Labor legislation gives some categories of employees the right to demand from the employer payment for travel to the place of vacation and on other grounds. This requirement is expressed by writing an application to pay for travel. Files in .DOC: Application form for travel payment Sample application for travel payment

Application for travel payment

- Help-call from the university dated December 25, 2016.

- Certificate confirming the fact that the session was completed in the period from 01/15/2019 to 02/16/2019.

- Receipt for the cost of air tickets from Surgut to Kemerovo and back.

It is possible that a collective agreement or other documents in the organization have adopted rules on the employer paying for travel, for example, to a place of vacation, for other reasons.

Typically, such documents also contain an approved application form and requirements for submitted documents.

Articles on the topic (click to view)

- Fine for late payment of vacation pay

- What to do with unused vacation

- What to do if your employer does not pay vacation pay

- How long after employment is vacation allowed?

- Is maternity leave taken into account when calculating pensions?

- Accounting for compensation for unused vacation

- Dismissal while on maternity leave

Required documents

Paying for travel on vacation is inextricably linked with a person’s presentation of justification for his right to compensation for travel expenses. That is, in addition to the application, the interested party must provide a number of supporting documents. Otherwise, it will be impossible to reimburse travel costs and back. The nature of the documentation provided depends on how the person got to the vacation spot and returned back.

In case of loss of supporting documentation, the interested recipient must obtain duplicates from the organization that issued the originals.

When traveling by personal transport

Each employee has the right to use his own personal vehicle to travel to his place of rest. Those who can compensate for travel to and from their vacation destination, including military and police officers, can also use their car for these purposes.

In this case, the shortest route will be taken as the basis for the calculation.

The costs themselves will be calculated based on the receipts submitted for the purchase of fuel at gas stations, the number of such points along the route, as well as the technical characteristics of the transport used, namely the amount of fuel consumed per hundred kilometers.

The location during the holiday is determined based on data on accommodation in a hotel or a rental agreement for residential premises. For military and police officers, such confirmation will be a mark on the vacation certificate.

When traveling by train and plane

To go on vacation and return back, a person can use rail or plane. In this case, compensation will depend on the category of workers to which the person is classified.

Those working in the Far North and similar territories will be compensated for travel on a branded compartment class train. As for air transport, payment for the economy option is allowed. Use of other classes will be at the employee's expense. That is, the supporting documents in this case will be travel tickets issued for the appropriate transport category - compartment and economy.

Similar fares are also paid for police and military personnel. In addition to tickets, for these categories, supporting documents will be receipts: receipts for the use of bedding, provision of travel services, payment of insurance premiums for passengers.

On a tourist package

Often a person can go on vacation using a voucher purchased from a travel agency, including outside the country. According to the requirements of current legislation, expenses for such trips must also be paid.

However, quite often difficulties arise with the presentation of supporting documents and, as a result, determining the amount of transportation costs. This is due to the fact that the cost of travel to the vacation spot and back is included in the price of the tour itself. Therefore, the necessary document in this case will be a certificate from a travel agency.

If a person has crossed the border of the Russian Federation, a copy of the passport page with a note about travel outside the country may be required.

Application for payment for travel to and from your holiday destination

[/important] There are some important nuances:

- the amount of payment for travel is made in the amount of 50% of the actually required amount;

- The place of vacation means the territory where the educational institution is located.

These rules apply not only to ordinary students, but also to graduate students.

Features of payment Payments of this type, made by the employer, have a large number of different features.

This applies to both tax collections and the calculation process itself.

[info]Taxes and contributions According to various regulatory documents, it can be argued that payment of travel to employees falling under a variety of categories is not subject to taxation. It is also not subject to contributions to extra-budgetary funds.

About the regions of the Far North

The list of regions of the Far North and equivalent areas was approved by Resolution of the USSR Council of Ministers dated January 3, 1983 No. 12.

Please note that compensation is due to employees who actually work in the Far North and equivalent areas. The address of the employer's location, if it differs from the place of actual business and is not “northern”, does not matter for the purposes of providing compensation. The above means that, for example, if an organization registered in Moscow has a separate division in the Murmansk region, then employees of such a separate division are entitled to travel compensation.

This is important to know: Is maternity leave included in length of service?

By the way, shift workers who only work, but do not live in the regions of the Far North and equivalent areas, are not entitled to compensation for travel on vacation (clause 4 of the Constitutional Court Resolution No. 2-P dated 02/09/2012).

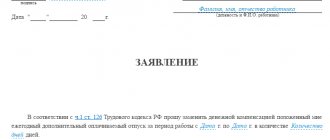

When does the right to compensation arise?

The amount, conditions and procedure for compensation of expenses for paying the cost of travel and baggage transportation to the place of use of vacation and back for employees of commercial organizations are established by collective agreements, local regulations, and employment contracts (Part 8 of Article 325 of the Labor Code of the Russian Federation). For example, the employer may establish the procedure for compensating such expenses in the Leave Regulations.

The employer can state that travel and baggage expenses are reimbursed in actual amounts, but limit, for example, that flights are paid at an economy class fare, long-distance train travel is paid in compartment cars, and baggage transportation weighs no more than 30 kg per person. person.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

The employer can also provide that compensation is subject to compensation for travel expenses not only within the territory of the Russian Federation, but also for travel expenses abroad.

Moreover, the employer can establish that compensation will be paid not only to the employee himself, but also to members of his family (for example, a non-working husband, wife, minor children who actually live with the employee).

The employer may provide that payment of compensation is made before the start of the vacation for the approximate cost of travel and baggage. And upon the employee’s return from vacation, based on the attached documents, the employee is compensated for the difference. Or a procedure may be established in which the cost of travel and baggage transportation is compensated after the end of the vacation and upon the submission of supporting documents by the employee.

It is important to take into account that the employer does not have the right to refuse to pay compensation or to unjustifiably underestimate it (clause 6 of the Constitutional Court Resolution No. 2-P dated 02/09/2012). The amount of compensation should provide the employee with a real opportunity to travel outside the regions of the Far North and equivalent areas for recreation and recreation (clause 5 of the Constitutional Court Resolution No. 2-P dated 02/09/2012).

Legal Aid Center We provide free legal assistance to the population

This includes both your own car and payment for transportation of your belongings, if the total weight of the suitcase does not exceed 30 kilograms. In addition, such employees can count on compensation for the carriage and travel of baggage with a non-working family member, including minor children. This right arises for the employee along with receiving paid leave for the first year of active work if he works for a specific employer. When paying the fare for your own employee and family members, it is based on the minimum values, taking into account the shortest route.

Payment for baggage transportation and the price relates directly to the funds issued from the state and federal budget.

How to submit an application for travel compensation?

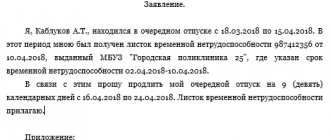

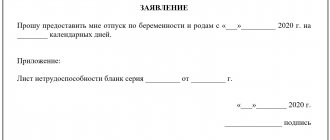

An application for compensation for travel to a vacation spot is drawn up in any form. It is addressed to the head of the employer and contains information about the full name. and the position of the employee, the amount of travel expenses, place of rest, route, method of receiving compensation (if necessary, indicating details). Documents confirming the expenses incurred must be attached to the application.

This is important to know: Payroll calculation after vacation

Here is a sample of filling out an application for compensation for travel to a vacation spot.

Most common mistakes

Mistake #1: If both spouses are employees.

If both spouses are employees, travel expenses are paid to each spouse at the place of duty. In this case, expenses are not paid to spouses as family members of the employee. Payment for travel expenses of their family members is made at the place of service of one of the spouses on the basis of a certificate issued at the place of service of the other spouse, which indicates that no money was issued at the place of service for travel of family members.

Error No. 2. If payment is made by bank transfer (for example, on the website), then you only need to pay with a card of a police officer, the Ministry of Internal Affairs or the National Guard. It is often mistakenly paid using the card of a relative, for example, a wife. No compensation will be provided in such a case.

Thus, compensation for travel to a place of rest for police officers, the Ministry of Internal Affairs and the National Guard is established by law. An advance is usually paid and used to calculate the shortest route to a specified destination. Upon the employee's return, the collected supporting documents can be used to clarify costs. If such documents are not submitted, you will not be able to receive full compensation and the cost of using your personal car.

After the end of the vacation and reappearance at the workplace, the employee provides all the necessary documents, after processing of which the final calculation of the amount spent will be made.

Calculation of vacation travel compensation

An application for payment for travel on vacation must be sent by the employee in advance, taking into account that by law the employer is obliged to pay vacation pay and compensation for the employee’s travel no later than 3 days before the vacation (Articles 136, 325 of the Labor Code of the Russian Federation).

To calculate compensation, the employee presents the paid tickets or reservations on hand, and upon return confirms them with itinerary receipts. If the total amount spent by the employee on travel and baggage transportation differs from that already received from the employer, the accounting department must make a calculation and add the difference.

At the same time, for a certain category of employees (federal government agencies and government agencies, as well as state extra-budgetary funds), the law provides a formula for calculating the amount of compensation if the employee was unable to provide supporting documents, depending on the type of transport running between the place of residence and the place of rest (clause 5 Rules, approved by Decree of the Government of the Russian Federation dated June 12, 2008 No. 455):

- for railway transport - at the rate of a reserved seat carriage;

- air transport - at an economy class fare;

- water transport - according to the tariff of a cabin of the X group of a sea vessel or a cabin of the III category of a river vessel;

- road transport - at the bus rate.

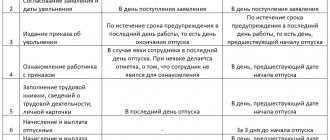

Submitting a report: instructions and procedure

Important! The report is submitted only on the eve of the vacation, 3 days before it starts.

The procedure for granting leave to the police, the National Guard or the Ministry of Internal Affairs is as follows:

- preparing a report;

- submitting it to a superior;

- signing a report;

- going on vacation.

List of required documentation:

- report in the prescribed form;

- vacation schedule approved by management;

- orders from superiors.

A report is the same statement containing the required details:

- name of the unit, department;

- Full name of the head of the department;

- title: REPORT;

- request for leave;

- vacation dates. Specify travel times and dates;

- the place where the vacation will take place;

- transport with which you will need to get to your vacation spot.

General requirements for submitting a report:

- it should contain information such as: employee's name, type of leave, duration and destination, date of departure and nature of travel;

- The report is accompanied by documentation of other family members traveling on vacation. These may be copies of marriage certificates and birth certificates of children. Since such documents are usually already stored in the personnel department, the report may be accompanied by a certificate of family composition;

- the HR department is the first to mark the report, which confirms the fact that the employee is going on vacation as scheduled;

- after this, the report is approved by the employee’s immediate supervisor;

- The accounting department calculates the tariff for payment amounts based on the type of transport and vacation spot.

The report can be found here.

Proving the amount of compensation in a dispute with an employer

Courts accept the following documents as evidence of travel expenses:

- receipts (cheques), sales receipts from gas stations for the purchase of fuel;

- certificates from bus stations about the distance of the shortest route by road to the vacation spot and back;

- certificates from bus stations and convoys about the standard fuel consumption for vehicles in which the employee traveled on vacation;

- evidence of the employee’s presence in the chosen place of rest (certificates from local authorities: village council, administration of the Moscow Region, information on registration in hotels and boarding houses).

Unilateral cancellation by order of the employer or other document of payment of compensation or fixation of a certain amount of such compensation (lower than the possible actual costs of the employee) is considered by the courts as a violation of labor legislation (section 6 of the Review of the practice of consideration by the courts..., approved by the Presidium of the Supreme Court of the Russian Federation on February 26, 2014).

How is the road paid?

Vacation travel in the Far North within Russia is paid. If a northerner decides to spend his free time abroad, he is paid for travel to a border post with another state. To receive the required compensation, the employee provides tickets, travel passes and documentary evidence of the trip to the organization’s settlement department. The cost of expenses is reimbursed regardless of the type of transport, with the exception of taxi. Train, bus, plane, sea transport, ferry are included in the list. Ticket prices are 100% reimbursed once every two years.

Example:

An employee of the Northern Metal Production Company went on vacation to Sochi for the first time in two years with his unemployed wife and minor son. Upon returning from vacation, the employee wrote an application for compensation payments, and provided the family’s round-trip tickets to the accounting department as proof of travel. Calculations have been made, the amount of expenses to the worker is reimbursed in full, equal to the cost of all tickets. The employee will have his next opportunity in two years.

Report for refund of travel money sample from Ministry of Emergency Situations

advocatus54.ru Video instruction “How to return an electronic ticket By returning electronic tickets, you agree to all the conditions listed below. You, as a user of the site, confirm your right and legal capacity, financial solvency, and also acknowledge responsibility for the obligations imposed on you as a result of the conclusion of this offer. The user who returns unused electronic tickets on the site acts on behalf of all passengers of the order, and therefore all passengers of the order are considered informed of the cancellation of the trip. A refund is possible for both the entire order and a specific e-ticket from the order. Return of travel documents issued for travel in a compartment-meeting room of the high-speed train "Sapsan" (service class 1P) is possible only if all 4 seats are returned at a time.