The employer has certain obligations to the employee, which are enshrined in the Labor Code. Let's look at the articles of the labor code on the payment of wages. The word “advance” is not used in the code of the Russian Federation; it is customary to call such a payment as wages for the first half of the month. We made this conclusion after considering articles 129 and 136 of the Labor Code of the Russian Federation.

Also, the articles of the code describe the timing of payment of an employee’s income: every half month the employee must be paid a portion of his earnings. In the labor and collective agreement, it is necessary to make a record of more precise dates for the provision of these payments to the employee. For example, on the 25th, an employee will receive part of the money earned for the first half of the month, and on the 10th of the next month, the employer must pay accrued amounts based on the results of work for the month.

For different structural units, you can set different paydays. This will allow the organization to plan its financial flows more freely. For example, administrative personnel should be paid income on the 28th and 13th, and operating personnel on the 25th and 10th.

But it is necessary to pay wages for the first half of the month before the 30th (31st) day (Article 136 of the Labor Code of the Russian Federation, letter of the Ministry of Labor dated 02.14.2017 No. 14-1/OOG-1293, letter of Rostrud dated 09.26.2016 No. TZ/5802-6-1).

If the payment date falls on a holiday or weekend, it is advisable to take advantage of the recommendations of the labor inspectorate and pay half of your earnings earlier. True, in such a situation, the next period between payments may exceed 15 days, but this will not be considered a violation. For example, payment deadlines are set on the 26th and 11th. October 11 will be a day off, therefore, wages for September must be paid to employees on Friday, i.e. October 9. And the next payment will be according to schedule, i.e. 26th, but only after 17 days. Such a deviation from the frequency of payments is not considered a violation of the Labor Code, because the employer fulfilled its obligations to the employee in compliance with all legal requirements.

Advance amount

But how can we determine the amount of payment for that part of the income that needs to be transferred to the employee for half the month? When determining the amount, you need to remember that the payment should include not only part of the employee’s salary (tariff), but also his permanent bonuses, the calculation of which does not depend on the results of work for the month or on the fulfillment of the monthly quota.

When calculating the advance, you should include part of the permanent remuneration for work performed and allowances in the form of compensation. For example, an employee works in shifts and his earnings include additional payments for night work (Article 154 of the Labor Code), and there may also be allowances for combining professions or length of service.

Allowances, which depend on the results of work for the month, are accrued to the employee when the payment for the entire month is formed. These include incentive payments (bonuses), which are accrued based on the results of completing work for the month, additional payments for overtime work, for work on weekends and non-working holidays (Articles 152, 153 of the Labor Code of the Russian Federation), regional coefficients, northern allowances, etc. d. The listed payments are not taken into account when calculating earnings for the first half of the month.

Deadlines for different employees

Another question that an employer may have is: is it possible in an organization to issue salaries to different employees at different times? Let's say the company is quite large, and there are several different structures within it. Can an organization transfer salaries to employees of one department on the 21st and 6th, and to others on the 25th and 10th?

The legislation allows the use of different terms for payment of salaries and advances in 2021 for employees of the same organization. But the difference between such payments should not be more than half a month, and the deadline should be until the 15th of the next month.

The Labor Code has a fairly clear position regarding this situation. And the above case falls under the current rules. This means it does not violate the law.

The employer must not forget to comply with Article 136 of the Labor Code of the Russian Federation. According to her:

- Salaries must be received by the 15th of the next month.

- The interval between payments cannot exceed 15 calendar days.

We also note that the establishment of different salary days at one enterprise does not fall under the definition of discrimination and does not entail any consequences.

It is better not to choose the 30th and 15th as paydays. This will create some convenience.

For example, in 2021, April consisted of 30 days. It turns out that the payment will need to be made on the last day of the month. In this case, the employer will have to withhold income taxes from both parts of the salary. This means that the accountant will need to make tax deductions twice in one month. Then in 6-NDFL the salary should be shown 2 times. And for each part of it you will need to fill out its own block of lines 100 - 140. For example, more convenient days for paying salaries will be the 27th and 12th.

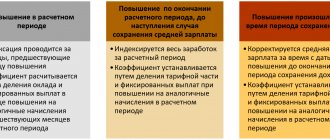

What is the best way to pay an employee - a fixed amount or a percentage of earnings?

The Labor Code does not prohibit the payment of wages for half a month based on a percentage of the salary (rate). For the employer, this method is even considered more convenient, because the accountant will not waste time calculating the amount and entering data on the time worked, and the employee himself expects a certain amount, which he receives regularly when transferring income for the first half of the month.

The accountant calculates a certain percentage, most often no more than 40-45% of the approximate monthly earnings. With this distribution of income, payments for the first and second half of the month are almost equal.

But, as practice shows, this method of payment will be incorrect, because an employee can provide sick leave or ask for time off, go on vacation, i.e. do not work fully half the month. Accordingly, the amount of income for half the month will be calculated incorrectly and will exceed the employee’s earned income. There may also not be enough accruals to withhold personal income tax.

There are cases when, at an enterprise with approximately the same level of remuneration, an accountant considers the option of using advance payments in a fixed amount. But if we talk about a fixed payment of income for half a month, then it is better not to use such accruals in practice, because inspection inspectors (controllers) regard it as a violation of employee rights and discrimination in the labor sphere (letter of the Ministry of Labor dated 08/10/2017 No. 14-1/B-725, letter of the Ministry of Finance dated 03/29/2016 No. 02-07-05/17670).

Which documents indicate payment days?

The deadlines for an employee to receive wages must include:

- In a collective agreement signed at the enterprise taking into account the opinion of the trade union.

- In an individual employment contract signed with the employee.

- In the provisions on the payment of wages, internal regulations , etc.

In the Labor Code in Art. 136 there are three documents that fix the deadlines: Internal regulations, labor and collective agreements.

According to the explanations of Rostrud, which are stated in letter No. PG/1004-6-1 dated 2012, it is enough to indicate the terms of salary payment in one document. In this case, the priority is the Internal Regulations. This is explained by the fact that the validity of this document applies immediately to all employees. While an employment contract regulates relations with a specific employee, a collective agreement may not be concluded at the enterprise.

When changing the timing of salary payments, the employer is obliged to issue an order about this and familiarize employees with it under a personal signature. In this case, the employee should be notified of the change in terms at least two months before the changes come into force. Also, after changing the terms of salary payment, an additional agreement to the employment contract should be signed with the employee, which will contain an indication of the change in the essential terms of the contract.

What amount should I pay to an employee who has just been hired?

Tax inspectors believe that an employee who has just been hired and worked only one day in the billing period already has the right to receive income for the first half of the month (Article 136 of the Labor Code of the Russian Federation). You just need to calculate his income in proportion to the time worked. And if you don’t pay, the employer can be punished and held accountable under Part 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

For example, the deadline for paying wages for the first half is the 30th (31st), payment of wages is on the 15th. Markov A. M. was hired on the 14th, for a position with a salary of 44,000 rubles. According to the production calendar, there are 22 working days in October. When determining the amount of income for the first half of the month, we will apply the conditions in proportion to the time worked for half the month. By the time of payment, two days have been worked, which means the payment amount will be 4,000 rubles. The employee will receive this amount on the 31st.

Since the situation with the hired employee is considered controversial, when determining the amount of earnings for the first half of the month, it is better to use a calculation proportional to the time worked.

Withholding and transfer of personal income tax

The calculation and issuance of advances and salaries according to the new rules are closely related to the transfer of personal income tax. Accountants often have a question about whether it is necessary to adjust the amount of the salary advance by the amount of deductions, or rather personal income tax, which currently amounts to 13% in the Russian Federation.

Tax transfers should be made no later than the next day after the payment of wages. Tax payment must be made twice a month: when transferring salaries and advance payments. The regulatory authorities explain that the withholding and transfer of personal income tax to the budget must be made upon final payment to the employee for the month.

How to formalize the change correctly?

According to Art. 57 and 136 of the Labor Code, the employer has no obligation to indicate specific days for payment of wages in the employment contract. He has the right to prescribe them in the internal regulations of the enterprise or a collective agreement.

The procedure for postponing the date of payment of wages directly depends on which document specifies the specific deadlines.

For ease of perception of information, we will consider each of the options in the form of a tabular document:

The date of receipt of wages is fixed in the document

Procedure for rescheduling

Internal regulations (IVR)

The transfer of dates occurs on the basis of an order issued by the enterprise.

After the changes, every employed citizen must be familiarized with them against signature. Since PVRs are local regulatory documents, decisions on changes are made by the employer without the consent of employees.

If there is a trade union in the company, its opinion must be taken into account when making changes.

If the collective agreement does not contain a clause regarding the procedure for making changes to it, then they are implemented through negotiations.

Typically, a special commission is created to amend such agreements. It should include representatives of both parties: the employer and the employees.

The results are recorded in a special additional agreement. It contains a free form, but must include new deadlines for receiving payment for work. The additional agreement is sent to the territorial labor authority for registration no later than seven days after signing.

The document comes into force from the moment of its publication, not registration.

According to Art. 72 of the Labor Code of the Russian Federation, when the date of salary payment changes, it is carried out by concluding an additional agreement with each employee. If a person does not agree with the change in the terms of the contract, the organization will have to settle it with payment of severance pay in the amount of two weeks’ earnings.

With this option, it is imperative to notify employees of the upcoming changes two months in writing.

The notification must contain not only the new dates for payment of wages, but also the reasons for the changes being introduced and explanations why the previous deadlines cannot be maintained.

If dates are recorded in two or three documents at the same time, then changes will have to be made to each of them.

For example, when the date is specified in the rules of procedure and employment contracts, an order is issued and notices are sent to employees two months in advance.

After which additional agreements to the employment contracts are concluded.

Is notice required for employees to reschedule?

An organization is obliged to notify staff about the transfer of wages for work only if a specific payment period is specified in the employment contracts.

Written notices are sent to employees no later than two months in advance.

When the deadlines for receiving payment for labor are agreed upon by the PVR, there is no need to ask the employees for consent; changes are made by order.

However, the employer is obliged to familiarize all personnel with the order.

order

An order to postpone the date of payment of wages is drawn up if the deadlines are determined by the temporary residence permit.

The law does not approve a special form for this document.

However, it must contain the information:

- name of the company and document;

- date and city of compilation;

- in one sentence - what the order is about;

- in which document the changes are introduced and their essence, the date from which the changes are made;

- responsible persons for making changes are appointed;

- manager's signature;

- a list of persons who must familiarize themselves with the order and their visas.

order to change the timing of payment of wages - word.

To familiarize employees, familiarization sheets are attached to the order, and personnel visas are included in them.

conclusions

Main conclusions:

- The procedure for carrying out the procedure depends on which document regulates the specific deadlines for receiving wages.

- The order is issued only if the deadlines are established by the PVR.

- If the dates of issue are determined by employment contracts, the employer notifies employees two months in advance of the upcoming changes. After this, additional agreements are concluded with each employee.

- When the terms are fixed by a collective agreement: a commission is created, a decision is made to introduce changes, and only after that one additional agreement to the contract is issued.

- Issue days cannot be less frequent than every half month. Payment is made no later than fifteen days after the end of the period for which the salary was calculated.

Change of salary payment deadlines: notification

Keep in mind that if an employee refuses to sign an additional agreement to the employment contract, the employer may recognize the change in salary terms as a change in organizational working conditions. In this case, the employer needs to notify each employee in writing about the upcoming change in the timing of salary payment. The employer must do this no later than 2 months before making changes.

If the employee does not agree with the innovations, then theoretically such an employee can be dismissed with payment of severance pay in the amount of two weeks’ average earnings (Article 74, paragraph 7, part 1, Article 77, Article 178 of the Labor Code of the Russian Federation).

How to properly issue it to new employees

Employers also have questions regarding wages for newly hired employees. Thus, the first part of the salary should not be issued later than 15 days after hiring. It turns out that you can transfer money at the end of the month only if the employee was officially employed later than the 15th.

What to do if a new employee has been working in the organization, for example, since the 2nd? By paying him a salary only by the 30th (later than 15 days after employment), the employer will violate labor laws. In this case, a fine of 50,000 rubles may also be applied to him.

If the employer is determined to issue wages in accordance with the Labor Code of the Russian Federation, then in the first month of work it is best to make 3 payments to the new employee at once within the following terms:

| When to issue salaries to new employees | ||

| Payment serial number | When to pay | How much to pay |

| 1 | On the day of payment of salaries to the workforce for the previous month | In accordance with the number of shifts/days worked in the current month |

| 2 | On the day of payment of the advance | Calculate as a regular advance, but subtract money already issued this month from the amount received |

| 3 | At the time of payment of salary for the coming month | Transfer the rest of your salary |

Starting from the 2nd month, salaries can be paid, like other employees.

EXAMPLE

The new employee started working on August 2, 2021. Staff salaries are paid on the 26th and 11th. The salary of a new worker is 22,000 rubles.

There are 23 working days in August 2021. The daily salary is:

22,000 rub. / 23 days = 956.52 rubles.

On August 11, you need to pay for the period from August 2 to August 11 inclusive. There will be 8 working days. Therefore, the payout will be equal to:

RUB 956.52 × 8 days = 7652.16 rubles.

On August 26 we issue salaries for the period from August 12 to 25. Number of working days – 10. Payment due:

RUB 956.52 × 10 days = 9565.2 rubles.

On September 10, you need to withhold tax, as well as deduct the amount from your salary and transfer the remaining amount:

22,000 rub. – 22,000 rub. × 13% – 7652.16 rub. – 9565.2 rub. = 1922.64 rubles.

Also see “What are the deadlines for paying salaries upon dismissal?”

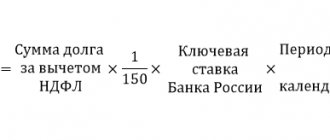

Compensation for violation of the deadline for issuing salary

In October 2021, the formula for calculating compensation for missed payment deadlines also changed. Now a day of delay will cost not 1/300, but already 1/150 of the key rate of the Central Bank of the Russian Federation, multiplied by the amount of money not received. In this case, compensation is calculated based on the delay of each payment due to the employee.

From June 19, 2017, the key rate of the Central Bank is 9%.

EXAMPLE

For July 2021, the employee’s salary was 60,000 rubles. Excluding income tax – 52,200 rubles. The deadline for issuing the advance (45%) is July 21, and the salary is August 6. The organization paid the debt only on August 9th. Compensations will be as follows.

From July 22 to August 6 inclusive – 15 days of delay. Compensation amount:

RUB 52,200 × 45% × 9%: 1/150 × 15 days = 211.41 rubles.

From August 7 to August 9 – 3 days of delay. Compensation amount:

RUB 52,200 × 9%: 1/150 × 3 days = 93.96 rubles.

Total amount of compensation:

211.41 + 93.96 = 305.37 rubles.