Payers

According to Art. 246 of the Tax Code of the Russian Federation, taxpayers in this case are Russian and foreign organizations, provided that they carry out business activities through representative offices opened on the territory of the Russian Federation.

However, legal entities that have switched to simplified regimes (USN, UTII, Unified Agricultural Tax) are exempt from this duty. This is the meaning of the simplified system: only one, single fee is paid.

If the main regime is combined with UTII, the tax is paid on the amount of profit received on OSNO.

In Art. 246 and 246.1 of the Tax Code of the Russian Federation indicate other persons exempt from this fee, but they are limited to participation in special projects (Skolkovo).

When to pay income tax in 2018

The procedure for making advance payments of income tax depends on the amount of the company’s revenue for the four quarters preceding the reporting quarter (clauses 2, 3 of Article 286 of the Tax Code of the Russian Federation). For example, in order to understand how to pay advance payments in the first quarter of 2021, you need to look at the amount of revenue for the first and fourth quarters of 2021. If the revenue does not exceed 60 million rubles, you pay only quarterly advance payments.

If the revenue is more than 60 million rubles, you can pay (Letter of the Ministry of Finance dated 03/03/2017 N 03-03-07/12170):

- or quarterly and monthly advance payments during the quarter;

- or monthly advance payments based on actual profit, in this case the declaration is submitted monthly (clause 3 of Article 289 of the Tax Code of the Russian Federation).

The deadlines for paying advance payments in 2021 are shown in the table (clause 7, article 6.1 of the Tax Code of the Russian Federation).

| For what period are advance payments made? | Payment method for advance payments | |

| Quarterly and monthly during the quarter | Quarterly only | |

| January | 29.01.2018 | – |

| February | 28.02.2018 | – |

| March | 28.03.2018 | – |

| I quarter | 28.04.2018 | 28.04.2018 |

| April | 28.04.2018 | – |

| May | 28.05.2018 | – |

| June | 28.06.2018 | – |

| Half year | 30.07.2018 | 30.07.2018 |

| July | 30.07.2018 | – |

| August | 28.08.2018 | – |

| September | 28.09.2018 | – |

| 9 months | 29.10.2018 | 29.10.2018 |

| October | 29.10.2018 | – |

| november | 28.11.2018 | – |

| December | 28.12.2018 | – |

Tax for 2021 must be paid no later than March 28, 2018, and for 2018 no later than March 28, 2019.

Values

Which BCCs should I pay income tax for 2021? Let's look at it in detail in the table, since the values depend on the type of profit, and there are quite a lot of them.

| Payment | Budget | Core Obligation, KBK | Peni, KBK | Fine, KBK |

| The amount of tax calculated by all entities, except for consolidated groups (the main BCC was changed by Order No. 26n) | Federal (FB) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| -//- | Regional (RB) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Fiscal payment for consolidated groups (main) | FB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| -//- | RB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Payment on profits of international holding companies (Order No. 26n) | FB | 182 1 0100 110 | ||

| -//- | RB | 182 1 0100 110 | ||

| Fiscal payments from the income of foreign organizations not related to activities on the territory of the Russian Federation through their permanent representative offices | FB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax obligations when fulfilling production sharing agreements, if the date of their conclusion is earlier than October 21, 2011 | FB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Income of Russian organizations in the form of dividends from participation in Russian organizations | FB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Mandatory tranches from the income of foreign companies in the form of dividends from participation in Russian organizations | FB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Payments to the budget from dividends from foreign companies in favor of Russian organizations | FB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Fiscal encumbrance on interest received on state and municipal securities | FB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax tranches on interest on bonds of Russian companies (this code was introduced only in 2021) | FB | 182 1 0100 110 | 1 0100 110 | 1 0100 110 |

| Budgetary obligations for NNGOs from the profits of controlled foreign organizations | FB | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

The same codes are also used to transfer advance payments.

Tax payment date

The tax period is a calendar year.

Reporting periods:

- quarter;

- 6 months;

- 9 months.

The tax return is submitted to the Federal Tax Service inspectorate after the end of the year and reporting periods. For companies that calculate advance payments every month, reporting periods are 1, 2 or 3 months. Advance monthly payments are made on the 28th of each month.

Quarterly payment is assigned to organizations:

- with quarterly revenue of no more than 15 million rubles for 4 consecutive quarters;

- NPOs that do not make a profit;

- foreign companies with official representatives in Russia;

- organizations financed from the state budget.

Quarterly payment is due on the 28th day of the month following the end of the quarter. To pay the fee, 2 payment orders are created to different budget levels. Payment is distributed to the following budgets:

- federal level - 3%;

- regional level - 17%.

The tax rate is 20% of profit.

Tax payment date 2021

The deadline for filing returns and paying taxes is the 28th after the end of the reporting period.

Firms that pay advances once a quarter are divided into 2 types:

- those who pay calculate the amount monthly, divided into 3 equal parts;

- those who pay an advance once at the end of the quarter.

Thus, the payment deadline is the 28th for all taxpayers.

Tax payment date 2021

The tax payment date for 2021 has not changed and falls on the 28th after the end of the reporting period.

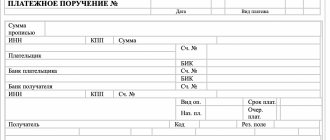

Making a payment order

The BCC for paying income tax is indicated in field 104 of the payment slip. Budget classification codes are established by the federal government and are valid throughout the country; for 2021 they were approved by Order of the Ministry of Finance No. 132n dated June 8, 2018. Other details can be clarified on the official website of the Federal Tax Service, having previously identified the tax office at the place of registration of the payer. These details are different for different legal entities; this must be taken into account when using sample payment slips.

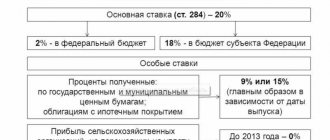

Payment of income tax in 2021: rates

The general income tax rate is 20% in 2021 (clause 1 of Article 284 of the Tax Code of the Russian Federation):

- 3% is credited to the federal budget;

- 17% are credited to the regional budget. By law of a constituent entity of the Russian Federation, this rate can be reduced for certain categories of taxpayers to 12.5%.

For some types of income and some categories of organizations, the Tax Code of the Russian Federation has established reduced income tax rates. For some - zero rate.

The income tax rate on dividends is:

- 13% if they are paid to a Russian organization (clause 2, clause 3, article 284 of the Tax Code of the Russian Federation);

- 0% if, on the date of the decision to pay them, the Russian organization to which you are transferring dividends owns at least half of your authorized capital for at least 365 consecutive days;

- 15% if they are paid to a foreign company (clause 3, clause 3, article 284 of the Tax Code of the Russian Federation).

Difficulties in transferring

Failure to fulfill transfer obligations for any reason will be the basis for the accrual of penalties. If an error is made in the KBK, the money does not disappear, it goes into the category of unexplained payments in the Treasury. If a code for another payment is specified, an overpayment will be generated for it. When reconciling with the tax office, this can be easily detected. To transfer funds using the required details, you must submit a corresponding application to the Federal Tax Service.

Usually, when an error is corrected, the tax office immediately cancels the penalty, because the funds were transferred to the Treasury, that is, to the budget, and the obligation was fulfilled; the date of transfer does not change. If the tax office continues to demand payment of penalties, its decision can be appealed to the court. Practice shows that this is an effective method.

Tax calculation example

How to calculate income tax and distribute it among the required BCCs is best illustrated by a numerical example. Let’s assume that for the first half of 2021 the company has the following indicators (thousand rubles):

- 1500 – revenue;

- 950 – cost;

- 15 – non-operating income;

- 35 – non-operating expenses.

Accordingly, the tax base will be 530 thousand rubles. (1500 + 15 – 950 – 35).

The total tax amount for the six months is 106 thousand rubles. (530 x 20%), including:

- 15.9 thousand rubles. (530 x 3%) – federal budget;

- 90.1 thousand rubles. (530 x 17%) – regional budget.

If the company made advance payments, then they need to be deducted and paid to the budgets with the corresponding BCCs.

The surest way to protect your company from problems due to incorrectly transferred taxes is to switch to comprehensive accounting outsourcing in 1C-WiseAdvice. We guarantee that you will never have:

- errors in KBK;

- the need to contact the Federal Tax Service to return the overpayment, clarify the payment and other issues that temporarily deprive working capital related to incorrect BCC in the payment order.

In our country, the formation of tax bills undergoes multilateral control, including through the use of special programs.

KBC for payment of penalties on insurance premiums for 2021

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Codes, penalties and fines

What are the 2021 income tax codes? These are sets of 20 digits that “encrypt” the necessary data. Let's say. The first 3 numbers are the so-called administrative section, they indicate where the funds should be sent:

- in the Pension Fund of the Russian Federation - 392;

- in the Federal Tax Service - 182;

- in the Federal Compulsory Medical Insurance Fund - 393.

Next come the numbers indicating the type of income, showing where it comes from, what the purpose of the payment is and its other features.

In addition to the taxes themselves, in the corresponding tables we see codes for fines and penalties. Penalties are charges for each day of late payment. A fine is a one-time monetary penalty. It is charged once, for gross violations of payment terms. If the tax service has imposed a penalty or fine on an organization or entrepreneur, the corresponding BCC must be indicated on the payment slip.

BCC for individual entrepreneur contributions for 2021

Individual entrepreneurs pay the BCC on their own. If an individual entrepreneur works at the same time as an employee, he still must pay contributions for himself - as an individual entrepreneur.

Entrepreneurs are required to pay mandatory contributions to their own pension and health insurance until they are “listed” as individual entrepreneurs and have a Unified State Register of Entrepreneurs (USRIP) entry about them. The age of the entrepreneur and occupation does not matter. And most importantly, contributions must be paid even if the individual entrepreneur does not receive any income.

Mistakes when paying taxes, how to avoid them

If the income tax was transferred to the wrong KBK, then there will be a tax arrears, which will be discovered by the tax office and will issue you a demand for late fees. This notification usually arrives in the taxpayer’s personal account, and is also displayed in 1C accounting if a connection with the Federal Tax Service is configured. It sets the deadline within which the penalty must be repaid. Your actions:

1.First of all, you need to go to the inspectorate and write a statement regarding the incorrectly indicated BCC and indicate the correct one, where this tax should be credited

2.Then pay the penalty, again carefully indicating the BCC

3. If there is a delay in the penalty, the tax office has the right to make the following request, only to the bank, to block the account. Blocking occurs in two ways:

- The account is completely blocked, but this usually happens when an organization owes the main tax

- Either for a certain amount of debt, that is, penalties, then within the limits of the remaining funds you can work

4. The bank is obliged to write off penalties from you and when they reach the Federal Tax Service, the block will be lifted

To avoid such oversights and unnecessary running around, analyze in advance when and to which BCC the tax must be transferred. Study changes in legislation to avoid unnecessary mistakes.

KBC for payment of fines on insurance premiums for 2021

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

KBC for payment of insurance premiums for 2021

The Russian Ministry of Finance approved new budget classification codes for payment orders for insurance contributions by Order No. 86n dated June 6, 2019.

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0220 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0220 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |