When and where to apply for an income tax refund

A taxpayer writes an application for an income tax refund if during the tax period he has the right to a deduction - property or social, and he wants to receive a deduction through the inspectorate.

For information on how to return personal income tax for treatment and education, read the materials “Procedure for the return of personal income tax (personal income tax) for treatment” and “Procedure for the return of personal income tax (personal income tax) for education” .

An application is also submitted if the taxpayer’s residence status has changed (he was a non-resident - he became a resident) and there is a need to recalculate personal income tax.

In addition, there are cases when a tax agent unnecessarily withholds and transfers the taxpayer’s personal income tax to the budget, and then ceases to exist. The error is identified, but it is no longer possible to return the tax through an agent. In this case, the taxpayer also needs to write an application for a personal income tax refund.

See “You cannot send an employee to the inspectorate for a personal income tax refund .

A taxpayer should apply for a refund of income tax to the tax authority at his place of residence. When changing the residence status, an individual must contact the tax office with which he was registered at the place of his residence or stay (clause 1.1 of Article 231 of the Tax Code of the Russian Federation).

In all other cases, personal income tax must be returned through the employer. ConsultantPlus experts explained step by step how to do this. Get free access to the system and see what steps you need to take to get your tax refund at work.

Refund of overpaid taxes

Often a situation arises when an overpayment appears on the personal account of an organization, individual entrepreneur or individual. There are different reasons for this:

- Incorrect tax calculation.

This can happen if the tax is calculated at a different rate, without taking into account expenses, insurance premiums, benefits, etc.

- Excessive amount of tax collected.

Overpayment for this reason may occur when a citizen applies for a personal income tax refund when claiming tax deductions. This also happens if the Federal Tax Service unlawfully collects tax in a larger amount than required.

- Paying tax in excess.

Most often, such an overpayment occurs when individual entrepreneurs or citizens pay tax in a much larger amount than necessary.

A taxpayer can find out about an existing overpayment:

- in your personal account on the Federal Tax Service website;

- directly from the Federal Tax Service.

The Federal Tax Service is entrusted with the obligation to notify organizations, individual entrepreneurs and individuals about detected facts of overpayment within 10 days from the date of its detection (clause 3 of Article 78 of the Tax Code of the Russian Federation).

The overpayment can be offset against future payments or returned to your bank account (Article 78 of the Tax Code of the Russian Federation). In both cases, you must contact the Federal Tax Service at the place of registration with a written application. You can submit it to the tax authority:

- personally or through a representative;

- through Russian Post (by sending an application by registered mail with a list of attachments);

- via TKS or through your Personal Account on the Federal Tax Service website.

Is it necessary to submit a 3-NDFL declaration and at the same time an application for a refund?

The taxpayer does not have to submit an application for a tax refund along with the 3-NDFL declaration. This can be done later. After all, the declaration will still be cameralized first. And this takes up to 3 months. You can submit your application within these 3 months or upon completion of the review.

See “The Ministry of Finance explained how long to wait for a tax refund under 3-NDFL” .

The application must be accompanied by documents on the right to deduction, on a change of residence and other supporting documents.

Personal income tax refund mechanism with the right to deduction

The state exempts from tax the part of a citizen’s income that he used for his socially significant expenses: buying a home, maintaining health, studying, etc. Income or a part thereof that a person received in the process of a major transaction may also be exempt from personal income tax. For example, when selling an apartment or car.

In all these cases, the right to a so-called personal income tax deduction arises.

A tax deduction is the exemption of part of the income received by a person from personal income tax. If personal income tax has already been withheld and paid on all income, the resulting difference can be returned.

It is important to know:

- Only income subject to personal income tax at the rate can be reduced through deductions 13%.

- Tax can be returned from the budget only if it has already been transferred to those who paid the income (for example, by the employer, who is also the tax agent for personal income tax).

- They will refund the tax at a rate of 13% , and not the entire amount of expenses. For example, if a citizen spent 100,000 rubles on treatment, declared a deduction and a refund, then 13,000 rubles will be returned to him. (RUB 100,000 × 13%).

Application form for personal income tax refund and procedure for filling it out

From January 9, 2021, an application for a refund is submitted in the form approved by the order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] as amended by the Federal Tax Service order dated November 30, 2018 No. ММВ-7-8/ [email protected]

The current personal income tax refund application form can be downloaded here.

And below we provide for you a sample of filling out an application for personal income tax refund for 2021 using the new form.

Read about the nuances of filling out an application for a personal income tax refund when applying for a social or property deduction in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

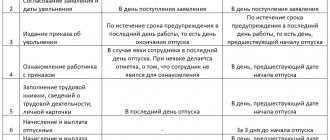

Return deadlines

After delivery of materials to the inspection and its acceptance of the received materials, if all information required for the return of excess amounts transferred is correctly filled out and provided, a decision is made within 10 days.

If there is insufficient information provided, the tax office sends a notification to the person who submitted the documents, indicating the reasons for the refusal or with a request to send additional materials that are not available for a positive resolution of the issue.

Notification of the decision is sent to the applicant no later than 5 days from the date of the decision.

If everything is in order with the documents, then according to clause 6 of Art. 78 of the Tax Code of the Russian Federation, the tax inspectorate is obliged to return the excess amount within 30 days.

In practice, it often happens that the money does not reach the applicant’s account for many months.

This is due to the fact that tax inspectors can warn about the verification of payments by the duty payer who has made a request for the return of excess transferred duty amounts. The period of such verification sometimes reaches 3 months.

The deadlines for sending an application to the inspectorate for the return of funds and the deadlines for the applicant to complete the request can be expressed in the table:

| Deadline for sending the request | Money back deadline |

| The request must be sent within 3 years from the date of overpayment of the fee (not from the date of detection). | The overpaid tax must be returned to the applicant within 30 days from the date of registration of the request. |

Results

An application for an income tax refund should be submitted upon submission of the 3-NDFL declaration or upon completion of its desk audit. The application form was approved by order of the Federal Tax Service of Russia dated 02/14/2017 No. ММВ-7-8/ [email protected] From 01/09/2019 its new version is applied.

Sources:

- Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Grounds for tax refund

Every officially employed employee of the Russian Federation must pay a mandatory fee of 13% of the income he receives (for work done, when providing housing for rent, etc.). However, the legislation of the Russian Federation provides for certain benefits that allow you to return part of the taxes paid on personal income. This circumstance is regulated by the Tax Code of the Russian Federation.

Personal income tax deduction can be made in several ways:

- as a discount on other taxes;

- by bank transfer to the applicant's account.

The deduction cannot be credited to the current account of a third party. It is only paid to the applicant who creates the refund request.

The legislation creates several circumstances that may be the basis for obtaining a tax deduction:

- purchasing real estate (housing or land, paying a mortgage);

- social expenses (for example, training, treatment or social insurance);

- charitable contributions.

In this case, it will be necessary to provide documents confirming the fact of the implementation of the specified circumstances - checks, sales agreement, agreement with the university and payment receipts, etc.

What documents will be needed

Basic list of documents for personal income tax refund:

- a copy of the passport of a citizen of the Russian Federation;

- form 3-NDFL;

- Form 2-NDFL (not provided when applying for a deduction from an employer);

- certificate of part-time income;

- statement.

Additionally, birth certificates of children, brothers/sisters are submitted to confirm relationship and a copy of the marriage certificate.

To reimburse the funds spent on treatment you will need:

- an agreement with a medical center for the provision of medical services;

- a copy of the license of the medical institution;

- certificate of payment under the contract.

To receive a deduction for education, in addition to the main package of documents, copies of the training agreement and licenses of the educational institution, as well as checks, receipts or other payment documents are additionally provided.

To receive a property deduction you also need:

- a copy of the purchase and sale agreement;

- an extract from the Unified State Register or a certificate of ownership;

- loan agreement;

- a certificate from the bank about the interest paid on the loan.

Rules for filling out an application to receive a personal income tax refund through the Federal Tax Service: step-by-step instructions

The document contains 3 pages containing information about the citizen and the circumstances of the assignment of the benefit:

- personal data (passport, TIN, full name, etc.);

- the basis for the purpose of the return;

- bank details;

- information about the Federal Tax Service where the documentation is sent.

Before filling out the form, it is recommended to prepare a declaration, income certificate, and passport. It is possible to enter data and send documents for deduction, including applications, via the Internet through the taxpayer’s personal account. The filling algorithm and required information are the same. Many of them do not require insertion because they are inserted automatically, making the process much easier. However, the online form must be certified with an electronic signature.

ATTENTION! Various branches of the Federal Tax Service have their own procedure for accepting applications. In some, it is acceptable to submit it together with other documentation, in others, sending is carried out after checking 3-NDFL. The application is sent via the Internet after the declaration has been approved and the possibility of a tax refund has been confirmed.

If more than one source of income was entered into 3-NDFL, and the benefit takes into account income from all places of work, then as many applications are drawn up as the number of employers indicated. That is, the number of documents is equal to the number of sections of 1 declaration.

Page 1

The first sheet of the application contains personal information about the payer and the circumstances of the deduction.

- The TIN must be entered (the checkpoint is provided for organizations).

- The following indicates the serial number of the application submitted to the Federal Tax Service in 2021 and the code of the authority. The latter can be found on the official website of the tax service.

- After entering your full name, the status of a citizen is entered - when processing a return, you select a unit. The basis for the benefit is stated in Article 78 of the Tax Code of the Russian Federation. In subsequent paragraphs, units are placed indicating the excess tax paid.

- Next, enter the amount of personal income tax to be returned - it is also indicated in the first section of 3-personal income tax. Then the period under consideration is indicated.

- After this, the OKTMO territory classifier is entered. It can be taken from the first section of the declaration or found on the official website of the Federal Tax Service.

Determination of OKTMO through an online service

- KBK in 2021 for personal income tax reimbursement is indicated as 18210102010011000110 (also present in 3-NDFL).

- Finally, indicate the number of pages (3) and attached sheets of other documents. When providing information in person, select one in the left column; through a representative, select two. Next, they leave a contact phone number, put down the date and signature.

Page 2

The second sheet contains bank details. At the top of the page its number, INN, and full name of the payer are duplicated. Next, enter the information of the financial institution where the funds will be transferred for return if they agree with the application. Therefore, it is important to correctly fill in the details of the bank and the recipient himself. The type of account is noted, for example, “08” - this is how the front account is indicated, according to the note on the third page. Other options are also indicated there. The account number is “1”, the recipient is “2”.

Application form for personal income tax refund, page 2

Page 3

The last sheet contains information about the citizen. You must indicate the surname and code of the document according to which the information is entered. Options can be found in the note at the bottom of the page. Usually the code “21” is used, which means that the data has been entered in accordance with the Russian passport.

Application form for personal income tax refund, page 3

Enter the number and series of the document, who issued it and the date. Next, the prepared application with a list of necessary documents (if submitted simultaneously) or after checking the declaration is sent to the Federal Tax Service in any convenient way. Before submitting an application via the Internet, it is important to check all the data, since once the action is completed, it is no longer possible to edit the paper.

Video - Filling out an application for a tax deduction

The procedure for filling out an application in the prescribed form

On the first page we indicate information about the amount, type of tax and payer.

- At the very top the “TIN” is indicated.

- For individuals, the “Checkpoint” field is not filled in.

- In the line “Application number”, “1” is indicated if the only (first) application is submitted in the current year. For each subsequent application in the same year, the corresponding number is indicated - 2, 3, etc.

- In the line “Submitted to the tax authority (code)” you must indicate the code of the tax authority to which the application is being submitted. You can find out the code on the page https://service.nalog.ru/addrno.do of the Federal Tax Service website. Usually you need to indicate the tax authority at your place of residence.

- In the line “Full name of the organization...” indicate your last name, first name, patronymic (if any) in block letters. In this case, each letter fits in a separate cell.

- In the “Payer Status” field “1” is indicated.

- In the “Based on the article” field “78” is indicated.

- In the “Type of amount” field: “1” is indicated.

- In the “Nature of payment to be returned” field, “1” is indicated.

- In the “Amount to be refunded” field, the amount of tax to be refunded is indicated, indicated according to line 050 of section. 1 declaration 3-NDFL.

- In the field “Tax (calculation) period (code)” for the deduction for 2019, indicate the code “GD.00.2019”.

- In the line “Code according to OKCode of budget classification”, indicate the BCC for personal income tax - 182 1 0100 110 - indicated in 2019-2020.

- In the cell “The application is drawn up on __ pages” the number of completed pages of the application is indicated.

- In the cell “with the attachment of supporting documents or their copies on __ sheets”, if the relevant documents are available, the total number of sheets of supporting documents, contracts, copies of checks, etc. is reflected.

- In the section “I confirm the accuracy and completeness of the information,” the value “1” is indicated if the application is submitted by you personally, or “2” if the application is submitted by your representative.

- Next, indicate the last name, first name, patronymic of the representative, and in the field behind it - the contact phone number. If the submission is made in person, then indicate your contacts.

- The field “Name and details of the document confirming the authority of the representative” is filled in if the application is submitted by proxy by your representative.

- The person submitting the application signs in the “Signature” field and fills in the “Date” field.

- The fields in the “To be completed by a tax authority employee” section do not need to be filled in.

The second page contains bank account details for receiving a personal income tax refund.

- At the top, the TIN and full name are indicated again in the fields.

- Next, fill in information about the bank account to which the personal income tax refund will be sent. Fill in: bank name, account type, bank BIC. It is best to request this information directly from the bank.

- In the “Account Number” field, enter the value “1” and enter the corresponding account number.

- In the “Recipient” cell, enter the value “2” and enter your full name.

The third page is filled out if it was not possible to indicate your TIN on the previous pages.

This page contains personal information:

- surname and initials (patronymic - if available);

- code of an identity document (for example, 21 - passport of a citizen of the Russian Federation, 07 - military ID), and its details - series, number, date of issue and who issued it.

Peculiarities

An individual’s application for a tax deduction is submitted to the Federal Tax Service at the place of registration of the applicant. It must indicate the taxpayer identification number. If it is missing, you must first obtain a Certificate of Registration with the tax authority.

Obtaining a TIN

To obtain a TIN, you must contact the inspectorate at the place of registration with a passport or birth certificate if the citizen is under 14 years of age.

Certificate of absence of debts

In some cases, the applicant may be required to provide a certificate of no debt to the state.

The document has two forms:

- with details of debts by type and tax;

- with a general formulation about the presence or absence of debts.

Installment or deferment of tax payments

According to the Tax Code of the Russian Federation, deferment or installment payment of tax payments is a postponement of payment deadlines to a later time within 1 calendar year. Deferment involves a lump sum payment, while installment payment involves splitting the amount to be paid into several parts. Taxes that are credited to the federal budget can be spread over three years.

The decision to provide such a tax benefit is made within thirty days from the date of filing an application for the benefit with the relevant authority.

Tax deduction

A tax deduction is a certain portion of income that is not subject to taxes, or a refund of part of the income paid for certain reasons. Overpaid funds are returned in several cases.

What expenses can be deducted:

- for a child under 18 years of age,

- treatment of the applicant himself, his children or parents,

- education of the applicant himself, his children or brothers/sisters up to 24 years of age;

- formation of a future pension;

- charitable activities.

Providing benefits

In order to receive such a deduction, you should submit an application for a tax refund to the tax office, a sample of which was discussed above. It is accompanied by mandatory documents justifying the right to the benefit.

The deduction is due to citizens who are:

- liquidators of the Chernobyl accident,

- disabled during military operations or the Great Patriotic War,

- heroes of the USSR or the Russian Federation,

- disabled people of 1st or 2nd group,

- participants in hostilities.

Refund or credit of overpaid amount

When submitting an application, a citizen has the right to choose the method of compensation for the overpayment. It can either be returned or used to pay future taxes.

KBK and OKTMO

KBK is a code for the budget classification of budget revenues, consisting of 20 digits. Each individual tax has its own BCC. You can find it on the website of the Federal Tax Service of the Russian Federation.

OKTMO is a general classifier of municipal territories, the code of the region in which the tax was paid. You can find it out from the receipt on which the tax was paid.