Salary payment terms

The timing of the payment of wages is regulated by Article 136 of the Labor Code of the Russian Federation, according to which it is paid:

- By issuing cash or transferring money to a person’s account.

- At least every 15 days, respectively, at least twice a month.

- Wages for a particular month must be issued to the worker no later than 15 days after the end of the month.

- Salary amounts are paid personally to the person (transferred to his account), unless otherwise provided by law.

All other issues related to wages can be decided by the head of the company at his own discretion, provided that he does not violate the above rules. Thus, the employer has the responsibility to:

- Determining the place for issuing funds.

- Determining the frequency of issuance (payments can be made more often than twice, for example, every week).

- Determining specific dates for the employee to receive advance payments and wages.

One of the common mistakes made by employers is to set a period rather than a specific date of issue. For example, wages will be issued from the 5th to the 10th. This is incorrect, the above article says that a specific date for the payment of salaries must be determined.

The essence of the advance and the legislation of the Russian Federation - what should the advance be and when will the payments be made?

There is no concept of “advance” in current legislation. However, this concept is well established and directly depends on the definition of “wages”.

According to the standards specified in Article 136 of the Labor Code of the Russian Federation , the employer is obliged to pay wages at least once every half month.

So, it turns out that the salary is divided into two parts - the first, advance payment is paid for the first 2 weeks of work, and the second part is paid for the 3rd and 4th weeks of the month.

Payment is made on the day determined by the contract (labor/collective) or established rules in the organization.

We will indicate which laws and legal provisions govern the calculation and payment of advance payments.

| Name of the law | Description |

| Letter of the Ministry of Health and Social Development of the Russian Federation No. 22-2-709, approved on February 25, 2009. | The accrual must be for each half of the month. The sum of the parts is approximately equal. The document contains an example of payment on the 25th and 10th of the next month. |

| Letter of the Federal Service for Labor and Employment No. 1557-6, adopted on September 8, 2006. | When determining the amount of the advance, you should take into account the time that the employee actually worked. That is, in order to receive two approximately equal amounts for the time actually worked in a specific period, the first payment must be made approximately in the middle of a specific working period. It is better to make payments in the middle of the month - on the 15th, 16th. |

| Article 361 of the Labor Code of the Russian Federation | If violations of the law are detected, the employer has the right to appeal the decision of state inspectors through the court or the state labor inspectorate. For example, if the advance payment is incorrect - on the 25th, when the person started work on the 1st. |

The employer must remember to indicate in the contract the date of payment of all parts of wages . If this is not done, disputes with employees may arise.

In addition, indicating only periods, and not specific dates, is a crime .

How to determine the payday and delay period

The Labor Code of the Russian Federation indicates that if the day designated as the date of transfer of advance payment or wages falls on a weekend, then the issuance of funds is carried out on the last day of work before it.

The table below shows several situations when you need to pay wages in advance and how this can affect the delay period.

| Date of payment of wages (advance) | Date to which payment must be postponed | Delay period |

| The date of payment of wages is determined on the 2nd of the month. May 2, 2021, according to the production calendar, will be a public holiday. | In this case, the salary must be paid no later than April 28, 2021, since all subsequent days will be days off. | Even if the employer pays wages on May 3, that is, tomorrow after the due date, the delay period will be 5 days. |

| The salary transfer date is set on the 9th day of the month. May 9, 2021 will be a public holiday. | In this case, salary payment must be made on May 8, 2021 | If it is paid on May 10, then the delay period will be 2 days, since in this case the payment is automatically postponed to May 8. |

Are taxes calculated on advance wages?

No taxes are written off or collected from the advance payment, as part of the salary , much less contributions and fees.

New in the calculation and payment of insurance premiums from January 1, 2017

Remember, that:

- Personal income tax is taken into account when calculating the employee’s total income for an entire month, and is accrued after the advance payment has been made. We can conclude that the tax is written off on the last day of the month for which the citizen received income, and it also includes the advance part. Upon dismissal, tax is withheld on the last day of work.

- Insurance premiums are also taken into account based on the results of the outgoing worked period.

- Fees for insurance against accidents and occupational diseases are also deducted from the citizen’s total income for the month that he has already worked, but not from the advance amount.

How to fill out a tax return in form 3-NDFL correctly - form 3 NDFL and filling samples

Now you know how the advance payment procedure works, and you can safely appeal and contact supervisory authorities to prove that you are right and return monetary compensation for the inconvenience.

Compensation for delayed wages

Article 236 of the Labor Code of the Russian Federation establishes the following rules for the payment of compensation amounts for late wages:

- The amount of compensation must be no less than 1/150 of the approved key rate.

- Compensation is calculated on the overdue amount, and not on the entire salary;

- Compensation is issued immediately, along with your salary.

The legislation regulates only the minimum threshold of compensation; an organization can increase it by stipulating this in local regulations.

The employer needs not only to pay compensation to the employee, but also to accrue all insurance premiums, as stated in the letter of the Ministry of Labor dated April 28, 2016, No. 17-3/OOG-692.

How many days can wages or advance payments be delayed?

In case of delay in payment of wages for a period of more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until the delayed amount is paid. You can submit Applications (2 copies) to the State Labor Inspectorate, the Prosecutor's Office, but it is better to go straight to the District Court (no state duty) with a Statement of Claim (3 copies), the Prosecutor's Office is of little use, the conveyor for producing Exemptions works well there. You can refer to documents, testimony and Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation” - this Resolution gives you the right to appeal to the Court and after 3 months, you can demand that measures be taken to secure the Claim, arrest of accounts, otherwise you will only waste your time. Do not delay with Applications. Article 142. Responsibility of the employer for violation of deadlines for payment of wages and other amounts due to the employee In case of delay in payment of wages for a period of more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until payment of the delayed amount. Review of legislation and judicial practice of the Supreme Court of the Russian Federation for the 4th quarter of 2009 (approved by the resolution of the Presidium of the Supreme Court of the Russian Federation dated March 10, 2010) Issues arising from labor relations Question 4. How much is payment made for the period of suspension of work, if an employee’s refusal to perform labor duties is caused by a delay in payment of wages? Answer. According to Art. 142 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code), in the event of a delay in payment of wages for a period of more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until payment of the delayed amount. An exception to this rule is the cases of prohibition of suspension of work specified in the said article. During the period of suspension of work, the employee has the right to be absent from the workplace during his working hours. Based on generally accepted principles and norms of international law and in accordance with the Constitution of the Russian Federation, one of the basic principles of legal regulation of labor relations and other relations directly related to them is to ensure the right of each employee to payment of wages on time and in full. The right of employees to refuse to perform work is a forced measure provided by law for the purpose of stimulating the employer to ensure payment to employees of the wages specified in the employment contract within the established time frame. This right requires the employer to eliminate the violation and pay the delayed amount. From Art. 236 of the Labor Code follows that in case of delay in payment of wages, the employer is obliged to pay it with interest (monetary compensation) in the amount specified in the article. The amount of monetary compensation paid to an employee may be increased by a collective agreement. Thus, the employer’s financial liability for delayed payment of wages involves not only compensation for the earnings received by the employee, but also the payment of additional interest (monetary compensation). This measure of employer liability occurs regardless of whether the employee exercised the right to suspend work. Moreover, since the Labor Code does not specifically provide otherwise, the employee has the right to retain his average earnings for the entire time of delay in payment, including the period of suspension of his work duties. Based on the above, an employee who was forced to suspend work due to a delay in payment of wages for a period of more than 15 days, the employer is obliged to compensate the average earnings he did not receive for the entire period of its delay with the payment of interest (monetary compensation) in the amount established by Art. 236 of the Labor Code. Information Agency "GARANT": https://www.garant.ru/products/IPO/prime/doc/1694384/#ixzz33ORbwXfx For information, unfortunately you may need this information more than once: Article 16 of the Labor Code of the Russian Federation. Grounds for the emergence of labor relations Labor relations arise between an employee and an employer on the basis of an employment contract concluded by them in accordance with this Code. In cases and in the manner established by labor legislation and other regulatory legal acts containing labor law norms, or the charter (regulations) of an organization, labor relations arise on the basis of an employment contract as a result of: appointment to a position or confirmation in a position; court decision on concluding an employment contract; recognition of relations associated with the use of personal labor and arising on the basis of a civil contract as labor relations. Labor relations between an employee and an employer also arise on the basis of the actual admission of the employee to work with the knowledge or on behalf of the employer or his authorized representative in the case where the employment contract was not properly drawn up. The actual admission of the employee to work without the knowledge or instructions of the employer or his an authorized representative is prohibited. Article 80 of the Labor Code of the Russian Federation. Termination of an employment contract at the initiative of the employee (at his own request) On the last day of work, the employer is obliged to issue the employee a work book and other documents related to the work, upon the written application of the employee, and make a final settlement with him. Article 234 of the Labor Code of the Russian Federation. The employer's obligation to compensate the employee for material damage caused as a result of illegal deprivation of his opportunity to work. The employer is obliged to compensate the employee for the earnings he did not receive in all cases of illegal deprivation of his opportunity to work. Such an obligation, in particular, arises if earnings are not received as a result of: illegal removal of an employee from work, his dismissal or transfer to another job; the employer’s refusal to execute or untimely execution of the decision of the labor dispute resolution body or the state legal labor inspector to reinstate the employee to his previous job; delay by the employer in issuing a work book to an employee, or entering into the work book an incorrect or non-compliant wording of the reason for the employee’s dismissal.

Article 236 of the Labor Code of the Russian Federation. Financial liability of the employer for delay in payment of wages and other payments due to the employee If the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation ) in an amount of not less than one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time from amounts not paid on time for each day of delay starting from the next day after the established payment deadline up to and including the day of actual settlement. The amount of monetary compensation paid to an employee may be increased by a collective agreement, local regulation or employment contract. The obligation to pay the specified monetary compensation arises regardless of the employer’s fault. Article 237 of the Labor Code of the Russian Federation. Compensation for moral damage caused to an employee Moral damage caused to an employee by unlawful actions or inaction of the employer is compensated to the employee in cash in amounts determined by agreement of the parties to the employment contract. In the event of a dispute, the fact of causing moral damage to the employee and the amount of compensation for it are determined by the court, regardless of the property damage subject to compensation. Article 391 of the Labor Code of the Russian Federation. Consideration of individual labor disputes in the courts The courts consider individual labor disputes at the request of the employee, employer or trade union defending the interests of the employee, when they do not agree with the decision of the labor dispute commission or when the employee goes to court without going through the labor dispute commission, as well as at the request of the prosecutor, if the decision of the labor dispute commission does not comply with labor legislation and other acts containing labor law norms. Individual labor disputes are considered directly in the courts on the basis of applications from: an employee - for reinstatement at work, regardless of the grounds for termination of the employment contract, for changing the date and wording of the reason for dismissal, for transfer to another job, for payment for the period of forced absence, or for payment of the difference in wages during the performance of lower-paid work, about unlawful actions (inaction) of the employer when processing and protecting the employee’s personal data; employer - on compensation by the employee for damage caused to the employer, unless otherwise provided by federal laws. Individual labor disputes are also heard directly in the courts: refusal to hire; persons working under an employment contract with employers - individuals who are not individual entrepreneurs, and employees of religious organizations; persons who believe that they have been discriminated against. Article 392 of the Labor Code of the Russian Federation. Time limits for applying to court for resolution of an individual labor dispute An employee has the right to apply to court for resolution of an individual labor dispute within three months from the day he learned or should have learned about a violation of his rights, and in disputes about dismissal - within one month from the day of delivery of a copy of the dismissal order to him or the day of issue of the work book. The employer has the right to go to court in disputes regarding compensation by the employee for damage caused to the employer within one year from the date of discovery of the damage caused. If, for good reason, the deadlines established by parts one and two of this article are missed, they may be restored by the court. Article 393 of the Labor Code of the Russian Federation. Exemption of employees from legal costs When filing a claim in court on claims arising from labor relations, including regarding non-fulfillment or improper fulfillment of the terms of an employment contract of a civil nature, employees are exempt from paying fees and legal costs. Article 145.1 of the Criminal Code of the Russian Federation. Non-payment of wages, pensions, stipends, benefits and other payments 1. Partial non-payment of wages, pensions, stipends, benefits and other payments established by law for more than three months, committed out of selfish or other personal interest by the head of the organization, the employer - an individual, the head of a branch , representative office or other separate structural unit of an organization - is punishable by a fine in the amount of up to one hundred twenty thousand rubles or in the amount of the wages or other income of the convicted person for a period of up to one year, or by deprivation of the right to hold certain positions or engage in certain activities for a period of up to one year, or forced labor for a term of up to two years, or imprisonment for a term of up to one year. 2. Complete non-payment of wages, pensions, scholarships, allowances and other payments established by law for more than two months, or payment of wages for more than two months in an amount below the minimum wage established by federal law, committed out of selfish or other personal interest by the head of the organization, the employer - by an individual, the head of a branch, representative office or other separate structural unit of an organization - is punishable by a fine in the amount of one hundred thousand to five hundred thousand rubles or in the amount of the wages or other income of the convicted person for a period of up to three years, or by forced labor for a term of up to three years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years or without it, or imprisonment for a term of up to three years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years or without it. 3. Acts provided for in parts one or two of this article, if they entailed grave consequences, are punishable by a fine in the amount of two hundred thousand to five hundred thousand rubles or in the amount of the wages or other income of the convicted person for a period of one to three years, or by imprisonment. for a term of two to five years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to five years. Note. In this article, partial non-payment of wages, pensions, scholarships, benefits and other payments established by law means payment in the amount of less than half of the amount payable.

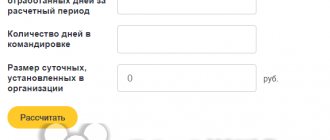

Formula and example of calculating compensation for 1 day salary delay

At May LLC, salary payments are set on the 25th of the current month and the 10th of the next month.

The accounting department should have transferred the sales manager A.A. Korolev advance payment in the amount of 20,000 rubles. She did this not on the 25th, but on the 26th. Accordingly, the delay is 1 day.

Calculation of the amount of compensation for delay:

Compensation amount = advance amount*1/150*key rate valid on the day of settlement*number of days of delay

Compensation amount = 20,000*1/150*7.25% *1 = 9.6 rubles.

Personal income tax is not withheld from the amount of compensation, this follows from the Letter of the Federal Tax Service dated June 4, 2013 No. ED-4-3/10209.

Examples of calculating advance payments in 2021

In order to calculate the amount of the advance starting in 2021, first clarify the organization’s internal rules on this issue.

How to earn a good pension - specific recommendations

Next, we calculate using the formula: tax is subtracted from the total salary (for the first and second half of the month), divided by the number of all working days and multiplied by the days already worked.

For example, you need to calculate the amount of the advance for April (let’s say the due date for payments is the 15th). Your salary is 30,000 rubles. In the first half of the month you had 11 working days.

(30,000 rub. – 3,900 rub.) / 21*11 – 13,671 rub.

3900 rub. - tax.

When must an employer pay compensation amounts?

The employer must provide compensation immediately with wages, reflecting it as a separate line on the payslip.

Example: May LLC was supposed to issue wages on the 5th, but delayed them by 1 day, and they were paid only on the 6th. In this case, compensation must be calculated and paid along with earnings on the 6th.

When should compensation be given for an overdue advance, when paying an advance or salary? Payment of compensation amounts for delayed advance payments is made on the day it is transferred to employees, and is not postponed until the date of wages.

What to do if they didn’t give you an advance

In fact, the deposit for the apartment confirms the intentions of both parties (I emphasize: both, and not just the buyer!) to complete the transaction.

Since legally the deposit is paid towards the future obligations of the parties, in order to give a deposit when purchasing an apartment, it is necessary to already have an agreement confirming the occurrence of these obligations between the parties. Any deposit agreement, deposit agreement, or, especially, a receipt will not be able to fully confirm the fact of the occurrence of obligations between the parties. If litigation arises on such documents, problems may arise, since they can be interpreted in two ways. Therefore, ideally, in order to give a deposit for an apartment, we need an apartment purchase and sale agreement, since it is from it that the obligations we need flow. And since such an agreement cannot be concluded without all the necessary documents and, in fact, money, for the sake of which it is postponed, it is best to formalize the deposit with a preliminary agreement for the purchase and sale of an apartment.

What to do if the company management refuses to pay compensation

In most cases, the employer does not charge compensation for late wages by default, especially if the delay was only one day. The amount to be paid with such a delay will be very small, but in this case, workers must still defend their rights.

To begin with, you can contact the management of the enterprise in writing with a request to accrue the compensation due. The application is drawn up in free form.

.

If management refuses to calculate compensation, the employee can appeal the violation of his rights to the relevant organizations.

In the table below you can see where a person whose rights have been violated can turn:

| Name of company | Application procedure | Complaint consideration period |

| State Labor Inspectorate | The employee writes a statement listing all the facts of what happened. | Within 7 days |

| Prosecutor's office | The employee writes a statement (complaint) in which he indicates all the facts of what happened | Within 30 days |

| Judicial authorities | The employee files a statement of claim, which must contain the specific demand of the plaintiff, in this case the calculation of compensation | In the order of consideration of cases by the court |

Disciplinary liability for the director in case of delay in payments

The head of the organization bears full responsibility for non-payment of wages. If a delay occurs, the director of the company may be reprimanded, reprimanded, or even dismissed from office for particularly serious violations .

In addition, if there is a trade union at the enterprise, it can also give its assessment of the current situation and point out to the director that such situations are inadmissible. The appeal of the elected body to the director occurs in the form of an application. The manager reviews the document within 7 days. At this time, it is necessary to eliminate all mistakes and punish the guilty. After all the activities have been completed, the manager, also in writing, reports on the work done.

Disciplinary sanctions are imposed for a period of 12 months.

Responsibility of the enterprise for delays in wages and non-payment of compensation

An administrative penalty may also be imposed on the employer for delaying wages. As well as for refusal to voluntarily accrue compensation for late payments. There is no separate article in the Code of Administrative Offenses of the Russian Federation for delayed payments, therefore the punishment is imposed in accordance with paragraph 6 of Article 5.27.

In this situation, the penalty is:

- From 1 thousand to 5 thousand rubles for individuals who are individual entrepreneurs;

- From 10 thousand to 20 thousand rubles for responsible employees of the company;

- From 30 thousand to 50 thousand rubles in relation to a legal entity.

This administrative penalty can be imposed on the employer even if the salary is delayed by 1 day.

If wages are delayed, the employer is obliged to pay compensation to employees, even if the delay is only one day. Compensation must be accrued by the employer on a voluntary basis; moreover, he must inform employees that they are entitled to compensation. As a rule, this information is included on payslips.

What percentage of the salary is the advance, calculation rules and payments in 2021

- Officials – fine from 1 to 5 thousand rubles. If a person has already been prosecuted for a similar offense, then a fine of 10 to 20 thousand rubles, or disqualification from 1 to 3 years;

- Individual entrepreneurs – fine from 1 to 5 thousand rubles. If a person has already been prosecuted for a similar offense, then a fine of 10 to 20 thousand rubles;

- Legal entities – fine from 30 to 50 thousand rubles. If a legal entity has already been prosecuted for a similar offense, then a fine of 50 to 70 thousand rubles;

When carrying out work, a person wants the result to be paid well and on time. But ignorance of the basic rules by which the calculation, payment, and withholding of taxes on wages and advances occurs often becomes a reason for the employer to delay making a transfer to his employee or not to make it at all. This article will tell you about the rules for paying advances and salaries, what percentage of the salary is an advance, liability for violating these rules, and how to correctly file and withhold taxes on salaries and advances.

Instructions for collecting wages

Delay of wages by the employer is prohibited by the labor legislation of the Russian Federation. If the boss refuses to pay earned money, the employee has the right to file a claim. If the employer fails to act, after receiving an official request to transfer wages, you can write a complaint to the Labor Inspectorate or file a claim in court.

Preparing a claim

The employer is obliged to pay wages on the day agreed upon in the employment contract. In case of dismissal of an employee, funds are issued on the last day of work, or on the first day of his application for salary.

The Labor Code of the Russian Federation allows termination of the performance of labor functions if the employer refuses to pay wages for two weeks, or more precisely 15 working days.

Asking your boss to give you a salary is useless. It is better to act in an official manner. The first stage is drawing up a claim addressed to the head of the enterprise.

There is no single claim form. However, the document should include key points:

- Full name of the employee, his position, contact telephone number and residential address;

- company name;

- Full name of the manager and his position;

- the name of the document itself (in our case, this is a claim for non-payment of wages);

- essence of the claim;

- requirements;

- consequences of failure to comply with the requirements described in the claim;

- date and signature of the applicant.

It is important to describe the problem in as much detail as possible. Explain at what point the employee did not receive wages, the approximate amount, as well as the consequences for the employee due to non-receipt of income.

For example, if an employee is obliged to repay a loan, then it is worth indicating the delay in fulfilling loan obligations, as well as the amount of accrued penalties and the total amount of accumulated debt.

Describe the requirements. Ask to pay not only wages, but also compensation required by law.

Submitting a complaint to the employer

A claim to the head of the enterprise can be sent in three ways:

- personally into the hands of the employer, or through his secretary;

- by Russian Post by registered mail.

In the first case, it is necessary to confirm receipt of the claim by affixing the date and signature of the receiving person. If the employee decides to send the document by mail, then he should order it. Confirmation of receipt of the claim by the manager will be a notification of delivery of the envelope.

Important!

The claim is drawn up in two copies. One is given to the manager, the second remains with the employee.

Complaint to the Labor Inspectorate

A complaint should be sent to the labor inspectorate if management fails to act after receiving a complaint.

There are no special rules for drawing up a document at the legislative level. However, for a fair assessment of the employee’s problem by department employees, the complaint is drawn up in duplicate, and the following information is indicated in it:

- full name of the department and its location;

- if possible, you can indicate the name of the official authorized to accept such documents;

- The applicant's full name, home address, telephone number, place of work and position;

- name of the enterprise where the employee is employed, address;

- Full name of the manager, his position;

- name of the document (complaint);

- the essence of the problem with a consistent and detailed description of it.

- requirements for the employer;

- request to the inspectorate employee to conduct an inspection of the enterprise;

- date of filing the complaint and signature of the applicant.

Important!

The labor inspectorate will refuse to consider a complaint if the document does not indicate the applicant’s full name and contact information.

The complaint is submitted personally to an employee of the department. In this case, the receiving party will mark the registration of the document.

A claim against an employer to the labor inspectorate can be sent by Russian Post by registered mail with notification. Confirmation of receipt of the envelope by the department will be the form given to the sender in case of delivery of the letter.

Going to court

If the measures taken by the employee against the manager did not lead to results, and the company still refuses to pay wages, you can file a claim in court.

Important!

The judicial authority will reject the claim if the citizen did not try to resolve the conflict peacefully, that is, without trial, but by filing a claim or filing a complaint with the labor inspectorate.

Through the court, an employee can recover not only unpaid wages, but also compensation for moral damage.

You can contact the judicial authority three months after the date of the first delay in wages or partial payment.

Important!

A claim for recovery of wages is filed only in a district or city court. The magistrate does not have the right to consider such cases.

For filing a claim in a labor dispute, the employee does not pay a state fee, and the costs are subject to recovery from the employer, but only if the employee’s claims are recognized.

The statement of claim is drawn up taking into account the information required to be included in the document, in free form. Sent personally through the department office, or by registered mail with notification.

What to include in the statement of claim

There is no single sample statement of claim for recovery of wages. However, the applicant must include some information in it.

- Fill out the header in the upper right part of the sheet. Here the name of the court, its location, the name of the plaintiff and defendant, indicating the place of residence, location and contact telephone numbers are indicated. Below is the amount of the claims, which includes the amount of unpaid wages, as well as compensation for moral damage.

- In the middle of the page you must write the name of the document. In our case, this is a “Statement of Claim for the recovery of wages and the amount of compensation for moral damage.”

- Next, the plaintiff describes the essence of the problem, starting with his full name, date of birth, place of work and position held. The main thing is to clearly and consistently describe your actions, as well as the manipulations performed by the employer.

- After describing the problem, it is necessary to present demands to the employer, supporting them with a link to current legal regulations. Thus, the employee proves the legitimacy of his claim.

- The documents attached to the claim are listed below, dated and signed.

The claim is drawn up in triplicate. One remains with the plaintiff, the second is sent to the court, and the third is sent to the defendant.

What to do if wages are not paid (delayed)? Where to contact? 2017-2018

According to Art. 136 of the Labor Code of the Russian Federation, wages must be paid at least 2 times a month - on days established by the internal labor regulations of a particular organization. In this regard, violation of the specified deadlines even by 1 day is unacceptable and may be grounds for holding the employer liable.

According to the Constitution of the Russian Federation, the prosecutor's office is a supervisory body authorized, among other things, to conduct prosecutorial checks on received complaints from citizens (see: How to file a complaint with the prosecutor's office (sample)?). Due to the fact that current legislation provides for several types of liability, the prosecutor has the right to conduct an inspection in order to apply the required sanctions against the unscrupulous employer.

Failure to pay wages on time is a violation of labor laws. Both the company and its officials may be fined for this. According to Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, the fine in the first case will be from 30,000 to 50,000 rubles. in the second - from 1000 to 5000 rubles. Instead of a fine, an organization may be subject to a measure such as administrative suspension of activities for up to 90 days (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). If, within one year from the moment the manager is brought to administrative responsibility, the terms of payment of wages are again violated, the manager, by a court decision, may be disqualified for a period of one to three years (Part 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). The labor inspectorate has the right to hold the company administratively liable for failure to pay wages on time. Why did the question arise? Did the employee complain?

In accordance with Article 136 of the Labor Code, wages are paid at least every half month on the day established by the internal labor regulations of the organization, the collective agreement, and the employment contract. The Labor Code does not regulate specific terms for payment of wages, as well as the size of the advance. At the same time, it should be taken into account that, according to Resolution of the Council of Ministers of the USSR dated May 23, 1957 N 566 “On the procedure for paying wages to workers for the first half of the month,” which is in force insofar as it does not contradict the Labor Code, the amount of the advance on workers’ wages for the first half of the month half of the month is determined by an agreement between the administration of the enterprise (organization) and the trade union organization when concluding a collective agreement, however, the minimum amount of the specified advance must not be lower than the worker’s tariff rate for the time worked. Thus, with regard to the specific terms of payment of wages, including advance payments (specific dates of the calendar month), as well as the size of the advance payment, they are determined by the internal labor regulations, the collective agreement, and the employment contract. Thus, in addition to the formal fulfillment of the requirements of Article 136 of the Labor Code on the payment of wages at least 2 times a month by the employer, when determining the amount of the advance, the time actually worked by the employee (the work actually performed) should be taken into account.

Sniper Web Studio

Measures of employer liability for delayed wages

If the employer refuses to pay wages or pays them incompletely, the employee has the right to file a complaint with the labor inspectorate and the court.

If the enterprise is found guilty, management will be punished. Its type directly depends on the severity of the offense. At the legislative level, three types of employer liability for non-payment of wages are approved: material, criminal and administrative.

Administrative punishment

The employer will incur administrative punishment if it violates the terms of payment of wages. Types of penalties are approved at the legislative level.

Important!

Administrative punishment will follow only if the employer is officially found guilty of violating the terms of payment of wages.

Table of fines in 2021

The amounts of fines are relevant for 2021 - 2021. Their change is possible only if the Government of the Russian Federation issues regulatory documentation regulating the amendment to the code.

| The person who will suffer administrative punishment | Amount of fine for a primary violation, thousand rubles. | Amount of fine for repeated violation, thousand rubles. |

| Executive | 1 – 5 | 10 – 20 |

| IP | 1 – 5 | 10 – 20 |

| Organization | 30 – 50 | 50 – 70 |

Important!

If the employer refuses to pay the fine, enforcement proceedings may be initiated against him.

Material liability

Based on the Labor Code of the Russian Federation, the employer is obliged to pay compensation for delayed wages, the amount of which depends on the employee’s average monthly salary, the Central Bank refinancing rate and the amount of delay.

In accordance with labor legislation, the employer is obliged to independently, without application, calculate and pay the amount of compensation.

Important!

The compensation amount for delayed payment of wages is due to the employee, regardless of the reasons for the delay in transferring funds.

What to do if the seller, after taking a deposit, delays the deal

1. A deposit is recognized as a sum of money given by one of the contracting parties against the payments due from it under the contract to the other party, as proof of the conclusion of the contract and to ensure its execution. 2. The agreement on the deposit, regardless of the amount of the deposit, must be made in writing. 3. In case of doubt as to whether the amount paid towards payments due from the party under the contract is a deposit, in particular due to non-compliance with the rule established by paragraph 2 of this article, this amount is considered paid as an advance unless proven otherwise.

My husband and I wanted to buy an existing beauty salon. They gave the owner a deposit equal to half the cost of the salon. He wrote a receipt and received money for the equipment of the beauty salon. At the moment, he again posted an advertisement for the sale of the salon, but he does not contact us - he did not answer the phone, and now he has turned off the phone. We are not refusing the purchase, but we know for sure that he has already spent our money - he invested it in the purchase of an apartment in another city. Now he lives in two cities. We have a suspicion that he may sell it to someone else. If we have a receipt, can we be considered the owners? What can we do if he sold it to someone? Can we take ownership of the salon? How long can the proceedings take? We don't know his residential address.

What are the penalties for employers for non-payment of wages in 2021?

/ (22 x 10) slave. days). Therefore, when paying an advance, the institution must give the employee at least 2,727.27 rubles.

But if the internal labor regulations, labor or collective agreement stipulate that the first part of earnings is accrued in a larger amount, then the amount of payment may exceed this amount.

Note:

When calculating the advance amount, you must proceed from the tariff rate (salary). Bonuses and other incentive payments, even if they are established by the organization’s remuneration system, do not need to be taken into account.

At the same time, we remind you that the Unified Tax must be paid once a month (clause 3 of Article 243 of the Tax Code of the Russian Federation). Personal income tax is also calculated based on the results of each month (clause 3 of Article 226 of the Tax Code of the Russian Federation), and there is no need to withhold tax from the advance payment (Letter of the Ministry of Finance of the Russian Federation dated March 6, 2001 N 04-04-06/84).

Fine for late payment of wages upon dismissal

The former employer must make the final payment upon dismissal or termination of the employment contract on the same day as the issuance of the work book. Payment of all amounts due must be made upon the employee's first request. If the last day was not a working day for him, payment is made no later than the next day, in accordance with Art. 140 of the Labor Code of the Russian Federation.

Failure to fulfill the specified deadlines on time is regarded as a violation of labor laws, for which administrative liability is provided.

In accordance with Art. 5.27 “Violation of labor and labor protection legislation” of the Code of the Russian Federation on Administrative Violations provides for fines for the employer for delays in wages in 2018.

In addition to the above, violation of the terms of payment of wages to a dismissed person also provides for criminal liability for the employer, according to Art. 145.1 of the Criminal Code of the Russian Federation. This happens if the delay in all payments due to the former employee is delayed for more than two months.