Paying taxes in 2021: new rates

The procedure for paying income tax in 2021 depends on the tax rate, which depends on the type of income (profit). See 2021 Income Tax Rates: Table.

As a general rule (and most often), income tax must be paid to budgets of two levels:

- 3 percent of the profit amount - to the federal budget (if the Tax Code of the Russian Federation does not establish a zero rate);

- 17 percent of the profit amount goes to the regional budget (unless the Tax Code of the Russian Federation and regional legislation provide for other rates). This procedure is provided for in paragraph 1 of Article 284 of the Tax Code of the Russian Federation.

3% goes to the federal budget and 17% goes to the regional budget. Apply these rates to profits received from 1 January 2021. For 2021 profits, apply different rates: 2% to the federal budget and 18% to the regional budget.

Corporate income tax, KBK—choose and pay

Considering that the corporate income tax, which is so diverse and represents a direct fee, any form of legal entity is required to pay it. These are joint-stock companies, closed and open, LLC (including those with foreign registration), which do not even have their own representative office, but simply receive money from an object in Russia. They all have the same right to pay it or receive benefits.

Benefits in the form of replacing payments with another fee are provided when an organization exits the general tax system (GTS) and switches to simplified taxation (STS) or, if we are talking about agricultural enterprises, to a unified tax for agricultural enterprises (UST).

Taxpayers involved in the gambling business and those who have not received any income do not pay the fee, since then there is no object of taxation.

It is worth emphasizing that in the event of a transition to a simplified taxation system, the income tax of the simplified tax system is not abolished, the KBK of which concerns dividends, that is, proceeds from so-called “passive” income - dividends or debt obligations. The KBK profit tax fine has a different code - this is always important to remember. The most common mistake made by employees of enterprises and accountants is when paying fines to the KBK, they indicate not the penalties themselves, but the collection from profits, since fines are often paid in a hurry.

Tax 2021: due date

Transfer the amount of income tax accrued for 2021 to the budgets no later than March 28 of the year following the tax period. That is, no later than March 28, 2021 (clause 1 of article 287, clause 4 of article 289 of the Tax Code of the Russian Federation). Calculate it (reduce it) taking into account the advance payments transferred during the past year (clause 1 of Article 287 of the Tax Code of the Russian Federation). Example. At the end of 2021, Cosmos LLC received a profit of 1,600,000 rubles. Income tax is accrued in the amount of:

- to the federal budget - 32,000 rubles. (RUB 1,600,000 × 2%);

- to the regional budget - 288,000 rubles. (RUB 1,600,000 × 18%).

During the year, Cosmos made advance payments in the amount of:

- to the federal budget - 29,000 rubles;

- to the regional budget - 199,000 rubles.

Advance payments for income tax reduce the amount of income tax payable at the end of 2021. Therefore she composed:

- to the federal budget - 3000 rubles. (RUB 32,000 – RUB 29,000);

- to the regional budget - 89,000 rubles. (RUB 288,000 – RUB 199,000).

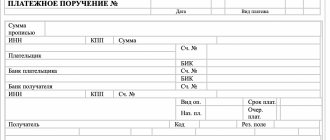

On March 28, 2021, the accountant of Kosmos (legal entity) formalized the payment of tax using the following documents: a payment order to the federal budget in the amount of 3,000 rubles; payment order to the regional budget in the amount of 89,000 rubles.

Kbk insurance premiums 2021 table – Enterprise Info

You will find the KBK for 2021 in a separate material.

Starting from 2021, some BCCs for paying taxes and contributions are changing (Order of the Ministry of Finance of Russia dated December 7, 2021 N 230n). In our tables you will find all the budget classification codes necessary to correctly fill out payments in 2021. Codes that have changed compared to 2021, as well as new KBK-2021, are in italics and marked with an asterisk.

KBK-2021 for paying taxes for organizations and individual entrepreneurs on OSN

Name of tax, fee, payment KBK (field 104 of the payment slip)

| Income tax, including: | |

| — to the federal budget (rate — 3%) | 182 1 0100 110 |

| — to the regional budget (rate from 12.5% to 17%) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| - for any property, with the exception of those included in the Unified Gas Supply System (USGS) | 182 1 0600 110 |

| - for property included in the Unified State Social System | 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK-2021 for paying taxes for organizations and individual entrepreneurs under special regimes

Name of tax, fee, payment KBK (field 104 of the payment slip)

| Tax under the simplified tax system, when the object of taxation is applied: | |

| - “income” | 182 1 0500 110 |

| — “income minus expenses” (tax paid in the general order, as well as the minimum tax) | 182 1 0500 110* |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

Organizations and individual entrepreneurs using the simplified tax system need to pay attention to the fact that a separate BCC for transferring the minimum tax has been abolished. From 2021, the minimum tax is credited to the same budget classification code as the simplified tax system paid in the usual manner. Read about the consequences of indicating the old KBK in the payment slip when paying the minimum tax in the Civil Code, 2021, No. 1, p. 63.

KBK: insurance premiums 2021

The BCC for all contributions controlled by the Federal Tax Service from 2021 has become new.

Please note that for contributions for periods expired before 2021 there will be one BCC, and for contributions for periods starting from 2021 there will be another. That is, if, for example, you transfer contributions for December 2021 in January 2021, then they are paid to the KBK intended for contributions for periods expired before 2021.

Kbk for contributions for periods expired before 01/01/2021

Type of insurance premium KBK (field 104 of the payment slip)

| Insurance premiums for compulsory health insurance paid to the Federal Tax Service | 182 1 0200 160* |

| Insurance premiums in case of temporary disability and in connection with maternity, paid to the Federal Tax Service | 182 1 0200 160* |

| Insurance premiums for compulsory medical insurance paid to the Federal Tax Service | 182 1 0211 160* |

| Insurance premiums for mandatory insurance in a fixed amount, paid by individual entrepreneurs for themselves to the Federal Tax Service | 182 1 0200 160* |

| Insurance premiums for mandatory insurance in a fixed amount, paid by individual entrepreneurs for themselves to the Federal Tax Service (1% contributions) | 182 1 0200 160* |

| Insurance premiums for compulsory medical insurance in a fixed amount, paid by individual entrepreneurs for themselves to the Federal Tax Service | 182 1 0211 160* |

| Additional insurance contributions for mandatory pension insurance for employees who work in conditions that give the right to early retirement, including (paid to the Federal Tax Service): |

Source:

New BCCs for insurance premiums from 2021

Starting from 2021, control over the calculation and payment of insurance premiums moves from the funds to the Federal Tax Service, and therefore the details of payment documents will change. New BCCs have already been approved for next year: insurance premiums for employees and to the Pension Fund in 2021 for individual entrepreneurs for themselves.

Kbk penalties for insurance premiums in 2021-2021

KBC penalties for insurance premiums - changes were made to them in 2021-2021. And this happened twice. This article will help you avoid getting confused in the codes and pay fines correctly. And at the same time we’ll tell you how to count them.

Calculation of penalties for insurance premiums in 2021-2021

Filling out a payment form when paying a fine

New BCCs for paying penalties on additional tariffs for insurance premiums from 04/23/2021

Changes in the KBK from 2021

Consequences of errors when paying penalties

Results

Calculation of penalties for insurance premiums in 2021-2021

Since 2021, the rules for determining the amount of penalties are regulated by clause 4 of Art. 75 of the Tax Code of the Russian Federation, containing 2 calculation formulas, in which the amount of debt is multiplied by the number of days of delay and by a rate equal to:

- 1/300 of the refinancing rate - applies to individuals and individual entrepreneurs (regardless of the number of days of delay in payment) and for legal entities that are late in payment by no more than 30 calendar days;

- 1/150 of the refinancing rate - valid only for legal entities and only for a period of delayed payment exceeding 30 calendar days, while for 30 days of delay a rate of 1/300 will be applied.

“Unfortunate” contributions, which continue to be supervised by the FSS, are subject to the procedure described in Art. 26.11 of the Law “On Social Insurance against Accidents and Occupational Injuries” dated July 24, 1998 No. 125-FZ, and are calculated using a formula similar to those described above using a rate of 1/300 of the refinancing rate.

Source: https://gyroscooter-72.ru/nalogi/kbk-strahovye-vznosy-2021-tablitsa.html

KBK for 2021: table

In 2021, to pay income tax, you need to use budget classification codes, which determine the identity of the payment sent to the budget for the purpose of paying income tax, penalties and fines by legal entities.

| Purpose | Mandatory payment | Penalty | Fine |

| Income tax in 2021 | |||

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the profits of controlled foreign companies | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

Read also

11.05.2017

Budget classification codes for 2021 were approved by order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. We invite you to familiarize yourself with the new KBK codes; they will be used when making tax payments in 2021.

| Payment | New KBK taxes for 2021 | KBK 2021 penalties | KBK 2021 fines |

| KBK 2021 for profit | |||

| To the budget of the Russian Federation system at the appropriate rates | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| To the federal budget | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| To the regional budget | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From dividends of Russian organizations from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From dividends of foreign organizations from organizations of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From dividends of Russian organizations from foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| KBK 2021 Personal Income Tax | |||

| Tax paid by the tax agent. In addition to income under Articles 227, 227.1, 228 (NK) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| For the income of individual entrepreneurs, notaries, lawyers, and others under Art. 227 NK | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| For income under Article 228 of the Tax Code | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| For the income of foreigners working in the Russian Federation under a patent under Article 227.1 of the Tax Code | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| KBK 2021 VAT | |||

| For goods produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| For goods imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| For goods imported into Russia when the tax operator is the Federal Customs Service | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| BCC 2021 for the property of organizations | |||

| Property not included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| BCC 2021 for the property of individuals | |||

| Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property in cities | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intersettlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| KBK 2021 transport tax | |||

| Organizations | 182 1 06 4011 02 1000 110 | 182 1 06 4011 02 2100 110 | 182 1 06 4011 02 3000 110 |

| Individuals | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| KBK 2021 for gambling business | |||

| Tax | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| KBK 2021 land tax | |||

| Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| In cities | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intersettlement territories | 182 1 0600 110 | 182 1 06 6033 05 2100 110 | 182 1 0600 110 |

| Within the boundaries of districts in cities | 182 1 0600 110 | 182 1 0600 10 | 182 1 0600 110 |

| In urban areas | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| KBK 2021 for mining | |||

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Coal | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| KBK 2021 water tax | |||

| Tax | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| KBK 2021 simplified tax system | |||

| 6% from income | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| 5-15% from the difference “Income minus expenses” | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Minimum tax | 182 1 0500 110 | 182 1 0500 11 | 182 1 0500 110 |

| KBK 2021 UTII | |||

| Tax | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| KBK 2021 unified agricultural tax | |||

| Tax | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| KBK 2021 patents | |||

| To city budgets | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| To municipal budgets | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Moscow, St. Petersburg, Sevastopol | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| KBC 2021 training camps | |||

| For the use of objects of the animal world | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Trade fee | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| For the use of aquatic biological resources, with the exception of inland water bodies | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| For the use of aquatic biological resources on inland water bodies | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

New BCCs for 2021 – excise taxes

| Payment | KBK 2021 taxes | KBK 2021 penalties | KBK 2021 fines |

| Products produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Goods imported to Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Russian cider, poire, mead | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Alcoholic drinks up to 9% alcohol (except beer, wine, champagne) | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Ethyl alcohol from food raw materials | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Ethyl alcohol from non-food raw materials | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Tobacco products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Petrol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Cars and motorcycles | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Diesel fuel | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

New BCCs for 2021 - contributions to extra-budgetary funds

| Contribution | KBK 2017 |

| PF for employees | |

| Within the established limit of the base for 2016 | 392 1 0200 160 |

| Above the established base limit for 2021 | 392 1 0200 160 |

| Additional tariff according to list 1 | 392 1 0200 160 |

| Additional tariff according to list 2 | 392 1 0200 160 |

| PF IP for yourself | |

| Based on the minimum wage | 392 1 0200 160 |

| With income over 300 thousand rubles | 392 1 0200 160 |

| FFOMS | |

| Contribution | 392 1 0211 160 |

| FSS for employees | |

| For sick leave and maternity leave | 393 1 0200 160 |

| For accidents and occupational diseases | 393 1 0200 160 |

| FSS IP for yourself | |

| Contribution | 392 1 0211 160 |

New BCCs for 2021 – duties

| Duty | KBK 2017 |

| Arbitration court | 182 1 0800 110 |

| Constitutional Court of the Russian Federation | 182 1 0800 110 |

| Constitutional courts of the constituent entities of the Russian Federation | 182 1 0800 110 |

| Courts of general jurisdiction, magistrates' courts | 182 1 0800 110 |

| Supreme Court of the Russian Federation | 182 1 0800 110 |

| Registration of legal entities, individual entrepreneurs, changes to documents, liquidation of legal entities | 182 1 0800 110 |

| For the use of the names “Russia”, “Russian Federation” and phrases with them | 182 1 0800 110 |

| For registration of vehicles and other actions related to vehicles | 188 1 0800 110 |

| For pricing agreements | 182 1 0800 110 |

Corporate income tax, KBK-calculation and rates

The KBK 2014 income tax and the procedure for calculating this year have been preserved. To calculate the fee, it is necessary to clearly define the income and expenses included in the reporting period, as well as the tax base that is subject to taxation. This tax base is multiplied by a certain tax rate. The budget classification code does not depend on the tax rate - there is a basic rate and special rates. Choosing the right tax rate is no less important than correctly determining the BCC. The basic rate is 20%, of which 2 percent goes to the federal budget, and 18 percent to the regional budgets.

Special income tax rates apply to special types of entrepreneurial activity that have their own specific characteristics.

Every year, tax officials propose changes to the system for calculating the tax levy on the profitable part. This year, as they say, “God has had mercy,” but last year was rich in innovations that are easy to understand, especially since the innovations concern a very narrow range of enterprises.

Firstly, owners of air and water transport can rejoice - the limits on accounting for food expenses have been removed. The depreciation procedure has changed - since 2014, property purchased with targeted funds can be subject to depreciation. Media and video files have been added to the list of intangible assets. Those who were obliged to pay advances at the beginning of the quarter are now not obliged to do so - theaters and museums are very happy.

The calculation of the tariff depends on the method of calculating the profit amount. The accrual method and the cash method differ in the time frames taken to determine the profit portion.

The transition to market relations has made profit tax the main tax in Russia. But constant experiments with taxation and a huge number of changes made by legislators on a regular basis often confuse entrepreneurs, forcing them to make mistakes. To avoid such errors, KBK - budget classification codes were introduced, designed to facilitate not only the accounting system on the part of the tax service, but also to simplify the life of enterprise accountants in navigating among the huge number of types of tax levies on profits and payments associated with them. The federal structure of Russia leaves its mark when, in addition to payments to the federal budget, regional characteristics are also taken into account separately. Thus, some regions (for example, the Murmansk region) have their own special tax rates and payment system, which only adds to the confusion. Many would like to see the future of the tax solely tied to regional budgets.

GLAVBUKH-INFO

Budget classification codes for 2021 were approved by order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. We invite you to familiarize yourself with the new KBK codes; they will be used when making tax payments in 2021.Payment

| New KBK taxes for 2021 | KBK 2021 penalties | KBK 2021 fines | |

| KBK 2021 for profit | |||

| To the budget of the Russian Federation system at the appropriate rates | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| To the federal budget | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| To the regional budget | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From dividends of Russian organizations from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From dividends of foreign organizations from organizations of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From dividends of Russian organizations from foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| KBK 2021 Personal Income Tax | |||

| Tax paid by the tax agent. In addition to income under Articles 227, 227.1, 228 of the Tax Code (TC) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| For the income of individual entrepreneurs, notaries, lawyers, and others under Art. 227 NK | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| For income under Article 228 of the Tax Code | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| For the income of foreigners working in the Russian Federation under a patent under Article 227.1 of the Tax Code | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| KBK 2021 VAT | |||

| For goods produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| For goods imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| For goods imported into Russia when the tax operator is the Federal Customs Service | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| BCC 2021 for the property of organizations | |||

| Property not included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| BCC 2021 for the property of individuals | |||

| Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property in cities | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intersettlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| KBK 2021 transport tax | |||

| Organizations | 182 1 06 4011 02 1000 110 | 182 1 06 4011 02 2100 110 | 182 1 06 4011 02 3000 110 |

| Individuals | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| KBK 2021 for gambling business | |||

| Tax | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| KBK 2021 land tax | |||

| Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| In cities | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intersettlement territories | 182 1 0600 110 | 182 1 06 6033 05 2100 110 | 182 1 0600 110 |

| Within the boundaries of districts in cities | 182 1 0600 110 | 182 1 0600 10 | 182 1 0600 110 |

| In urban areas | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| KBK 2021 for mining | |||

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Coal | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| KBK 2021 water tax | |||

| Tax | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| KBK 2021 simplified tax system | |||

| 6% from income | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| 5-15% from the difference “Income minus expenses” | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Minimum tax | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| KBK 2021 UTII | |||

| Tax | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| KBK 2021 unified agricultural tax | |||

| Tax | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| KBK 2021 patents | |||

| To city budgets | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| To municipal budgets | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Moscow, St. Petersburg, Sevastopol | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| KBC 2021 training camps | |||

| For the use of objects of the animal world | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Trade fee | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| For the use of aquatic biological resources, with the exception of inland water bodies | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| For the use of aquatic biological resources on inland water bodies | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

New BCCs for 2021 – excise taxes

| Payment | KBK 2021 taxes | KBK 2021 penalties | KBK 2021 fines |

| Products produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Goods imported to Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Russian cider, poire, mead | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Alcoholic drinks up to 9% alcohol (except beer, wine, champagne) | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Ethyl alcohol from food raw materials | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Ethyl alcohol from non-food raw materials | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Tobacco products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Petrol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Cars and motorcycles | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Diesel fuel | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

New BCCs for 2021 - contributions to extra-budgetary funds

| Contribution | KBK 2017 |

| PF for employees | |

| Within the established limit of the base for 2016 | 392 1 0200 160 |

| Above the established base limit for 2021 | 392 1 0200 160 |

| Additional tariff according to list 1 | 392 1 0200 160 |

| Additional tariff according to list 2 | 392 1 0200 160 |

| PF IP for yourself | |

| Based on the minimum wage | 392 1 0200 160 |

| With income over 300 thousand rubles | 392 1 0200 160 |

| FFOMS | |

| Contribution | 392 1 0211 160 |

| FSS for employees | |

| For sick leave and maternity leave | 393 1 0200 160 |

| For accidents and occupational diseases | 393 1 0200 160 |

| FSS IP for yourself | |

| Contribution | 392 1 0211 160 |

New BCCs for 2021 – duties

| Duty | KBK 2017 |

| Arbitration court | 182 1 0800 110 |

| Constitutional Court of the Russian Federation | 182 1 0800 110 |

| Constitutional courts of the constituent entities of the Russian Federation | 182 1 0800 110 |

| Courts of general jurisdiction, magistrates' courts | 182 1 0800 110 |

| Supreme Court of the Russian Federation | 182 1 0800 110 |

| Registration of legal entities, individual entrepreneurs, changes to documents, liquidation of legal entities | 182 1 0800 110 |

| For the use of the names “Russia”, “Russian Federation” and phrases with them | 182 1 0800 110 |

| For registration of vehicles and other actions related to vehicles | 188 1 0800 110 |

| For pricing agreements | 182 1 0800 110 |

| < Previous | Next > |

KBK for taxes and insurance premiums in 2017

Ministry of Finance By Order dated 07.12. 2021 No. 230n amended the budget classification codes: a minor correction was made for some, others were excluded. The changes came into force on January 1, 2021. They cover in particular the following sections:

- Corporate income tax – applies to firms working with foreign companies and receiving income from them.

- USN – changes affected organizations using the taxation object “income minus expenses”. The minimum tax and advance payments will be made to a separate BCC.

- Insurance premiums - from 2021, the tax office will take over the administration (with the exception of contributions for injuries), so the combination of some numbers will change.

Since new BCCs are introduced in 2021, the old ones will become invalid. From January 1, 2021, the accountant will not be able to use the old values even when making a payment for the previous period, otherwise the funds will not be considered paid.

Our KBK table for 2021, prepared by financiers based on data from the Ministry of Finance of the Russian Federation, will help prevent troubles when making financial transactions. But if the accountant nevertheless uses the information for 2021, the mistake made can be corrected (the payment will need to be clarified).

View budget classification codes for 2021: “KBK for 2016”