The role of the power of attorney

Any work must be paid, and the worker can receive payment either personally in the company’s accounting department, or by transferring earnings to a personal salary card. The second option has recently become the most popular. This is due to its convenience: it does not require any extra effort on the part of the employee, everything happens automatically.

However, sometimes, for some reason, such methods of paying wages are impossible. For such cases, the law provides for the possibility of receiving wages through an authorized person presenting a written power of attorney.

Payment of wages

The Labor Code of the Russian Federation obliges employers to pay wages to employees based on work results at least 2 times a month (Article 136 of the Labor Code of the Russian Federation). More specific deadlines can be set directly by the internal regulations of the organization (IP), however, the final payment should be made no later than the 15th day after the month of accrual.

If the employee is absent on payment days, other persons, for example, relatives, can also receive their earnings. But to do this, you should prepare a power of attorney to receive your salary in advance.

There are 2 ways to issue wages. Management has the right to decide independently how to make payments:

- through the cash register in the presence of the employee himself;

- non-cash (transfer to bank cards).

The first method requires the direct participation of an employee who needs to sign payment documents when receiving funds. If the calculations represent charges to bank cards, the actual presence of the employee is not required, just as there is no requirement for a power of attorney to receive a salary by another person (a sample document is given below).

Does an employer have the right to refuse to receive a salary by proxy?

According to the law, if a power of attorney is drawn up in accordance with all the rules, endorsed by a notary and presented on time, the employer does not have the right to refuse to pay wages to its bearer.

The only condition: simultaneously with the power of attorney, the employee’s representative must provide the cashier with his passport (or other document proving his identity).

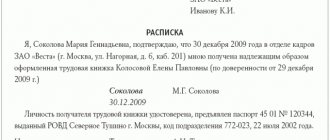

When checking a power of attorney, the employer's representative must check all the data from it with the information from the proxy's passport in the most careful manner. You should also pay close attention to the signature of the principal himself: it must be certified by the head of the personnel department or another employee of the enterprise who has a document at his disposal that allows him to compare signatures.

It would be good if, before sending his representative to collect his salary, the employee of the enterprise finds the opportunity to warn the employer that he will not be able to personally receive the money he earned. This will avoid misunderstandings and unnecessary suspicions.

What rules must be followed

The employee can draw up the document manually or in printed form. In the first case, you must adhere to the general rules:

- no errors or corrections;

- legible handwriting;

- reliability of all information.

The employer must carefully study the contents of the document so that no claims arise later. Particular attention should be paid to the validity period and information about the right to receive funds. Subsequently, this document is attached to the cash receipt and/or payroll.

For whom can a power of attorney be drawn up to receive wages?

A power of attorney can be issued to any legally capable person who has reached the age of majority and has a passport as a citizen of the Russian Federation. This could be a relative, work colleague or any other close person to whom the trustor can confidently entrust receiving the money earned.

From the moment the money is issued to the bearer of the power of attorney, responsibility for the safety of the funds, right up to their transfer to the principal, passes to him.

It should be noted that some powers of attorney can be drawn up with the right of substitution (only they must be certified by a notary), but in relation to this type of document it is better not to resort to the right of substitution.

Characteristics of the document

A power of attorney for the transfer of funds is a written authority where one person (the principal) transfers the right to another person (the attorney) to represent his interests before third parties. In other words, the employee gives the right to his friend, relative, colleague to receive a salary instead of him.

When all actions are performed correctly, the rights and obligations of the parties arise. A power of attorney for salary becomes a legal basis for fulfilling the request of an absent person. According to paragraph 1 of Art. 185 of the Civil Code of the Russian Federation, an employee can issue this document to any person, but subject to certain conditions:

- obligations are transferred voluntarily;

- the attorney is not under the influence of alcohol or drugs at the time of signing the document;

- the authorized person is legally competent, has not been prosecuted and has reached the age of majority.

In practice, there are various situations when an employee cannot personally receive money and is forced to make a power of attorney to receive a salary . These include:

- temporary absence of an employee from the city (departure);

- undergoing a course of treatment (inpatient);

- reluctance to see your former employer;

- other reasons.

Please note: when receiving money through a bank account, you can issue a power of attorney at a financial institution.

Basic rules when drawing up a power of attorney

Today there is no single correct, unified power of attorney template, so employees of enterprises and organizations can write it in any form. The only thing that must be taken into account is that the structure of the power of attorney complies with the norms for writing this type of paper from the point of view of office work and the rules of the Russian language.

In addition, there are a number of requirements that the document must meet in terms of content. It should include:

- personal information about the employee: his position, last name, first name and patronymic, name, address of the organization and structural unit in which he works, as well as passport data (series, number, place and date of issue);

- information about the authorized person: his full name, again passport details and the date of execution of the document (without it it will not acquire legal force);

- the period during which the power of attorney will be considered valid;

- a complete and most detailed list of all rights and powers of the principal’s representative, including receiving wages and the right to sign statements and other payment documents. If the amount to be received by the principal’s representative is known, it must be indicated in the document in numbers and words.

No inaccuracies or errors are allowed in the text of the power of attorney. If any such errors occur during the preparation of the document, they do not need to be corrected; a new form should be drawn up. Abbreviating words and entering abbreviations in the text of the document is also prohibited.

The document is drawn up in a single copy and after presentation to the organization’s cash desk, the cashier must put a note in the payroll statement that the salary was issued by proxy.

How to draw up a power of attorney

To draw up a power of attorney, you must adhere to the following rules:

- registration of the powers of a representative is carried out in simple written form - you can write by hand or print on a computer);

- The power of attorney can be certified by a notary, as well as at the place of work, study or in the hospital of a medical institution - if the employee is there (clause 3 of Article 185.1 of the Civil Code of the Russian Federation);

- the power of attorney is drawn up in any form, but with the presence of mandatory elements (there is no special format for a power of attorney to receive a salary).

Mandatory elements of a power of attorney include:

- data (full name) of the employee (principal) and the authorized person - they are given without abbreviations (clause 1 of article 19 of the Civil Code of the Russian Federation);

- passport details of the principal and authorized person - this information will help identify the person who applied to receive a salary;

- the date of execution of the power of attorney - without its indication, the document loses its force (clause 1 of Article 186 of the Civil Code of the Russian Federation);

- information about the validity period of the power of attorney;

- an indication of the powers granted to the authorized person by the principal;

- personal signatures of the principal and the authorized representative.

An employer's official who is forced to issue wages by proxy must be attentive and careful. It is necessary to carefully study the text of this document - whether it contains an indication of the right to receive a salary and whether its validity period has expired. The cashier who issued the salary to the authorized person attaches the power of attorney to the cash order or payroll (paragraph 3, clause 6.1 of Directive No. 3210-U).

Find out how to arrange the release of deposited wages from the cash desk by proxy in ConsultantPlus. Trial access to the system can be obtained for free.

For current issues of compliance with cash discipline, see the material “Procedure for conducting cash transactions.”

Compliance with these simple rules will eliminate conflicts and material losses.

A sample power of attorney to receive salary can be found on our website.

What to pay attention to when registering a power of attorney

There are also no strict criteria for drawing up a power of attorney: it can be written in handwriting (with a ballpoint pen, but in no case with a pencil) or printed on a computer.

It is important to comply with only one condition: it must contain two signatures - the principal, as well as the person certifying his autograph (a notary or, for example, an employee of the HR department of an enterprise). In this case, the use of facsimile signatures, i.e. printed in any way is not allowed when drawing up a power of attorney.

POWER OF ATTORNEY

city of Moscow the first of May two thousand and thirteen

I, gr. Ivanova Maria Ivanovna, born April 13, 1984, living at the address: Moscow, st. Central, 1 apt. 1, passport series 1123 number 234555, issued by the Department of the Federal Migration Service of Russia for Moscow on May 13, 2001, department code 231 - 790,

I trust gr. Ivanov Ivan Ivanovich, born January 30, 1981, living at the address: Moscow, st. Central, 1 apt. 1, passport series 3456 number 239987, issued by the Department of the Federal Migration Service of Russia for Moscow on July 17, 1999, department code 231 - 790,

received at the cash desk of Privet LLC, located at: Moscow, st. Novaya, 3, the salary due to me for one month (April) 2013, sign for me and perform all actions related to the implementation of this order.

The power of attorney was issued for a period of one month.

_________________

(signature)

On May 01, 2013, this power of attorney was certified by me, Pravdiva L.N., a notary of notary office No. 1, license No. 567 issued on January 1, 1999).

The power of attorney was signed by gr. Ivanova M.I. In my presence. The identity of the principal has been established and his legal capacity has been verified.

Registered in the register under No. 67546.

Charged at the rate: 500 rub.

Notary: __________________________ (signature)

Download the document “Sample. Power of attorney to receive salary"

How to certify the form

The norms of paragraph 3 of Art. 185.1 of the Civil Code of the Russian Federation stipulates that such powers of attorney do not have to be certified by notary offices. When contacting a notary, you will have to pay for the service, and the specialist, in addition to his signature, must put a stamp. You can also certify the document in other structures:

- at the employee’s enterprise, for this you can contact the HR department or the company’s lawyer in advance so that they can verify the fact;

- in a medical institution, if the employee is in a hospital, this action can be performed by the chief physician of the hospital;

- educational institution, this applies to cases where the student’s power of attorney is certified by the university administration.

In these cases, document certification is free of charge.

When becomes invalid

First of all, I would like to note the fact that the validity period of a document of trust for receiving a salary is not provided for by law. Therefore, on this basis, it is allowed to issue such a document for an indefinite period, and it is necessary to indicate it in the text of the power of attorney itself.

However, the law says differently that in the absence of such a record, the trust will be valid for exactly one year, after which it will automatically cease to exist.

A trust document will be invalidated if the employee revokes it or the attorney refuses this procedure. There are other reasons for early termination of trust provided for by law, these include:

- the death of one of the parties, their incapacity, or in the event that one of them goes missing;

- termination of a power of attorney due to the liquidation of a legal entity.

Can an employer refuse

A question often arises related to an employer’s refusal to pay wages to an outsider. Guided by the law, if a trust document is drawn up in accordance with all the necessary parameters, certified by a notary service and submitted within the required time frame, the authorities are simply obliged to issue funds to the trustee.

The main requirement for receiving this money is to present your civil passport along with the power of attorney so that the employer can verify the identity of the representative.

Before issuing wages to an outsider, management must clearly read all the information specified in the trust document. At the same time, the personnel department must verify the employee’s signature on the power of attorney and the signature on a special document available directly at the institution - they must be identical.

There are also situations in life when there are still problems when an outsider receives an employee’s salary. This can happen even if he has the appropriate power of attorney.

This happens in particular due to the fact that the employee did not warn management before this procedure that he did not have the opportunity to come for the money and, therefore, it would be received by a person entrusted to him. Therefore, in order not to cause unnecessary problems either for yourself or for other persons involved in this procedure, it is recommended to notify the manager about this situation in advance.