked 5 days out of the required 22. The salary for the reporting period can be calculated as follows: 40,000 / 22 x 5. The actual salary for 5 days will be 9,090 rubles.

We recommend you study! Follow the link:

How to calculate an advance payment for an individual entrepreneur using the simplified tax system

Although the resulting amount does not reach the subsistence level, the organization does not violate the rights of the employee, since the seamstress worked for an incomplete period.

If the employee was not present for the entire monthly working period, then calculations are carried out according to the first formula. If a person did not show up, but by virtue of the law he is entitled to retain his wages, then its amount is calculated using the second formula, taking into account the average number of working days in a month. As a result, the employee receives the sum of indicators for the payroll and time while maintaining the salary.

How to calculate salary for a day, month and partial month: step-by-step instructions

It should be noted that this situation does not always happen. A huge number of workers do not fully work the current month for many different reasons. Someone was on vacation or on a business trip, someone was sick or took a short vacation at their own expense, and someone simply got a job not on the 1st, but, say, on the 10th or, on the contrary , quit before the end of the calendar month.

Quite often it is necessary to know how much an employee is supposed to be paid if he has not worked a full month. At the same time, you need to explain to him why this particular amount was accrued. And tell it in an accessible language - in order to avoid misunderstandings and complaints to the labor inspectorate. And it doesn’t hurt to insure yourself in case of possible claims from the latter.

We recommend reading: Benefits for Children of Repression

If the employee worked on weekends

Even if an employee did not work fully for the whole month, for example, due to illness, he can work on weekends or holidays. But this does not mean that some days can be replaced by others, that is, if an employee was sick for 3 days and worked on weekends for 3 days in the same month, this will not mean that he worked the entire month. That is, it is impossible to simply pay him the required salary; it is necessary to make a calculation.

Let's take a closer look at an example: (click to expand)

Employee Turkina M.A. in October 2021, I took vacation at my own expense on the 4th, 5th and 6th. At the same time, in October she worked 3 days off – October 14, 21 and 28.

She worked 22 days in October, that is, as much as indicated in the production calendar, but she simply cannot pay the salary. Let’s calculate Turkina’s salary based on the fact that her salary is 30,000 rubles.

Work on weekends in the organization is paid at double the rate.

30,000 / 22 x 19 + 30,000 / 22 x 3 x 2 = 25,909.09 + 8,181.82 = 34,090.91 rubles.

How to calculate salary for part-time work

Kvarta LLC operates on a five-day work week schedule. Kamysheva’s employee I.K. works as a senior cashier with a salary of 20,000 rubles per month. In June 2021 Kamysheva I.K. wrote a statement asking to be transferred to a part-time work week from Monday to Thursday. The employee was transferred to a different work schedule on July 1 based on the order of the manager with the appropriate execution of an additional agreement to the employment contract. Let's calculate the salary of Kamysheva I.K. for the month not fully worked - July.

Koklyushkina I.N. was on vacation from January 9 to February 2, 2021 inclusive. Since there were holidays from January 1 to January 8, they are not paid; therefore, the employee will only receive vacation pay for January. If an employee works all days of February, she will receive a full salary regardless of the fact that she did not work on the 1st and 2nd.

Calculation under the commission system of remuneration

The commission system helps to motivate the employee to do his job, because the more money he earns for the company, the higher his own income will be. In sales, every day of work missed equals lost money. And the calculation itself includes only 2 indicators: the amount of income from sales and the percentage of this income that the employee is entitled to. This can be visually written like this:

5% - this is how much the employee is entitled to from the income from the sales he makes.

600,000 rubles is the income brought by the employee.

600,000 × 0.05 = 30,000 rubles.

But employers can use a commission system in conjunction with a time-based system. Then the employee goes to work every day, for which he is paid a salary, and for each sale he receives an additional percentage. And then absenteeism will be taken into account in the calculation. Let's include a salary of 10,000 rubles in the previous example. The employee missed a whole week, i.e. 5 working days out of 21 in the billing month.

10,000 / 21 × 16 = 7,619.05 rubles (part of salary based on salary).

600,000 × 0.05 = 30,000 rubles (part of the salary based on a percentage of sales).

7,619.05 + 30,000 = 37,619.05 rubles (monthly salary).