How to write an application

In order to receive additional payment for benefits, the employee must submit an application in free form. The application includes the header of the document, the main part confirming the employee’s rights to recalculation and a transcript of his request, as well as a list of attachments.

This document should contain the following information:

- Employer company name.

- Full name of the head of the employing company.

- Employee's position.

- Full name of the employee.

- Document name : “Application”.

- Request for a recalculation of compensation for a certificate of incapacity for work with reference to clause 2.1 of Art. 15 FZ-255.

- Sick leave numbers for which recalculation is required and the period for recalculation.

- List of applications.

- Date of application.

- Signature and decryption.

When and where to apply

In exceptional cases, an employee should apply for additional payment to the Social Insurance Fund.

It is worth noting that, according to the explanations of the FSS, if the employee does not have information from the previous employer about the amount of earnings and it is not possible to obtain it, then this cannot serve as a basis for refusing recalculation. The employee has the right to submit an application addressed to the employer with a request to forward the request to the Pension Fund to obtain information about his earnings at his previous place of work.

After receiving such data, the benefit will be recalculated.

The procedure and established form for sending a request to the Pension Fund are approved in the relevant Order of the Ministry of Health and Social Development of 2011 No. 21n.

If such a statement is received from an employee, the employer is obliged to forward the request to the Pension Fund within two working days.

Thus, if an employee brings the employer a certificate of his income from his previous place of employment, then he can recalculate sick leave for the previous three years. To do this, you need to receive a written application for recalculation from him.

For various reasons, an employer may incorrectly calculate compensation for days of temporary disability for a subordinate. This type of error is not critical and can be fixed.

To do this, it is necessary to make the appropriate manipulation of the documents - the sick leave is recalculated after presentation of the certificate. Since the basis for adjusting payments must be serious, the presentation of a certificate of temporary incapacity for work (hereinafter referred to as LVN) is mandatory.

- On what basis are recalculations made?

- Information from a former employer

- Contents of the income paper

- The procedure for calculating average monthly earnings

- Recalculation procedure

Basic Concepts

A sick leave certificate is a document issued by licensed medical institutions, which indicates the period of temporary incapacity for work of a person. The form has a unified form approved by the Ministry of Health and Social Development. In 2021, an electronic form of the document will also be acceptable. The grounds for issuing a sheet include:

- injury or illness of the employee himself;

- restorative procedures, aftercare;

- illness of one of the family members who requires care;

- pregnancy and childbirth.

Filling out the form is the responsibility of employees of medical institutions, and control over the correct formation of the document is exercised by the employer. His interest is based on the fact that management pays compensation from its own funds and then requests them from the Social Insurance Fund. Errors and inaccuracies in the form will lead to refusal from the fund.

The amount of payment is determined by several parameters:

- average salary;

- insurance experience;

- number of days of incapacity.

It is important to know! The employer calculates the payment based on the provided certificate, which indicates the third point and his information about salary and length of service. If an employee brings data from previous or other places of work about his earnings, then the accounting department must recalculate the amount.

On what basis are recalculations made?

According to labor legislation, the period of temporary incapacity for work is paid:

- by the employer - up to three days of absence;

- the subsequent time spent in poor health is paid by the Social Insurance Fund (hereinafter referred to as the Social Insurance Fund, the Fund).

Payments are made in the amount of average daily earnings for each day of illness. An employee cannot be fired during illness.

Based on this, we can distinguish two legislative guarantees for employees that the organization cannot violate:

- fixing the average salary;

- the workplace also remains behind the person.

These norms are prescribed in the Labor Code of the Russian Federation.

An important point is that the Fund transfers a volume of funds, the size of which not only corresponds to average income, but is also proportional to the time worked, that is, length of service. So, depending on what insurance time is listed in the employee’s work book, he is paid 60, 80, and 100 percent of the average monthly profit.

Officially employed persons are accrued insurance coverage due to the employer making contributions. Unofficial work deprives a citizen of such a privilege, and he will not be able to count on sick leave.

The company is not required to wait for the subordinate to provide income information. Typically, a standard form is submitted upon hiring, but if this does not happen, the accounting department pays benefits based on the data the company has.

Changing the payment amount is possible:

- When providing information about previous earnings - if it is possible to obtain it.

- If the enterprise stops working, the citizen has the right to contact the new employer with a request to send a request to the Pension Fund. The procedure for applying to this body with a similar request and sample documents are approved by Order No. 21 n dated January 24, 2011.

Sometimes, when calculating the required amounts, the employer makes incorrect calculations for various reasons.

In any case, the initiators to recalculate the amount of compensation are:

- Employer.

- Worker.

A trade union can also apply, but in this case it will be regarded as an application on behalf of the employee.

The employer may initiate a recalculation of the amount paid in the following cases:

- This happens if the doctor made a note on the certificate of incapacity for work that the patient did not adhere to the discipline being treated: did not come to appointments, refused treatment procedures, did not take medications, etc.

- Also, unilaterally, management has the right to charge a larger amount than was initially established. This happens when an organization decides to increase payments for a certain position.

- If the organization identified errors when accruing sick leave. And also in some other cases.

The list is not closed, as each employer may have its own reasons for recalculation.

To verify the payments made, the employee must write a corresponding statement addressed to the manager. If the subordinate’s request is justified, then the organization will have to pay the missing funds.

Often, if a citizen has recently been hired by a company, then to determine his average earnings, salary statements from his former workplace may be needed. To calculate the average salary, the period of the last two years of work is taken.

Accordingly, the new employer will need information about income for this period of time.

Recalculation of sick leave for the past period is possible within a three-year period upon presentation of the necessary documentation.

If benefits are overpaid

Now let's consider a situation where the employee's benefit was paid in a larger amount than it should be.

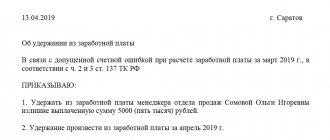

Collection on a legal basis

Let’s say right away that it is allowed to recover the amount of overpayment from the benefit recipient if:

- he turned out to be dishonest (for example, he submitted documents with deliberately incorrect information, hid information affecting the receipt of benefits and its amount, etc.);

- There was a counting error when calculating benefits.

This is stated in part 4 of article 15 of Law No. 255-FZ, part 2 of article 19 of Law dated May 19, 1995 No. 81-FZ (hereinafter referred to as Law No. 81-FZ) and paragraph 85 of the Procedure and conditions for the appointment and payment of state benefits to citizens with children, approved by order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n (hereinafter referred to as the Procedure).

Let us also recall that employees who receive benefits are required to notify employers no later than one month of the occurrence of circumstances that entail a change in the amount of benefits or termination of their payment (clause 83 of the Procedure).

Collection on a voluntary basis

You can ask the employee to return the overpaid benefit amount voluntarily or obtain his consent to offset the overpayment against a future benefit payment or deduction from wages. The employee is not obliged to agree to these options if there is no fault or calculation error. If the employee does not object to returning the excess amount of benefits received, he must confirm his consent in writing (application) (FSS letter dated 08/20/2007 No. 02-13/07-7922). Otherwise, the overpaid amount may be reimbursed by the guilty person or, when the guilty person is not found, written off as expenses at the expense of the organization’s net profit.

Not subject to collection

When an overpayment of benefits to an employee is not related to his dishonesty or an accounting error, it will not be possible to recover the amount of the overpayment from him, unless he voluntarily wishes to return it, allows it to be deducted from earnings or offset against a subsequent benefit payment.

Another situation is also possible when the amount of overpaid benefits is not recovered - the employee has already received benefits for the current month and in the same month he experienced circumstances in which he loses the right to receive it. For example, an employee was on maternity leave. She received benefits for the current month, and a few days later in the same month she decided to interrupt her vacation and go back to work full time. In this case, the amount of overpaid monthly child care benefits is not withheld. Payment of benefits stops from the next month (clause 83 of the Procedure).

Information from a former employer

The basis for calculating benefits for LVN is the presence of two documents:

- LVN;

- salary papers for the past 2 years.

The paper, which records the amount of income at the previous company (hereinafter referred to as the Certificate), is an important basis for determining the amount of payment in case of disability.

Yes, Art. 13 of Federal Law No. 255-FZ establishes several rules for calculating sick leave funds:

- compensation is paid at the current place of work;

- if a person is employed in several organizations, then payments are made to each of them in full in accordance with the general calculation rules.

If within two years before the benefit was calculated, the employee was employed in several companies, then the amounts are paid from the funds of the current company based on the salary that the person received over a two-year period (they are displayed in the Certificate).

Expert opinion

Mikhailov Vladislav Igorevich

Legal consultant with 8 years of experience. Specializes in criminal law. Member of the Bar Association.

The form of the paper must comply with the rules established by law. Order of the Ministry of Labor of the Russian Federation dated 2013, as amended 2021 No. 182 n, establishes the form of the certificate and the procedure for its issuance.

Since the legislator has established a unified form, the employer does not have the right to draw up the paper at his own discretion. For convenience, the person responsible for issuing the Certificate in the organization always has a template at hand.

The employee who deals with this issue may be a specialist:

- from accounting;

- from the HR department.

Therefore, if necessary, an employee should contact these departments of the enterprise to obtain a Certificate.

Certificate for sick leave from previous place of work

> > Tax-tax May 14, 2021 is needed if the employee, before the occurrence of an insured event, does not have sufficient experience at his current place of work to calculate benefits.

The nuances of issuing such a certificate and some issues that a person needs to know about upon dismissal will be discussed below.

Documents and forms will help you: A certificate upon dismissal for calculating sick leave is necessary so that in the event of illness, the employer at the insured person’s new place of work has the opportunity to correctly calculate temporary disability benefits. In accordance with clause 2 of Appendix 2 to Order of the Ministry of Labor dated April 30, 2013 No. 182n, issuing a certificate in the form given in Appendix 1 to the same document is the responsibility of the employer.

If possible

Contents of the income paper

The employee’s income form is issued on the last working day along with the work book. If it is not possible to provide the paper on time, participants can agree to hand over the form later by hand or by mail.

In any case, the employer must draw up and deliver the Certificate to the employee upon his first request within three days from the submission of the application.

The content and form of the form must comply with the rules established by the above-mentioned Order.

So, the contents of the document should display the following statements:

- Title of the paper.

- When is it compiled and under what number is it registered at the enterprise.

- The main part of the document.

This is standard paper design.

The body of the document should contain the following:

- the details (name, codes, address, contacts) of the policyholder (the employer who made payments to the Fund) are indicated - he can be either an individual entrepreneur or a legal entity;

- employee information – passport information, full name, addresses, telephone numbers;

- insurance number of an individual personal account;

- the period that a person worked in the organization - the date of employment and dismissal;

- employee income for which the employer transferred contributions to the Social Insurance Fund;

- periods of incapacity for work (pregnancy, etc.) when money was not transferred to the Social Insurance Fund.

The paper can be drawn up either by the director of the organization or by the head of the structural unit.

The procedure for calculating average monthly earnings

Here is an example of calculating daily allowance limits:

- If we calculate the average daily earnings paid under the LVN, then

- (718 thousand + 755 thousand)/730 days.

- The minimum amount depends on the subsistence level (hereinafter referred to as the minimum wage), you need to take the monthly minimum wage, multiply it by the number of months for two years, and divide by the number of billing days in the period (730 days):

- 9.489x24/730

Thus, the smallest amount to pay for one day of temporary disability cannot be less than 311 rubles. 91 kopecks

However, it must be taken into account that these indicators are taken without taking into account the influence of experience. These amounts are due to a person if, by law, he is entitled to 100%. Otherwise, you need to calculate the final value as a percentage of the length of service.

It is not actual years that are taken into account, but calendar years. So, if a citizen fell ill on July 16, 2021, income indicators will be taken not from July 16, 2021, but from 01/01/16.

Help 4 FSS

Contents ————————————————————————— ¦ Steinway JSC ¦ ¦ ¦ ¦ Accounting statement N 37 ¦ ¦ ¦ ¦ dated May 25, 2011 ¦ ¦ ¦ ¦ Contents of a business transaction: correction of an error made during the calculation of temporary disability benefits.

¦ ¦ ¦ ¦ When calculating temporary disability benefits for the period from January 11 to January 21, 2011.

pianist V.A. The bonuses paid to Blütner in January 2009 and October 2010 in the amount of 5,800 rubles were not taken into account. and 7500¦ ¦rub. respectively. ¦ ¦ As a result of incorrect calculation, the amount of the benefit amounted to ¦ 12,306.47 rubles. (RUB 816,700: 730 x 100% x 11 calendar days) instead of RUB 12,506.89 (RUB 830,000

: 730 x 100% x 11 calendars. days).

¦ ¦ The amount of benefits subject to additional accrual is equal to 200.42 rubles¦ ¦ (11,369.86 rubles - 11,187.67 rubles). ¦ ¦ In addition, as a result of incorrect calculation of benefits, arrears arose for personal income tax in the amount of 26 rubles.

(RUB 12,506.89 x 13% -¦ RUB 12,306.47 x 13%)

Recalculation procedure

If circumstances arise that have already been described above, the employer can independently change the calculations for previous years.

The employee has the right to submit an application for adjustment of the deduction amount. The application is written to the director of the enterprise or the head of a structural unit. It is compiled in free form.

There is no single template for writing a paper in the legislative norms, but an employee can ask the HR or accounting department about the availability of a template.

In order for the requirements to be satisfied, the applicant must attach the following documents to the application:

- Certificate from a medical institution.

- A document of the established form from the former employer.

If the documents are drawn up in violation of the law, the employer has the right to reject the application.

If everything is in order, the employer will not be able to refuse, since the scales are tipped in favor of the subordinate. The law in this case clearly protects the rights of the employee: if there is evidence for an increase in payments, and the citizen has substantiated the demands, then his application must be granted.

The statement is drawn up according to the rules that are usually used in business communication. Therefore, the petition states:

- details of the enterprise, full name of the manager, applicant;

- name of the paper;

- request for changes in the billing period;

- number and signature;

- Help is also included.

There is no statutory time limit for satisfying the applicant's demands, but it must comply with the rules of reasonableness of time. This means that once the request has been received and a decision has been made, the application must be processed.

The requirement must be complied with immediately. This will allow you to avoid misunderstandings with the employee and fines from the state labor inspectorate or the Fund.

The benefit during illness is accrued to the employee on the nearest date of payment of earnings, part 8 of Art. 13, part 1 art. 15 Federal Law No. 255-FZ. If there is a delay in payments, the employee is entitled to additional compensation provided for in Art. 236 Labor Code of the Russian Federation.

As for changing the amount of benefits from the Social Insurance Fund, the application procedure is similar to that outlined. An application is also written addressed to the head of the Fund and the payment document corrected by the employer is attached along with a certificate of incapacity for work and a Certificate.

Following the above recommendations, difficulties with re-registration of the payroll period should not arise, since conscientious employers usually do not prevent their subordinates from exercising this right.

Recalculation of sick leave is permitted provided that an error was made in the initial calculation of the amount due to the employee.

Application for recalculation of sick leave after payment (sample)

Reimbursement of sick leave supplement from the Social Insurance Fund in connection with recalculation

What calculation period is used when determining sick leave benefits?

The time frame taken into account is understood as the period preceding the day of illness and, as a consequence, temporary disability. To determine average earnings, a period of 24 months is taken. The latter, as already noted, directly affects the amount of the benefit.

When calculating the amount of disability payments according to a sick leave, deductions transferred to a citizen for the two previous years are not taken into account if their total amount exceeds:

- 2016 - 718 thousand rubles>;

- 2017 - 755 thousand rubles>;

- 2021 - 815 thousand rubles>;

- 2021 - 865 thousand rubles;

- 2021 - 912 thousand rubles.

The limit by which hospital payments are determined is directly dependent on the maximum base for calculating contributions to the Social Insurance Fund. Thus, large amounts are not taken into account when calculating average earnings. The portion exceeding the established limit is discarded from the total amount.

If for any reason the authorized person responsible for calculating sick leave has a problem determining the period, then the latter can be replaced. However, it is worth remembering that the entire time period is subject to replacement, and not its individual parts.

The employer must clearly understand what needs to be done if the employee brings a certificate issued from the previous place of employment. The document will indicate the amount of earnings, and at the request of the subordinate, a recalculation of hospital payments will be required. So, the main point in such a situation is the complete protection of the subordinate at the legislative level. Current legal acts clearly establish the employee’s right to an increase in benefits. The employer does not have the right to reject a citizen’s request. The only option when an organization can refuse to satisfy a request is the absence of a correctly filled out application and a certificate in the form approved by the order.

The application submitted by the employee to the management of the enterprise does not require special knowledge and skills. However, the general structure must be followed. To change the period used for calculating sick leave, you need to write something like the following text: “Please change the period that affects the determination of the amount of temporary disability benefits from 01/01/__ - 12/31/__. as of 01.01.__ – 31.12.__ (Certificate in form No. 182n, which is the basis for the change, is attached).

Application for recalculation of sick leave after payment (sample)

Application for recalculation of sick leave after payment (sample)

According to clause 2.1 of Art.

15 of the Law “On Mandatory Social Insurance...” dated December 29, 2006 No. 255-FZ, the employer calculates the amount of sick leave benefits based on the documents that he has at his disposal on the day of calculation. But later, the employee can bring certificates of earnings from previous places of work, and on their basis the benefits are recalculated.

You can recalculate only those sick leaves for which benefits were assigned no earlier than 3 years before the moment when the employee brought the certificate.

Read about the nuances of calculating sick leave in this material.

To recalculate benefits from an employee, you must receive a free-form application. You can see an approximate example on our website:

When will sick pay be recalculated?

Federal Law on Social Insurance No. 255-FZ of December 29, 2006 establishes three cases in which the employer is obliged to recalculate sick leave for the previous period:

- Obtaining new information about the employee’s earnings for the billing period.

- Dishonesty of the employee: presentation of a false certificate of incapacity for work or certificate of income.

- Calculation errors: arithmetic or due to incorrect application of legal regulations.

The employer is obliged to recalculate sick leave if the employee, after accrual of benefits, brings certificates of earnings from previous employers received during the billing period. The benefit is recalculated three years before the date of receipt of new information about the employee’s income. For a longer period, accruals are not corrected or recalculated (Part 2.1 of Article 15 255-FZ).

IMPORTANT!

In a situation of prolonged illness and the issuance of a new certificate of incapacity for work, the working period is not recalculated due to long sick leave. The calculation period for the continuation of the BL is similar to that used when calculating the primary one.

Reimbursement of sick leave supplement from the Social Insurance Fund in connection with recalculation

Reimbursement of expenses for additional payment of benefits occurs in the same way as reimbursement of any other social security - by submitting the appropriate set of documents to social insurance, incl. application and certificate-calculation with a sick leave certificate attached, to which the employer first makes corrections, specifying the amount of average earnings and the amount of benefits.

You will find a sample statement of calculation for sick leave.

In the information “Compulsory social insurance in case of temporary disability and in connection with maternity (question and answer),” social insurance explains that if an individual cannot obtain a certificate from a previous employer, then the current employer, at the request of the employee, can send a request to the Pension Fund of the Russian Federation to obtain information about past income. Based on information from the Pension Fund, the benefit can be calculated, and such benefit will be reimbursed by the Social Insurance Fund.

Accounting certificate: how to draw it up correctly

Accounting for the economic activities of an enterprise is based on various primary documents.

One of them is an accounting certificate. You will learn the writing sample, purpose, scope and other nuances from our consultation.

Any enterprise has the right to independently develop “primary” forms, approving them in its accounting policies. But sometimes it is difficult to justify certain business transactions due to the lack of an established document form for them. For example, calculating daily allowance or expenses. An accounting certificate will help eliminate this problem.

It can be used in other cases (see table). Some cases of using an accounting certificate Situation Explanation The company is required to use separate accounting for VAT Reveals the methodology for separate accounting for VAT Correction of data from the reporting period and previous years To solve this problem, use an accounting certificate to correct an error

Recalculation of sick leave in the program “1C: Salaries and Personnel Management 8” (edition 3)

Example. Employee of TEKS LLC Drozdov V.A.

presented a certificate of incapacity for work, from which it follows that he was ill from 06/20/2019 to 06/25/2019 (6 days). Drozdov V.A.

has been working at his main place of work full time since March 18, 2019. A certificate from another employer about the amount of earnings for the pay period (2017).

Expert opinion

Mikhailov Vladislav Igorevich

Legal consultant with 8 years of experience. Specializes in criminal law. Member of the Bar Association.

and 2021), necessary for calculating the benefit, the employee did not provide. The benefit was calculated in accordance with the law and paid at the earliest date of payment of wages, 07/05/2019.

A certificate from another employer was submitted on July 17, 2019. The amount of earnings was:

The employee’s total insurance experience at the time of the insured event is 4 years 6 months. It is necessary to recalculate temporary disability benefits.

When calculating benefits for temporary disability using the Sick Leave document (section Salary – Sick Leave – Create button or section Salary – Sick Leave) on the Main tab, uncheck the Take into account the earnings of previous policyholders, because a certificate of the amount of earnings from another employer for the billing period (2017).

and 2021) the employee did not provide (Fig. 1).

In our example, the benefit is calculated based on the minimum wage, because earnings for the billing period (2017)

and 2021) the employee does not have.

The employee’s total insurance experience at the time of the insured event is 4 years and 6 months. According to paragraph 1 of Art. 7 of Federal Law No. 255-FZ of December 29, 2006, an insured person with an insurance period of up to 5 years is paid temporary disability benefits in the amount of 60 percent of average earnings.

The daily allowance is: 370.85 rubles. (average daily earnings) * 60% (percentage of payment from earnings) = 222.51 rubles.

The benefit amount is: 222.51 rubles. * 6 days of illness = 1,335.06 rubles.

The benefit was paid on the earliest date of payment of wages – 07/05/2019.

On July 17, 2019, the employee submitted a certificate of earnings from another employer to calculate benefits. The amount of earnings received from other employers is registered in the document Certificate for calculating benefits (incoming) (section Salary - Certificates for calculating benefits) (Fig. 2).

After registering the certificate, you must recalculate the benefit. Click on the link Correct from the primary document Sick leave.

In the Month field, enter the month for recalculating sick leave. Since in our example, June is closed (the final calculation and payment of wages has been made and accounting data has been generated) and the certificate was provided on July 17, 2019, then July is indicated.

Check the box Take into account the earnings of previous policyholders (Fig. 3).

As a result, the benefit will be automatically calculated taking into account earnings from the previous place of work (Fig. 3, Fig. 4).

For the purpose of analyzing the accrual results, you can generate a printed form for calculating average earnings by clicking the Print – Calculation of average earnings button (Fig. 5).

The daily benefit amount is: RUB 2,092.40. (average daily earnings) * 60% (percentage of payment from earnings) = 1,255.44 rubles.

The benefit amount is: RUB 1,255.44. * 6 days of illness = 7,532.64 rubles.

In our example, during recalculation, the benefit amount increased. Accordingly, the employee must pay additional benefits. Additional benefits must be paid in the amount of RUB 6,197.58. (RUB 7,532.64 – RUB 1,335.06 (previously accrued benefit). The benefit was paid on July 20, 2019.

The date of actual receipt of income in the form of temporary disability benefits is the day the income is paid. The tax withholding date is also the payment date.

The deadline for tax payment is no later than the last day of the month in which such payment was made. In our example, the additional payment of benefits will be reflected in the calculation in form 6-NDFL for 9 months of 2021.

Section 2 will indicate the dates: on line 100 – 07/20/2019, on line 110 – 07/20/2019, on line 120 – 07/31/2019 (Fig. 6).

The compensation paid for employee sick days can be recalculated if there are sufficient grounds for this. The basis may be a certificate from a previous place of work, which will document both the income and length of service of a citizen, if it was not listed in the work book.

How to recalculate sick leave from the previous period? Who pays off the unpaid amount? What period is acceptable for recalculating previously calculated amounts? All these questions may arise before the employer upon presentation of a certificate from a previous place of employment.

Summary

1. Vitalya 14:39 hello, I need help. The situation is this: I have been paying alimony since 2010, regularly, every month. And then the ex-wife found out that alimony can also be calculated from sick leave. I submitted an application to the bailiffs, and the bailiff calculated my debt for sick leave for 7 years. Is this legal? It seems that according to the law, no more than 3 years is possible? What needs to be done to make a recalculation, and which articles should I refer to? How to make it?

1.1. If you were in the custody of the bailiffs, then they can calculate it for 7 years, but if not, then you just presented the sheet, then you can calculate it for no more than 3 years. You can file a complaint against this decision in the order of subordination in accordance with Art. 122 Federal Law “On Enforcement Proceedings”. If you do not agree with this decision, then you can appeal to the court.

2. I came back from maternity leave and had to go on sick leave. I handed in sick leave, but didn’t write an application for replacement years, I was paid at the minimum. Can they recalculate if I write this application now?

2.1. Good afternoon! You can write if 6 months have not passed since the date the certificate of incapacity for work was submitted to the accounting department. Good luck to you!

3. If the total insurance period is 11 years, and the organization where I work accrues the amount of sick leave for 4 years. Can I apply for recalculation of sick leave? I have employment contracts and certificates for all 11 years.

3.1. Good evening, dear visitor! In this case, you have every right to apply for recalculation. All the best, I wish you good luck.

4. Can I write an application for recalculation of sick leave (it was already paid to me today, 09/06 on my payday), if I have been on maternity leave for the previous 2 years? Replace with 2012-2013, since from 2014 to 2021 I was on maternity leave.

4.1. Yes, you can write such a statement.

The application must be written in two copies, one of which should be given to the employer, the second should be kept with you, having previously secured a note on it that a copy was received by a representative of the organization.

4.2. If you have already been paid, then in this case you can no longer recalculate your sick leave. This had to be done before receiving payments.

5. I took sick leave from work to care for my child. Sick leave is paid for the last two years. In the last two years before the sick leave, I was on maternity leave for a year and a half.. sick leave was accrued and no one told me that it was possible to change the billing period for calculating sick leave.. is it possible to write an application for recalculation and change the billing period for accrual sick leave?

5.1. • Hello, If the sick leave has already been calculated and paid, then I think it’s too late to apply and change the pay period. I wish you good luck and all the best!

6. I have been working for the organization since 2011 in April, went on maternity leave in 2014 in March, left 1.5 years as expected in November 2016, worked in March 2021, from the beginning of April I went on sick leave, handing in my sick leave and for me day and day of sick leave we counted about 250 rubles. Maybe I should write some kind of application for recalculation of sick leave.

6.1. Hello! It is necessary to submit an application to the employer to change the calculation period for sick leave on the basis of Article 14 No. 255-FZ.

7. Can they refuse an application for recalculation of sick leave (replacing the two previous years with the years before the birth), due to the fact that I was on maternity leave and without leaving, I am going on a second maternity leave? Thanks in advance.

7.1. Good day! The employer does not have the right to refuse to recalculate sick leave due to the fact that you have been on maternity leave for the previous 2 years.

7.2. Hello! You have the right to request a replacement of the billing period when calculating the maternity leave sheet if you were on maternity leave, Article 14 No. 255-FZ.

7.3. Good day! No, no one can refuse to accept and consider your application, as well as recalculate

Grounds for recalculation

Compensation for days of incapacity for work is calculated based on the existing documented insurance period and the employee’s average daily income. The insurance period is considered to be the period during which the employer made regular contributions to the social insurance fund.

To date, the insurance experience includes:

- All periods worked under an employment contract and entered into the work book.

- The time when the work was carried out part-time or when concluding civil law agreements.

- Years of military service.

- Child care leave, no more than one and a half years for one child and three years for two or more children.

- Time without work, if its absence was due to the fact that the spouse followed his husband/wife in the military and was not able to work, but no more than three years.

As can be seen from the listed points, not all periods that can be counted as length of service are reflected in the work book. The employee must himself confirm the excluded insurance sections with documents, because only based on the documents will the accounting department be able to make correct calculations.

Another point that is considered fundamental for calculating benefits is income for the last 24 months. If an employee has worked for the organization for less than two years and has not provided a certificate of income from his previous place of work, then calculations will be made based on the data that was accumulated at this workplace.

The presence of an official document on wages for the missing period will allow recalculation of benefits already accrued.

Legal regulation

Law No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006, in Article 15, paragraph 2.1, establishes that the employer is obliged to calculate compensation upon presentation of sick leave, based on the documents that he has in availability.

The same law allows citizens to initiate a recalculation of previously accrued amounts upon presentation of documents that may affect the amount of payments.

Federal Law 255 allows for the recalculation of sick leave for the three years preceding the date of submission of documentary evidence. Earlier sick leave certificates cannot be recalculated.

Limitations on payment for the number of sick days

Due to the fact that the law establishes such in connection with caring for a sick family member, the employer must have information about the days of incapacity for care already spent.

To do this, the employer must organize a record of such days for each employee in relation to each family member for whom the employee provided care.

If, by the time the next certificate of incapacity is presented, the employee has already exhausted the established limit of sick leave payment for a given family member, then such sick leave will not serve as the basis for payment of benefits, but will confirm a valid reason for the employee’s absence from work.

When determining the duration of payment for a period of temporary disability, it is necessary to take into account the periods during which benefits are not paid. Such periods include (Clause 1, Article 9 of Law No. 255-FZ):

- the period of release of the employee from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation, with the exception of cases of temporary disability of the employee due to illness or injury during the period of annual paid leave;

- the period of suspension from work in accordance with the legislation of the Russian Federation, if wages are not accrued for this period;

- period of detention or administrative arrest;

- period of the forensic medical examination.

There is also an exception to these cases. If a mother (another family member actually caring for a child), while on annual leave, takes out sick leave to care for a sick child, the sheet will be opened from the date when the mother must go to work (clause 42 of the Procedure for issuing certificates of incapacity for work). A similar situation arises when applying for sick leave to care for a child while the mother is on maternity leave, leave to care for a child until he reaches the age of three, leave without pay, as well as when visiting a doctor for such sick leave on weekends or non-working holidays, etc.

Example While on regular vacation until May 30, 2010, Kruglova E.A. On May 29, 2010, she applied for a certificate of incapacity for work to care for a sick child.

The sheet will be issued to her only from May 31, since May 29 and 30 fall on the employee’s vacation. If the employee’s vacation ended on May 28, she would also be issued a certificate of incapacity for work from May 31, since May 29 and 30 are days off.

Required documents

Expert opinion

Mikhailov Vladislav Igorevich

Legal consultant with 8 years of experience. Specializes in criminal law. Member of the Bar Association.

In order to prove the need to recalculate previously paid disability benefits, the employee must provide a package of documents.

It may consist of only two forms:

- Application with a request for recalculation based on the submitted documents.

- Certificate of income received from the previous place of work.

Instead of a certificate of income for the previous period, or along with it, forms may also be provided indicating the presence of previously unaccounted for insurance years, which can significantly affect the percentage of payment.

If the employee does not have the opportunity to obtain such certificates from his former employer, then he can request that the organization’s accounting department submit a request to the Russian pension fund. To provide information, the Pension Fund will require an application from the employee himself and a written request from the employing organization.

Based on the information received from the Pension Fund, a new calculation is made, which is then transferred to the Social Insurance Fund.

Payments after dismissal

In the case where an employee went on sick leave after the official dismissal, compensation for disability can only be received if the sick leave itself was opened by the clinic within a month after the termination of the employment contract and the mark in the work book. Similarly, in some cases, sick leave is closed after dismissal, if it was open at the time of the employment contract.

To receive disability benefits, the employee must contact his previous employer with the appropriate documents.

- Sick leave.

- Sheet of temporary incapacity for work.

- Identity document.

- Employment history.

If a dismissed employee started sick leave within a month after dismissal, he can apply to his former employer for compensation for sick leave

It is necessary to submit all documents to the accounting department for payment of benefits with the application.