A payslip is an official written notification to employees that they have been accrued wages, indicating the amount of earnings, bonuses or funds collected and the total amount of wages for the period worked.

Is it obligatory for an employer to notify his subordinates about wages, and what rules for issuing notification sheets are provided for by current legislation.

Article 136. Labor Code of the Russian Federation

The obligation to inform employees about accrued wages is assigned to employers in Article 136 of the Labor Code of the Russian Federation “Procedure, place and timing of payment of wages”:

When paying wages, the employer is obliged to notify each employee in writing: 1) about the components of the wages due to him for the corresponding period; 2) on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee; 3) about the amount and grounds for deductions made; 4) about the total amount of money to be paid.

Pay attention to the fragment from the first sentence of the quote: “... is obliged to notify...”, and this suggests that notifying the employee (issuing a pay slip) is not a right, but a direct obligation of the employer.

The procedure for issuing pay slips and their form must be specified in the local regulations:

The form of the pay slip is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Article 372 of this Code for the adoption of local regulations.

How the pay slip form is approved

The legislation does not approve a single form of such a document. The Labor Code of the Russian Federation states that the employer has the right to develop the form of the payslip independently. The main thing is that it be approved by order in the manner established by the local regulations of the organization.

The use of an unapproved form is the basis for collecting penalties from the employer for violating current legislation.

The procedure for working with payslips can be prescribed in the regulations on remuneration.

As a rule, the wage regulations stipulate the following:

- pay slip form;

- frequency of notification of wages;

- the method of issuing such sheets to the organization’s personnel.

As a rule, the procedure for preparing a payslip in an organization is established by the regulations on wages

The form of the payslip can be introduced in the organization, taking into account the opinion of the trade union.

In this case, the approval order will be as follows:

- The persons developing the payslip send it to the trade union committee.

- The document is analyzed by representatives of the trade union within five days, after which a decision is made in favor of the proposed sample or adjustments are made to the submitted form of the document.

- Once the form of the payslip has been agreed upon by all parties, an order is issued to approve such a document.

The order approving the form of the pay slip indicates a link to an article of the Labor Code of the Russian Federation, which regulates the procedure for providing employees with information about wages

The order to approve the form of the pay slip must contain the following information:

- name of company;

- order number;

- date of drawing up the order;

- references to legal norms confirming the need to prepare a payslip;

- the phrase “I order you to approve the form of the pay slip...”;

- methods of issuing the sheet to staff;

- an indication that the document has been agreed upon with the trade union (if this is true);

- Full name and position of persons controlling the document approval procedure;

- signatures of all responsible persons and the head of the organization;

- application containing a sample calculation sheet.

If the form of the payslip has been agreed upon with the representative body of workers, this is recorded in the order approving this document

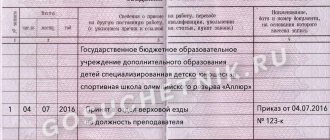

How to fill out a salary slip

The payroll slip must contain the following information:

- name of company;

- Full name and personnel number of the employee;

- the position of the employee and the department in which he works;

- the period to which the accruals correspond;

- time worked by the employed person per month (days and hours);

- on what basis and in what amount were deductions made;

- components of earnings;

- list of deductions from earnings (including personal income tax);

- the amount to be issued;

- the amount of monetary compensation (if the deadlines for issuing earnings were violated);

- the amount calculated upon dismissal of an employee (when relevant);

- organization seal (optional);

- Manager's signature (preferred).

The payroll sheet must contain information about the employee to whom remuneration is paid.

Thus, the document form should have the following sections:

- accrued (salary, bonus, vacation pay, etc.);

- withheld (for example, alimony and tax);

- paid (for example, advance);

- payable (the total amount of money that is issued to the employee for a specific month is indicated here).

Some organizations indicate payment and deduction codes on the document form. In this case, employees must be familiarized in advance with the decoding of the codes used in the organization. Most often, income and deduction codes from 2-NDFL certificates are used in payslips.

List of possible codes in the payroll sheet:

- 1010 - income in the form of dividends;

- 2000 - earnings for performing work duties;

- 2001 - remuneration paid to directors, members of the management body, etc.;

- 2010—amounts accrued for work under GPC agreements (except for royalties);

- 2012- vacation payments;

- 2201 — amounts of royalties;

- 2300 - amount of hospital benefits, etc.

When payslips are not issued

Vacation payslips

Pay slips need not be issued separately for vacation payments. In this case, experts refer to Letter of Rostrud dated December 24, 2007 N 5277-6-1 “On the procedure for settlements with an employee in the event of granting him unused vacation followed by dismissal, as well as the absence of grounds for the employer to issue a special pay slip to the employee when paying vacation amounts ", in part 3. of which it is said:

In accordance with Art. 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to notify each employee in writing about the components of the wages due to him for the relevant period, the amount and grounds for deductions made, as well as the total amount of money to be paid.

Payment for vacation is made no later than three days before it starts. Based on the definition of “wages” given in Art. 129 of the Code, payment for vacation is not payment of wages. In this regard, we believe that there is no reason to assert that the employer must specifically issue a pay slip to the employee when paying vacation amounts.

When calculating and paying the second part of wages to employees (usually at the end of the month), everyone should be given pay slips, including the employee who went on vacation, which will contain information about the total amount of money to be paid (already paid) .

Pay slips for advance payment

Pay slips may also not be issued separately for advances. This follows from the letter of the Ministry of Labor of Russia dated 05.24.18 N 14-1/OOG-4375:

Thus, the employer is obliged to notify the employee of the components of wages when paying wages, in accordance with the form approved by the employer. At the same time, the Labor Code of the Russian Federation does not regulate the procedure for notifying an employee about the components of wages (pay slip).

We consider it necessary to note that the generally accepted practice when applying remuneration systems in which salaries or monthly tariff rates are established for employees is the issuance of payslips indicating the accrued monthly wages.

At the time of payment of the first part of the salary (advance), as a rule, all accruals and deductions due for the month (including the first half), such as bonus payments, accruals for sick leave, the amount of calculated personal income tax, deductions for writs of execution, etc.

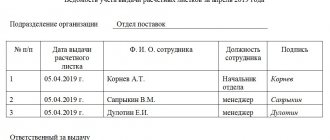

Order on the procedure for issuing a settlement document

An order must be issued.

Labor legislation stipulates that the employer or his representative is required to confirm the actual actions of issuing the paybook to the employee. Of course, if you just hand over a document, it will hardly be possible to confirm that it was issued.

It is for this reason that a local regulatory document should be developed and approved. Each organization makes its own decision on the development of a draft act.

List of information specified in the Order Requirements:

- The preamble indicates which normative document is being referred to. This is the Labor Code of the Russian Federation, article 372;

- In the order part, it can be reflected that this document approves: Regulations on the procedure for issuing a pay book in the hands of an employee, or this order can be fixed in the Order itself;

- Further, the text part establishes the immediate procedure for issuance, which is established by the employer. The order part indicates the persons responsible for the execution of the document, as well as which official is entrusted with control;

- The document is sent for legal examination. Lawyers may also make a number of suggestions and comments. Elimination of deficiencies is carried out during the review of the document;

- After working out the draft Order with the legal department, the document must be agreed upon with interested parties: the employer, the head of the settlement bureau, the chief accountant, the human resources department;

- Approval is made by the manager;

- Based on the document, the trade union body draws up a reasoned opinion, which is printed on a separate sheet of paper;

- The document was approved and the order was put into effect.

The presence of an order or other administrative document is mandatory; this is controlled at the state level.

Payslip form

There is no unified form of pay slip. It must be developed independently or a suitable template used by other enterprises must be found. If your accounting program allows for the printing of payslips, you can use it, just check that this payslip contains all the indicators provided for in Article 136 of the Labor Code of the Russian Federation.

As mentioned above, when considering Article 136 of the Labor Code of the Russian Federation, the pay slip must be approved by the local regulatory act of the employer.

Can the company show the sheets to other employees?

Article 88 of the Labor Code of the Russian Federation talks about maintaining confidentiality when transferring personal data of employees.

Employees who have access to personal data of staff must be familiarized with the provisions on the confidentiality of personal data upon signature.

Displaying information about an employee to other persons without his written consent is prohibited by law.

Since the pay slip contains information about the employee (his last name, first name or personnel number), as well as data on his earnings, it should be handed out to the employee himself.

Transferring leaflets through third parties who do not sign the agreement on maintaining the confidentiality of personal data may be regarded as an illegal action.

Pay slip in electronic form

According to Art. 312.1 of the Labor Code of the Russian Federation, a payslip in electronic form can only be sent to a remote worker. But the Ministry of Labor and Social Protection of the Russian Federation, in its letter dated February 21, 2021 N 14-1 / OOG-1560 “On notifying the employee about the components of the salary (pay slip) via email,” reports the possibility of transmitting the pay slip electronically to employee email:

... if an employment contract, collective agreement, or local regulatory act provides for a procedure for notifying an employee about the components of wages (pay slip) via email, then this procedure, in our opinion, does not violate the provisions of Article 136 of the Labor Code of the Russian Federation.

Now a payslip in electronic form can be sent not only to remote workers, as mentioned above, but also to all other employees, only this must be specified in one of the documents listed above.

Shelf life

Is it necessary by law for an organization to keep sheets containing information about the components of employees’ salaries?

According to the order of the Ministry of Culture of the Russian Federation No. 558, pay slips are stored subject to control checks for five years, and in the absence of personal accounts for 75 years.

However, current legislation does not provide for the need to store copies of payslips.

To provide inspectors with wage notices, two copies should be created, and the employer keeps the second one for himself.

Let's sum it up

- Issuing a pay slip is the direct responsibility of the employer.

- The form of the payslip is approved by local regulations.

- The payslip must be issued in writing or sent electronically if the employment contract, collective agreement, or local regulatory act provides for a procedure for notifying the employee about the components of wages via e-mail.

- A payslip must be issued to all employees, including those who receive wages by bank transfer.

- It is not necessary to put a signature or seal on the pay slip, since this is not clearly indicated in the regulatory documents.

- Payslips can be issued to employees in writing or sent electronically once a month when the final portion of wages is paid.

There is an opinion that it is better to issue pay slips in written form against signature in a specially kept book (magazine). Or, in the pay slip itself, provide a tear-off part with the employee’s signature, which will remain with the employer. This will be confirmation for the labor inspectorate that pay slips were issued, if suddenly the employee for some reason forgets about it.

According to the results of a survey conducted on the Klerk.ru portal, more than half of employers do not issue pay slips to employees, despite the fact that administrative liability is provided for this.

How to give an employee a pay slip?

The Labor Code states that it is necessary to notify subordinate colleagues in writing. Often this requirement is carried out by notifying employees on paper.

The pay slip is drawn up and printed, after which it is given to each employee.

At the same time, Article 136 of the Labor Code of the Russian Federation says that the form of the settlement notice sheet for issuance to employees must be approved by the employer himself in a local regulatory act.

That is, an order must be created to approve the form of the pay slip, which is carried out taking into account the opinion of the bodies representing the interests of the labor collective.

The absence of local acts and an order to approve the form of the salary notice sheet is considered a violation of labor legislation and provides for criminal liability for the employer.

Providing sheets in electronic form does not contradict current legislation. It can be sent to the employee’s email or entered into the database of a special program that contains the organization’s salary sheets.

Such a procedure for issuing will be a legal action if such a form of notification is approved by an act and order of the company.

Thus, according to the law, wage slips can be issued in the following ways:

- on paper for signature in person;

- electronically by mail;

- in electronic form using special software.

The chosen method of issuing information to personnel should be enshrined in the local regulations of the employer’s organization.

Deadline for provision by law

According to the Labor Code, payment for the period worked in the form of wages must occur on time at least twice a month. Notification of accruals is made once a month upon the final payment of wages for that period.

In most cases, employers issue salary notices to employees upon payment of full monthly earnings.

It is not recommended to issue it for the advance period, since all the components of the monthly earnings are not fully known.

There is no need to notify about the transfer of vacation funds. But at the time of dismissal, a full calculation must be made and the employee must be notified of all accruals and deductions due to him.

Transfer order for signature

To protect itself from prosecution, fines and proceedings with employees, the employer can approve the documentary form of salary slips with their issuance against signature.

To do this, management draws up a normative act approving the form of the pay slip, while taking into account the opinions of bodies representing the interests of employees, a trade union, for example.

An order is also created to familiarize colleagues with the form in which they will receive such sheets - in paper for signature, in electronic or other form.

It is not necessary to print the sheets to obtain the employee's signature on receipt of information about his wages.

The issuance of salary slips against signature can be done in several ways:

- approve the form of the document with a detachable part on which the employee’s signature will be placed confirming its receipt;

- keep a journal or record of issuing written slips, where employees will sign upon receipt;

- enter employee signatures into the payroll.

However, the law does not oblige the employer to take signatures from employees regarding receipt of salary notices.

Is it possible by law to refuse the paper version?

The law does not prohibit, if necessary, the transition from a paper version of pay slips to an electronic one.

Such actions will be considered lawful if another form, not in paper form, is approved in the company’s local regulations and provided for familiarization to employees against signature.

Is it legal to send by email?

According to the resolution of the Ministry of Labor No. 14-1/OOG-1560 of 2017, sending electronic salary notifications to employees does not contradict the law.

Such actions of the employer will be considered lawful if the electronic form of the sheets is approved by a regulatory act or specified in an employment or collective agreement with familiarization in the team under signature.

The main thing is that the procedure for issuing pay slips is brought to the attention of employees and is officially approved by local acts and orders.

Employer's liability

For failure by the employer to issue pay slips, administrative liability is provided for in Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation “Violation of labor legislation and other regulatory legal acts containing labor law norms” in the form of a fine:

- for officials and entrepreneurs - from 1000 to 5000 rubles;

- for legal entities - from 30,000 to 50,000 rubles.

In addition, the pay slip must be given personally to the employee to whom it was issued, since the pay slip contains personal data that cannot be disclosed. Liability for violation of the rules governing the processing and protection of personal data is discussed in Article 90 of the Labor Code of the Russian Federation.

What should you do if you don’t give information about your salary at work?

The Labor Code provides for mandatory notification of employees about the payment of wages, indicating the accrued amounts, bonuses, deductions and the total amount of earnings.

Failure to issue pay slips will be considered an unlawful action that entails administrative liability.

In this case, the employee should contact the accounting department of his organization with a request to issue pay slips, which is obliged to do this.

If such a request is ignored, you can contact the labor inspectorate of your city. When conducting an audit at an enterprise and establishing the fact of non-issuance of salary slips, the employer and the employee responsible for issuing them will be subject to administrative liability in the form of fines.

Liability and penalties for non-delivery

If it is established that Article 136 of the Labor Code of the Russian Federation has not been fulfilled in terms of issuing slips, namely the absence of written notifications to employees about the accrual of wages, allowances and deductions, monetary fines will be imposed on the organization.

According to the Code of Administrative Offences, such a violation is punishable by:

- for officials a fine of 1,000 to 5,000 rubles;

- for entrepreneurs a fine of 1,000 to 5,000 rubles;

- for legal entities a fine of 30,000 to 50,000 rubles.

In the case of a secondary offense, the amount of the fine increases for officials to 10,000 rubles, for legal entities to 70,000 rubles.

Is there personal data in the calculation?

The employer should remember that it is inadmissible to disclose personal data that may be contained in the pay slip. If it indicates the last name, first name and patronymic of the employee, then it is necessary to ensure the confidentiality of such information.

You cannot pass the sheets through third parties or simply put them on the table in the absence of an employee on site. From the point of view of data safety, it is recommended to hand over the invoices personally to each employee or entrust this to the heads of departments, having first obtained from them a receipt for non-disclosure of personal data.

The best option would be no full name. in the calculation. This does not contradict the norms of the Labor Code of the Russian Federation. As an individualizing feature, you can indicate the employee’s personnel number, having previously notified him of this.

Transmitting payments by email will also ensure the safety of personal data.

Should employees be familiarized with the order and the approved form?

After issuing an order to approve the payslip, it must be familiarized with signature by the persons who are responsible for its implementation.

The remaining members of the enterprise's work team also need to be notified of its acceptance. It is imperative to draw up a list of employees who must confirm with their signature that they have been informed of the order.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Salary