The very concept of working time implies the period during which the employee fulfills his labor obligations in accordance with the contract concluded with him and the principles of internal regulations. This definition also includes other time periods called working time in the Labor Code.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Legislative norms

According to Article 91 of the Labor Code of the Russian Federation, the norm cannot exceed 40 hours per week. In cases where the employer, following the law, must establish reduced working hours, 24, 35 or 36 hours per week are approved.

Labor Code of the Russian Federation

The RV norm is necessary for setting wages, as well as for paying for hours worked overtime, on weekends and holidays.

What is meant by working time?

An officially employed citizen must work in an official position for a certain time established by labor legislation and internal regulations of the enterprise.

During this period of time, he undertakes to perform his duties efficiently and not to violate the discipline and internal regulations of the company.

The time during which all of the above conditions are met is considered to be working time.

The standard working hours are calculated by calendar periods depending on the schedule of a particular employee and his status, namely:

- by month;

- by quarter;

- in a year.

The responsibility to record the time actually worked by a person lies on the shoulders of the manager, in accordance with Article 91 of the Labor Code of the Russian Federation.

RV standards

The following time standards are distinguished:

- Work week. It may consist of five days (Saturday and Sunday are days off), or six, but its duration should normally be 40 hours, or with a shortened time period - 24, 35 or 36.

- Change. The concept of a work shift includes the time after which workers engaged in the same labor process replace each other. It happens during the day and at night. When working in shifts, sometimes such a nuance arises as the inability to reduce the duration of the shift when it is provided for (for example, on a holiday). Then this time is considered overtime and is paid in accordance with overtime standards or compensated by providing time off. Payment for the night shift (from 22.00 to 06.00) occurs at an increased rate, which is approved by the employer.

- Working day. The time during the day during which work is performed. Normally equal to 8 hours.

- Accounting period. Time worked for a calendar period (for example, a quarter or a month, but not more than a year). This period allows you to compare the hours with the standards established by law. This is a unique form of control over the RV norm.

- Occupancy limit. Employment limit established by law. An example would be a part-time job. The number of hours worked in this case cannot exceed half of the daily wage rate per month. With a 40-hour work week in October 2021, part-time work should not take more than 84 hours.

RV accounting is selected in accordance with the specifics of the enterprise.

Features of calculating man-hours

What else should you consider when trying to calculate man hours? Legally, the following periods, while considered part of the work process, are still not included in the number of man-hours:

- rally or strike

- absenteeism,

- shortened day,

- holidays,

- weekend,

- fulfilling civic duty (voting, donating blood, undergoing a medical examination),

- easy to manufacture,

- sick leave,

- lunch break,

- internship,

- business trip,

- vacation.

In other words, man-hour figures cannot serve as the basis for employee compensation payments. They are needed only as an analysis of the duration of the work itself.

Also, when calculating a unit of labor hour, you need to pay attention to such subtleties as:

- calculations become difficult when the enterprise does not operate according to the standard eight-hour schedule - only the total number of hours actually worked must be taken into account;

- calculations for some special categories of employees (disabled people, nursing mothers, students) must be carried out individually;

- it is imperative to make changes to the accounting sheet after each work milestone for each employee - at the end of the day or week;

- Daily monitoring of the execution of work itself is important so as not to include information about downtime or breaks in the table as time worked.

In such situations, the formulas for allocating labor hours will vary.

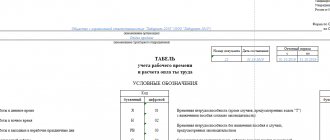

Man-hours should be calculated each time separately and for each employee, entering data on an individual form.

Calculation for an organization with a full work schedule

As already described above, there is no one multifunctional expression that would allow in all specific cases to obtain adequate results that correspond to reality: as many types of graphs as there are formulas.

However, there is the most standard one, on the basis of which calculations are often made:

K x T = H/h , where

K – total number of employees,

T – working timing,

H/h – man-hour.

This simple expression helps highlight the total number of hours and employees.

How to make a man-hour calculation. Example for a company with a full-time work schedule

We need to make calculations for July. The production employs 50 people. There were 23 weekdays in the month of July. Then the calculations using the universal expression will look like this:

50 x (8 x 23) = 9200 man-hours.

What to do when in an organization that has the same standard work schedule, in some months some of the employees had a rest due to holidays, and some worked on a reduced schedule? Or did one of the employees work overtime ? Such data should also be taken into account when making calculations of man-hours.

How to calculate man-hours. Example for companies with regular working hours and overtime or shortened hours

It is necessary to make calculations for the month of May. There were 23 weekdays in May, of which one pre-holiday day (8th) was shortened by an hour and three days fell due to holidays (1st, 2nd and 9th). The company employs ten people. Of these, half worked short hours on pre-holiday days, and half worked overtime on holidays. Then a complicated calculation using a universal expression occurs in several stages and looks like this:

1 x (8 x 23) = 184 man-hours worked by one employee in May,

5 x (184 – 1 x 1) = 905 man-hours worked by 5 employees on a schedule reduced by one hour on one of the pre-holiday days,

5 x (184 + 4 x 3) = 980 man-hours, 5 employees worked overtime for four hours a day during the 3 holiday days schedule,

All employees devoted 905 + 980 = 1885 man-hours to work in the month of May.

In addition to the man-hour, there is also the concept of a man-day - a unit that measures the work time of employees with a non-standard schedule.

Calculation for organizations with a part-time work schedule

When an organization employs several people with regular and part-time work, or the company itself has a part-time work schedule, calculations using expressions must be made for each employee.

How to calculate man-hours. Example for organizations with part-time work schedule

The company employs eight people. Each of them comes to work for five hours a day. There are 23 working days in August 2021. This means that the calculation of labor hours should be done as follows:

8 x (5 x 23) = 920 man-hours.

How to calculate man-hours. Example for companies with mixed (part-time and full-time) work hours

The company employs 8 employees. Five people work five hours a day, and three people work an 8-hour day. There are 23 working days in August 2021. So, the calculation of man-hours here will look like this:

5 x (5 x 23) = 575 man-hours,

3 x (8 x 23) = 552 man-hours,

575 + 552 = 1127 man-hours worked in August by all personnel.

Calculation for organizations with a shift schedule

Today, a shift work schedule is common. Many people work a day every other day, two days after two, a day every two, or a day every other three. In such cases, to obtain an objective picture, it is better to carry out calculations for each individual employee, inserting into the expression numbers reflecting the time and total number of days of work.

How to calculate man-hours. Example for companies with shift work schedules

Two employees replace each other every other day, working 12 hours a day. There are 20 weekdays in September 2021. Bearing in mind that out of 20 one employee will work 10 days, man-hours should be allocated as follows:

2 x (12 x 10) = 240 man-hours.

Rules and examples of working time calculation

Calculation of working hours takes into account a large number of factors, but the main one is the work schedule. It can be daily, weekly and cumulative. The latter assumes a shift schedule.

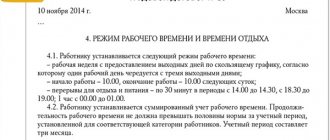

In addition, when accounting for radioactive substances, the following are provided:

- type of working week: five-day, six-day;

- daily duration of work;

- the time when the work was started and completed;

- breaks;

- sequence of working days with non-working days;

- number of shifts in 24 hours;

- the presence of holidays, when the working day is reduced.

Calculation per month

In general, the calculation of RP for a month during a five-day period is carried out using the following formula:

Ntotal = Prv: 5 x Krd – 1 h. x Kppd, where:

- Ntotal—RV norm;

- Prv - duration of RT per week (40.35, 36 or 24);

- Krd - number of working days in the period (month, year);

- Kppd - the number of pre-holiday days.

For example:

There are 21 working days in October 2021. This means that with a 40-hour week it will be: 40: 5 x 21 - 0 = 168 hours. At 36 hours: 36: 5 (days) x 21 = 151.2 hours. Hence the conclusion is this: the maximum working time in October 2021 should not exceed 168 hours.

Six days

A six-day week also cannot exceed 40 hours in total.

Let's take the same October with a six-day week. There will be 26 working days, the norm is 168 hours. 168 divided by 26 equals approximately 6 and a half hours a day. But in the Russian Federation, during a six-day working week, a 7-hour duration of work time is used, and before the weekend it is reduced to 5 hours.

On the eve of a holiday, during a five-day workday the working day is reduced by one hour, while during a six-day workday it cannot be more than five hours.

Number of working days between dates (formula)

Excel has a function called NETWORKDAYS. Its arguments are the start and end dates. These are required values to enter. And also an optional argument - holidays. When entering data about holidays, these days are excluded from the calculation.

How can an employee change their working hours? Find out from our article. What is meant by available working time fund? See here.

RV calculation for 2021

How to calculate standard working hours for 2021?

The production calendar is taken as a basis. Here you need to take into account that the year is a leap year, and there are 366 days in it. Working days are 247. Weekends and holidays are 119. There are only two pre-holiday days this year.

Calculating using the formula (if a 40-hour work week is taken), it turns out: 8 * 366 - 2 = 1974 hours.

From here you can calculate the average monthly rate: Simply divide the resulting number by 12. The result is 164.5 hours.

If we take into account a week consisting of 36 hours, then the year will be 1776.4 hours. And with a 24-hour week, there are correspondingly 1183.6 hours of RT.

Calculation for shift schedule

With this type of schedule, cumulative time tracking is often used.

Summarized accounting is used for shift schedules, sliding days off and approval of flexible working hours.

The need for such accounting arises in cases where the required norm, for example, 40 hours a week, is not maintained. But it is leveled off over a certain accounting period - it can be 1 month (which is more convenient), a quarter or a year.

Example:

Driver Yu.P. Ivanov, who works at Petra LLC, where summarized accounting has been introduced, and a quarter is taken for calculation, worked 447 hours from January to March inclusive of 2021.

Of them:

- 118 hours in January;

- 145 hours in February;

- 184 hours in March.

This driver is an employee with a 40-hour work week. This means that the norm for the first quarter is 447 hours, where :

- 120 hours - January;

- 159 hours - February;

- 168 hours - March.

From the calculations it is clear that the norm was not exceeded.

Calculation of RV on a business trip

The seconded person performs an official assignment, and not his own function specified in the employment contract.

In accordance with this, the time spent by an employee on a business trip is not the working time defined in Article 91 of the Labor Code.

The duration of RT in this case is set based on several factors:

- nature of the job assignment;

- fulfillment conditions;

- operating mode of the receiving party.

If you are hired on a business trip on weekends or holidays, these days must be marked on the time sheet and paid accordingly.

How to properly record employee working hours? You can find an example of an order for the summary recording of working hours here.

What should you do if you quit your job and find out that you are pregnant? Find out here.

Calculation of RR with a schedule of days in three

This type of schedule is classified as either shift work or flexible work. In this case, the standard of 40 hours per week cannot be met. Therefore, hours exceeding the norm will be considered overtime, and their number will be determined at the end of the accounting period.

Here it is more convenient to choose a period for accounting equal to one year. Then the processing will be compensated by the shortfall.

Non-standard conditions

The calculation algorithm given above is not suitable for an enterprise in which employees work in shifts, provided that the duration of the shift is set individually. In this case, it is more convenient to use a different formula for calculating man-hours:

Chh = Ch1 + Ch2 + Ch3 ... + Chn,

Where:

- Chn is the actual hours worked per month, calculated for a specific employee individually.

In simple words, for the calculation, the number of hours that all workers worked, but separately, is calculated. And then the results obtained are summarized. Please note that all calculations must be made on the basis of data from time sheets.