Filling out form 6-NDFL raises many questions among tax agents who accrue and pay income to individuals. Since an error in calculation can lead to a fine, any reporting indicator must correspond to accounting data. Line 040 in 6-NDFL is no exception. When filling it out, the employer is obliged to take into account the ratios developed by the Federal Tax Service for verification.

The calculation of 6-NDFL was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). It shows generalized amounts of income and personal income tax. The report consists of two sections, the first of which is filled in with a cumulative total, and the second contains data for the last quarter of the reporting period.

How to fill out line 040 in 6-NDFL for 2021

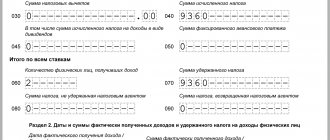

Section 1 is intended for generalized indicators for the entire period. On page 040 6-NDFL, tax agents show the amount of calculated tax for the reporting/tax period for all individuals, starting from January 1 of the current year. It is filled out according to tax registers.

Line 040 is directly related to accrued income and the applicable tax rate. Therefore, if different tax rates on personal income were applied, you need to fill out several pages of Section 1, according to their number.

Example 1: Filling out multiple sections 1

In 2021, Most LLC accrued income to all personnel in the amount of 2,640,000 rubles. One of the employees is a non-resident; his annual salary is 480,000 rubles. Since different tax rates were applied (13% for residents and 30% for non-residents), you need to fill out the first two sections of the form.

The accountant of Most LLC filled out the 1st page of Section 1 as follows:

- p. 010 - 13 – tax rate for residents;

- line 020 – 2,160,000.00 – accrued income of resident employees (2,640,000 – 480,000 = 2,160,000);

- line 040 – 280,800 – calculated tax amount, 13% of income (2,160,000 x 13% = 280,800).

Page 2 of Section 1 was completed as follows:

- p. 010 - 30 - tax rate for non-residents;

- line 020 – 480,000.00 – non-resident salary;

- pp. 040 – 14 4000 - calculated tax on the income of a non-resident employee (480,000 x 30% = 280,800).

In this case, the totals for lines 060-090 summed up for all rates must be filled out only on the first page of section 1.

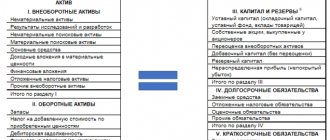

What are indirect costs

According to tax legislation, all expenses of an enterprise are divided into indirect and direct. If the direct costs of an enterprise are, first of all, production costs, and they arise on the basis of manufactured products or the performance of any work, then indirect costs are a set of costs that are directly related to production.

Indirect ones include:

- General production expenses. These are the costs of organization, maintenance and production management. For example, a certain amount was allocated for the repair of a machine, which was reflected in indirect costs.

- General running costs. These costs directly affect the production process.

Indirect expenses are written off exactly in the period in which they were accrued. Direct payments are distributed over all reporting periods.

What order of distribution of expenses will be carried out at the enterprise directly depends on the type of activity of the organization.

What are indirect costs? The Tax Code in Article 318 says:

“All expenses of an enterprise that are not classified as direct and non-operating expenses are classified as indirect.” The enterprise independently determines what it classifies as indirect or direct expenses.

Direct costs:

- Wage.

- Rent.

- Production costs.

That is, direct expenses are those that are constant, while indirect expenses can change depending on unplanned expenses.

Let's look at an example of what applies to indirect costs.

The organization is engaged in baking cakes. Having produced a certain amount of products, she sent them to a retail outlet for sale. Based on the contract, products must be returned after the expiration date. Some of the products were returned to the confectionery and went for processing.

The Tax Code classifies these expenses as direct. But there are exceptions when expenses for processing products can be written off in a certain reporting period. Certain types of expenses are also prescribed by law:

- Company insurance (Article 272, paragraph 2).

- Advertising and all related expenses (Article 264, paragraph 4).

- Entertainment expenses (Article 264, paragraph 2).

Any action of the enterprise must be recorded in the income tax return.

Control ratios for line 040

The Federal Tax Service has developed control ratios for 6-personal income tax (letter dated March 10, 2016 No. BS-4-11 / [email protected] ). For line 040 there are two main relations:

- page 040 = (page 020 – page 030) x page 010 / 100;

- page 040 ≥ page 050.

What do these ratios affect:

- If the first specified equality is not observed, then the tax office may consider that the tax is underestimated or overestimated. As a consequence, a request for clarification from the tax agent. If the tax is underestimated, the agent may be fined. The calculation takes into account the deductions provided, so a violation may also occur if the tax on line 040 is indicated correctly, but the applied deductions were not reflected on line 030.

- The fixed payment for a foreign person who paid for a work patent (p. 050) cannot be higher than the amount of the calculated tax. If the second equality is not satisfied, then the report is filled out incorrectly. In addition, the Federal Tax Service Inspectorate will be interested in the situation when page 050 is filled out, but the inspectorate did not issue a notice to the employer to reduce the tax.

Example 2. Filling out line 040 with deductions

Karavan LLC paid employees a salary of 860,000 rubles. Standard deductions were applied - 42,000 rubles. Personal income tax on all income is 13%, the amount of calculated tax is 106,340 rubles. How the given data will be reflected in the report:

page 010 – 13%

pp. 020 – 860,000.00

pp. 030 – 42,000.00

pp. 040 – 106 340.

We check line 040 with the control ratio: (860,000 - 42,000) x 13/100 = 106,340, 106,340 = 106,340 - the check showed that there was no error.

stroka_040_v_6-ndfl.jpg

Related publications

Filling out form 6-NDFL raises many questions among tax agents who accrue and pay income to individuals. Since an error in calculation can lead to a fine, any reporting indicator must correspond to accounting data. Line 040 in 6-NDFL is no exception. When filling it out, the employer is obliged to take into account the ratios developed by the Federal Tax Service for verification. The calculation of 6-NDFL was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). It shows generalized amounts of income and personal income tax. The report consists of two sections, the first of which is filled in with a cumulative total, and the second contains data for the last quarter of the reporting period.

Error in line 040 in 6-NDFL

In some cases, the numeric value of page 040 may differ from the specified total in the test equation shown in the previous example.

Control ratios allow deviation of the numbers on page 040 due to arithmetic error. The tax is calculated in whole rubles, so inaccuracies arise. When calculating the tax, an amount of more than 50 kopecks is rounded to the nearest ruble, and less is discarded. Since information in the report is entered from registers, the result may differ either down or up. A deviation of up to 1 ruble per individual is considered acceptable.

The valid value is checked like this:

page 060 x 1 rub. x number of lines 100,

Moreover, the number of lines 100 is taken into account for the current year as a whole.

Example 3: Deviation due to rounding

Individual entrepreneur Shchegolev paid his 12 employees wages in the amount of 157,815 rubles for the 1st quarter of 2019. Standard deductions provided are 8,400 rubles. The calculated personal income tax indicated on page 040 of form 6-NDFL according to tax registers is 19,418 rubles. Line 100 of the report showed 4 payments.

Checking the reference ratio: (157,815 – 8400) x 13% = 19424.

19424≠19418, equality does not hold, the difference is: 19,424 – 19,418 = 6 rubles.

We consider the permissible error: 12 people. x 1 rub. x 4 lines = 48 rubles.

Since 6 rubles. is within the permissible error range (6 < 48), then the value p. 040 is acceptable.

Main mistakes when filling out form 6-NDFL

| Article of the Tax Code of Russia | Type of error | Reason for error |

| Articles No. 226, No. 226.1 and No. 230 | The amount in cell No. 040 about the amount of income tax differs from similar data in form 2-NDFL | The control ratio of the data in Form 6-NDFL was not carried out |

| Article No. 223 | Reflection of information about the withholding of income tax in cell No. 070 in the month of accrual in which the tax was not actually withheld. For example, indicating tax data for June, which will actually be paid in July. | Failure to comply with the basic provisions specified in the order of the Federal Tax Service No. MMB–7–11/450 |

The table was compiled on the basis of the most common inaccuracies indicated in the letter of clarification of the Federal Tax Service No. GD-4-11/222162 dated 01.11.17.

Comparison in 6-NDFL pages 040 and 070

In the calculation of 6-NDFL, lines 040 and 070 “Amount of tax withheld” do not always coincide. Discrepancies arise due to the procedure for recognizing income and reflecting payments in the statements:

- Line 020 shows the accrued income of the period, however, their payment to individuals, and therefore the withholding of the tax calculated from them, specified in page 040, may occur in the next reporting period. Line 070 shows the tax withheld when paying income in the reporting period. Let’s say that the salary and calculated personal income tax for January-March were calculated and shown in the 1st quarter on lines 020 and 040, but the March tax will not be included in line 070, so the salary payment and tax withholding occurred in April, i.e. next quarter.

- Line 070 may reflect tax withheld from payments for the previous period, accrued and recognized as income earlier, but paid to employees only in the current reporting period, for example, from salaries for December of last year, paid in January of the current year. Another example: the June salary was issued in July - on line 040 the June tax will be shown in the report for the 1st half of the year, and on line 070 - in the report for 9 months.

If in 6-NDFL line 070 is greater than line 040, or vice versa, this is not an error. The indicators of these lines most often do not coincide and they are not checked by control ratios.

Let's sum it up

- Line 040 in 6-NDFL is located in Section 1 and reflects the estimated amount of tax to be withheld from income accrued for the period. It is accompanied by lines reflecting the generalized data from which this amount was obtained (the amount of the rate, the volume of income and deductions).

- The data for line 040 is not only generated in compliance with all tax calculation rules, but is also reflected in the report in accordance with these rules - on an accrual basis, separately at different rates, applying deductions only to income taxed at a rate of 13%, and separating from information generated for a rate of 13%, data related to dividends.

- The rules for reflecting the figure in line 040 are standard for the 6-NDFL report. It is filled out in each of the reports and in each of the sets of lines 010-050, allocated when applying different rates. For a rate of 13%, the appearance of a zero value in the line is not excluded.

How to fill it out correctly?

When filling out line 040 6-NDFL, you need to consider the following important rules:

- Personal income tax is calculated from income accrued from the beginning of the year of the reporting period to the end of the period for which 6-personal income tax is submitted.

- When calculating, you must also take into account deductions due to individuals.

To fill out field 040 you need to make the following calculations:

- Subtract from the accrued income from line 020 the required deductions from 030.

- Multiply the difference result from the first action by the bet size from field 010.

Different types of income may be taxed at different rates (from 9 to 35 percent), so income tax is calculated separately at each rate. If during the period employees were paid income taxed at different rates, then section 1 of form 6-NDFL is filled out separately for each.

An important point: in line 040, fill in the amount of calculated personal income tax (not withheld, not paid), namely calculated - which is calculated from accrued income.

Read about filling out line 020 in 6-NDFL here.

How is it different from field 070?

Line 070 is also located in the first section of 6-NDFL and reflects the amount of income tax withheld.

When filling out a report, the indicators on lines 040 and 070 are usually different. In some cases they may be equal.

Where does the error in the indicators of lines 040 and 070 come from? Field 040 reflects the calculated personal income tax, and field 070 reflects the withheld tax.

The date of tax calculation and withholding may vary.

The date of calculation of personal income tax is the date of actual receipt of income:

- for wages and advances for the first half of the month - the last day of the month for which wages are accrued;

- for vacation pay, sick leave, compensation, payment upon dismissal, dividends - the day of payment of funds.

The date of personal income tax withholding is considered to be the day the funds are issued to the employee or the day they are transferred to the card.

Thus, for wages for the 1st and 2nd half of the month, the date of calculation and deduction will be different (calculation on the last day of the month, deduction on the day of payment of wages for the second half of the month: from the 1st to the 15th of the next month).

For other types of income, these dates coincide.

An error when filling out lines 040 and 070 of form 6-NDFL arises precisely because of the discrepancy between the specified dates for wages.

From the salary for the last month of the period, personal income tax will be calculated on the last day of the period (that is, the amount of calculated tax will be included in line 040 of section 1), and withheld in the next month when paying salaries (that is, the withheld personal income tax will not be included in field 070 of section 1).

At the same time, personal income tax, which is withheld from wages for the month preceding the reporting period (December of the previous year), may be included in 070; this amount will not be included in line 040. This is true provided that the salary for December of last year was paid in January of the current year.

Accordingly, the indicators of lines 040 and 070 may differ by the amount of personal income tax equal to the difference between the salary tax for the last month of the reporting or tax period and the salary tax for the month preceding this period.

Example:

When filling out the 6-NDFL calculation for 9 months of 2021, the tax will be calculated from the salary for September on September 30, 2018, and this amount will be included in line 040 of section 1, and the tax will be withheld at the beginning of October, for example, on October 5, 2018, this amount will not be included to line 070 of section 1.

At the same time, personal income tax will be calculated from the salary for December 2021 on December 31, 2017, and withheld at the beginning of January 2021. This means that this tax will be included in line 070 of the report for 9 months of 2021 and will not be included in 040.

Sample filling

Employees received the following salary amounts in 2021 (total for all employees):

| January | February | March | April | May | June | July | August | September |

| 125000 | 130000 | 130000 | 130000 | 120000 | 145000 | 130000 | 130000 | 130000 |

When filling out 6-NDFL for 9 months:

- Salary for December 2021 = 130,000 – paid in January 2021. Personal income tax withheld for December = 16,900 (withheld in January 2018), no one is entitled to deductions.

- Salary for September 2021 = 130,000 – paid in October.

- Amount of accrued income (line 020) = 1,170,000.

- Deductions (line 030): suppose only one employee has the right to a deduction per child in the amount of 1,400; for the first 9 months of 2018, he is entitled to a deduction amount of 1,400 * 9 = 12,600.

- Amount of calculated tax (line 040) = (1,170,000 – 12600) * 13% = 150,462.

- Amount of tax withheld (line 070) = (1,170,000 – 8*1400) * 13% + 16900 = 150,644.

As you can see, there is a slight difference between the indicators of lines 040 and 070. This is normal and is not considered an error, because the calculated personal income tax did not include the salary tax for December 2021 and did not include the salary tax for September 2021. On the contrary, the withheld personal income tax included the salary tax for December 2021 and did not include the salary tax for September 2018.

Example of filling out section 1 of 6-NDFL

Settlements with personnel in the organization are carried out on the 5th and 20th. This norm is enshrined in local regulations. In 9 months 2021 accruals amounted to:

- January – 175,000.00 rub.

- February – 190,000.00 rub.

- March – 210,000.00 rub.

- April – 180,000.00 rub.

- May – 230,000.00 rub.

- June – 220,000.00 rub.

- July – 255,000.00 rub.

- August – 235,000.00 rub.

- September – 320,000.00 rub.

Total for 9 months. In 2021, the organization accrued income to employees in the amount of RUB 2,015,000.00. From the beginning of the year, one employee is provided with a deduction for the first child in the amount of 1,400 rubles, the second - for the third child in the amount of 3,000 rubles. In total, deductions were provided for the period in the amount of 39,600 rubles. (1400 x 9 + 3000 x 9). How to fill out section 1 of the form for 9 months. 2021:

- 010 – 13.

- 020 – 2015000.

- 025 – 0.

- 030 – 39600.

- 040 – 256802 (2015000 – 39600).

- 045 – 0.

- 050 – 0.

- 060 – 5.

- 070 – 256802.

- 080 – 0.

- 090 – 0.

Note!

If in the required period the employer made accruals at different personal income tax interest rates, a separate block is formed for each of them according to gr. 010-050. Cumulative results are entered in gr. 060-090 on the first sheet.

An example of filling out indirect expenses in a profit declaration

Let's look at how the indirect expenses of line 040 incurred for the 4th quarter of 2021 are formed using an example:

| Costs incurred during the reporting period | |

| Types of costs incurred | Amount, rub. |

| Depreciation bonus for a car | 30 000 |

| Depreciation bonus for repairs of structures | 15 000 |

| Payment of property tax | 5 000 |

| Transport tax | 15 000 |

| Administrative department salary | 50 000 |

| Insurance contributions for administrative department salaries | 6 500 |

| Payment for advertising services | 3 000 |

| Payment of utility services | 2 000 |

| Payment for communication services | 1 500 |

| Purchasing stationery | 1 000 |

| Total: | 129 000 |

| Line by line filling in indirect expenses in the income tax return | |

| Line 040 | 129 000 |

| Line 041 (transport tax and property tax) | 20 000 |

| Line 042 (depreciation premium for the car) | 30 000 |

| Line 043 (depreciation bonus for repairs of structures) | 15 000 |

It is important to consider that in the absence of profit, most of the costs incurred can be accepted as indirect. Thus, this will reduce the amount of the tax base, since indirect costs are not directly tied to revenue, unlike direct costs.

Answer: When calculating income tax according to the income tax return, line 020 (sheet 02 of the declaration) reflects expenses that reduce the amount of income from sales in accordance with Appendix No. 2 to sheet 02 of the tax return. According to this appendix, the amount of income from sales is reduced only by recognized expenses associated with production and sales. Consequently, expenses that are not accepted for tax purposes in the amount of 5 thousand rubles should not be included in the calculation of the tax base. Thus, the loss from the main accounting activities will be 50 thousand rubles, and the loss on the tax return will be 45 thousand rubles.

If the specified subsidy corresponds to the list of income in accordance with Art. 251 of the Tax Code of the Russian Federation, which are not taken into account when determining the tax base provided they are used for their intended purpose, or were received in accordance with paragraph 11 of this article, then in this case the tax base for the payment of income tax does not arise.

GUARANTEE:

The information presented here is not a normative act and is of a recommendatory nature in the form of explanations for specific requests of taxpayers, which means it has legal consequences only for persons to whom it is addressed individually. The Department of Tax Administration of the Russian Federation for SD also indicates that these recommendations cannot serve as a basis for confirming their positions in the judiciary and other organizations

Print (Ctrl+P)

1C: Accounting enterprise 3.0