The employer can withhold part of their earnings from employees’ wages either voluntarily or compulsorily.

The first case includes circumstances that are not strict in accordance with current legislation and require a statement from the employee. The second includes taxes and amounts under executive documents. In the first case, and sometimes in the second, the order is issued by the employer.

Regulatory documents on regulation of deductions from salaries

Russian legislation firmly regulates official deductions from employee wages:

- types of deductions are described in the Tax Code of the Russian Federation (mandatory - these are taxes at the initiative of employers and at the will of the employee himself);

- how enforcement proceedings are carried out, as stated in Federal Law No. 229 of October 2, 2007;

- the salary accruals by which the amount of alimony payments are calculated are specified in Government Decree No. 841 of August 18, 1996.

- the procedure for withholding alimony, transferring compensation for harm to health, for the loss of a breadwinner - these payments, withheld exclusively by court decision, are regulated by Art. 138 Labor Code of the Russian Federation, clause 3, art. 99 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ;

- the procedure for withholding alimony, transferring compensation for harm to health, for the loss of a breadwinner - these payments, withheld exclusively by court decision, are regulated by Art. 138 Labor Code of the Russian Federation, clause 3, art. 99 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ;

- deductions for unworked vacation days, excessive advance payments, results of accounting errors –

- deductions for unworked vacation days, excessively issued advances, results of accounting errors - Art. 137 Labor Code of the Russian Federation;

- voluntary deductions from salaries at the request of an employee, their amount is not limited, are regulated by Letter of Rostrud dated September 26, 2012 No. PR/7156-6-1.

Can the amount of material damage be deducted from an employee’s salary?

Material liability of personnel arises in the presence of the following circumstances:

- damage to the enterprise was caused due to illegal actions of the employee;

- there is a connection between the employee, the unlawful act and the damage caused;

- the employee’s guilt has been proven and is not disputed by him.

If all of the above points are present, the employer has every right to recover the material damage caused from the employee’s wages.

Therefore, before proceeding with recovery, the head of the organization must create a special commission of investigation and establish the fact of the violation, the employee’s involvement in it and the amount of damage caused to the enterprise.

According to Art. 238 of the Labor Code of the Russian Federation, the employee is obliged to compensate the employer for direct damage caused.

It is impossible to recover from wages only the amount of lost profits.

In what cases is it possible to deduct funds from wages?

Labor legislation clearly lists the cases in which the employer has the right to withhold funds:

- At the initiative of the employee himself.

- The employee did not actually work out the money he received. Most companies have adopted an advance payroll system, and this is one of the unpleasant consequences it can lead to.

- A business trip or relocation of an employee was planned (with a budget allocated), but it did not take place.

- If the enterprise has established production standards, and the employee has not met them.

- If the employee is at fault that there was an error in the accounting documents in favor of increasing the funds allocated for his salary.

- If the working year was not completed due to vacation.

- If, as a result of the employee’s actions or inaction, there is downtime at work.

In addition to these situations (they can be challenged), there are cases of mandatory retention. Specifically, these are court orders. If an employee is a debtor of alimony payments, a defaulter of traffic police fines, etc., then his salary must be reduced by the appropriate amount.

The only exception to the rule is the last “peaceful” month of cooperation between employer and employee. That is, the employee leaves, but only due to a reduction in staff, being sent to military service, due to the return to work of the previous employee, etc.

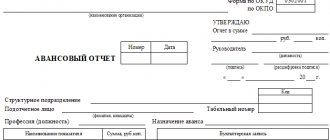

Samples of orders to withhold advance payments and accountable amounts

1. Reimbursement of unearned salary advance

The company has the right to deduct unearned advance payments from dismissal payments.

2. Repayment of unreturned imprest amounts

The organization must give the employee money before his business trip or before moving to work in another area (clause 6.3 of the Bank of Russia instructions dated March 11, 2014 No. 3210-U).

No later than three days after the deadline or from the date of return to work, the accountable person is required to fill out an advance report for the accounting department on the amounts spent and attach documents confirming the expenses.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

If the remaining accountable amounts are not returned, the employer has the right to deduct them from the salary within a month with the consent of the employee.

What percentage of funds should be retained?

In most situations, it is enough to keep 20%. This applies to property damage, shortages, etc. If there is more than one writ of execution, then it is permissible to withhold up to 50% of the total amount issued for the month. Labor legislation provides for cases when up to 70% of wages are deducted. This:

- alimony payments;

- if a crime was committed, resulting in material damage;

- there has been a death of the breadwinner;

- the employee was subject to punishment in the form of corrective labor.

If the employer does not have this information and withholds, for example, 100% of wages for any violation, then the negligent employee has the right to even go to court regarding this incident. If everything is formalized properly, he will win the case regarding the violation of his rights. In any case, both parties should be aware that 20% is that part of the salary that can be withheld by the employer from the employee for valid reasons. And for the rest it will be necessary to look for reasons in the labor code.

Exceptions to the rules

If an agreement on financial liability has been concluded, the employer has the right to recover the entire amount from the employee. By mutual agreement, you can pay in installments, deducting gradually from each subsequent salary.

The same is done if, during the trial, the employee was found guilty of any administrative offense that resulted in material damage to the organization.

The employee may also express a desire not to receive part of the funds. He can, for example, transfer his finances immediately to repay the loan, to a charitable organization, trade union, insurance fund, etc. It is worth keeping in mind that in order to carry out such actions, the company’s accounting service will need to have a written statement from the employee himself. It must clearly indicate that this is his initiative and he fully agrees with these actions.

What it is?

Any legally significant action performed at the enterprise must be formalized by an appropriate order from the manager. The transfer of inventory items (material assets) to a new financially responsible person in connection with the dismissal of the previous one is no exception.

The need to conduct an inventory of assets in connection with the departure of the employee who was responsible for them is stated in Part 3 of Clause 27 of Order No. 34n of the Ministry of Finance of the Russian Federation dated July 29, 1998.

How to correctly formalize an order from the head of a company to transfer inventory and materials in connection with the dismissal of the person responsible for them is described in detail below.

How to apply correctly?

It is immediately worth noting that today there are no officially approved rules for the preparation of such documents. However, when preparing an order, the following generally accepted requirements must be taken into account:

- prepared in writing;

- the document is drawn up on A4 paper;

- the content should clearly, clearly and concisely express the essence;

- Registration details (number and date) are required;

- An exclusively formal writing style must be used;

- the finished document must contain all the necessary signatures.

In general, the standard form of an order for the transfer of company assets in connection with the dismissal and change of a financially responsible person includes the following standard points:

- title of the document, date and place of preparation;

- the employee's full name, date of dismissal and position held;

- Full name of the new financially responsible person to whom the inventory and materials should be transferred;

- the date of acceptance and transfer of material assets that were entrusted to the dismissing employee under the relevant agreement (his details are indicated);

- F.I. O. persons responsible for the transfer and acceptance of assets (usually the resigning employee and his successor are appointed);

- the composition of the commission that will have to carry out the inventory;

- the full name of the official who is responsible for monitoring the implementation of the relevant order;

- required signatures.

Are there uniform design rules?

It should be noted that the forms of internal administrative documentation of business entities are not regulated in any way at the legislative level. This means that organizations independently develop and approve standard forms for certain documents.

Thus, at present there is no officially approved form of order for the transfer of inventory items in connection with the dismissal of a financially responsible person. Each organization uses its own samples of such documents.

Who signs?

Special attention should be paid to signatures in the order for the transfer of material assets. First of all, it must be signed by the head of the company who issued this document. In addition, the following officials must familiarize themselves with the order on the transfer of inventory items against signature:

- a resigning employee who previously bore financial responsibility;

- a new employee who is responsible for ensuring control over the company’s assets;

- members of the inventory commission, including its chairman;

- the person who is responsible for carrying out the order.

For each person mentioned in the order, the position held, full name (full name) must be indicated, and a personal signature must be affixed opposite.

Document accounting and registration

As noted above, any order from the head of the organization, including the transfer of material assets in connection with the dismissal of the responsible person, must undergo a registration procedure.

According to clause 65 of GOST R 51141-98, registration of a document means recording its credentials in the prescribed manner, which will subsequently record the fact of its creation, sending and receipt.

Registration of orders at the enterprise is carried out by making an appropriate entry in a special registration journal. Typically, this record includes the following information about the document:

- serial number;

- date of creation of the order;

- a name that briefly expresses its essence;

- number of applications (if any);

- Full name of the responsible person.

The order form itself indicates the date and number of its registration.

Storage rules and periods

In paragraph 1 of Art. 17 of the Federal Law of the Russian Federation “On archiving in the Russian Federation” states that organizations are obliged to store archival documents, including records of personnel, for the period of their storage prescribed in the current legislation.

In accordance with paragraphs. in clause 19 of section 1.1 of the order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558, orders relating to the administrative and economic activities of the organization must be stored for 5 years.

This category also includes written orders from the manager regarding the transfer of inventory and materials in connection with the dismissal of the financially responsible person.

The basic rules for storing documentation generated during the activities of the organization (including orders) are prescribed in Section II of Order No. 526 of the Ministry of Culture of the Russian Federation dated March 31, 2015. So, the following requirements must be met:

- documents that have a limited period (up to 10 years) must be stored in the structural divisions of the organization (usually the office), and after this period they are subject to destruction;

- papers in storage must be systematized according to a number of characteristics (chronology, subject matter, structural division, etc.);

- documents must be placed in a specially equipped room intended for storing archival papers;

- Regulatory conditions for storing orders and other local acts must be ensured, as well as the requirements for their placement must be met;

- It is mandatory to periodically check the safety of archival documents.

Preparation

Before proceeding with the execution of the order, it is necessary to document the damage (if the withholding occurs at the initiative of the employer and in connection with the damage incurred). Such documents may be inventory reports, a special act on damage to company property, or other materials. If we are talking about an accident, then the supporting documents can be acts from the insurance company, car service receipts, invoices for the purchase of parts, etc.

An important point: the payment documents presented to the employee must indicate the full amount of wages. It includes the bonus part, compensation, for length of service, etc. And deductions will be calculated from this total amount.

What payments cannot be collected?

The law provides for income that is not subject to withholding:

- one-time financial assistance;

- maternity capital funds;

- reimbursement of travel expenses to a treatment center;

- compensation payments;

- pensions due to the death of the breadwinner;

- money paid by the employee as alimony;

- funeral allowance;

- money paid to people who were injured and so on.

The full list is contained in Federal Law No. 229.

Who sets the minimum wage for employees and in what order – read this article.

Components of an order

It is advisable to print the text of the order on the organization’s letterhead. The paper must contain:

- Date of preparation;

- city (place);

- order number;

- reason for withholding funds;

- what percentage of the salary is the amount of withheld funds;

- the amount of the withheld amount in rubles;

- hold date;

- grounds for withholding (supporting documents);

- signature of the head of the organization;

- signature of the employee whose salary is being withheld.

In most cases, the written consent of the employee will be required to draw up an order to withhold funds from wages. This is the only way to achieve legal literacy in matters of the relationship between employer and employee. In the absence of mutual agreements, they resort to recourse to the courts, but this rarely happens.

conclusions

There are several main points on the topic:

- The Labor Law establishes the amount of deductions from wages in the amount of no more than 20%, according to executive documents up to 50%.

- To recover material damage caused, an investigation is first conducted, and then a collection order is issued. For an accountant, it is a documentary basis.

- The employee's consent to recovery is required only if the amount of damage is more than the average monthly salary. If he does not provide it, the employer has the right to file a claim in court.

- The collection is made after deducting 13% income tax from the accrued salary.

- The form of the order is not established by law; it is drawn up according to the templates of the employing organization.

Order to stop withholding

When the employee himself requests deductions from wages in writing, this is a special case when the limits and restrictions of the Labor Code, which largely protect the interests of personnel, cease to apply. To begin such deductions, an order is needed.

But if an employee decides to stop voluntary transfers through salary deductions, this is his right. To accomplish this, another order is needed to cancel the first one. To do this, the employee needs to perform one of two actions:

- write another statement - a request to stop withholding funds from his salary for the specified purposes;

- When writing the initial application, indicate the period after which it will no longer be valid and funds will need to stop being transferred.

Foundation documents

obliges the employer to first create a commission to investigate and determine the amount of material damage.

The employee must be required to provide a written explanation of what happened.

If he refuses to give them, you need to draw up a corresponding act.

At the end of the investigation, it is recommended to create a report with the amount of damage caused to the company.

Art. 248 of the Labor Code of the Russian Federation states that in order to recover, the employer must issue a decree (order).

It is he who will act as the documentary basis for deduction from salary.

If the employee does not agree to pay the debt, and the amount of damage is more than his average monthly earnings, the debt can only be collected through the court. Then the court decision will serve as the documentary basis.

In such circumstances, an additional retention order is not drawn up.

The employee has the right to voluntarily deposit the entire debt into the cash register or write an application for monthly deduction from wages in any amount.

In this case, the law does not impose restrictions. You can write an application in free form.

Is the employee's consent required?

The employee's written consent to recover damages caused by him is required only if the amount exceeds the employee's average monthly earnings.

The rule is established by Art. 248 Labor Code of the Russian Federation.

If the amount is smaller and there are documentary grounds, the employer has the right to collect the debt without the consent of the guilty party.

The amount of average earnings is calculated according to the Regulations approved by Government Decree No. 922 of December 24, 2007.

For example, if an employee breaks the organization’s equipment, an investigation is conducted and the amount of damage is confirmed in the amount of 50 thousand rubles, and the employee’s monthly income is only 35 thousand rubles, without the employee’s consent, the debt can only be collected through a judicial authority.

And, if the perpetrator’s monthly income was 70 thousand rubles, the employer would not need the employee’s consent to collect it.

Application example

statements of consent to withhold funds to compensate for damage caused to the employer - word.

Order for compensation for damage caused to the enterprise

The legislation does not provide for a special form of such a document. Therefore, the order is issued in free form.

However, there are mandatory items that are recommended to be included in it:

- full name of the organization;

- the name of the document itself;

- brief description - what the order is about;

- Date of preparation;

- a brief description of the situation with links to accompanying documents and laws;

- a requirement to withhold no more than 20% of the monthly salary of a specific employee, indicating his full name and position;

- list of documents - grounds with details. This could be: an act of identifying a violation, an explanatory note, an agreement on financial liability, an act of refusal to write an explanatory note;

- director's signature;

- familiarization visa for the guilty employee.

The document is drawn up on a sheet of format A - 4 without any errors. The presence of false information in the order, and, accordingly, unlawful deduction from wages, can lead to the employer being held liable.

Sample order

order to recover damages from an employee – word.

Example of a request to terminate deductions

Written if the date of termination of deductions was not indicated in the first application.

Director of Felix-M LLC Kolobkov P.A. caretaker N.L. Solovykhina

STATEMENT

I ask you to stop deducting 8,000 rubles from my salary starting September 12, 2021. in favor of Solovykhina E.N., since the girl for whose maintenance these funds were transferred became an adult.

I am attaching a copy of the birth certificate of E.N. Solovykhina to the application.

01.08.2021

/Solovykhin/ N.L. Solovykhin