Let's understand the concepts

Accounting entries - what are they?

This is a way of reflecting business transactions in accounting, in which accounting accounts are used in accordance with the current working chart of accounts. Moreover, most transactions are reflected using the double entry method. Only some accounting entries can be compiled using a simple method. In other words, to reflect any completed fact of economic activity, the accountant makes an entry as a debit to one accounting account and a credit to another accounting account in the amount of the completed transaction, expressed in monetary terms.

When drawing up transactions, economic entities use a working chart of accounts, which is developed on the basis of a unified chart of accounts (USC) and instructions for its use. However, the ENP depends on the type of economic entity.

Thus, non-profit organizations when developing RPS use Order of the Ministry of Finance dated October 31, 2000 No. 94n (as amended on November 8, 2010). Budgetary institutions apply Order of the Ministry of Finance No. 157n dated December 1, 2010 (as amended on September 27, 2017). However, for public sector employees, additional instructions apply depending on the type of institution.

What is meant by “product” in accounting?

An accounting product has the meaning of any acquired property that was purchased solely for the purpose of resale, but at an inflated price.

In accounting, all goods are accounted for at the selling price, and here are the expenses it consists of:

- Payment of the cost of goods upon purchase to the supplier.

- Costs associated with advertising and other information needs for the speedy sale of goods.

- Monetary incentives given to intermediaries, agents or sales representatives during the purchase or sale of goods, as well as all acquisition costs.

To account for goods, their value and quantity, account number 41 is used in accounting. Enterprises and individual entrepreneurs that are on a simplified tax system immediately include VAT in the cost of purchased goods. If the company is an ordinary taxpayer, then VAT is accounted for separately. You can find out the purchase price and the amount of VAT from an invoice or expense, tax invoices from companies that are subject to regular taxation.

If a product is written off, sold or returned, it will be debited from account No. 41.01. The mechanism for writing off goods most often occurs using the method of finding the average cost per unit: the same product purchased at different prices is summed up and divided by the total number of units. This is how the average cost is found.

Goods can be written off to the following accounts:

- upon sale, the goods are written off to account 90, where revenue and costs are compared;

- if damage, loss or shortage occurs, then from account 41 the amount is written off to, which is called “Losses, shortages from damage to valuables”;

- if the goods were transferred for commission sales or handed over to an agent, then they are called shipped and are written off to account 45. This invoice is called “shipped goods”. After the final sale occurs, the goods will be written off to account 90 from account 45. The selling price will be calculated in exactly the same way as if the sale was handled by the original company.

Learn more about accounting for goods for beginners - posting tables with examples.

What are accounting services?

All types of accounting correspondence can be divided into two large groups: single (simple) and double (double entry method).

A simple method of preparing accounting entries is to use only one ledger account to record a particular transaction. This method of accounting is called simple. An example of such entries is the reflection of the movement of liabilities and assets in off-balance sheet accounts.

For example, when reflecting the receipt of a fixed asset on the off-balance sheet, the accountant makes an entry: Debit 01 (for non-profit organizations) or Debit 21 - for public sector employees.

It is worth noting that some economic entities have the right to keep records using a simple method, in simple words - to compile single accounting entries. However, non-profit organizations and public sector institutions do not have the right to such a privilege. They are required to maintain the main accounting system using the double entry method. That is, make double entries in accounting.

Thus, double accounting entries are considered to be entries made using two accounts simultaneously. Thus, one transaction in monetary terms - a specific amount is immediately reflected in the debit of one account and in the credit of another account. Double accounting entries (examples) - table - are given below.

Compiling double entries in the accounting of public sector employees has its own distinctive features. Let's look at them in more detail.

Postings for revaluation of fixed assets

Commercial organizations do not have an obligation to revaluate unless this is stipulated in their accounting policies. If fixed, then the revaluation should be carried out on the last day of the year with a frequency of no more than once a year

At the same time, it is important for the accountant to correctly reflect in the transactions the results of the revaluation of fixed assets, including revaluation or depreciation of the value of objects

Purposes of revaluation

Revaluation can be carried out only in relation to funds that are the property of the organization to determine the real market value of fixed assets. During the use of the OS, prices for materials, components, installation services, etc. change.

In addition, the indicator of market value is influenced by the factor of obsolescence of the OS. For example, the market value of a machine produced two years ago will be much lower than its residual value if new, more modern models have been released during this time.

In general, revaluation is used to:

- Determining the real cost of the OS on the market;

- For financial analysis of the state of the organization;

- If the organization plans to attract investments or increase the authorized capital.

Procedure for revaluation

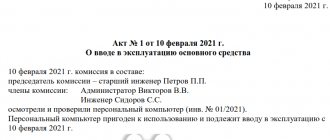

To carry out the revaluation, the head of the organization issues an appropriate order.

To revise the cost of fixed assets, it is necessary, at a minimum, to check the actual availability of these objects. If the asset has not previously been revalued, the value is recalculated based on the current value. For previously revalued assets, the replacement cost is taken. Both the initial cost of the object and the amount of depreciation are recalculated.

There are two ways to revaluate the cost of an operating system:

- direct recalculation;

- indexing.

In order for the revaluation results to have legal force, the revaluation enterprise must use the services of professional appraisers.

Types of revaluation

As a result of recalculation, the value of an asset may either increase or decrease. In the first case, we talk about additional valuation, in the second - about depreciation of the object.

Example of revaluation of fixed assets with postings

When the cost of the OS increases, we receive an additional valuation. Consequently, it will be necessary to recalculate accumulated depreciation.

By calculating the depreciation rate, we can overestimate the amount of depreciation:

- 25,000 rub./100,000 rub. = 25%;

- that is, 110,000 rubles * 25% = 27,500 rubles.

When revaluing fixed assets, the organization’s accountant made the following entries:

| Dt | CT | Operation description | Amount, rub. | Document |

| 01 | 83 | Reflection of the cost of revaluation (110,000-100,000=10,000) | 10 000 | Accounting information |

| 83 | 02 | Reflection of depreciation recalculation (27,500 - 250,000 = 2,500) | 2 500 | Accounting information |

Example of depreciation of fixed assets with postings

When the cost of the OS decreases, we get a markdown:

- We determine the degree of wear: 200,000 rubles/50,000 rubles = 25%;

- We calculate the new amount of depreciation: 160,000 rubles. * 25% = 40,000 rub.

Postings for depreciation of fixed assets in accounting:

| Dt | CT | Operation description | Amount, rub. | Document |

| 91.2 | 01 | Reflected decrease in the value of the object (200,000-160,000) | 40 000 | Accounting information |

| 02 | 91.1 | A decrease in accrued depreciation is reflected (50,000 - 40,000) | 10 000 | Accounting information |

Economic meaning of revaluation

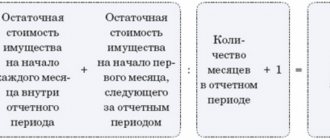

Revaluation of fixed assets can help reduce the tax burden. In particular, reduce the amount of property tax.

Revaluation of fixed assets is carried out only in accounting, therefore, after it is carried out, differences inevitably arise with tax regulations, which also affects income tax.

From the site: https://buhspravka46.ru/buhgalterskie-provodki/provodki-po-pereotsenke-osnovnyih-sredstv.html

Features of making entries in accounting

Let us determine the key features of drawing up entries for the establishment of the budgetary sector:

- Methods for reflecting business transactions in accounting must be enshrined in the accounting policies of the organization.

- All entries must be reflected in accounting exclusively in rubles, that is, in the currency of the Russian Federation.

- Accounting entries are subject to registration in some primary documents, and then reflected in accounting registers: special journals or orders.

- When reflecting records, it is necessary to maintain chronological order.

- If errors and inaccuracies are detected in accounting records, it is necessary to make corrective entries in accordance with the established procedure.

Let’s make a reservation right away that the organization itself is obliged to approve the working plan of accounting accounts. That is, list those accounts and subaccounts that the company will directly use in accounting. When compiling accounting entries, the table can contain all accounts according to instructions, or only specific values.

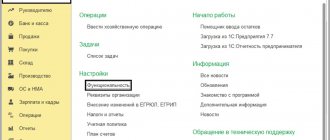

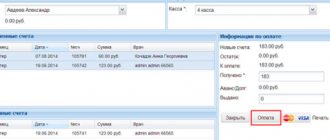

Online compilation

Computer technologies make work much easier. Where previously 5-6 accountants were required, now one can cope. Online postings, accounting, error checking - the list of available options is not limited to this.

Online technologies make life much easier

Modern software and hardware systems, depending on what operations will be carried out, offer ready-made solutions. The accountant can only confirm the actions. Salary, expense report - postings cover almost everything. The only thing that has not yet been implemented in accounting is the introduction of primary data. Alas, this is still the prerogative of man. Whereas drawing up transactions using computers and even online services is already a thing today.

How to compose: key principles

Officials have provided basic drafting principles that must be followed without fail. Let's figure out what requirements for the preparation of records are enshrined at the legislative level:

- All accounts are divided into active, passive and active-passive accounting accounts.

- At the end of the period, active BSCh can only have a debit balance. For example, this is an average for reflecting fixed assets. In simple words, the residual value of an asset cannot have a negative (credit) balance.

- Passive accounts only have a credit balance. A debit balance at the reporting date indicates an accounting error. Example: accounting accounts for recording liabilities 0 302 00 000 can only have a loan balance.

- Active-passive accounts can have both a credit and a debit balance. For example, an accounting account for reflecting taxes and insurance premiums is 0 303 00 000 (the balance can be a credit - debt, or a debit - overpayment).

Based on the accounting data, the final financial report is formed - the balance sheet. Indicators of passive accounts form the liability of the balance sheet, active ones, respectively, form the asset. But active-passive assets can be reflected in both the assets and liabilities of the balance sheet. For example, an overpayment of taxes (debit balance on account 0 303 00 000) forms an asset, and debt on the same account forms a liability.

Next, we will define examples of accounting entries for public sector employees.

Retirement of equipment

Disposal of equipment can be carried out either through liquidation or through sale.

Equipment sales

| Dt | CT | Description | Sum | Document |

| 01 Disposal of fixed assets | 01 | Write-off of original cost | 112,000 rub. | Act OS-3 |

| 02 | 01 Disposal of fixed assets | Write-off of accrued depreciation | 34,000 rub. | Act OS-3 |

| 91_2 | 01 Disposal of fixed assets | Write-off of residual value | 78,000 rub. | Act OS-3 |

| 62 | 91_1 | Revenue accrued | 84,000 rub. | Transfer and Acceptance Certificate |

| 91_2 | 68 VAT | VAT charged on sales | RUB 12,814 | Invoice |

Equipment disposal

| Dt | CT | Description | Sum | Document |

| 02 | 01 Disposal of fixed assets | Reflection of the amount of depreciation | 74,000 rub. | OS write-off act |

| 01 Disposal of fixed assets | 01 | Reflection of original cost | 81,000 rub. | OS write-off act |

| 91_2 | 01 Disposal of fixed assets | Write-off of residual value | 7,000 rub. | OS write-off act |

Examples of accounting entries

So, let’s define examples of accounting entries for a budget organization. We will consider typical entries in the context of the main areas of accounting.

We calculate personal income tax wages and contributions

| Operation | Debit | Credit |

| Salary accrued | 0 401 20 211 0 109 XX 211 | 0 302 11 730 |

| Sick leave accrued at the expense of the Social Insurance Fund | 0 303 02 830 | 0 302 13 730 |

| Personal income tax accrued | 0 302 11 830 | 0 303 01 730 |

| Writ of execution, union dues deducted from earnings | 0 302 11 830 | 0 304 03 730 |

| Salaries are transferred to employee cards | 0 302 11 830 | 0 201 11 610 |

| The benefit was paid from the Social Insurance Fund | 0 302 13 730 | 0 201 11 610 |

| Insurance premiums accrued | 0 401 20 213 0 109 XX 213 | 0 303 02 730 – VNiM 0 303 06 730 – NS and PZ 0 303 07 730 — FFOMS 0 303 10 730 — OPS |

| Taxes and fees paid | 0 303 XX 830 | 0 201 11 610 |

Settlements with suppliers and contractors

| An advance payment has been made for the upcoming provision of services, work, and supplies of goods. | 0 206 21 560 — communication 0 206 22 560 — transport 0 206 23 560 — communal apartment 0 206 24 560 — rent 0 206 25 560 - maintenance work 0 206 26 560 - other work, services | 0 201 11 610 |

| Services accepted for accounting | 0 401 20 XXX | 0 302 ХХ 730 |

| The offset of the advance is reflected | 0 302 ХХ 830 | 0 206 XX 660 |

| The balance of the debt has been transferred | 0 302 ХХ 830 | 0 201 11 610 |

Fixed Asset Accounting

| The advance payment transferred to the supplier of the fixed asset is reflected | 0 206 31 560 | 0 201 11 610 |

| OS delivery reflected | 0 106 XX 310 | 0 302 31 730 |

| Advance credited | 0 302 31 830 | 0 206 31 660 |

| Final payment listed | 0 302 31 830 | 0 201 11 610 |

| Services for delivery, installation, configuration, installation of the facility are taken into account (costs are included in the initial cost of the operating system) | 0 106 XX 310 | 0 302 2Х 730 |

| The object is accepted for accounting at the generated initial cost | 0 101 XX 310 | 0 106 XX 310 |

Inventory accounting

| Advance payment for the supply of MPZ has been transferred | 0 206 34 560 | 0 201 11 610 |

| MPZ supplied under contract | 0 105 XX 340 | 0 302 34 730 |

| Advance credited | 0 302 34 830 | 0 206 34 660 |

Next, we suggest that you familiarize yourself with the key features of compiling accounting records for public sector institutions and non-profit organizations. In the articles you will find current examples of accounting correspondence, as well as the norms of current legislation and the basic rules for organizing and maintaining records in areas (fixed assets, wages, settlements, etc.).

Reflection of income, expenses and financial results

| Operation | Debit | Credit |

| Income and expenses from core activities | ||

| Sales revenue reflected | 62 | 90 |

| VAT charged on the sales amount | 90 | 68 |

| Reflects the cost of goods sold, products, services rendered | 90 | 41, 43, 20 |

| Write-off of management expenses reflected | 90 | 26 |

| Business expenses written off | 90 | 44 |

| Other income and expenses | ||

| Income received from other sales | 62 | 91 |

| Cost of materials sold written off | 91 | 10 |

| Interest accrued on received loans and borrowings | 91 | 66, 67 |

| Interest accrued on issued loans and borrowings | 66, 67 | 91 |

| Financial results | ||

| Profit received from sales is reflected | 90 | 99 |

| The loss received from the sale is reflected | 99 | 90 |

| Positive results from other activities | 91 | 99 |

| Negative result from other activities | 99 | 91 |

| Profit tax accrued | 99 | 68 |

| Retained earnings are reflected at the end of the year | 99 | 84 |

| Based on the results of the year, the resulting loss is reflected | 84 | 99 |

| A decision was made to pay dividends | 84 | 75 |

| Dividends transferred to founders | 75 | 51 |

Legal documents

- By Order of the Ministry of Finance No. 94n

Compiling correspondence: a cheat sheet for state employees

| By fixed assets | “Which accounting records should state employees use for accounting of fixed assets” |

| “How to keep accounting for depreciation charges: calculations and accounting entries” | |

| “How to write off fixed assets of a budget institution” | |

| “We understand the features of accounting and taxation when selling fixed assets” | |

| Settlements with suppliers and contractors | “How to keep records of settlements with suppliers and contractors” |

| “How to reflect a penalty in accounting: correspondence and rules” | |

| “How to reflect bank guarantees in accounting” | |

| Salary and benefits | “Which accounting entries to use to reflect payroll transactions” |

| “How to keep track of your deposited salary” | |

| “Which accounting entries to use to account for benefits” | |

| Cashless payments | “How to record current account transactions” |

| Cash discipline | "How to keep track of cash" |

| “Check yourself: the procedure for conducting cash transactions” | |

| Settlements with accountants | “How to keep records of settlements with accountable persons” |

| “How to withhold an accountable amount from your salary” | |

| “We process the return of accountable amounts” | |

| “How to keep track of travel expenses in a budget organization” |

Intangible assets

Intangible assets in an enterprise are usually called values without certain tangible boundaries; they cannot be touched, seen or felt. But they can be used over a long period of time and generate income. Their cost is also transferred to depreciation charges.

Most often, intangible assets are rights that arise in the form of:

- copyright and other agreements for created works of art, literature, programming objects, etc.;

- patents for inventions, certificates, industrial designs, licenses and trademarks for their use.

Intangible asset transaction tables for beginners - Intangible asset accounting.