Procedure for establishing and paying wages guaranteed by law

The legislation clearly states that the procedure for calculating and terms of payment of remuneration for work performed are mandatory conditions of the employment contract (Article 57 of the Labor Code of the Russian Federation). The salary amount is determined in accordance with the employer’s current remuneration systems, as well as other calculation parameters enshrined in the organization’s local acts that do not contradict current legal norms. The amount of earnings due to an employee based on the results of work performance is determined by mutual agreement of the parties to the employment contract when it is signed (Article 135 of the Labor Code of the Russian Federation).

Payment of remuneration for labor is made at the place where the employee performs his official functions. Payment to the employee of funds for work done in the interests of the employer is made for each half of the month. The day of earnings transfer is established by local regulations of the company, but it should not be later than 15 calendar days after the end of the accrual period (Article 136 of the Labor Code of the Russian Federation). If the payment date coincides with a holiday, the employee must receive the money on the nearest previous working day. Vacation pay must be transferred to the employee no later than 3 days before the start of the vacation.

Any delay in transferring earnings compared to the specified deadlines will be a direct violation of labor laws. Moreover, such behavior of the employer can be regarded as coercion to work without pay, and such actions are expressly prohibited in Art. 4 Labor Code of the Russian Federation.

Compensation concept

The Labor Code of the Russian Federation regulates the relationship between employee and employer. Among the fundamental points of communication is the payment of wages at a certain frequency, namely, every 15 days of the month. In the first half of the calendar month, the so-called advance payment is received, and after the deadline, the entire salary is received. If the employer does not respect the rights and interests of his employees, then payment of monetary compensation is provided for him.

Turning to the Constitution, namely paragraph 3 of Article 37 , you will see that at the legislative level there is a mention that a citizen’s work must be paid, and the amount of his salary must be no less than the minimum wage established in the country. In this case, the delay is considered to be the period from the next day, which is determined by the date for calculating payments. Very unpleasant consequences can occur for the leaders of the organization. Article 37 of the Constitution of the Russian Federation

What is the procedure for paying compensation for delayed wages?

In Art. 236 of the Labor Code of the Russian Federation clearly establishes the unconditional obligation of the employer to pay compensation for delayed wages. Basic principles of its calculation:

- Accrual for each day of delay, starting from the date following the day established for payment of earnings;

- The amount of debt is determined minus the personal income tax due to the budget (clause 4 of Article 226 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated 01.02.2017 N 03-04-06/5209);

- To determine the amount of compensation, the key rate of the Bank of Russia is used.

Attention!

If compensation is paid from the advance debt (for the first half of the month), then there is no need to reduce the amount of debt by personal income tax for the calculation. This is due to the fact that the date of receipt of salary for the purpose of calculating tax is recognized as the last day of the month and before this moment its deduction is unlawful (clause 2 of Article 223 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated February 13, 2019 N 03-04-06/8932) . If there is a delay at the end of the month, its amount for the second half must be reduced by personal income tax.

In Art. 236 of the Labor Code of the Russian Federation establishes the procedure for determining the amount of the minimum additional payment for late payment of wages. To calculate it, use the formula:

At the same time, the legislation does not prohibit the employer from paying a penalty for late payment of wages in a larger amount, having previously fixed it in the internal documents of the organization.

Why do you need a calculation?

Calculation of compensation for delays in mandatory payments is necessary for almost all officially employed people. Salaries and other payments may not be accrued on time due to a number of reasons, including economic instability in the country, a change in management in the organization, or dishonesty in fulfilling its obligations.

In real life, few citizens demand payment of compensation for delayed wages due to the employer’s disregard of the laws. In order to avoid this, everyone needs to know the legal framework and be able to calculate the amount of compensation. To receive it, the employee must submit an application to the labor inspectorate, which will impose a penalty for failure to comply with the terms of the contract.

How to calculate a penalty for missing a salary transfer deadline (example)

The employee has a salary of 35,000 rubles and an advance payment of 19,700 rubles. paid on time. From November 16 to November 30, 2019, the employee worked 70 hours out of a standard 160 hours. Salaries for the second part of the month were supposed to be paid on 12/05/2019, but the actual transfer occurred on 12/09/2019, that is, 4 days later. The key rate is 6.5%. What is the amount of compensation?

- We calculate the amount of earnings for half a month: 35,000/160 x 70 = 15,312.5 rubles.

- We determine the amount of personal income tax (19700 + 15312.5) x 13% = 4551.63 rubles.

- Debt amount minus personal income tax: 15312.5 – 4551.63 = 10760.87 rubles.

- The amount of compensation is equal to: 10,760.87 x 6.5% x 1/150 x 4 = 18.65 rubles.

Procedure for employees

The state guards the rights of the working population, therefore, in the text of the articles of some legislative acts you can see the procedure for actions that an employee needs to carry out in order to receive compensation payments.

In order to achieve justice, there are several ways to resolve the problem, and all of them involve contacting various authorities. An employee can file a complaint with the State Labor Inspectorate, file a claim in court, contact his organization’s labor dispute commission, simply terminate his official duties and relationships under the employment contract, or contact the prosecutor’s office.

However, each method has its own nuances that you should pay attention to.

Video - Compensation for delayed wages

Commission for Enterprise Disputes

As a rule, such a body functions in large enterprises. The main function of this education is to resolve labor conflicts between management and workers. Sometimes the dispute commission is represented by a trade union. After filing a claim for delayed wages, a response to your request must be received within 10 days. The application is registered by the commission and accepted for consideration.

However, deadlines must be met. The appeal must be made within a three-month period from the moment non-payment occurred in relation to you. The dispute can be considered in the presence of the employee himself upon his written application. The application must provide all reliable information, as well as an account statement where no funds have been received for a long time.

State Labor Inspectorate

To contact the labor inspectorate, you must file a complaint. A sample of it can be found on the Internet. The complaint is reviewed within 30 days. Based on the results, the inspector contacts the employee. Then he sends an order to the administration of the organization where the work activity is carried out on the need to eliminate existing violations. Unfortunately, it is impossible to submit such a document anonymously. But based on Article 358 of the Labor Code, you can ask to remain incognito. Article 358. Responsibilities of state labor inspectors

The complaint must indicate the reason for writing.

In the event that wages are not transferred to the employee within 15 working days. He may stop performing his official duties until the funds along with compensation are credited to his account. However, the employee must inform his supervisor in writing of his intention to resign from his job duties. A copy of the application remains with the employee.

Court

One of the most effective ways to oblige an employer to pay money along with compensation is through litigation. The employee only needs to draw up a statement of claim and attach documentation to it proving his case. You can contact us if your interests are violated.

The statement of claim must be drawn up in accordance with the requirements of Article 131 of the Civil Procedure Code. It should contain the following information:

- Activity data.

- Period.

- Terms of payment.

- Debt calculation.

- Information about an attempt to resolve relations peacefully.

Article 131. Form and content of the statement of claim

The court considers the statement within 30 calendar days. And if violations of workers’ rights are detected, a court date is set.

Prosecutor's office

An appeal to the prosecutor's office is possible if earnings are delayed in payment for 2 or more months. In this case, a criminal case is opened, and the reason for this is the inaction of the labor state. inspections. At the same time, a claim is filed in court. An employee of the prosecutor's office becomes your representative, participates in legal proceedings with you, and defends the rights of the employee. The case has been put under control until the employer begins to pay the amount of the debt along with the amount of compensation.

Every employee should have an idea of what to do in a situation if the promised wages are not accrued. The ability to assert and defend one’s rights is the key to success in the service. Stop violations of your rights and legitimate interests yourself.

Procedure for taxation of compensation for late payment

In 2021, the following procedure has been established for paying taxes and contributions to the budget on the amount of penalties for late wages:

- Personal income tax on the amount of additional payments for missing the date of salary transfer is not subject to personal income tax, as a compensation payment established by current laws (clause 3 of article 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated February 28, 2017 N 03-04-05/11096);

- Since the specified payment is not named as excluded from the base for calculating insurance premiums in Art. 422 of the Tax Code of the Russian Federation, they will need to be paid (Letter of the Ministry of Finance dated 03/06/2019 N 03-15-05/14477);

Attention! Based on the legislative norms in force until January 1, 2017, the Presidium of the Supreme Arbitration Court of the Russian Federation concluded that it is possible not to charge contributions in terms of temporary disability and maternity for the amount of compensation (Resolution dated December 10, 2013 N 11031/13). However, at present this position does not find support from inspectors from the Federal Tax Service.

How to calculate salary delays

If wages are not paid, it is necessary to understand that this is a direct violation of fundamental human rights enshrined in the Constitution of the Russian Federation. According to paragraph 3 of Art. 37 of the Constitution of the Russian Federation, everyone has the right to remuneration for work without any discrimination and not lower than the minimum wage established by Federal Law.

Violation of the established deadlines for the transfer of wages is regarded by labor legislation as forced labor (Article 4 of the Labor Code of the Russian Federation).

Compensation for delayed wages in 2021

Salaries are paid at least every half month. The date of remuneration is set no later than 15 calendar days from the end of the period for which it was accrued (Article 136 of the Labor Code of the Russian Federation).

The employer approves the dates of payment of wages in one of the following documents:

- internal labor regulations;

- collective agreement;

- employment contract.

If the day of payment of wages coincides with a day off or a non-working holiday, payment is made on the eve of this day.

How to calculate compensation for delayed wages?

Article 236 of the Labor Code of the Russian Federation establishes a minimum level of 1/150 of the Central Bank key rate. The key rate as of September 18, 2017 is 8.5%. Interest is accrued for each day of delay, starting from the next day after the due date for payment until the day of actual settlement, inclusive. In case of incomplete transfer of wages on time, the amount of monetary compensation is calculated from the amounts actually unpaid on time (Article 236 of the Labor Code of the Russian Federation).

If the key rate changes during the period of delay, both rates are included in the calculation of compensation for delayed wages in proportion to the period of their validity.

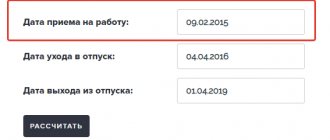

The calculator for calculating compensation for delayed wages 2021 will help you determine the amount of debt.

Calculator for calculating salary delays in 2021

When entering data, please note that compensation is calculated from the amount unpaid to the employee after personal income tax was withheld, i.e., from the amount “in hand.”

To calculate your compensation, enter your data into the 2021 Late Wage Compensation Calculator.

Calculator: Calculation of compensation for delayed wages

The employer has the right to set an increased percentage for late wages; in this case, its amount is fixed in a collective or labor agreement, or any local regulation.

If our calculator for calculating salary delays in 2021 did not help, we will make calculations using the formula:

Calculation example

For example, let’s set the following payment deadlines:

- 15th - final payment for the previous month;

- 28th - advance payment.

The employer transferred wages for August 2021 on October 20. Accrued wages for August amounted to 40,000 rubles. Local regulations establish an advance payment of 40% of the salary. Based on this:

- the advance is 16,000 rubles. The date is set - August 28;

- final payment - 24,000 rubles. The date has been set - September 15.

Personal income tax is not withheld when paying an advance. In the final calculation, personal income tax is calculated from the full amount (clause 4 of article 226 of the Tax Code of the Russian Federation).

For calculation, we apply the above formula.

Interest on advance = 16,000 x (8.5% / 150) x 55 days = 498.67 rubles.

Interest on earnings = 18,800 x (8.5% / 150) x 45 days = 479.40 rubles.

In accounting, compensation is reflected by entry Dt 91.2 Kt 73.

These expenses are not accepted for income tax purposes and do not reduce income under the simplified tax system (Letter of the Ministry of Finance dated October 31, 2011 No. 03-03-06/2/164).

You can set the individual amount of compensation by picking up a calculator for calculating delayed wages. Compensation for delayed salaries in 2021 due to violation of deadlines is subject to taxes and contributions in accordance with current legislation.

Procedure for calculating taxes and contributions

Monetary compensation provided for in Art. 236 of the Labor Code of the Russian Federation, is exempt from taxation on personal income on the basis of clause 3 of Art. 217 of the Tax Code of the Russian Federation (letter of the Ministry of Finance dated February 28, 2017 No. 03-04-05/11096).

If there is no described procedure for calculating compensation in a collective or employment agreement, but the accrual is carried out in a larger amount than provided for in Art. 236 of the Labor Code of the Russian Federation, the excess amount is subject to personal income tax (letter of the Ministry of Finance dated November 28, 2008 No. 03-04-05-01/450).

The list of amounts not subject to insurance premiums is established in Art. 422 of the Tax Code of the Russian Federation. Compensations for violation by the employer of the established deadline for payment of wages are not named in the mentioned list, therefore, they are subject to insurance contributions in the generally established manner (clause 2 of the Letter of the Ministry of Finance dated March 21, 2017 No. 03-15-06/16239).

How to get compensation

As follows from legislative norms, the calculation of compensation is the responsibility of the employer. But in practice, the employer is in no hurry to voluntarily fulfill his duties.

In case of violation of his rights, the employee must contact the labor dispute commission or labor inspectorate.

If wages are accrued but not paid, the employment contract with the organization has not been terminated, then 3 months are counted from the moment of dismissal or from the moment the accrual of wages ceases (clause 56 of the Supreme Court Resolution No. 2 of March 17, 2004).

If a deadline is missed for valid reasons, the labor dispute commission or the court can restore it and resolve the dispute on the merits (clause 5 of the Supreme Court Resolution No. 2 of March 17, 2004).

Simultaneously with the application to the labor inspectorate, the employee has the right to file a complaint with the prosecutor's office and the court. The claim is filed in court within one year from the date of the established deadline for payment of the specified amounts (Article 392 of the Labor Code of the Russian Federation).

How else can an employer be punished for delay?

The material losses of a company that fails to pay wages on time are not limited to paying late fees. In addition, if such a fact is revealed by supervisory authorities, the organization may pay a fine in the amounts specified in Part 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation. If the court satisfies the corresponding claim brought by the employee, the employer may be awarded to pay the amount of moral damage caused to the employee.

If the delay in payment of wages in full exceeds a period of 2 months or in a partial amount of 3 months, the company may face criminal prosecution under Art. 145.1 of the Criminal Code of the Russian Federation. However, in order to apply such a severe punishment, it will be necessary to prove the intent of the owners and management of the company, which in practice is not so simple.

Salary calculation

Salary, or otherwise, tariff rate, is not equivalent to wages. We can say that salary is a certain basic value, that is, the minimum wage established by the staffing table for a certain position for a certain time, without taking into account allowances and compensations.

It is these basic indicators that the calculator takes into account. To get the correct result, the calculator needs to know:

- salary size;

- number of working days in a month.

The calculator will convert working days into standard working hours and give the final amount (excluding compensation, bonuses, overtime, etc.) minus personal income tax.

The calculation algorithm corresponds to the formula TS / DM × RD = ZP, where:

- TS is the tariff rate;

- DM is the duration of a calendar month, that is, 30, 31 or 28/29 days;

- WP are working days worked in a particular month.

Attention! The calculator is provided for calculations based on standard hours. That is, the correct result can only be obtained based on 40 working hours per week (Article 91 of the Labor Code of the Russian Federation). This means that the calculator can be set to the condition of any number of days worked per month, but it is impossible to change the calculation with the condition, for example, of a 6-hour working day or overtime.